I certainly hope that the action over the past two weeks has grabbed your attention and made it clear to you that gold is in a bull market. Since January 2016 it left the bear title behind and has been in Phase I of its bull market. Many however, still use the term “bear market” when referring to gold because it is in the stealth phase otherwise referred to as Phase I. Phase I is the accumulation phase, where gold mostly operates below the radar. It’s where informed, serious, long term investors use the ignorance of the public to accumulate. Phase I has been active now for three and one half years.

It appears the gold market is getting positioned to break out into Phase II. I suspect when it does it is going to do it with a bang! It may make its entrance in grand fashion. After all, Phase II is the mark-up phase where it begins to get the attention of the public through price action. I do know one thing, I sure wouldn’t want to be short gold.

In this report I sift through the entire class of stocks in the PM sector and select 7 stocks to hold over the next 5 years. This collection of stocks is intended to serve as a buy and hold core group of solid performers. They are not shoot-for-the-moon long shots, but are intended to be core holdings. But don’t worry there is plenty of exploration optionality imbedded in the group, there will be plenty of speculative upside.

The Gentleman’s Entry Is Now Closed

Retail investors are a pathetic lot. They are ruled by recency bias, price action and the crowd. They can’t see much beyond daily price fluctuations. Ironically, they are why we have gentleman’s entries. When a bull market reveals itself it then shows its hand and the proper course of action is then to sit tight rather than trade. But the weak kneed retail investor ends up getting shaken out instead. This is what we witnessed over the past 3 months. They can’t take the pain when the market pulls back as they likely miss-sized their positions and they don’t have the conviction to see beyond the immediate price action. They get rattled and they bail. They likely bought on a tip so they puke out their position. Their actions force prices further down and deliver the gentleman’s entry.

Who is Plunger?

Before I chronicle how the gentleman’s entry played out, it might help to know who is Plunger. He is a crusty old guy who doesn’t suffer fools gladly. After majoring in economics in college he has studied markets for almost 40 years. In real life he sits in the front left seat of a 500,000 lb. widebody. He is the guy you want to be there when you are flying over freezing Siberia 2,000 miles from the nearest airport since there is not much left that will surprise him. If you need metaphors, think Col Nathan Jessup played by Jack Nicholson in “A Few Good Men”…You can’t handle the truth!

It’s why I have little time for those who were unable to read beyond the headline “It’s Time to Back-up the Truck for a Gentleman’s Entry”. That report was published on April 28th and it stated that the gold stocks would dip one more time then bottom within 4 days of either side of May 9th. Essentially it delivered the market on a platter to the membership. When the price did indeed drop one particular member couldn’t see past the headline and in his words spewed out that it was “just more wrongness”. He couldn’t see beyond a daily move when in fact this report proved to be probably the outstanding market call in the gold bull market since 2016.

In the chart above one can see that the price bottomed one day after the optimal day as stated in the Gentleman’s Entry call, smack in the middle of the stated 8 day trading window. Even better, the price stayed in this buy range for an entire 3 weeks while never going lower than the target window. This allowed buyers to calmly pick away at the shares being dumped by shell shocked retail investors.

Just like last November when I had pointed out that the bottom was in, ALL Professional Opinion was again black bearish. This proved to be another great opportunity for those who had the fortitude and could look at the overall landscape and actually listen to the market.

The “Back Up The Truck for a Gentleman’s Entry” call was IMO the finest call. It was indeed a gutsy action, but I knew what people needed was boldness and courage. It was intended to give that guy on the fence an ounce of that courage to make his own decision. I hope it provided you that bit of extra nudging you may have needed and you took action.

A look into Gold’s Big Picture.

