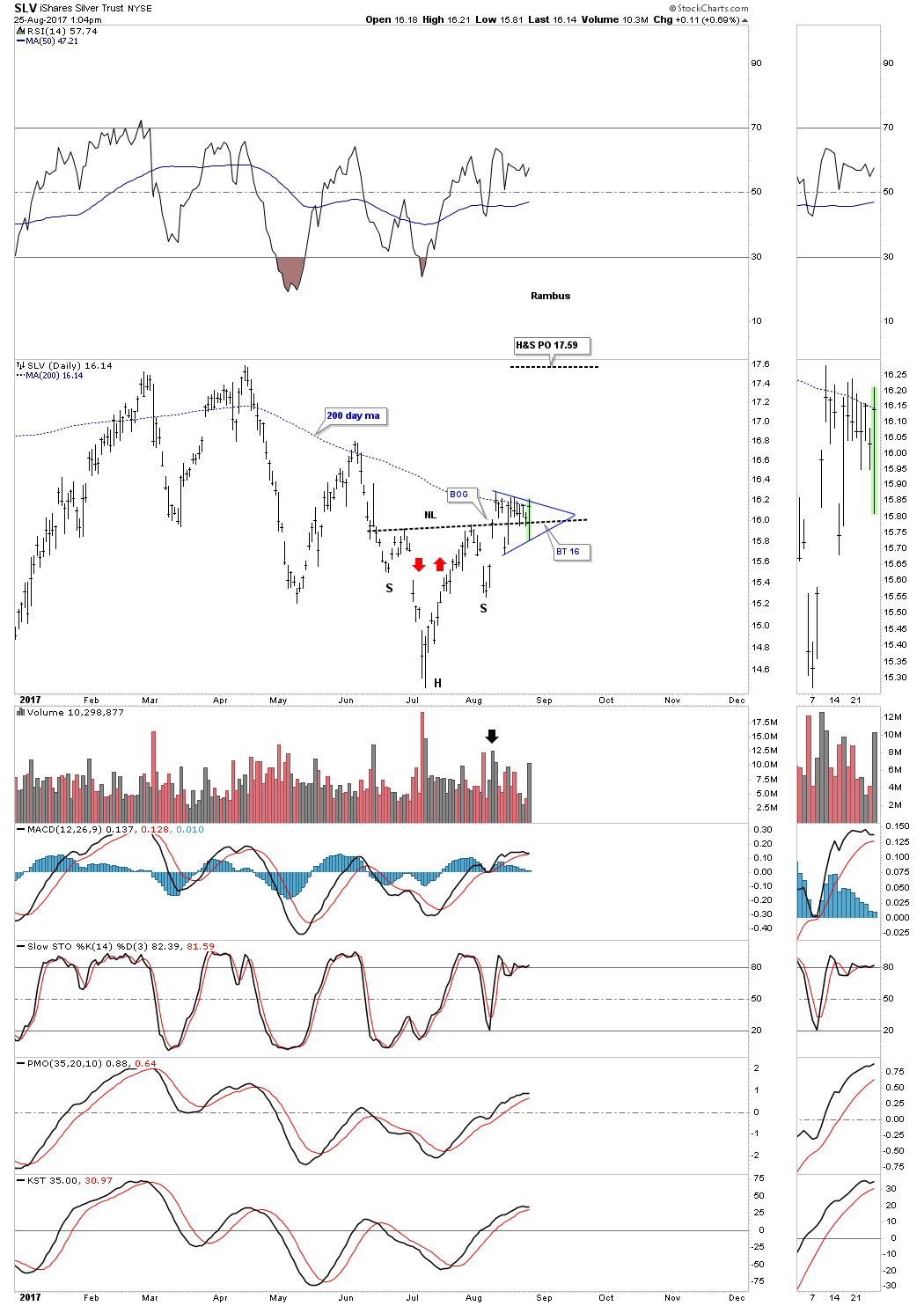

This first chart for SLV is a daily chart which shows the original H&S bottom with a breakout gap and then a strong backtest. I have shown you in the past that it can be a bullish setup when you see a small consolidation pattern form just below, just above or right on an important trend line, in this case the neckline. With today’s spike down and subsequent rally SLV could be forming a small triangle right on the neckline with the price action overlapping on both sides of the neckline. The 200 day ma is still holding resistance at the top of the potential blue triangle. The volume looks like it’s expanding today which would help for a bullish setup.

