Trivia Question-Who said this quote?

“Gold gets dug out of the ground in Africa, or some place. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

–Warren Buffet

You probably heard on Friday that he just bought 21 million shares of Barrick, the world’s first tier gold producer.

The world has now changed

Buffett, of course, has spent the last 30 years denigrating gold, now he embraces it. This is the ultimate green light for the sector, it has now been legitimized in the canyons of Wall Street. Whereas before asset managers feared getting fired for owning gold stocks, they will now fear getting fired for NOT owning gold stocks because of Warren’s action. The gold bull market now sits at the cusp of the publics point of recognition (POR).

I cannot emphasize how significant this is. Buffet has been the dam, holding back the great flood of investment dollars into the gold bull market. As long as Buffet steered clear the lemming institutional money managers would avoid the sector as well. The dam broke on Friday afternoon after the market closed when Berkshire’s 13f filing was publicly released revealing he had bought about $500m of Barrick last quarter. He’s now given tacit permission that the average investor needs to own some gold stocks. Don’t think people won’t notice.

Big smart money figured this out about a year ago. Last Year savvy investors such as Jeff Gundlach, Sam Zell, Mark Mobius, Ray Dalio, Paul Tudor Jones, plus others made public pronouncements that they had secured large gold positions. Mind you these leading edge free thinkers had never been known for taking on gold positions before. But they saw what was coming and they knew it was now time. They loaded up when it was still cheap.

However Buffet, was busy praising companies such as Delta Air Lines for buying back stock thereby hollowing out its balance sheet and lowering its resilience to any possible adversity. Later on when the inevitable black swan hit, his position got crushed and he bailed losing billions. So Buffet was a hold out mired in the past. But there’s nothing like a sharp stick in the eye to wake one up. Apparently he’s got some of that old time religion now. That’s right, time to have some honest money…It’s time for gold.

One final point on Buffett, it’s not difficult to assume that he holds other major positions in gold miners. The 13f discloses what he bought prior to June 30th. He knows that once the cat is out of the bag on his total position reversal it will likely lead to a rush into the sector. My bet is he has been buying other gold stocks throughout the month of July. Furthermore, he has been dumping financial stocks such as Goldman. I wonder where he is parking that cash?

The POR cometh

Two great Dow Theory analysts, William P. Hamilton and Robert Rhea postulated that both bull and bear markets unfold in three psychological phases.

Bull Market Phases:

Phase I– Accumulation or stealth phase. Few people notice this rise since few people are watching. Well informed savvy investors however establish long term positions at depressed values. The public never even knows its happening.

Phase II-The mark-up phase. This is the longest phase of the bull. Improving business conditions cause prices to advance. This attracts the attention of investors. Over time investors come to understand the forces that drive the trend. Violent corrections occur shaking out latecomers. The POR always comes in phase II, typically around the 1/3 mark of the phase.

Phase III- Mania or blow off phase. The public finally drops all hesitation and fear and embraces the uptrend. They buy with no regard to values, instead they buy simply because it’s going up. Informed investors sense danger and distribute shares to the public and seek safety.

Rambus has often stated how crucial it is to know where you are in the cycle. I use my understanding of these phases as a tool giving me direction of how to invest.

The POR

Apparently our friend Warren just had his own personal POR. My view is that the publics recognition point lies immediately in front of us. How long? I think within two months. We first must get through the present pull back then advance above gold’s peak of $2090 set on August 7th. At that point resistance should melt and there will be little point to deny the existence of the bull. With Warren’s actions giving the green light the public has now been cleared to enter the sector. It could be explosive.

The POR is a psychological inflection point. It results in an accelerated surge because enough people wake up to the new reality. Those who are familiar with Epsilon theory see the similar principle when people go from public knowledge to common knowledge. Ben Hunt writes on this here:

Recall how for years Harvey Weinstein’s behavior was public knowledge. They even joked about it at the Oscars. If one wanted to know about his criminal behavior it was out there, but everyone thought it was their inside secret. However at a certain moment (call it a POR) it became common knowledge. Once this occurred EVERYTHING changed, and it changed in a second. The next day his wife left him (like she didn’t know already?) and incredibly even his attorney left him!

