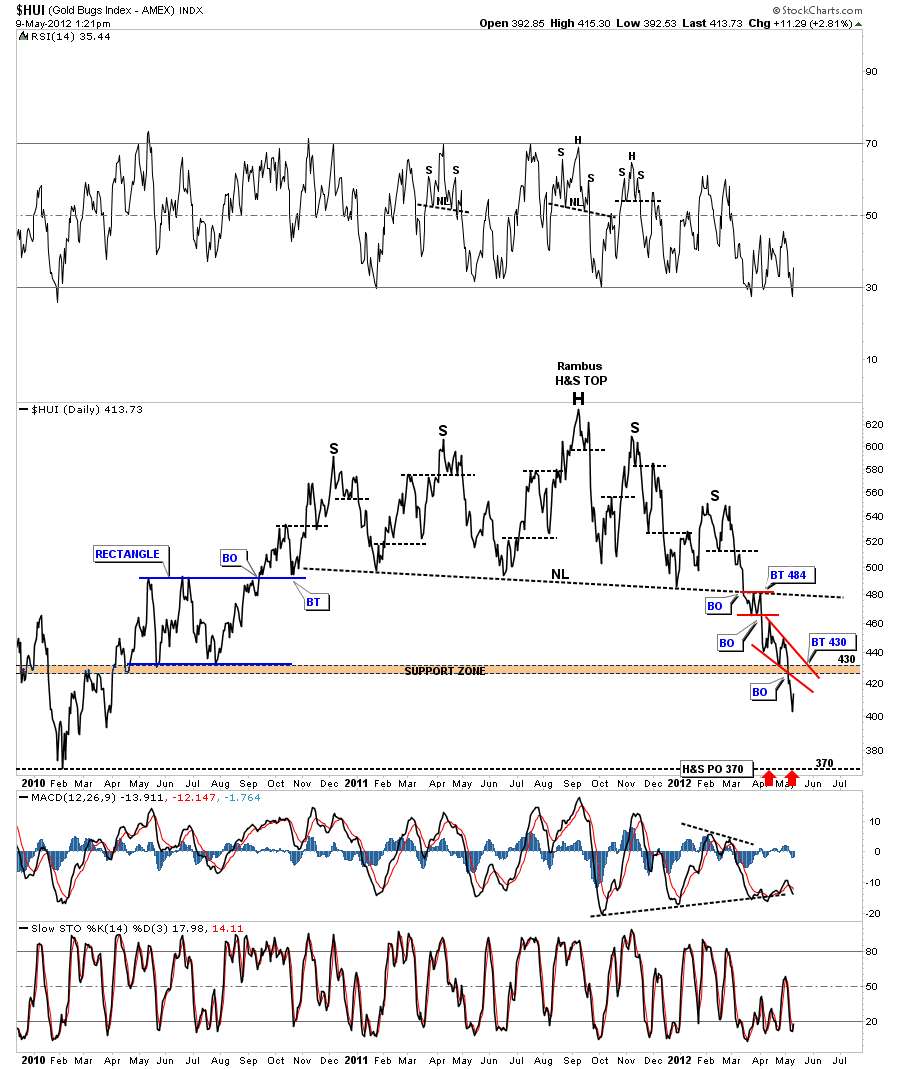

This morning I got an e mail from a subscriber that asked several important question regarding the HUI and the precious metals stocks. First, he wants to know if the big H&S price objective down to the 360 area is still valid? Yes, the 360 is our real first area of key support as it’s the big H&S price objective, at a minimum. There is also a low made back in February of 2010 that should give us some initial support.

