In this weekend report I want to get everyone up to speed on the US dollar and gold.This week will mark the start of the 6th week of consolidation time for the precious metals complex. We are now in the timing band if these little consolidation patterns are going to be little flag type patterns. These type of patterns generally last between 3 to 6 weeks before they are complete and produce a move of similar magnitude that led up into these patterns. These patterns will look like they formed in the middle of the impulse leg when the move is completed.

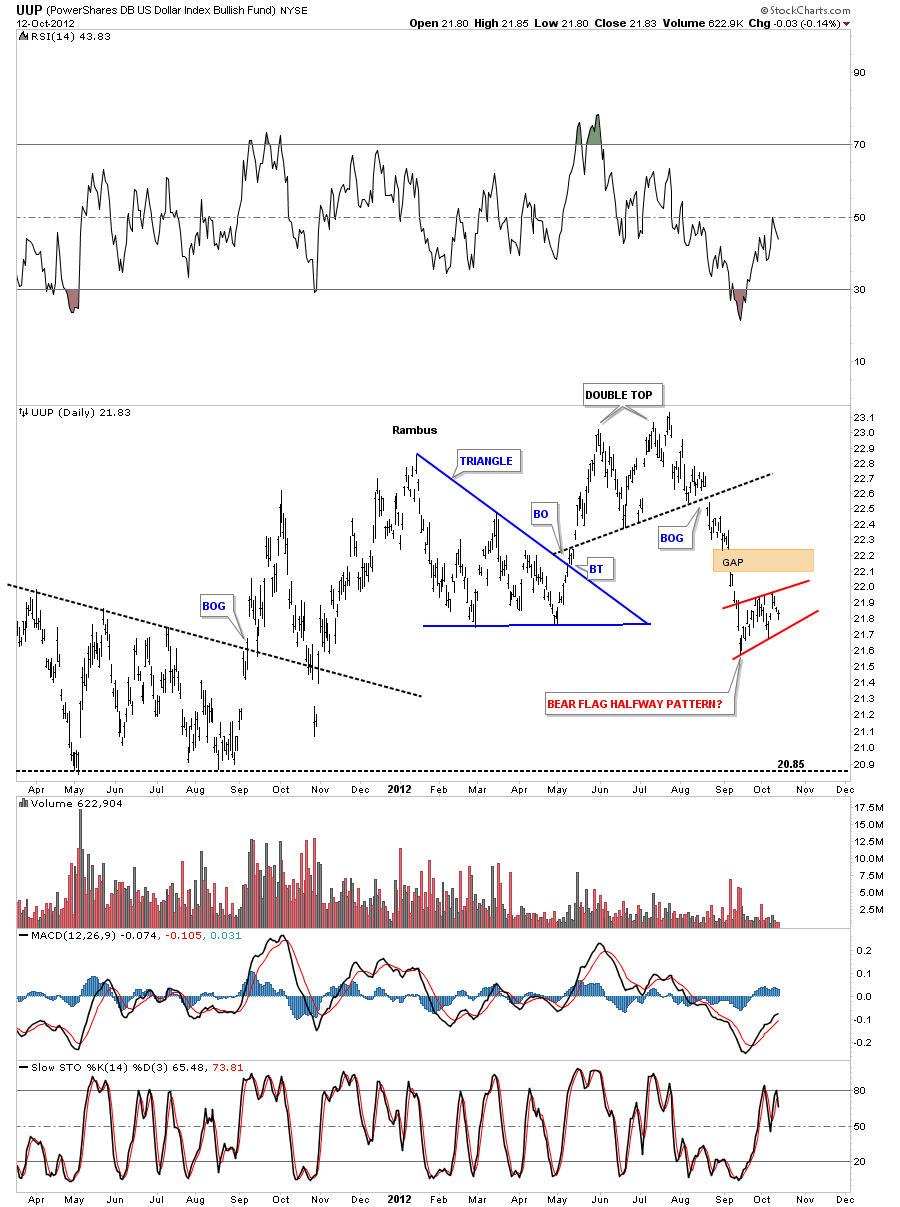

The most important chart we have to look at first is the UUP chart which is the US dollar etf. On the daily chart below you can see the possible bear flag that is equal in time to alot of the precious metals stocks small consolidation patterns. A breakout of the bottom red rail will complete the consolidation period and set the stage for the second leg higher for basically the risk on trades including the stock markets. Its still unknown how much longer the UUP will chop around within the boundaries of it’s bear flag but at some point the pattern will be complete and the move to risk on trades will begin in earnest.

