This content is for Yearly and Monthly members only.

Subscribe

Subscribe

Already a member? Log in here

Tonight I would like to update you on some of the longer term gold charts we’ve been following which are still hanging in there from the bullish perspective. Keep in mind these are long term charts so changes come slowly.

Lets start by looking at the long term weekly chart for gold which shows its 2011 bear market downtrend channel we’ve been following for a long time now. Back in July of this year the price action broke out above the top rail and just recently the top rail was backtested from above and we are getting a bounce exactly where we needed to see a bounce.

Normally at the end of a long protracted bull or bear market you will find some type of reversal pattern buildout. As you can see the 2011 top built out the 6 point rectangle just below the all time highs. Currently gold has built out the blue triangle with the 5th reversal point falling just shy of reaching the bottom rail. I have seen in the past that sometimes when the 5th reversal point fails to reach the bottom rail it can be a sign of strength, meaning the bulls are not waiting around, red circle. If the bulls are truly in charge the next thing we’ll want to see is a new high above the previous high that was made on the initial breakout.

This next chart is probably the most important chart for gold as it shows the possible H&S bottom building out. We’ve discussed in the past that big patterns lead to big moves. This potential H&S bottom is 4 years in the making and is big enough to lead the next leg of gold’s bull market much higher if the neckline is broken to the upside. Currently the neckline comes in around the 1350 area.

There are several other possibilities we been follow as well for gold. This next chart is a monthly look which shows the ping pong move taking place between the top rail of the blue expanding falling wedge and the bottom rail of the black expanding falling wedge. Again, we are seeing gold bouncing right where we need to see it bounce.

The blue expanding falling wedge without the top rail of the downtrend channel or the much bigger black expanding falling wedge.

Almost 2 years ago gold broke out above the top rail of the blue 7 point falling wedge with the top rail holding support on two backtests. It would be nice to see a white candlestick form at the end of this month and if the breakout is going to really take hold we should see a string of white candlesticks form all in a row which tells you the impulse is very strong. In a strong move down you will see a string of black candlesticks all in a row.

Gold’s major bull market uptrend channel with the 2011 bear market downtrend channel with the possible 2015 H&S bottom.

Gold’s long term monthly chart showing the potential H&S bottom.

Gold’s 40 year chart.

This is the Short version :

On the 2 hour charts I’ve spotted several small H&S bottoms building out on some of the stock market indexes. It wasn’t until Monday of this week that they began to show themselves when several broke out above their necklines. Some of these small H&S bottoms are part of a bigger pattern that has been building out for most of this year. At a minimum their price objectives should get some of the stock market indexes back up to the top of their 2016 uptrend channels.

Lets start with a 2 hour chart for the SPX which shows it gapped above its neckline on Monday of this week and closed at a new all time high today. A backtest to the neckline would come in around the 2482 area.

Several weeks ago I posted this chart which was showing how the original rising wedge, blue dashed trendiness, was morphing into a bigger pattern as shown by the red circles with a symmetry false breakout of the top and bottom blue dashed rails. It’s getting pretty busy in the apex, but you can see how the small H&S bottom fits into the bigger pattern that began building out back in February of this year. If that little H&S bottom plays out it strongly suggests the SPX is going to breakout topside from that 7 month morphing rising wedge in a new impulse leg up.

