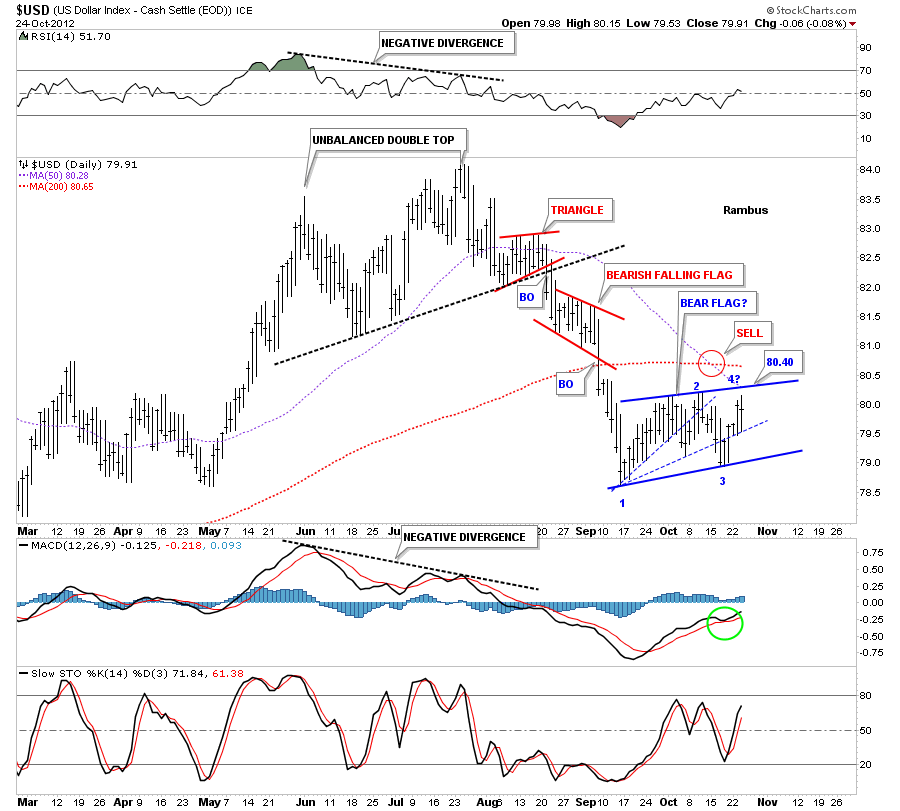

Tonight is a good time to look what has been happening this week in regards to the risk on trades and the precious metals complex. Lets start with the US dollar that is still chopping in a fairly tight trading range. Its already had 2 false breakouts to the downside, blue dashed rails, and is currently attempting to touch the top blue rail. The top blue rail price comes in around 80.40 which should be critical resistance. The other scenario I see could be that the US dollar is putting in a 3 point double bottom reversal pattern. The top blue rail is most important right now. If the dollar fails at point #4 and starts to decline the the bear flag is the most likely pattern. On the other hand if the dollar breaks above the top blue rail that will change the game entirely as that would confirm a double bottom is in place. So we wait and watch the price action for further developments. Note the 50 dma has crossed below the 200 dma offering a sell signal.

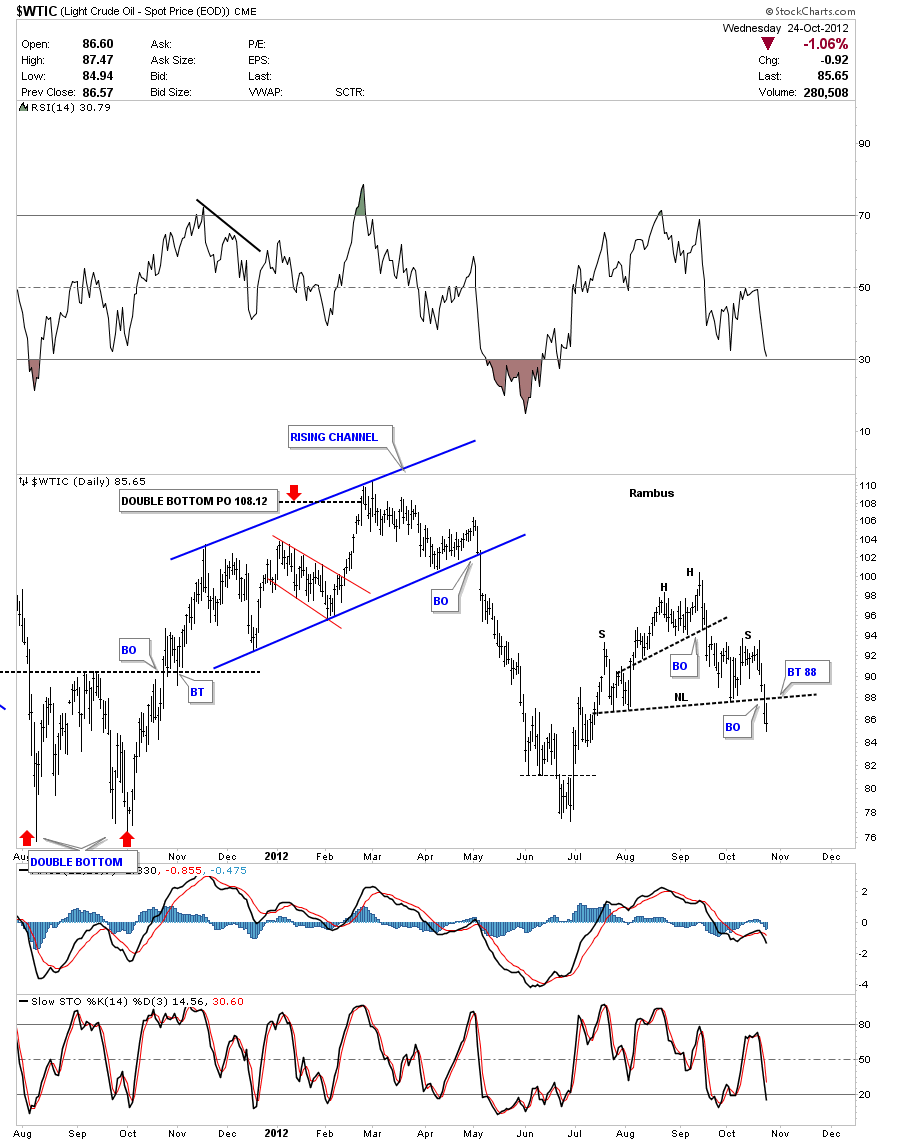

Oil looks like it has put in a H&S top which isn’t good for the risk on trade. The head portion is an unbalanced double top. The breakout occurred yesterday with some follow through today. Watch the backtest to the neckline at 88 for confirmation of the breakout.