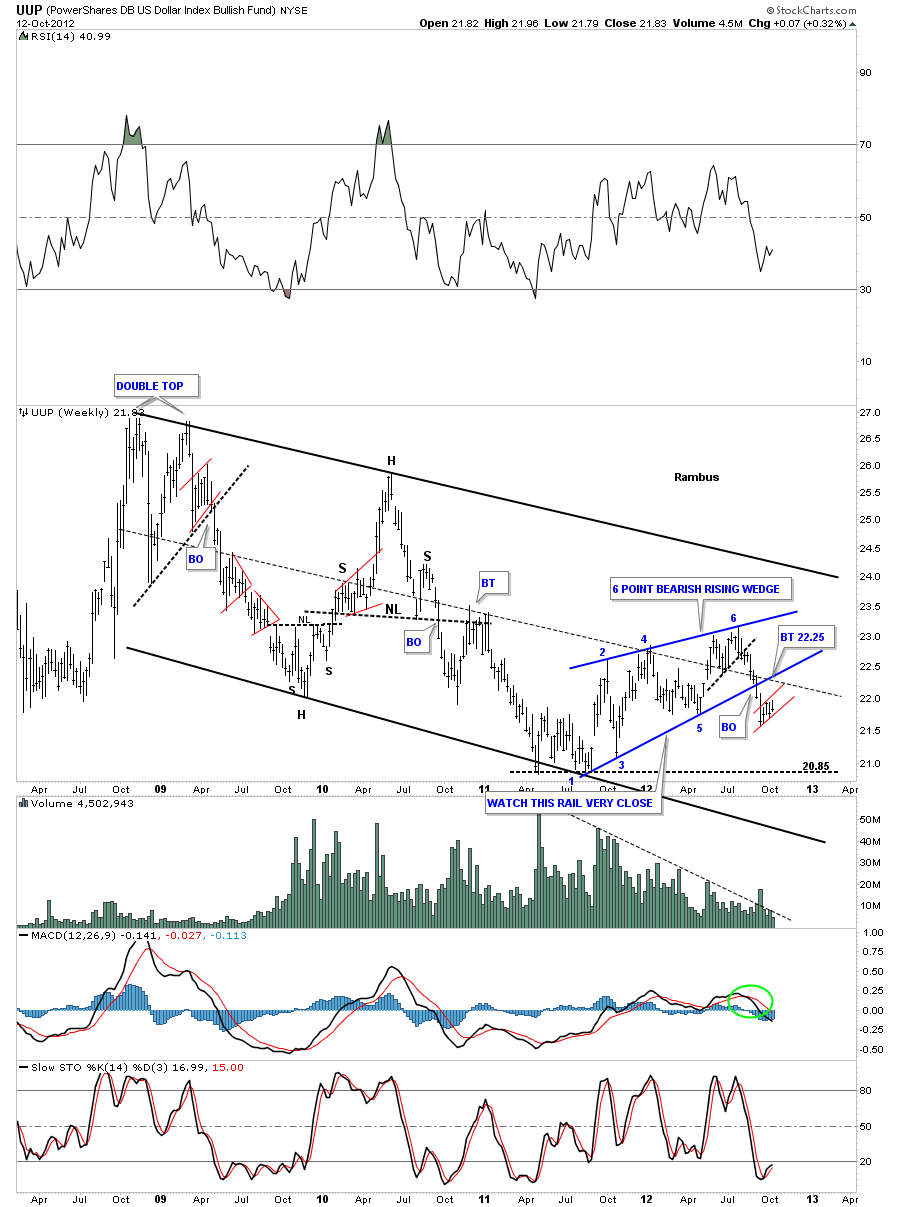

The weekly look shows the small red 5 week old bear flag still building out below the 6 point blue bearish rising wedge.