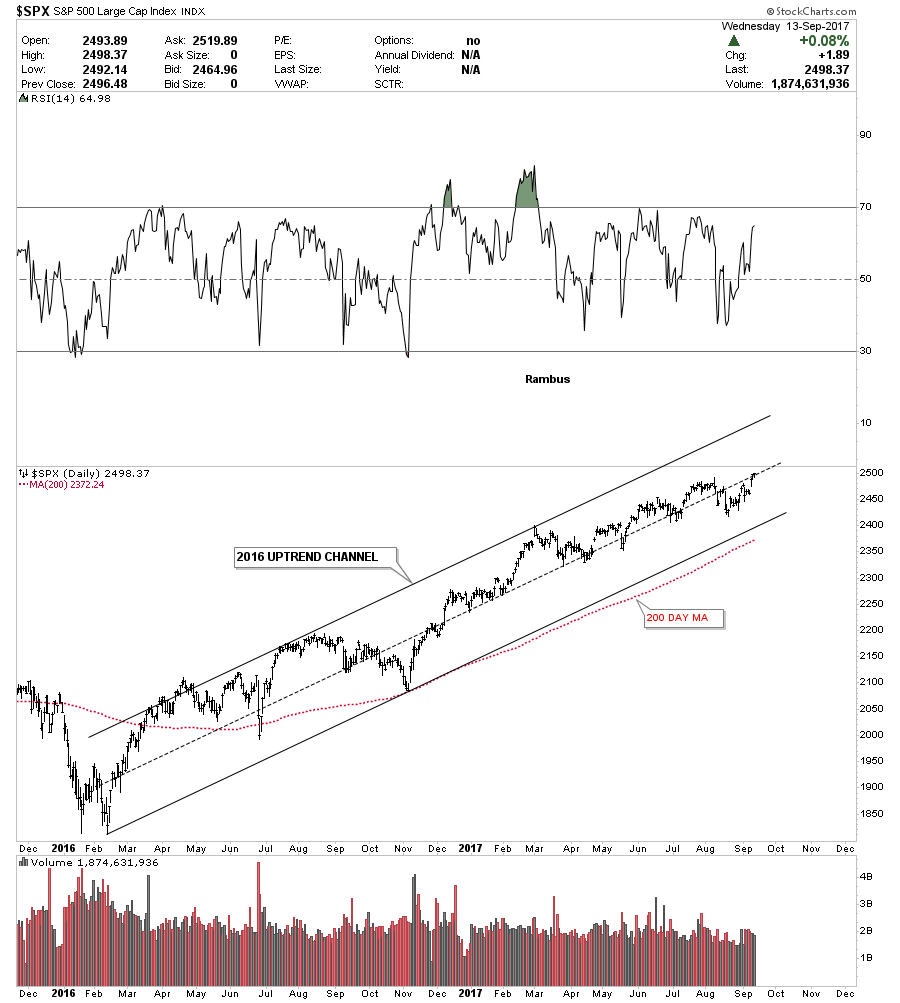

Below is a 2 year daily chart for the SPX which just shows its 2016 uptrend channel. On many of the stock market indexes the 200 day moving average does a good job of showing you the angle of the uptrend channel.

Perspective is everything when you discover what may be an important chart pattern. The weekly chart below shows the 2 year H&S consolidation pattern that corrected the last impulse move up. Now you can see how the blue morphing rising wedge fits into the very big picture. Keep in mind the rising wedge hasn’t broken out yet so the pattern isn’t complete. The reason I think the rising wedge is going to breakout topside is because we are in a bull market and patterns like this tend to form in strong bull markets. If we do get the upside breakout from the rising wedge I would view it as a halfway pattern that would have formed between the neckline and the ultimate price objective.

As I mentioned earlier perspective is everything. Below is a 20 year monthly chart for the SPX which we’ve been following before the top rail of the 13 year expanding flat top triangle consolidation pattern was broken. On this chart I’m showing the 2014 and 2015 consolidation period as a bullish expanding falling wedge halfway pattern. I have to tell you that it has been pretty lonely being a long term bull, but it has even been harder over the last several months as the rising wedge has been developing on the daily charts above. It’s these long term charts that take out all the noise that give me the confidence to hang in there when most say the bull market can’t keep going up. This chart shows you the wall of worry since the breakout from the blue bullish expanding falling wedge.

Again perspective is everything when you look at this 75 year quarterly chart for the SPX. The blue expanding falling wedge on the chart above is the small red consolidation pattern at the top of this chart. This chart along with the Jaws of Life on the INDU has given us a look into the future that few want to believe. For whatever reason investors love to hear bad news or that the markets are going to crash. Fear sells where bullish scenarios go by the wayside. For all the reasons this bull market that began in March of 2009 can’t keep going up, it keeps going up regardless of all the reasons it can’t, and there are a millions reasons why it can’t keep going up. The price action above all else has the final say when everything else is boiled away.

This weekly chart shows the INDU’s H&S consolidation pattern with the breakout and impulse move higher.

The monthly line chart for the Jaws of Life.

Below is the 75 year chart for the INDU which shows the Jaws of Life and a glimpse into the future.

The Most Hated Bull Market in History chart for the INDU.

Below is a 25 year look at the NDX which shows some beautiful Chartology. Note the bullish rising wedge which formed just below the all time highs that gave the NDX the energy it needed to finally move on to all time highs. Classic Chartology

There’s always a bull market In healthcare

This next chart is for our many long term holders that don’t like to trade every little wiggle a stock makes and are looking for something to hold on to. This was one of the big leaders during the first leg up and then built out the blue triangle consolidation pattern.

The long term monthly line chart. Think of the blue triangle as a halfway pattern

I had planed on showing you some charts on oil, but I’ve run out of time. The bottom line is that until something changes the bull market, it is what it is and all the negativity about the economy or fundamentals or whatever one uses to gauge the health of the stock markets is not going to make you a dime. Trying to short a bull market is one of the hardest things to do as many have found out. Realize that everybody who has tried to catch THE Top of the Most Hated Bull Market in History since 2009 has lost money.