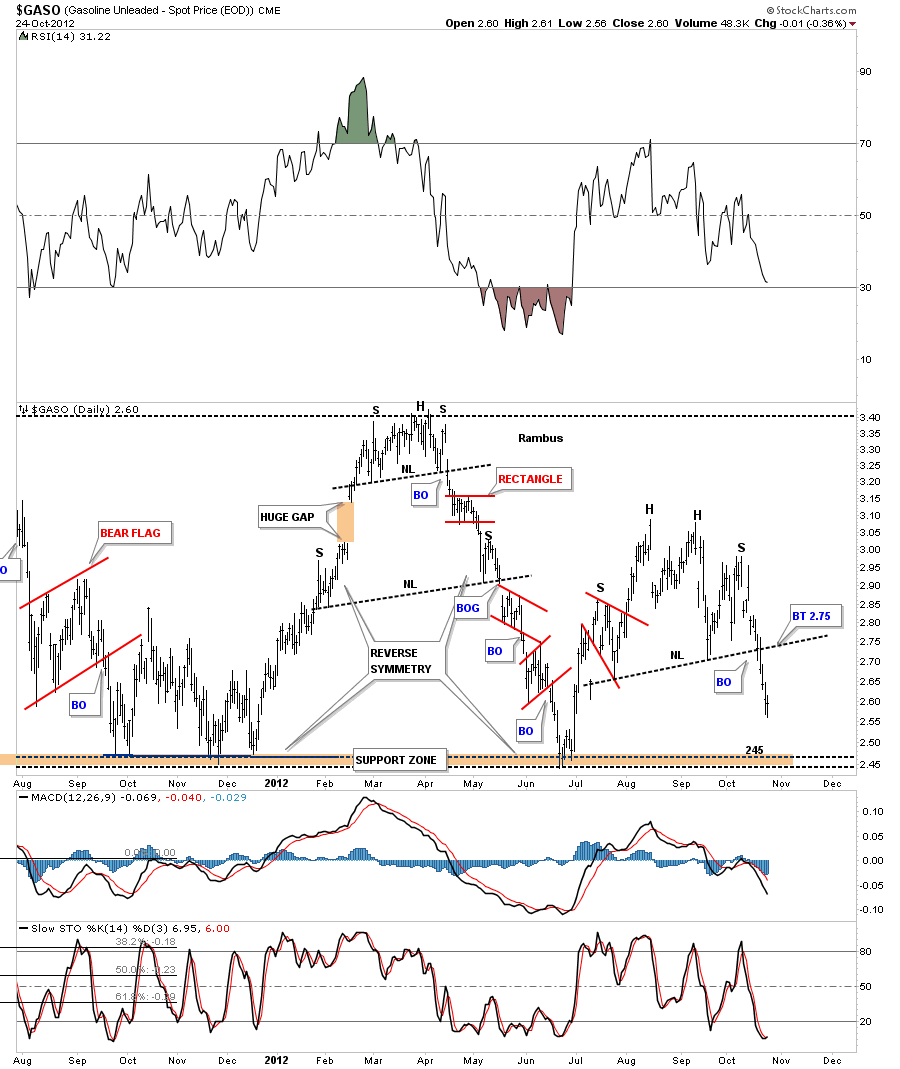

The gasoline chart also has a H&S top in place.

