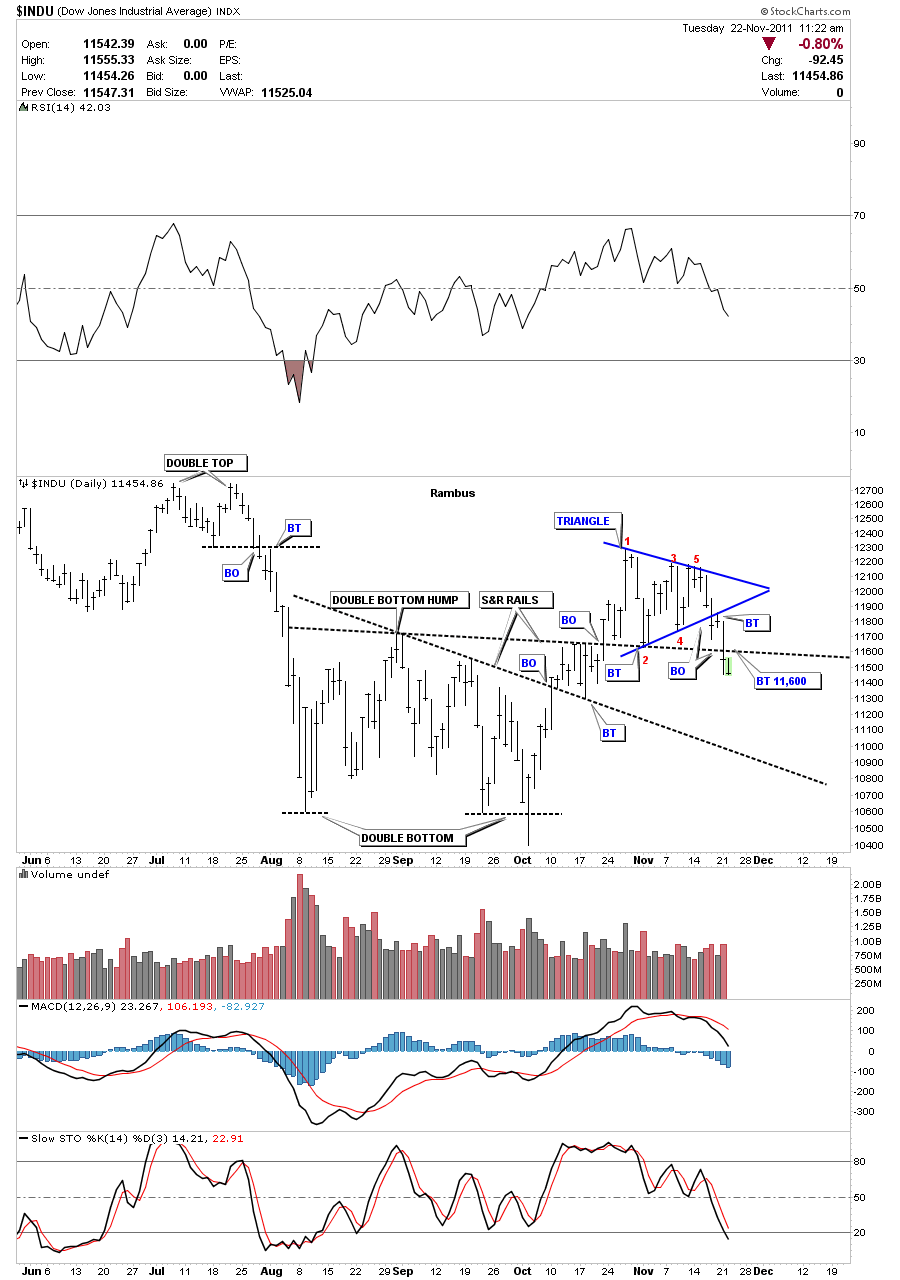

Below is the 6 month daily chart of the Dow showing our 5 point triangle reversal pattern with the breakout and backtest last week. Keep in mind that a reversal pattern is reversing a trend that has been in place. So now we know that the uptrend on the Dow has been reversed to the downside and that is the way you want to play the stock markets now. Until we get some kind of reversal pattern to reverse our current trend from down to up the trend will remain down except for some minor counter trend moves. There are many ETF’s now that you can play the downside or short the stock markets. Depending on your risk tolerance, there are 2 times or 3 times bear ETF’s. Some focus on the big caps some on the small caps or just about any corner of the market now has an ETF, exchange traded fund. QID is short the COMPQ, TZA is short small caps, SPXU is short the S&P 500. And one of my favorite, if the risk trade comes off is SMN which is short basic materials. These are just a few examples. There are many more to chose from. Anyway back to the Dow Jones. Yesterday’s move down broke thru the first support area at 11,600 the upper S&R rail. We could still do a backtest of that rail, which would be a good low risk entry point but its not mandatory. The next area of support will be the lower S&R rail.

Dow 6 month daily 5 point triangle reversal pattern.