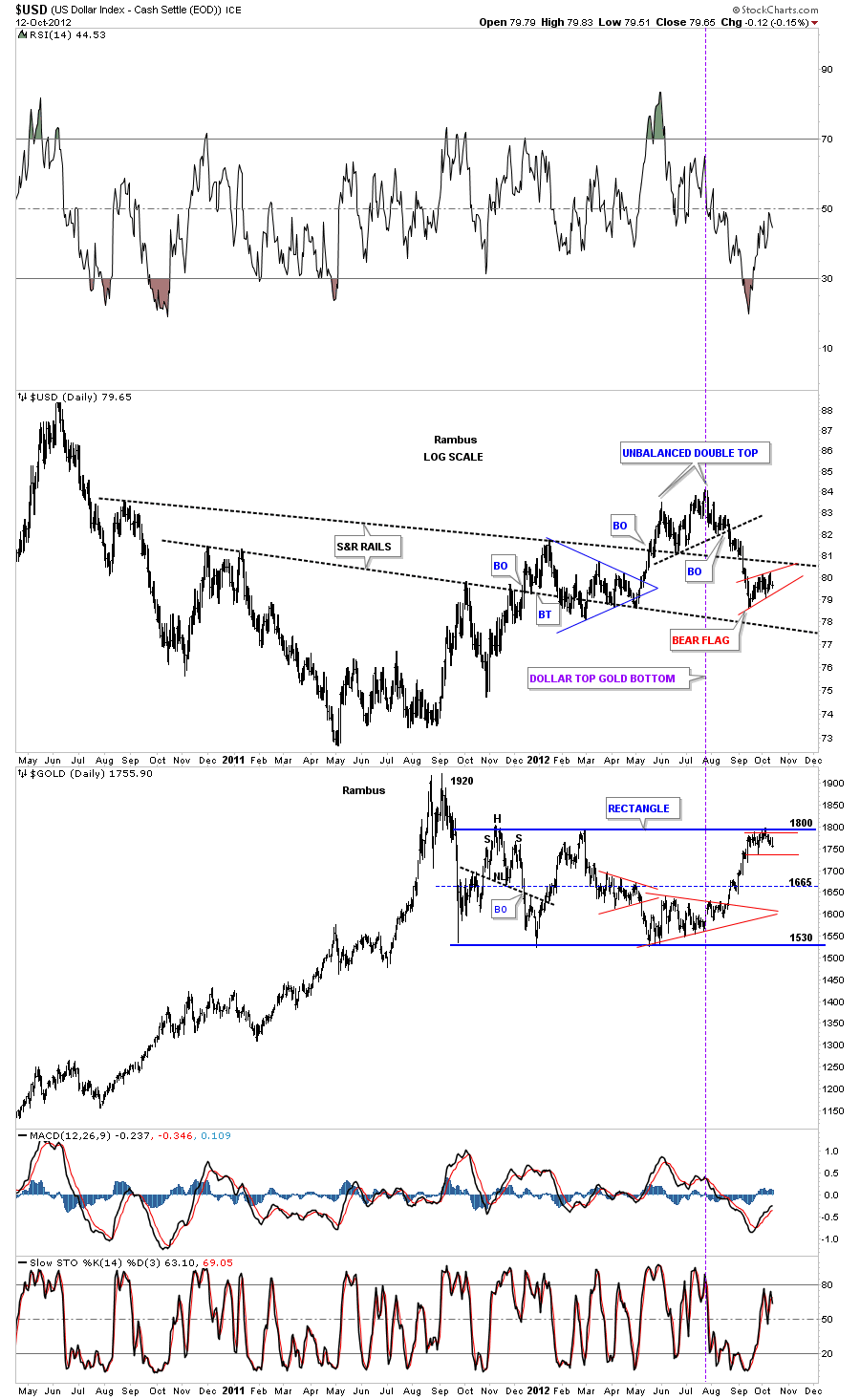

The next chart is a combo chart with the US dollar on top and gold on the bottom. The purple dashed vertical line shows how the US dollar and gold have been trading in the opposite direction since the dollar topped out above 84. You can see if the dollar breaks down below it’s red bear flag that will propel gold up and over the critical resistance rail at 1800 and complete the 5 point rectangle reversal pattern I’ve been showing for sometime now.

