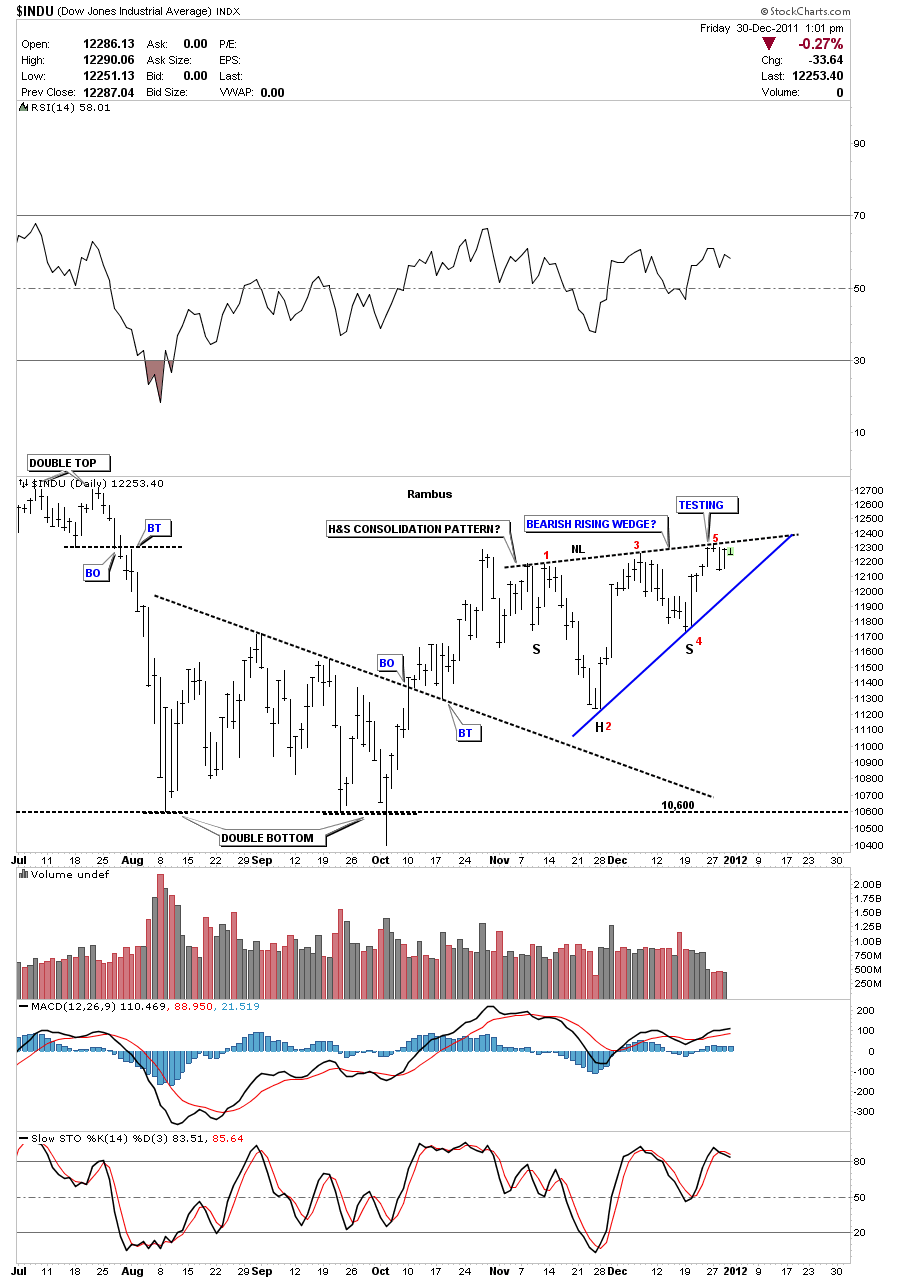

Last week I presented a chart of the Dow that showed a possible H&S consolidation pattern. Since that time the Dow has failed to break the neckline, to the upside, as this weeks action wore on. Potential patterns are just that until you get confirmation of a breakout on heavy volume. Neither has occurred with the Dow. It looks like the potential neckline is now going to act a the top rail of a bearish rising wedge. I left the annotations in place on the possible H&S consolation pattern on the chart below so you can see what has transpired. Usually after about 4 or 5 days, when you trade at a resistance rail and fail to get through, the stock will usually give up and start to decline. I think this is what we are about to see now. I’ve labeled the bearish rising wedge with red numbers. If we take out the bottom rail that will complete a 5 point reversal pattern which is what we want to see as the markets have been rising. This Dow chart will be a good proxy for adding to your short ETF’s as this is a low risk setup. We have a line in the sand with the top rail of the bearish rising wedge now in place.

Dow Jones daily potential 5 point bearish rising wedge.