Today I am going to lay out the case of a major market top and how it fits into the geopolitical backdrop of today. We then profile the trade set-up to look for and finally I will forcefully remove your Rose Colored Glasses you have been wearing since January 2017.

In Barbara Tuchman’s “The Guns of August” she argues that August 1914 was when the Gilded Age died and the modern era actually began. The book opens with the famous depiction of Edward VII’s funeral in 1910 attended peacefully by all the kings of Europe. Never again would the body of world leaders be unified and cut from a similar cloth. The war ushered in a new world, not recognizable from the past. Not since that time have we witnessed such diplomatic folly as in the month of August 1914. Today we wonder are we witnessing a similar conflict between a super power and the client state of China which is an emerging super power? Could it unfold in a similar fashion?

Since May I have chronicled the topping process associated with a post bubble contraction. We have witnessed the following sequence:

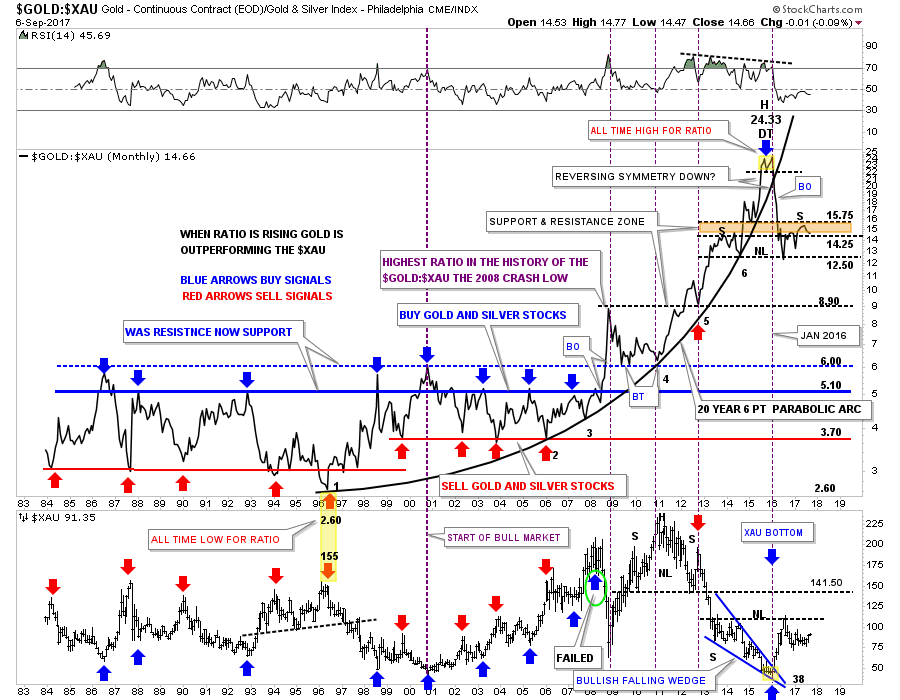

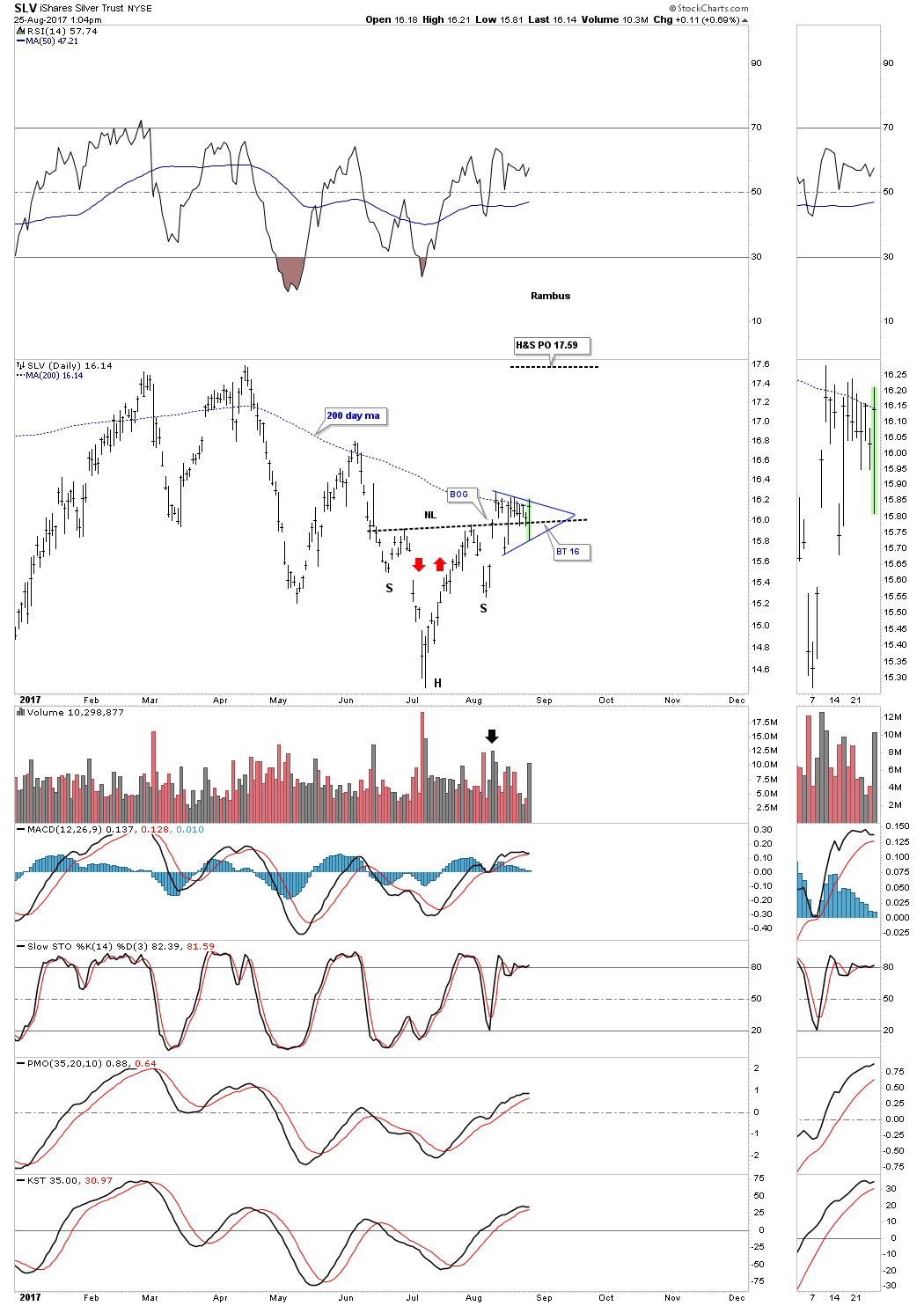

1 The Gold-Silver ratio initially warning of an upcoming credit contraction in the future.

2. European stocks putting in a top in the traditional time window of May-June

3. USA stocks embarking on a final run for the roses, one last hurrah over the summer.

4. The Gold-Silver ratio signaling a confirmation of its original signal.

5. Yield curve flattening and credit spreads widening

6. Investor psychology embracing market top behaviors.

7. An initial crack in the US indexes in the time window of August or September.

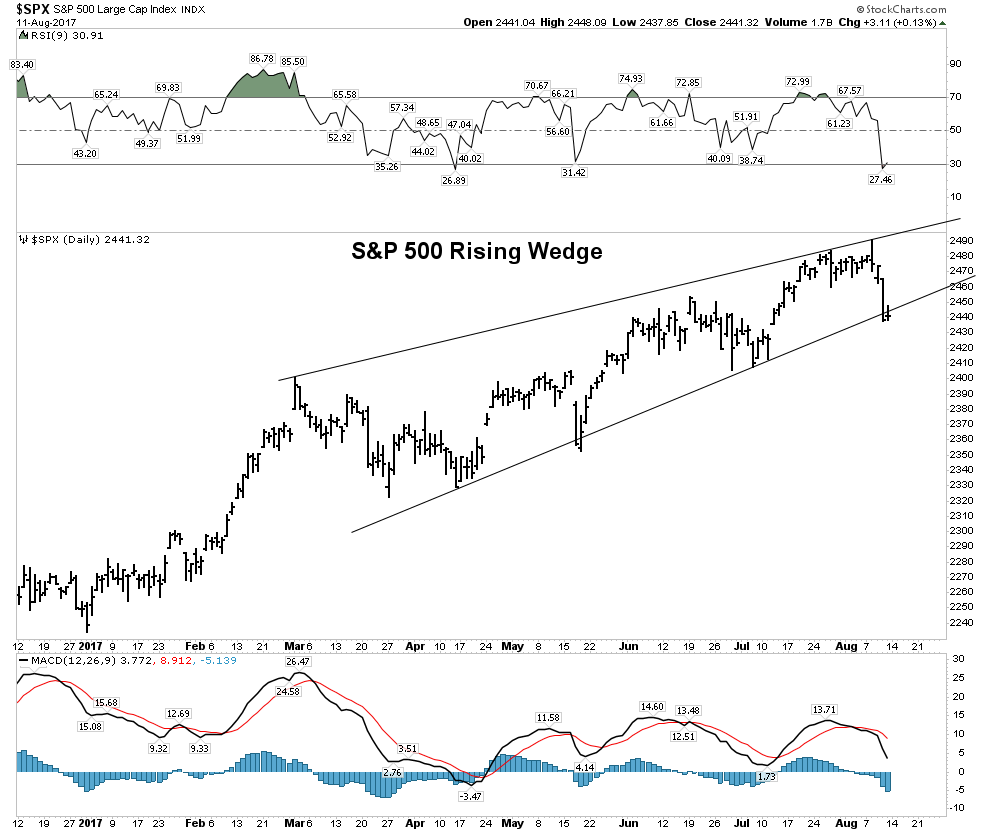

The Topping Process

Over the summer we have watched the indexes relentlessly rise despite narrower breath. The FAANGs drove the NASDAQ and Boeing drove the Dow over the past 6 weeks. The DOW being a price weighted index, was inordinately influenced by Boeing, now a $240 stock. Boeing’s rise accounted for 75% of the DOW’s gain since the beginning of July. Strip Boeing out of the DOW and the index barely even rose… Same with the FAANG’s effect on the NASDAQ.

This of course is classic topping action. It masks the underlying exhaustion which has been occurring in individual issues. The exhaustion expressed itself in a lack of volatility. On August 8th the S&P 500 had gone 13 days in a row with less than a 0.3% fluctuation. This has never occurred since records have been kept since 1927. This compression then expressed itself with the VIX exploding over 80% in a raucous 3 day move.

Bearish market signals have been evident to the few who cared to interpret the charts. Let’s take a look at some of the flashing red flags available to all who care to see:

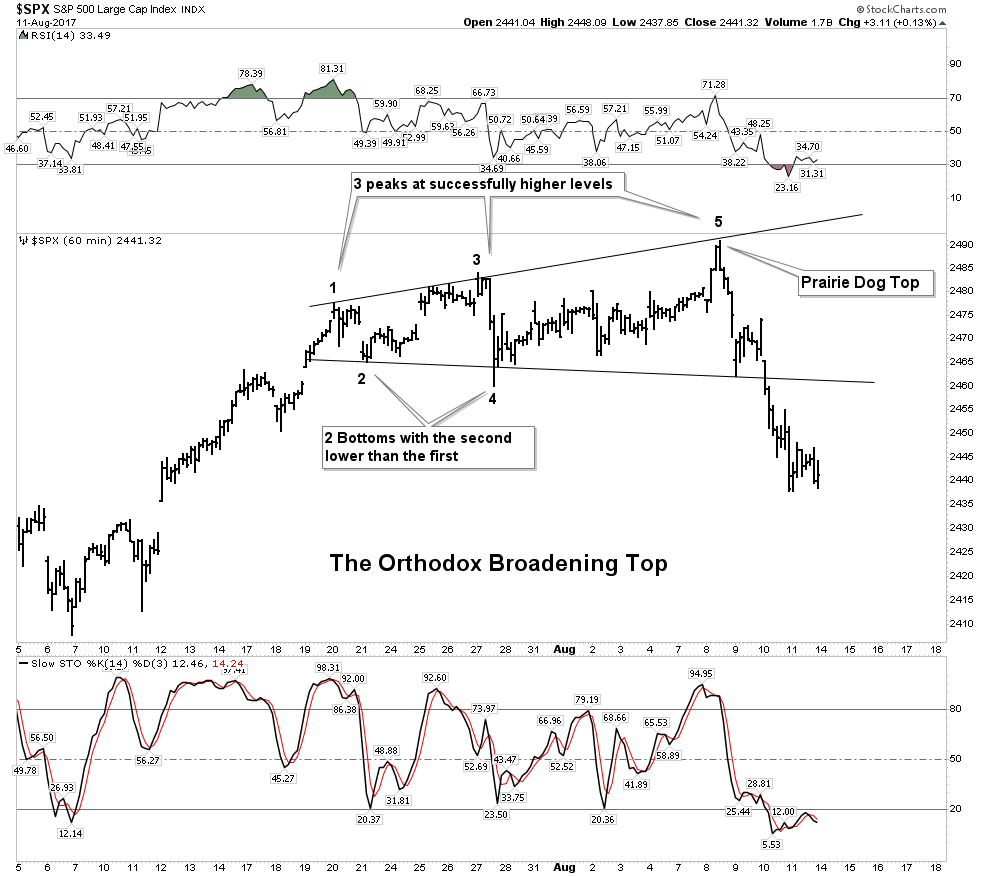

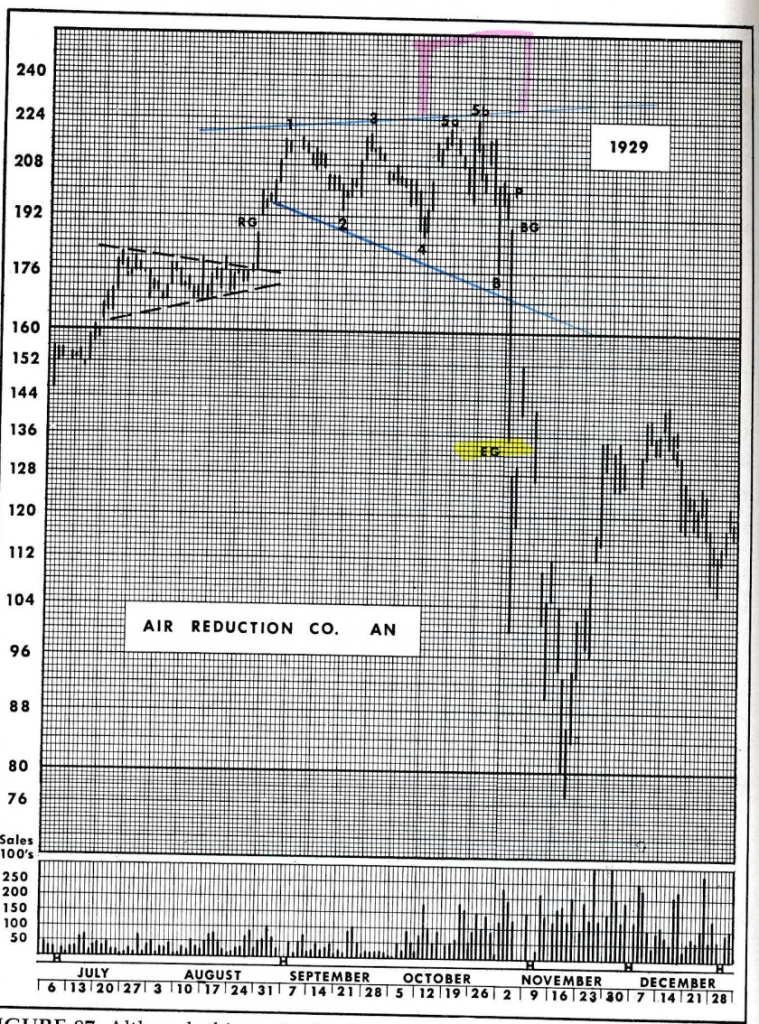

S&P 500 Orthodox Broadening Top

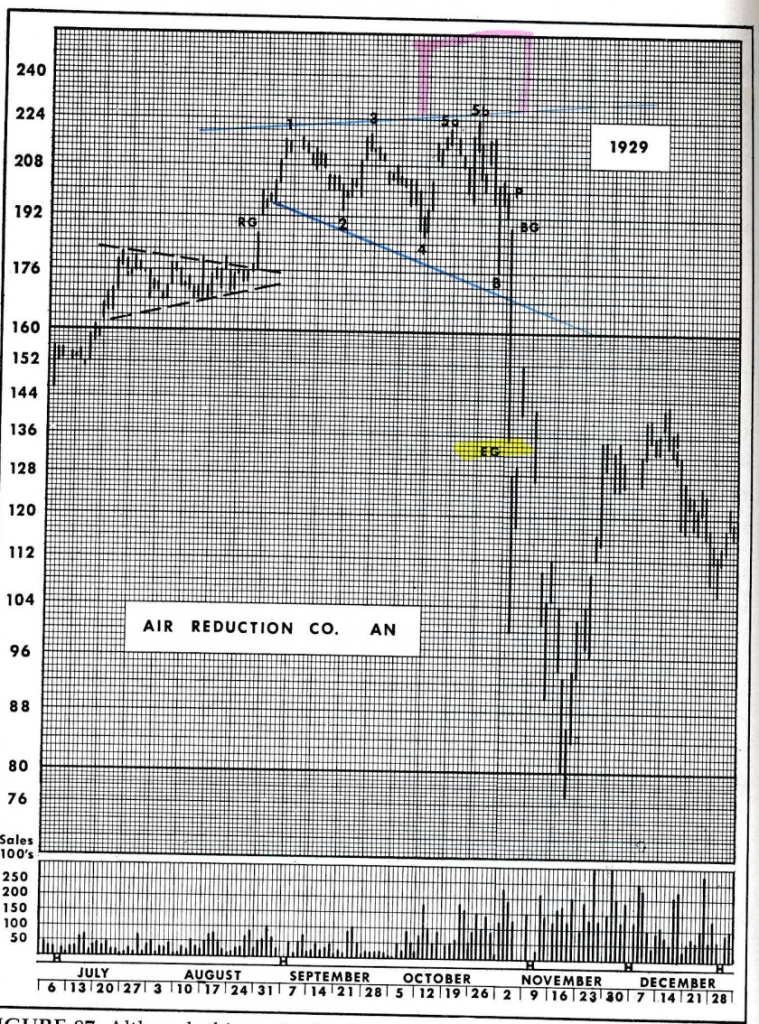

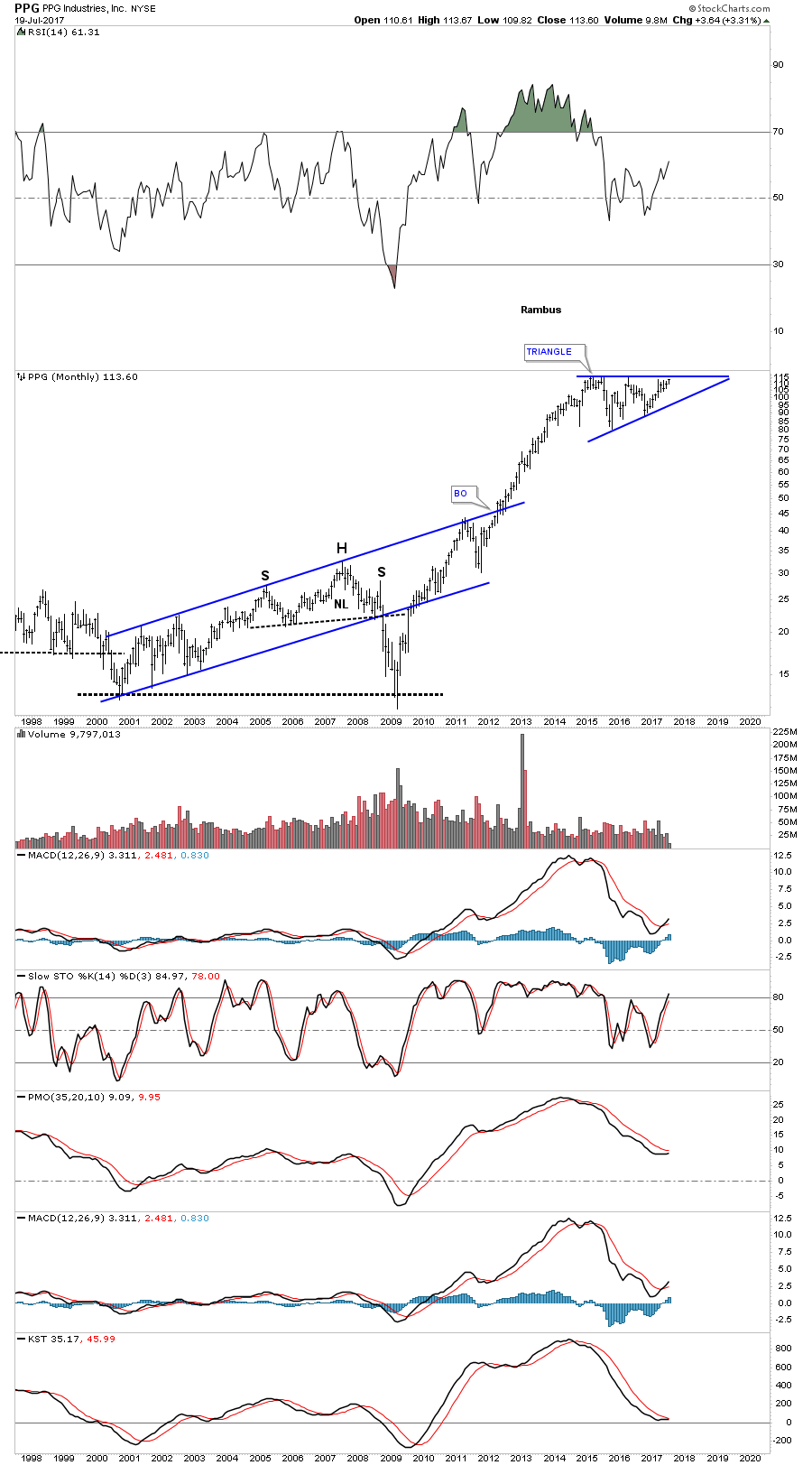

Pull out your copy of the bible of technical analysis: Edwards and Magee. Look under the index for “The Orthodox Broadening Top”. The example they use is Air Reduction Co. from 1929. I will scan and post below:

E&M remind us this type of top comes from low volume markets (check) and it is precisely defined on the chart (check). It’s definition is:

“It has three peaks at successfully higher levels and, between them, two bottoms with the second bottom lower than the first. The assumption has been that it has been completed and an in effect as an important reversal indication just as soon as the reaction from its third peak carries below the level of its second bottom”

Knights, I believe in making charts as simple and uncluttered as possible. Clean charts deliver the most powerful messages. This chart above should make you sit up and take notice. It is classic, right out of the pages of the Edwards and Magee reference book.

My analysis of this chart actually shows weak exhausted action. E&M state that 4 out of 5 examples of this pattern have a re-test of high #3 (point #5). This re-test often exceeds the high by up to 3%. We see this re-test in the above example in Air Reduction Co labeled as 5b. In our present day case we see the S&P spike high in a prairie dog top with no ability to rally for a re-test. This is a case of exhaustion and in my analysis is quite foreboding.

I emphasize that E&M characterize this pattern as “extremely bearish” and it depicts the last stages of a Primary Uptrend. That’s right,- PRIMARY. This was the principle pattern that exhibited itself in numerous individual issues in the 2 months leading into the crash of 1929.

Within this current broadening top formation we can also see two loosely formed H&S tops as well. Bottom line: This is a treacherous reversal pattern.