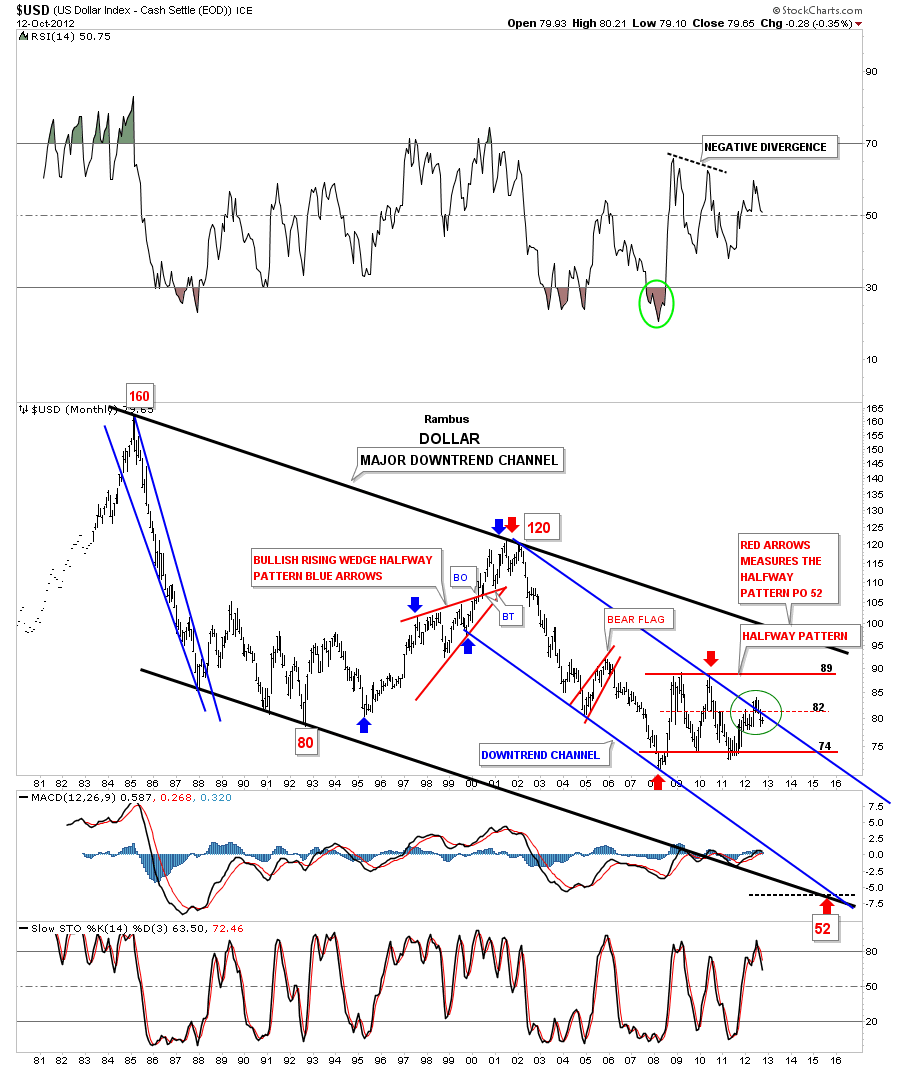

The last chart I would like to show you is the long term look at the US dollar that shows the blue downtrend channel inside the much bigger long term black downtrend channel. The green circle shows what now looks like a false breakout above the top blue trendline. As you can see the dollar is now trading back below the top blue rail for the last month and a half now. Its not the prettiest rectangle I’ve ever seen but I’m going to label it as a rectangle halfway pattern as measured by the red arrows. If in fact the red rectangle ends up being a halfway pattern the price objective would come in around the 52 area three or four years from now.