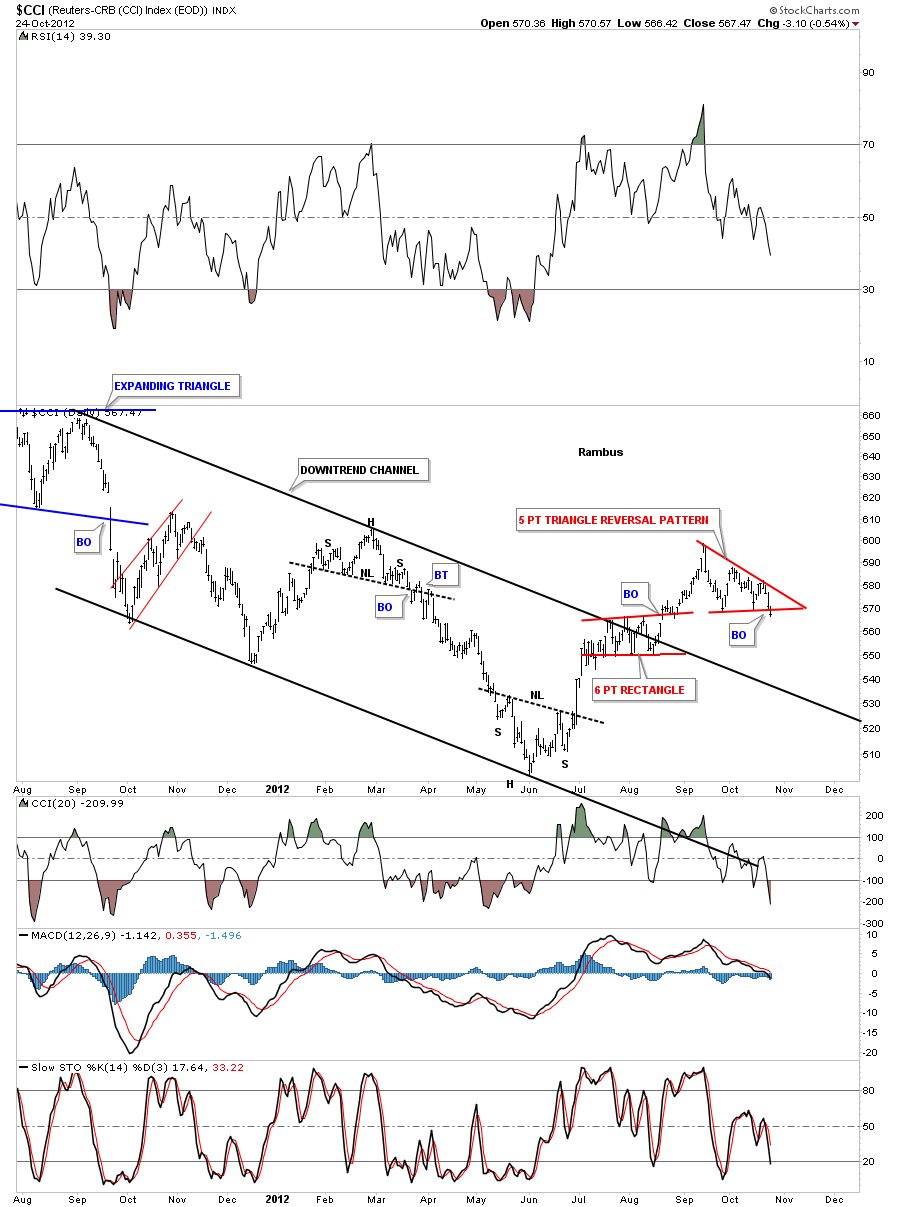

Next lets look at the CCI commodities index that appears to be breaking out to the downside from a 5 point triangle reversal pattern today.

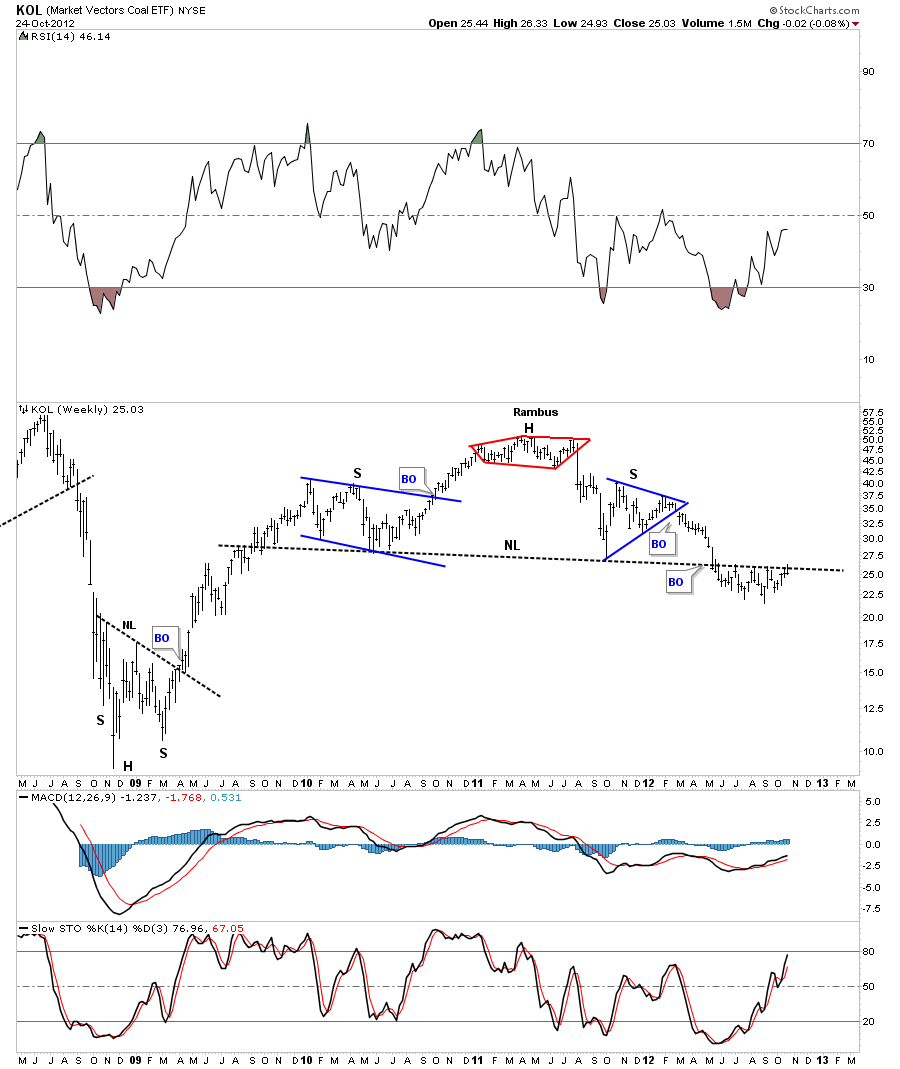

KOL is a coal etf that shows a huge H&S top pattern in place. Notice how the price action, on the backtest has failed for almost 6 months now. It really needs to close above the neckline to negate the H&S top pattern.