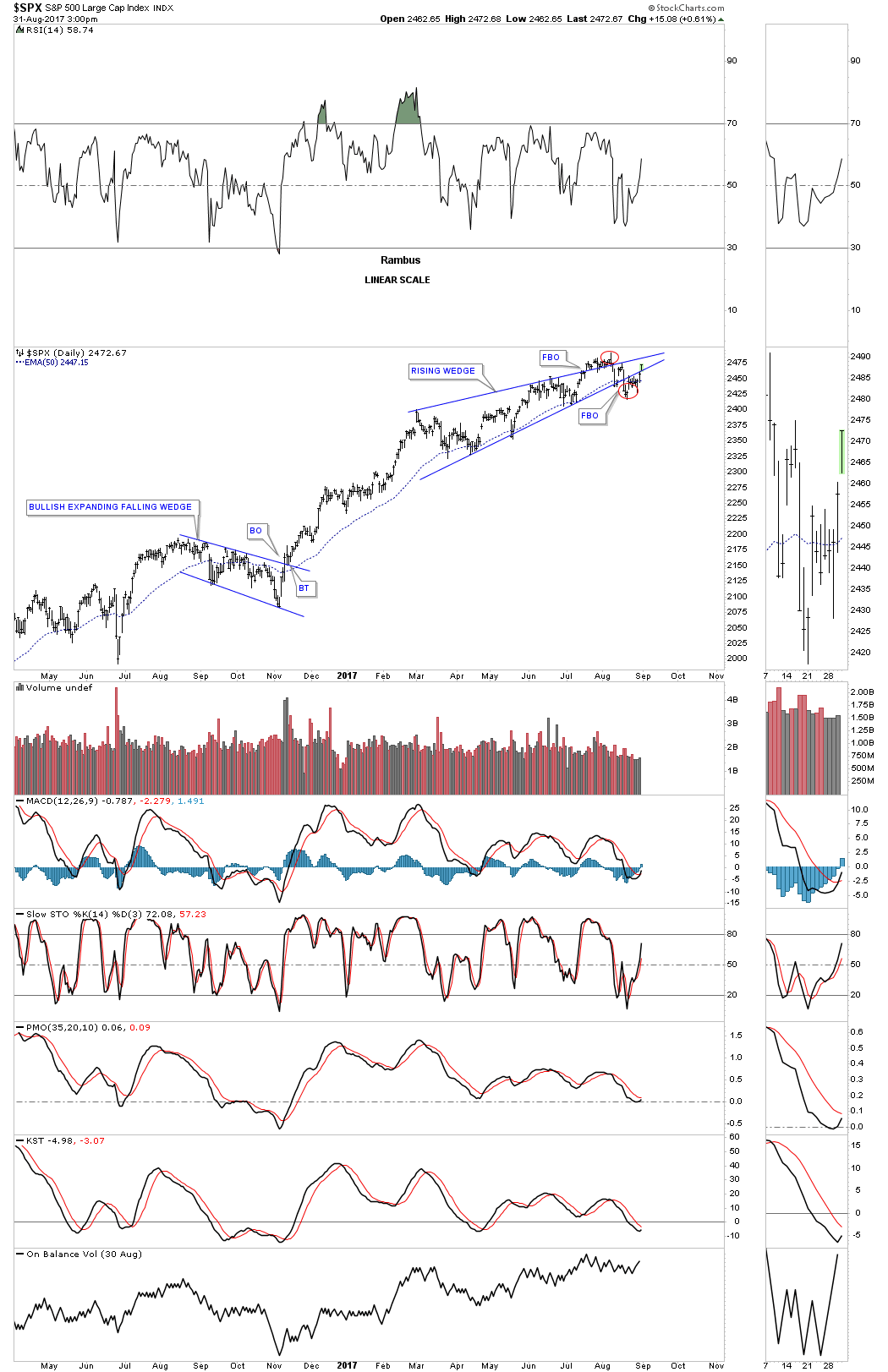

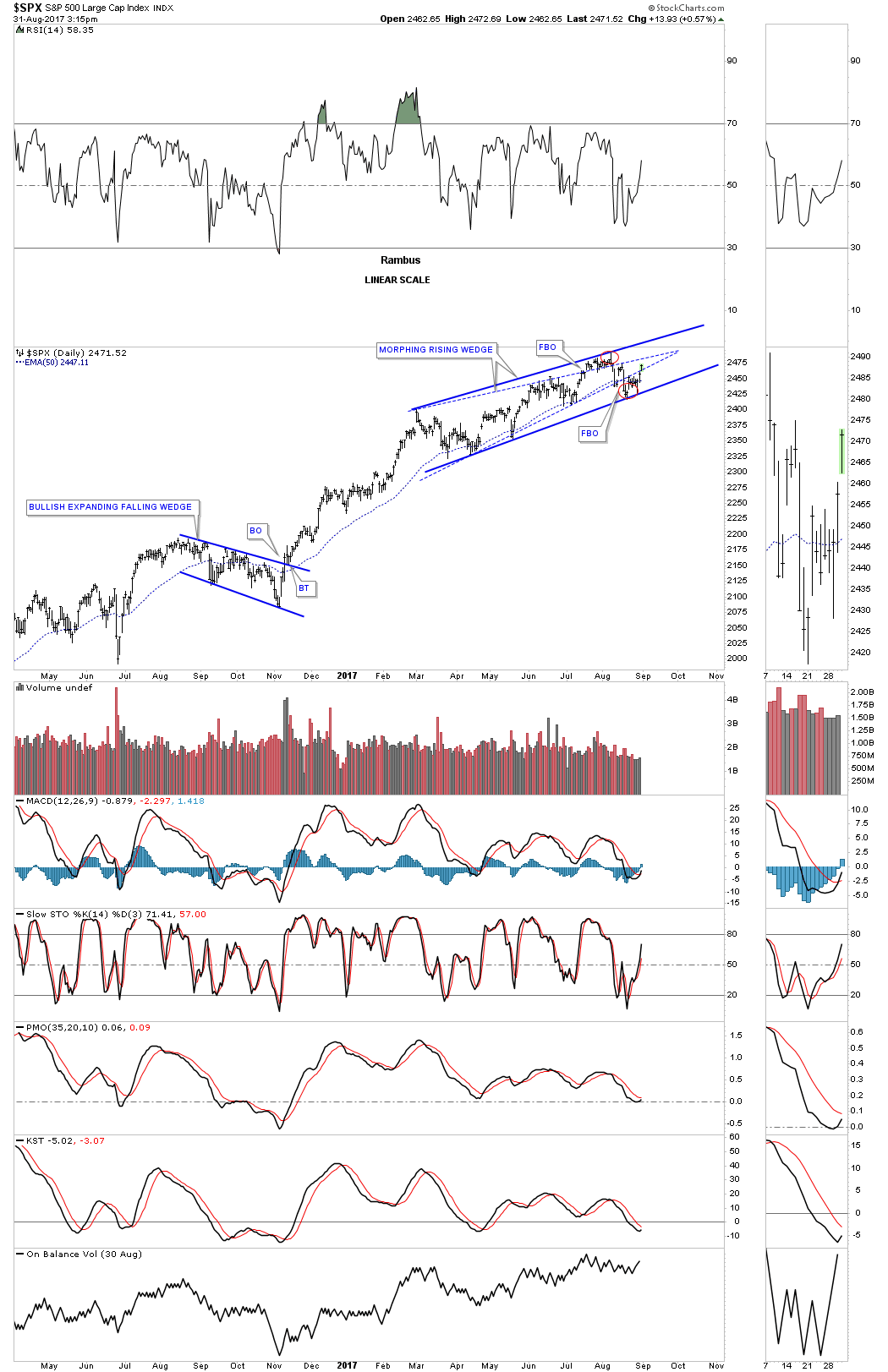

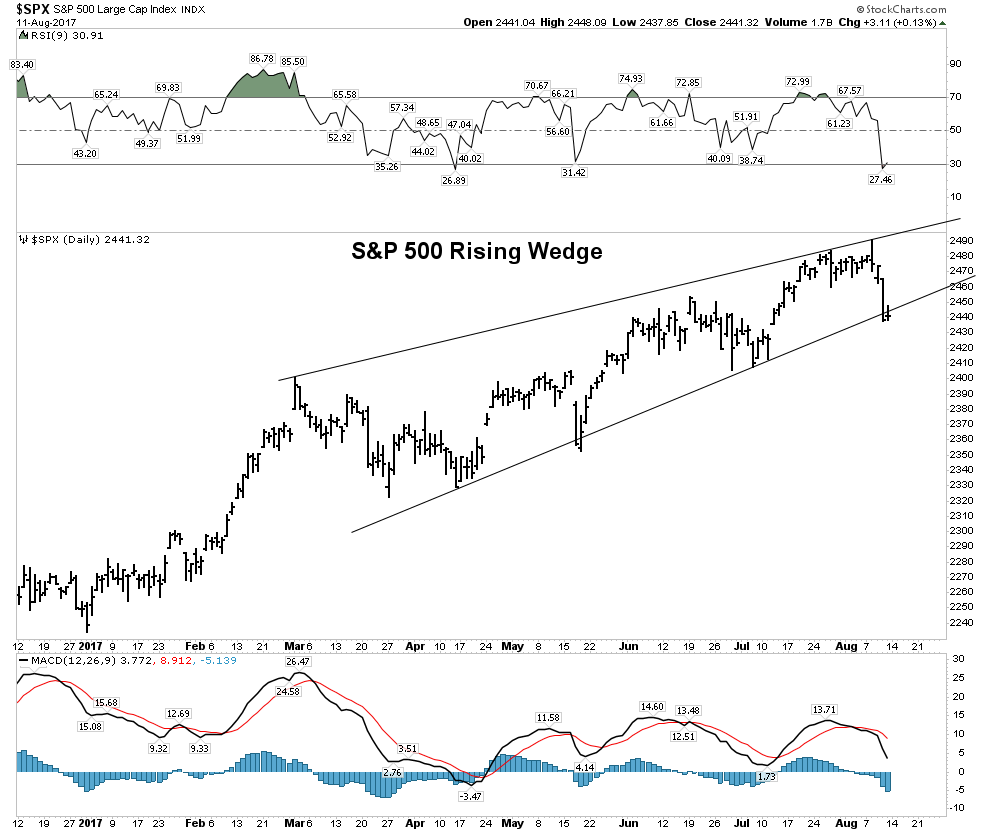

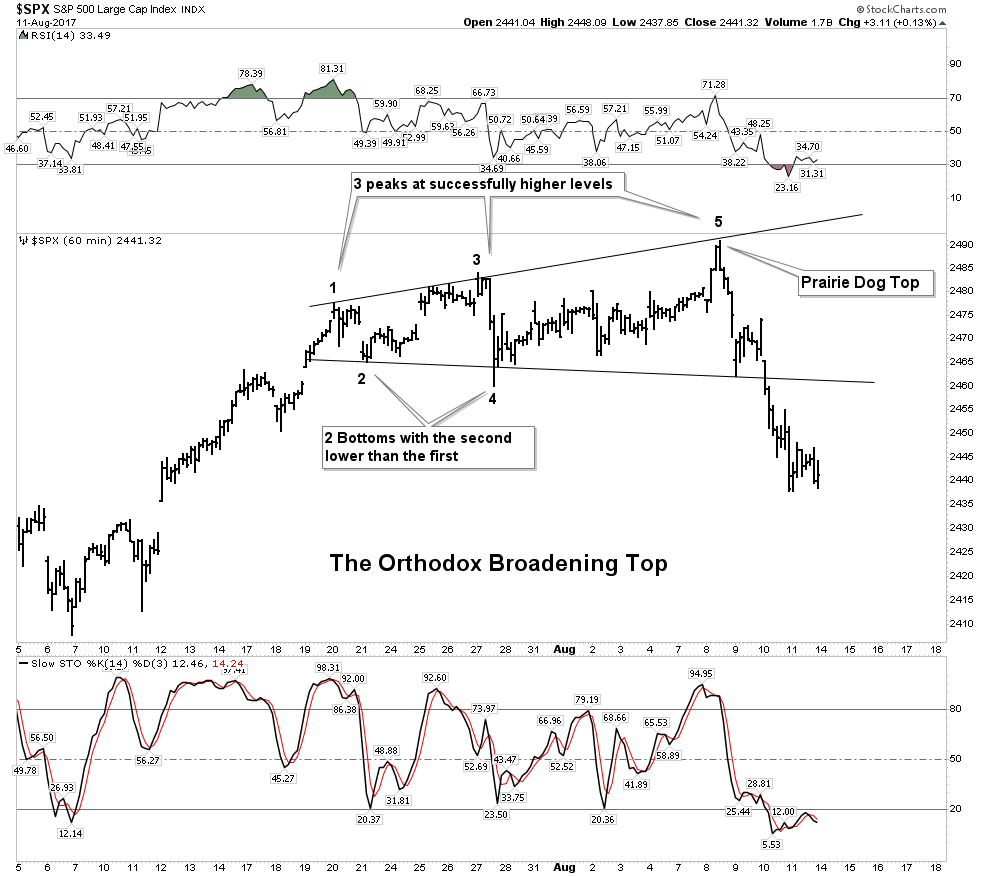

S&P 500 Bearish Rising Wedge

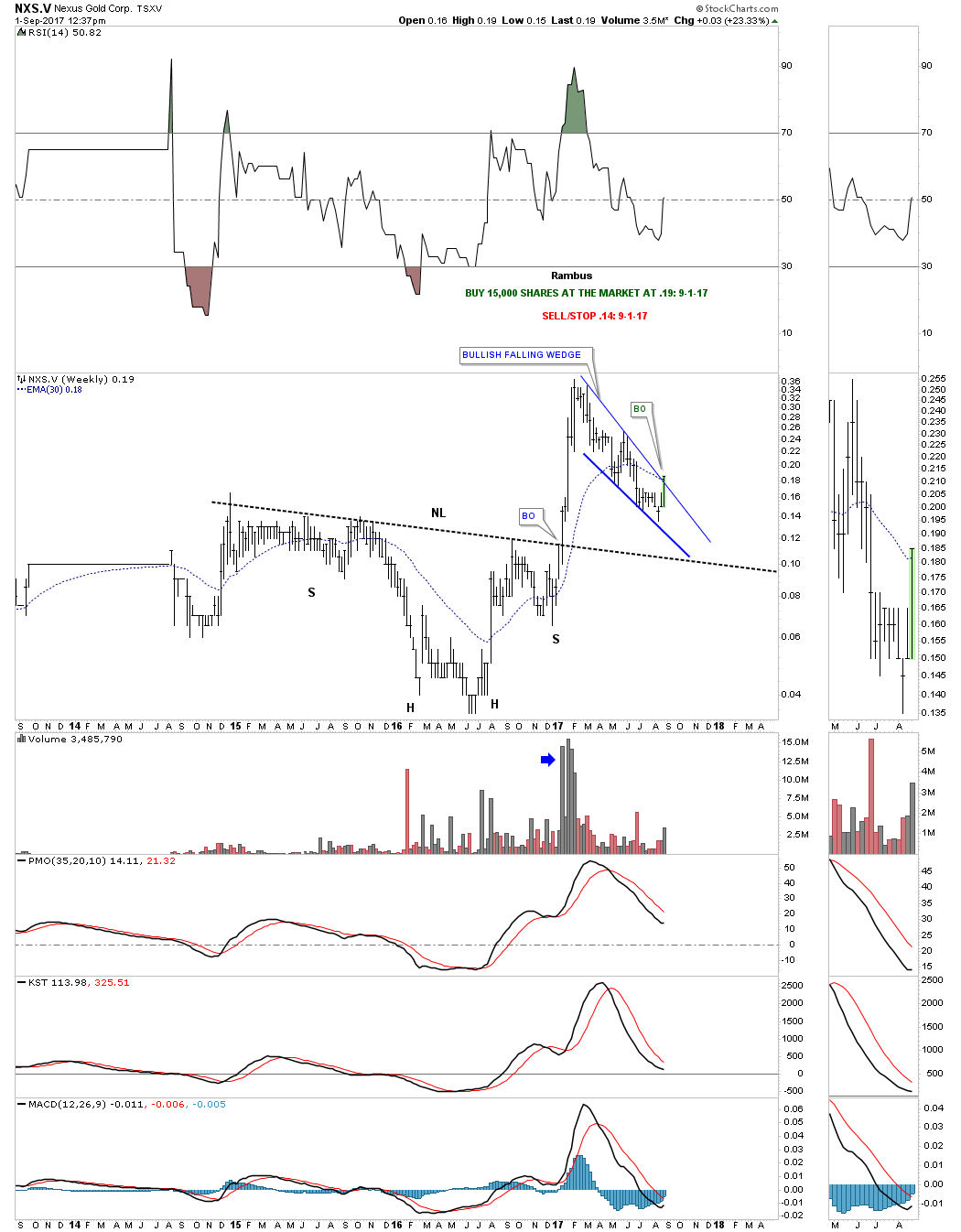

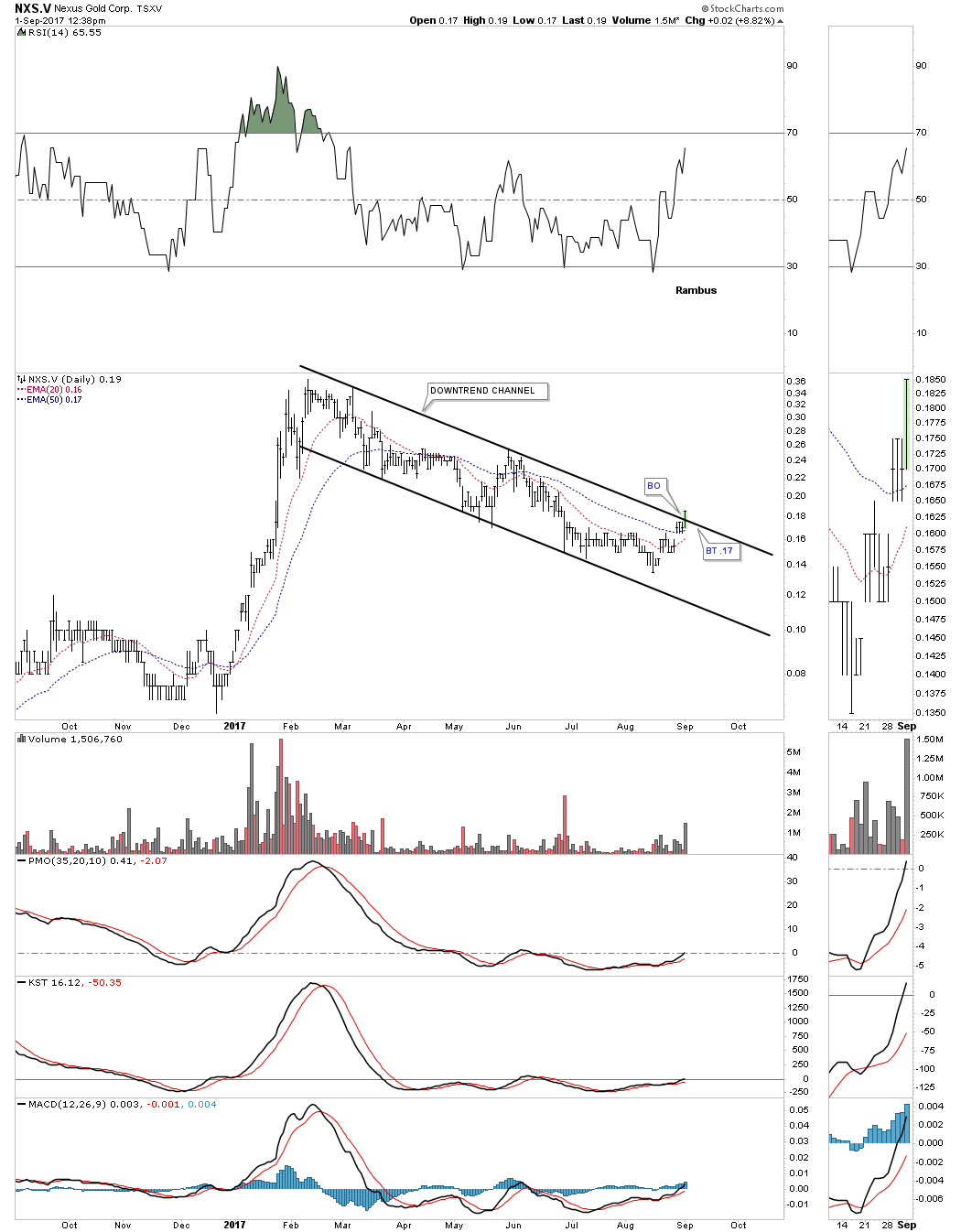

If we step further away and look at a daily chart over the past 8 months we see the S&P 500 forming a presumedly bearish rising wedge. I will cover the investment set-up later on at the end of this section.

Red Flags Everywhere

The FAANG stocks have risen relentlessly all year long, however recently have been broadcasting major trouble ahead. Let’s take a look at some of the red flags:

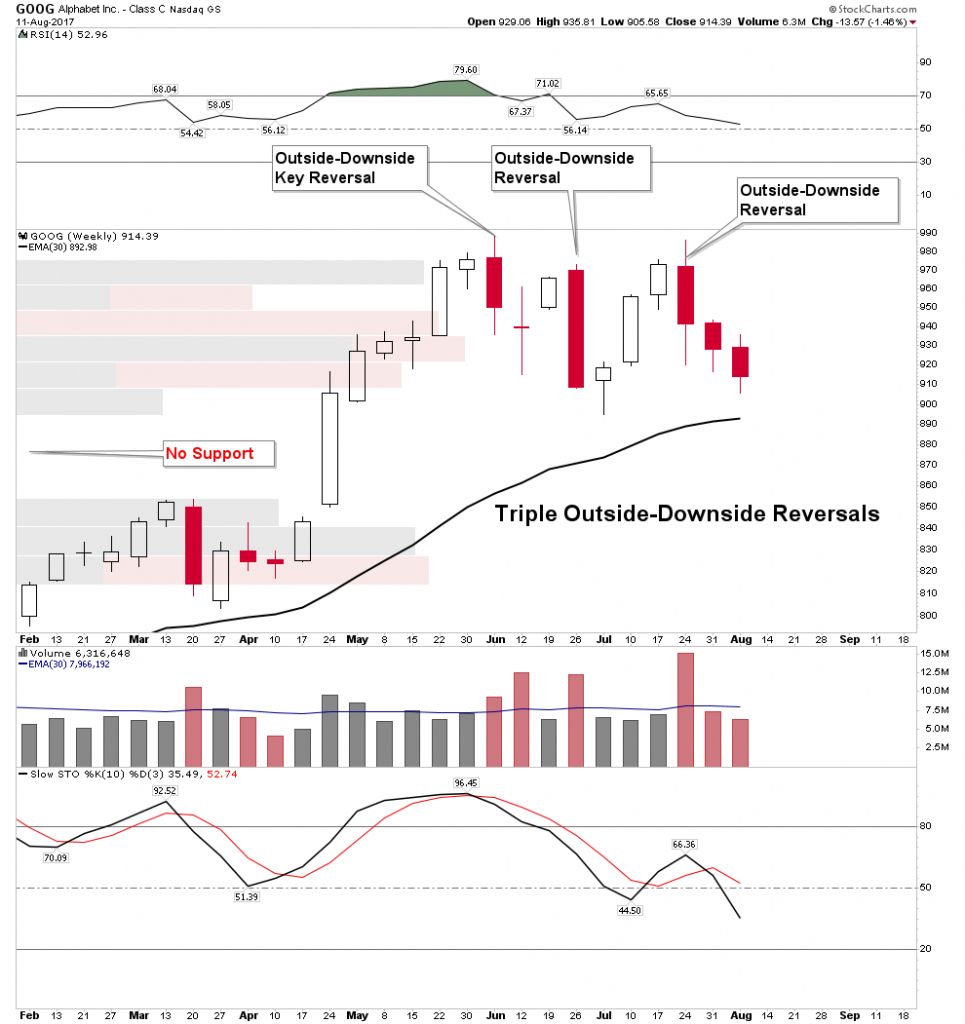

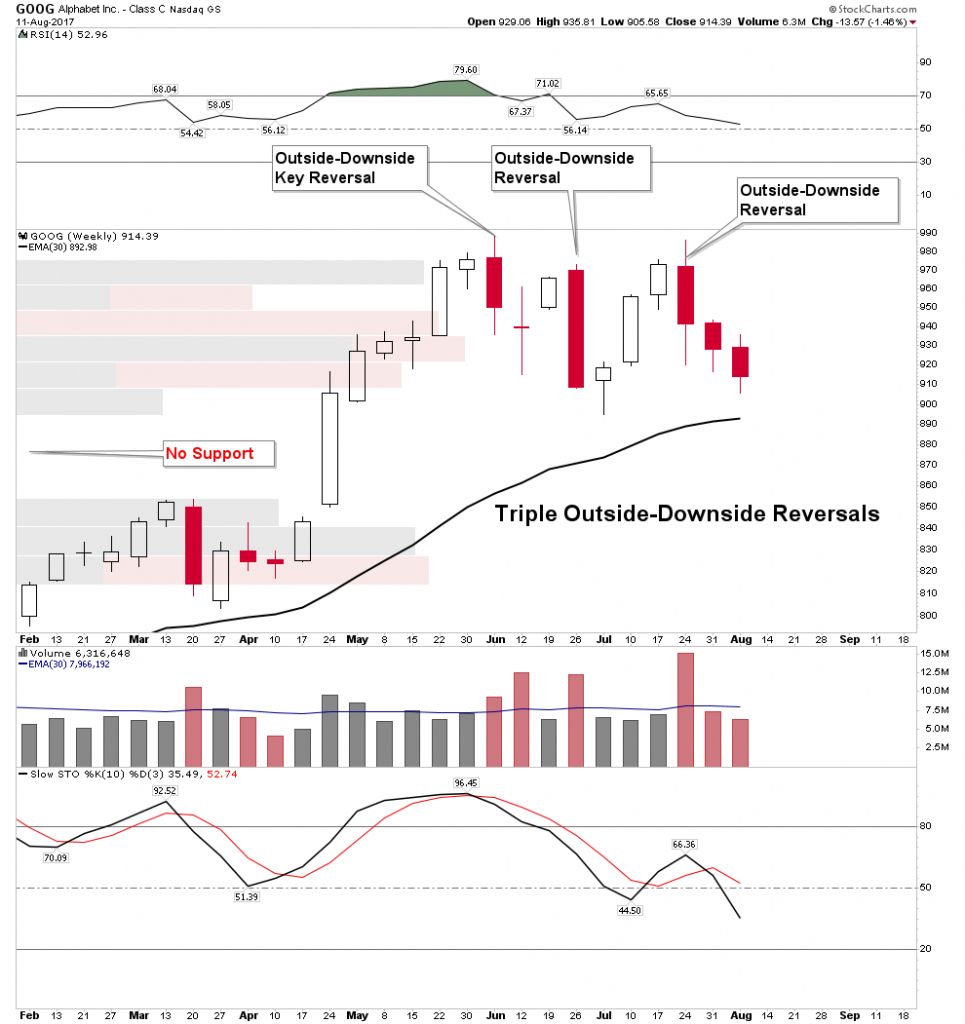

Google

Google of course is widely owned and at $900 can no longer generate much upside volume as it’s hard for the little guy to move the needle with his low order size. Therefore, it is very significant when we see 3 Outside-Downside reversals with one being a KEY reversal (reversing new highs) all within an 8 week span! If Google breaks $900 on a weekly closing basis it has the potential to trigger a trap door as one can see there is no support until it reaches $855.

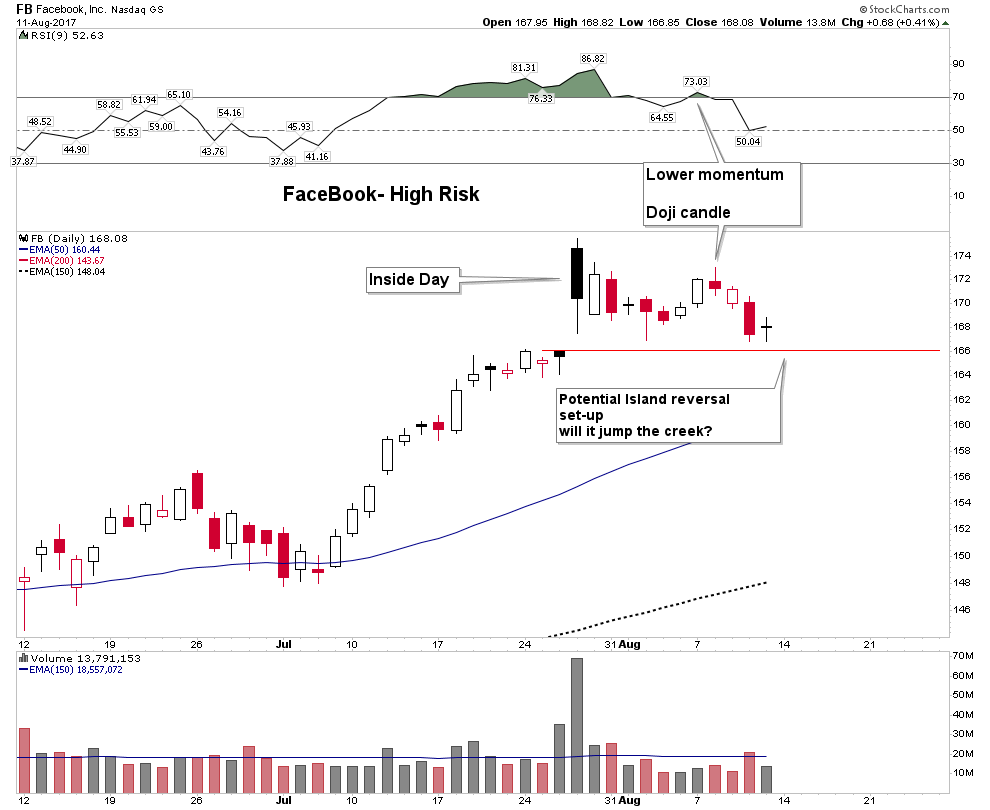

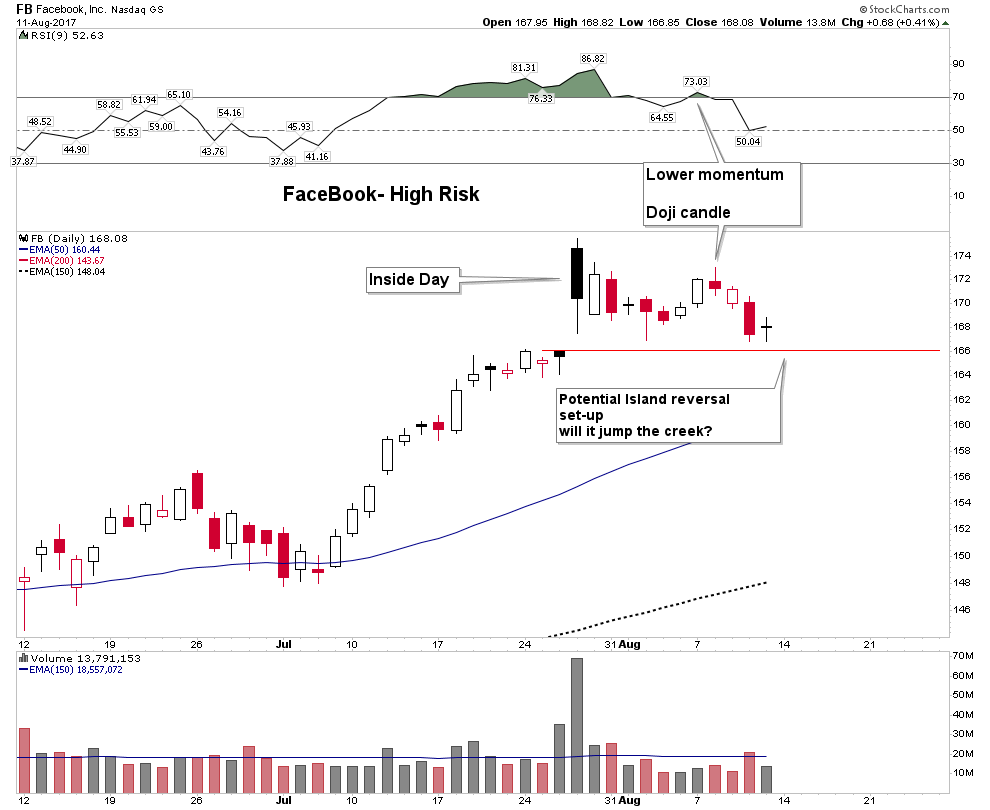

Facebook

Here we have a very high risk stock. If you own this do you feel lucky? It opened July 27 with great fan fare and put in a black candle inside day. This is a sign of exhaustion. Note the following attempt to rally failed with a red doji, change of trend, candle. Since the black candle top, down days have exhibited more volume than up days. This stock is at high risk of triggering a very bearish Island Reversal if it jumps the creek below the red line.

