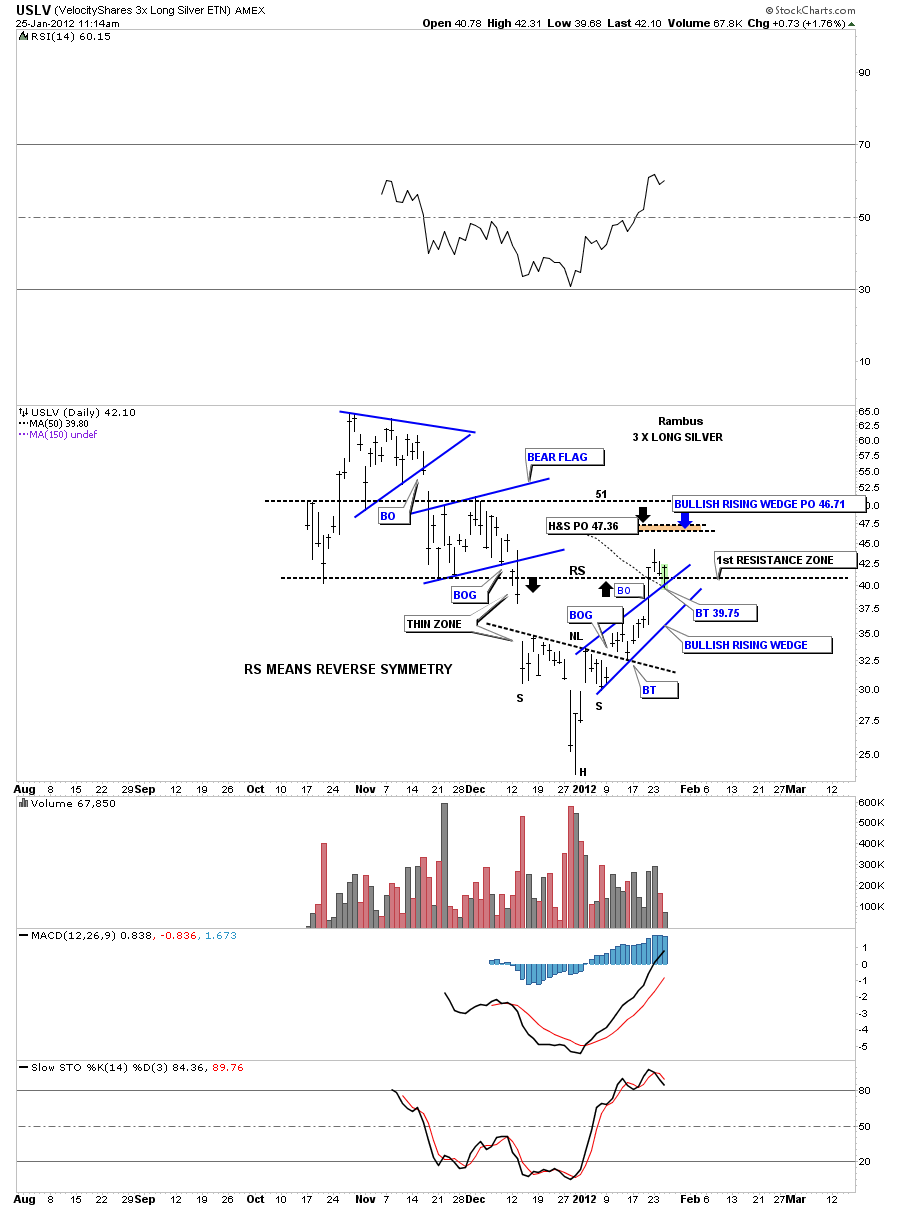

USLV is a fairly new etf for silver. It is 3 X long silver which makes it a very volatile trading vehicle which can be good or bad. So far the trade has been working very well. As I showed you on the previous post for SLV this new etf seems to be tracking SLV pretty good. You can see the bullish rising wedge and the backtest this morning to the top rail. I have the price objectives for both the inverse H&S and the bullish rising wedge shown in brown. Both price objectives are very close to each other which is what I like to see. Both patterns confirming a similar price target. We are entering an area that was a congestion zone on the way down that was a bear flag. What I would like to see happen is that we reach our price targets around the 47 area and even possibly as high as 51 which is the top of the congestion zone. Then a chopping move between say 51 or where ever the high turns out to be and a low somewhere around the first resistance zone at 41 marked on the chart below. What this would do is create a right shoulder of a much bigger inverse H&S bottom. But for right now we’ll just focus on getting up to the top of the congestion zone, bear flag, made on the way down.

USLV breakout and backtest to the bullish rising wedge.