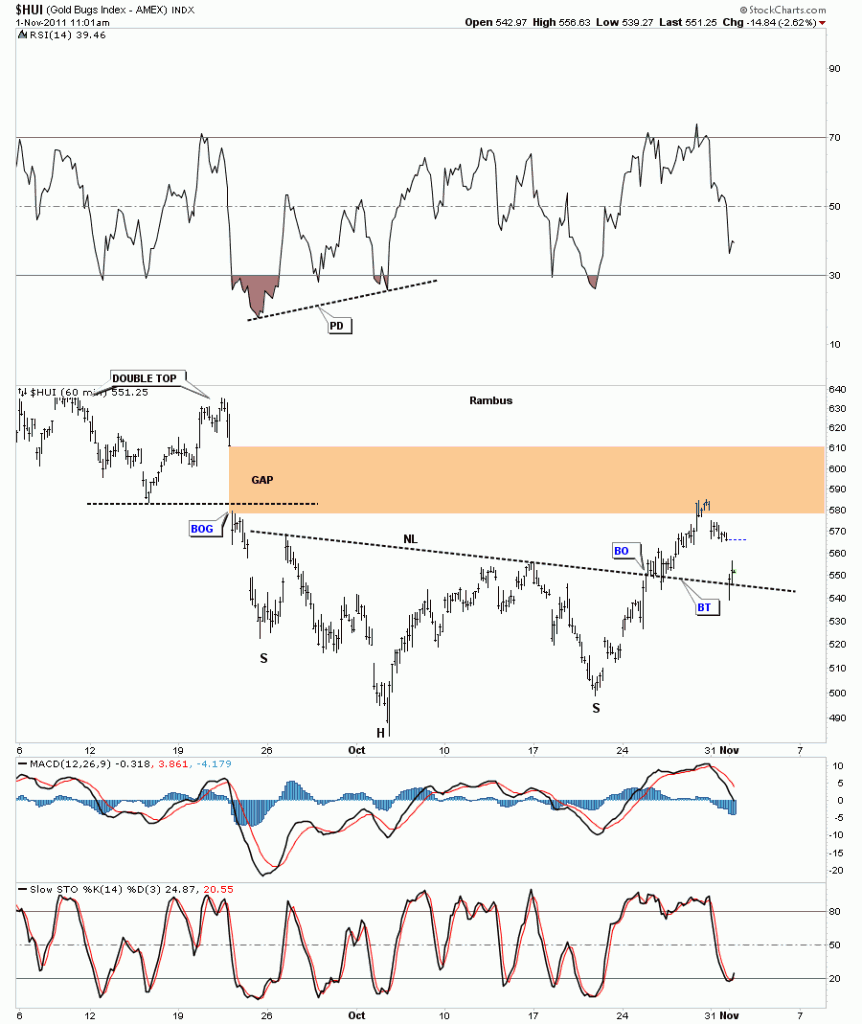

Just like gold and silver the HUI is also backtesting an important support rail, the neckline of a 5 week inverse H&S that formed on the bottom rail of the much bigger one year expanding triangle. These backtests never feel good when you watch them in real time. Always feels like the end of the world but in actuality the backtest represents a very low risk entry point. You have a line in the sand where you can enter a sell/stop if the backtest fails. So watch the neckline very close in here and act accordingly.

HUI 60 minute H&S backtest to the neckline.

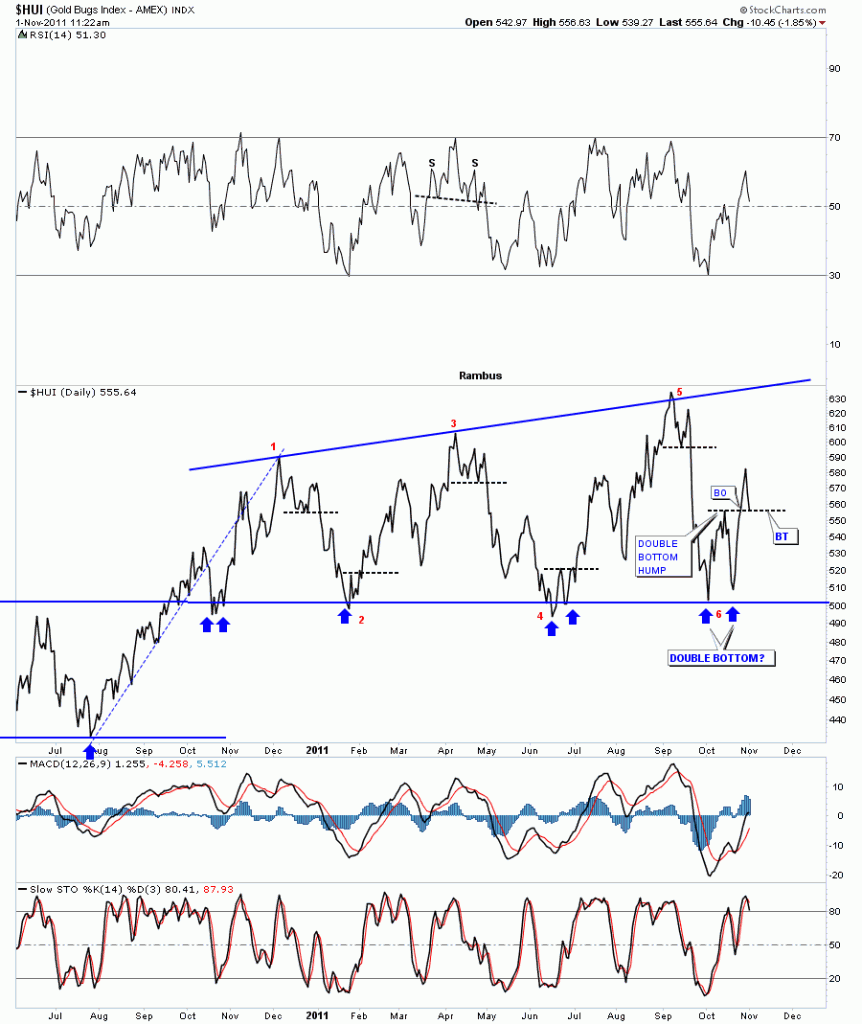

Below is a daily line chart of the HUI. The 500 area has been a good place to buy precious metals stocks for the last year. I labeled our last bottom as a possible double bottom. As you can see today’s action has taken us down to the double bottom hump. What we want to see on this daily line chart is for today’s close to be real close to where it is right now or higher. If this is truly a double bottom then the double bottom hump will hold support.

HUI double bottom hump support.