World reserve currencies and monetary regimes rarely last more than 60-80 years. Our present system began in the Summer of 1944 at the Bretten Woods convention in New Hampshire. Major Western currencies were pegged to the USD and the USD was pegged to gold. The right to exchange dollars into gold which were accumulated through a trade surplus kept the system in balance and demanded fiscal discipline. Over the next 25 years however, US politicians no longer desired discipline and resorted to printing excessive US dollars beyond its gold backing. This led Nixon to renege on the gold exchange provision of Bretten Woods I on August 15 1971. Within 2 years a great bull market in gold was borne in which gold ran from $36 to $850 inside of 10 years. This was the first bull market leg in the Bretten Woods I monetary regime. It priced in the massive credit creation of the past 30 years.

In 1975 Bretten Woods II was formed where the USD became the petrodollar. Rather than gold backing the USD, oil essentially backed it as all oil exports from OPEC were now invoiced only in US dollars forcing oil consuming nations to purchase dollars to buy oil.

The next bull market in gold began in 2001 and ran for 10 years. It was fueled by emerging market growth and the purchase of gold. After its peak in 2011 it went through a crushing bear market for 4.5 years. It is my analysis that the third and final bull market in our existing monetary regime began in January 2016. It will be driven by debt collapse and currency debasement. This bull market will usher in a transition to whatever follows King Dollar and Bretten Woods I & II

As in virtually all bull markets we can expect it to unfold in three distinct phases. Since Jan 2016 gold has been in phase I… the stealth accumulation phase. Three and a half years is an extraordinarily long phase I which leads me to suspect that the eventual bull market will be massive. With the recent 3 month long secondary reaction now apparently over the gold stocks are now poised to transition into phase II.

Phase II

Phase II is known as the mark-up phase. Over time advancing price action attracts the publics attention and they become drawn to the market. As the market goes higher the fundamental reasons for the move gradually become evident by the public. Activity and price action begin to feed on themselves. Back in phase I the public was totally unaware that the sector had bottomed, whereas now in phase II they begin clamoring to get in.

At some point, usually about one third of the way into phase II the market reaches a point of recognition (POR). This is where the public collectively realizes that it is a real bull market. Prices surge upward as investors chase stocks with a fear of missing out. Once this surge is over it is typical to have a hard secondary reaction to shake out all the Johnny come late-lies .

Things are shaping up nicely for the gold bull.

Recently I have emphasized that the gold bull market is the opposite side of the coin of the general stock market. Judging by Plunger’s end of bull market exit indicator the END IS NIGH. This week it finally triggered a sell signal:

One can see the history here: when the 2/20yr spread traced out a horizontal triangle at the top of the last 2 bull markets then broke down it signaled the top of the bull market. This week the market finally triggered an exit. Mr. Market did everyone a favor and put on a violent short squeeze for anyone who saw this and decided to take action and sell.

Let’s zoom in on today’s topping triangle:

This appears to be setting up Phase II of the gold bull market.

7 Stocks to hold for the bull market in gold

Knights I leave you with this: 7 stocks I plan on holding for the next 5 years. These stocks form the center of the core of my PM portfolio. They won’t be the highest performers, but they are solid and have enough embedded exploration potential to offer discovery upside. Go ahead and own some juniors at some point, but these stocks should put one in good stead for the next 5 years. This core group includes gold, silver, platinum and palladium and offers liquidity. Hold them for yourself, then in 5 years think about selling them to your neighbor who watches CNBC and hates gold today.

Kirkland Lake (KL)

I am ashamed to admit that I have been late to this party. Don’t ask me why, I just never bought it. I suppose I committed one of the most amateur mistakes there is. I was afraid to buy it because it had gone up so much. Recently however, I confronted myself and recognized my mistake. During the gentleman’s entry I took the opportunity to back up the truck on KL. If you are not aware of the story behind KL I suggest you sit up and pay attention. Despite going from $2 to $38 since the gold bull began in 2016 this stock has much further to go over the next 5 years. In fact it is wildly exciting what lies ahead as what we have here is the unveiling of the next major large cap producer.

