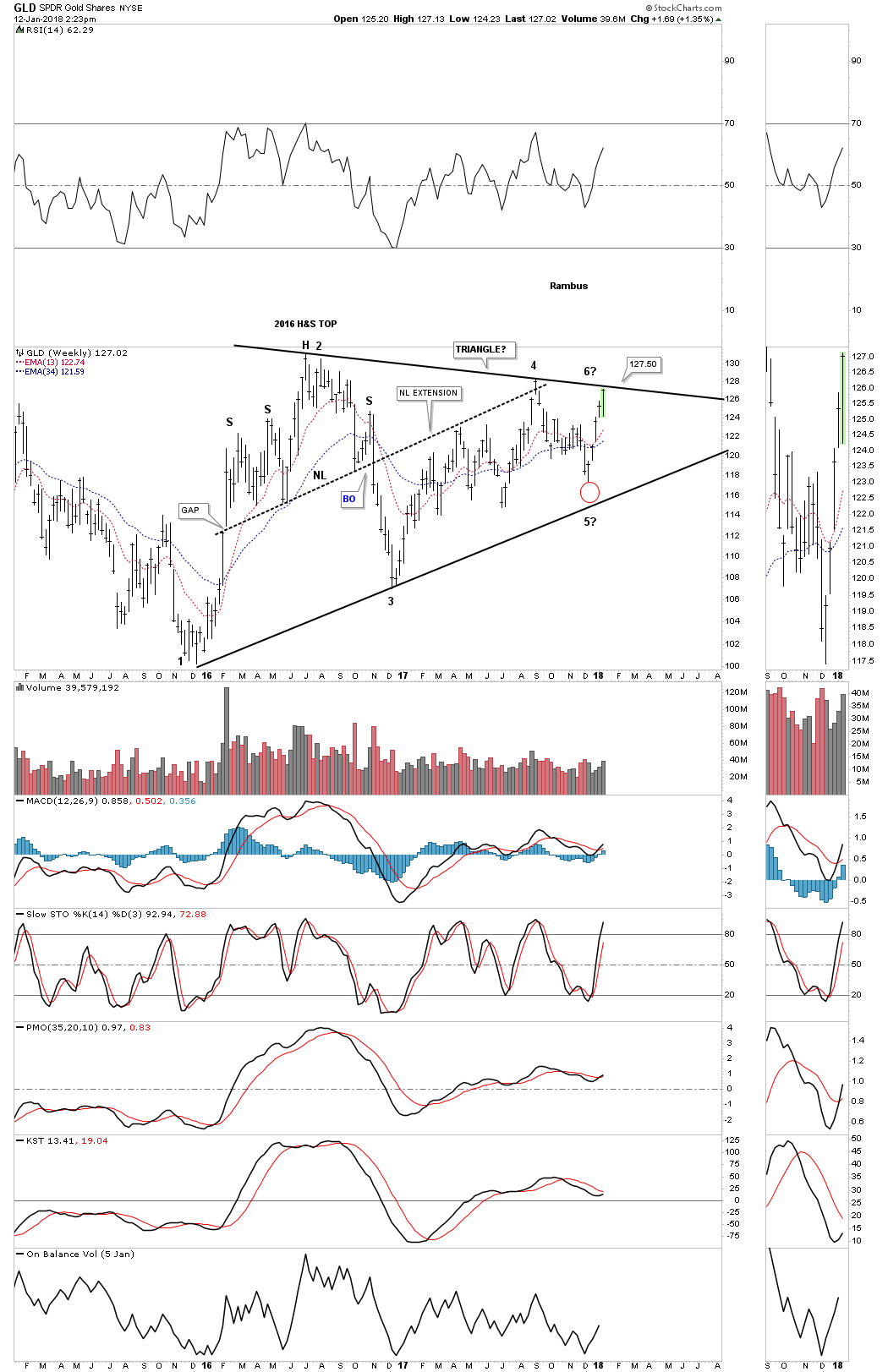

Just a quick update on GLD which is showing the price action approaching the top rail of its triangle trading range which should be around the 127.50 area. Many times during the formation of a 5 point triangle reversal pattern the price action will fail to make it all the way down to the 5th reversal point which suggests the bulls are eager to get positioned. A touch of the top rail will complete the 5th reversal point technically putting the triangle into the reversal category to the upside.

