This mornings upside gap could be important at least in the short term and maybe even longer term. Many of the necklines we’ve been following on the Markets Update were gapped over which is the first sign the bulls are showing some strength. We are at roughly breakeven right now in DUST and JDST. Until we get more information cash in these two seems prudent.

DUST: Close all positions at the market at 11.65.

JDST: Close all positions at the market at 6.75.

GLL: Hold for now.

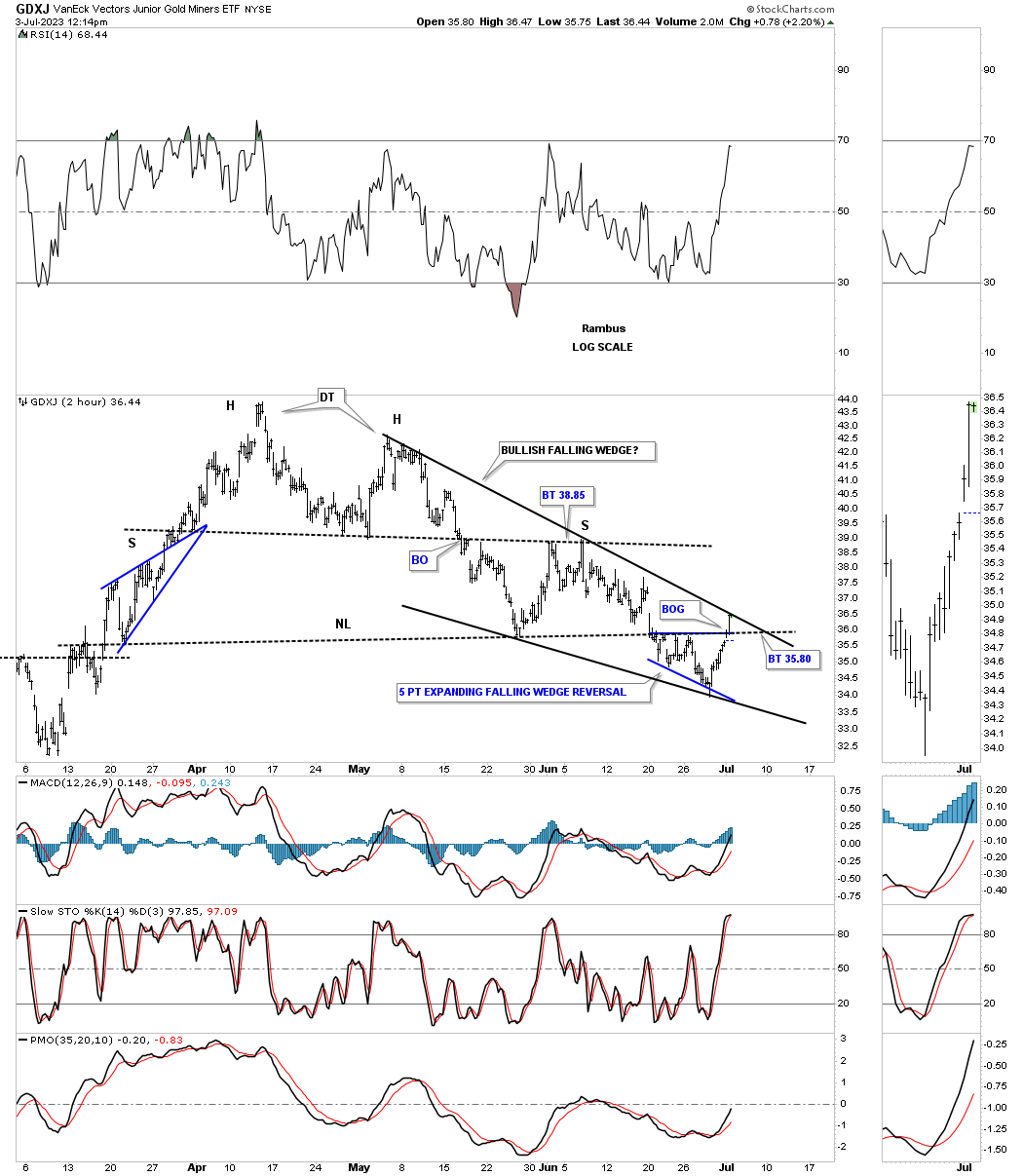

This 2 hour chart for the GDXJ shows a blue 5 point expanding falling wedge reversal pattern that formed just under the neckline with a breakout gap above both the top rail of the expanding falling wedge and the neckline this morning. I’ve added a trendline to the double top high and one where the GDXJ bounced off the neckline for the first time showing a possible bullish rising wedge. The top trendline still hasn’t been broken but the blue expanding falling wedge is suggesting that it will happen. The first area of resistance is now overcome for the GDXJ.