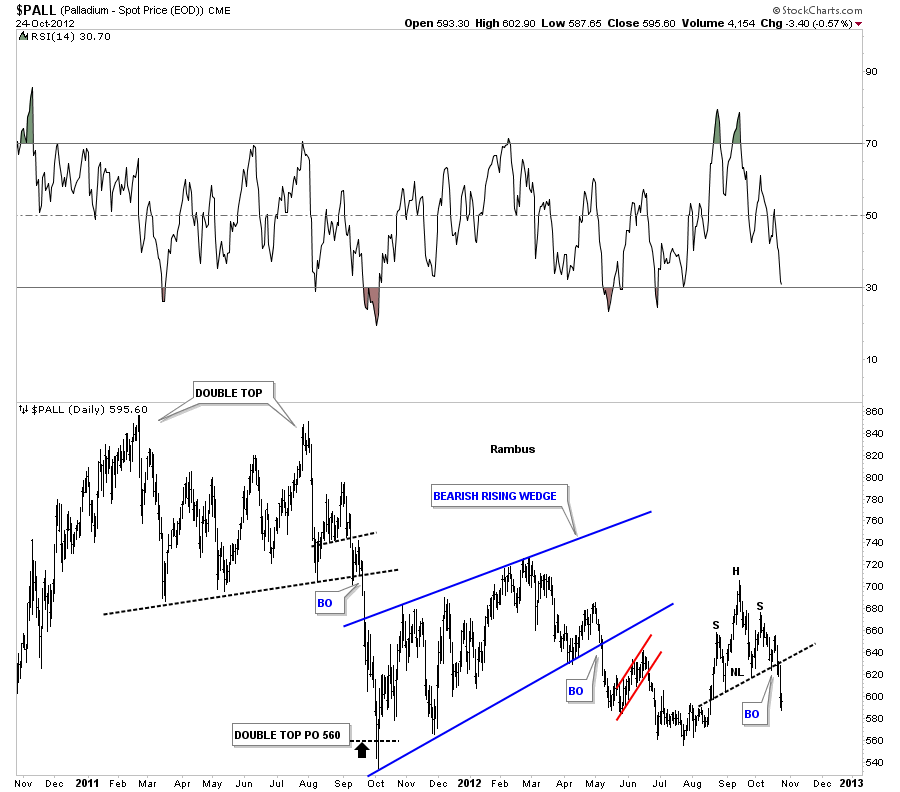

Lets now look at a couple of precious metals that don’t get a whole lot of attention but are important to follow for the overall big picture. Up until yesterday we could only speculate if PAL’s H&S top was a valid pattern.

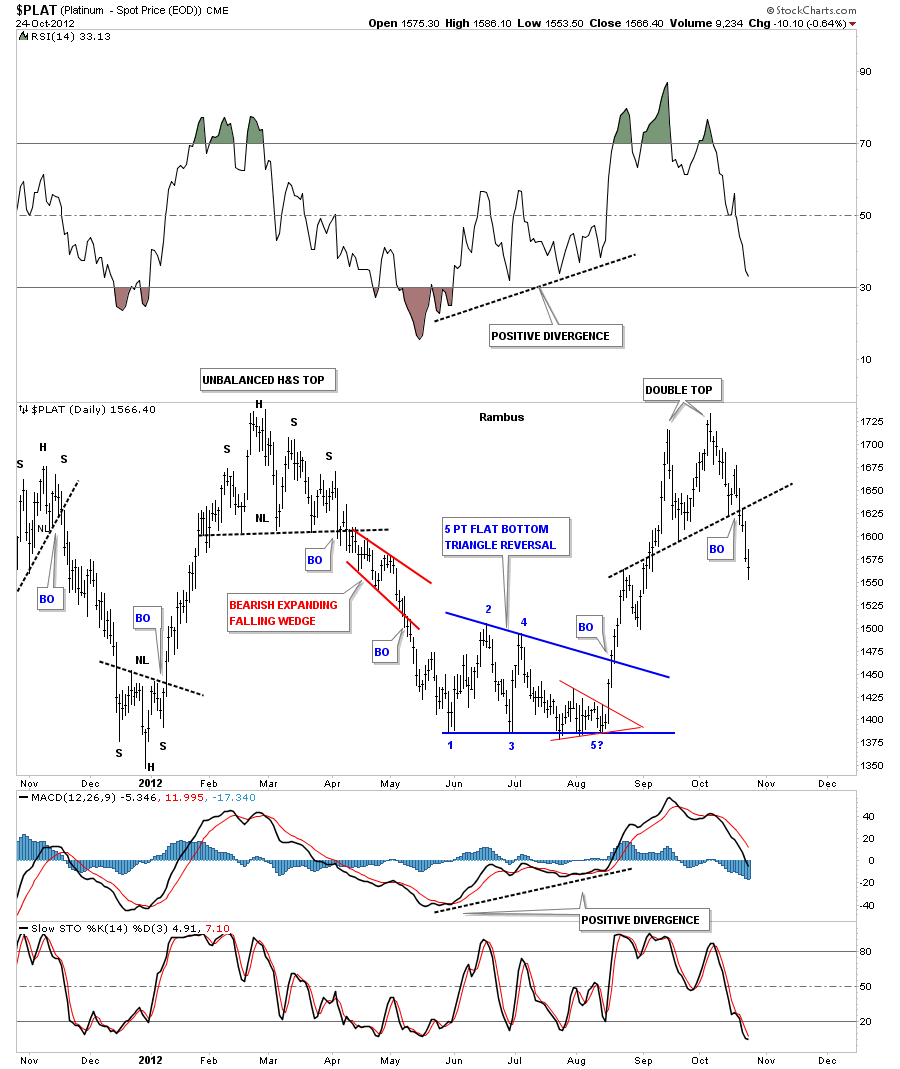

Platinum has a double top in place now.