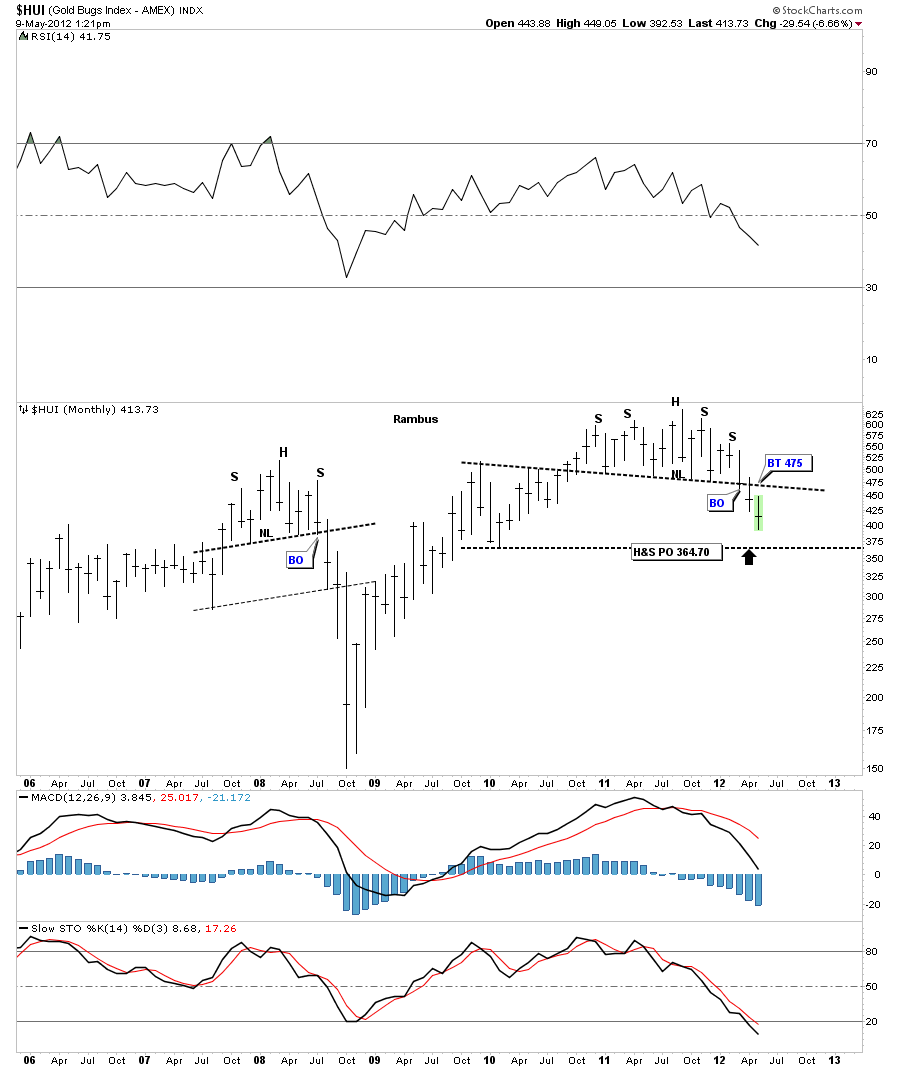

Next he would like to know if we hit the H&S price objective down at the 360 area would it be a good place to accumulate precious metals stocks? First of all this is a huge H&S top that is a reversal pattern, reversing the uptrend made off the 2008 crash lows. This is a massive top formation that is going to take time and lower prices to put in a lasting bottom. The topping pattern is about 18 months or so in the making. We are now only several months into the correction. A rule of thumb is the larger a top, bottom or consolidation pattern is the longer the move will be in time and price. If our current H&S top only took several months to complete we would be in a completely different ball game. I would not be looking for a major reversal like I see happening with our present H&S top. So the answer to your question would be the 360 area may offer us a decent counter trend trade against the big downtrend that is in play right now but not for accumulating precious metals stocks for the long term IMHO. What we are seeing today is a short covering rally that will get everyone excited again.

The last question he asked, which is very important to each individual investor is, should I sell my core holdings? That’s a hard question to answer because each individual investor has a different psychological profile. Some can’t stand the least bit of pain while other investors can ride a correction out and not bat an eyelash. As I’ve mentioned several times I’m not holding any precious metals stocks at this time. This is my preference. Many of you may recall the big bull market in the 90’s that had many analysis saying the Dow would go to 25,000 based on this or that and that a new paradyme was underway. Its really hard not to get caught up in all the hype when so many are talking the same thing. Nobody knows for sure if this bull market is over for the precious metals complex or that we still have several thousands of dollars to go yet for gold. I can’t prove it because I didn’t trade the gold bull market in the 70’s but I bet the fever was high and most analysis didn’t even come close to selling out at the 850 top because gold was going to 1000 or 1500 or whatever price anybody wanted to put on it. That is how the tech bubbled ended with everyone looking for much higher prices. Very few got out at the top. I was lucky because I could read a chart and seen what was happening but my broker, at the time, rode the whole thing down because buy and hold is the only thing most investors know. So all I can tell you is that we have a major top in place and how low we go is anybodies guess at this time. When I seen the H&S top pattern in 2008, on the HUI, I had no idea of the magnitude of the crash that was to follow. All I knew was we had a H&S top in place and it was reversing the uptrend that had been in place since the beginning of the bull market. We tripled the H&S price objective before the HUI found its bottom. As I said before we are going to get some short covering rallies that will knock your socks off but they will be against the downtrend that is now in place. Holding a core portfolio of PM stocks has to be a personal choice. A choice based on your own knowledge and personal make up. My first rule of thumb is to protect ones hard earned capital. If I sell out too early and the markets go against me I’m not afraid to buy in higher as its better to buy in higher than to be caught in a downdraft that you can’t get out of. I hope I’ve answered your questions.

HUI daily line chart.

HUI monthly with the 2008 H&S top.