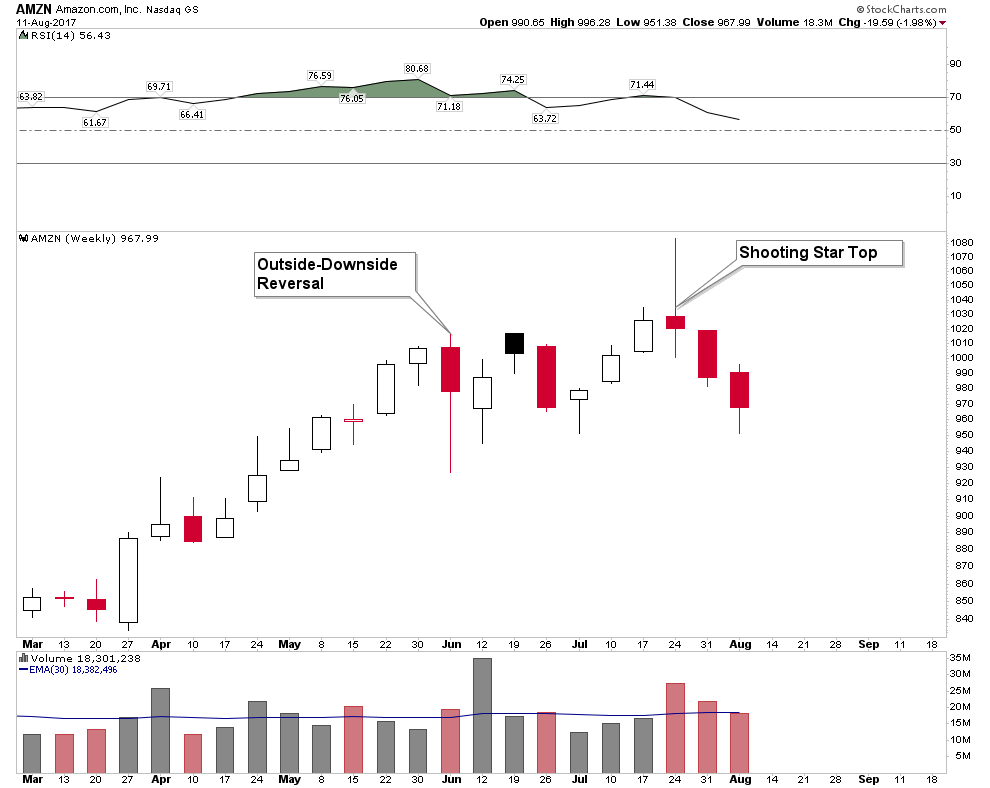

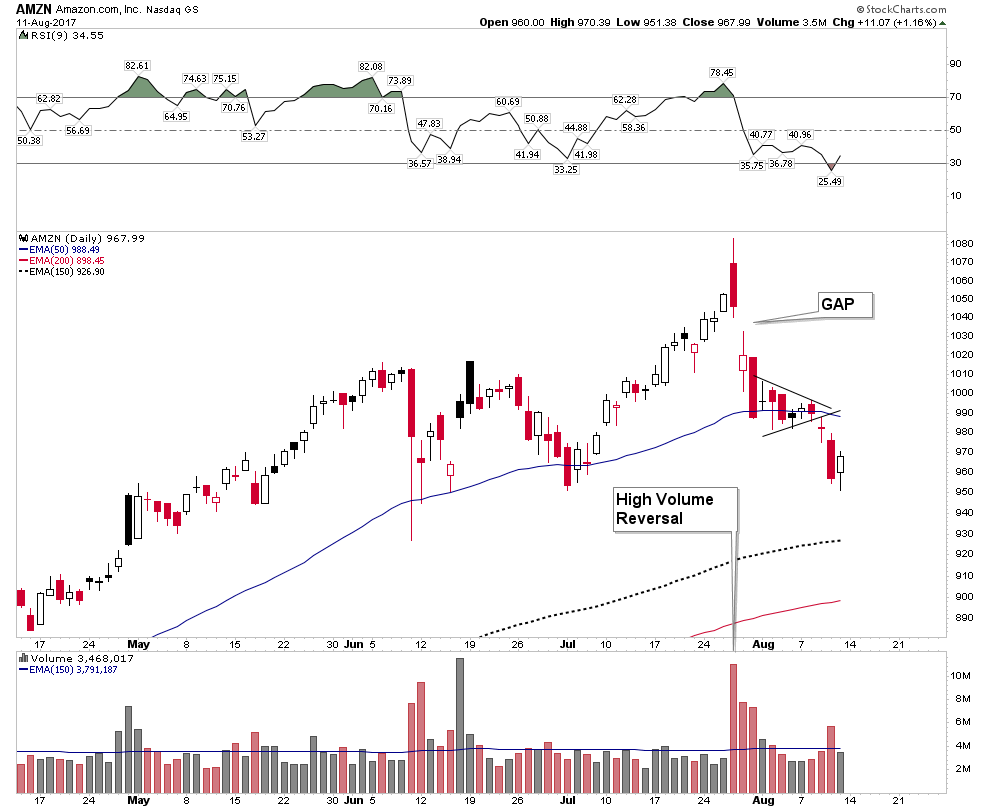

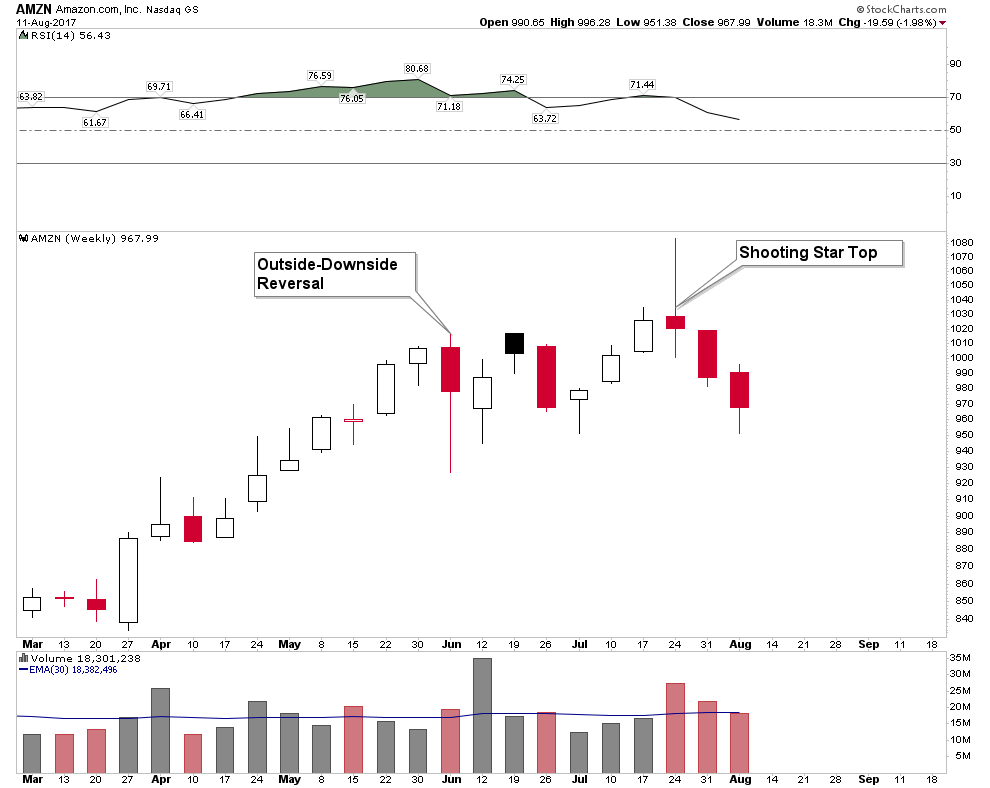

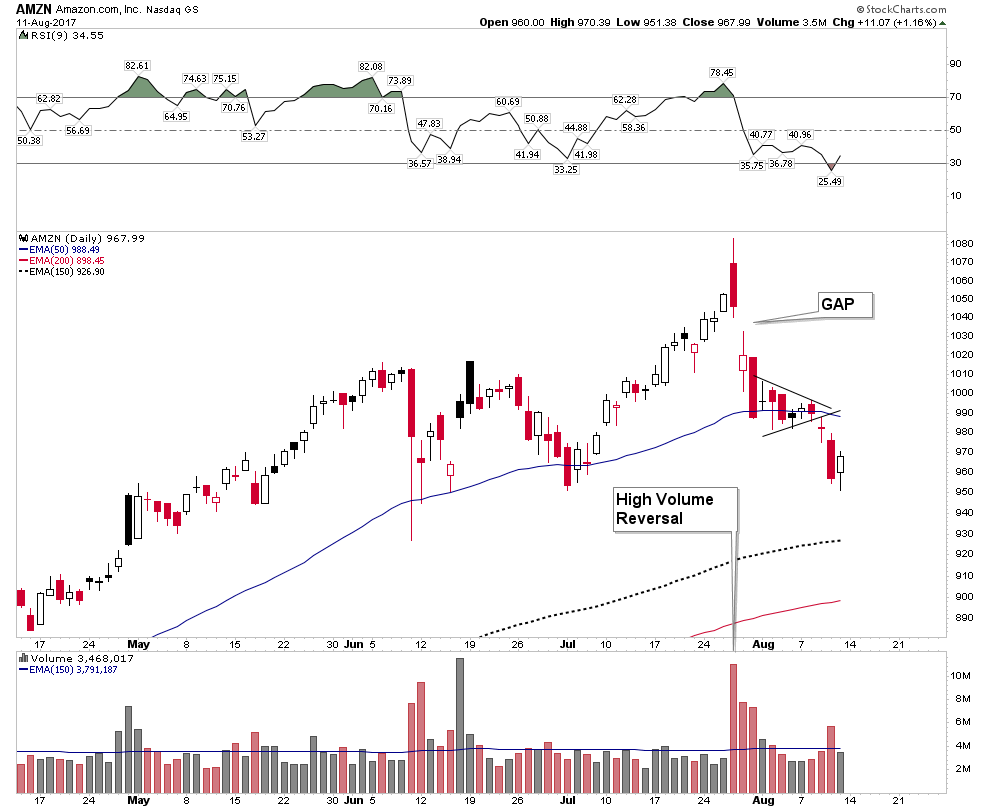

Amazon

Weekly: Outside Reversal with a high volume weekly shooting star top. What else do you want folks.

Daily: High Volume Key reversal off the top with a gap down the next day. Checkmate!

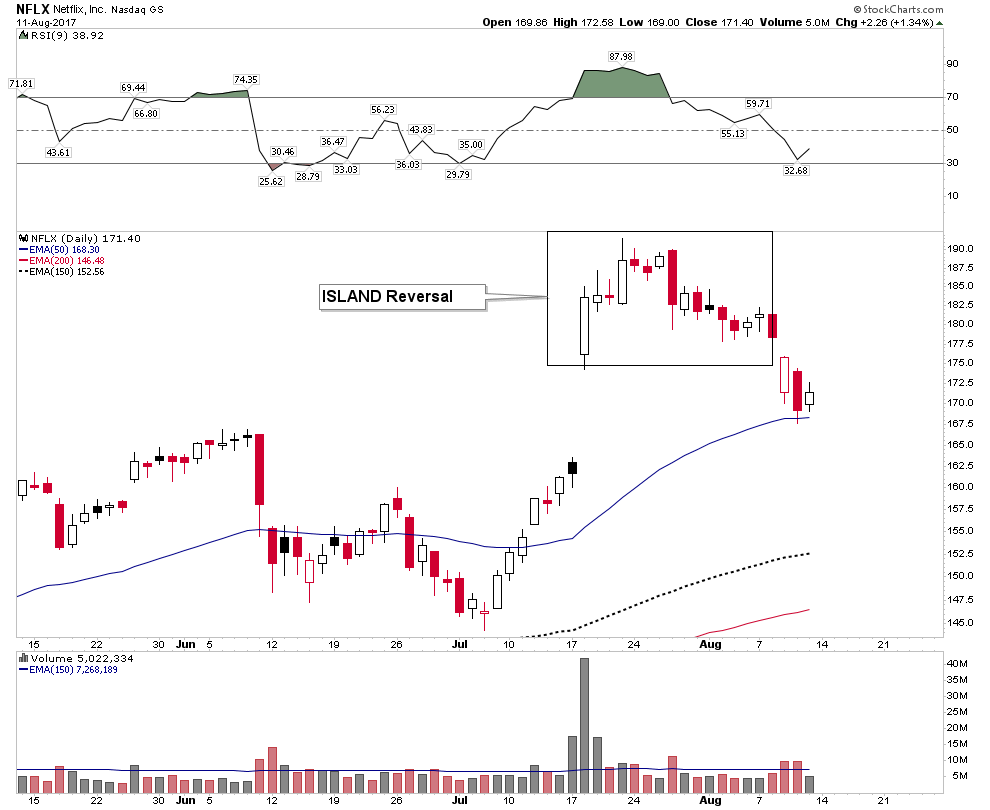

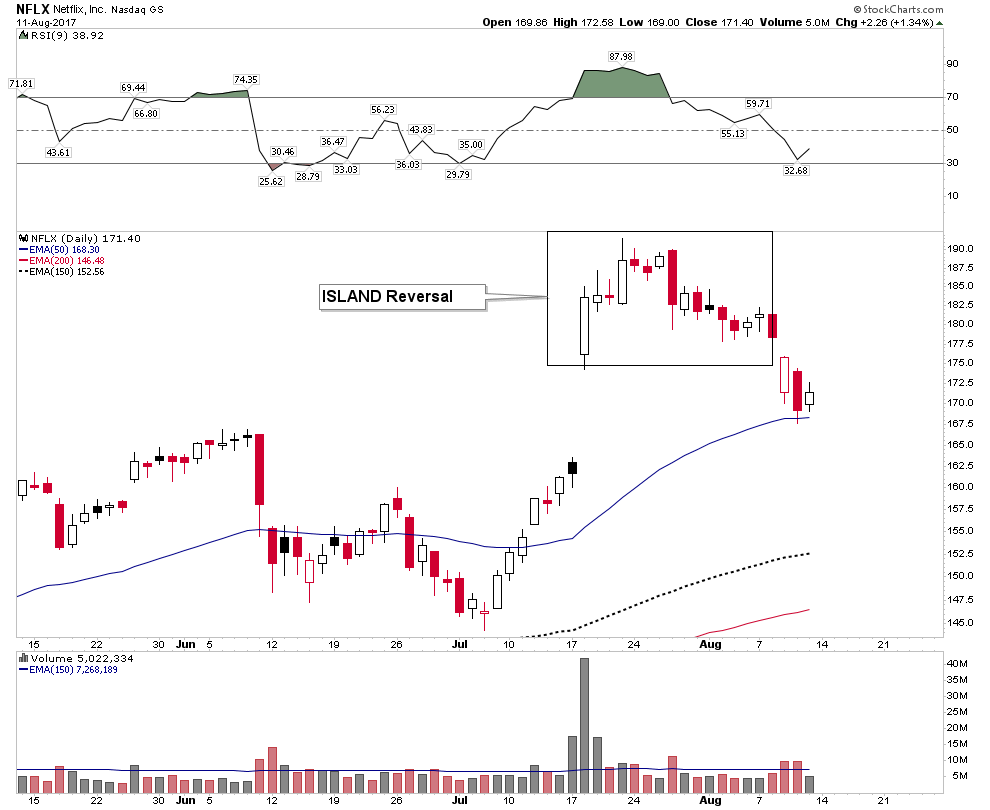

Netflix

Standard Island Reversal off the top. This is high risk.

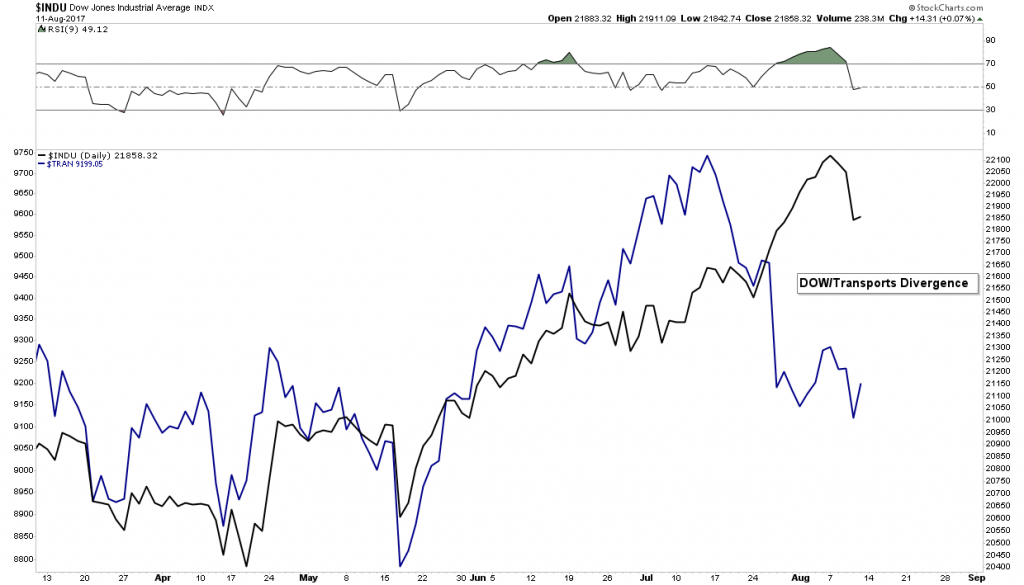

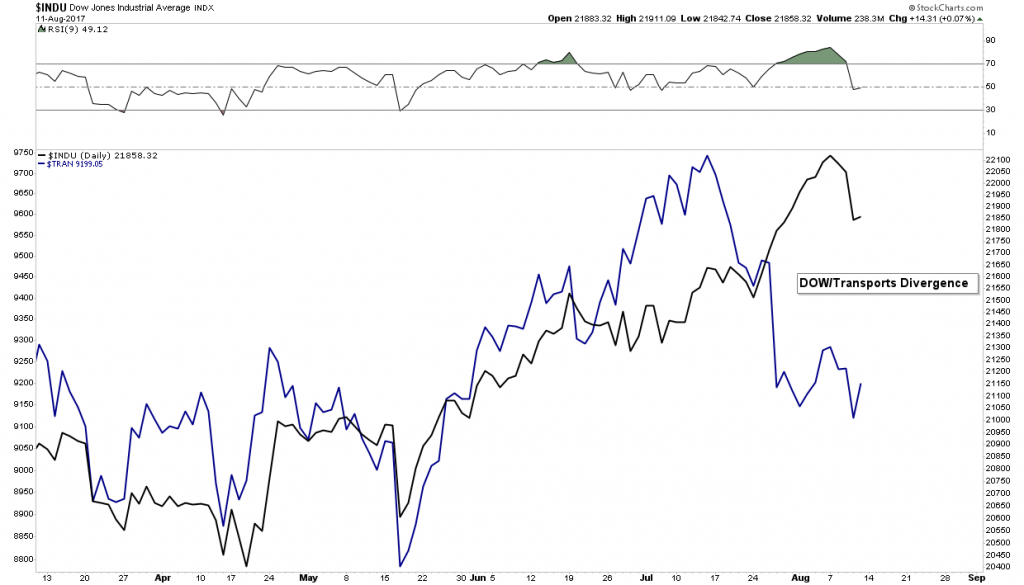

There are many other examples of technical failures right off their tops, but these are the highest profile. The point is there are many charts showing profound technical signs of failed tops. The DOW Transports have also been displaying a divergence with the Dow for the past month which occurs typically at market tops:

Bull Markets Don’t Die of Old Age

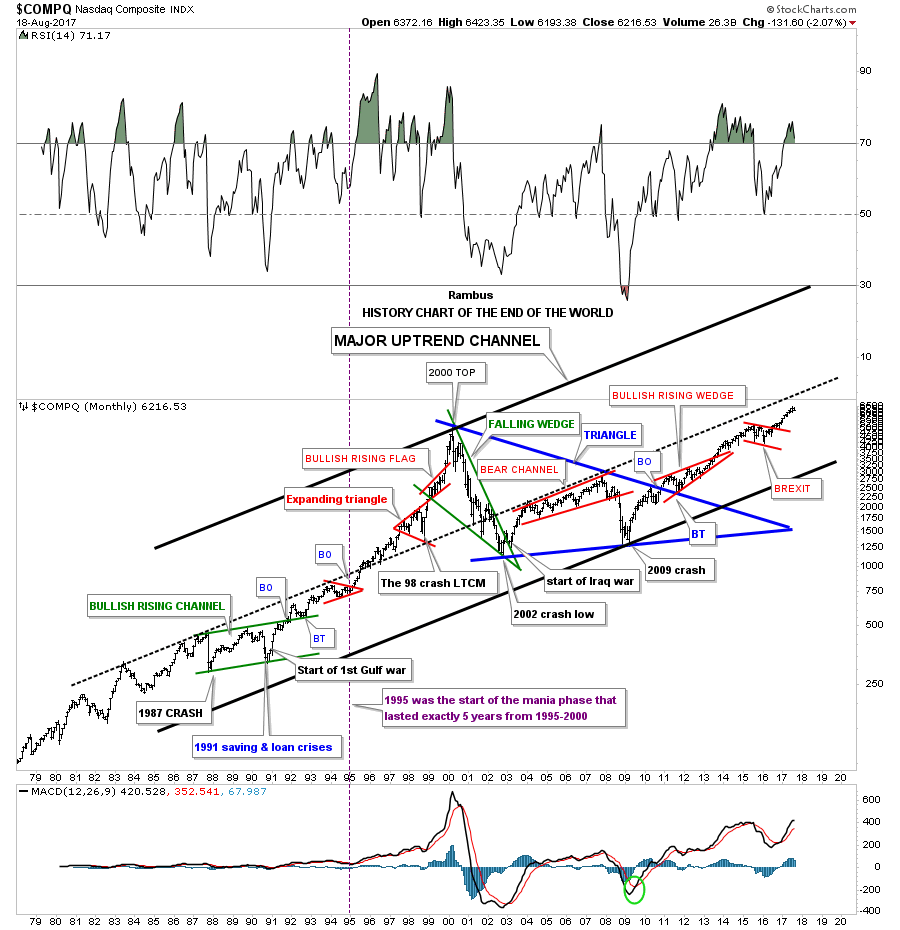

Really? Well that’s the Wall Street narrative at least, however all rules have limits. This bull market began in March of 2009 making it one of the longest in history. In a recent study of the 32 longest bull markets throughout the world over the past 100 years to include Europe and Asia the current NASDAQ bull market is the second longest bull market over the past 100 years of all markets!

The Dow has now eclipsed all previous bull market durations in the DJIA in all of its history. The second longest was the bull of the 1920’s which lasted 419 weeks. Today our bull is at 440 weeks. One of the indisputable facts in the study of bull markets is that the longer a bull market lasts the higher the probability the ensuing bear market develops into a deeper bear market.

Years which end in 7 have historically had a tough go of it during the 3rd and 4th quarters. 1907, 1937, 1987 had major crashes in the 4th quarter. Other years had strong sell offs as well, such as 1917,1957 and 1977. 2007 was the precursor to the financial crisis of 2008. There clearly is a 10 year cycle in the markets and it often bottoms in the later part of the 7th year.

We have all seen numerous measures of extreme valuation of today’s market, but we also know that markets can’t be timed using valuation. Excessive valuation however, will always be corrected. Many would say this cycle wont end until the little guy comes back into the market. Guess what, he already has! Here is a quote from Charles Schwab Brokerage:

“In Q2 after years of avoiding equities, Schwab clients opened the highest number of brokerage accounts in the first half of 2017 since 2000. This was the biggest first half increase in 17 years. Total client assets rose 16% to $3.04 Trillion.”

In summary: The little guy is in.

Again, there are so many anecdotal signs of an imminent top I cannot begin to chronicle them all here. Recently Warren Buffet passed the $100 million mark in cash. You of course know he does not sit on cash at market bottoms.

Thursday afternoon I was watching Bloomberg financial TV with the Dow trading down almost 250 points when a market strategist from a Wall Street brokerage house was confidently stating this was a buy the dip opportunity. He seemed so sure of himself and smug, having been conditioned to do so over the past 8 years. So if you think the market can’t drop because so many people are looking for it to drop, you are just not thinking…it can, and conditions are ripe.

The Trade Set-up

Of course anything can happen. If North Korea announces this weekend they are going to suspend future missile tests I am sure the S&P would rip upward through the entire Broadening Top formation to new highs. There are no guarantees about anything and a myriad of different outcomes are possible, but this is what I would look for in rough fashion: I expect an aggressive backtest up to at least the bottom S&R line of the broadening top formation around the S&P 2460 level. Why? Because the ingrained buy the dip mentality has programed Wall Street to buy it. They simply can’t help themselves. Any hint of good news should spark a rally. I think the only reason it didn’t occur on Friday was because of weekend uncertainty.

Also from a technical perspective we are set up to rally right now. Look at the NDX Down vs Up Volume. It has been a great indicator of past bottoms. It shows when the market is washed out at the lows. Thursday’s big down day shows the market is now washed out and ready to rally. Any positive news should cause a bounce. But I am not playing it. My trade is to find an entry point for the short side.

I prefer to sit and watch and stalk the market. I want to see how the SPX chart at the beginning of this report and the QQQ chart below resolve themselves and to look for a short entry.

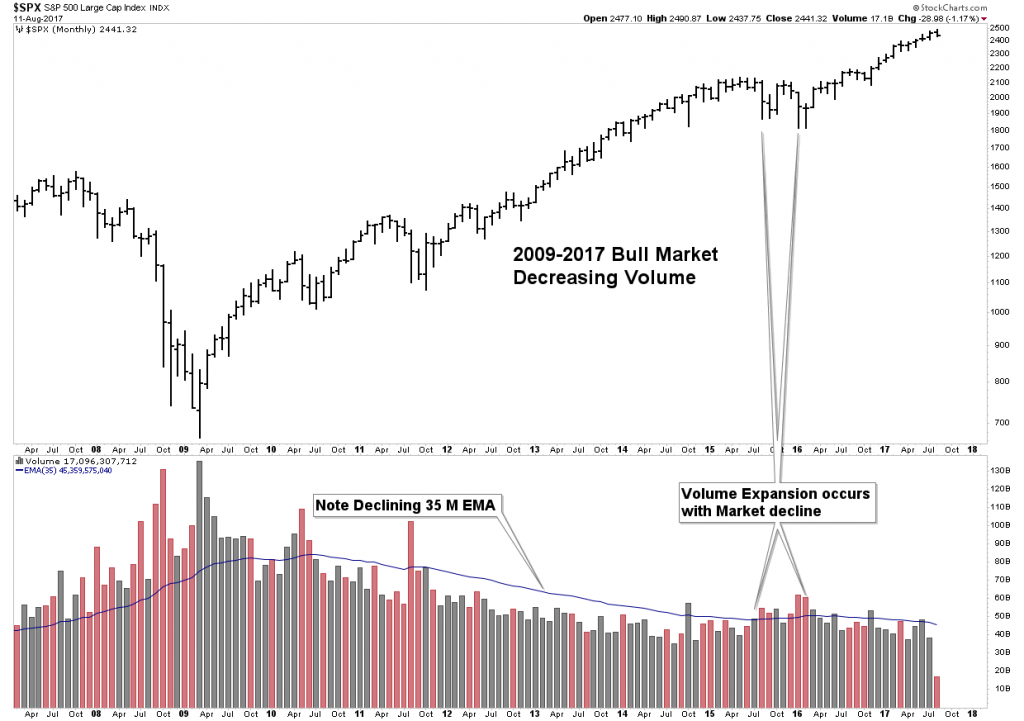

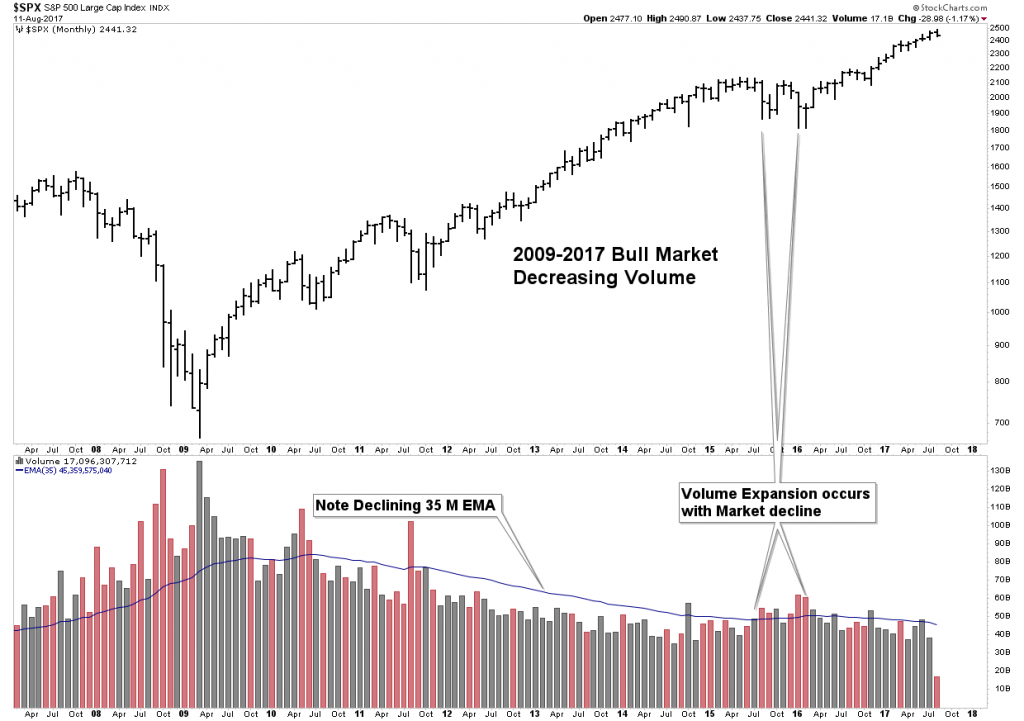

S&P Big Picture

The message of the below chart to me is this entire bull market, since 2009 has been engineered and is phony. I understand that goes against the grain for many. But I ask where is the volume? Real bull markets ride along a tide of increasing volume. This “bull market” has had progressively decreasing volume. If I had to guess…and we are allowed to, I would think that when the inevitable bear market comes along it will be fast and furious as illiquidity will lock up the market.

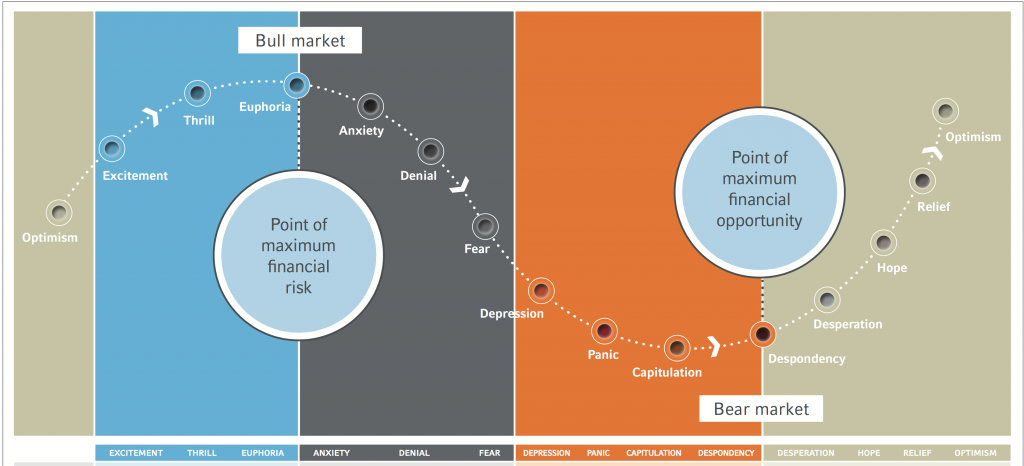

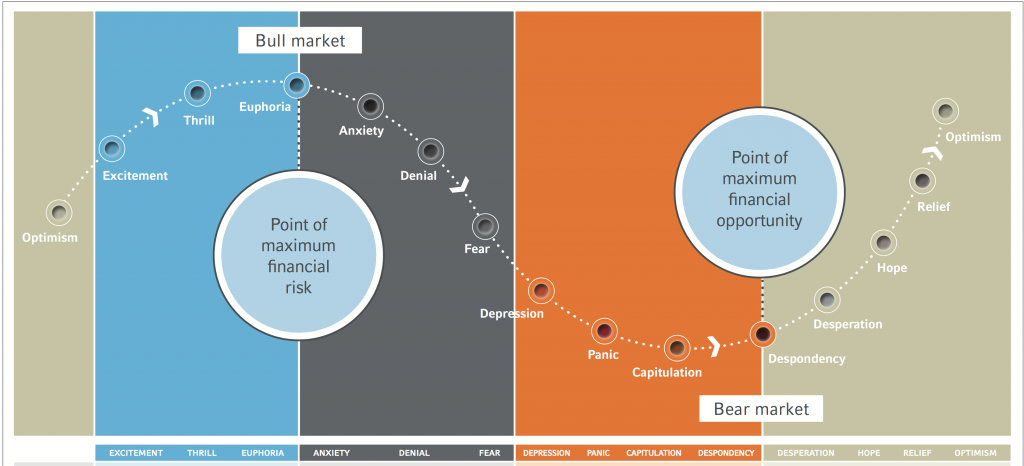

The Market’s Cycle of Emotions

The below chart shows where we are in the emotional market cycle. We are just now leaving the euphoria stage and approaching the anxiety stage. It was only a week ago where mass Trump rallies celebrated how great everyones 401Ks were and the Dow’s string of advances seemed to never cease. How fast things change. By late October we may already be to the fear stage.

It’s Time to Remove Your Rose Colored Glasses- The Currency Deflator.

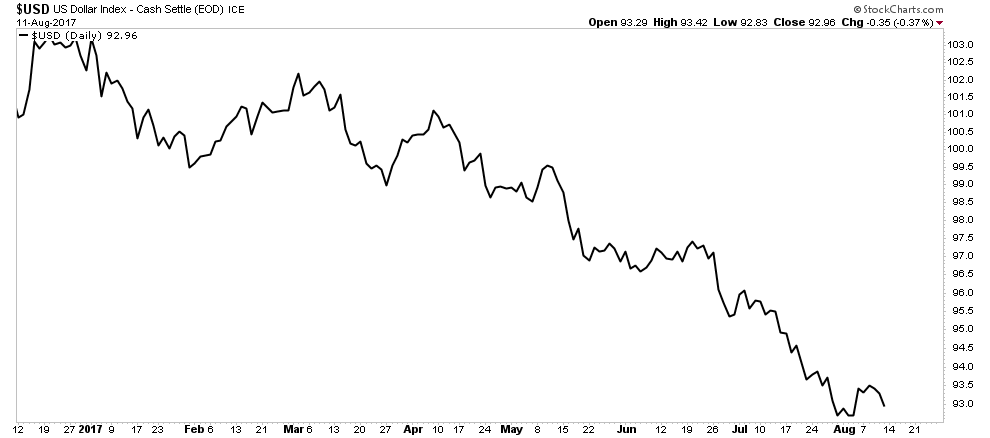

Since Jan 3, 2017 the USD has been in a decline with plenty of debate as to its future path. The overriding question: Is the USD now in a Primary Bear market? I do not believe it is, instead I interpret its move as a secondary reaction in an ongoing Primary Bull market. That said, since Jan of this year the USD has been in a downtrend. Therefore if you are a Dollar centric person everything we buy or sell has been affected by the decline of the USD.

