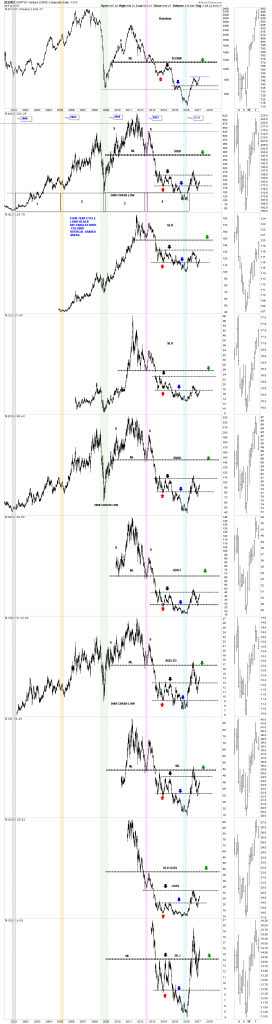

I try to post this combo 10 chart for the PM complex at least every 3 weeks or so as it gives you a good sense of which areas within the precious metals sector are the strongest or weakest. Since the rally out of the December 2016 low the juniors have been leading the way higher including the $CDNX which is a Canadian small cap index that has many precious metals stocks.

Looking at the sidebar you can see this was the first down week for the $CDNX since the December 2016 low which is pretty amazing. What else is amazing is how the precious metals and the miners have diverged in a big way over the last two weeks. Again looking at the sidebar, which gives you a close up look at the last four months of trading, note the price action in GLD and SLV which are still rallying hard to the upside. Now look at the rest of the precious metals stock indexes which are showing a massive divergence taking place over the last two weeks as they are moving lower. Normally this isn’t a good sign for the overall health for the PM complex.

In this Weekend Report I’m going to take an in depth look at many of the precious metals stocks looking for clues as to the health of this sector. Many of these stocks make up the big cap PM indexes like the HUI, GDX, XAU and GDX. How these stocks trade so do these indexes. Have a great weekend and all the best…Rambus