( Subscriber note: I was asked to step in on short notice due to a power outage at the Rambus house)

Post Bubble Contraction (PBC) What is it?

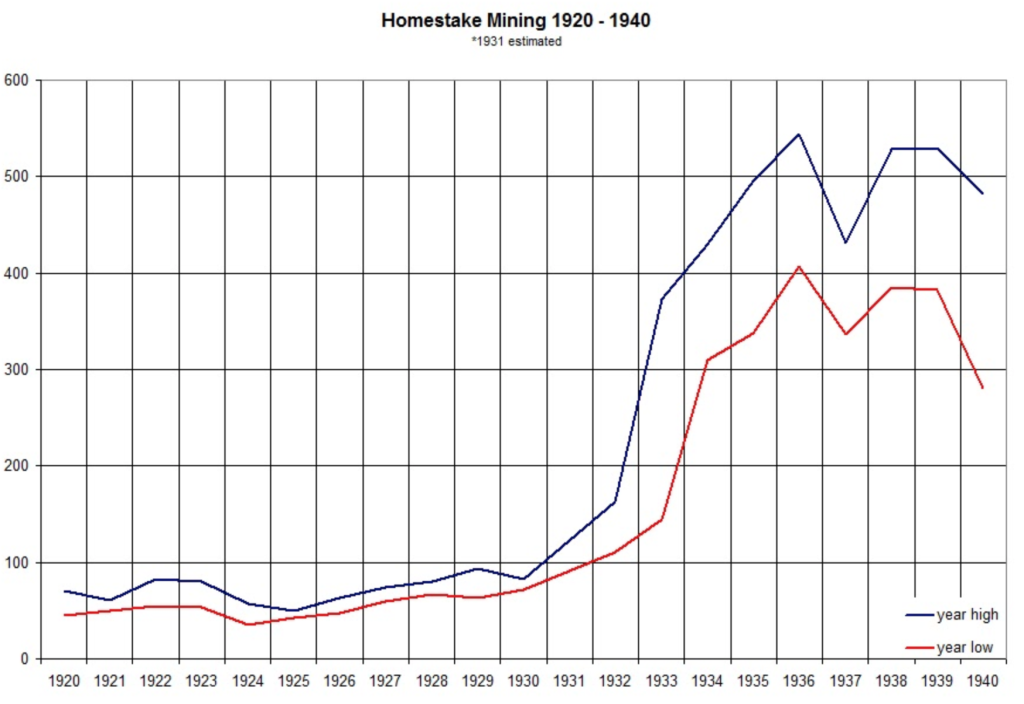

it’s just what it sounds like. After a financial bubble deflates an economy contracts and credit gets reigned in. A recession or something worse unfolds. Most stocks go down, however it is the best of all worlds for gold stocks. There have been multiple bull markets in gold stocks over the past 120 years, however there has only been one which was fueled by a PBC. This of course occurred in the 1930’s and was a rip roaring uptrend in the midst of the general decline of stocks where the DOW lost 89%.

The great bull market in gold stocks of the 1970’s was actually not a PBC market. It was fueled by the end of Bretten Woods 1 and the massive money printing of the past 40 years. The 2001-2011 bull market was actually a continuation of the the 70’s bull after consolidating those 70’s gains for 20 years and it too was not a PBC bull market.

I began learning about a PBC gold market about 20 years ago from Bob Hoye. Incidentally he still interviews on Howestreet and is reportedly older than Moses himself. PBC gold bull markets only come around once or maybe twice a century, they are pretty rare, yet they are nirvana for the PM mining stocks, because of the unique impact on a companies P/L sheet.

It’s all about profit margin. (Plus a little fear doesn’t hurt)

There is so much misinformed trash about gold stocks on the internet and youtube. One often sees someone posting charts claiming record underperformance of gold stocks to gold. This comparison is worthless. It is all about production margins, it is not about the gold price. This is why a PBC bull is so outstanding. It is because input costs actually go down while the end product gold goes up. This results in a surging increase in profit margin. In fact gold doesn’t even have to go up as long as its real price goes up.

Now you might be thinking, what a minute, input costs have been going up that’s why gold stocks have been such dogs even though gold has steadily risen for the past few years. Well, you’re right, that is up until now. You also may think that input costs are going to just keep going up, after all everybody knows that! If you think that then here is where you are wrong already. Input costs are leveling off and beginning to go down.