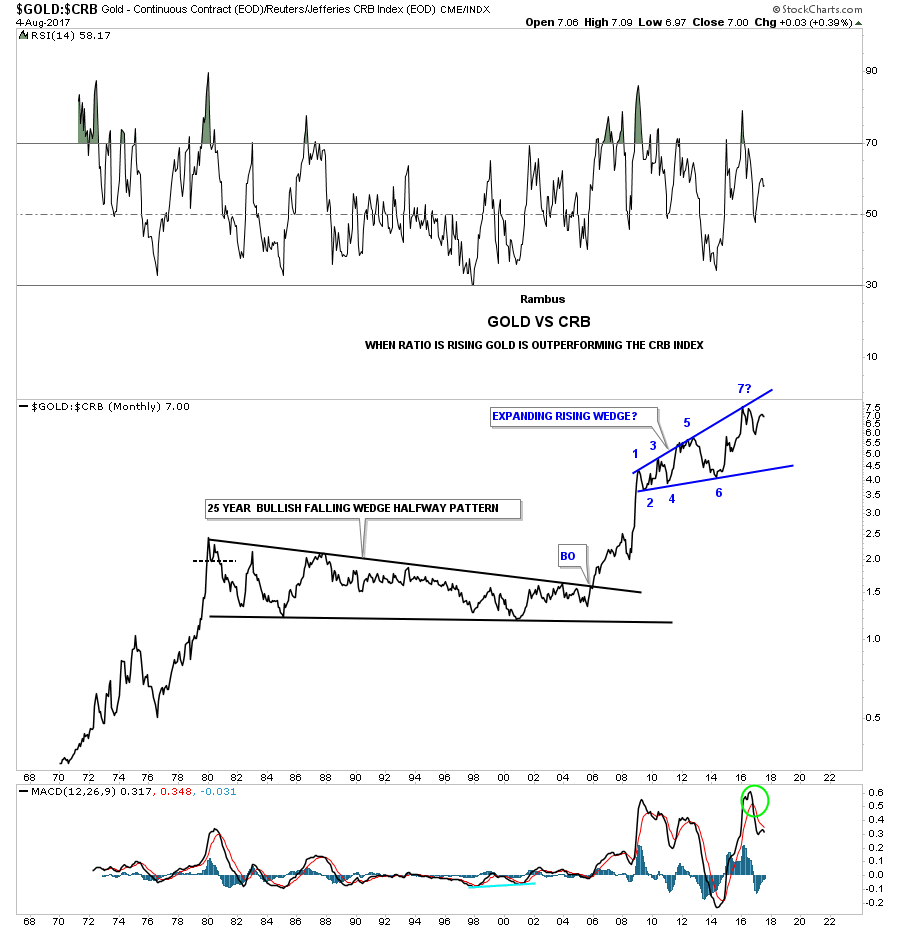

The weaker USD has assisted commodity and gold prices. Simply stated a weak USD has elevated the price of financial and real assets. If the USD is your currency you have been viewing the markets through Rose Colored glasses. Well I am now going to remove those glasses so you can see how the world really looks. I warn you it’s not pretty.

I received this inspiration while sipping on a scotch in Edinburgh Scotland two weeks ago. It was one of those Ah-Ha moments. As USD people we see everything through the USD lens, and I wondered what would it look like if we were to see it from a different, yet equally valid perspective.

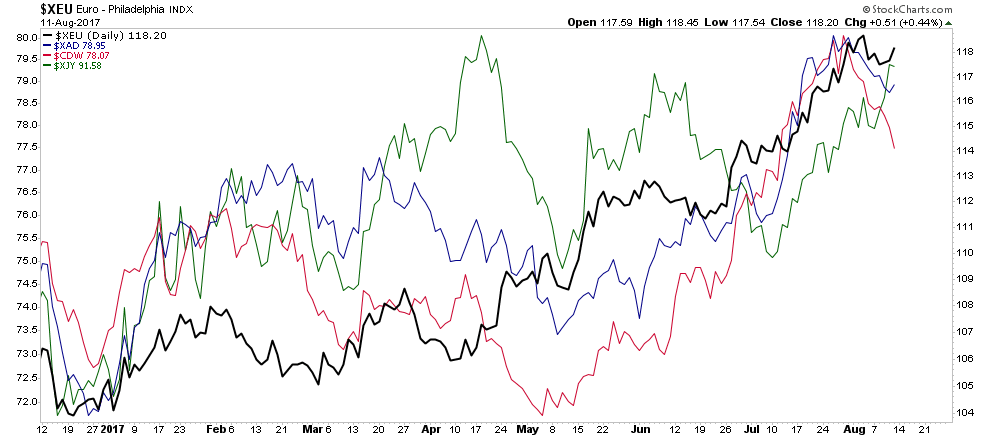

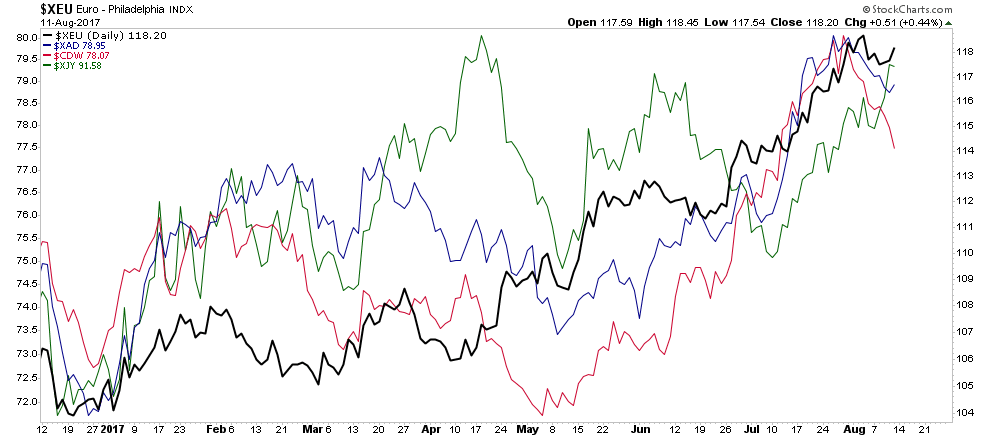

Below is a chart of the Yen, Euro, Canadian & Aussie Dollar. Since January they have squiggled around a lot, but have ended up pretty close relative to each other. So I am going to use the Euro as a proxy for all currencies to correct asset prices for the weakness in the USD we have seen this year. This is called a currency deflater. We correct the effects of a declining currency by dividing assets by the Euro.

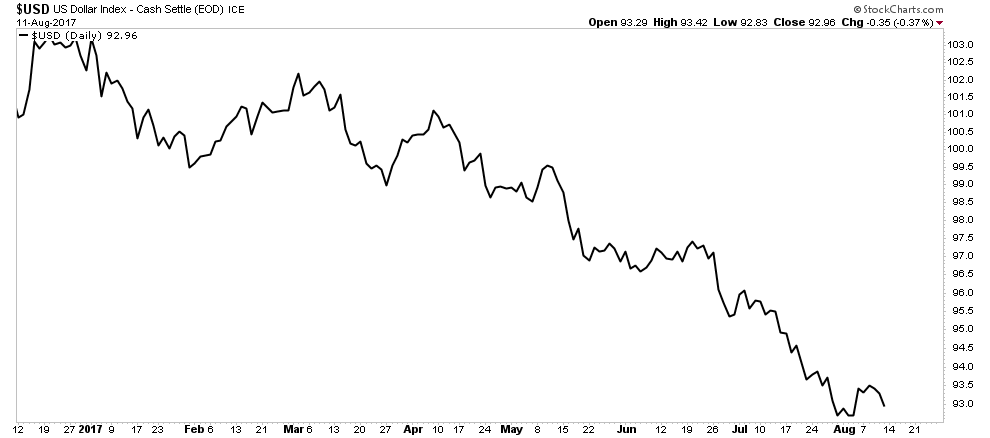

Here is a view of the USD since January. Above we have currencies going from bottom left to top right and below we have the USD going from top left to bottom right. Significant indeed!

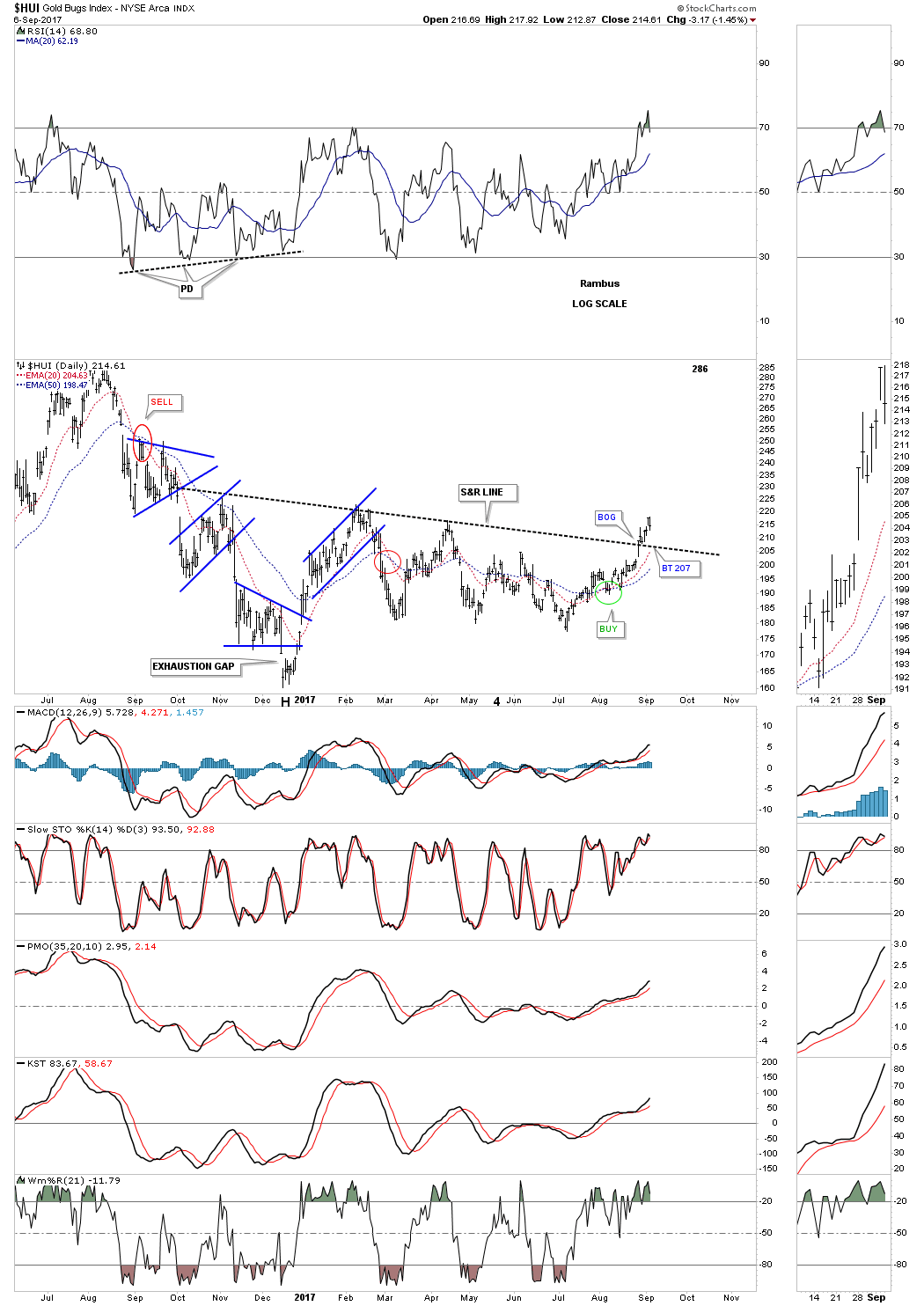

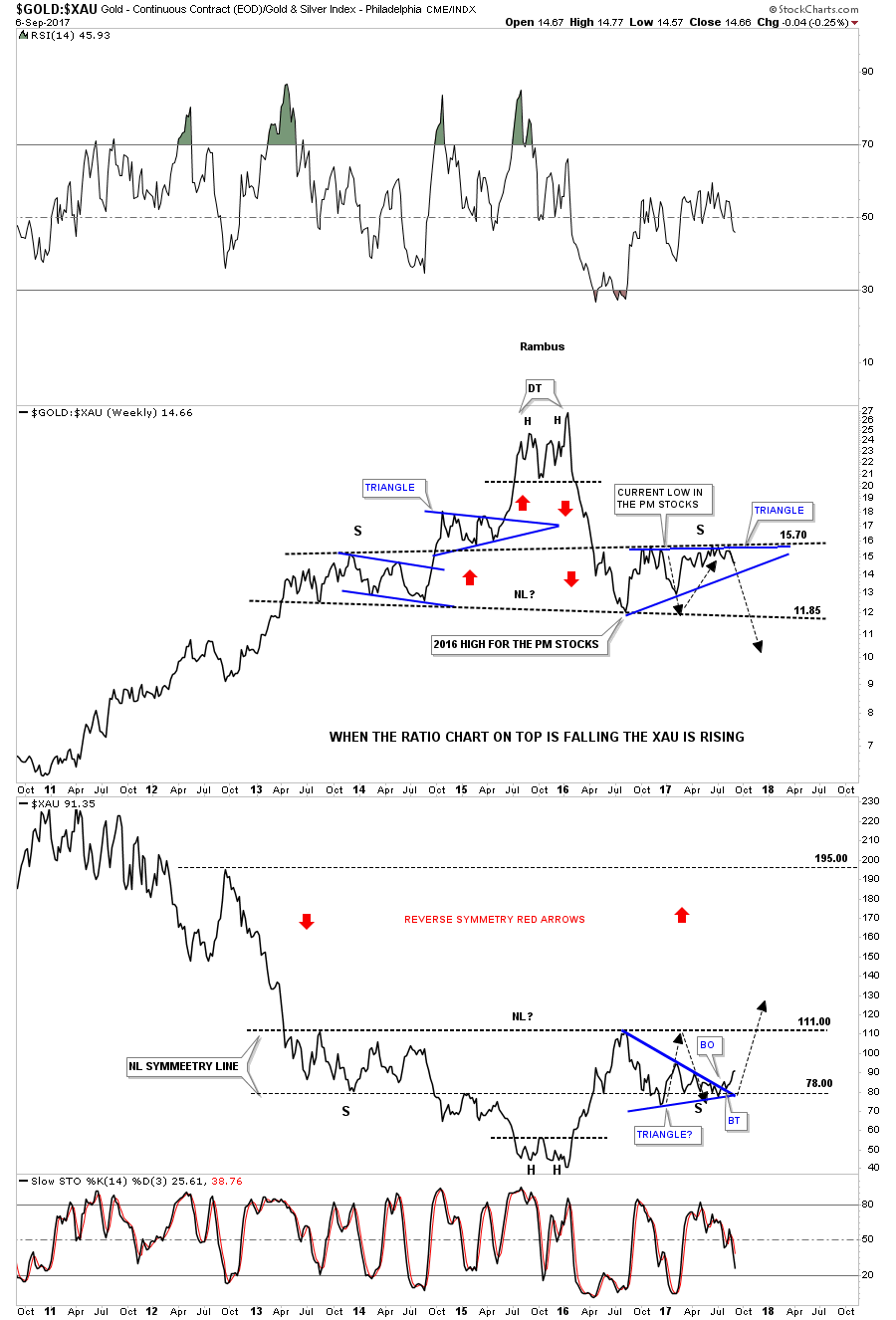

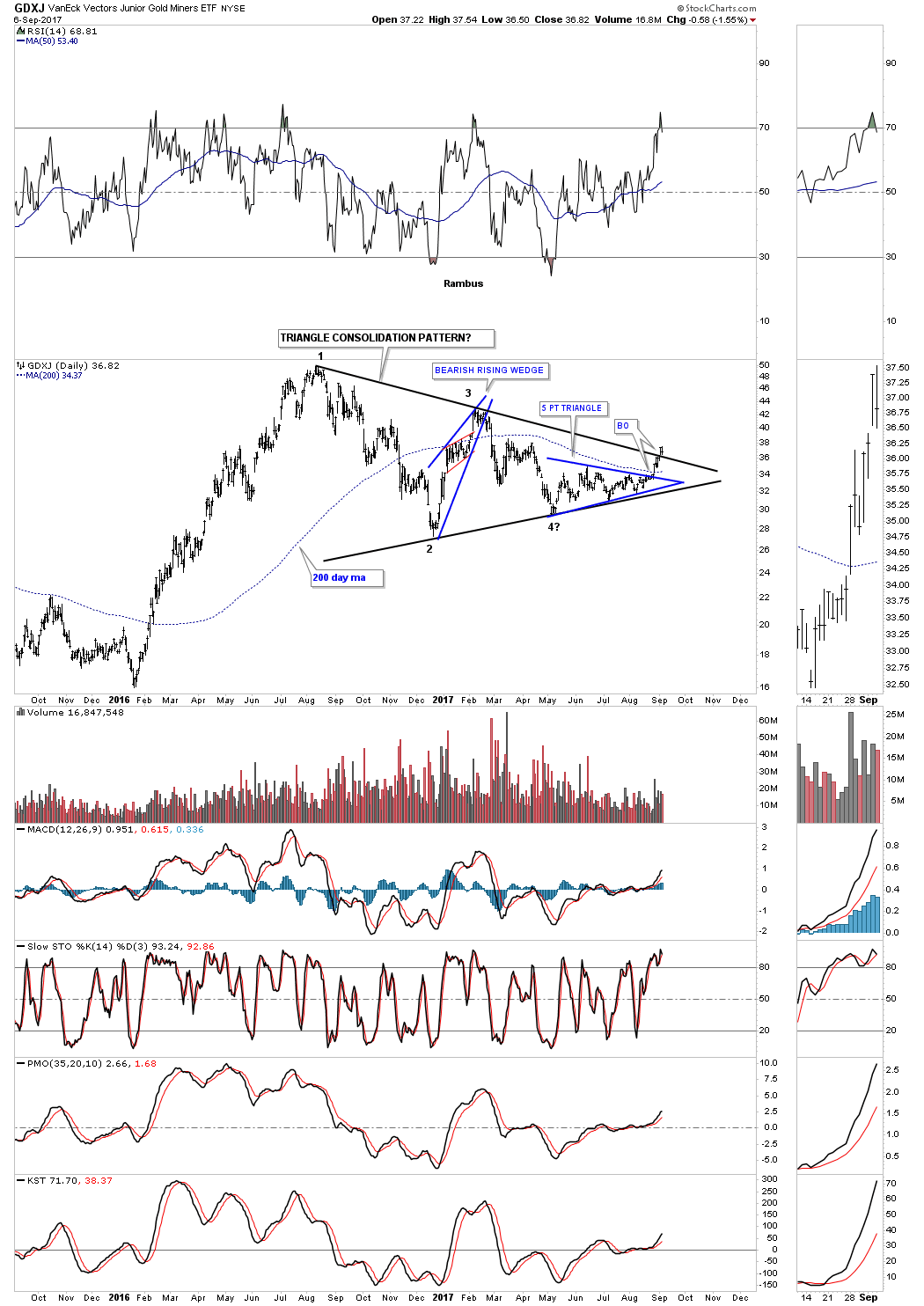

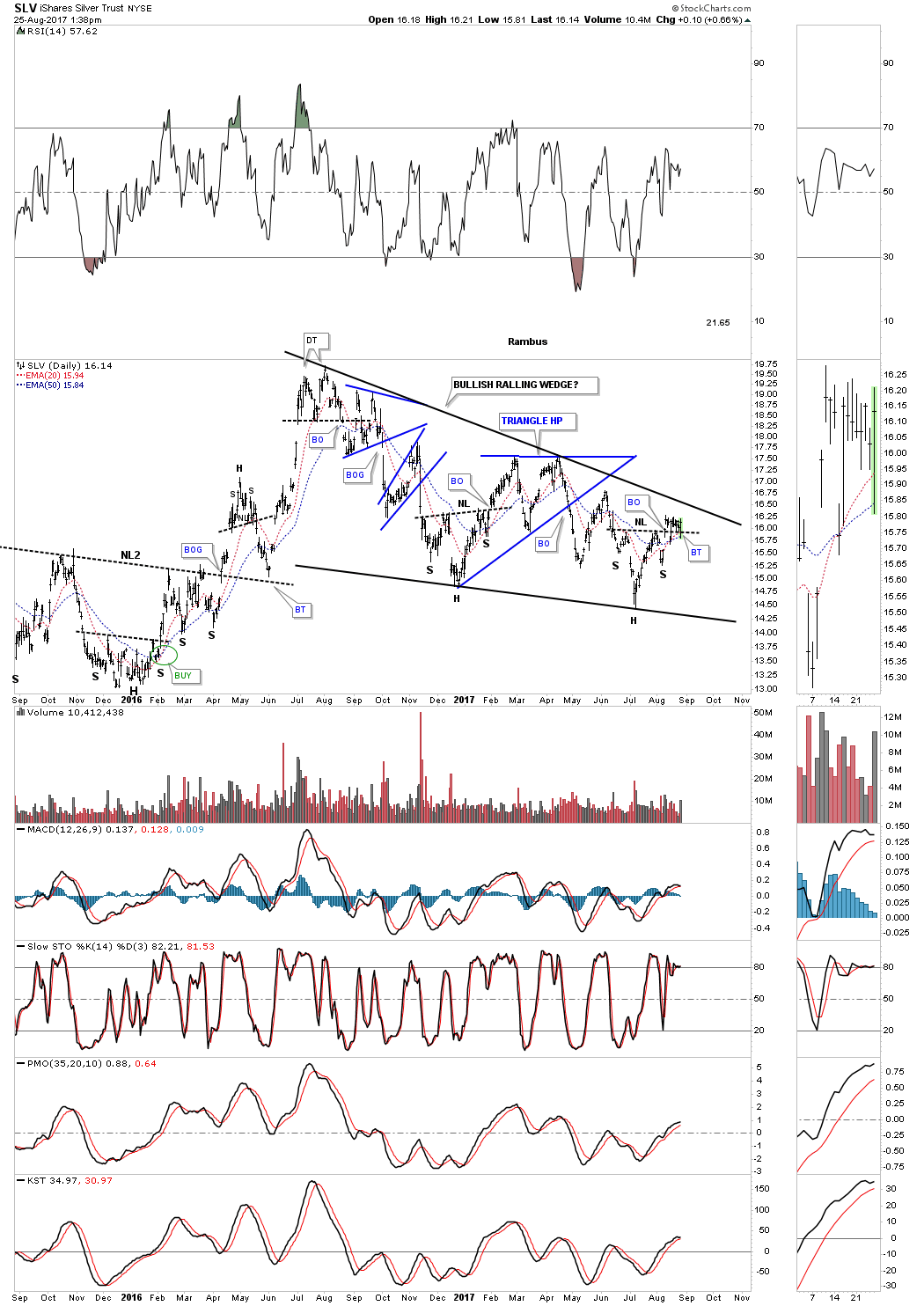

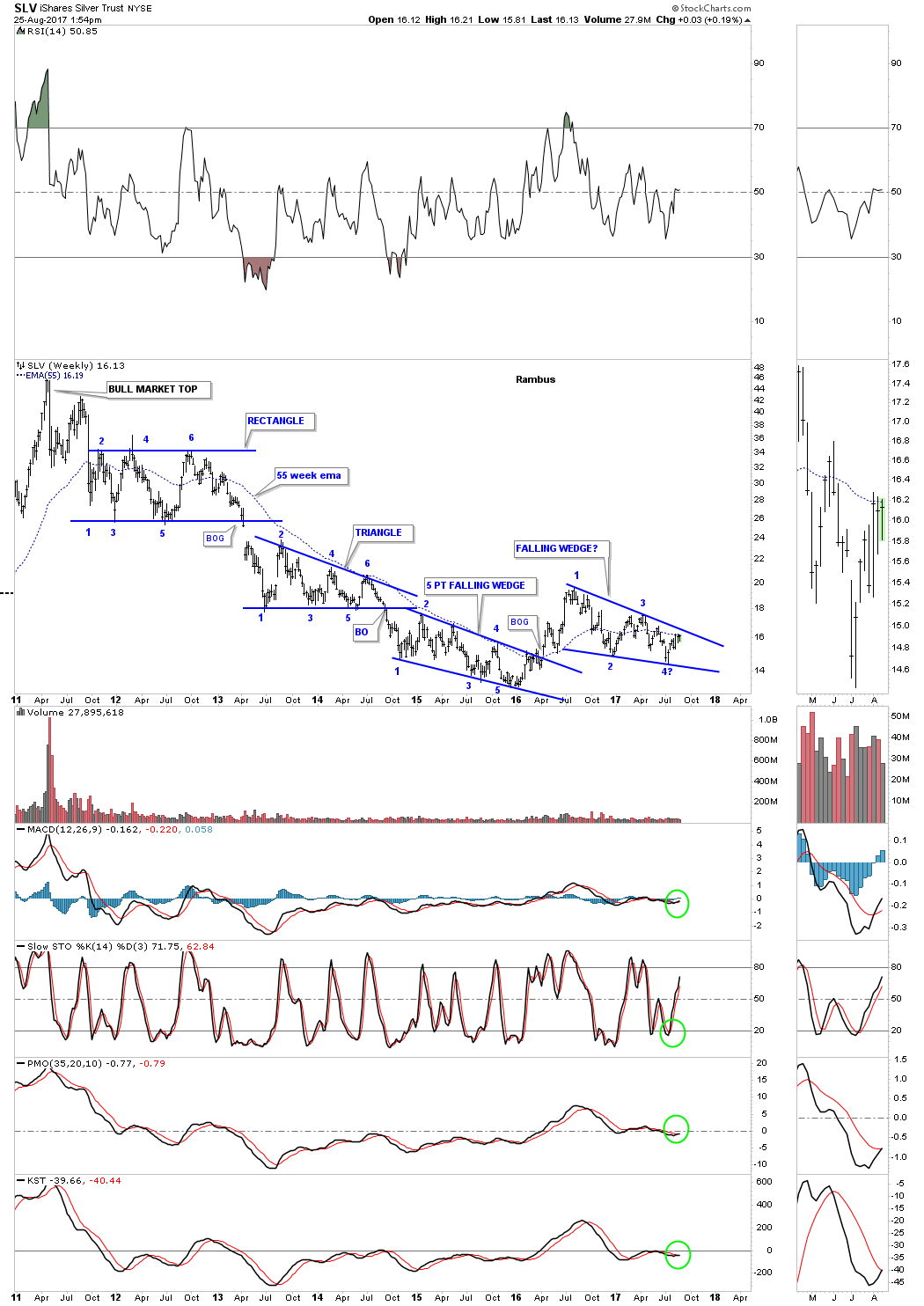

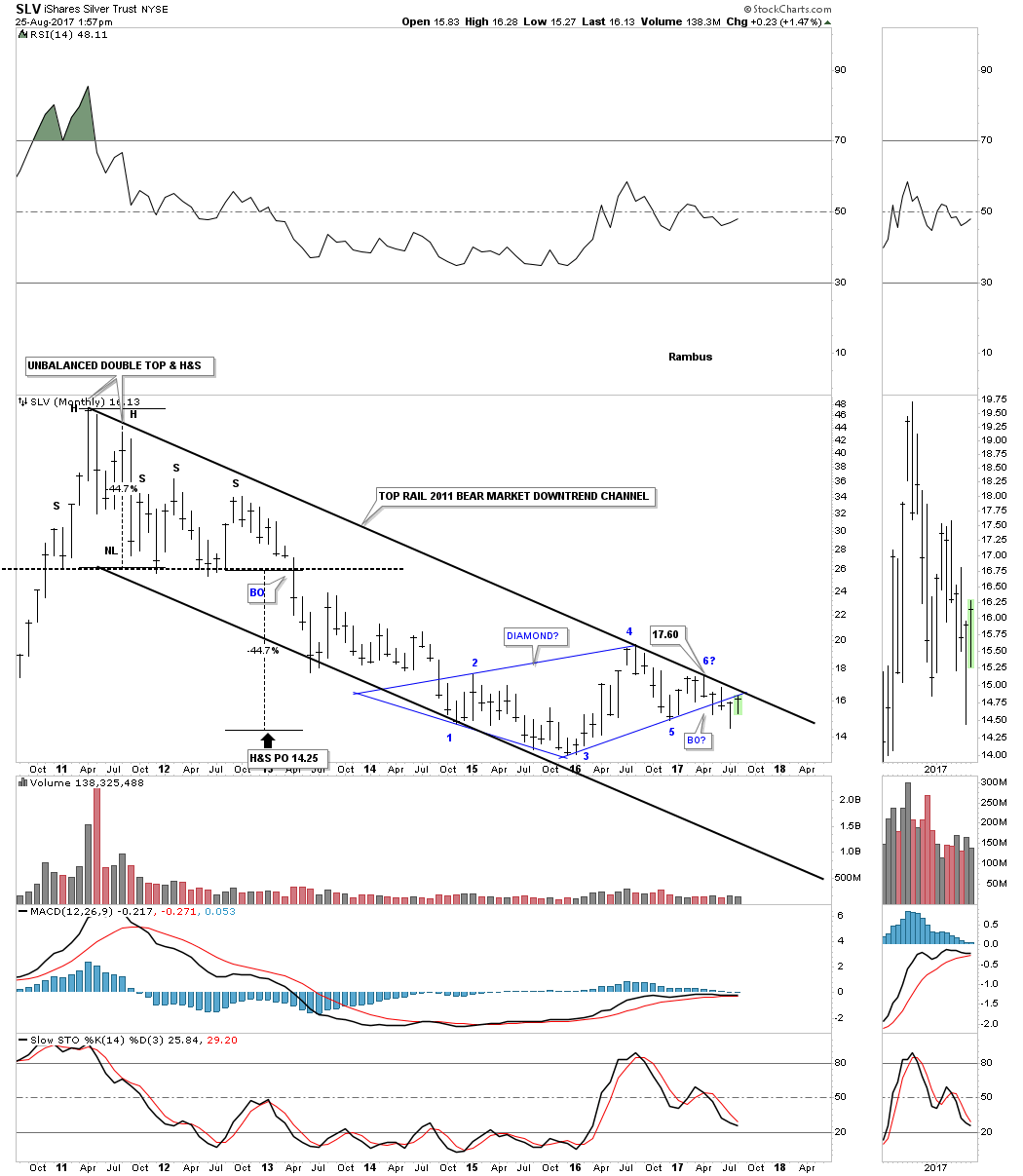

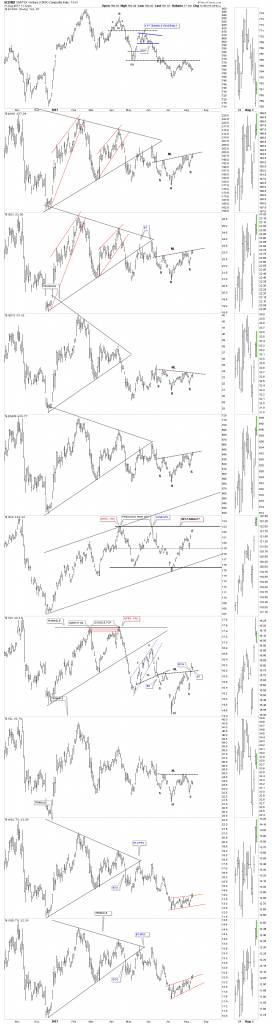

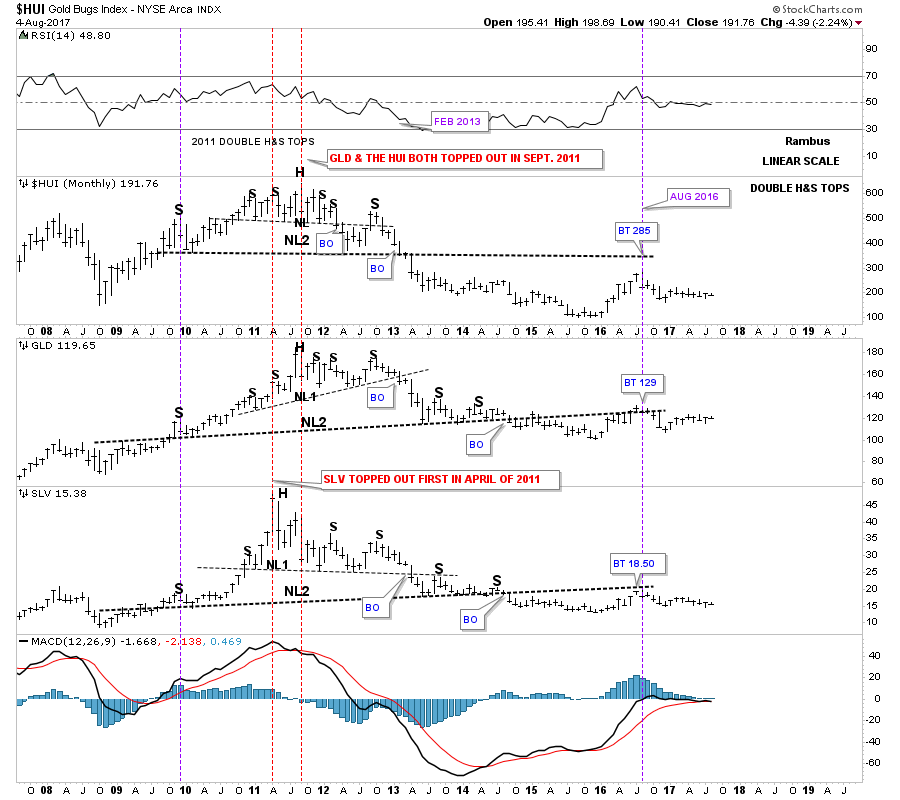

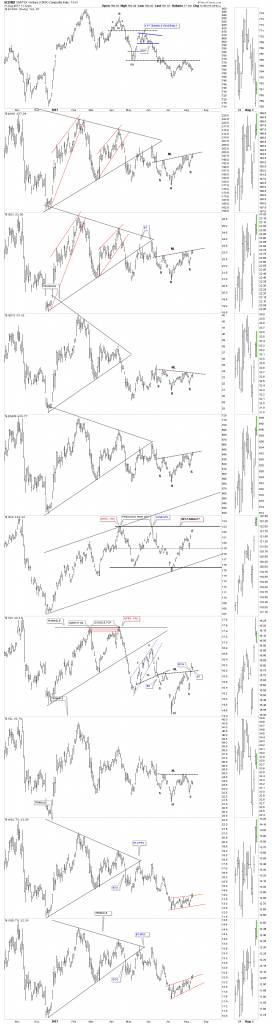

But before I show you the currency deflator I will post the most recent PM composite by Rambus so you can see what these indexes look like in their home currency:

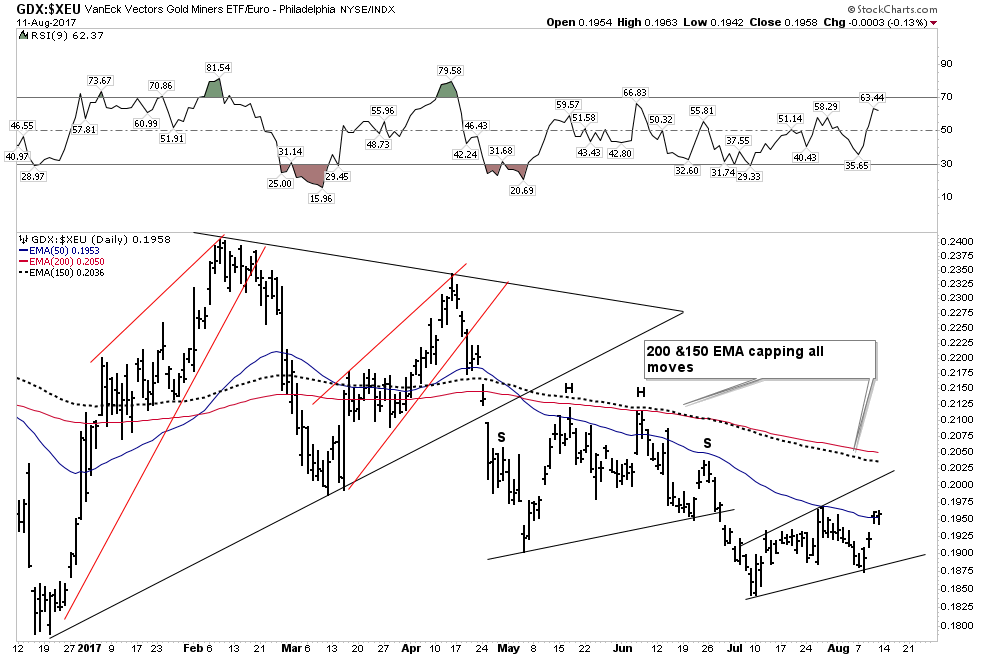

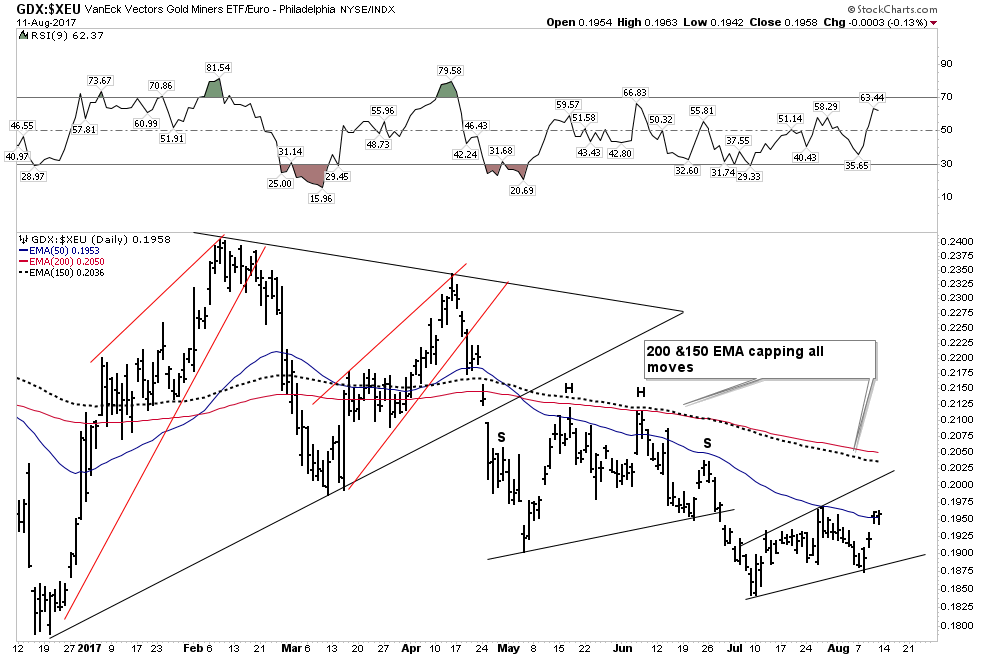

GDX

It is important to compare this chart with the GDX chart Rambus depicted above in his Composite PM chart. In his depiction the GDX seems to have a fighting chance to establish a bottom by putting in an inverted H&S and seems poised for a possible break upward over its NL. However if we strip out the currency tailwinds it reveals a pathetic collapse in the making.

Note how the rallies are progressively weaker each time there is an attempt to make a bounce. After the the urgent decline in late April which fell out of the triangle, it has been capped by the 200 & 150 EMA. Overall it appears to have a one-way ticket to an eventual capitulation washout.

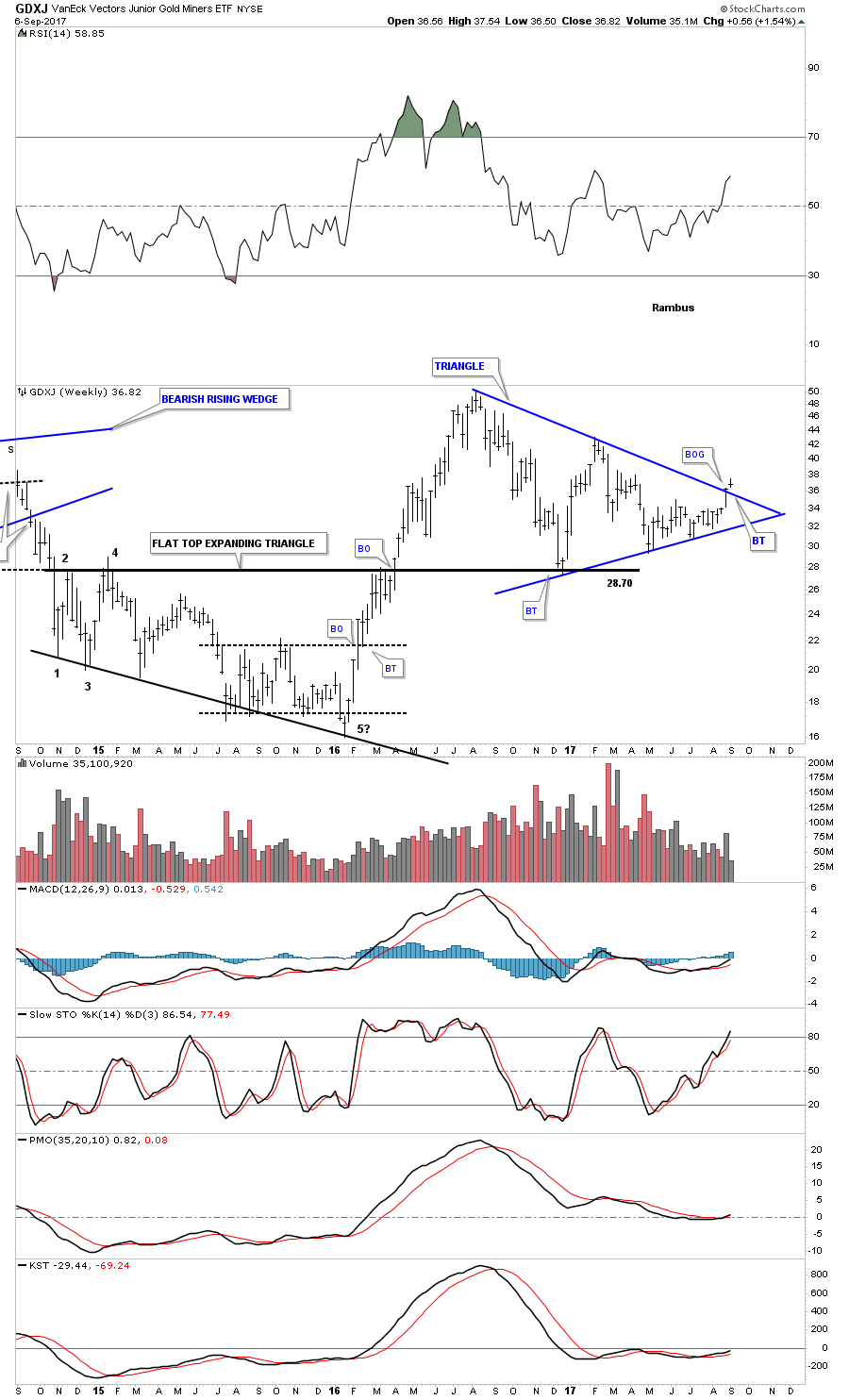

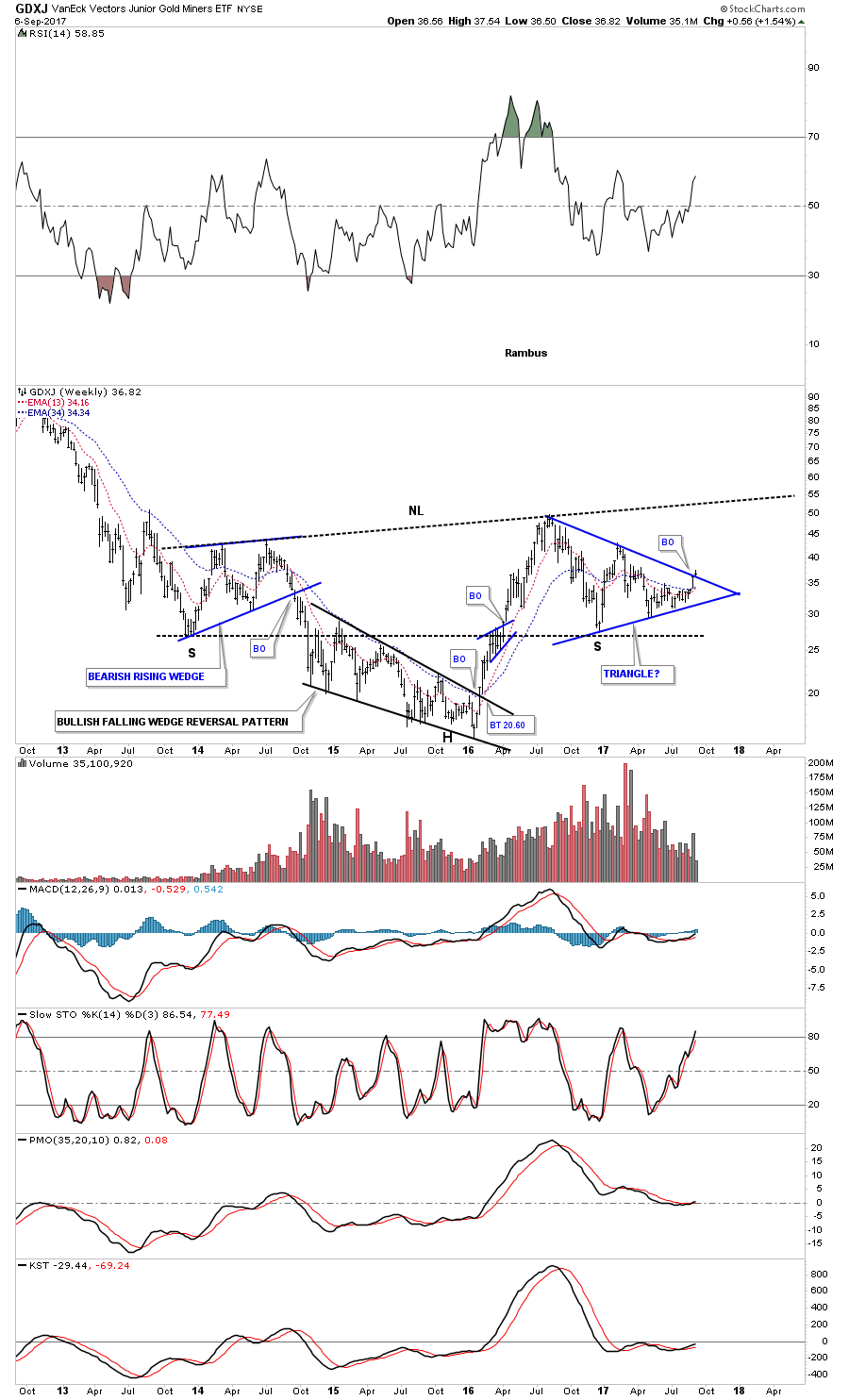

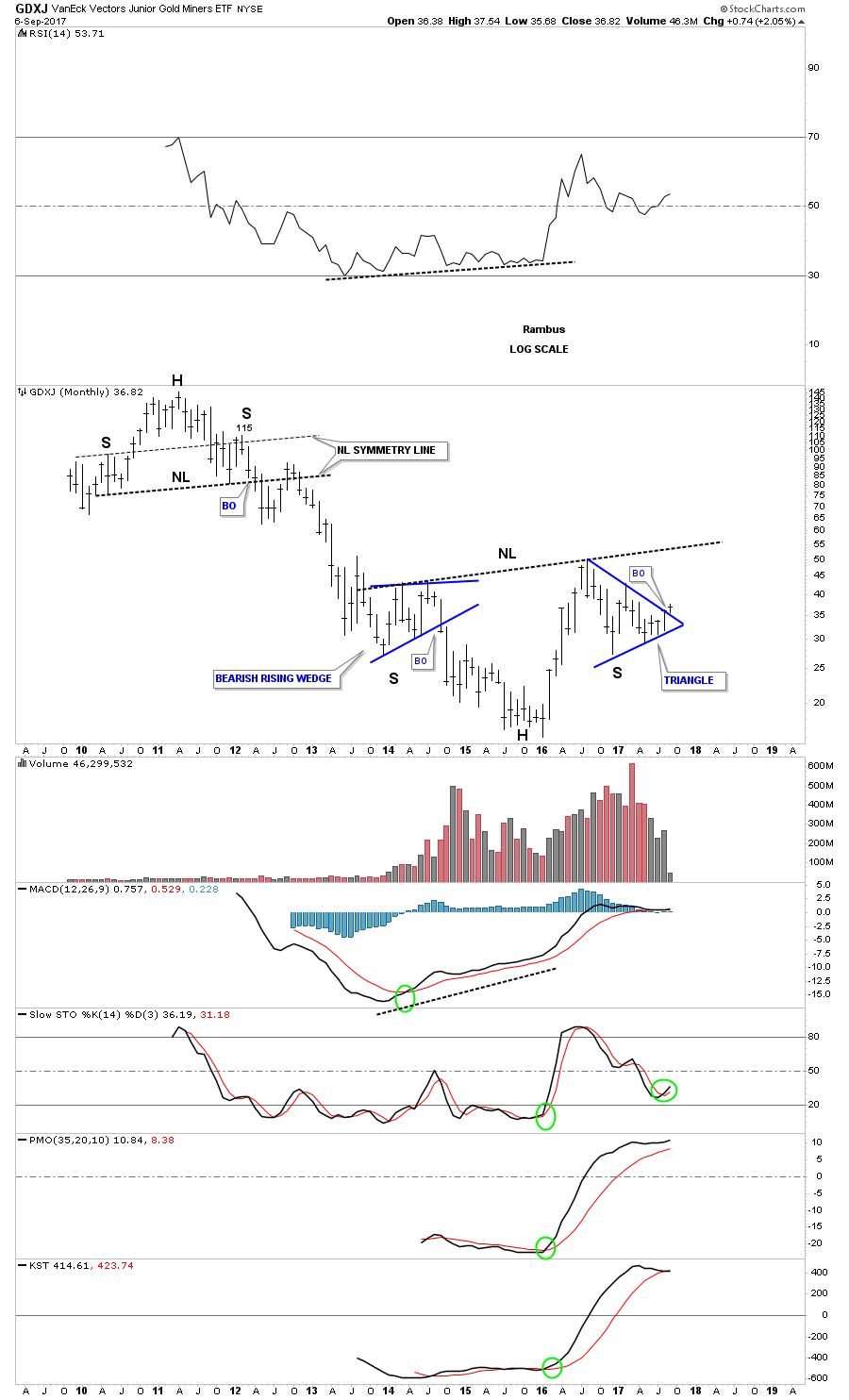

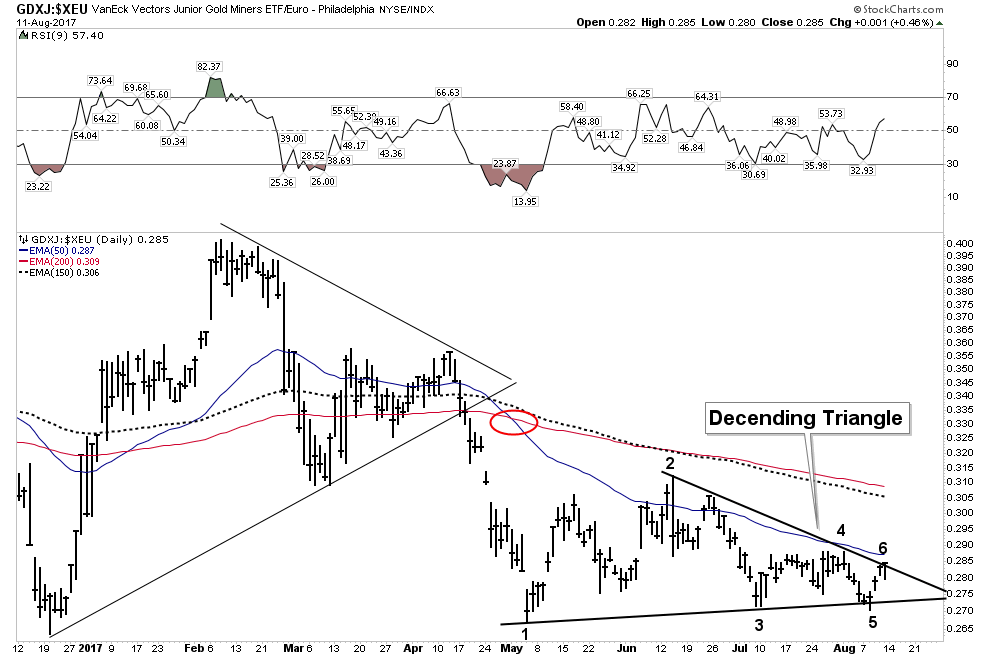

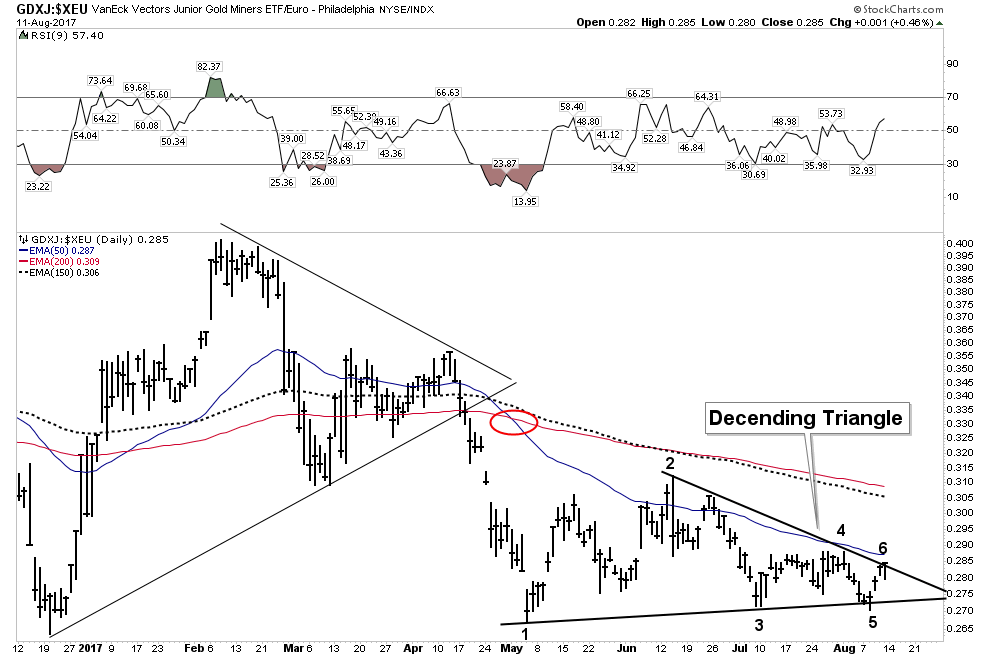

GDXJ- It get’s worse

Below we deflate the currency effects out of the GDXJ and we see a chart of grim liquidation. Up until mid April the GDXJ had enough energy to at least coil within the bounds of a horizontal triangle, however after the urgent gapping decline from the triangle its next consolidation became a descending triangle. Keep in mind this formation depicts supply coming in at progressively lower levels each time price rises. Ultimately it most likely is bearish with a probable resolution to the down side. Again we see all movements capped by the 200 and 150 EMA. It is becoming so week that the 50 EMA is now acting as resistance, whereas it didn’t before.

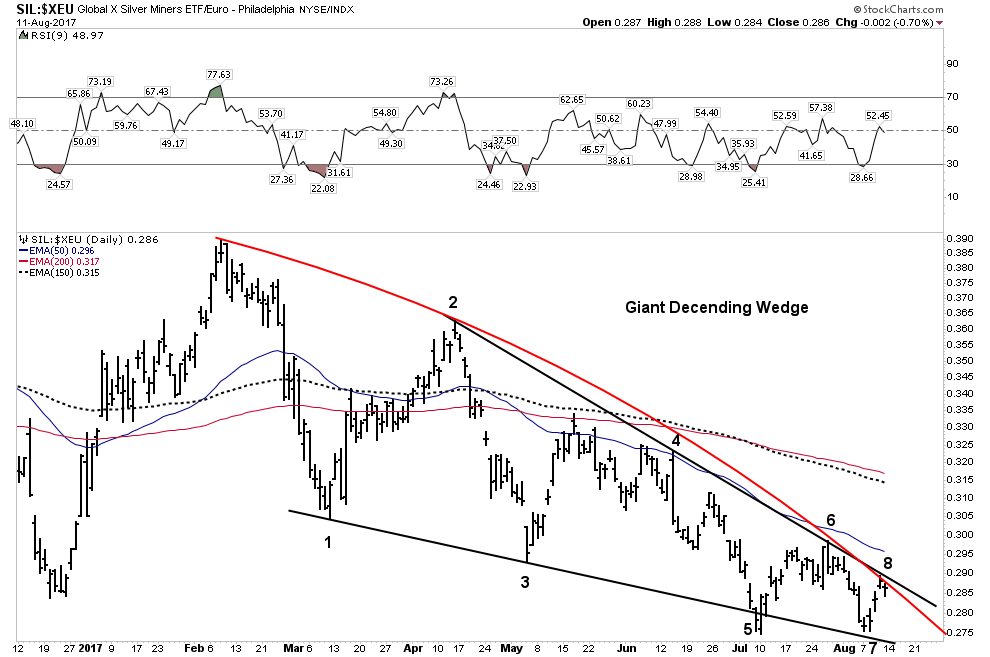

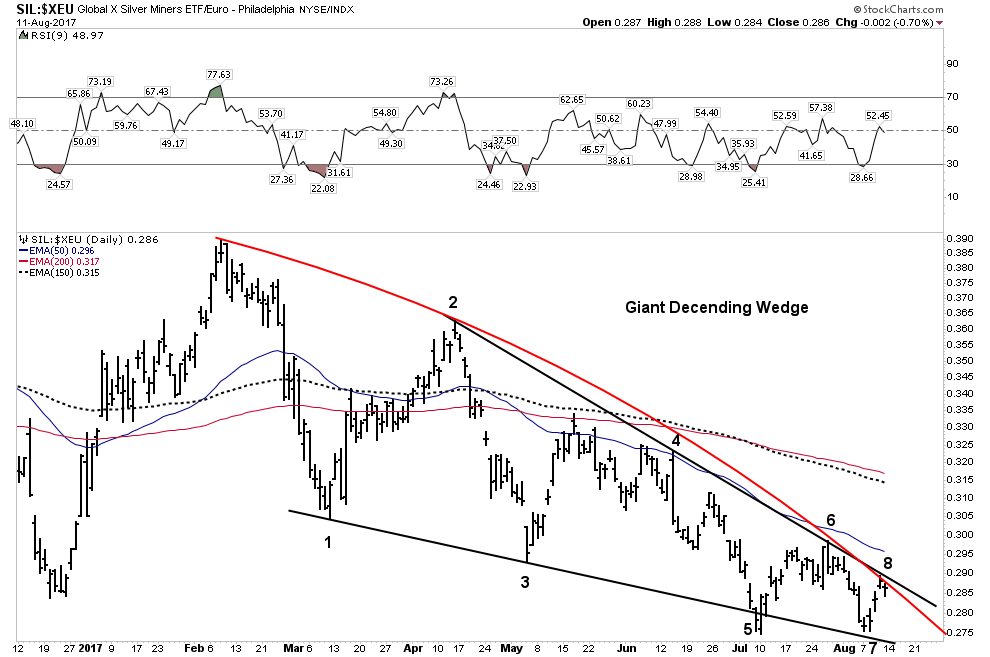

Silver Miners (SIL)

This depicts a slowly accelerating downward parabola bounded by an 8 point (?) descending wedge. Again, it is increasingly unable to generate enough upward power to penetrate any moving averages.

This type of pattern has the potential to drop out of such a long authoritative structure in catastrophic fashion. Kind of like this:

Keep in mind Silver Majestic is regarded as one of the leaders of the group. In Rambus’ PM composite you may have wondered why the two bottom charts, the XGD and HGU have been perennial weak sisters? The reason is because these two indexes are in Canadian Dollars. That’s right they don’t have the declining USD propping them up hence their bearish patterns building out. Currently they each are bounded within a bear flag.

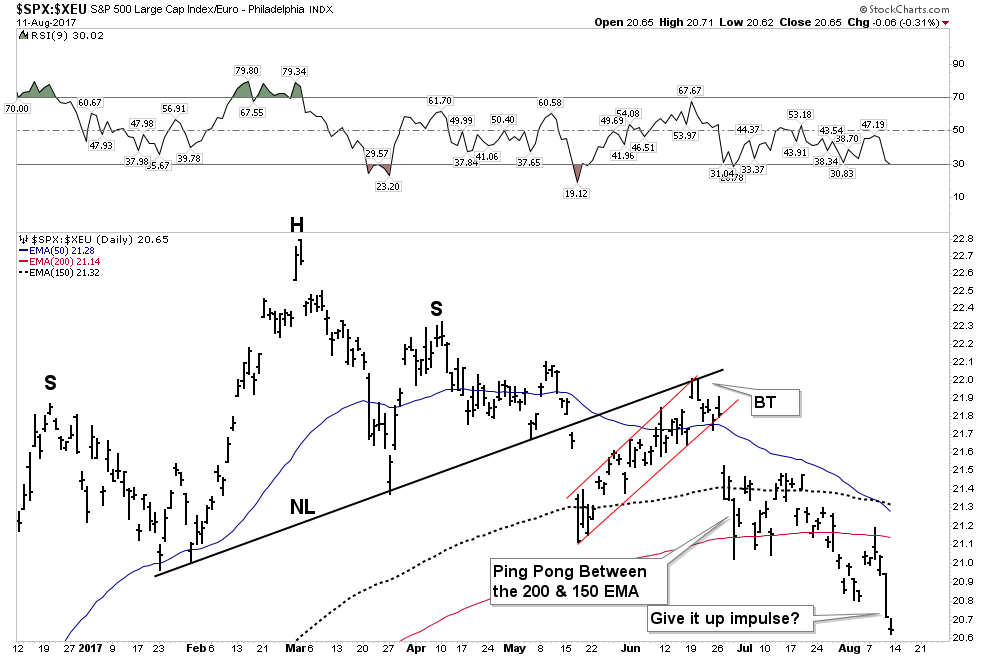

The Currency Deflater and the S&P

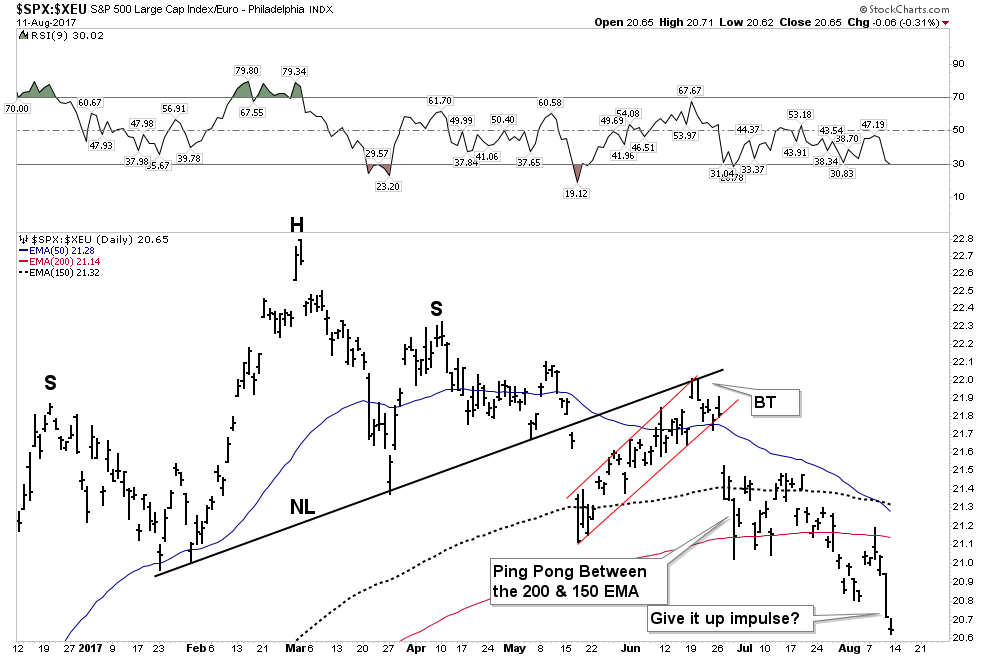

Now let’s turn our little currency deflator towards the S&P 500. The results are shocking! You may have thought you have been in a bull market all year. Well if you were not from the US you most certainly were not. This chart is devastatingly classic.

