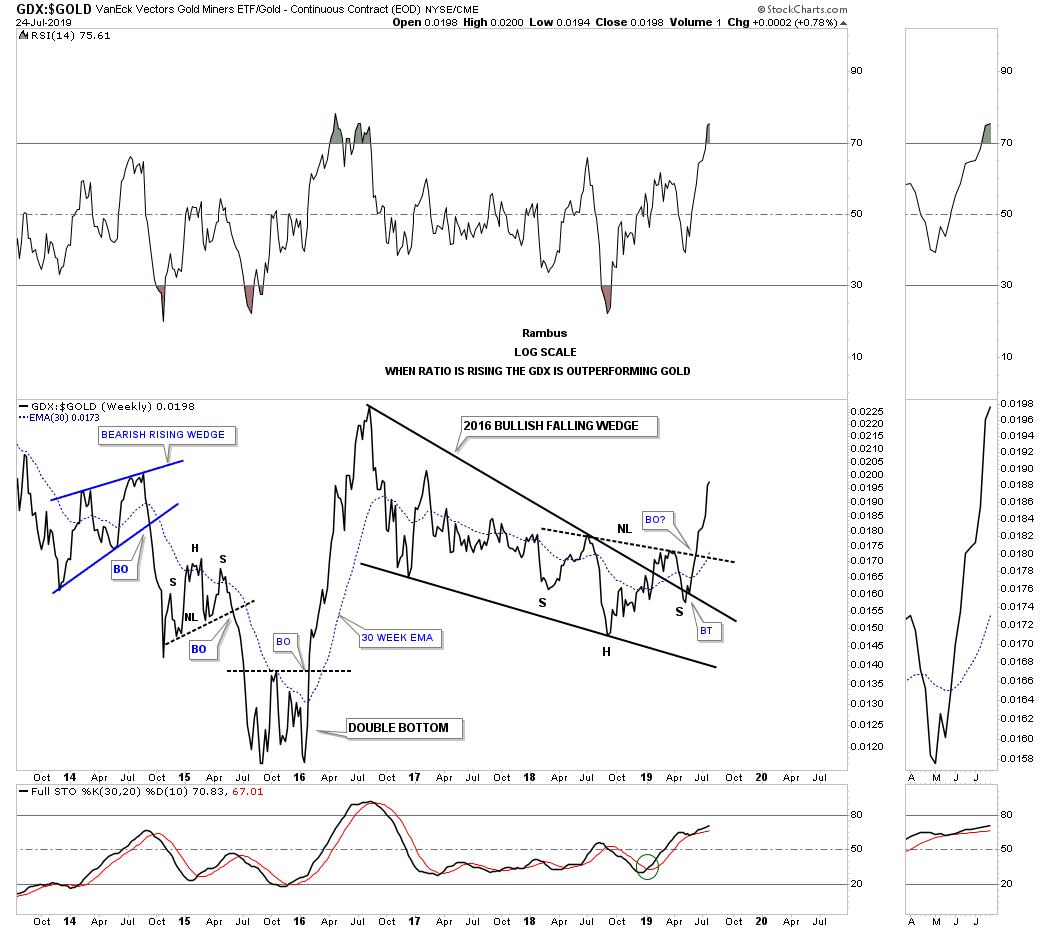

One thing we like to see durning a bull market in the PM complex is for the GDX to outperform gold. Below is a weekly ratio chart which compares the GDX to gold. When the ratio is rising the GDX is outperforming gold. Since the breakout from the 2016 bullish falling wedge with the H&S bottom at the fourth reversal point the GDX has been strongly outperforming gold which is a bullish development.