Look at oil. Realize that oil is down 41% from its peak over two years ago. If the world enters into a recession, it’s pretty easy to see lower prices ahead. The price of explosives is now down significantly which is a major input cost. Typically any recession would also moderate labor costs as well. None of this happened in the last gold bull market because it wasn’t a PBC bull market, yet the HUI still went up 17X.

Oil trending down (call it a bear market?)

Homestake in the last PBC bull market

The Macro Case

This article doesn’t allow the space to lay out the case in full that the economy is headed towards a contraction so I will just state that one should be able to see all the elements to a PBC lining up. Economy reaching peak debt, stock market bubble in the final stages with gold and silver starting to trend higher. The conditions are all set and I believe the bond market is in a bottoming phase and ready to run higher in a counter trend move for up to a year.

I am not forecasting a deep recession, although I see the possibility of it occurring. The malinvestments in the economy are so great caused by fraudulently low interest rates over the past 15 years that a deep contraction will be needed to cleanse the system. This clean out could still be put off for another cycle perhaps. What I am saying is that a PBC style bull market is in the cards even if it lasts only 2-3 years.

PBC Gold Stock Strategy

Another way to phrase this is “How to move into a different economic class within 3 years” If I play this one right I think that’s exactly what’s going to happen. I don’t think people realize what’s about to happen in these stocks. I don’t even think gold bugs realize it.

Mid-Tier gold producers are set-up to have 5-10 bagger runs over the next 2-3 years. That is where I have focused my firepower, in the middle. Except for a few exceptions I am not even going to worry about the juniors. I don’t need them to achieve my goals and don’t even want to try to sort out the lifestyle companies which most of them are. The mid-tier producers are in the sweet spot with reduced risk and low cap starting points. My strategy is to limit my number of holdings to only quality high potential companies who are able to expand production and lower costs. I will employ a judicious use of margin ONLY after corrections and the uptrend has resumed. Margin gets taken off after the move matures.

The Right Mindset

Gold investors have been so battered over the past 13 years that most do not have the right mindset to be successful in this bull market. I see it everyday in the emails I receive from friend’s and the nervous comments in all the forums. Frankly, gold investors simply can’t stand to make money they are so afraid. Remember scared money doesn’t make money. You’ve got to change your mindset, one has to be able to embrace the bull market. I suggest one read or revisit chapter 5 in “Reminiscences of a stock market operator”. That’s a good place to start.

Also I will recap a story that I heard Stanley Druckenmiller tell. He tells the tale of his first promotion in a stock investing firm. He was a very young man of 26 right at the start of the great bull market in 1982. He got promoted over everyone senior and more experienced than him to run the shop. These were men who ran portfolios all through the 1970’s with a lot of experience. When his boss promoted him he asked him why do you think you got this promotion? Stanley replied, well I figure I worked hard and did a good job.

His boss snapped back and said Wrong! I promoted you over all others for the same reason 19 year old men make good soldiers. You are too stupid to fear anything!

What his boss knew was that the market was entering into a new secular bull phase and the senior managers were too scarred to be able embrace a bull market. They had learned to sell when a market neared previous highs. It is how they kept their jobs. They would not be able to adopt a new mindset. That is to envision a market that once it reached its old highs would then break out and run to levels previously deemed inconceivable.

This old mindset is present in most gold investors today even though they watch youtube videos clickbaiting silver to the moon.

Mid Tier Growth Prospects

I am not offering any recommendations to invest in, but I will mention Westdome as an example of the type of company I am referring to. These mid-tier producers IMO offer the best balance between risk and upside return within a 2 year framework to invest in.

Westdome captures the theme of increasing production while significantly lowering their costs. Plus they have been somewhat off the radar and sports a still reasonable $1.2b market cap. Here are some numbers for their turned around Kiena mine:

For 2024 gold grade to go from 7.7 to 14 gpt.

AISC to drop from $2.100 to $1,100 That’s a massive drop.

Production growth in 2024 is projected to be up 139% over 2023

This is a huge turn around for this company and should unfold inside of 18 months. If one then applies the PBC model to it and if gold could run to $3,500-$4,500 over the next 2 years these type companies could become 5-10 baggers.

WDOFF

Again, I am not recommending Westdome for anyone as I don’t know your investment objectives, but there are several of these type set-ups out there, just do a little digging.

Silver Stocks- An even Bigger Potential

Silver is a very misunderstood market. Most people like to think of silver as golds little brother. Or the caboose behind gold. Cute but incorrect.Silver is an entirely different ballgame. In fact I feel it has little in resemblance to gold. Because of this the risk dynamic of silver is in another universe than gold.You want risk then hitch yourself to silver. Again we don’t have the space to explore why this is, I will just say the structure of the market is so completely different than gold. Above ground supply for silver is minuscule, whereas gold is huge. Short interest is a large percentage of supplies or production whereas not so with gold. This gives it the huge volatility that it has and the moonshot runs it has in the end game.

