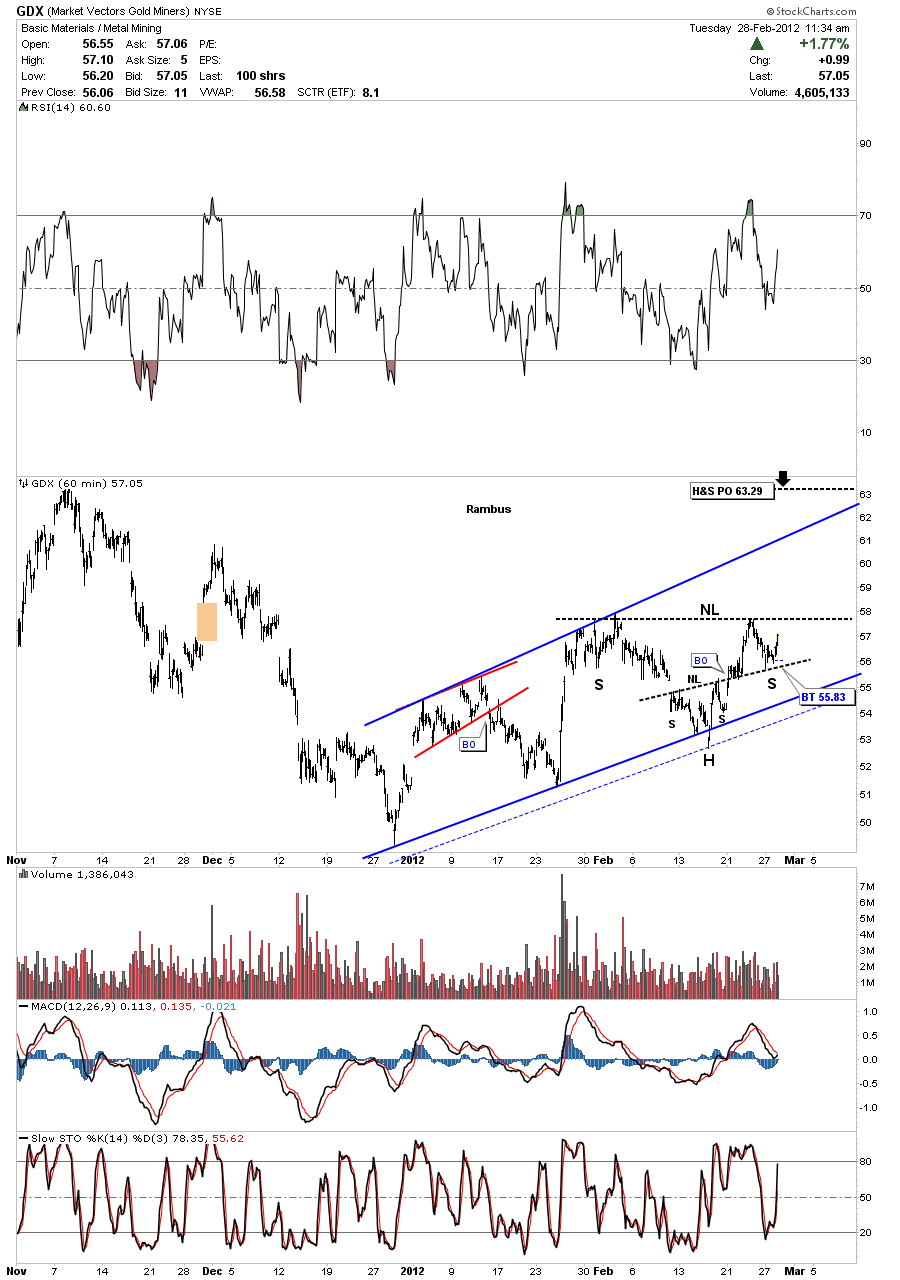

GDX backtested the neckline yesterday from a small inverse H&S bottom that formed on the bottom blue rail of the uptrend channel. I believe that backtest yesterday is now going to be the right shoulder of a bigger inverse H&S bottom. Its a similar setup that silver made. If you recall the low in silver, at 26, formed a small inverse H&S bottom that has turned out to be just the head of a much bigger inverse H&S pattern. If this bigger inverse H&S patterns plays out the price objective should be around 63.29 or so.

