This week the FED backtracked on future rate hikes and any further shrinking of its balance sheet. They tacitly endorsed permanent monetizing of government debt, the gold sector took notice and gapped higher on Friday. It is simply amazing how rapid the Powell FED has gone from tough guy to stock market pansy boy, ruled by the stock market’s demands.

Free market economists have stated for decades that once interest rates reach the zero bound, you can’t get off. They have now been proven right. Alan Greenspan corrupted the markets and addicted them to easy money. Bernanke was a naive intellectual who enabled the market to go from being a light abuser to becoming a hard core easy money addict. Janet Yellen was simply a pathetic dealer who supplied easy money to the market while whispering platitudes that the market would soon be weened off of easy money and all would be well. Enter Jay Powell with good intentions to normalize rates and the FED’s balance sheet. He had a plan to ween the market off of easy money, but as Mike Tyson says: “Everyone has a plan until you get hit in the face”. After the first punch was thrown and the market dropped 19% the plan went out the window. We can now see that Jay is just another pansy boy unable to stand up to the markets insatiable need for easy money. Where is Paul Volcker when we really need him?

This entire process of credit expansion followed by an attempt to get off the zero bound has taken 32 years to get to where we are today, The FED has been attempting its magic trick since 2008 but as of Friday the gold market declared it’s no longer buying it.

The Great Generational Bull Market in Gold is now-Game On!

Gold knows it, we now know it…but the public is always late to the party, so it will be slow going at first, but that just gives us a little more time to position ourselves for what is coming. No Knights it’s not too late to get on board, it’s actually just the beginning.