That’s what the gold market is at the cusp of right now…the POR. Indeed the public is about to wake up.

Below is how I choose to define the psychological phases of this bull market so far. The GDX shows much more volatile ranges than gold, however looking at gold, the mark-up phase II began early fall 2018 and is now just getting recognized by the public as a bull market even though its approaching its 5th year!

So that’s where gold is at in the market cycle. That’s essential to know, but what I really want to talk to you about is how this is going to unfold from here and how to play it. My view is this is the opportunity I have sensed for my entire adult life. All the mistakes I have made, all the accumulated knowledge I have, all the market cycles I have witnessed have prepared me for this moment. If I play my cards right, I can move into a different economic class. I’m not into rap music, but Eminem got it right in his song Lose Yourself:

“If you had one shot or one opportunity to seize everything you ever wanted in one moment would you capture it, or just let it slip? You got one shot- Don’t miss your chance to blow, this opportunity comes once in a lifetime”

No, Eminem doesn’t know anything about the gold bull market, but he’s got the principal right here: You’ve got one shot, don’t miss your chance to blow.

E.B. Tucker, author of “Why Gold Why Now” recently put it this way:

“We are in a secular bull market in gold that you will never see in your life again. This is a powerful move that has so much horsepower that it’s not for trading. You should take your hands off the wheel and just let it go.”

Why is this happening? Because we are now in the end game to our monetary regime. It may take another 10 years to fully play out, but the fuse has now been lit, the great unraveling has now begun.

The reason I describe this opportunity in such dramatic fashion is because I sense a lot of you harbor a lot of fear. Remember scared money doesn’t make money. I see so much emphasis on corrections and drawdowns rather than girding oneself to maintain ones position. What I see out there is investors in a bull market operating with a bear market framework which results in one ending up on the sidelines watching the trend run away. So let’s put this into a perspective.

