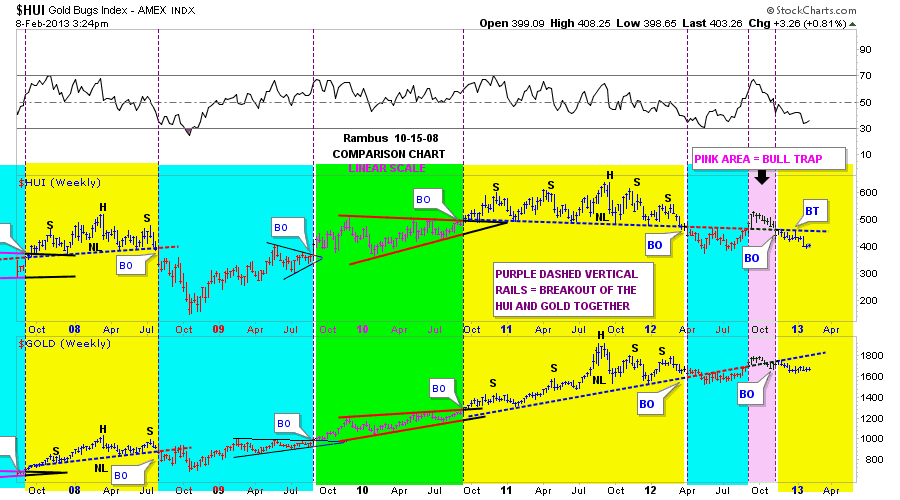

Below is a combo chart I use to track the HUI and gold as they build out their consolidation patterns. As you can see they generally form the same type of consolidation patterns that breakout at the sametime. Even though gold has performed much stronger than the HUI they still tend to build out the same type of consolidation patterns. Note the two H&S top patterns that formed in 2011, yellow shaded area. They both broke below their respective necklines about the same time, blue shaded area. As you can see they both then broke back above their necklines for a short period of time that looked like the original H&S tops were invalidated. The pink shaded area shows what I now call a bull trap. That little move above the necklines sucked in alot of bulls at the time including me. But once the price action broke below the necklines again the trap was set. Those that have held on hoping for a significant rally are getting further and further in the hole. As you can see on the HUI chart on top, it had one last backtest from below that told us that neckline was still HOT and in play. The price action has been drifting slowly down from that last backtest. If the HUI and gold can ever trade back above those necklines that would be a very bullish setup but until then caution is warranted.

FREE TRIAL

http://rambus1.com/?page_id=10

More at