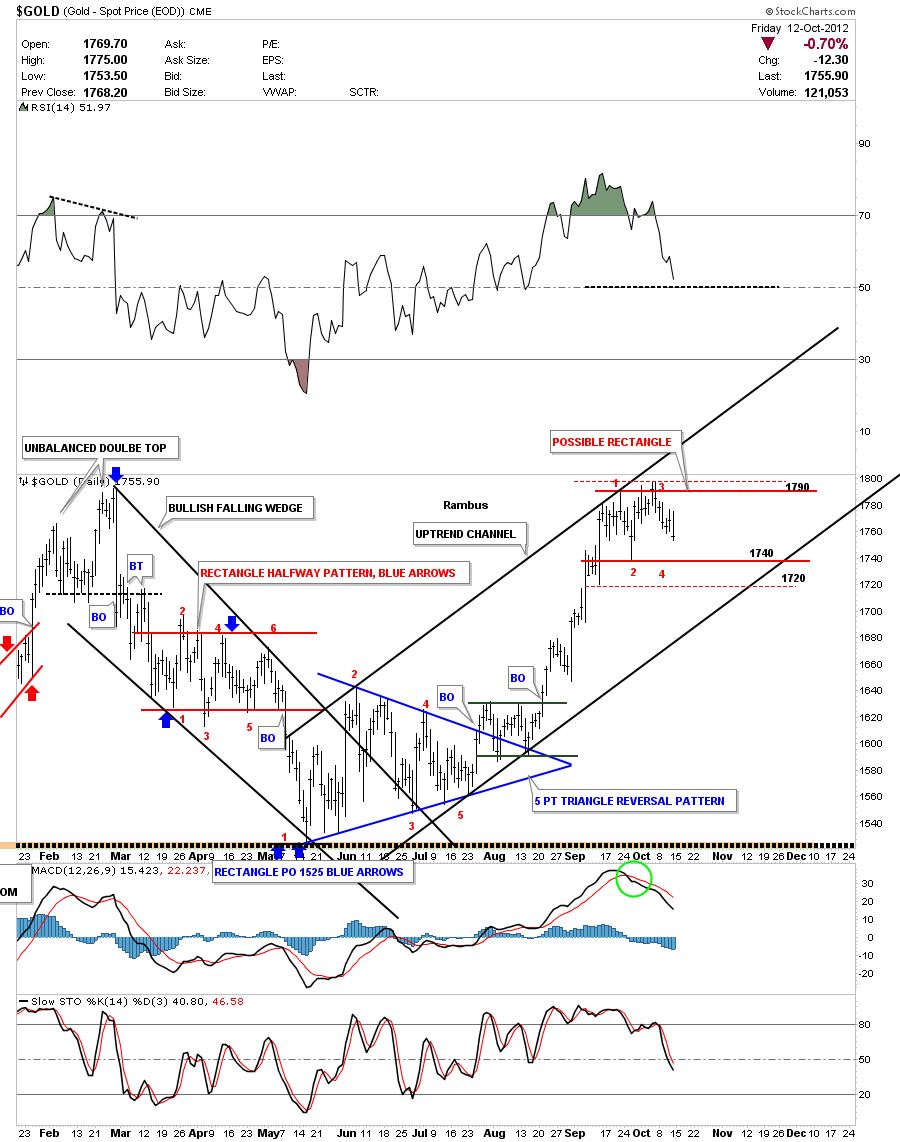

Lets now take a look at a daily chart of gold that I showed you several weeks ago with an uptrend channel and a possible horizontal trading range between 1740 and 1800. It looks like gold wants to test the 1740 bottom rail again which is about 15 points lower from Fridays close. I really wouldn’t like to see gold trade much below the 1720 area that was a previous low made on the way up. In a strong uptrend we shouldn’t see a lower low form.