Kirkland consists of two major assets. Fosterville in Australia and Macassa in Canada. The grade on these two mines is simply stunning. While the average gold mine may mine 1.5gm ore Kirkland mines 30gm+ ore. The huge move one sees in the stock over the past 4 years is due to the development of the Fosterville mine. Some say Fosterville is the next Red Lake… high grade & district scale. Fosterville has wowed the world with 30 gm high grade production. Not only that, but its cost per ounce has been steadily dropping to $330/oz. Production has zoomed from 140,000 oz to 600,000 oz due to grade and it has the potential to run to 1.0 million oz/yr. This is all so bullish and it’s not all priced in. But here is the kicker… its project in Canada, Macassa appears to be another Fosterville in the making and it’s not priced in! The numbers coming out of Macassa are simply stunning. The drill results from the new amalgamated break will floor you. 8 holes of 2.5m 162gm… 15 holes 2.4m 89 gm. Bottom line they could be 1-2 years from producing a 90gm deposit! The last amalgamated break near Macassa resulted in a 25 mil oz discovery, and this new one appears to be 2-3 times the grade!

Grade is King

It’s still early days with Macassa and much needs to be proven, but the grade is unheard of. Production has the potential of matching Fosterville. Over the next few years Kirkland could advance into a 1.5-2.0m Oz/yr producer with costs continuing to decline to sub $300/oz. This would all put Kirkland in a class of its own, but just think what would happen if the gold price started to advance and capture the publics attention. All I can say is Wow!

Below is the daily chart showing the recent break out. If the price backtests the break out line to $35-36 consider it an opportunity.

Because Kirkland has advanced so far already it won’t be one of the biggest percentage performers from this level, but it’s a must hold position IMHO. They presently make $1.37/share earnings. By 2022 they have guided to $4.76/share. None of this includes the bonanza grades of Macassa or the price of gold going up. Think of the possibilities! I now own it with an average cost of $31. I plan on holding for the duration. My expected return: 5 bagger. (minimum)

The Royalties- SAND, OR, WPM

I am including three royalties in the 7-core group. That’s almost half of the group. Why? Because I consider them no-brainer holds for the bull market. Don’t think of the royalties as mining companies, instead think of them as finance companies. They are financially efficient akin to an insurance company. They strip out operating risk and are not capital or labor intensive. Plus they have incredible leverage imbedded in them to the gold price. They essentially mitigate the main risks that mining companies possess.

To show just how efficient the royalties can be consider Franco Nevada. This 14 Billion dollar market cap company has less than 30 employees. How incredible is that! They have no caterpillar tractors gulping diesel fuel and have a cost of capital much lower than an operating company. I am not including the two senior royalties (FNV & RGLD) as it’s my belief the 3 up and comers I am listing offer more upside.

Sandstorm- SAND

Sandstorm is the largest holding in my portfolio. Noland Watsen is focused on building this company into a juggernaught. He has attached himself from the hip to the future success of this company. The majority of his personal net worth is held in SAND stock. If the company does nothing from here within 3 years its production will triple. It’s stated cash flow does not include royalty projects that are not economic at today’s gold prices. If gold were to advance to over $1,500/oz these projects come alive and the leverage explodes upward.

Below is the weekly chart. Frankly I see it as a Chartology masterpiece. Breakout from a 3 year channel, followed by a 3-month bull flag backtest to the channel. The bull flag recently was itself broken out from and now the flag is being backtested as well. The chart seems to be saying…all aboard… last chance for the upcoming ride.

The daily chart shows the backtesting of the bull flag. 5.3 would seem to be the perfect entry, if one is not already in.

My 5-year expectations for Sandstorm? 5-7 bagger.