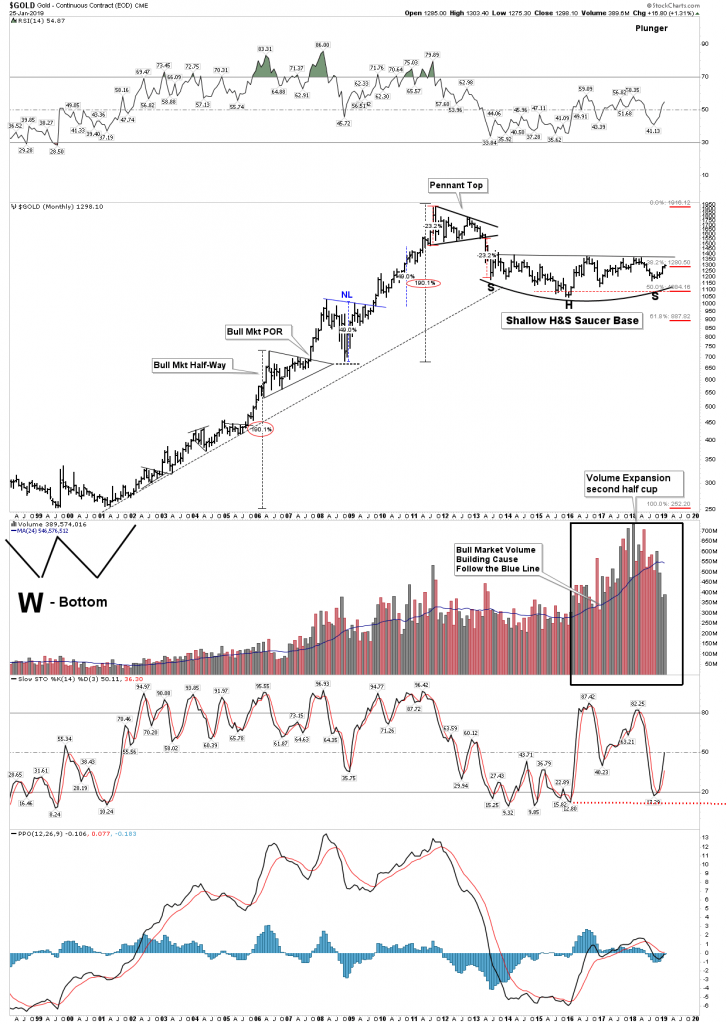

In the chart above we have yet to see a break above the NL of the massive 6-year base, but once it does the public will begin to take notice and the pace should speed up. Gold built out its saucer base during its 50% retracement of the 10 year first leg up of the previous bull market in gold. The rising volume in the second half of the saucer signals it has been building cause and the strength to blast through the NL, likely to happen in the near future. Gold’s surge Friday has the earmarks of the initial launch which occurred in August 1982 when the great secular stock bull market took off. Gold’s liftoff on Friday seemed to say in no uncertain terms that in regards to FED policies “We Won’t Be Fooled Again”.

The collapse of the FED’s plan to raise rates and contract its balance sheet has been rapid. Even though it was destined to fail from the beginning the speed of its demise has been surprising. All it took was a mild Wall Street panic after a 15-20% decline in the stock market. Let’s review what we have just witnessed: A fortress FED announced a detailed rolloff schedule of T-Bonds from its balance sheet in addition to rate hikes up to a level of normalization. This process was declared to be on “AutoPilot” or a set schedule. As recent as October 3rd, Powell stated the FED was a long way from neutral. Then in early December Powell stated the FED’s plan was “not flexible”. Then after the first little dip in the market the FED announced its plan was now data dependent. Three weeks after the dip the FED announced that it is now almost done, with both rate hikes and balance sheet reduction. So the FED has now laid the ground work to abort QT and stop raising rates. It’s real easy to see that QE4 now sits right around the corner after the next market drop.

Wow, that sure didn’t take long and gold isn’t having any part of it.

At this point even Helen Keller can see that the FED is not going to be able to shrink its balance sheet. This has been inevitable from the start and the FED didn’t solve anything through its wanton 10-year monetary parlor trick which only served to pile on thick layers of debt in both the private and public economy. The bubble has now been pricked and yes,… gold gets it!

So let’s review were we are in the gold bull market:

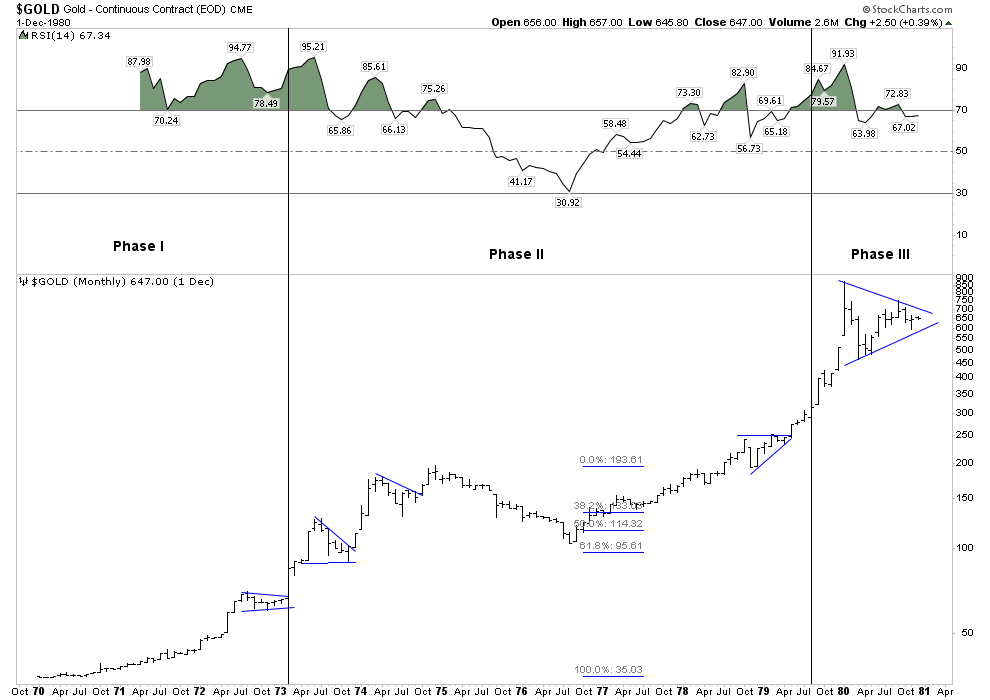

We have covered this ground before, but let’s encapsulate it. The USD became the world’s reserve currency in July 1944 after the Bretton Woods convention. The US actually paid for this privilege by paying off mountains of debt owed by the British. This system ushered in monetary stability over the next 25 years, but the US abused its responsibilities through money printing. Principally, the government fought wars (Vietnam, Cold War) and funded a war on poverty (resulting in more poverty) using not tax collections, but printed money. The US hid this reckless monetary debasement through two measures, it pressured trading partners NOT to exchange their surplus dollars for gold and it conducted gold suppression operations on the London gold exchange between 1961-1968. Ultimately these operations failed leading to Nixon de-linking the USD from gold. This all laid the groundwork for the first major bull market in gold from 1968-1980.

After a 12-year 25X bull market gold needed a rest. So gold took a 21 year rest where it digested its gains through a secular bear market. Meanwhile, the general stock market underwent the first leg up in its 18 year secular bull market from 1982-2000.

The next gold bull market (first chart) lasted 10 years going up by a factor of almost 8X. After topping in 2011 it underwent a 4 year 50% bear market where the major miners declined a brutal 80%. Juniors typically declined around 90% with the weaker issues simply folding. A full blown washout.

Present Bull Market

Gold bottomed in December 2015 with the stocks bottoming a month later in January 2016. The first leg up was a rocket, with the stocks rising 155% over 7 months. Gold investors thought the bull market was on full guns, while the public was totally unaware. It was classic phase I action.