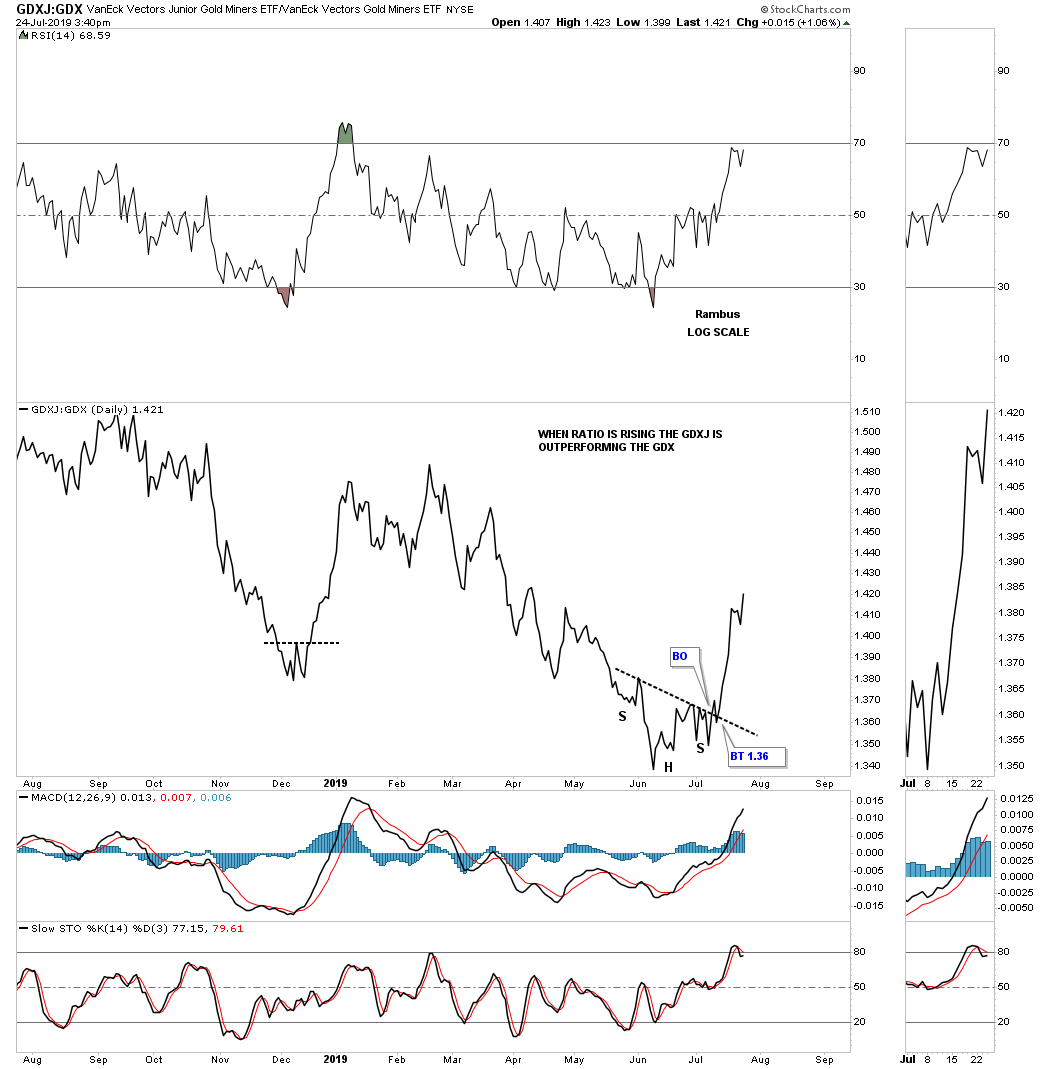

An even better setup for the PM complex is when the small caps, GDXJ is outperforming the GDX big cap PM stocks. Below is a daily ratio charts which compares the GDXJ to the GDX that shows a H&S bottom which has reversed the underperformance of the GDXJ small caps to the GDX big caps which are now outperforming the big caps.