Gold and it’s Super Secular Bull market

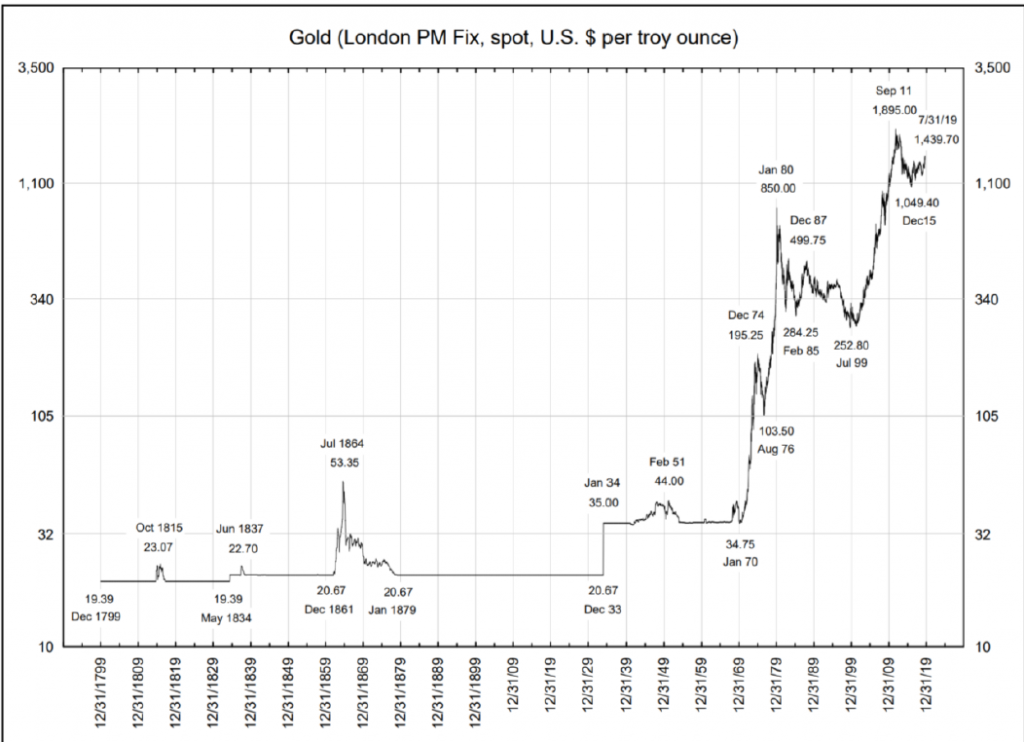

How does this bull market fit into the big picture? The present bull market which began in late 2015 is the final extension in the trend which began on August 15 1971 when the US severed the link of the USD to gold. Following this event gold entered a 10 year bull market from 1971-1980.

After gold’s 23X increase in the 70’s gold digested this move over a 20 year period, it was then ready for its next leg up. This move lasted 10 years from 2001-2011 where it saw a 7.5X move. Next was the inevitable corrective bear market where gold lost 47% over a 4-year crushing decline from 2011-2015. This clean out was so complete that the gold mining stocks lost 80-90% while the juniors dried up and blew away. The stage has now been set for the final third leg up in the super secular uptrend in gold.

It’s likely that this bull market will end with the public demanding that currency regimes be again linked to gold in an attempt to reestablish a form of honest money. The past 50+ years will then be seen as a failed experiment of monetary lunacy.

I understand that many consider this discussion on the fringes so I will end it there and stick to the charts, however it’s necessary because it allows us to construct a game plan going forward and how to play this final leg up. Let’s examine these three legs up over the past 50 years.

Leg 1 1971-1980

One could actually argue that this began in 1968 with the failure of the London gold pool. Look it up on Wikipedia if you need the education. Once the gold price suppression ended it began a slow rise. Sometimes however, markets take a while to grasp the underlying fundamentals and the market didn’t really figure out what was happening until 1971. By 1972 the public came in and the great bull was on. Gold stocks had a great time of it in 1973 through mid 1974. For those who positioned themselves they captured stellar returns in the producers, but it flamed out in August 1974 simultaneous with President Ford signing into law the legalization of gold ownership to be effective on December 31st 1974. A classic case of sell the news.

Gold then went into a crushing 2 year bear market where it lost 44%. As it turns out this was the correction which separated Phase II from Phase III of the 10 year bull market. The back half of the bull market from 1978-80 went on to become legend. We still talk about it today, it was not uncommon for juniors to go from 20 cents to $150.

This 10 year run was a classic full-scale commodity style bull market. First it was the established majors that ran. Next the mid-tier. After the 2 year cyclical bear the juniors ran and finally the green field moose pasture stocks went to the moon. But all of this activity eventually led to new discovery with many major mines coming into production throughout the 1980’s.

We saw this happen in the oil patch as well. Rising oil prices in the 70’s eventually led to new discovery. Two major oil basins were discovered, North Sea and North Slope (Alaska), the result of elevated prices coaxing greenfield exploration. The new discoveries in both of these sectors led to prolonged bear markets due to new supply, 20 years in gold and 16 years in oil.

Leg 2 2001-2011

This 10 year 7.5X increase in gold was driven by easy money. One would think that the 18 fold rise in the HUI would have resulted in a massive increase in gold production, but it didn’t. This is because of the nature of expansion in the development of the gold miners. Instead of organically growing from cash flow and investor funds, gold miners chiefly grew through bank financing (cheap money remember). Therefore, these companies were ruled by the banks. Management focused on hedging their production and validating the banks definition of the asset through extensive feasibility studies. The result was a lack of entrepreneurial achievement and few discoveries. Eloenore and Frute del Norte were the only significant greenfield discoveries in the cycle.

This dearth of discovery over the last cycle has set up this cycle to be unique and points to the direction that active investors should position themselves in this third leg up.

In the chart below note how the 2 year 44% decline in gold from 1975-6 was just a halfway corrective pattern in the 10 year bull market. The market then built out a 20 year bullish wedge prior to the next 10 year upward extension ending in 2011.