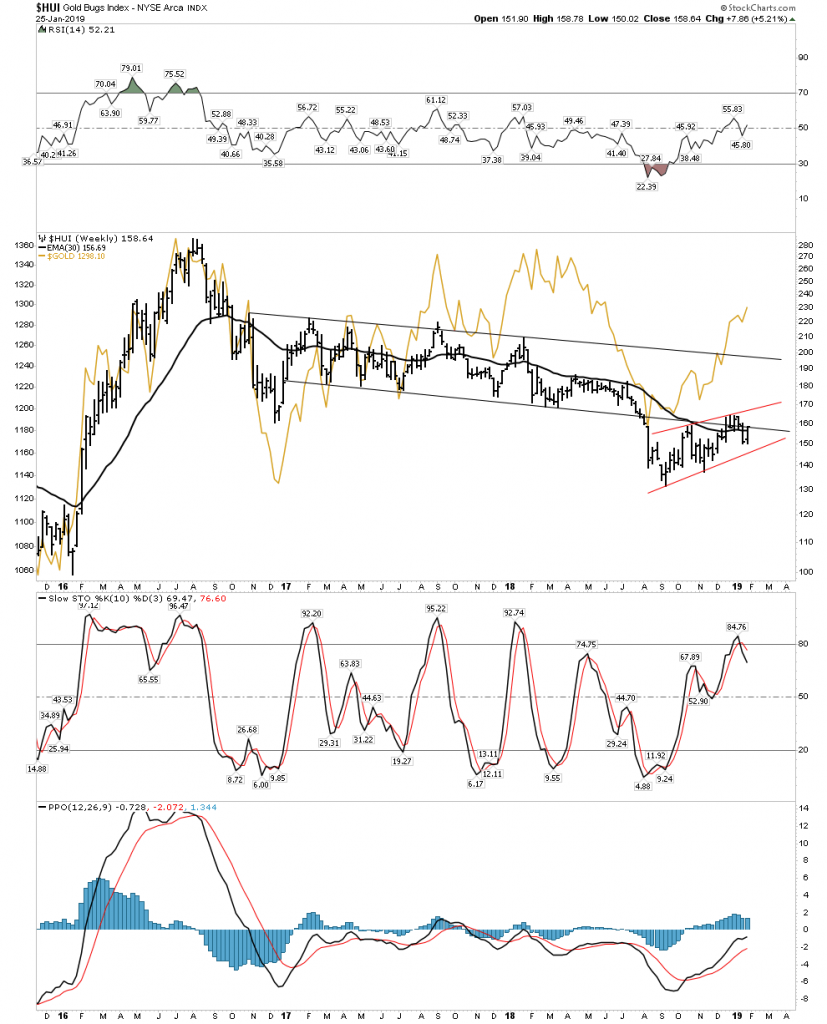

But markets are never easy as the next 25 months was spent digesting the huge gains made in that first leg up. It was a cruel process as the weaker companies and most of the silver stocks gave most of those big gains back. Think of it as the great shake out. It served to allow the market to sift through and separate the wheat from the chaff. It also had the effect of fully demoralizing the faithful. It reached its bottom in September 2018 after 25 months of grinding the last remnant of believers. I can think of no one who remained bullish at that point. The word bull market had virtually been erased from the sector. I had not abandoned it, however I kept it mostly as a formality since the indexes still remained above the 2016 lows, but my conviction had been worn pretty thin.

Above we can see the initial leg up followed by the 25 month slow grind all juxtapositioned with a gold overlay. Today the gold stocks won’t fully be “out of the woods” until they break above the upper channel boundary, but other indicators are all lining up to include the industry fundamentals and investor psychology. Since September price action has been bullish and when the dip in early November failed to follow through to the downside I postulated that we had just witnessed a bottom in the gold market. I mentioned that bottoms come in an atmosphere of black pessimism where virtually ALL EXPERT OPINION was universally bearish. This is exactly what occurred as expert gold opinion was explaining why gold was about to drop further and they were urging subscribers to either sell or hedge to the downside. The GDX responded by putting on a 6 week 19% rally into December.

Above we see the final 2-month annihilation drive from early July to early September which clocked the market 25% to the downside. This finished up the 25 month corrective process and served to clean out any last vestiges of weak hands. By doing this it set the stage for the next advance in the bull market.

Note that since the GDX put in its early January top 3 weeks ago, it has been correcting the 6-week 19% move. Volume trailed off as the pullback reached the 150 EMA. This is healthy bull market action. In the chart above we see where the expression “don’t short a dull market” comes from. In a bull market if you short when volume is waning, expect a stick in the eye and that’s what happened Friday! What we see above is all text book stuff, which is simply more argument that we are in a bull market.

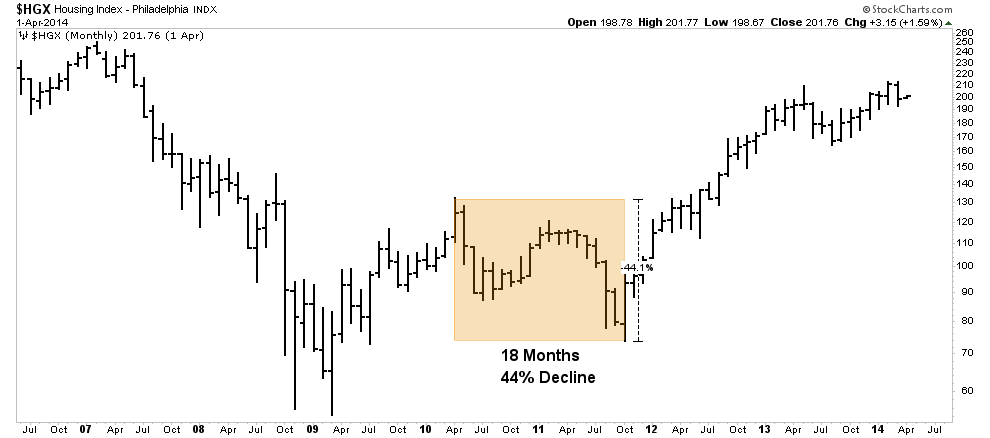

The extended 25 month retest witnessed in the gold sector is very typical of markets coming out of deep bear markets. Below we see an example using the housing sector . After the housing crash the housing index double bottomed with a 6 month retest then went on to digest the grand move over a 31 month period before resuming its uptrend, today’s gold market took 25 months.