What we have to do now is to see how the price action interact with the top rail. Most likely we should see a reaction backdown initially that could be very shallow if it’s time for the triangle to complete. If the bulls are really fired up we could see a gap above the top rail which would be very bullish.

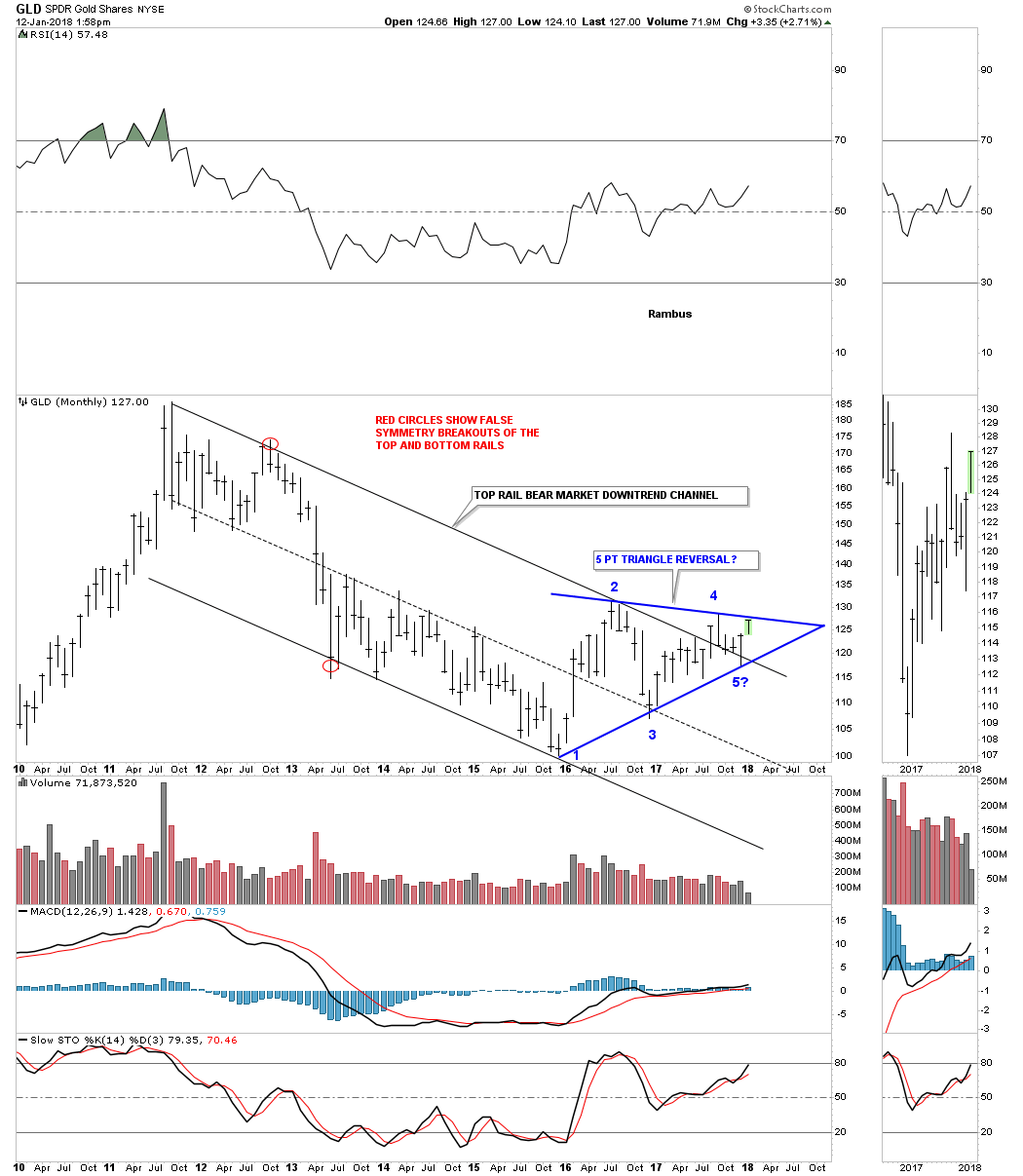