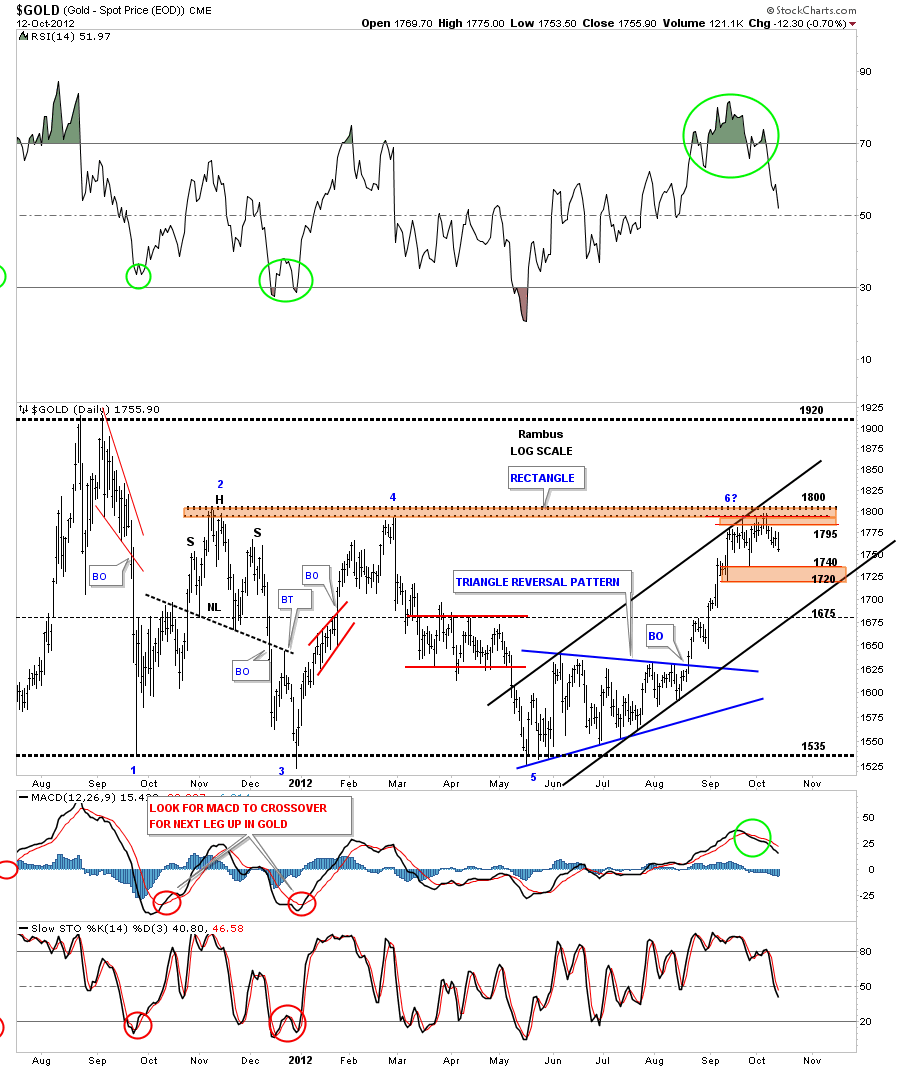

Below is a longer term daily look at gold that takes in the big completed rectangle. So far the resistance at 1800 was to be expected on the last hit as everyone knew this was a resistance zone. The thing I’m would really like to see is a small consolidation pattern form right where it is now to build up the energy to finally takeout the top rail at 1800. So far so good.