Leg 3 2016-202X

In the last cycle the senior miners disbanded much of their exploration departments. Future discoveries would now come from independent small junior companies. The first 4 years of today’s bull market have been dominated by the royalty companies due to their safety and diversification. Next the majors booked nice gains over the past 18 months. But now I believe it’s time for the juniors to be the big performers in this bull market. The difference between this bull market and the 2001-2011 bull market is this is going to be a discovery led bull market.

This is principally due for two reasons. First the majors have to replace their dwindling reserves and second due to the character of the money flow. In the previous bull market the money came from the banks and was ruled by the banks. They demanded the money be spent on further defining the economic feasibility of their deposits as opposed to more aggressive discovery. This cycle will have organic money from both investors and free cash flow. This money will be deployed to where it is rewarded…value creative new discovery.

When we see the next discovery register a 100 bagger it’s going to wake up an entire new generation of gold investors to the possibilities. Yes, a rebirth has begun and it’s still the ground floor…this is your one shot.

It’s about to get wild in the junior sector.

The present correction in gold and silver

The action in gold and silver over the past week is most likely just a violent shakeout prior to moving to higher highs. The Johnnie come late-lies of July need to get shaken out. The model for these moves is typically a 4-8 week consolidation. It would be normal for a test of the 50 EMA and RSI to decline to around 30. If these parameters can be met it would provide a low risk entry point to add to ones positions.

My advice would be to spend the next 2-3 weeks sifting through your list of juniors and get your buy list ready. Below are 10 PM miners and 2 base metal companies which I would consider prospective candidates:

Novo resources NVO.v

Quinton Hennigh continues to plow ahead developing this grand strategy of harvesting the Pilbara. Recently I ran across valuable comments by Keith Barron about Novo. He states: “The Novo discovery will be the lowest cost gold mine in the industry, by a massive margin. Maybe sub $100/Oz.” Did you get that? Novo still suffers from credulity after its glitzy marketing pitch at the Denver show three years ago. Novo is still cheap and a HUGE opportunity IMO.

Irving Resources (IRVRF)

Another Quinton Hennigh project. This is a unique opportunity developing a project in Japan. The company is politically connected with the right entities to make it work. It has all the elements to get to production.

