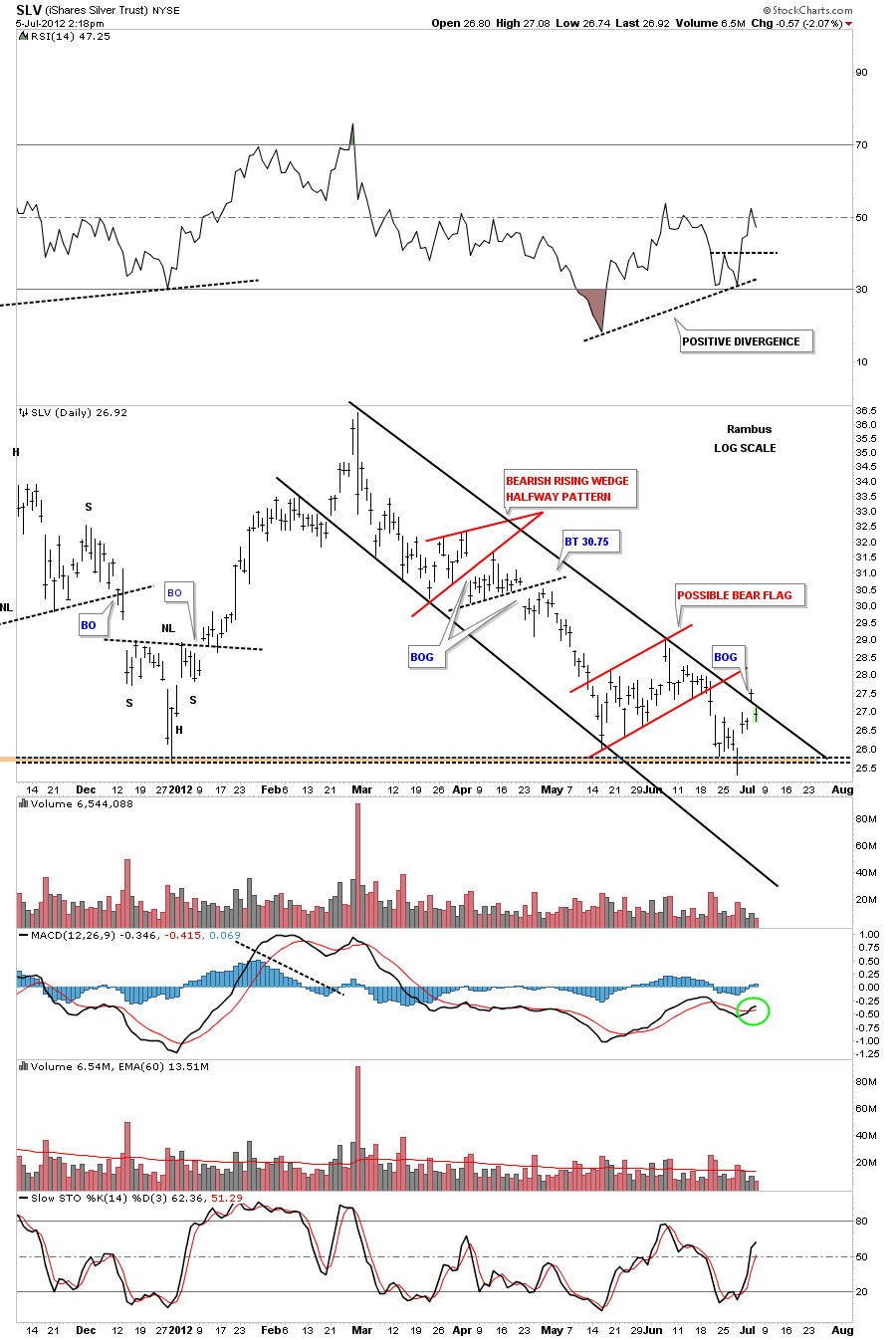

Tuesday SLV had a big gap move above the top rail of the downtrend channel. Today SLV gaped below the same trendline. With today’s move SLV has basically closed the gap from Tuesday. If SLV can trade back above the top rail of the downtrend channel that would be a big positive. Right now we can view the top rail of the downtrend channel as a Support & Resistance rail, Above positive and below negative. There are a couple of positives we can see on the chart below. There is a positive divergence on the RSI indicator at the top of the chart. Also the MACD indicator at the bottom of the chart has just crossed over. So until SLV can trade above the top rail of the downtrend channel we have to be cautious for the time being. I would like nothing more than to see SLV get back above the top rail on some nice volume.