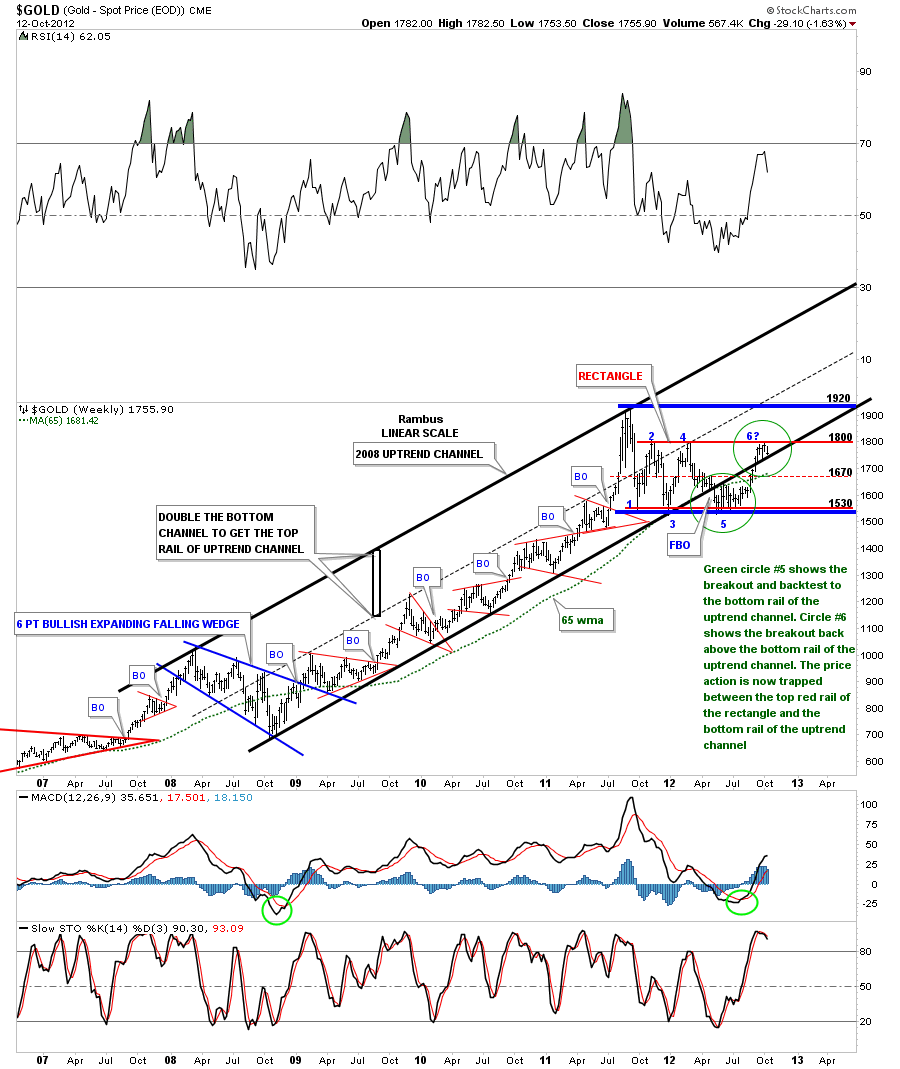

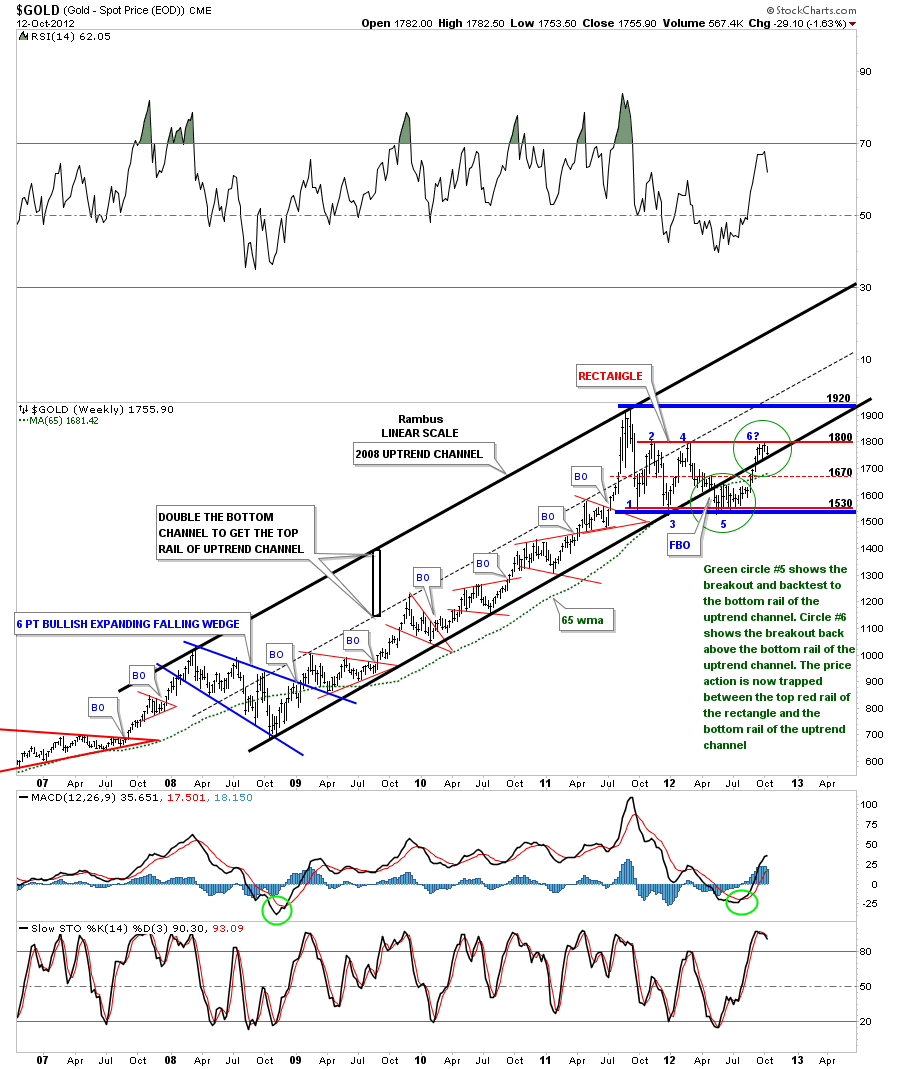

This last chart for gold is a weekly chart that I showed you many time in the past. I call this chart my 2008 uptrend channel chart as its the best look at the huge impulse leg up off the 2008 bottom. First I want to focus your attention to the bottom black rail of the uptrend channel. If you recall when gold broke that bottom rail of the uptrend channel, to the downside, that was one of the reason I had to put the model portfolio into cash. That was also about the time the HUI was also breaking below its neckline. So from a technical perspective I had no choice. The lower green circle with the #5 in it shows the breakout to the downside and then a nice clean backtest to the underside of the bottom uptrend rail. That was textbook. That same area started to trade sideways and didn’t break much lower which eventually carved out that 5 point triangle reversal pattern that is the bottom at point #5. I said at the time that the 5 point triangle reversal pattern would have enough energy to get the price of gold back up to the top rail of the big red rectangle which has occurred.

Sticking with the same chart lets now focus in on the second green circle that has point #6 in it. This is where it gets interesting. Once gold was able to trade above the bottom black rail of the 2008 uptrend channel, that was a very bullish situation, as it showed gold being very strong. Now gold is trapped between the top red rail of the rectangle and the bottom rail of the 2008 uptrend channel. As you can see on the chart below the price action is being squeezed out into an apex where the two trendlines come together. Its only going to be a matter of time before one of those trendlines gives way. This brings us back to why I showed you the dollar charts above because if the dollar breaks down from the bear flag gold will breakout above the top red rail at point #six. Once gold trades comfortably above the top rail of the rectangle the top red rail will reverse its role and act as support on any decline. It will also confirm the 5 point rectangle as a reversal pattern to the upside.