Osisko (OR)

Osisko is a bit of a different animal. It comes with what its CEO Sean Rosen calls the accelerator model, which is essentially their exploration arm. Rosen is likely the most connected knowledgable operator in the industry. Force of nature comes to mind. There are a lot of moving parts to Osisko as the company owns shares in a lot of various companies with exploration potential. It owns shares in Osisko mining, and many others. Plus it owns probably the best royalty in the world on the Canadian Malartic mine. A 5% royalty on the 10th largest mine in the world which produces 700,000 oz/yr. This is a world class tier one royalty. Most royalties are typically 2-3%, but Osisko owns a 5% royalty on one of the best mines in the world and it is in North America. This is a core asset, but the Eleonore royalty is what offers huge upside. That’s because it is a new open ended mine plus it has rights to all future discovery. Goldcorp is now just starting to lower their sights on exploration in this area.

The weekly chart below may not seem too exciting, but keep in mind Osisko is the new kid on the block. It is relatively unknown. It has been coiling energy and did I mention it pays a near 2% dividend.

The daily shows it is presently in consolidation back test mode. I already own a ton of it, but if it gets down to $10 I will buy even more.

5-Year expectations- 5 bagger (with a dividend)

Wheaten Precious Metals (WPM)

This royalty has been a laggard. Chiefly because it has been in transition from a silver royalty to a diversified gold/silver/platinum/palladium royalty. The company was knee capped for years by the money grubbing politicians of the Canadian CRA. WPM had a strong legal case so they went nose to nose with the CRA. WPM won the case which caused the big gap in the chart. Nice to see the little guy win out over the central authorities every once in a while. So WPM is playing catch-up and it’s not too late. It has been a bit of a laggard since it is still very silver orientated and silver has been a dog. But keep in mind that once a PM bull market gets going silver comes on strong.

The weekly shows how stretched to the downside WPM got. Now it looks ready to rock.

WPM trades much like the silver stocks… it’s very whippy. Maybe a gap fill just above 21 would offer a last chance opportunity. (but I wouldn’t count on it)

I continue to buy WPM when new funds come in. I got real lucky on this one as I bought 10,000 shares in the $15 range right when I made my bottom call last November. No, I didn’t know the tax agreement was imminent, I just smelled bombed out value no matter who won the tax battle. I continue to aggressively buy this stock.

5-Year expectations- 5+ bagger

Sprott Inc. (SII.to)

Who made the most money in the California gold rush? The pick and shovel suppliers did that’s who! That’s the concept of owning Sprott Inc. They are the go-to brokerage firm in the resource industry. They are in the center of the deal flow and have spent the past 10 years positioning themselves for when the good times return. They have a huge ability to expand their market cap. Newsletter writer Dan Ferris considers Sprott his number one buy and hold and he is not even a resource/mining guy.

Think of it this way: Sprott has a market cap of $738m (yea, that’s less than a billion) and Ferris expects them to free cash flow $1.5 Billion at the top of the cycle (perhaps 2025). Plus they have no debt, what major brokerage firm do you know with no debt?

If you follow my stuff, I presented Sprott on a silver platter to the membership. Before Ferris or Doug Casey recommended Sprott to their readership you heard about it here first with a convincing chart attached. I took a major position right off the lows and traded it once after the Casey recommendation. I got back in with the gap fill back in late November. This has been a major trading success story and testimate to Chartology trading.

Below we see a monthly chart. I hope you can see the potential here that this chart is screaming at you. Such a huge massive base and it’s doing all the right things on its own time schedule. Don’t try to tell this stock what to do, just attach yourself to it and go along for the ride.

My expectations for Sprott over the next 5 years are aggressive: 10-20 bagger potential.