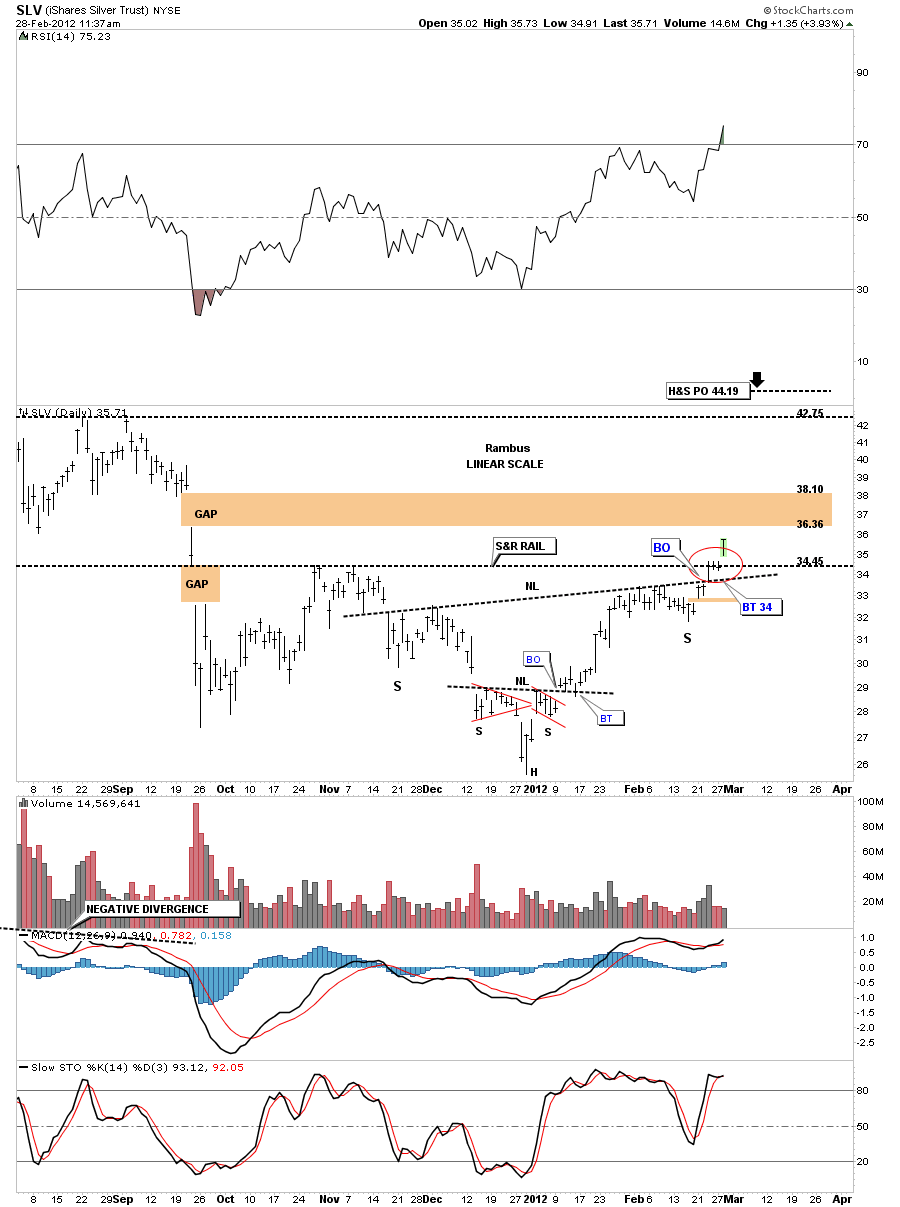

Here is a similar setup on the SLV chart where the bottom, at 26 formed a small inverse H&S pattern. After breaking out of the small neckline SLV rallied all the way up to the 33 area where it consolidated and formed the right shoulder of a much bigger inverse H&S base. You can see we broke the neckline 4 days ago with a nice little gap, hung around the previous high that was made on the way down 34.45, and today we are taking off again. Silver is entering what is called a thin zone, meaning the move down was very fast. In fast moves down like that there isn’t time to build any consolidation patterns that will offer and resistance when prices eventually turn back up. You can see the big gap just above where no trades were made. Silver is in a position to where it can reverse symmetry to the upside now mirroring the move down to some degree. Anyway SLV is looking very good in here.