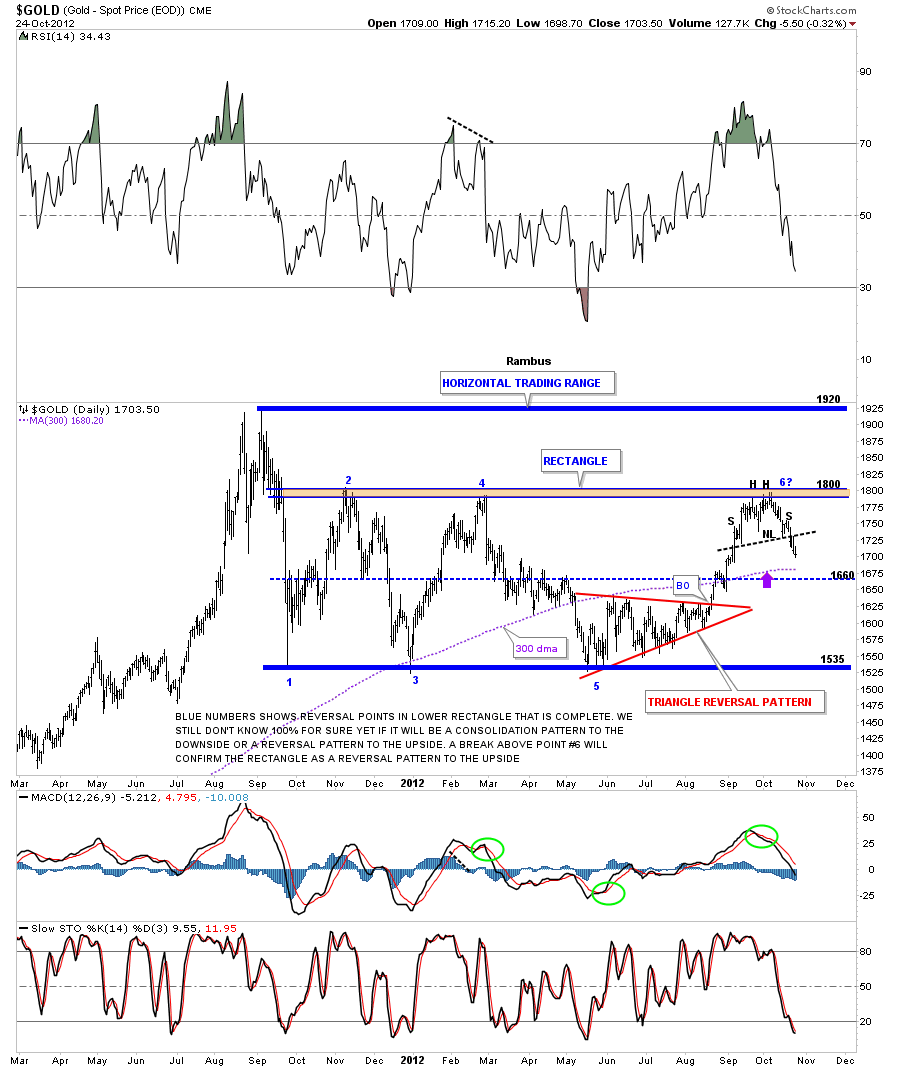

Gold has a H&S top in place that broke to the downside on Monday. I have to be perfectly frank right here. The placement of the recent H&S top, at the top rail of the big rectangle, is not a good sign. Gold has now completed it’s 5th reversal point which now throws it back into a rectangle reversal pattern for the time being. Gold is currently embarking on it’s 6th reversal point which is an even number if it touches the bottom rail. That would put this big rectangle into a consolidation pattern to the downside. All is not lost yet. Alot of times when you have a nice symmetrical rectangle like gold is showing, the last reversal point will come in at the center of the rectangle, blue dashed horizontal rail, at 1660. The H&S top has a price objective down to 1660 so we have to keep an open mind in here.