The Rehash- Why?

I hope you are starting to see that by reviewing the monetary landscape since Bretton Woods in 1944 the big picture is starting to gel. All of these events are connected as they are all part of the process of a full monetary cycle. We have had 2 major bull markets in gold over the past 50 years and we are now in the early stages of bull market #3. It is my analysis that this one is the final one in the lifecycle of the fiat USD. The USD cannot survive a full credit cycle… that’s obvious. A full cycle would experience interest rates returning to above 10% and with today’s levels of debt the currency simply blows up before that point. So gold will be reflecting all of the events coming down the pike, both deflation and inflation and it will be performing its monetary role of preserving wealth and purchasing power as the fiat USD undergoes fractures and fissures.

Let’s put together what we will likely see. The Balance sheet of the FED has eroded steadily since the New Deal in the 1930’s. It is this balance sheet that backs the money which is in circulation. This reporter seems to understand this:

(I hope you enjoyed that)

The US has been able to maintain its dollar system through petrol wars and reigning in any defectors from its system. Note what happened to Saddam Hussein and Gaddafi when they attempted to defect from the US petro-dollar. More powerful countries such as Russia and Iran were frozen out of the USD banking system and subject to sanctions. But the US is now less able to enforce its global and financial hegemony. Its system of controlling ports and chokepoints around the world is becoming impaired. China’s claim over the South China Sea would allow control over a large percent of shipping in the world and new military technologies will blunt US military capabilities.

The US Dollar’s value is presently being maintained by a PBC short squeeze. When this runs its course the FED’s balance sheet will be what supports the dollar. Therefore a debt saturated economy will provide a tipping point and gold will come into the breach as it did in 1980-81. Debts have not mattered over the past 25 years, but that era is coming to a close. Rising debts were manageable only because interest rates were declining. Within 2 years rising rates will begin to feed into government funding costs and the flaws in the debt structure will be revealed.

The remedy to US problems will likely result in a USD devaluation. This will be an attractive option since it will relieve the US Government from a large part of its debt burden. It will also devalue the huge pile of treasury debt the Chinese hold, which will pop their credit bubble allowing strategically important countries to escape the China debt trap. It would also be a protectionist measure increasing the demand for American labor. Bottom line: it would be great for the US Government, but of course devastating to the US middle class.

A devaluation would provide raw fuel to a bull market in gold.

It’s time to expand ones exposure to the gold sector

The recent 3 week pullback in the gold stocks was mild and shallow, indicating latent demand in the sector. There are buyers on the sidelines who want to get in and they are not waiting any longer as the gold stocks appear to be in the early stages of breaking out from an extended base formation. Friday was likely the “kick off” to the move and it is time to hitch oneself to the trend. One should not chase prices if not already in, but it is time to lock in ones position for the bull market.

One should structure his portfolio according to his goals and risk tolerance. I have built the core of my holdings around the royalties. After that I have a few larger scale majors and a handful of mid-tier producers. After that I maintain a group of juniors with exploration potential.

Newmont and Barrick– two undervalued mega-majors which will trade like ETF’s since they are broadly diversified and deeply liquid. They both can serve the role of core holdings.