A well formed broad duration H&S with an urgent break below its NL. The break is followed up with a prolonged back test repelled at the NL. A violent gap down from its BT followed by a classic ping pong move between the 200 & 150 EMA followed by a final “give it up” drop and fall away. This is an incredibly bearish chart!

You can continue this exercise with other indexes to see how it has been the weak USD that has given us the perception that the markets have been healthy. Take off your Rose Colored glasses and you quickly see the deterioration that lies within going on all year. In fact, deflation has been eating away the markets like termites in an abandoned house. Eventually the winds blow and the collapse ensues.

Coming back to the point of the currency deflator, we can see that it’s the weak USD dollar that has maintained the appearance of healthy markets. So what happens if the USD resumes its primary upward trend? It’s pretty simple really, a rebounding USD would crush commodities and anything related to the precious metals. It most likely would have the same effect on the general stock indexes.

Eventually however, in a post bubble contraction (PBC) both gold and the reserve currency should catch a safe haven bid and can climb together. When this occurs it should be the start of the initial phase of the bull market in precious metals which lies ahead.

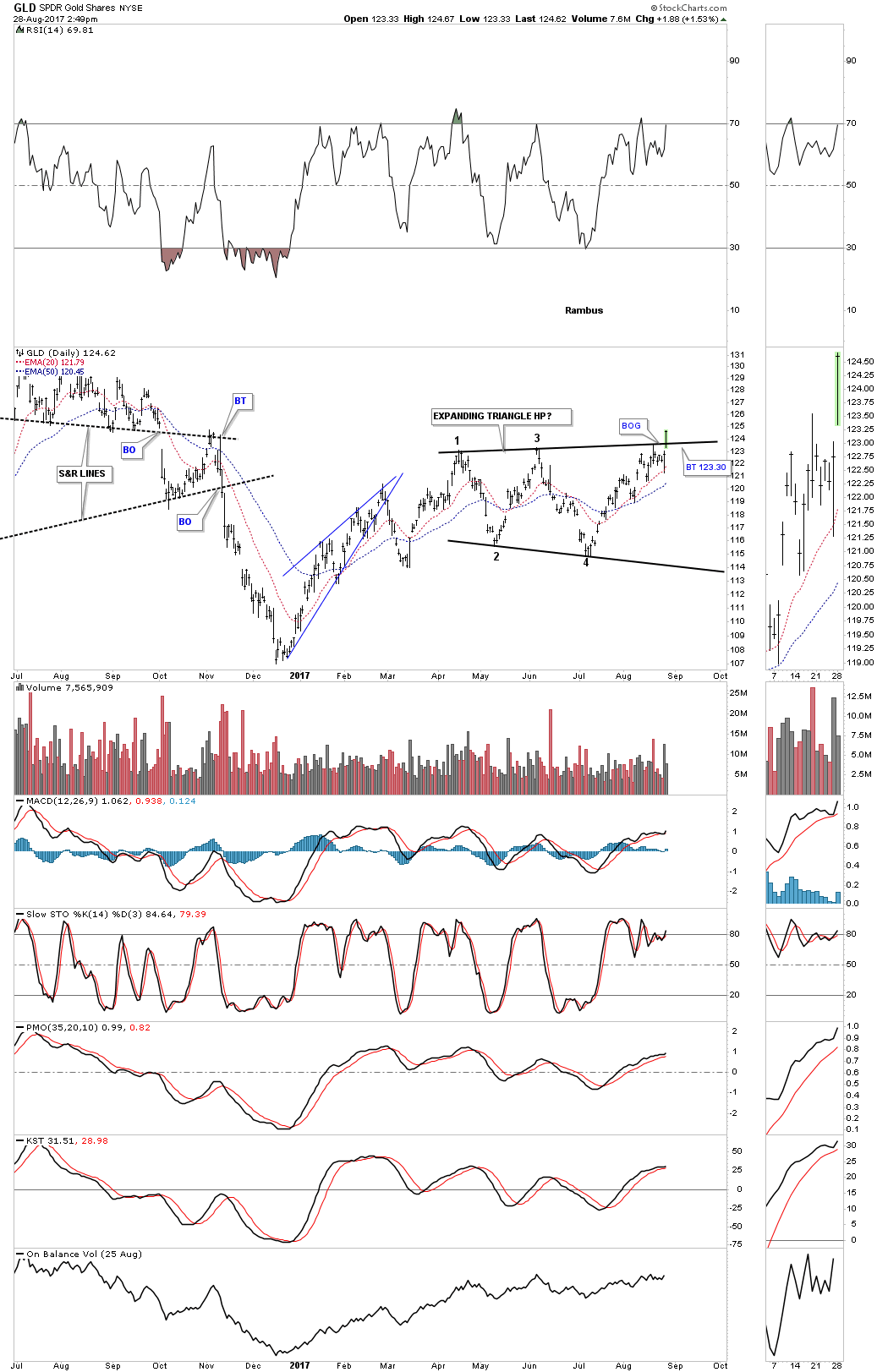

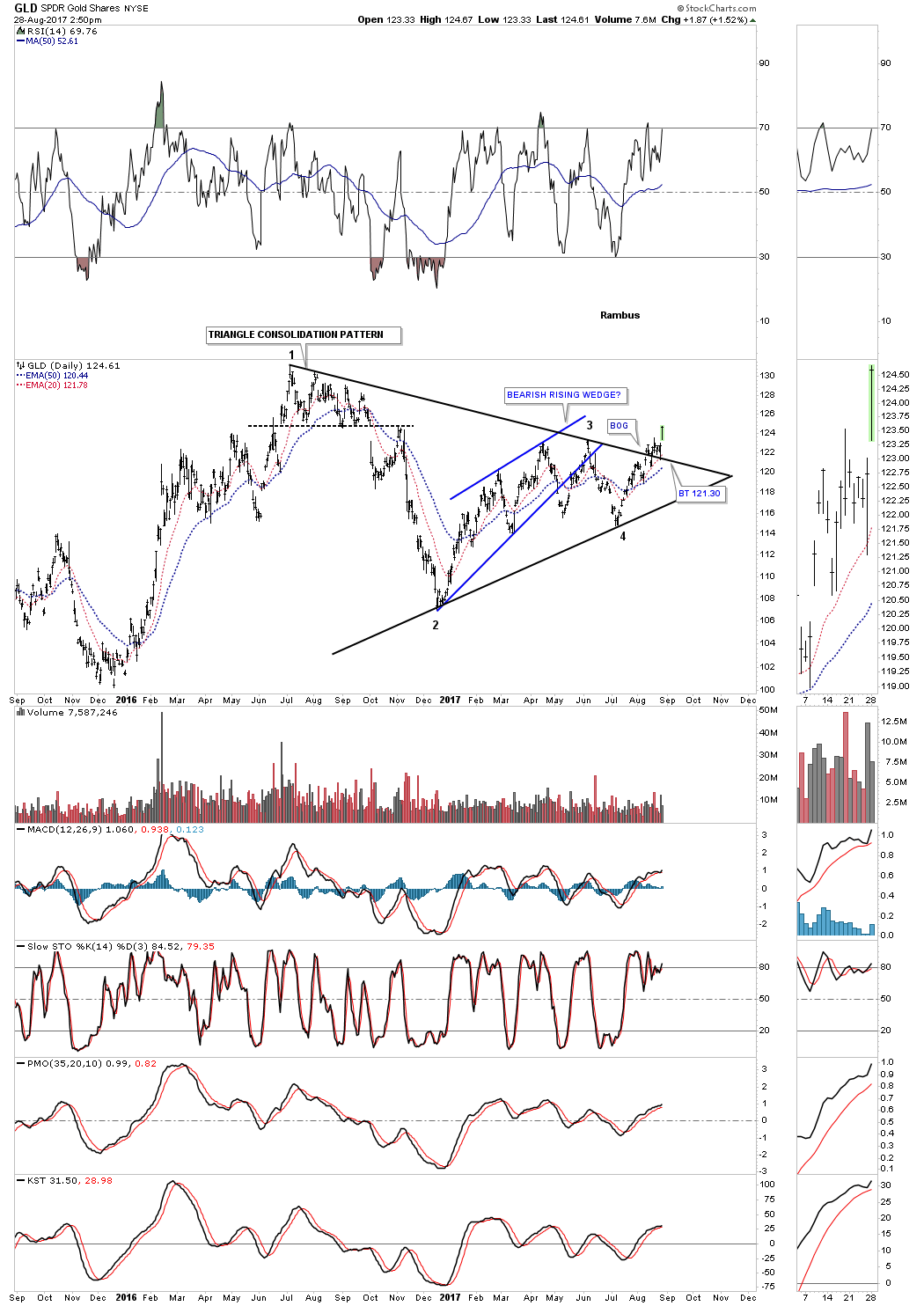

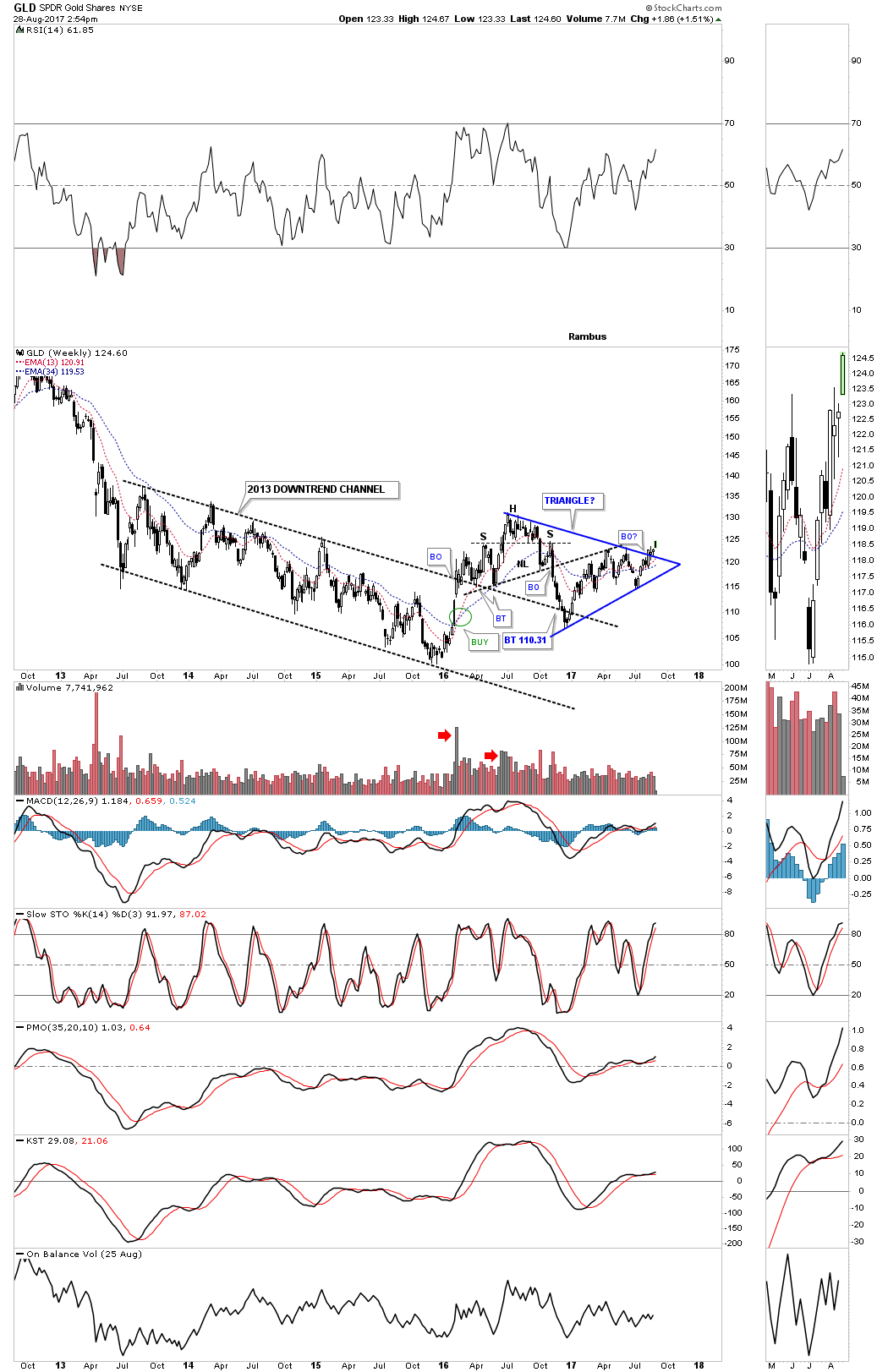

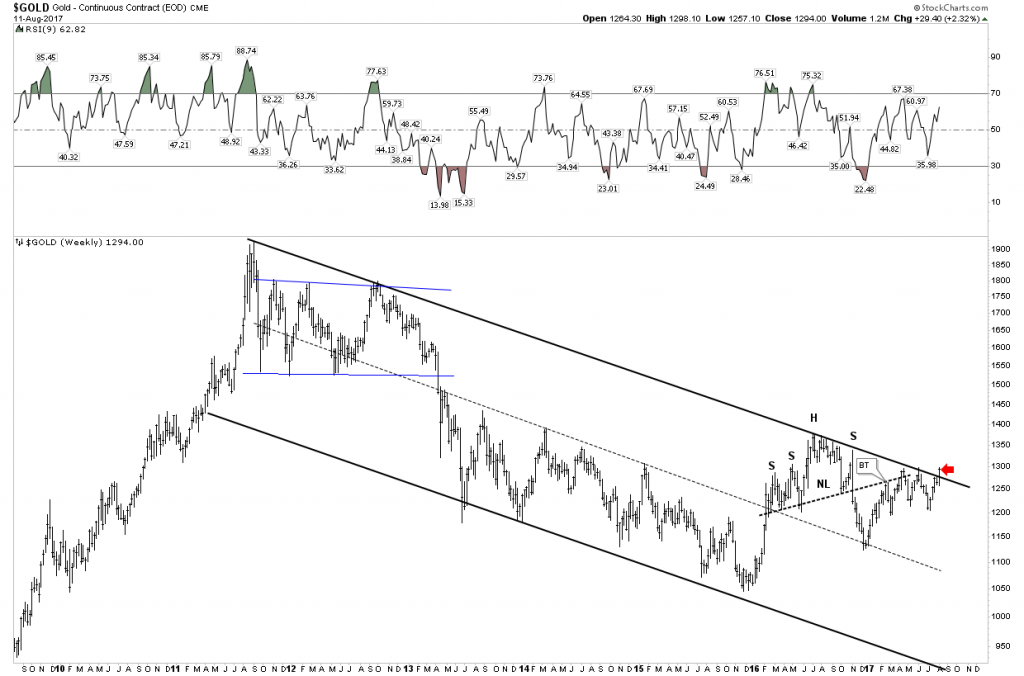

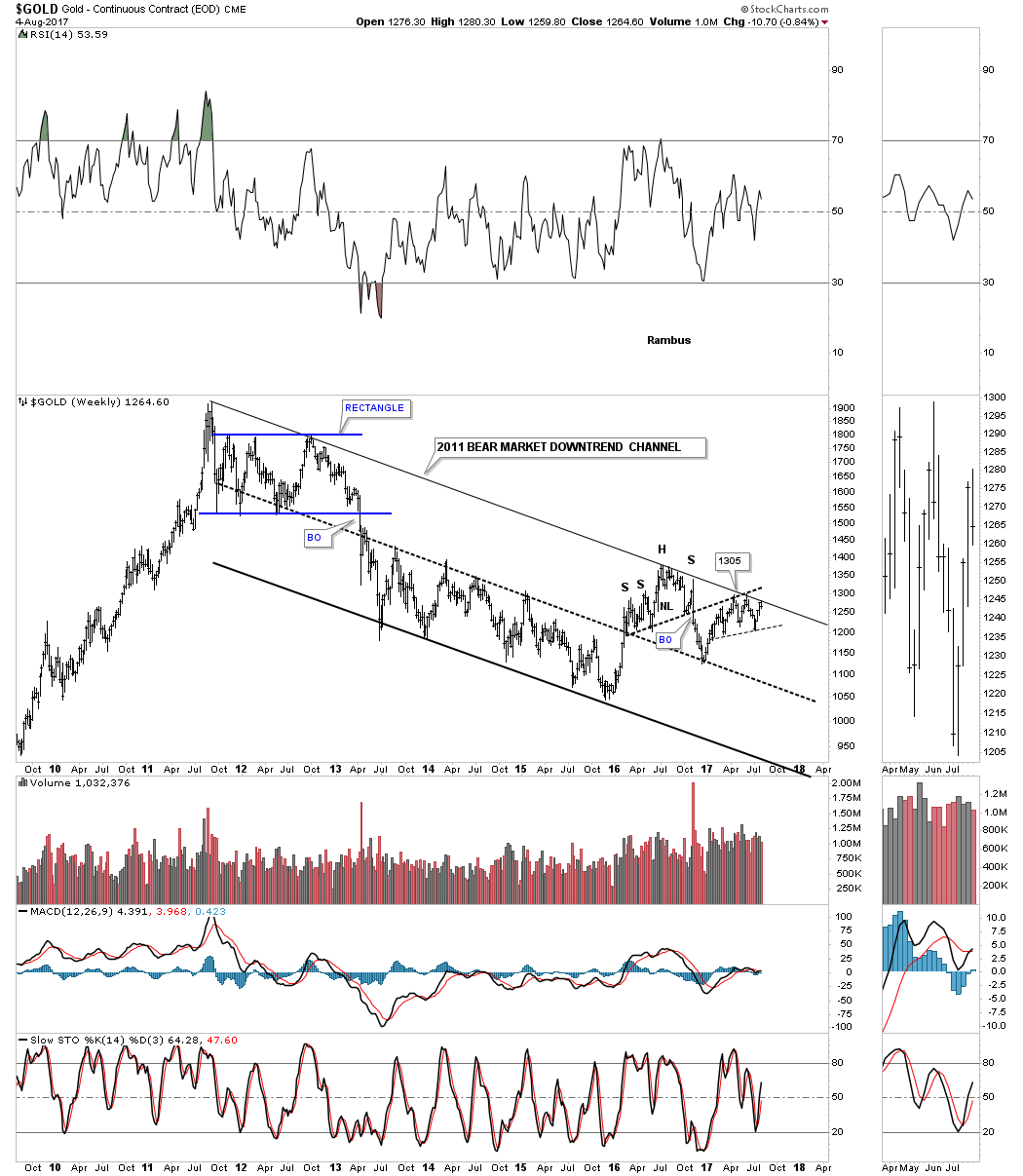

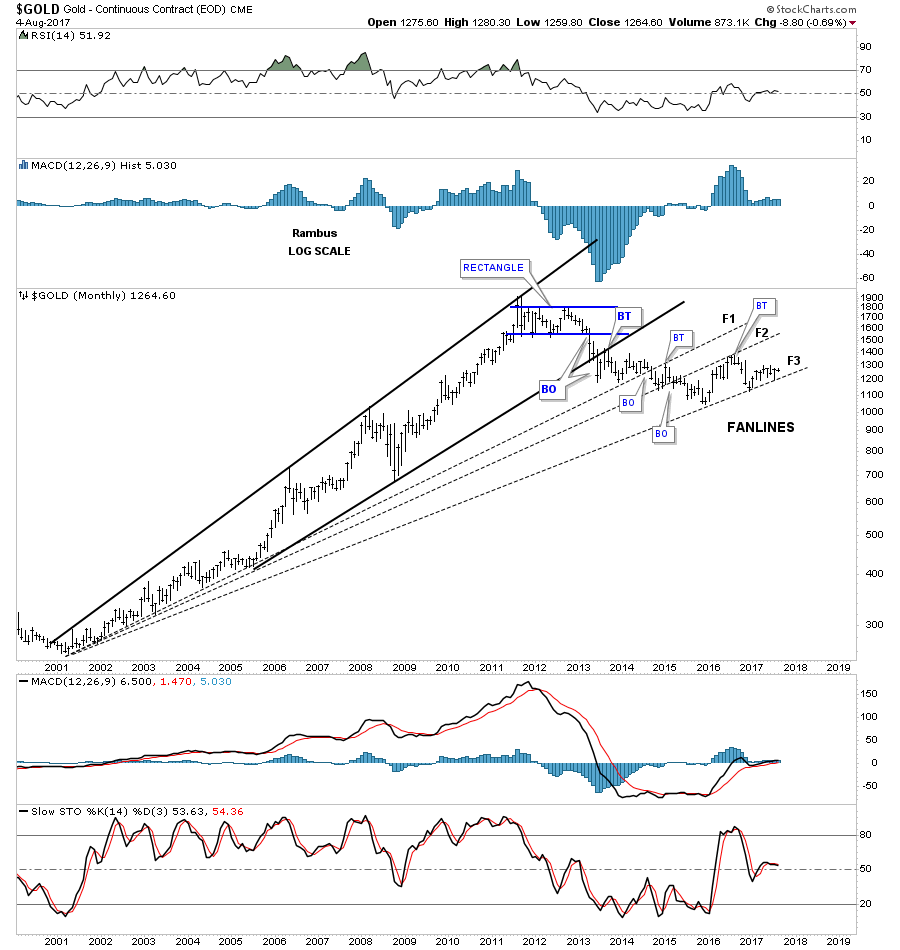

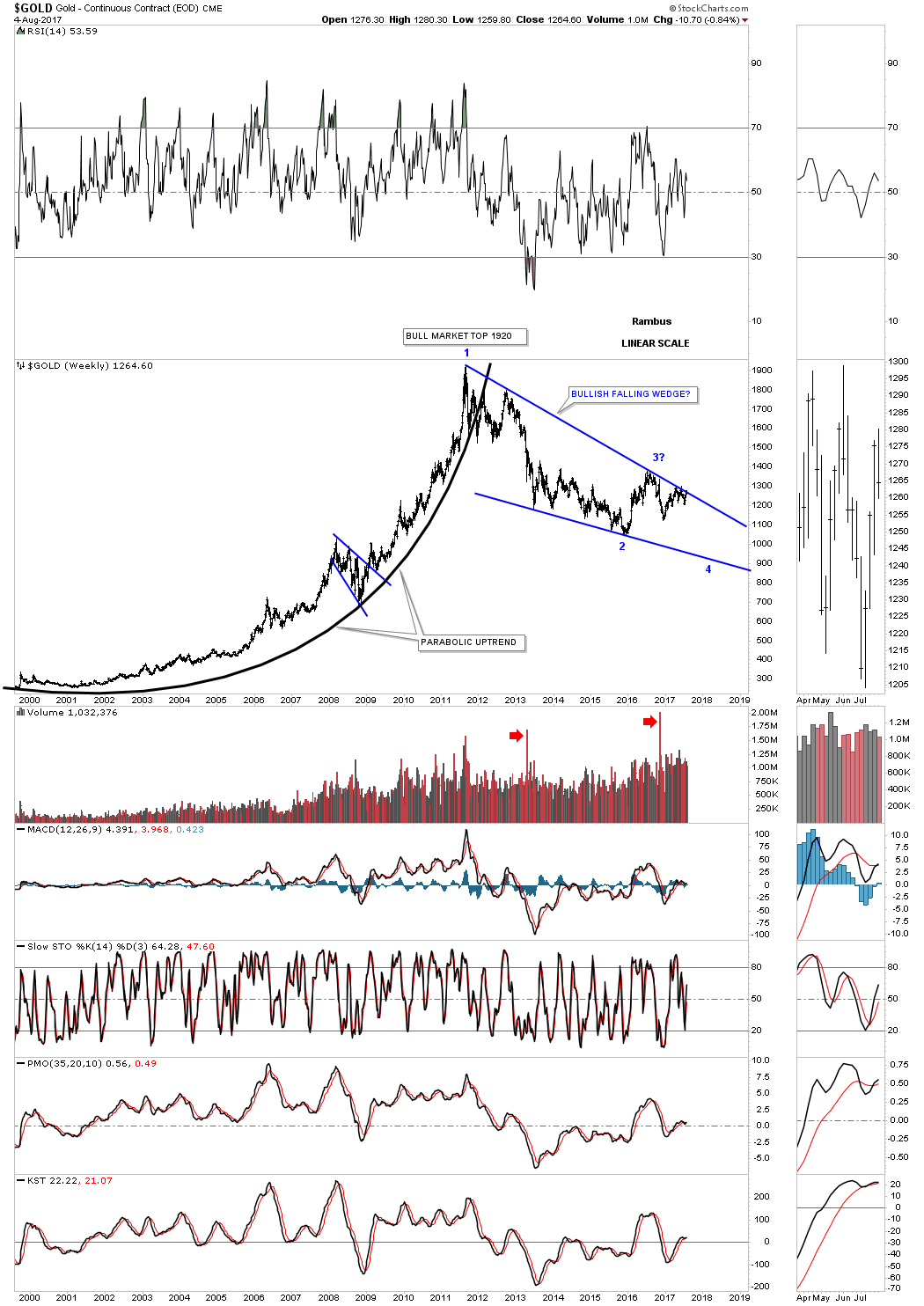

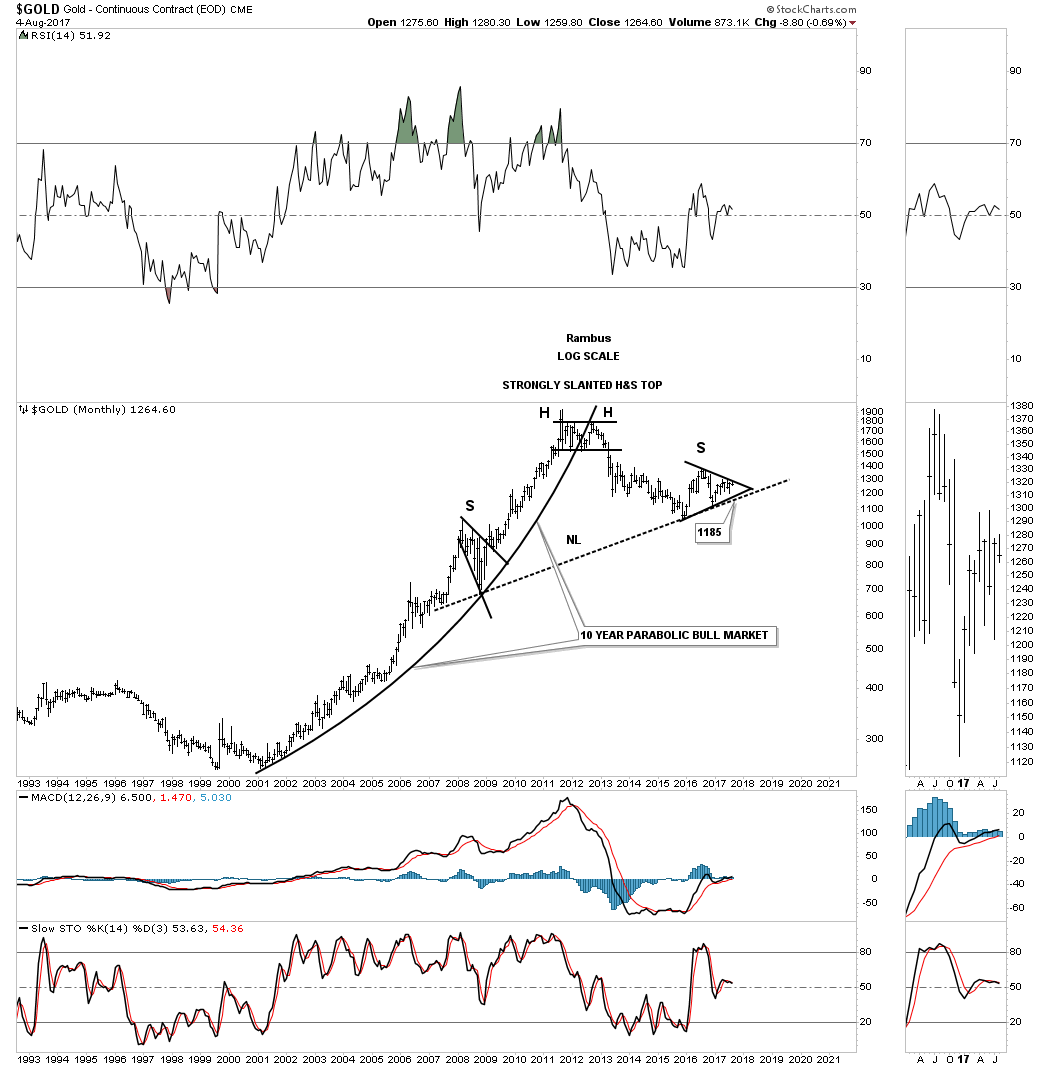

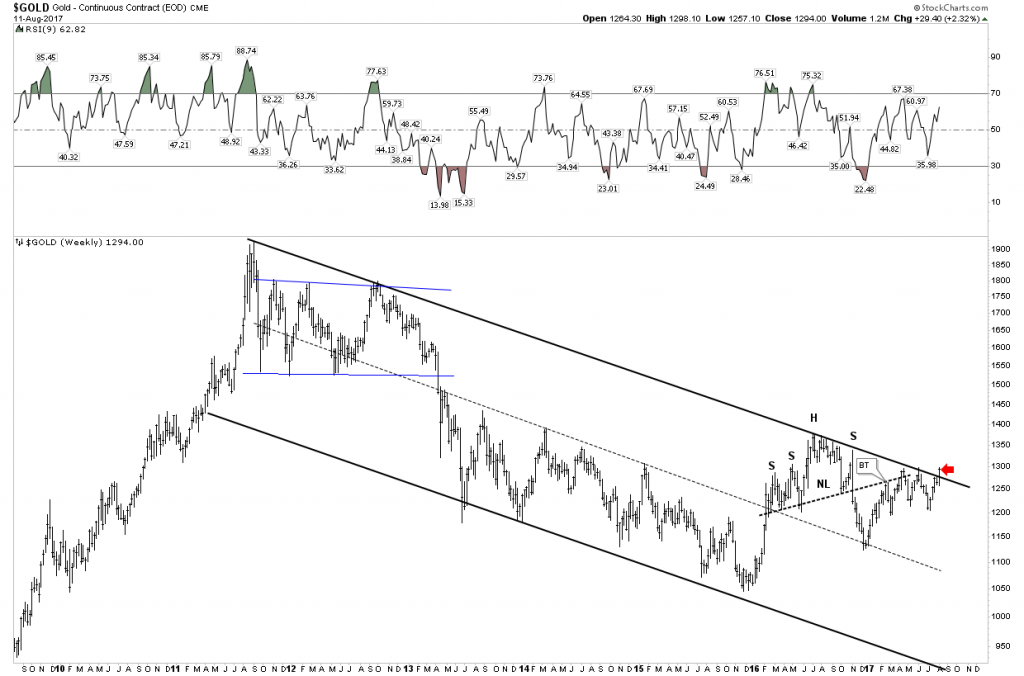

Gold- How it fits in

How gold fits into all this is very tricky. If we take out the USD tailwind gold has a decidedly bearish look. But the geopolitical aspect could very well give gold a pop going forward. It’s really hard to analyze, however just the fact that it is right now peaking above its 6 year downtrend line should be enough to get enough gold bugs lathered up to give it a bump higher.