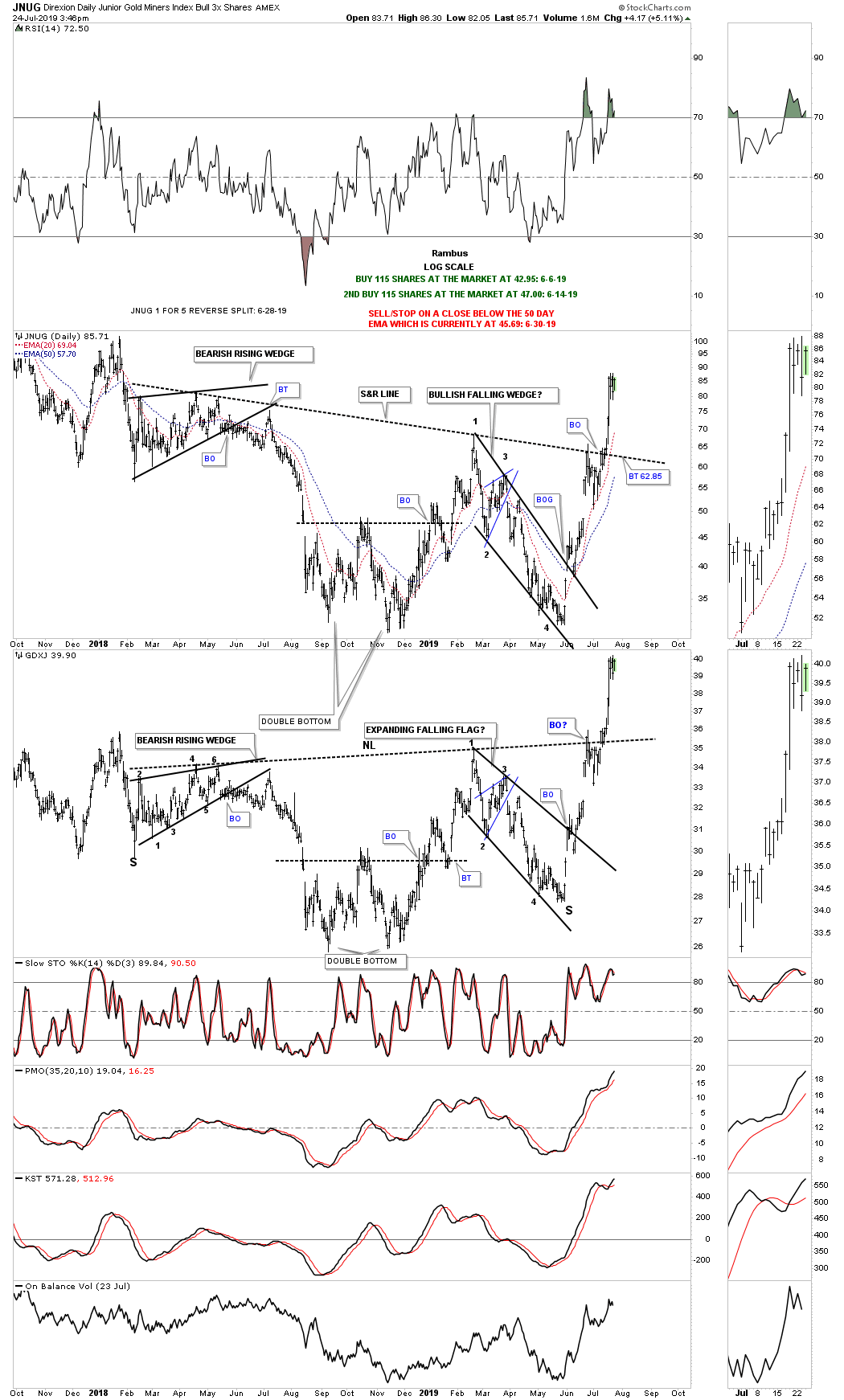

You know you are in a strong impulse move when a stock you buy doubles in 6 weeks. This is now the second stock in the PM portfolio that has doubled. Below is the combo chart which has the JNUG on top with the GDXJ on the bottom.