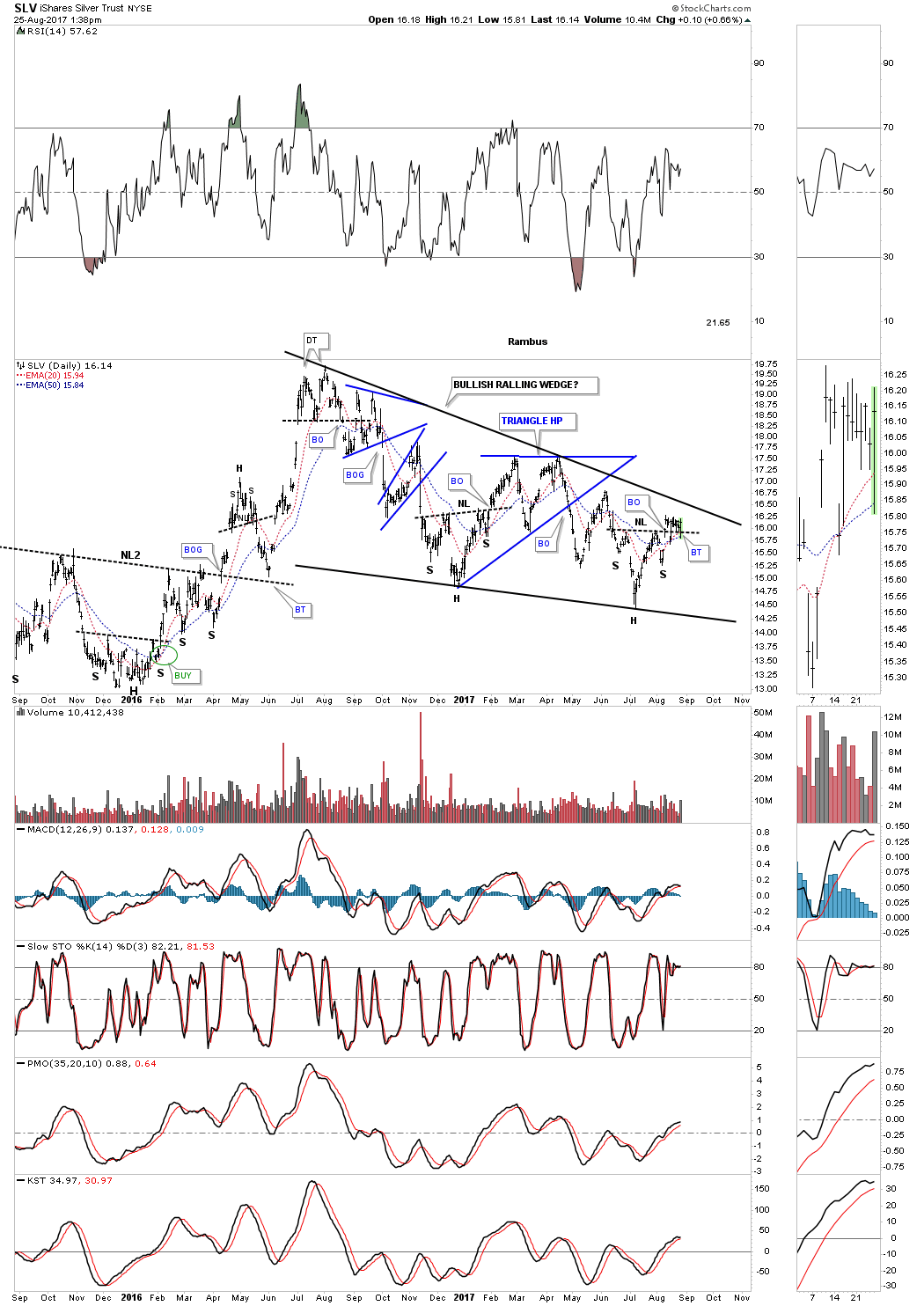

Below is a 2 year daily chart for SLV which is showing a potential one year bullish falling wedge building out with the H&S bottom we just looked at on the daily chart above forming at the 4th reversal point. If our current H&S bottom plays out it will ensure a breakout of the top rail of the bullish falling wedge. The 20 day ema has crossed above the 50 day ema which is giving a buy signal.