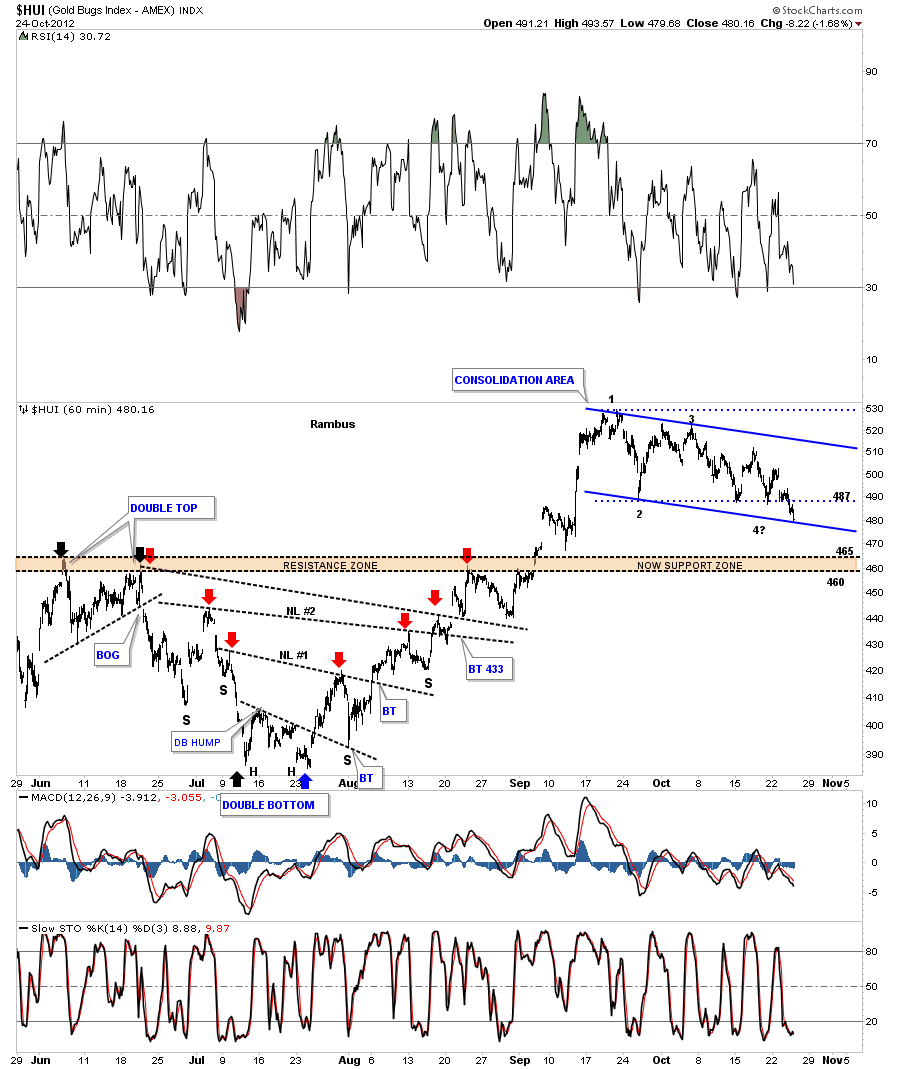

Lets take a look at the 60 minute chart of the HUI that shows it breaking below the horizontal rail today. We are now entering the pain area I’ve been telling you about. We now have a lower low in place. Today’s price action stopped right on the parallel trendline made off the top rail. Now 487 becomes key resistance that needs to be overcome for the HUI to move higher.

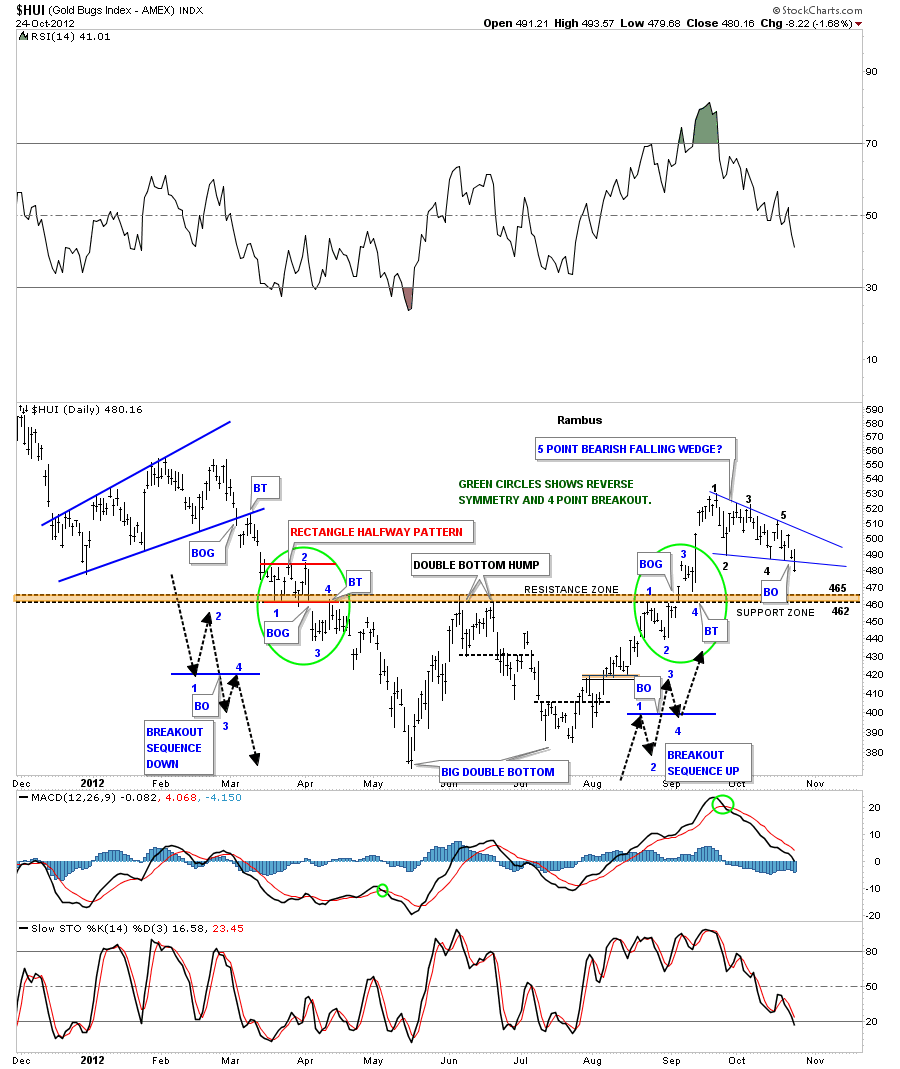

The next chart is a daily look that shows a potential 5 point bearish falling wedge. I’ve tweaked it just a tad to get the 5 reversal points. Today could be a breakout day. I want to keep everything in perspective right here. You can see the brown shaded area that has done a good job of showing support and resistance. Below its resistance and above its support. Its critical that the HUI stays above the 460 area. That area is our line in the sand. As long as the HUI stays above the brown shaded area we will hold our model portfolio stocks. We were lucky enough to buy most of the portfolio stocks below the brown shaded area that gives us a little more leeway. For the investors that bought above the brown shaded area the pain is getting stronger as each day passes.

