This week the Japanese Yen backtested neckline #2 of a possible triple H&S bottom at the 94 area. Below is a weekly line chart which shows the price action closed right on the neckline. To say this weeks backtest was critical is an understatement. How the yen goes so does gold for the most part.

Below is the exact same chart as the one above except it’s a bar chart that shows the subtle differences. The reason this backtest is so important, is because if neckline #2 holds support then the low for the third right shoulder will have formed. Reverse symmetry suggests we could see a ping pong move between neckline #2 and neckline #3 as shown by the black arrows, before we see a resolution to this 2 1/2 year pattern. The yen has made a series of higher highs and higher lows since the head was put in place a year ago.

This next long term weekly chart shows a pretty symmetrical H&S bottom as shown by the neckline symmetry line which shows the low for the left and right shoulders. The backtest this week was a little sloppy but so far the neckline is holding support.

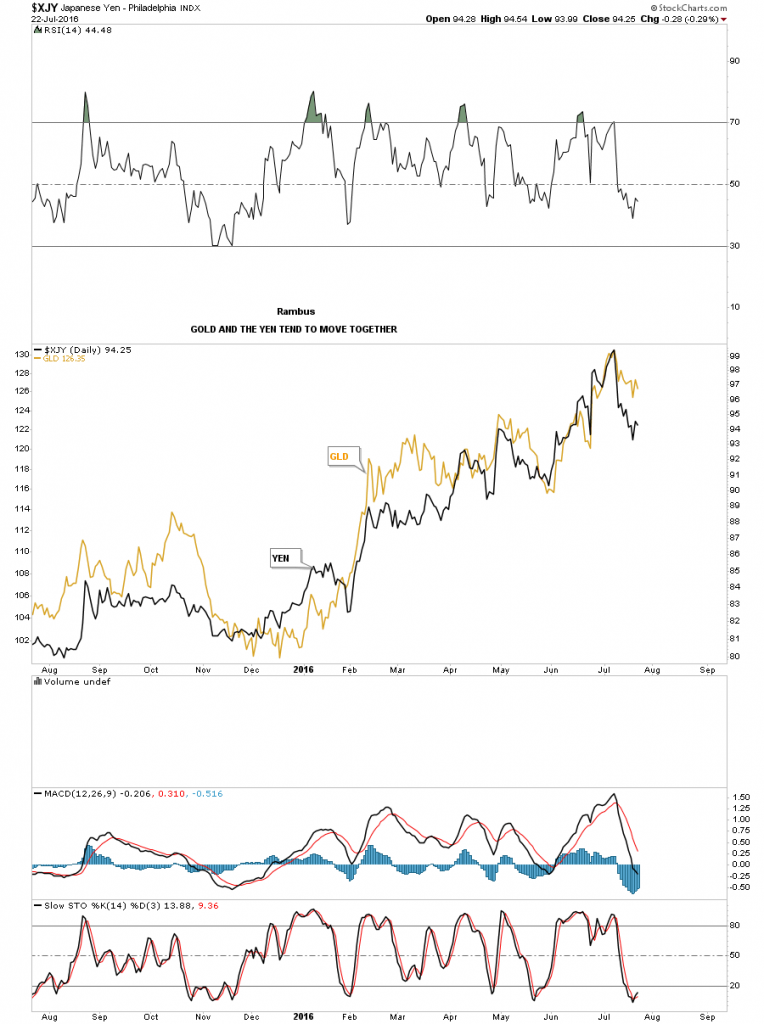

This next chart I overlaid gold on top of the daily line chart for the yen which shows why this currency is so important for gold. Sometimes one can be a bit stronger or weaker than the other but they tend to move together so you can see why the 94 area on the charts above is so important. If the backtest to the neckline holds support then there is a good chance that gold will also be finding support. It looks like next week is shaping up to be another very important week in the precious metals complex. Have a great weekend. All the best…Rambus