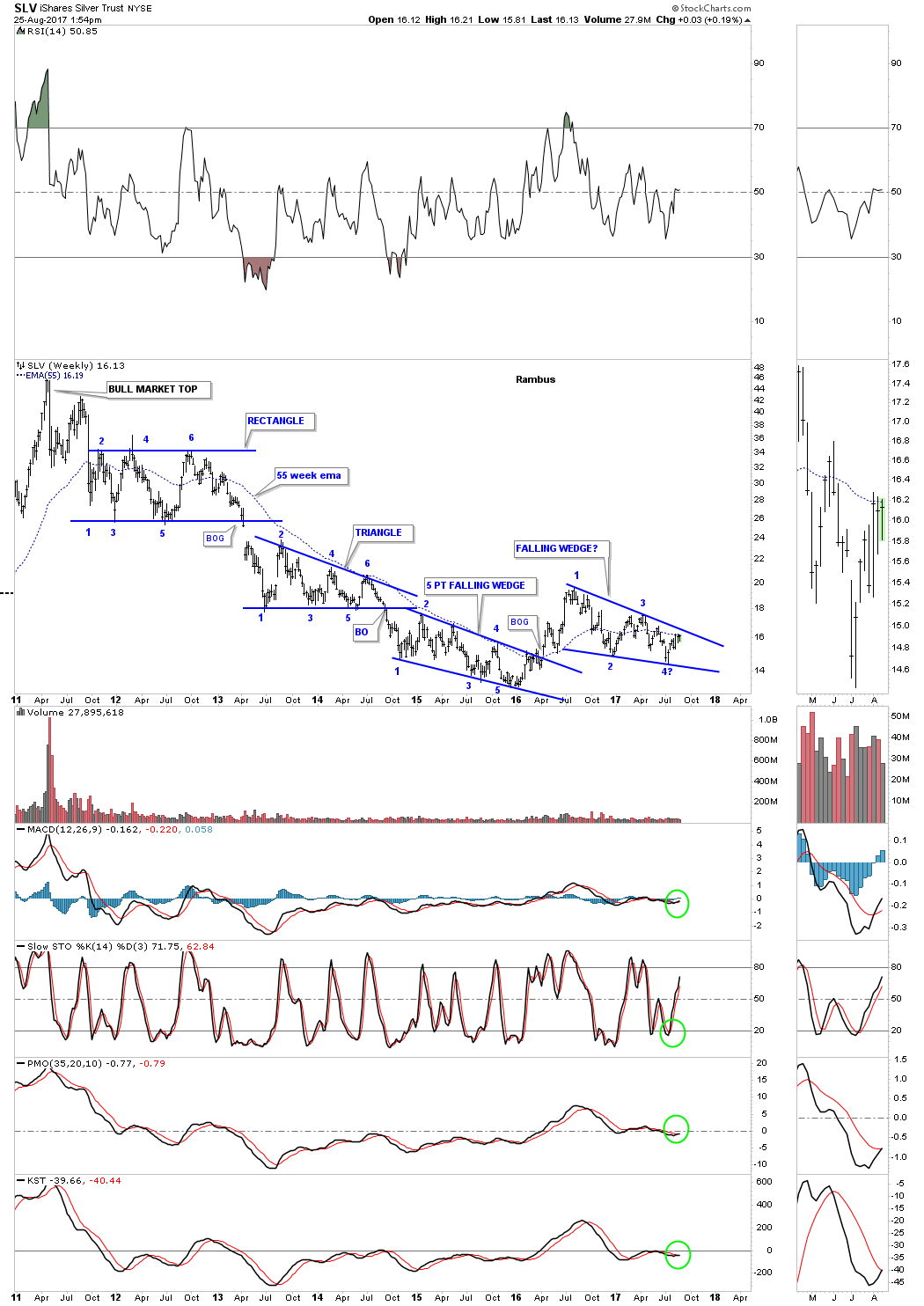

The long term weekly chart below shows how the potential bullish falling wedge fits into the big picture. Because it’s forming above the 2016 low it only needs 4 reversal points to be a consolidation pattern to the upside. Note the previous falling wedge had 5 reversal points that may have reversed the bear market. When one looks at this chart you can see why the bear market has been so painful. Most of the time some type of consolidation pattern was building out. If our current falling wedge breaks out to the upside you can begin to see a large rounding bottom forming starting all the way back at the April 2013 low.