Agnico Eagle– North American security with top management

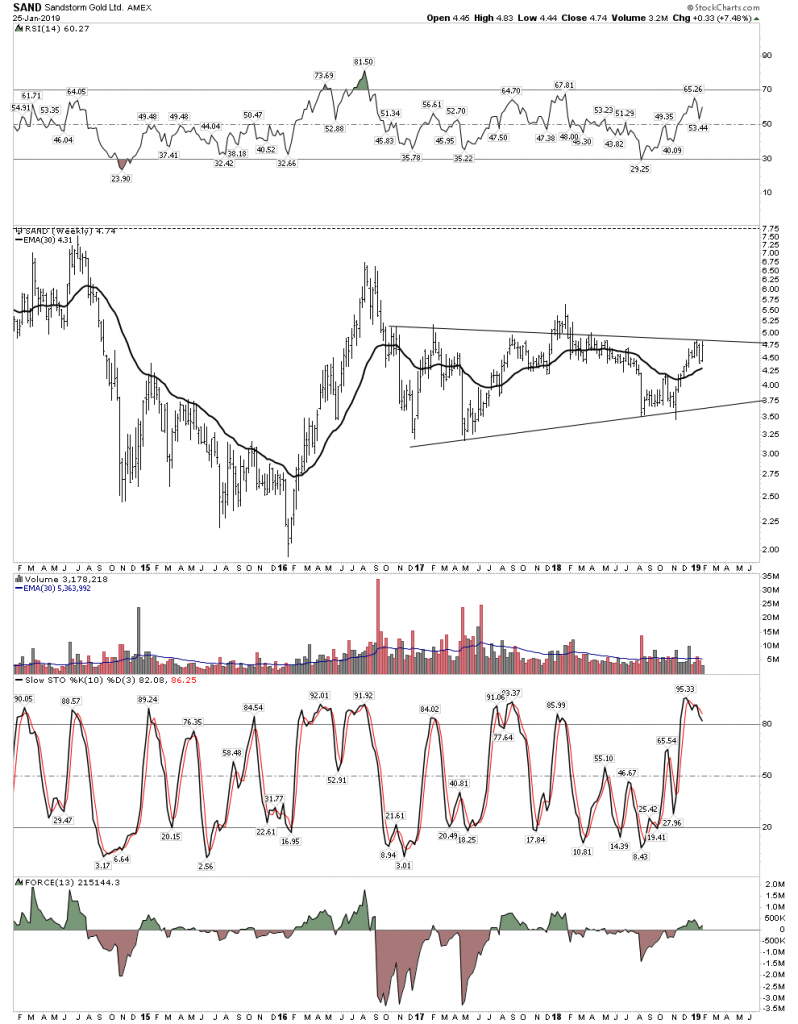

Sandstorm– New kid on the royalty block

Aggressive focused management. I like Noland Watson’s approach of not suffering fools gladly. He does no-nonsense deals, this stock has huge leverage to the upside.

Osisko– CEO Sean Rosen is likely the most capable and connected in the industry. Depressed price, huge upside.

Wheaton PM– This company has had a field day acquiring streams over the past 5 years when financing dried up. It’s now ready to cash in. This stock is very cheap.