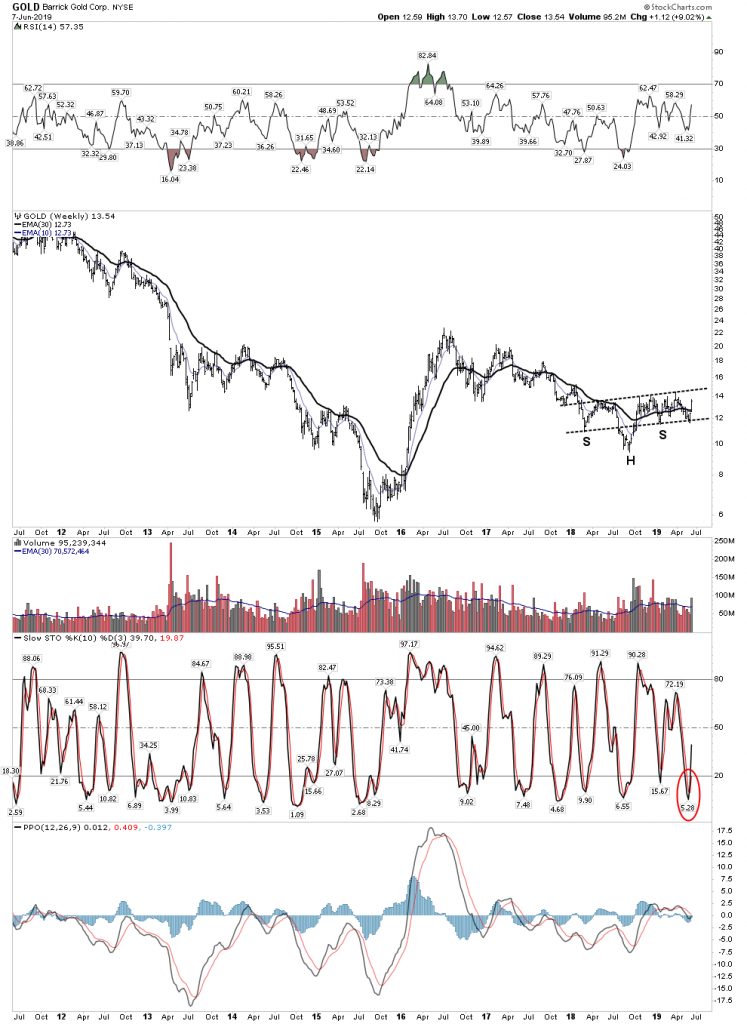

Barrick (GOLD)

This may surprise you that I chose Barrick as a core holding. Seems stodgy and run by empty suits, right? Well hear me out. Barrick is becoming an entrepreneurial company which holds more tier one gold mines than any other company in the world. It’s not going to be the bloated big-cap company of the past, Mark Bristow the new CEO will make sure of that. He came from Randgold Resources which was known for its entrepreneurial vision and mining development skills.

What investors don’t yet see is that gold will become something special in the next bull market. So special that nations will seek it at all cost. Why? Because gold is and has always been real money. When Nixon reneged on the US backing of the USD with gold he said it was “temporary”. Well, he will be proven to be right as serious currencies will once again require some form of a gold backing. When this occurs the assets owned by Barrick will be considered a national treasure.

Institutional capital will pour into companies such as Barrick and Newmont. Pension funds will hold Barrick stock as well as the average mutual fund. But here is the thing, Barrick is still dirt cheap. It still suffers from the sins of its past, but times will change and it is not too late to buy a tier one asset at a bargain price.

The below weekly chart of Barrick shows how devastated this stock was by the bear market. The senior big-cap stock of the sector was taken down 90% from its bull market highs. This process purged its excesses of the past. Debt was expunged and management sent packing.

The daily chart below shows the right shoulder of its massive H&S bottom of the past 2 years.

Expectations: 8 Bagger.

I could have picked several decent candidates for a big-cap gold stock to hold for the next 5 years. Runner ups would be NEM, AEM, AU, but Barrick is the most under appreciated and under priced.