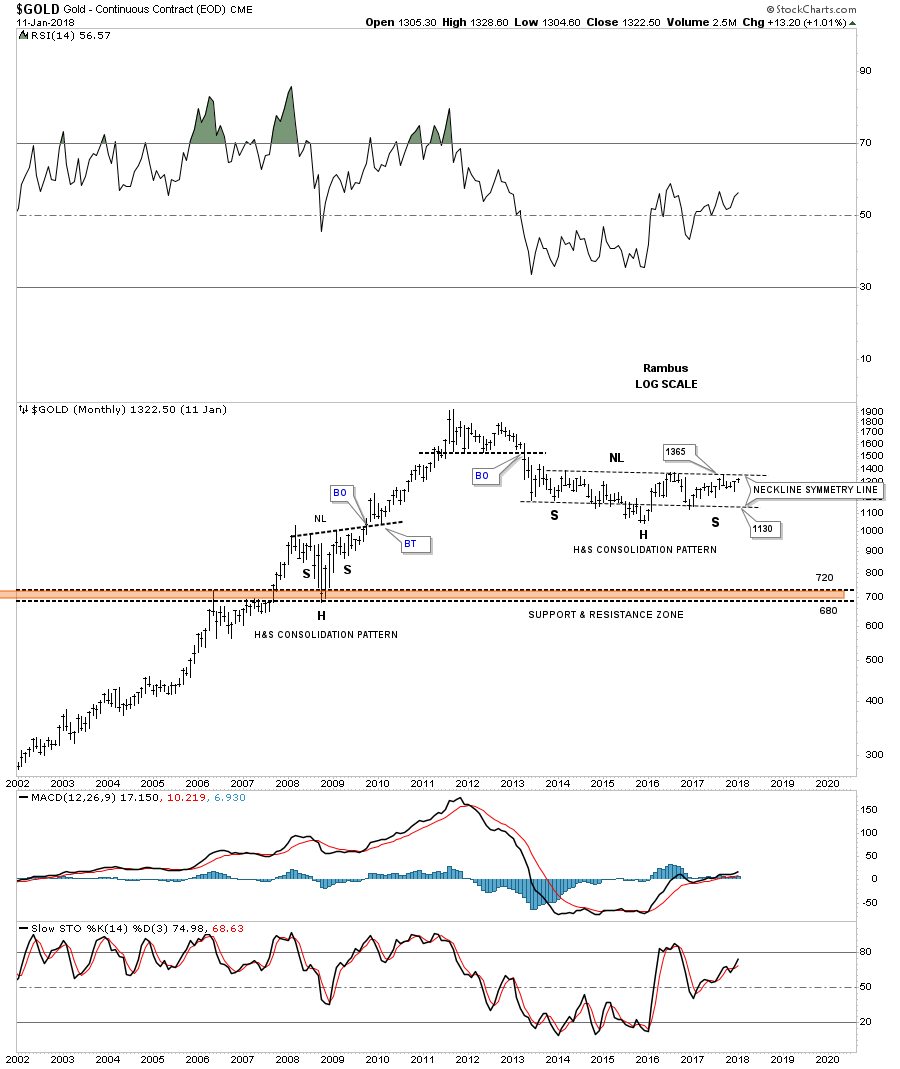

If this is the end of the bear market we need to see some type of reversal pattern build out or several reversal patterns for that matter. If the triangle ends up completing its 5th reversal point that would be a reversal pattern. As you know there is a very large H&S bottom that is also building out.

The possible 5 year H&S bottom.