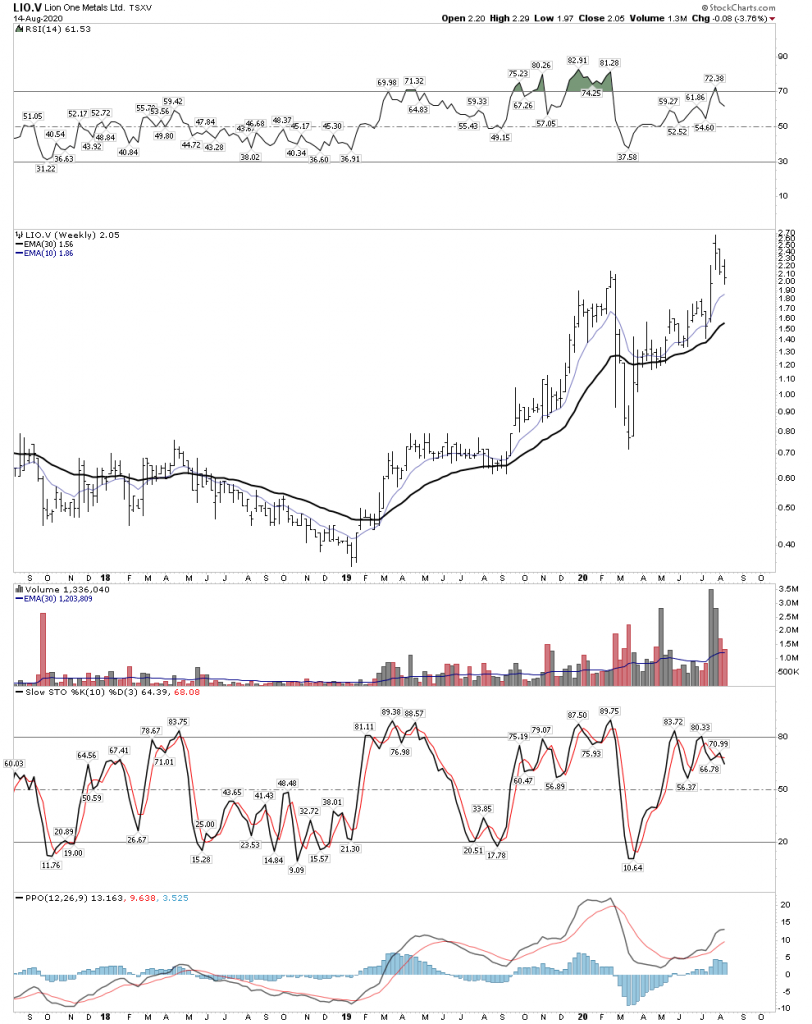

Lion One (LIO.v)

Yet another Quinton Hennigh project, this time in Fiji. It’s checked all the boxes and the seniors are likely to be sniffing around it in short order with its recent high grade drill hit.

Corvus (KOR.to)

There are a lot of prospective explorers hunting around in Nevada for the next big discovery. Any of them could hit, but one has to focus ones investment capital. My choice is Corvus as the most likely to discover. Don’t be turned off by its elevated price any real discovery leads to 10+ baggers.

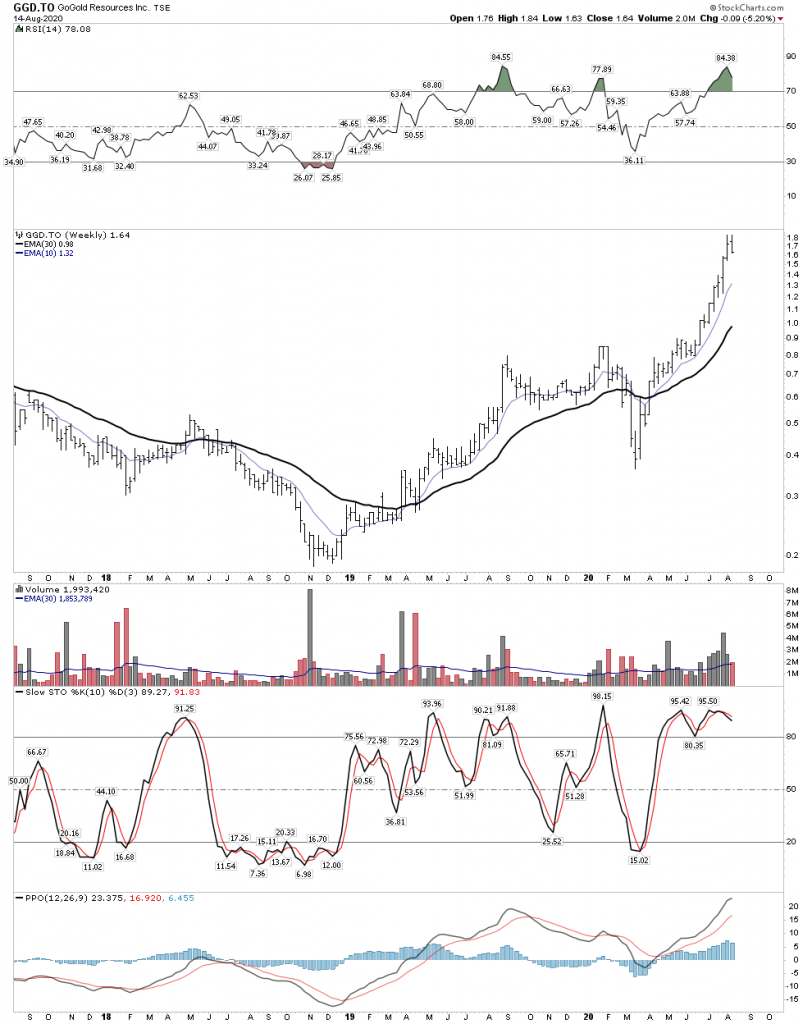

GoGold (GGD.to)

First off the name is a misnomer. It should be GoSilver, as about 70% of the economic value comes from silver. This is a great story, I call it the next Silvercrest. I recommend going to YouTube and typing in GoGold and listen to a few interviews with CEO Brad Langille. This guy is a proven serial successful developer. Their goal is to discover then sell the asset, however they are fully capable to developing it themselves as they have done it three times before. This play is to me one of the most underrated, safest, well financed, development stories out there. I’ve stepped up to the plate and taken on a 100,000 share position. This is the quintessential be right-sit tight holding.