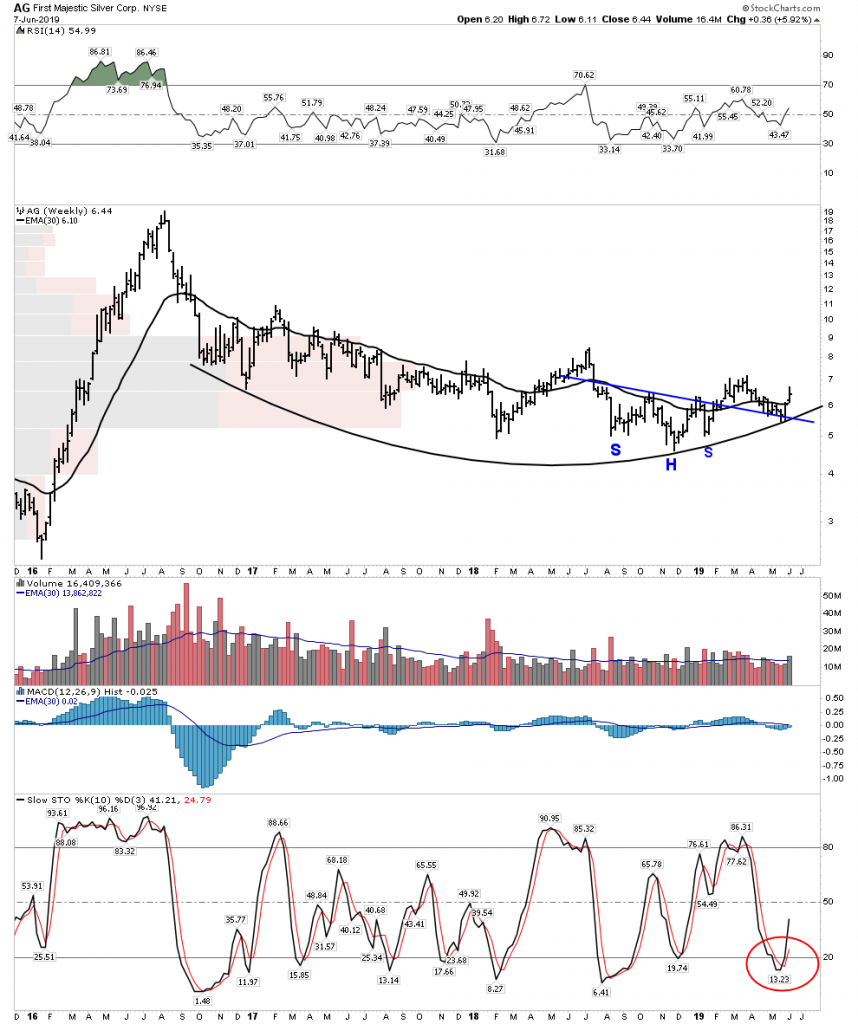

First Majestic (AG)

AG might surprise you as it’s not an obvious standout. I wanted to pick a silver focused stock because once silver gets going one wants to have the exposure of a pure silver stock. WPM will represent you well, but a pure silver stock is a must have. AG does not have the best assets. They don’t have the highest grade. But Kieth Niemeyer has been a surviver and he has consolidated multiple mines in Mexico and made them work. He is positioned for the big move ahead. MAG may be a more obvious choice since it is a clean high grade mine with no warts that virtually can’t fail, but it could be bought by Fresnillo tomorrow and the best you would do is double your money.

The stock of AG seems to tell the story. It has been through a brutal bear market and has suffered along with everyone else yet it’s building out a powerful bottom. It has further to go in building it out, but eventually it is going to break out. Silver comes on strong in the second half of PM bull markets, so I would wait until it fills it’s gap on the daily chart around 5.8 before buying. But with a gold/silver ratio of 90, which is the highest in 25 years, silver offers great value.

Once silver breaks to the upside this stock will fly as it has huge leverage to price.

Expectations: 10 Bagger.

Knights I leave you all with this: Success requires patience, but one must be aggressive when it is time.

We have had 8 days in a row with gold going up. It needs to take a break. It doesn’t have to make its move and break out now. We are not going to tell the market what to do, instead we are going to give it time. If you know you are in a bull market and you get caught in a drawdown that’s ok, you will be alright if you bought quality. If you can just be patient and align yourself with the primary trend it will change your life.

Be Right-Sit Tight.

Plunger is resident market Historian at Rambus1.com