These charts above are showing that the risk on trade is entering a very critical area. The consolidation period is now 5 weeks in the making which isn’t all that long but if gold is in a strong move higher this might be all it takes to make the breakout move higher. Notice all the small red consolidation patterns that formed between the 2008 low and the top at 1920 made last September within the 2008 uptrend channel. Put yourself in one of those many red consolidation patterns to get a feel of time, as time can wear most investors out waiting for the price action to start. All the best…Rambus

…………………..

EDITOR’S NOTE :

Rambus Chartology is Primarily a Goldbug TA Site where you can watch Rambus follow the markets on a daily basis and learn a great deal of Hands on Chartology from Rambus Tutorials and Question and Answeres .

Most Members are Staunch Goldbugs who have seen Rambus in action from the 2007 to 2008 period at www.goldtent.org and now Here at Rambus Chartology since early 2012 .

To review his Work and incredible calls from the 2007-2008 period click on the top right sidebar in the “Wizard of Rambus” ….”What If !!” Post

To Follow Rambus Unique Unbiased Chart Work and participate in a Chartology Form with questions and answeres and learn the Art and Science and Mindset of a Pro Trader please Join us by subscribing monthly for $29.99 at

www.rambus1.com

We have many subscribers from all over the world who are glad they did as they enjoy the many daily updates and commentaries provided at this exciting new site

As you will see Rambus (Dave) has prepared us for this difficult period by being one of the only ones to see and warn about this incredibly debilitating PM smackdown as early as Jan 2 2012 …click on the” HUI Diamond in the Rough” Post in the “Wizard of Rambus” top right

More Recently Rambus called a Bottom in HUI in this post…and has subscribers on board for a Powerful Run to the Upside

http://rambus1.com/?p=5651

What is he seeing Now ?

You will find Rambus to be a calm humble down home country tutor with an incredible repitoir of all the TA based protocols tempered with his own one of a kind style…simply put…He wants to keep his subscribers on the right side of these crazy volitile and downright dangerous markets

See you at the Rambus Chartology

…………………….