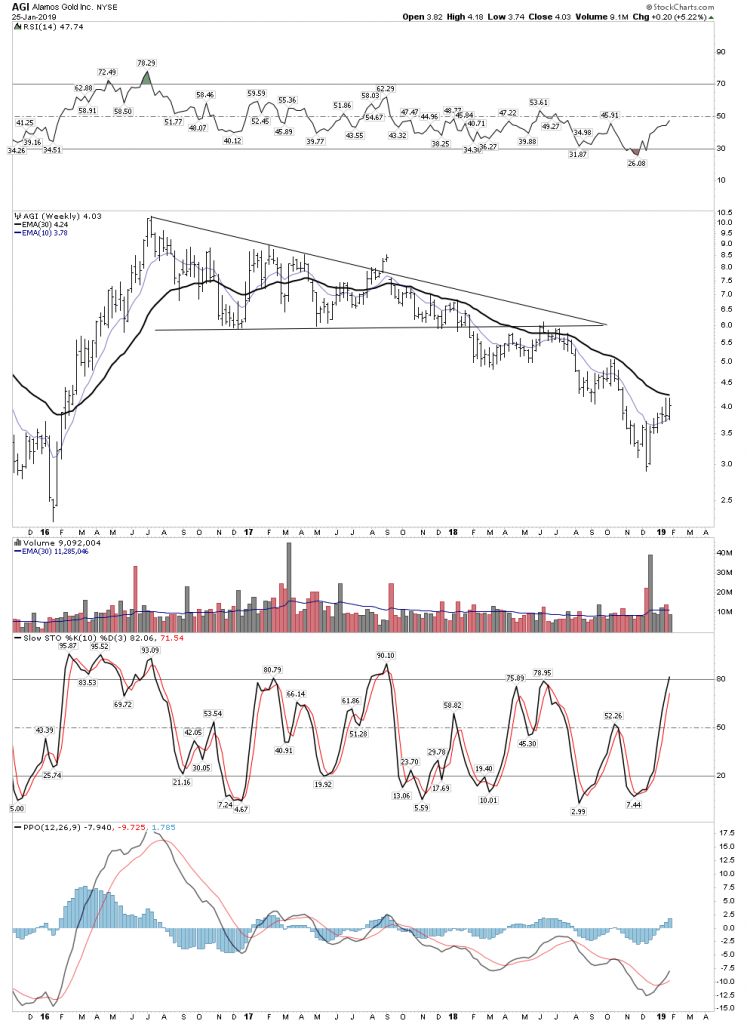

Alamos– Got so beat up in the industry drawdown it’s now ready to get back on track.

Oceana Gold- Big base can support a big move

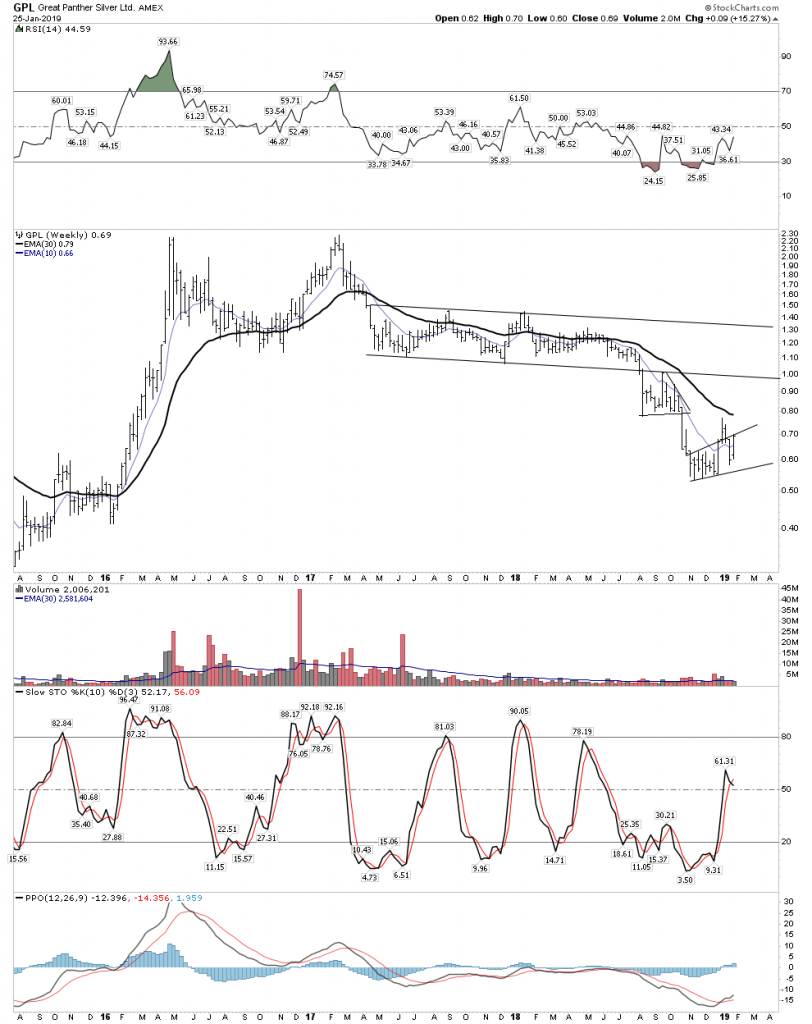

Great Panther-Under new management with gold properties in Brazil. This beaten down turnaround has huge potential

