This stock has been on my radar screen along with about 25 more small cap PM stocks that I haven’t had room to buy for the Junior Portfolio. This stock is a good example of why a person needs a big basket of these little Juniors because you never know which ones are going to really takeoff. Everyone has their own idea on how to play these little guys but from my experience it really pays to buy a big basket of these very volatile stocks.

I have had three different, 400% to 500% portfolios gains, starting back in the spring of 2002 by buying a big basket of at least 15 junior stocks. One portfolio didn’t have one stock over a dollar. I truly believe we are embarking on another one of these 400% to 500% gains in the precious metals junior stock portfolio as they have been so decimated. Actually many topped out in 2004 and 2005 with many more topping out in 2011. If you’ve been following the PM complex for many years then you know exactly what I’m talking about. This is what we live for, another opportunity to do this all over again. I know most of our subscribers come with a precious metals complex background so this isn’t new to you but if you’ve never participated in one of these big moves in the juniors they can be something to behold.

I strongly urge you to think about this. If you make some money in the Kamikaze Portfolio take some of those profits and start putting them into some if these juniors precious metals stocks. You will still get a lot of leverage without the pressure of watching the volatility in the Kamikaze Portfolio. In the early part of this bull market these rallies generally lasted about one year from trough to peak. If December marks the low then we are already several months into this new impulse move higher. We never know 100% for sure what the future holds so all we can do take advantage of a good setup until something tells us it’s broken. Right now, by looking under the surface of the precious metals stock indexes, there are some very encouraging signs that tells me this could very well be the start of a new impulse move higher. We’ll know in hindsight.