Again don’t be turned off by the fact that GoGold has run hard recently. Think Silvercrest around late 2018 (chart below) GoGold has much further to go.

Americas Gold and Silver (USAS)

This stock has delivered a pretty rough ride to anyone who has held it. To me however, it’s a real under the radar sleeper. It won’t be much longer as it will soon be noticed. I like the management and if you want leveraged silver upside this company will provide it. When it finally get’s recognized it’s going to blow. Eric Sprott sees it, he backed up the truck on it some time ago. It’s still tiny with a $331m market cap.

Below I think it’s readily apparent that once USAS breaks above former resistance it’s going to fly… a real wealth creator. Plus it’s in a very nice buy zone right now due to the back test.

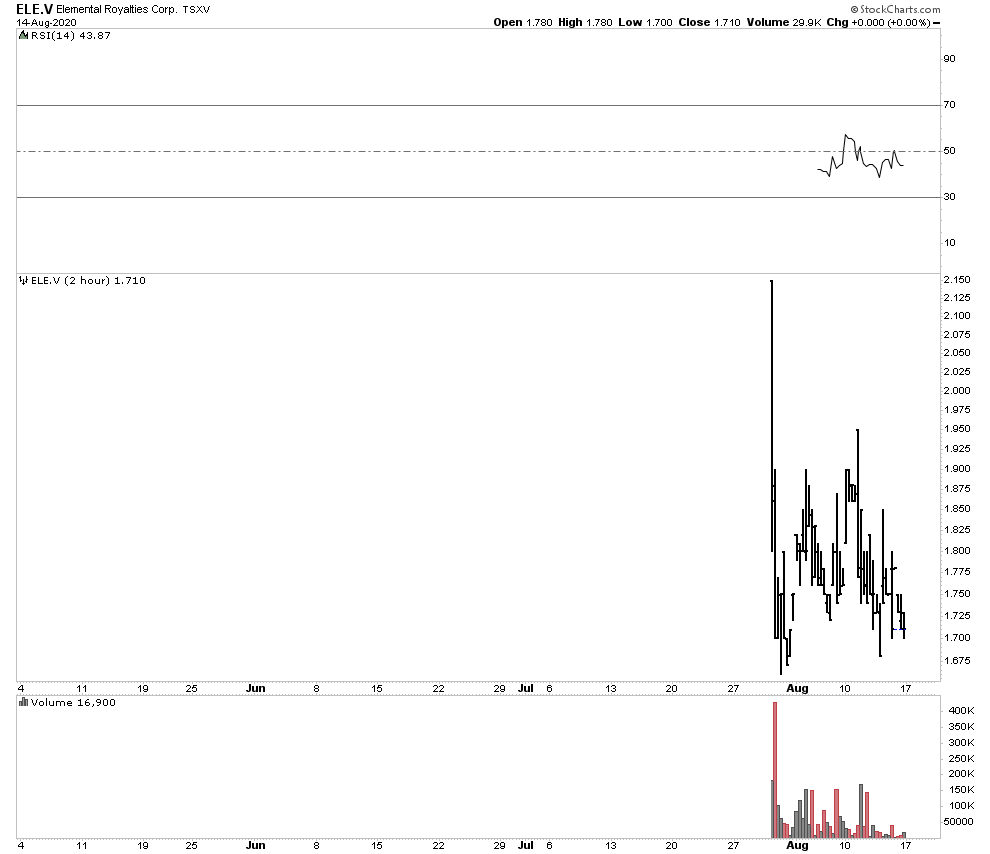

Elemental Royalties Corp (ELE.v)

Here is a new issue one might consider. As you likely know the royalty space is starting to get somewhat crowded in North America. Royalties have done very well and offered safety and leverage in this bull market. But the royalty play has been a North American phenomenon. With all the gold mining going on in Australia there has been little royalty exposure. Well, Elemental is entering this void with an Australian focus. I myself participated in the IPO and it’s fresh out of the gate.