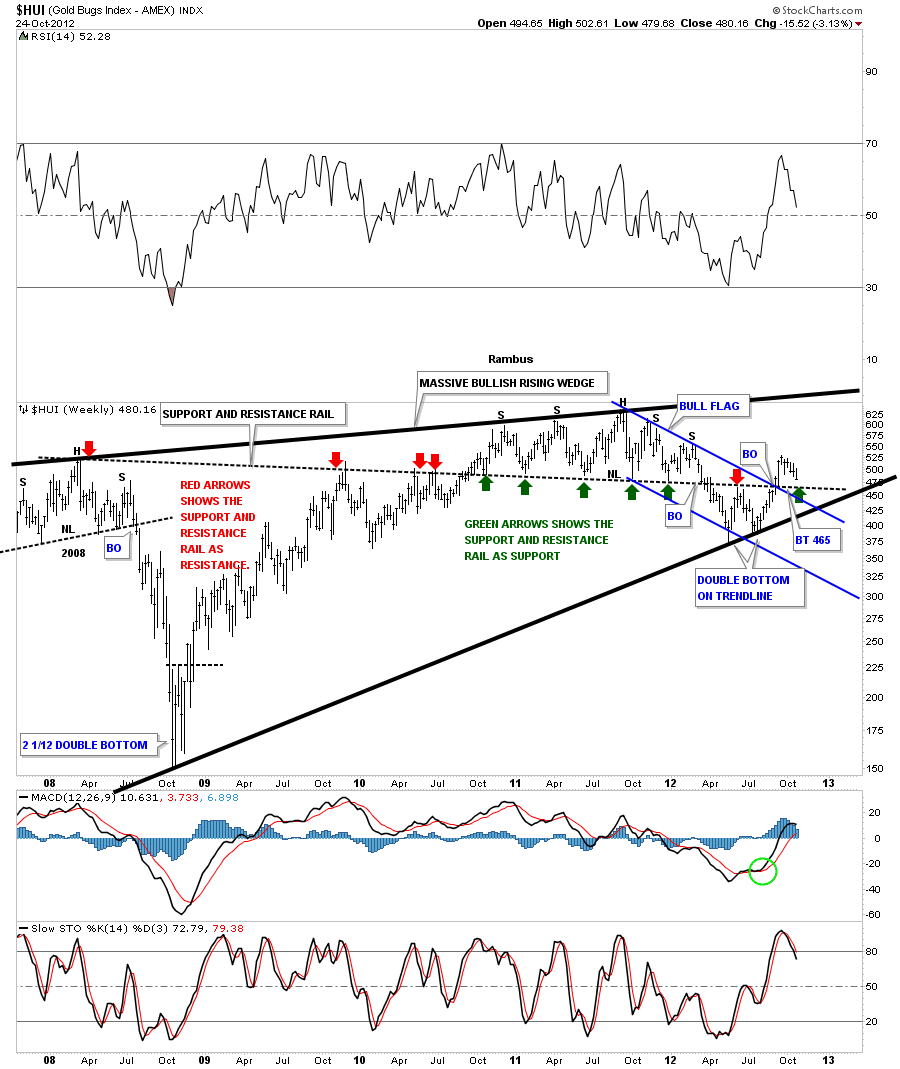

This next weekly chart really puts the 460 number into perspective. As you can see the support and resistance rail has done a masterful job of showing support and resistance going all the way back to the 2008 H&S top.