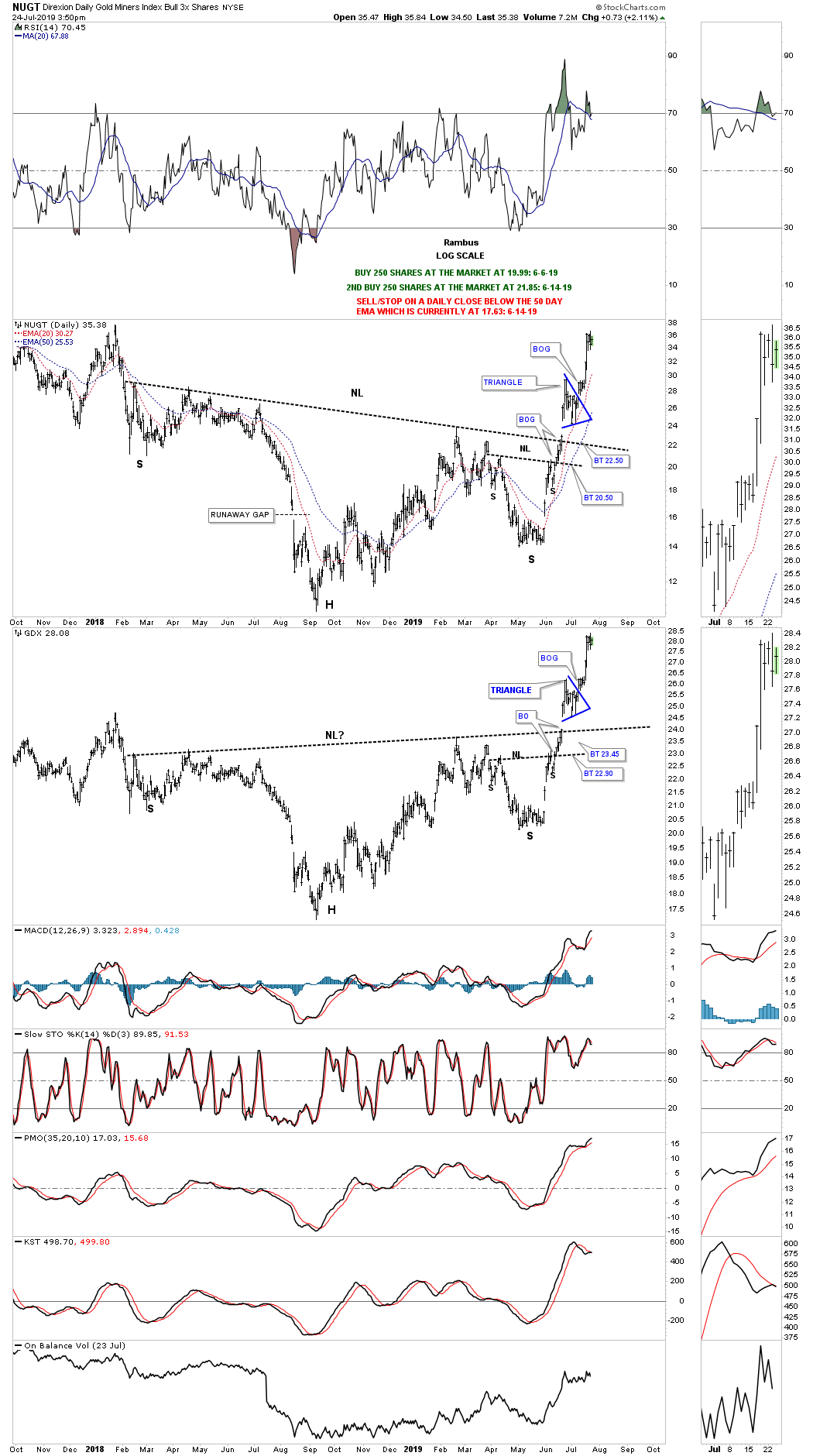

Next is the combo chart which compares the NUGT to the GDX. NUGT still needs to tack on about 5 more points before we can see a double.

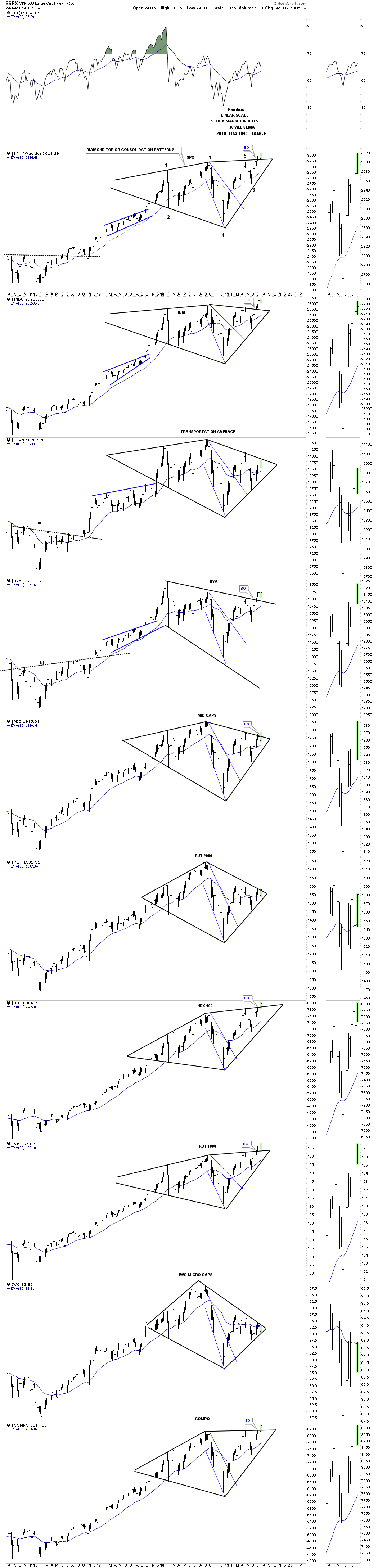

This last chart is the weekly combo chart for the US stock markets that shows another index joining the party today the MID, mid caps. This only leaves the Transportation Average, RUT and the IWC which are all hitting the top rail of their diamonds.