Therefore I caution everyone to limit your silver positions and do not take on margin. The volatility in this bull market is going to take your breath away because for the first time silver is actually in shortage and when that shortage hits industry I have no doubt the government will intervene. Perhaps by freezing the physical ETFs and liquidating them. This shouldn’t occur until perhaps the $75 level, but once that is achieved it’s going to be a wild ride. Because of the unique structure of the silver market it has the potential to drive the stocks crazy up and down.

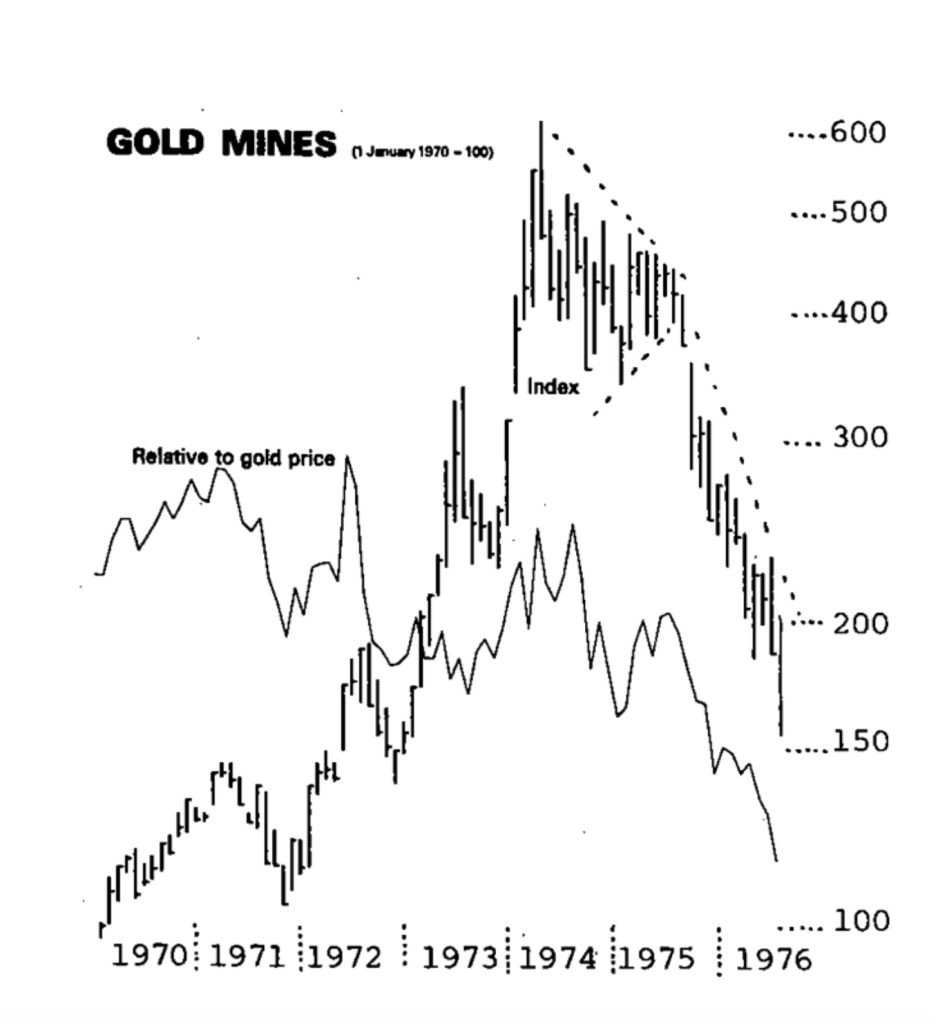

1970’s First half Bull Market

I will leave you with a chart that I believe is a good analog as to what lies ahead for the gold stock PBC bull market. This is a chart of the South Africa Johannesburg gold mine index. I regard it as an analog because back then it was the South African stocks that received institutional ownership. I believe that the large cap North American companies will enjoy similar returns since institutional money will begin flowing into these companies after 2 bang out earnings quarters and the S&P 500 rolls over. I expect this point to occur by the end of 2024.

I would place ourselves presently in the early part of 1972 on this analog chart. Just look at the performance over the next 24 months from early 1972.

Good Luck

Plunger