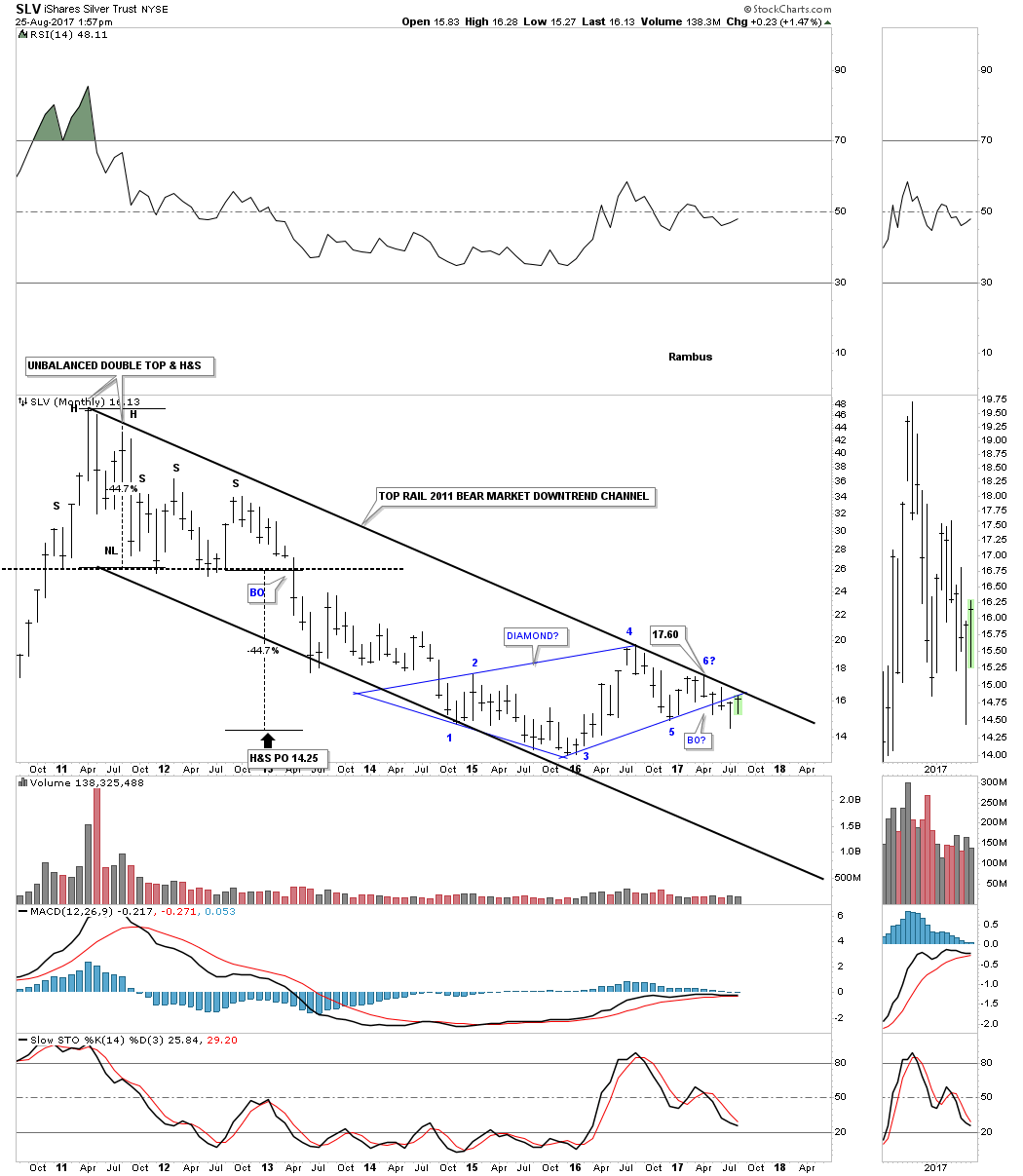

This last chart for SLV shows the last major hurdle that stands in the way of a possible new bull market. Putting all the pieces of the puzzle together if the bullish falling wedge, we looked at on the charts above plays out, then the top rail of the 2011 bear market downtrend channel will be broken to the upside. We can’t have one without the other.