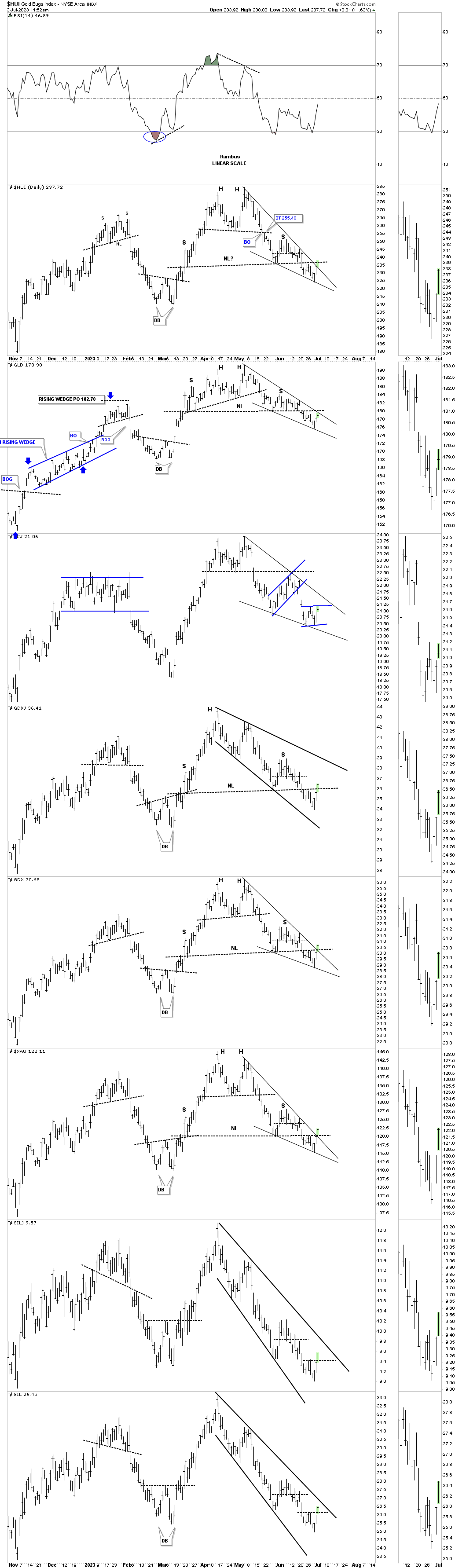

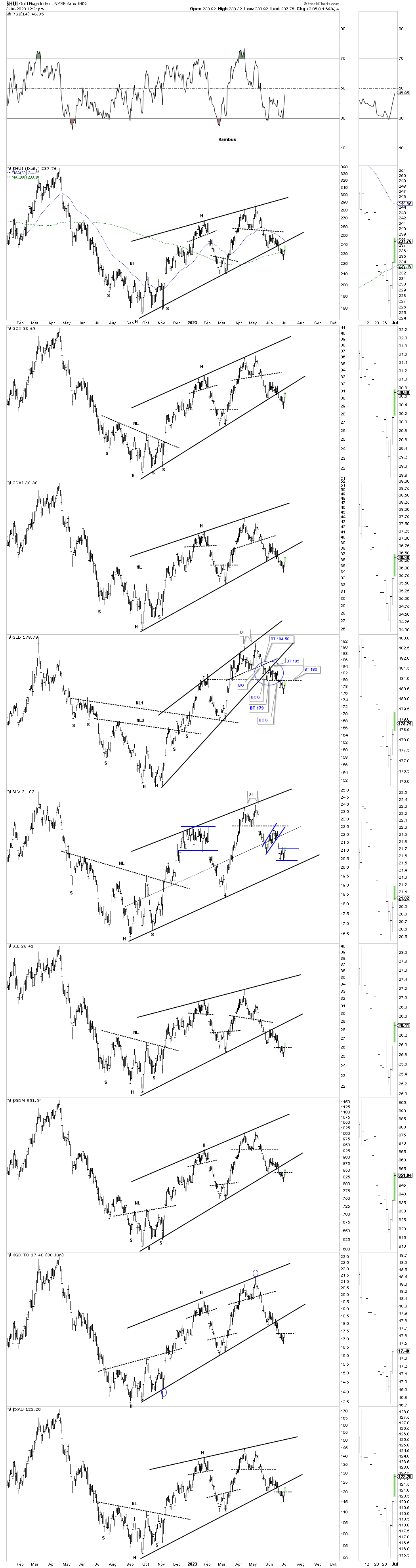

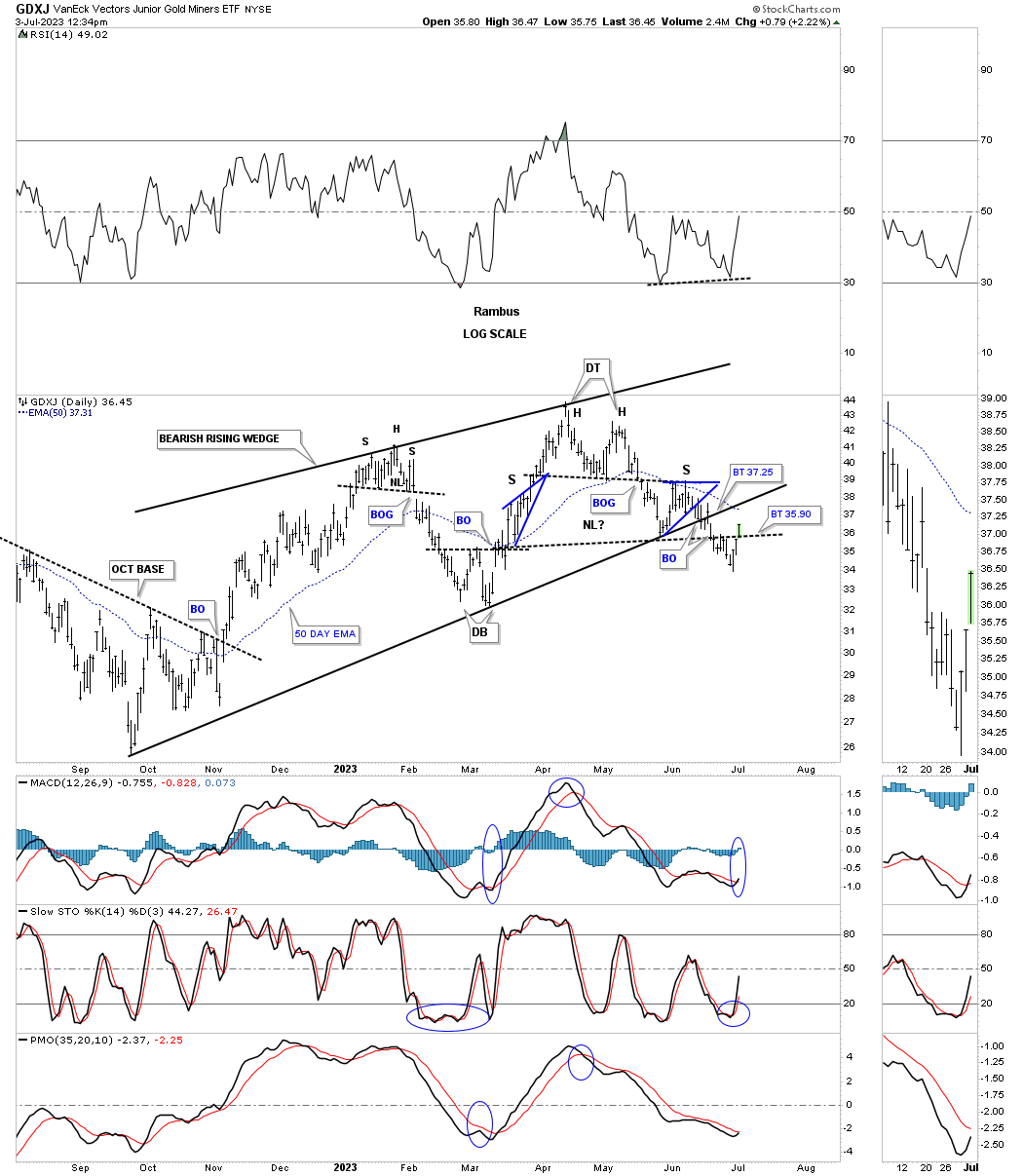

This is the daily chart we’ve been following showing the H&S tops with the breakout below the neckline. As you can see some of the necklines have been gapped over this morning. With todays gap I’ve added a top trendline off the double top high and the two lows which is showing a falling wedge in many cases with todays gap opening gapping above the top trendline. It is always important to understand a gap opening.