. It’s much easier to go with the price action and what it’s telling you to do than to fight it. Maybe we crash into October like so many are predicting, but on the other hand what if we don’t? All the best…Rambus

A Lot of members ( and Outsiders) are expressing disbelief ,and of course, some goldbugs outright ridicule, for Rambus Weekend Report with very dire “potential” prices for Gold and the prediction that the Dow et al will Outperform Gold for a long time going forward.

GOLD INTERESTING POTENTIAL TARGETS https://rambus1.com/2017/07/09/weekend-report-135/

Personally I understand why these charts and what they are implying can be very disturbing to Gold Investors …BUT I have found by experience that dismissing Rambus Long term Charts and Analysis out of hand is usually a Big Mistake.

Here are some examples of other LONG TERM calls that were ridiculed and dismissed as coming from a lunatic.

Note the links to the complete posts are provided but for those too busy to read them all , the key chart from these posts is just below the link.

……………………………………

THE JAWS OF LIFE : October 2014

There seems to be a lot of confusion out there as to whether the stock markets are bullish or bearish. Is the Dow Jones in a topping pattern as so many analysis are suggesting? I’ve seen some charts that are calling the big trading range , on the Dow Jones going all the way back to the 2000 bull market top, THE JAWS OF DEATH. Man it doesn’t get anymore dire than that. As usual I have a different take on the JAWS OF DEATH, which I would like to share with you tonight .

Before we look at the first chart for the Dow Jones I need you to clear your mind of everything related to the stock markets in any shape or form. That means no Elliot Wave counts, Time Cycles, Gann Lines , volume studies, no indicators of any kind. Clear your mind of every article you’ve ever read on the stock markets, bullish or bearish. And last of all, NO CHARTOLOGY. I want you to look at just the pure price action without any bias whatsoever. From that point we can then start to see what is really happening to the Dow Jones and related markets .

https://rambus1.com/2014/11/19/wednesday-report-49/

So…here is what happened…The call was made at the end of 2014…after that 2015 saw 2 hard back tests to the top jaw and then since 2016 a big rally has ensued. it would be easy to have given up on this call but that top line ultimately held.

…………………………………………………………………………

US DOLLAR BEARS PREPARE TO HIBERNATE MARCH 2013

https://rambus1.com/2013/03/10/dollar-bears-about-to-go-into-hibernation/

Here is what happened next :

After 15 more months of going sideways to down , The dollar suddenly took of in a strong impulse move. from 80 to 100. (Rambus still hasn’t given up on the idea this consolidation is a halfway pattern ) TBD.

………………………………………………………………….

PRECIOUS METALS STOCKS TOO BIG TO FAIL : FEBRUARY 2013

https://rambus1.com/2013/02/22/precious-metals-stocks-too-big-to-fail/

What happened next ?

HUI failed and fell to 100 before recovering

……………………………………………

Here is a Call on Silver (via SLV) that I couldn’t believe at the time .”SLV BLUE DIAMOND” January 2013

Followed soon after by “SLV RED DIAMOND” November 2013

And then: Look at those POs

………………………………………………………….

One More :

BLACK FRIDAY IN THE ENERGY MARKETS is a compilation of a long term call made initially September 2014..The Compilation follows the evolution of this thread which was posted as Friday Nite Late Charts…

https://rambus1.com/2014/11/29/friday-night-charts-21/

And then

………………………………………

So: as I started to say. After seeing all these Long term calls. You would agree that discounting Rambus long term work can be hazardous to your financial health.Since these are long term , as you have seen , they do take time and twists and tradable turns to fulfill however.

No guarantees of course but the track record for long term is pretty good eh ?

Fullgoldcrown

……………………………………………………

WHAT IF GOLD HAS A DROP DEAD LINE ? January 2 2017

Now I would like to start showing you the very big picture which begins to bring all the pieces of the puzzle together. This first weekly bar chart for gold shows the potential massive double H&S top with the 1100 area being the most important price point for gold at neckline #2. If neckline #2 gives way the price objective will be down to the 500 area, which seems impossible at this time, but big patterns create big moves. Note the multi year base made back in the late 1990’s which launched gold’s bull market that took over five years to build out.

Just a note to check Plungers Posts at the Forum. Some very interesting developments worth your while.

(Link to the forum is on the top right here)

Remember Forum access is free with your subscription. it is a separate log in and for most a separate password.

FGC

gmag@live.ca