It’s always hard to forecast a false breakout in anything, but that’s what I will be looking for if gold pops above its down trend line. Most assuredly a major conflict in Korea will rally the metal, but I don’t see it as sustainable.

Gold and Silver Stocks- The Question on Everyones Mind

The universal question is what happens to the PM stocks if the market tanks in the fall? The PBC model allows for the PM stocks to fall in sympathy with the market, after all they are stocks also. But here is the thing, historically the PM stocks are the first to recover after the initial wave of selling. We saw this play out in the 2008 crisis.

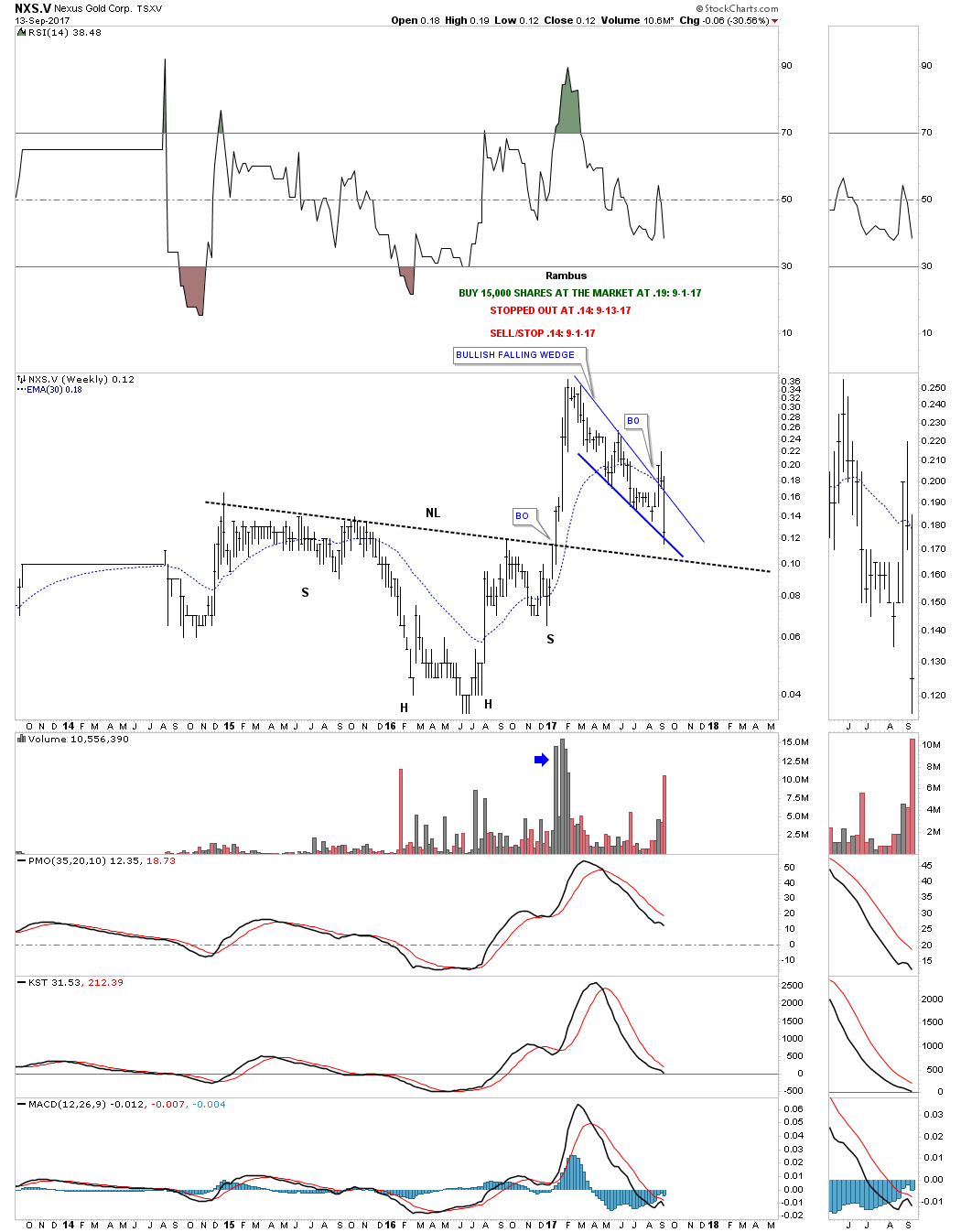

Traders Review

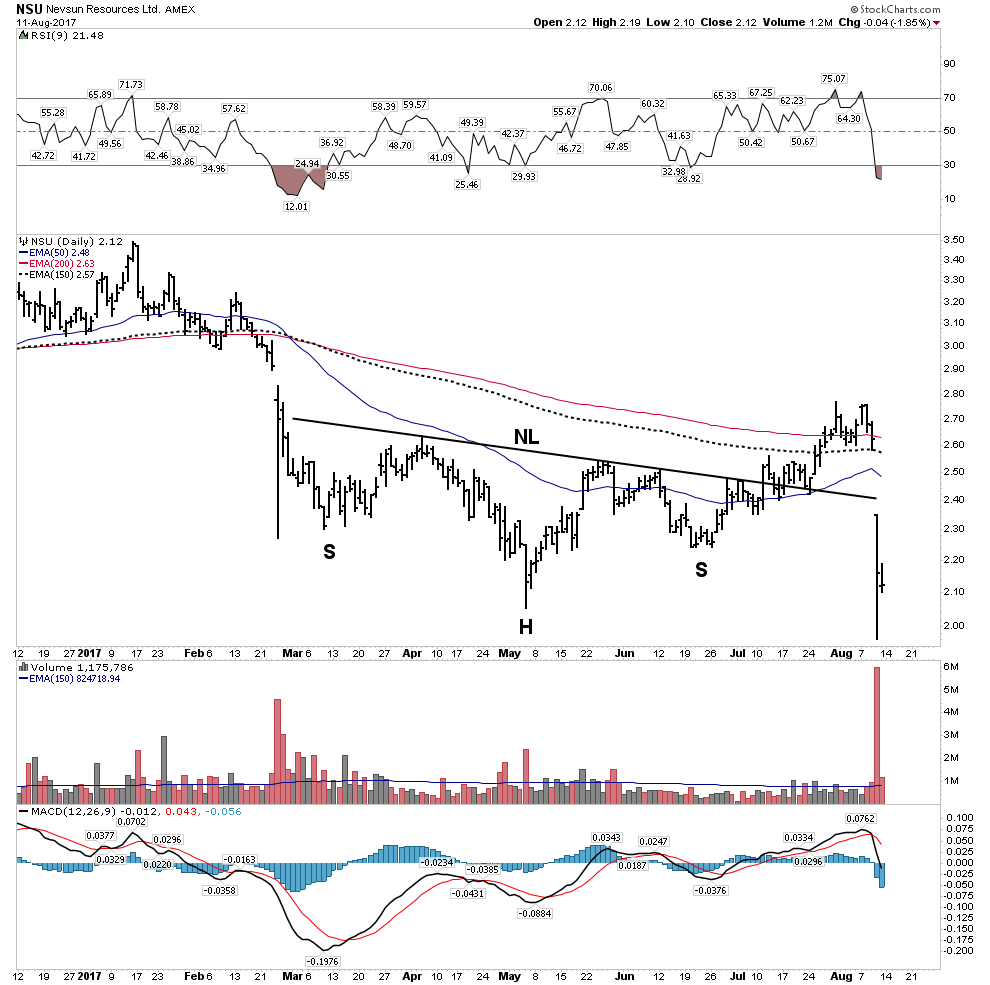

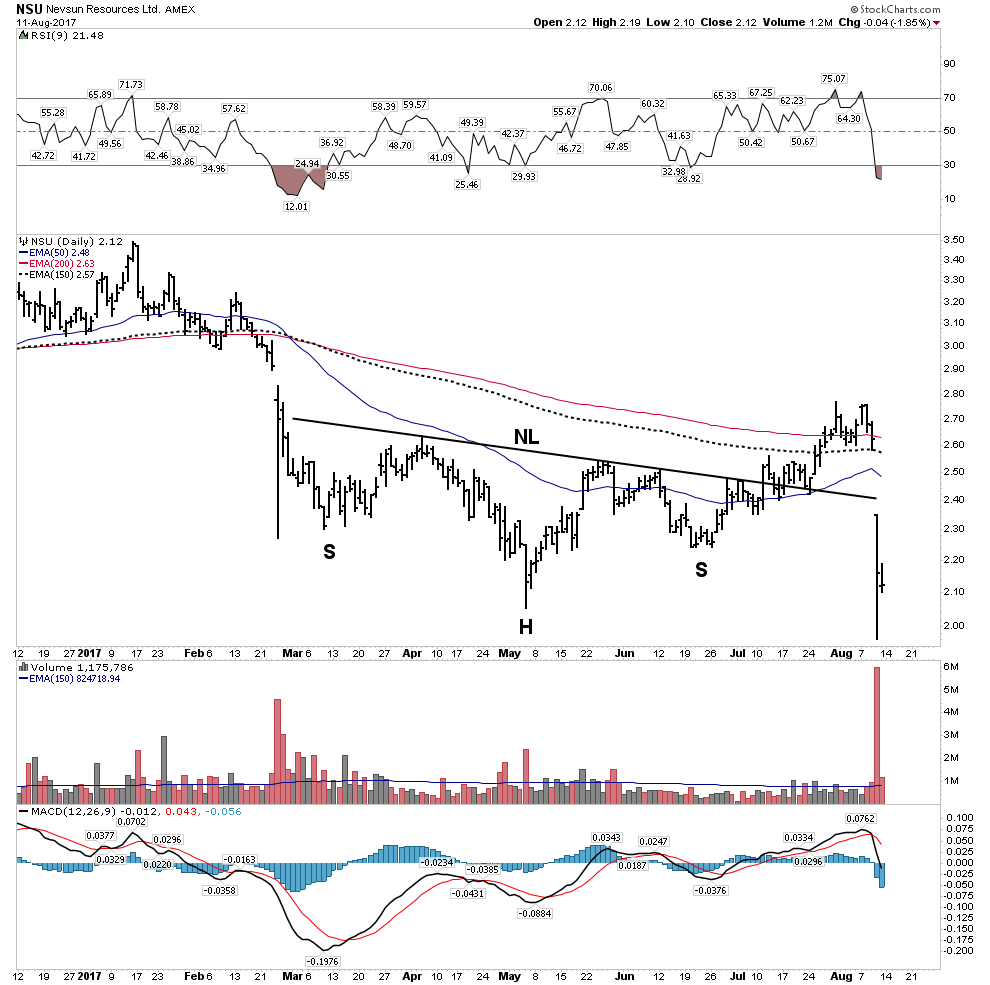

Im my last report I outlined the bullish opportunity in the electric metals. This is a long term investment thesis which will play out over time, however in the short term a bear market in the general stock market is likely to cause the price of metals and the mining companies to decline. As a value investor one must be willing to buy opportunity whenever it appears. This is exactly what occurred this week with Nevsun.

Recall in the last report I stated:

“There is a risk of a significant drop when next quarters earnings are released due to continuing metallurgical issues with the Bisha mine in Eritrea related with their zinc extraction.”

This is exactly what happened this week when the stock got knocked down due to the company announcing an earnings miss. It was expected. The drawdown was particularly steep (-20%) due to announcing a reduction in the life of the Bisha mine in Africa plus pushing back the PFS into next year. After discussions with my broker it is our view that the company wanted to clear the decks and get out all the bad news in one announcement and start out with a clean slate.

As a result, I doubled down on my investment near the lows and now have a large position in NSU. Keep in mind that the Investment thesis for this company is NOT based on the Bisha mine, but instead the copper assets in Serbia. Therefore I see this as a great opportunity to buy a world class copper asset for absolute firesafe prices. Also keep in mind that this is a potential likely takeover by Lundin Mining.

Knights if you are going to be in this business of resource investing and speculation, one must be able to act on the fly and recognize a deal when it presents itself. These prices may not last long.

Novo Resources

Another comment from my last report:

“I am clearing the decks and finding cash to buy more of Novo, be brave knights… Oh, and I am not waiting for a pull back.”

“But once you buy, one has to hold on with all your might. Don’t trade it, don’t “register” your profits, Be brave and just hold on.”

At the time of this report Novo’s price had closed over the weekend at 2.67. Upon opening Monday morning after my recommendation anyone wanting in received a gift as it immediately dropped to 2.22. This past Friday Novo reached a high of 3.85, in all an increase of 73% over the optimal buy point immediately after the report.

Here is the point: I have listened to a lot of commentary on Novo and virtually everyone has stressed the stock is way ahead of itself and one should stalk the stock and buy it on a pullback. I argued otherwise. That technique leaves you standing at the station wishing you were on board. The best course has been as I stated, gird your loins and pay up then hold on for all you are worth. I have seen enough of these to know this is the best way to conquer this one….Rambus Chartology- Value added indeed!

I continue to add to my Novo position, buying another 25,000 shares at the opening this past Thursday. I am not done buying as I believe the potential for this stock could prove to be life changing

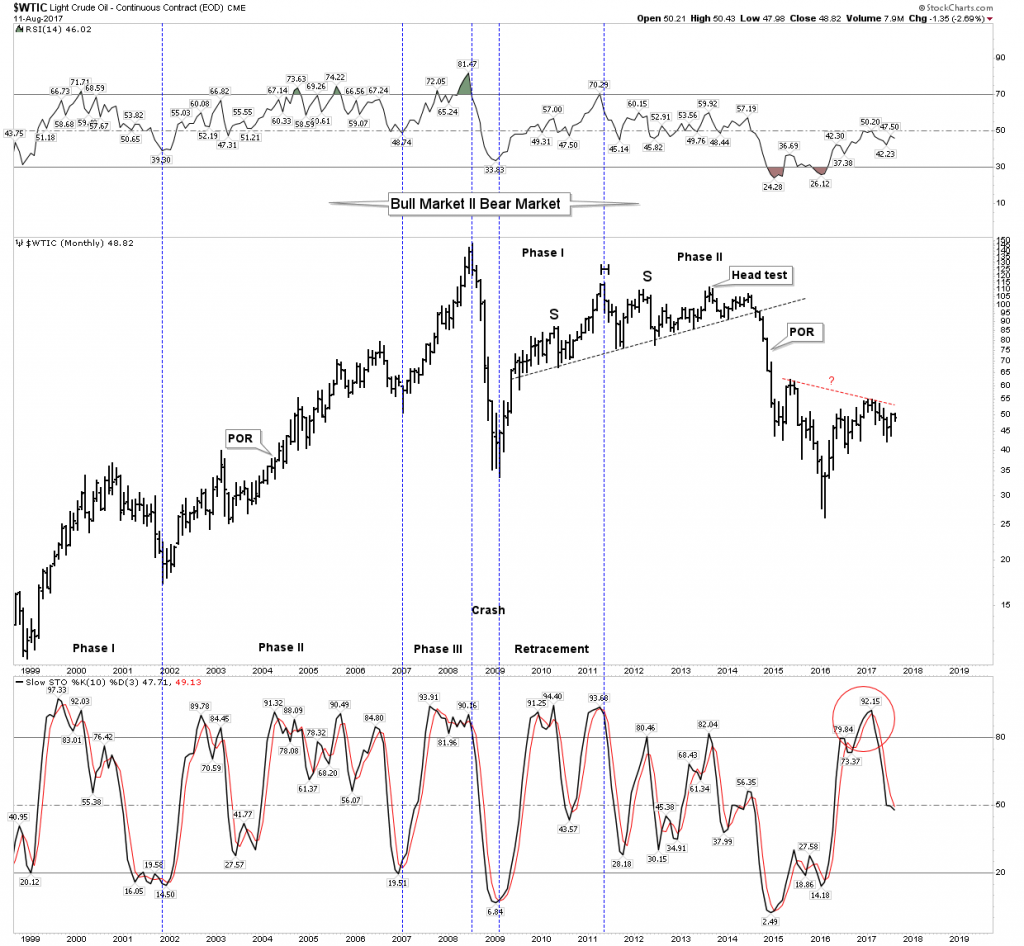

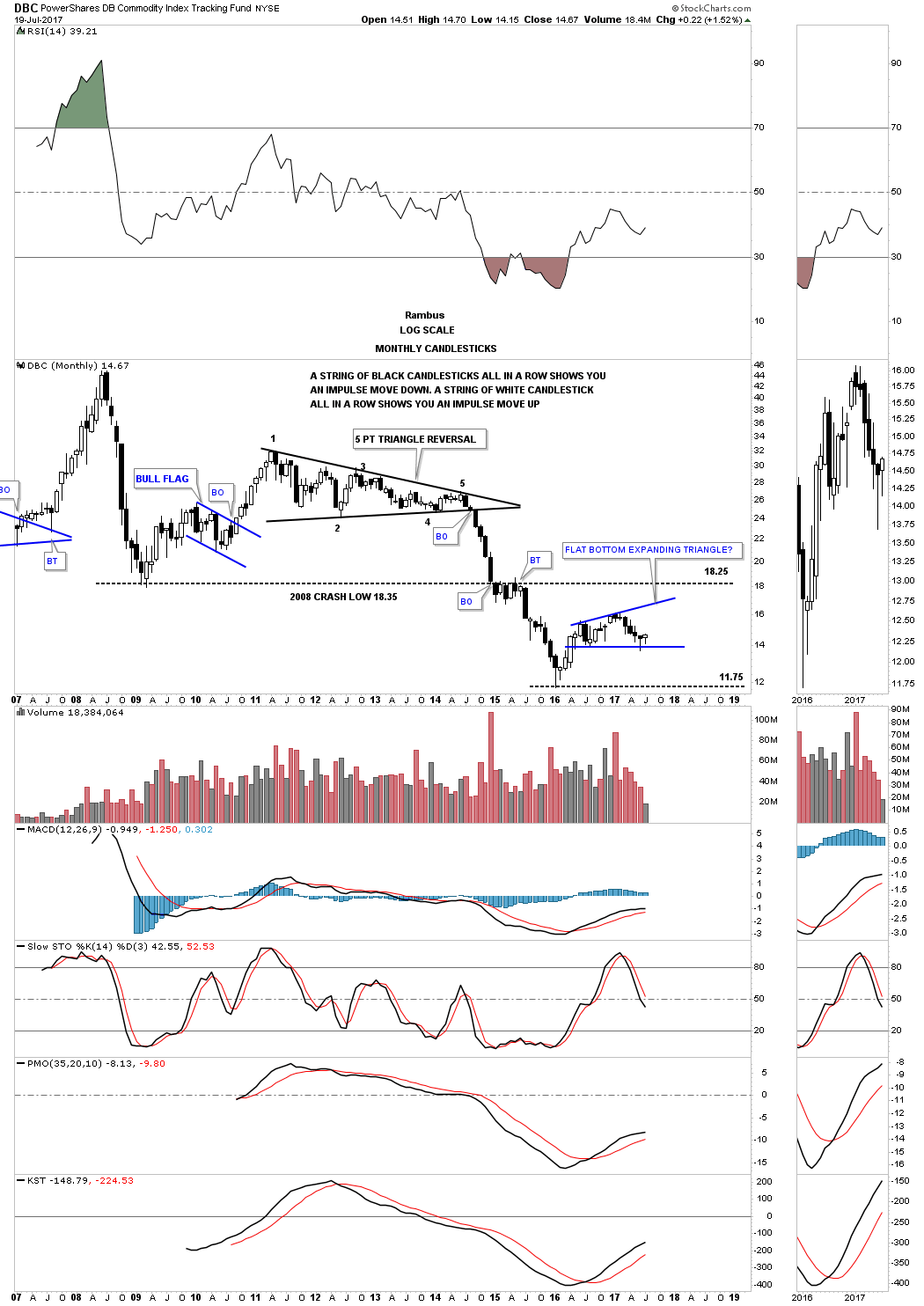

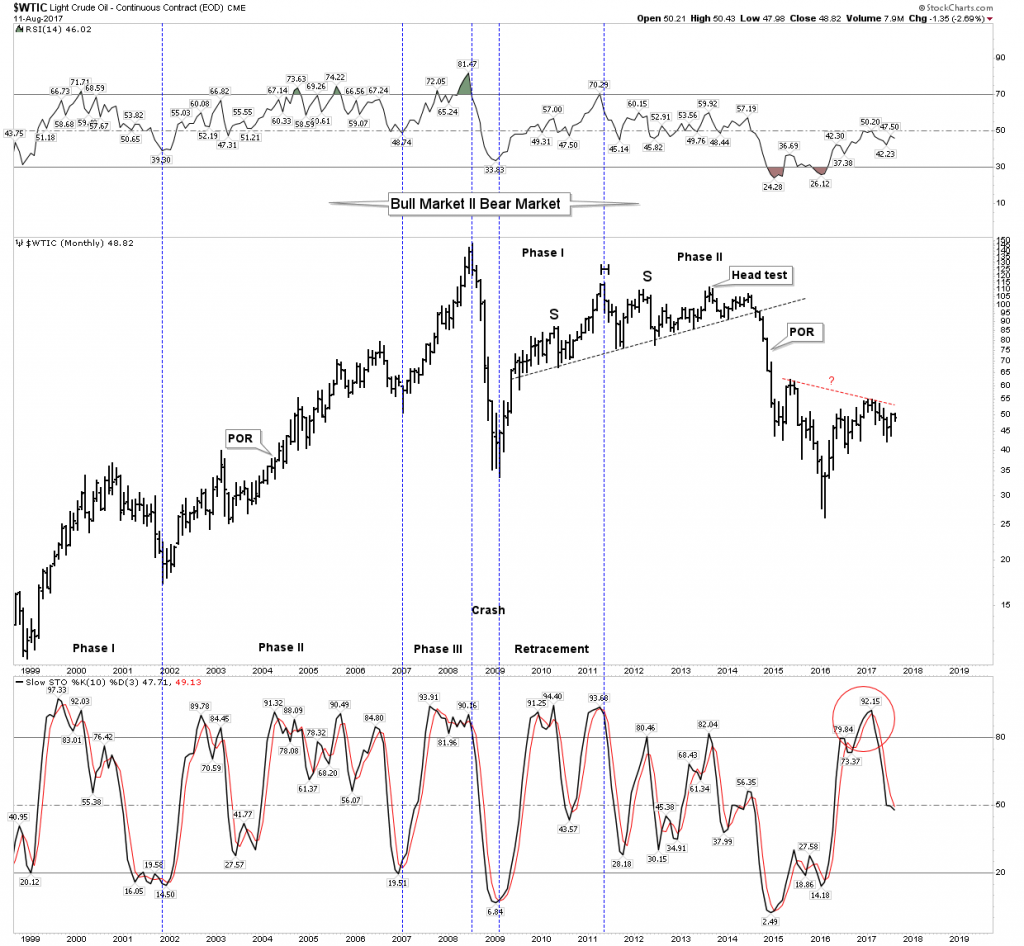

Plunger’s Big Trade- The Oil Short

This has been on the back burner since early July allowing the recent BMR to run its course. It appears time to start moving it back up front as it may be approaching prime time once again.

Recall my big picture analogy of the kinetic energy super ball bouncing down the staircase adding energy and amplitude with each successive bounce. With that picture in mind it appears this bounce is about to run out of gas. Plus stochastics are now turning down. As a result I started shorting oil again this week, however only an entry position since it still has the potential to surprise and rally into the 50’s. No one ever said this game was easy and the current red triangle buildout at the down sloping blue dashed resistance line could go either way. I am starting to build a position based on it going down.

The outcome is still in question however, if the bulls are still in control there remains the chance the current horizontal triangle could be a half-way pattern with the ultimate PO around the extended dashed apex line in the first chart. If this were to occur, obviously one should cover ones short position.

Here is an interesting Fib guide to the extent of previous retracements. It’s at previous max retracements now!

The long term linear chart shows the two bearish formations forming on both sides of the S&R line. Resolution soon to come.

And the proprietary big picture chart shows we are still locked in a secular bear market for oil. The last one lasted 18 years (1980-1998) and we are currently 9 years into this one.

Ultimately with the onset of the next bear market and recession the forecast is for much lower oil prices.

Market Shorts- IBM and CLI

IBM has been a barn burner short, it has been my second largest winner this year. The chartology has been so clean and classic and still has further to fall. IBM is a victim of the Amazon juggernaut. Two-thirds of IBM’s revenue is exposed to competition from the most brutal competitor in the history of commerce- Amazon. Recall what Bezo’s likes to say “Your margins are my opportunity”. IBM is a has-been company, soon to be sent to the slaughter house by the new price structure reality.

IBM still has broad institutional ownership who haven’t yet figured this out. Institutions act like lemmings, when they have their ah-ha moment its going to be a deluge. They will all exit together in one cathartic capitulation. That’s the message of the IBM chart… you can see it coming and why I have such a large position.

One warning however, as we all know Mr. Market would like to make this drop lower without any shorts profiting from it. So at some point prior to this event expect a short squeeze to drive out the shorts. I have noticed an early stage positive divergence in momentum on the daily chart and I stand ready to cover my short at a moments notice…you should be ready too…

Mack-Cali Realty Corporation (CLI)

This is a classic Weinstein short set-up and this week turned out to be a nice little surprise. Lately it has been trying my patience as I have been short for a few months, but the chartology finally came through. Note the beauty of this set-up. Rounding arching top with the 30 EMA finally bending over and providing overhead resistance. Very broad H&S with lot’s of unoccupied airspace to fill on the downside. They don’t get much prettier than this one.

Ivanhoe

Last report I mentioned:

“Well, I think there may be a chance that it may be somewhat exhausted. Maybe, maybe not. Therefore the chart below gives me pause. Maybe we will get a pullback corrective move.”

This was mentioned with the stock above the NL. The caution was warranted, and yes indeed it was a bull trap. One wants to own this stock, however I plan on waiting to get a much better entry position…patience.