Mawson Gold (MAW.to)

Staying in Australia we have Mawson. Of course you have heard about Fosterville, and how it put Kirkland lake in the chips and on the map. This one discovery has propelled Kirkland into the rank of majors… Impressive! The whole storyline is absolutely fascinating as it shows a pathway to value creation. They decided to look at this old played out resource through different eyes. Eric Sprott got wind of it and sent Quinton Henning down to Australia to check it out and give him his opinion. Quinton liked it. What they did is drill deeper, not much deeper, just a little bit and it was enough. This one idea allowed Eric to make reportedly north of $300-400 million. It is the means that Eric is going around and buying up the entire silver exploration and development sector today. It just shows you what a discovery can do for you.

Of course any such success is going to draw in the copy cats. Fosterville South (FSX.v) is one such group. It was put together to play on the lust for the next discovery. Not saying they won’t find it, but this group has capitalized (note the name) on the Fosterville gold rush. They are fully valued.

Mawson, however is a proven Finnish company trying to do the same with better prospects without all the arm waving. They are drilling under previous discoveries. I like the chart… it tells me they are onto something and it’s still cheap ($114m Market cap). Again I like round numbers I hold 100,000 shares.

Aurania (ARU.v)

Kieth Barron discovered the Fruta del Norte in Equator. His stock was a 100 bagger inside of 10 months.. ya baby. Keith is a very likable fellow, yet when he tried to develop the asset politics began getting in the way and he was forced to bail. He wisely sold out to Kinross for reportably north of $100 million personal profit. With such a windfall (during a bear market) he moved to Geneva Switzerland and sat out the bear market enjoying life. During this time he came to realize he only got one bite of the apple. He wants the whole apple so he is back.

He realizes that an essential element of the junior game is to have a captivating story. A story that allows one to attract capital. Boy he’s got one in spades and he’s a great story teller. He is searching for the lost cities of gold. This is not just marketing this is the real deal. In his years between projects he discovered in the Vatican library 500 year old documents outlining how rich these lost cities of the conquistadors were. They haven’t been touched since then and he has staked the claims and he is going to find it.

Gold Terra (YGT.v)

This is an interesting prospect. Just outside the city of Yellowknife (one of our alternates flying back from Europe, so its a real airport) several mines were shut down due to low gold prices. (The Giant and Conn mines) These have not been drilled out for 60 years, there is still plenty of gold there. It has existing infrastructure and is very prospective.

Trilogy (TMQ)

This is my primary copper development position. It’s in Alaska and it’s access road has now been approved. They have a partner that will be a chief means to finance the mine. Robert Freidland thinks copper is a bigger money maker than gold. Trilogy has all the goods for the upcoming second revolution in electricity.

Blackstone (BSX.au)

If one is talking copper IMO he also needs to mention Nickel. The second electrical revolution is all about battery storage. We don’t know the optimal battery chemistry yet, whether it favors cobalt, lithium or whatever. But what we do know is nickel is the prime material, and we don’t have enough of it. Blackstone is the perfect undervalued development play IMO and the market is beginning to realize this. I brought this to the forum about two months ago, it’s been a double since but it still has much further to go.

So there are 10 PM and 2 base metal junior companies that will likely do very well over the course of this bull market. Those of you who prefer passive investing will do fine just to hold the gold or silver stock ETF’s or the handful of mutual funds that offer exposure. Those of you who are looking for the big score however, well the juniors are calling.

Personal Note

This week I hung up my headset and ended my professional career in aviation after over 40 years. Career highlights include over 30,000 hours total flying time to include 1,500 hrs in the F-16 and 23,000 hrs in the Boeing 767 which includes over 2,000 ocean crossings. I now turn my total focus towards navigating the bull market and scouring the world on my own terms.

Plunger’s last flight