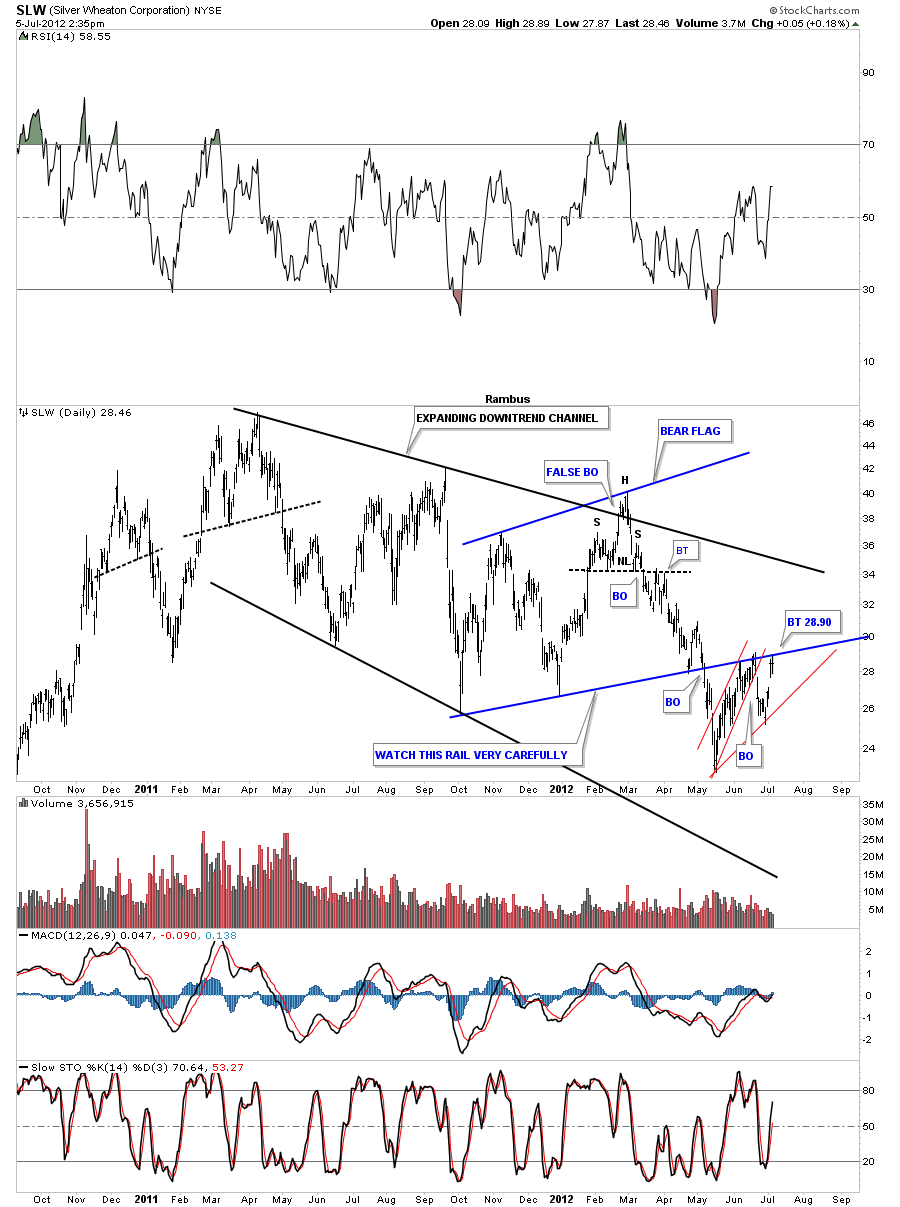

SLW has rallied back up to the blue rail of the bear flag which has acted as a support and resistance. Above positive and below is negative. SLW is a very important stock to follow to gauge the strength or weakness in silver. If SLW can trade above the bottom blue rail of the bear flag it will be talking to us. Like the SLV chart above we are getting close but we just need a good strong up day to get above the overhead resistance.