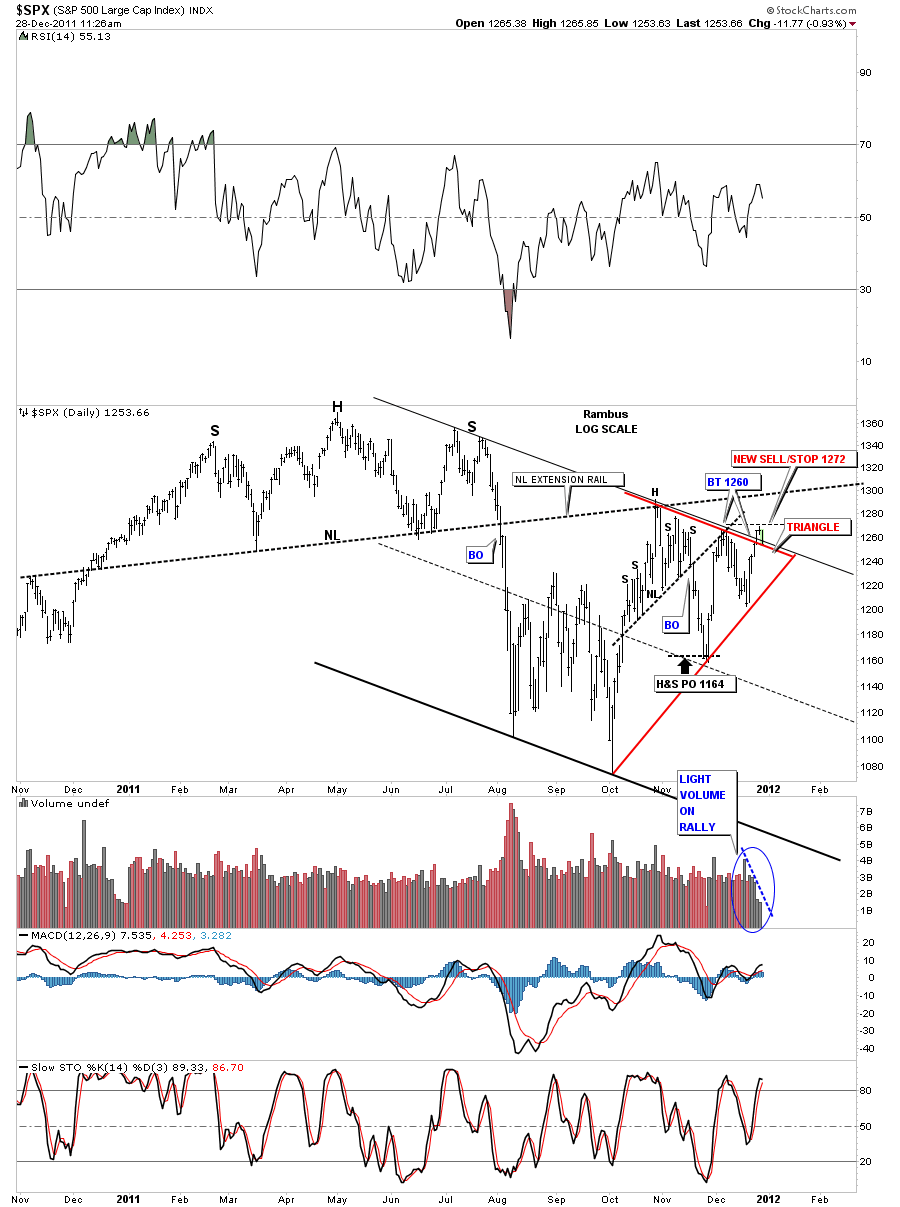

Yesterday we got to within 2.63 points of hitting the sell/stop that I showed last week. We are still at a very critical area right here. We need to see the SPX close back below the downtrend rail and back into the triangle. The whole rally of the last 6 days or so has been on diminishing volume and that is why I called into question the breakout. Remember we are using the S&P 500 as a proxy for the other stocks that are listed on the sidebar. Just in case you missed it, yesterday we added UUP to the model portfolio which is long the dollar.

S&P 500 daily sell/stop at 1272.