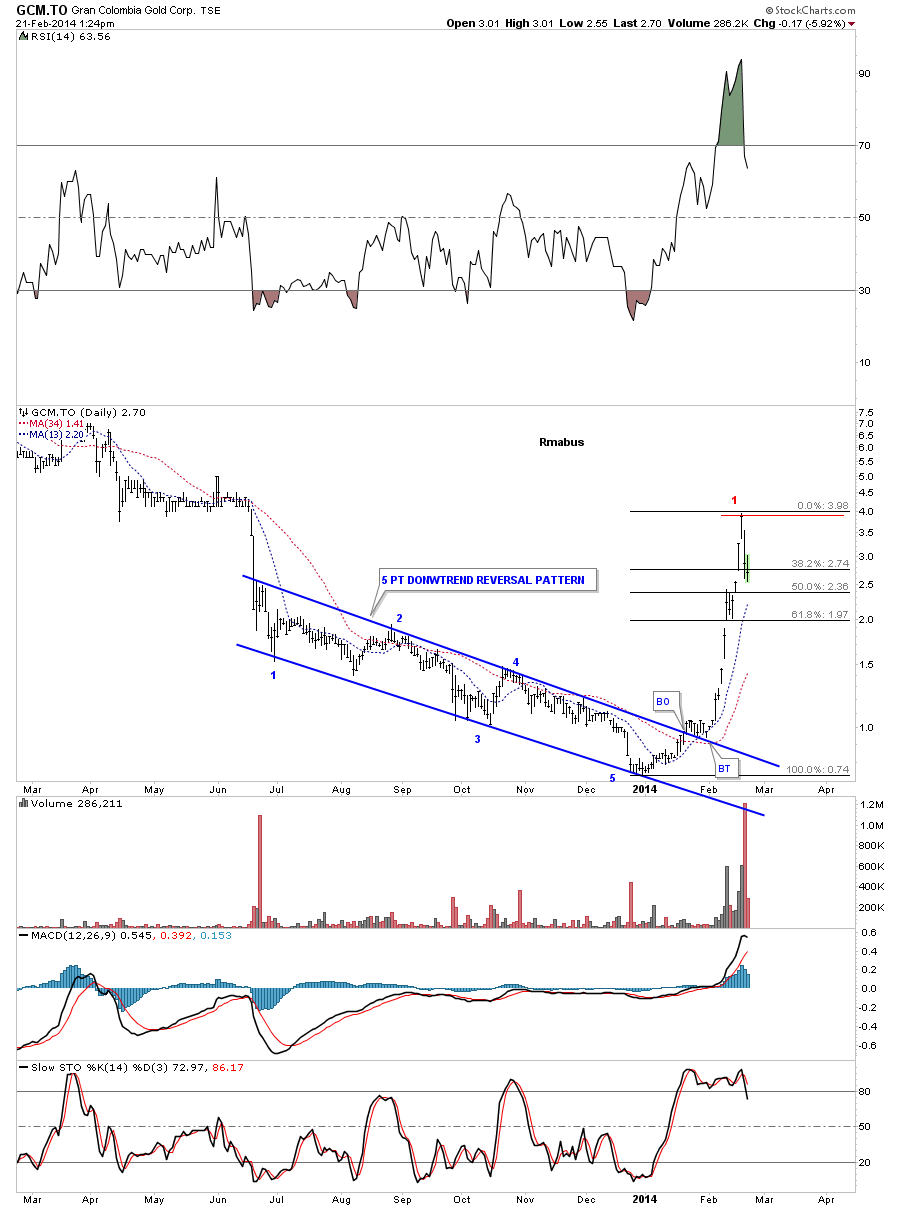

The daily chart shows the big blue 5 point downtrend reversal pattern that was broken to the upside in January and did the backtest in the early part of February. There was no way to know what would happen next but as you can see the price action just went vertical right after the backtest was complete. At this point I would be looking for some type of consolidation pattern to form to digest the recent gains. I put on the Fib tool that may show you where the 2nd several point may come into play. It would be nice to see a decent consolidation pattern of several months form so it can charge forward again. Two steps forward and one step back.

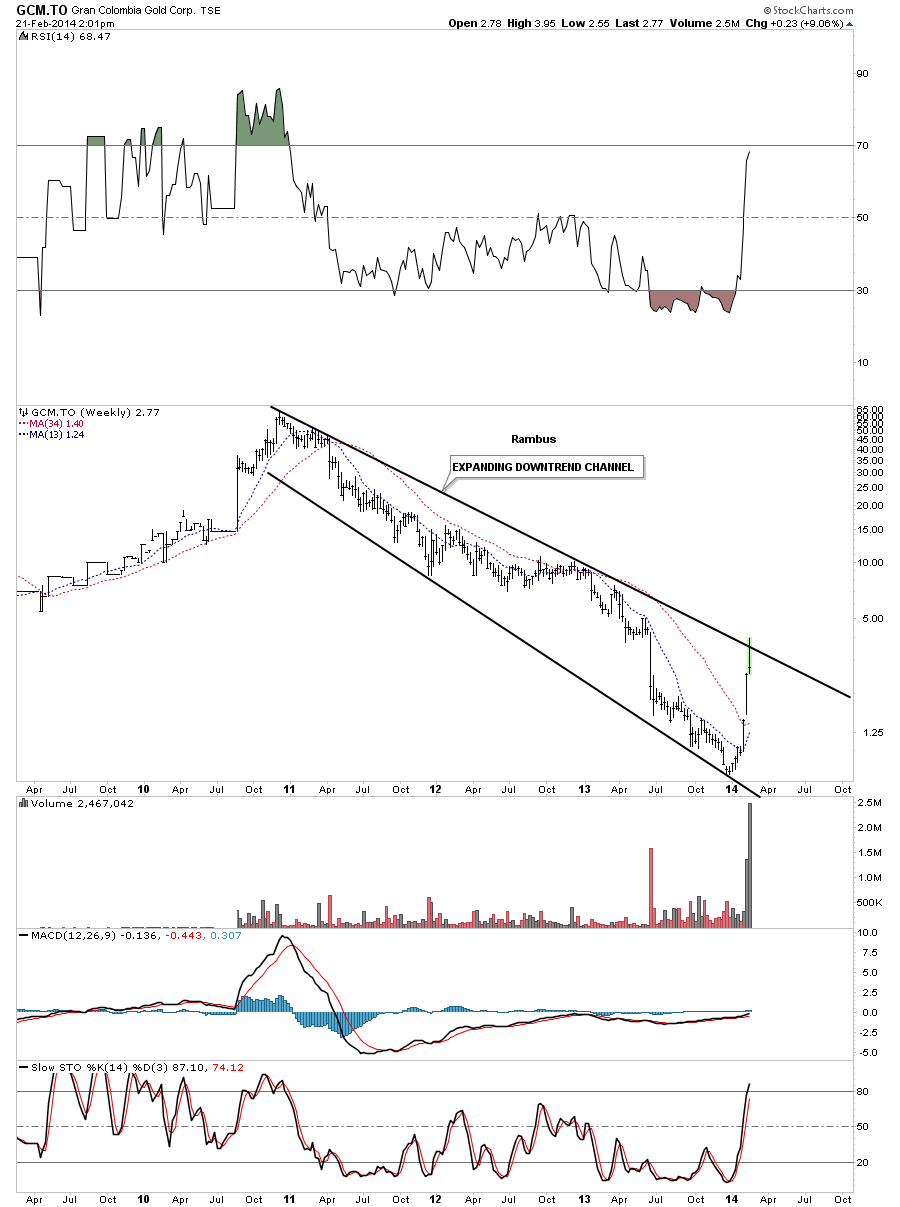

The weekly chart shows you why this stock stopped going higher. The sharp rally hit the top rail of the expanding downtrend channel and is backing off telling us that top black rally is still very HOT. A break of the top rail will signal the bear market is over for this stock and would be a good place to buy or add more shares.