The real area of resistance is the bottom rail of the October rising wedge with the backtest still underway which started late last week. A close back above the bottom trendline would negate the breakout.

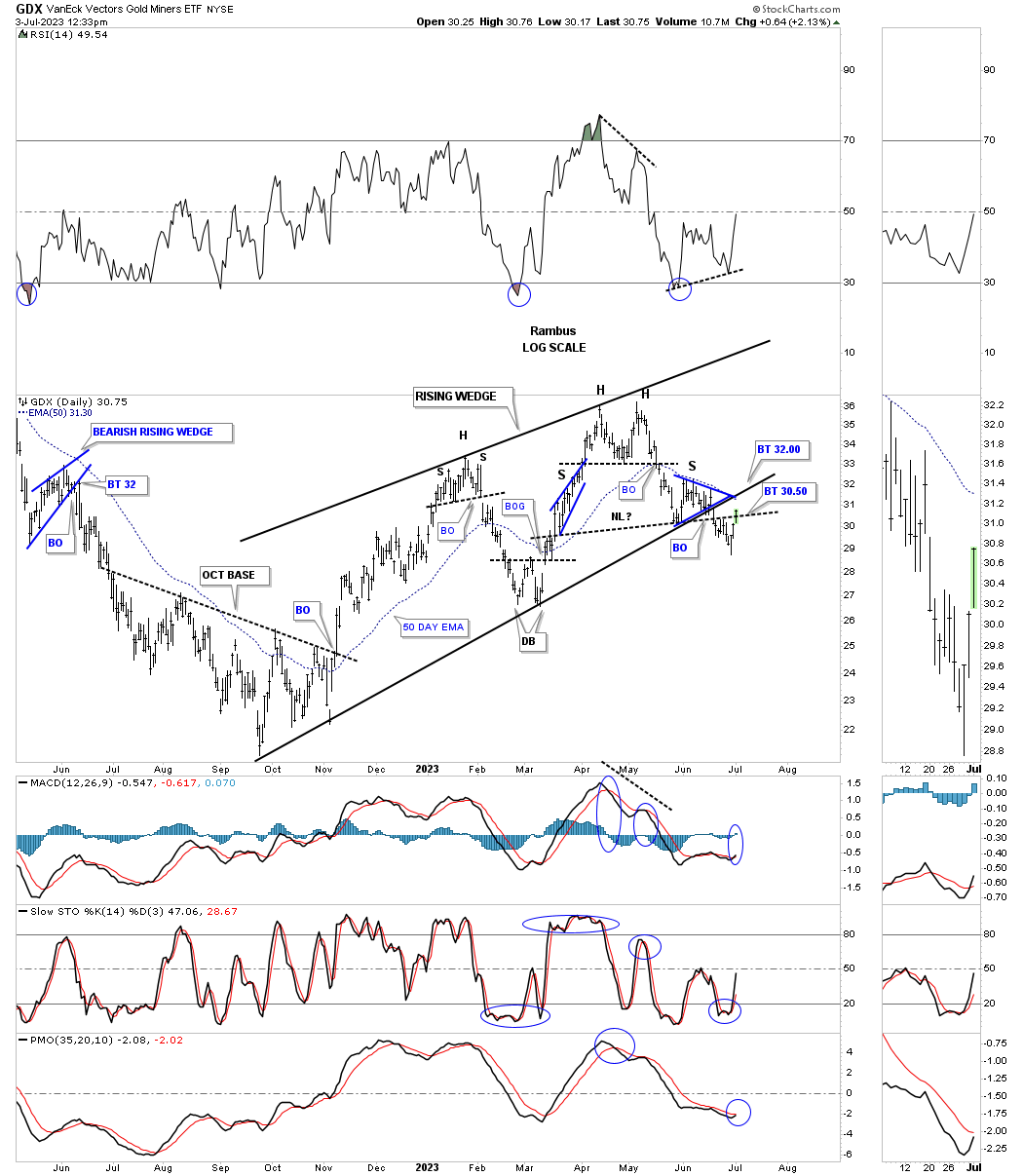

The daily chart for the GDX.

The daily chart for the GDXJ.