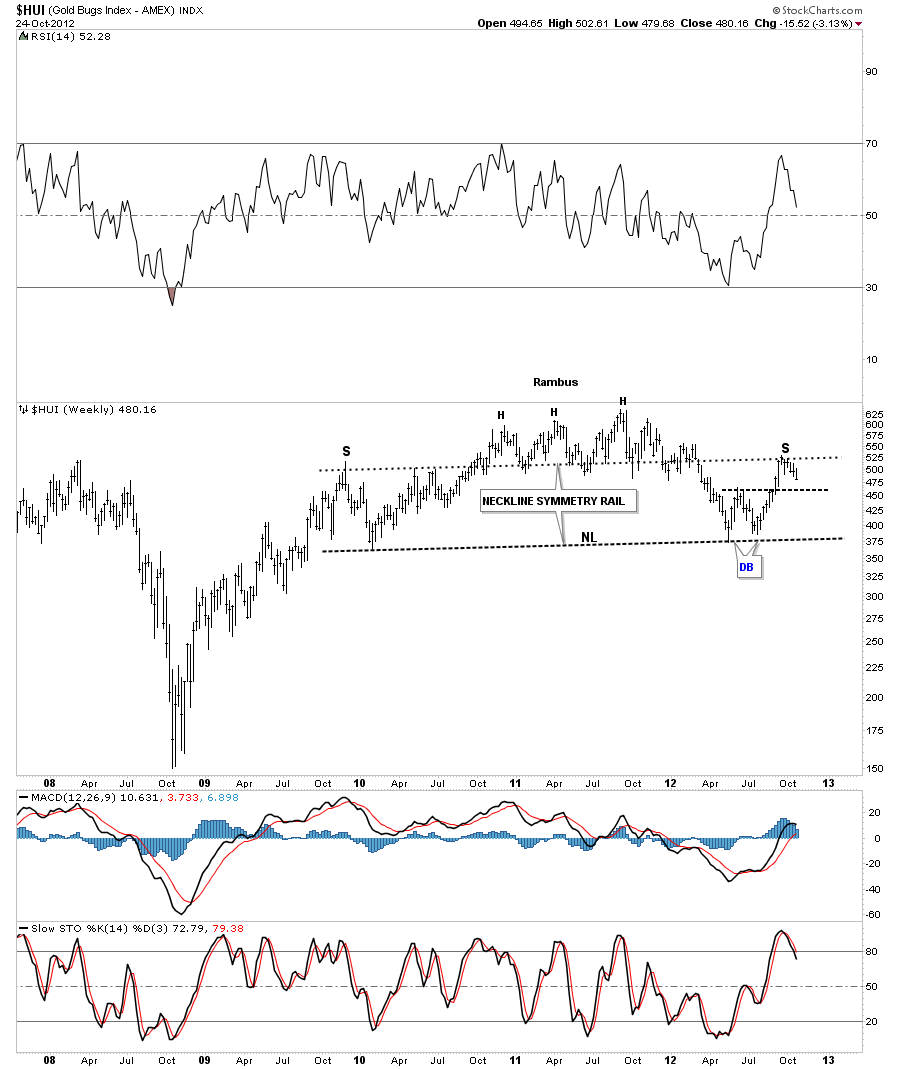

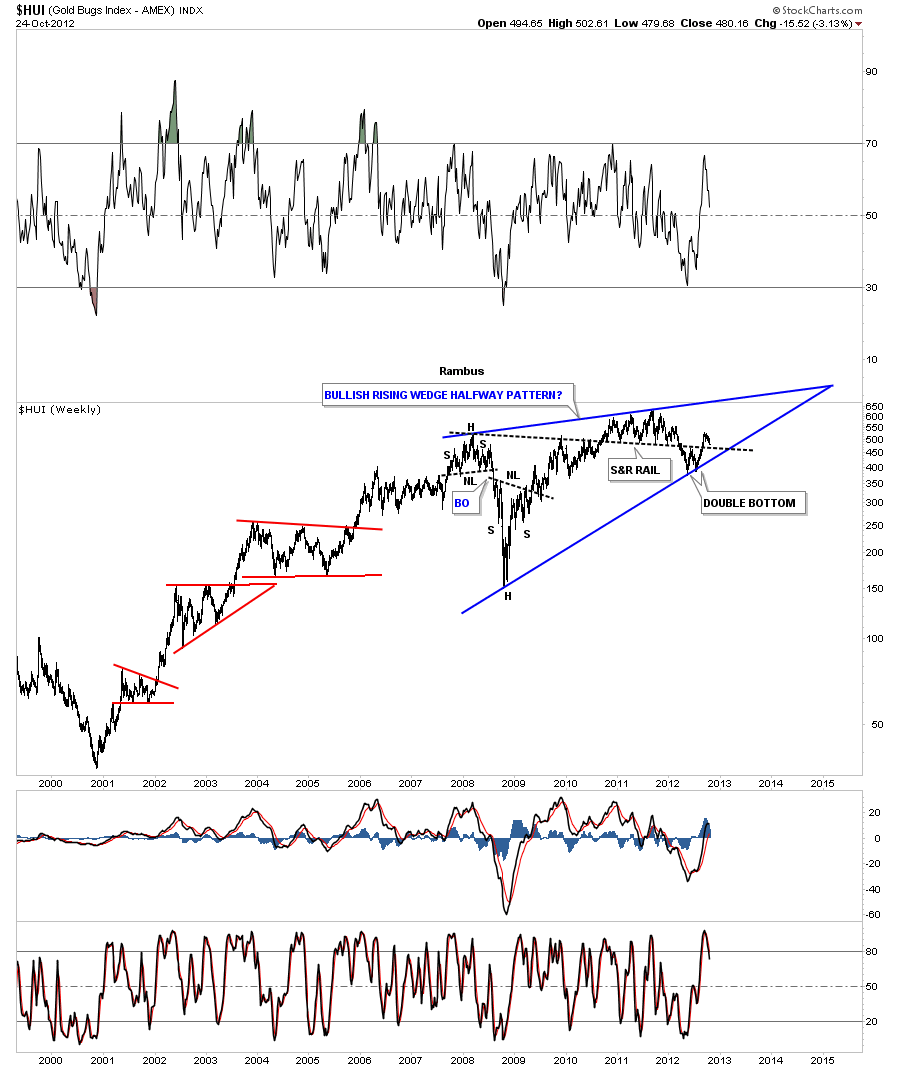

I want to leave you tonight with two big long term patterns for the HUI. One is bearish and one is bullish. Keep in mind neither one is complete yet. If you’ve followed my work over the years you know I can change direction if the charts are telling me to. You may recall I was pretty bearish when the HUI broke below the neckline which was the right call. But as soon as things started to turn around I didn’t waste anytime getting back to the long side. Now we are approaching another critical area that will tell us which side of the market to be on.

The bearish chart I want to show you is a potential very large H&S top. I’ve added a neckline symmetry rail that is a parallel neckline taken off the left shoulder top. This can often times give you a place to look for a right shoulder high if indeed a H&S pattern is forming. As you can see the HUI has started to reverse right at the neckline symmetry rail at the right shoulder top. This chart also shows you why the 460 double bottom hump is so critical to hold.

The last chart I want to leave you with is a bullish look that could have big implication going forward if it plays out. This chart pattern is a bullish rising wedge halfway pattern to the upside. Again you can see how important the 460 area is as shown by the support and resistance rail. If the HUI can find support there it will be on its way to the top blue rail. A break of the top blue rail will send the precious metals stocks into orbit.

So there you have it. The 460 area is the most important line in the sand for the HUI. Everything basically hinges on what happens there. If it can hold then we should see much higher prices. I think we will initially see a bounce off the 460 rail. From there we will just have to see how it trades and then act accordingly. I’m sorry for the late post but there was alot to cover tonight. All the best …Rambus

……………………………..

EDITOR’S NOTE :

Rambus Chartology is Primarily a Goldbug TA Site where you can watch Rambus follow the markets on a daily basis and learn a great deal of Hands on Chartology from Rambus Tutorials and Question and Answeres .

Most Members are Staunch Goldbugs who have seen Rambus in action from the 2007 to 2008 period at www.goldtent.org and now Here at Rambus Chartology since early 2012 .

To review his Work and incredible calls from the 2007-2008 period click on the top right sidebar in the “Wizard of Rambus” ….”What If !!” Post

To Follow Rambus Unique Unbiased Chart Work and participate in a Chartology Form with questions and answeres and learn the Art and Science and Mindset of a Pro Trader please Join us by subscribing monthly for $29.99 at

www.rambus1.com

We have many subscribers from all over the world who are glad they did as they enjoy the many daily updates and commentaries provided at this exciting new site

As you will see Rambus (Dave) has prepared us for this difficult period by being one of the only ones to see and warn about the incredibly debilitating PM smackdown as early as Jan 2 2012 …click on the” HUI Diamond in the Rough” Post in the “Wizard of Rambus” top right

More Recently Rambus called a Bottom in HUI in this post…and has had subscribers on board for a Powerful Run to the Upside

http://rambus1.com/?p=5651

BUT

What is he seeing Now ?

You will find Rambus to be a calm humble down home country tutor with an incredible repitoir of all the TA based protocols tempered with his own one of a kind style…simply put…He wants to keep his subscribers on the right side of these crazy volitile and downright dangerous markets

See you at the Rambus Chartology

www.rambus1.com