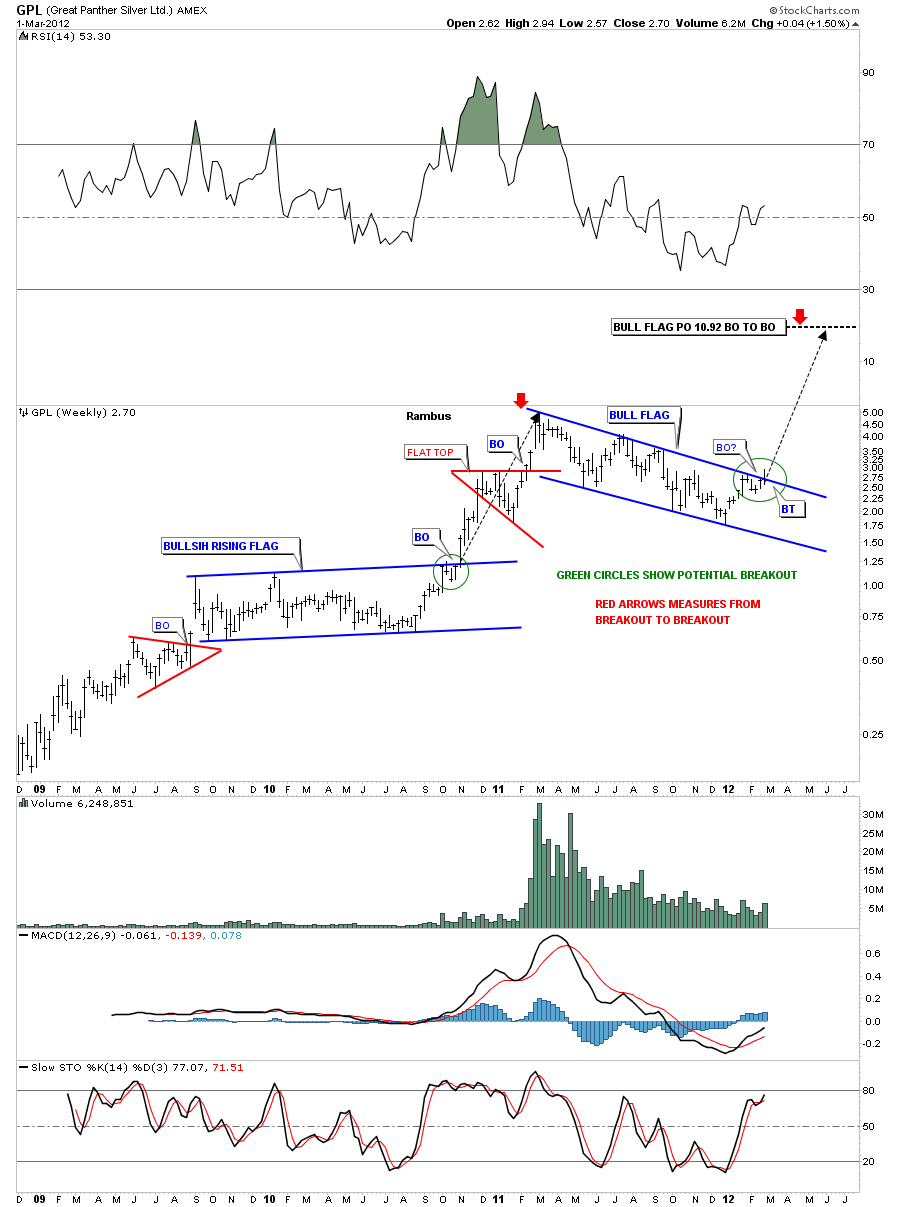

GPL broke the top rail of it’s downtrend channel earlier this week and is now backtesting the potential breakout. Sir iluvpms ask about a price objective for GPL as he own shares of this stock. There are 2 ways I measure for a price objective. The first way is what I call the breakout to breakout method. To use this method you have to have 2 completed consolidation patterns. First you measure from the breakout of the lower consolidation pattern, in this case, and measure all the way up to the first reversal point in the next consolidation pattern just above, red arrow. You then take that measurement and add it to the breakout of the upper consolidation pattern to get your price objective. The chart of GPL below shows this first method, breakout to breakout, green circles on chart.

You can see this method has a price objective to about 10.92 or so. The other method I use is to measure the impulse leg in the lower consolidation pattern to the first reversal point in the consolidation pattern just above, blue arrows.Take that measurement and add it to the last reversal point in the bull flag to get your price objective at 13.85. By putting both the measuring methods together it gives a zone, brown area at the top of the chart, in which to look for the move to exhaust itself.

By putting these two measuring techniques together we have a price target of 10.92 on the low side and 13.85 on the high side. I hope this answers your question on how high this potential move may carry once the impulse leg gets underway. All the best iluvpms…..Rambus