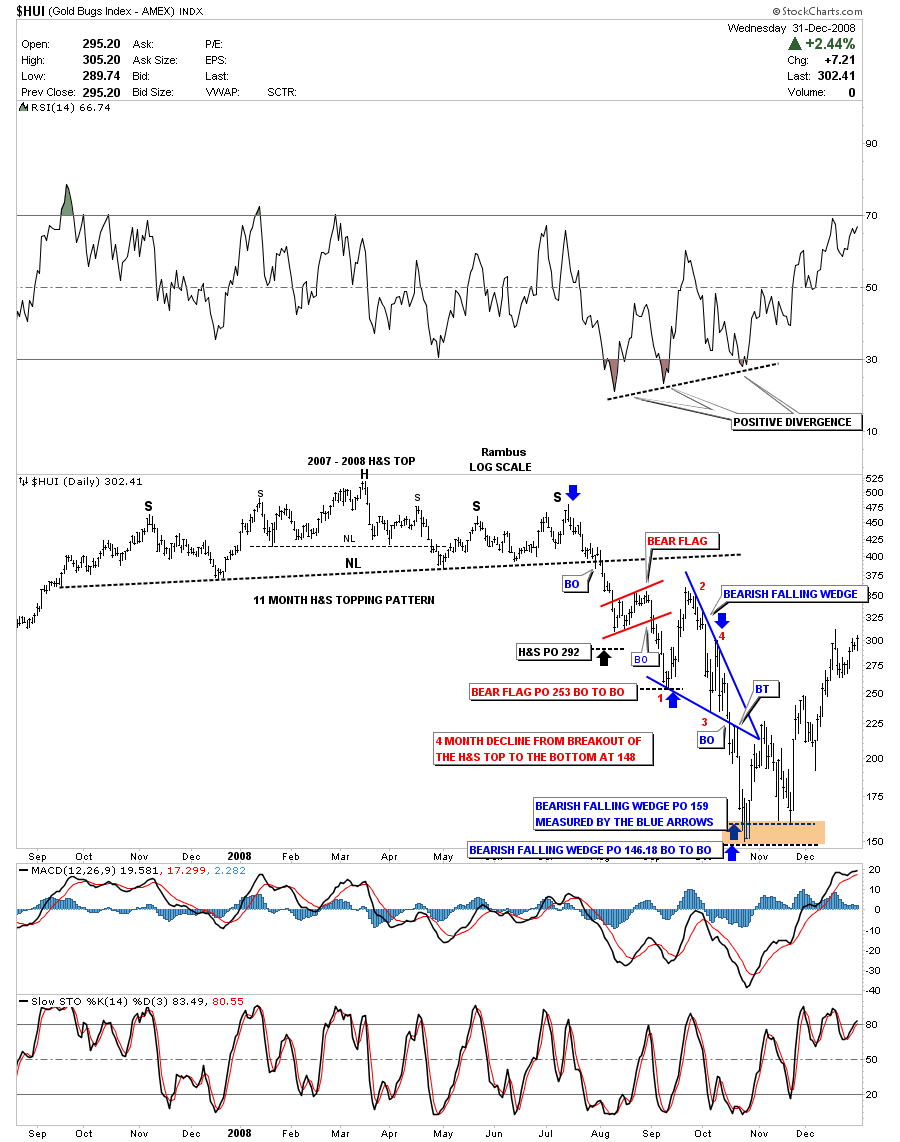

Below is a snap shot of the 2008 H&S top on the HUI. That top took 11 months to complete and four months after the breakout to reach it’s final low at 148. You can see two consolidation patterns that formed on the way down the little red bear flag and the much bigger bearish falling wedge. Once I was able to identify the big blue bearish falling wedge I was then able to put a price target for that move down. Note points one and two on the bearish falling wedge. That counter trend rally was just over 100 pts. Put yourself in that time frame and how would you have reacted at the time. I can tell you from experience its very very hard not to get insecure about your position but knowing the major trend was down made it easier to ride the counter move up. In our current situation we have had a big move down and a counter trend rally or short covering rally can come out of the blue but knowing that the main trend is down should give one confidence to ride the move out.

HUI 2008 H&S top.

………………………………………………………..

EDITOR’S NOTE :

Rambus Chartology is Primarily a Goldbug TA Site where you can watch Rambus follow the markets on a daily basis and learn a great deal of Hands on Chartology from Rambus Tutorials and Question and Answeres .

Most Members are Staunch Goldbugs who have seen Rambus in action from the 2007 to 2008 period at www.goldtent.org and now Here at Rambus Chartology since early 2012 .

To review his Work and incredible calls from the 2007-2008 period click on the top right sidebar Deja Vu

To Follow Rambus Unique Unbiased Chart Work and participate in a Chartology Form with questions and answeres and learn the Art and Science and Mindset of a Pro Trader please Join us by subscribing monthly for $29.99 at

www.rambus1.com

We have many subscribers from all over the world who are glad they did as they enjoy the many daily updates and commentaries provided at this exciting new site

As you will see Rambus (Dave) has prepared us for this difficult period by being one of the only ones to see and warn about this incredibly debilitating PM smackdown

You will find Rambus to be a calm humble down home country tutor with an incredible repitoir of all the TA based protocols tempered with his own one of a kind style…simply put…He wants to keep his subscribers on the right side of these crazy volitile and downright dangerous markets

See you at the Rambus Chartology

…………………….