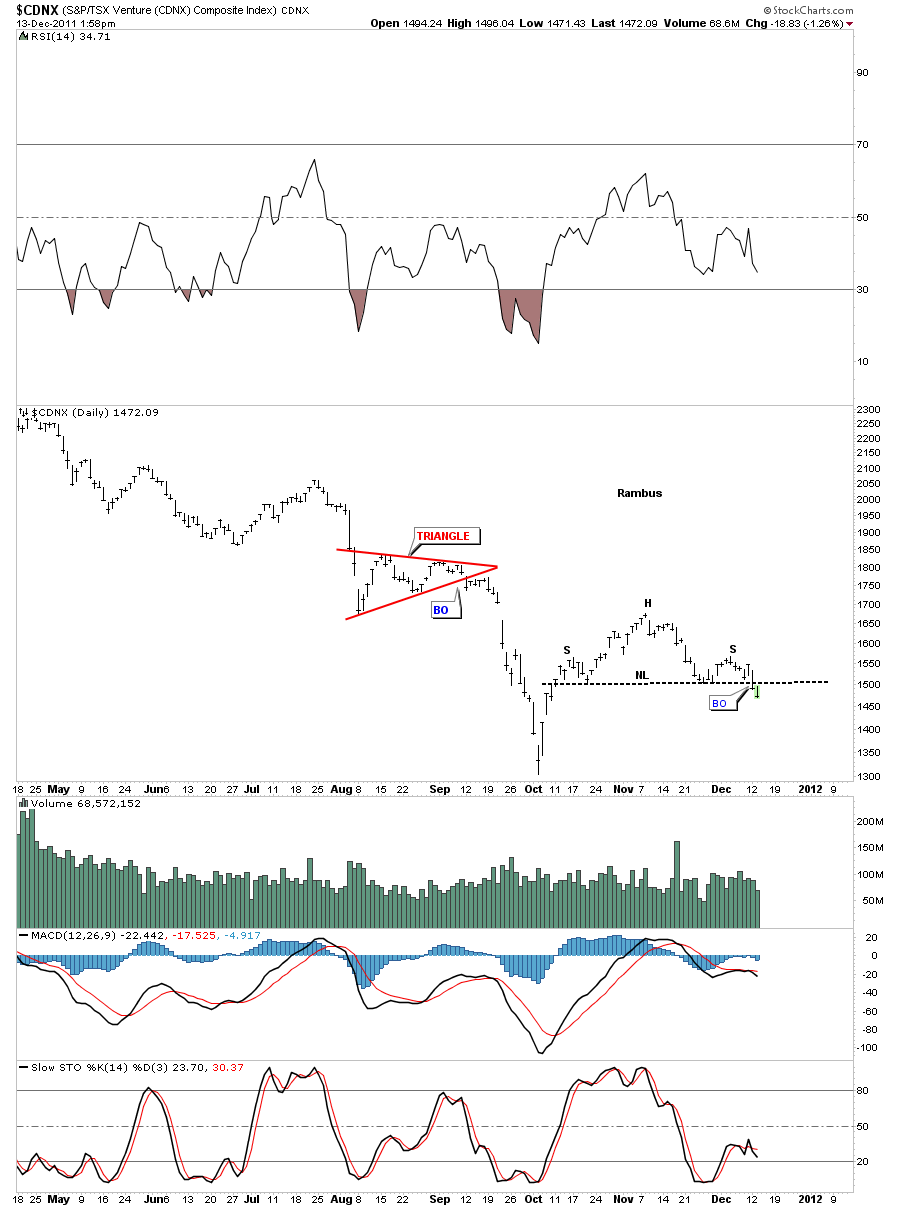

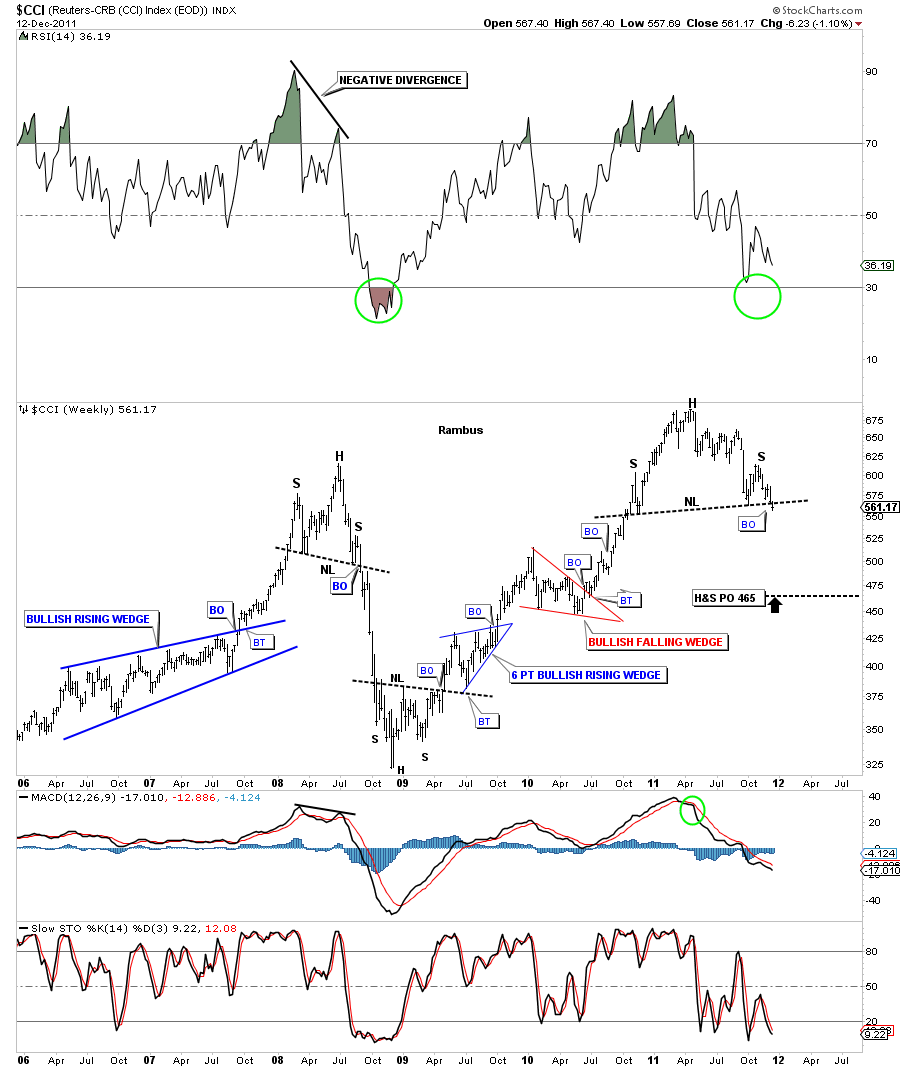

In the weekend report on H&S patterns I showed these two stocks that had a nice H&S top in place but hadn’t broken the neckline yet. With the dollar breaking it’s own neckline today, on the upside, the CCI and CDNX have broken their own necklines, to the downside, this morning.

CDXN daily H&S breakout.

The CCI commodities index broke it’s H&S neckline yesterday. That is telling you commodities are going to under pressure going forward.

Folks I can’t stress enough how important it is right now to protect your self from what I see coming down the road. All these H&S patterns are shouting loud and clear to protect your hard earned capital. There will be few if any stocks that will be able to go against the liquidation in a deleveraging spiral that seems close at hand. We are just at the very beginning stages of this process. There is an old adage on wall street that says “he looses the least amount of money in a bear market is the winner” to that I say “bah humbug”. There are many ETF’s that make it easy to short these markets. This is not a time to be thinking of buying your favorite little junior precious metals stocks because they may have good drill results or some other positive new. As 2008 showed the baby WILL get thrown out with the bath water. Having cash available at the end of what lies ahead will be the best way to pick up bargains but if you don’t raise cash now it will be too late and you will end up selling in a panic when the pain gets to much to bear. You can look at it this way. If I’m wrong the worst that could happen to you is that you still have all your capital to work with. Its a no brainier IMHO. The markets are going to be around alot longer than we will so there will be plenty of more opportunities, down the road, to put your hard earned capital to work.