Uranium- A quick word

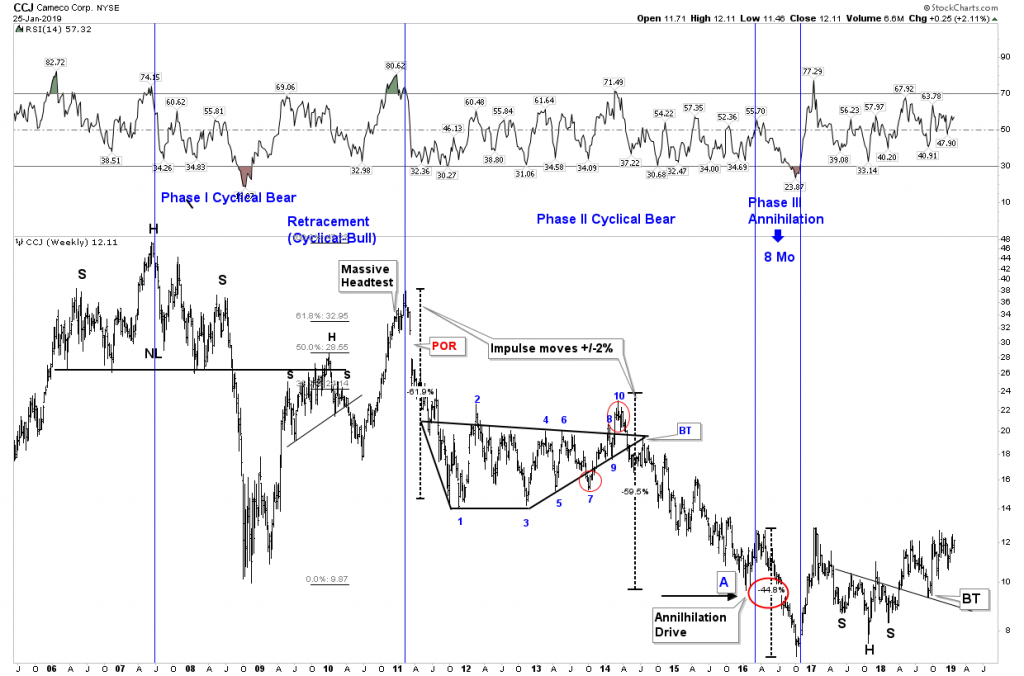

We can learn a lot from the uranium market. If one can ride the uranium bull and stay strapped on then the gold bull should be easy work for you. I suggest you use the uranium bull as a training ground. Take on a small position so you can handle the volatility and learn how to ride the bull. This sector has shown us all the elements of an early stage bull market. The fundamentals are in place, but investors simply can’t overcome their skepticism as few people will admit the bull has begun.

It’s has been a wild shaker, which is why I have constantly mentioned that uranium stocks are the most volatile stocks in the universe. Admittedly, it has been hard to hold on and maintain ones position, but that’s exactly what one must do. Remember Be Right-Sit Tight. The hardest thing about a bull market is not letting the bull throw you off. One has to strap on tight and hold on.

What will likely happen is the market will try hard to shake out the weak hands right before the market goes binary. What is binary? It is when the spot price jumps in a short time to the future long term contract price. The gap between the two rests between $29 and $60. Spot now is around $29 whereas new contract pricing will come in initially around $50-60. Essentially it is like a huge gap between bid and asked price. At some point price will leap across the gap. If you are going to be in this sector, you should be in it before this event.

UPC– Uranium Proxy

Here we go knights, it has driven the skeptics crazy… get ready

Weekly view – volatility in spades

Cameco– looks like the bear market is over

Nice bottoming action:

UUUU- Energy Fuels… member of the wild bunch…hold on tight.

enCore– up and comer:

Sure uranium is a bit of a side show, but don’t underestimate what this can do for your portfolio.

Friday was a big day in the gold market. A possible kick off day to the next leg up. It’s going to be a wild ride with plenty of skeptics and shakeouts… don’t get thrown off.