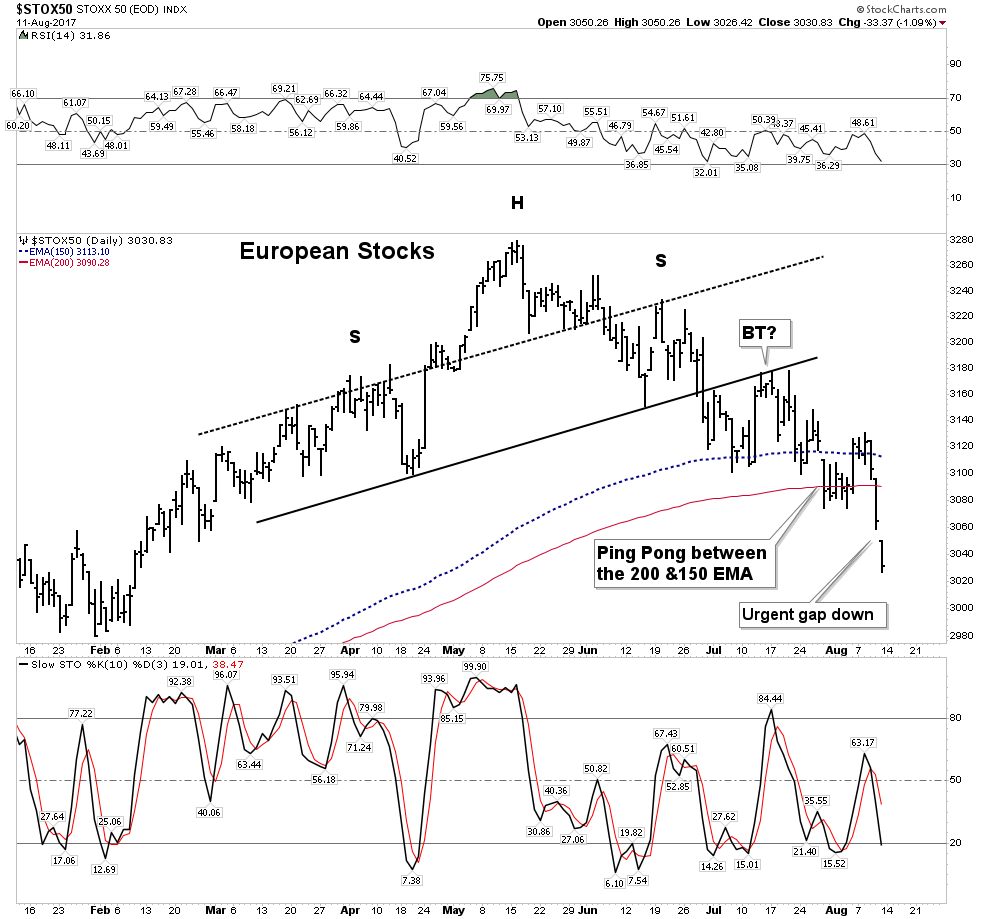

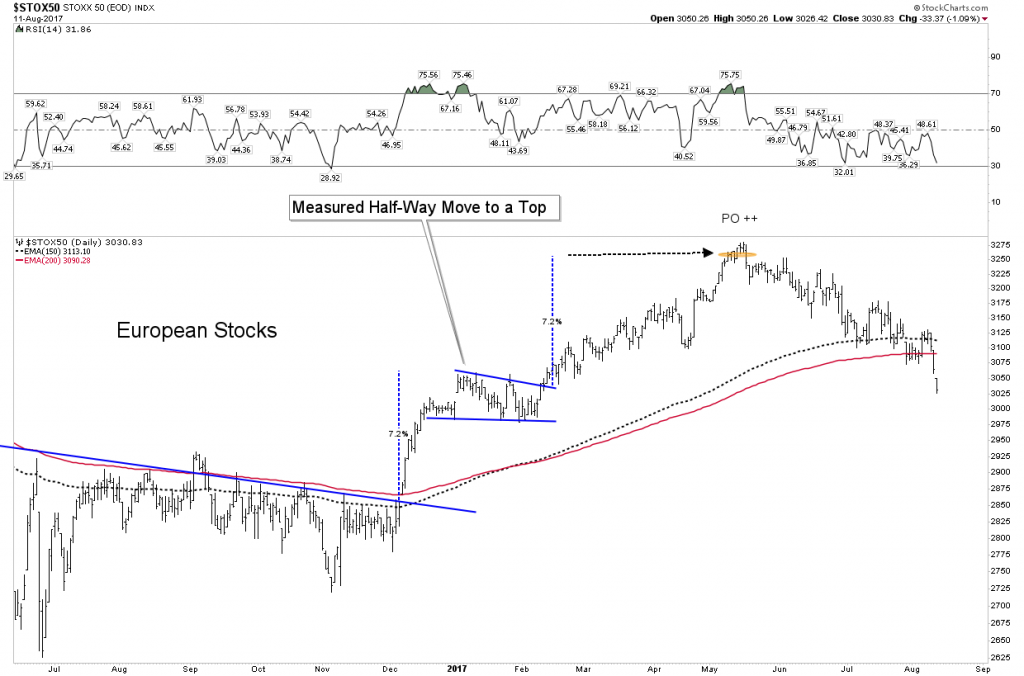

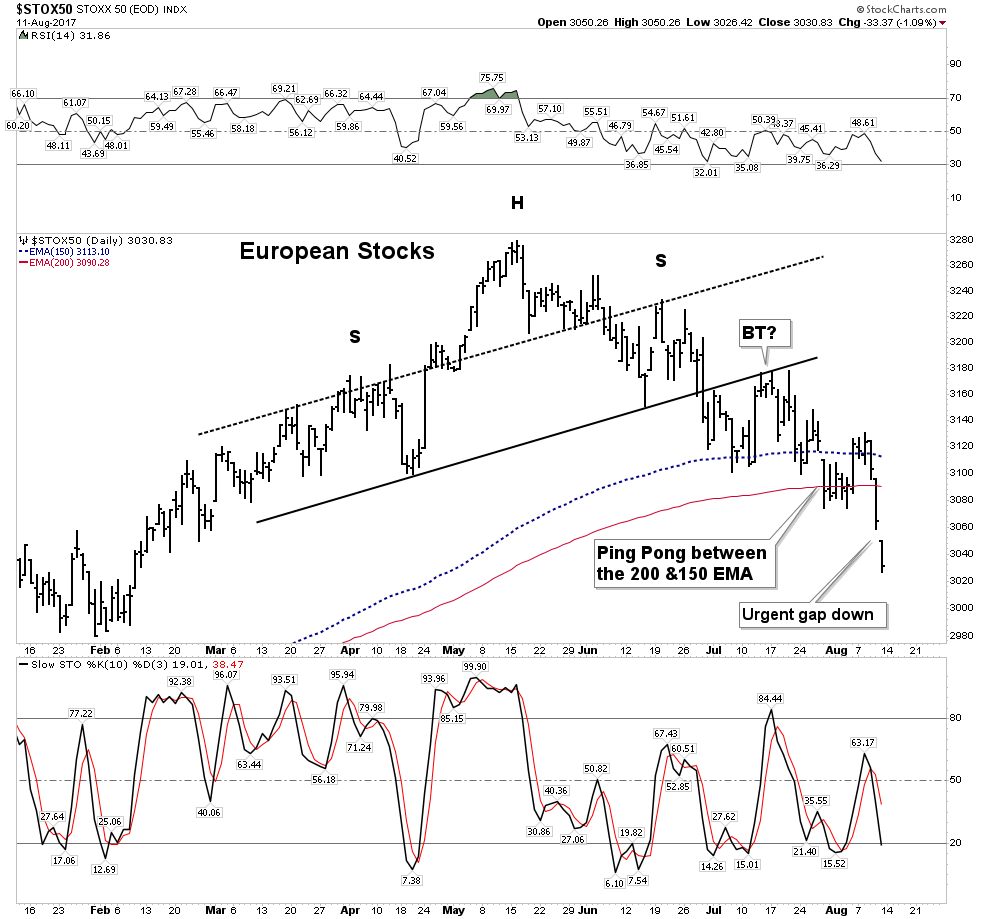

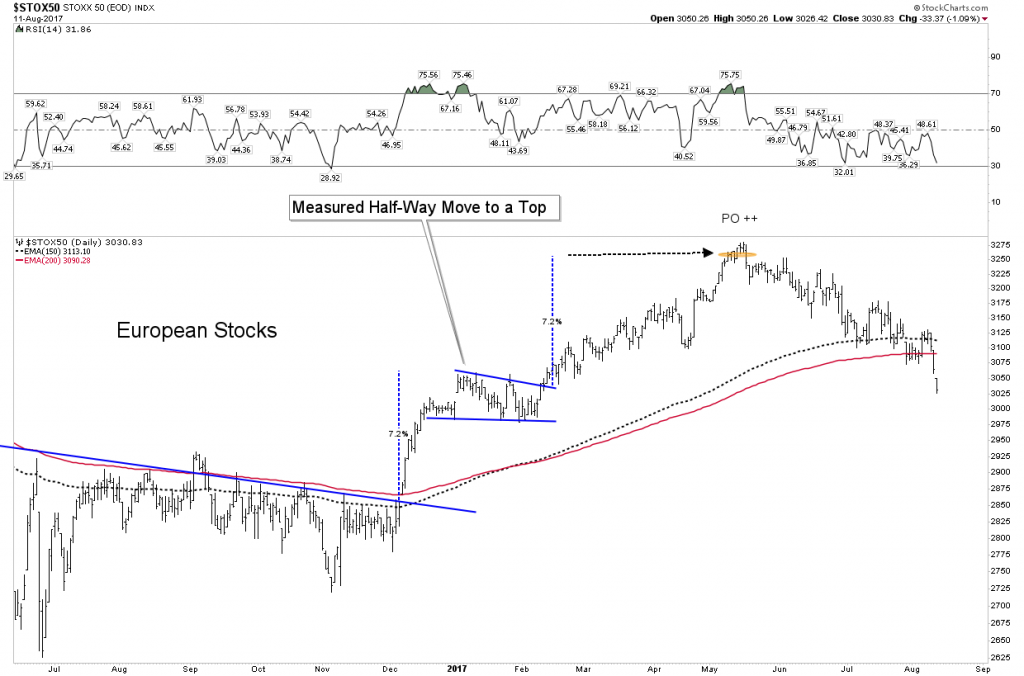

European Stocks

Recall the PBC thesis called for European stocks peaking in May-June followed by a USA peak in Aug-Sept. This appears to be occurring according to script. We now have the Euro stocks following through IAW the model. It’s actually an amazing progression which began with a H&S reversal top spanning over 3 months thus establishing its broad authority. This was followed up by a break of its NL with ensuing back test over a 3-week period. Next we see a break of the 150 EMA (30 W EMA proxy) with a classic ping pong indecisive move for two weeks. Finally we see an urgent “give it up” move with a running gap to the downside. The STOXX50 index represents the largest super-sector leaders in the Eurozone in terms of free-float market capitalization. The index captures about 60% of the free-float market capitalization of the EURO STOXX Total Market Index. It is the most comprehensive measure of Euro stock markets.

Think back to late May when this model was proposed. The markets seemed so strong, but the model provided guidance going forward….trust the model.

Clearly, the above chart is a bearish looking set-up which is a bit of a conundrum because European economic and trade numbers have actually been improving significantly. Again, we defer to the charts as discounting future conditions.

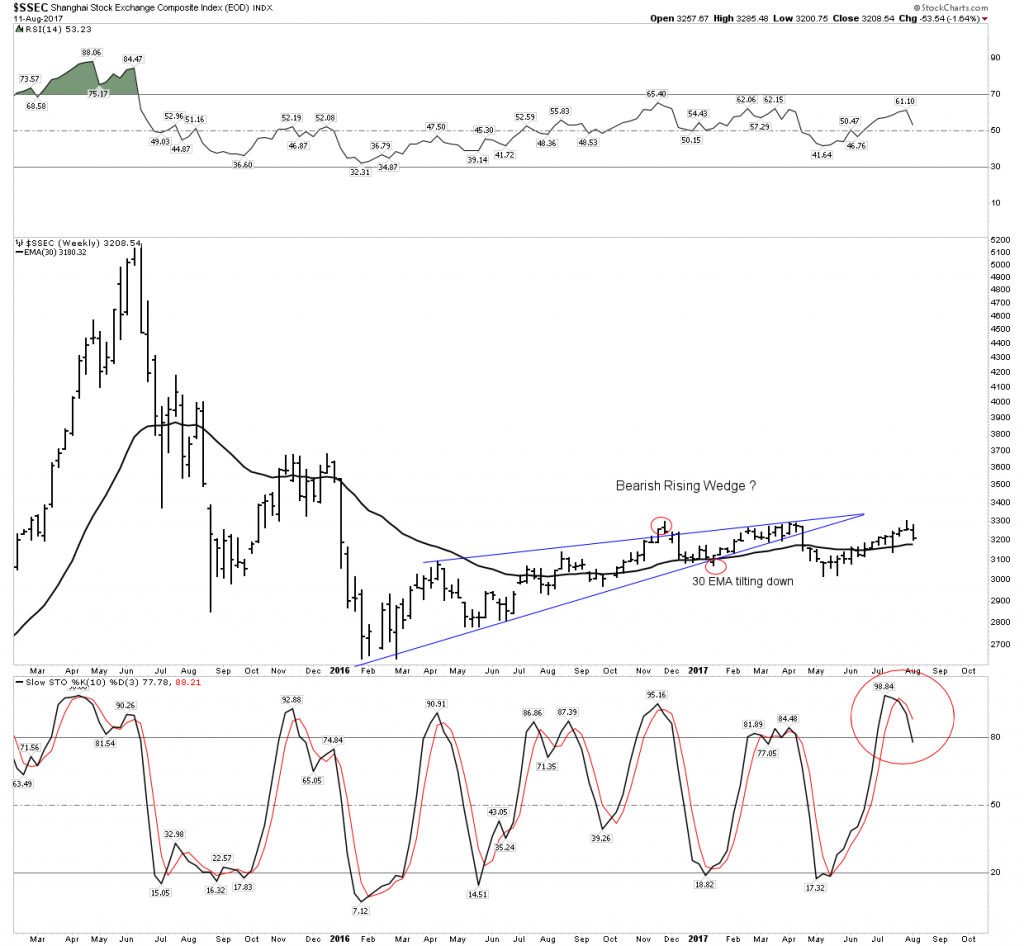

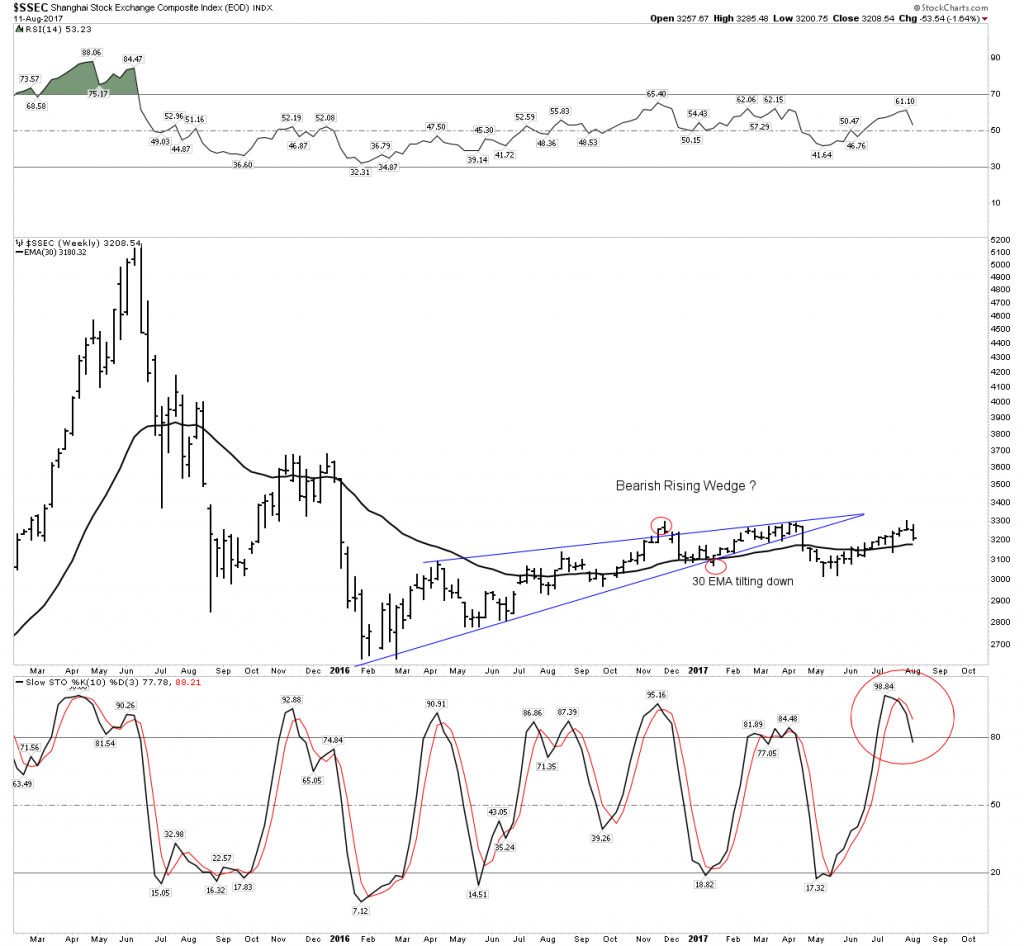

China- At a Critical Juncture

I am bullish on the Chinese stock market over the long term. It actually has not gotten over priced as our market has since it has spent the past 10 years digesting its previous gains. However it appears to be ready to trend downward after being in a flat bearish rising wedge for the past 2 years. I am avoiding virtually all stocks at this time

India is in a strong rally, but again I prefer to sit on my war chest at least until the fall season.

Inflation- Not out of the woods yet

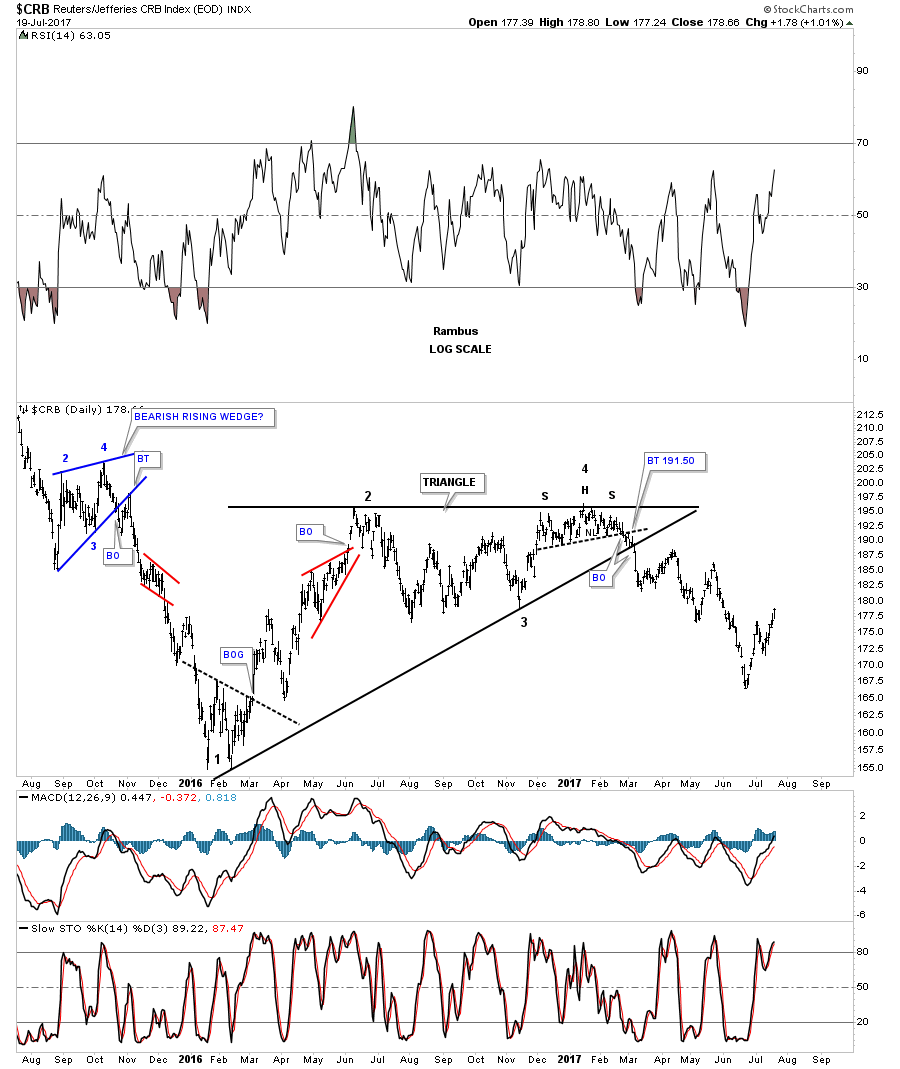

In an Orwellian world inflation equals growth. That’s pretty much what the FED has told you. The narrative is the FED is succeeding in their inflation campaign, but the charts are not yet confirming this story. Let’s take a look.

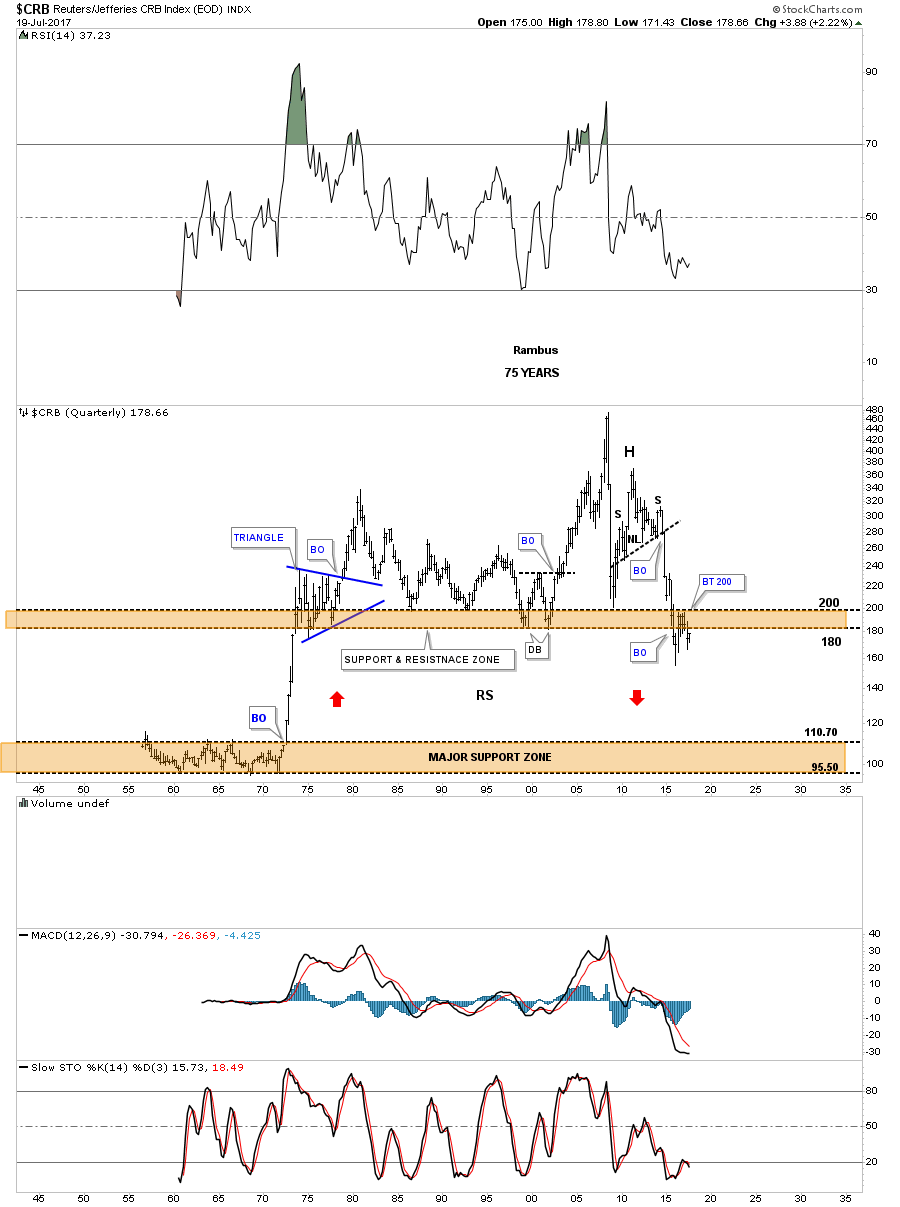

Our long term CRB index is what I like to call the scariest chart on the planet. Since breaking its 40 year support line it has been unable to rise up above it after 2 years of trying. It still appears in back test mode and I shouldn’t have to tell you there is NO SUPPORT below these levels. Simply stated if price falls to early 1970’s levels it’s monetary Armageddon. We have been assured by the money printers that they have “got this”. It’s all under control… but is it?

Let’s zoom in and look at the action over the past two years. It’s pretty obvious what’s been going on here knights. This has been a back-test retracement rally just like we saw in the oil market from 2009 to 2014. Follow the action here: In April a bearish rising wedge failed at the 150 EMA then fell through its NL. It then followed up with a bounce back to be repelled by the same 150 EMA. Note its life above the NL was then short lived. It now dropped in a deep dive below the NL with another BT failing below the NL. This is all eerily similar to the way oil broke down in late summer of 2014 to crash from $100 down to $27. Sit up and pay attention knights.

Currency Deflater again revealing the true story

Again, this failing pattern has occurred despite the USD providing a wind at the back of commodities all-year-long! So let’s take out the currency advantage and see how it looks.

All I can say is OMG look out below. What a violent breakdown! And what happens when or if the USD resumes a primary up trend? The current red bear flag has just been violated and could be a half way pattern to the down side. This chart is telling us its time to head to the chopper.

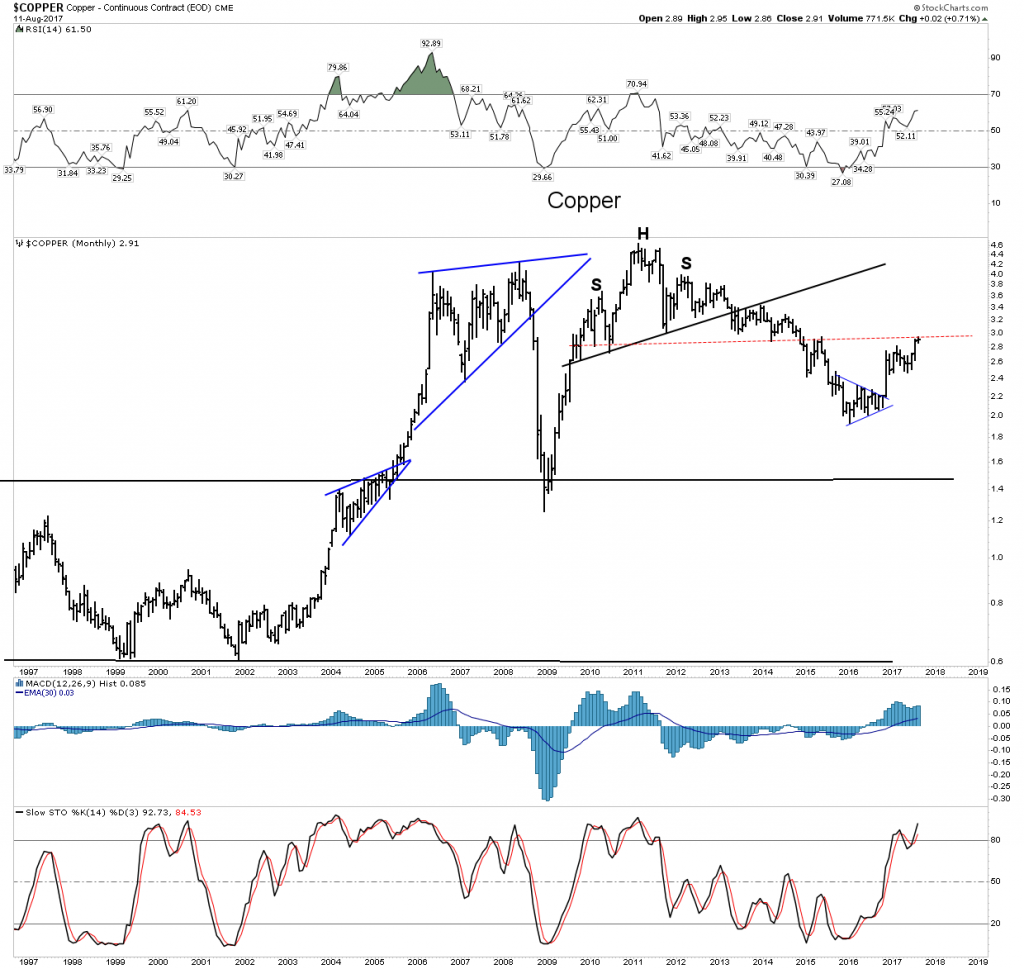

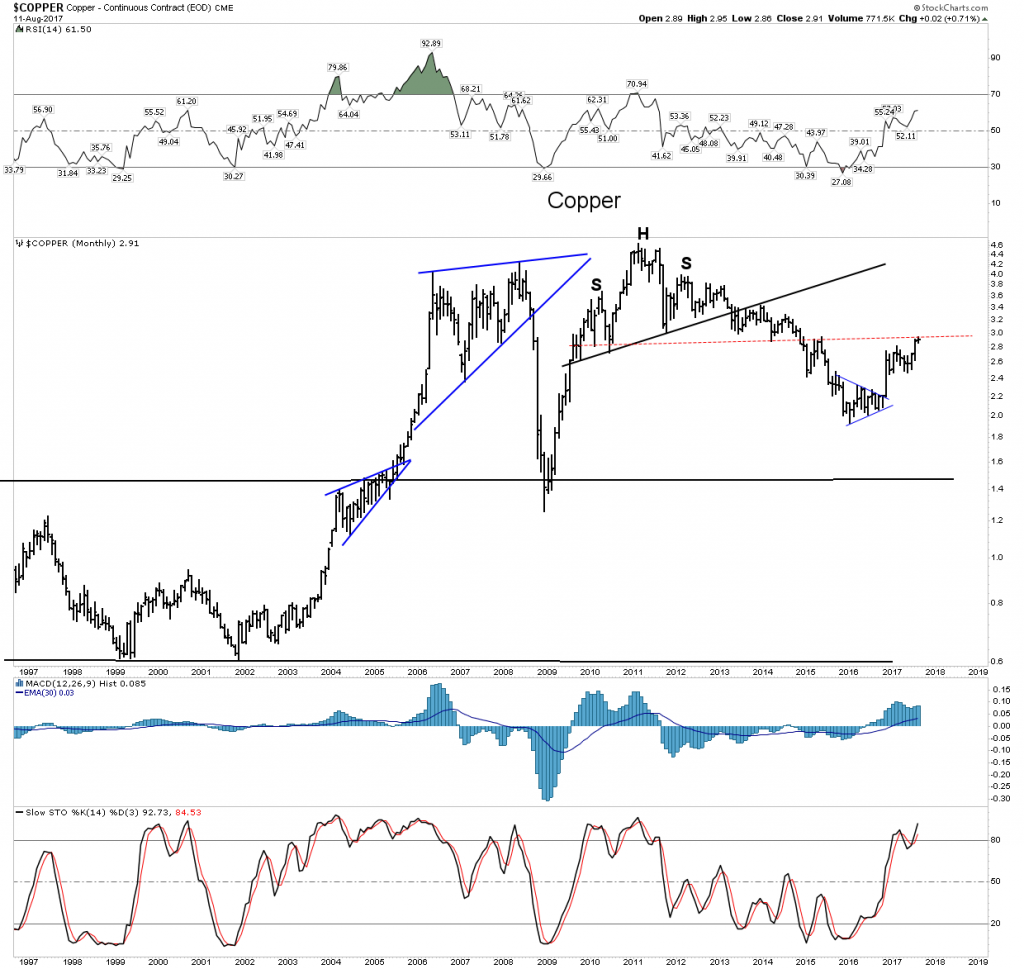

Copper- Also not out of the woods yet.

Despite the great long term prospects for this metal its chart indicates it too, may not be ready for prime time. It has had a great move and this may be indicative of future leadership, however it needs more follow through to get itself out of the woods.

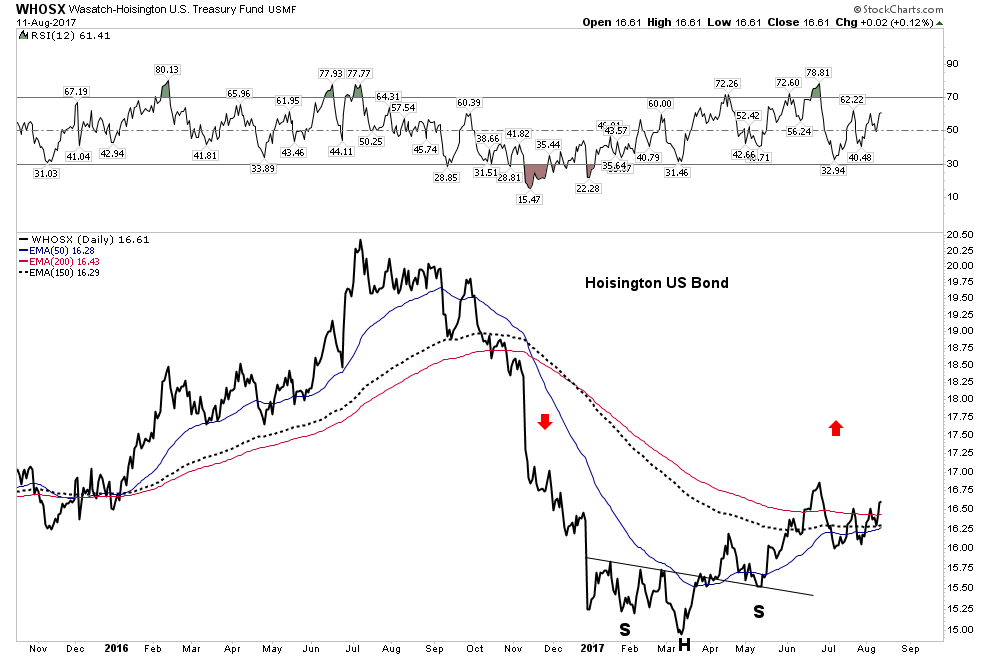

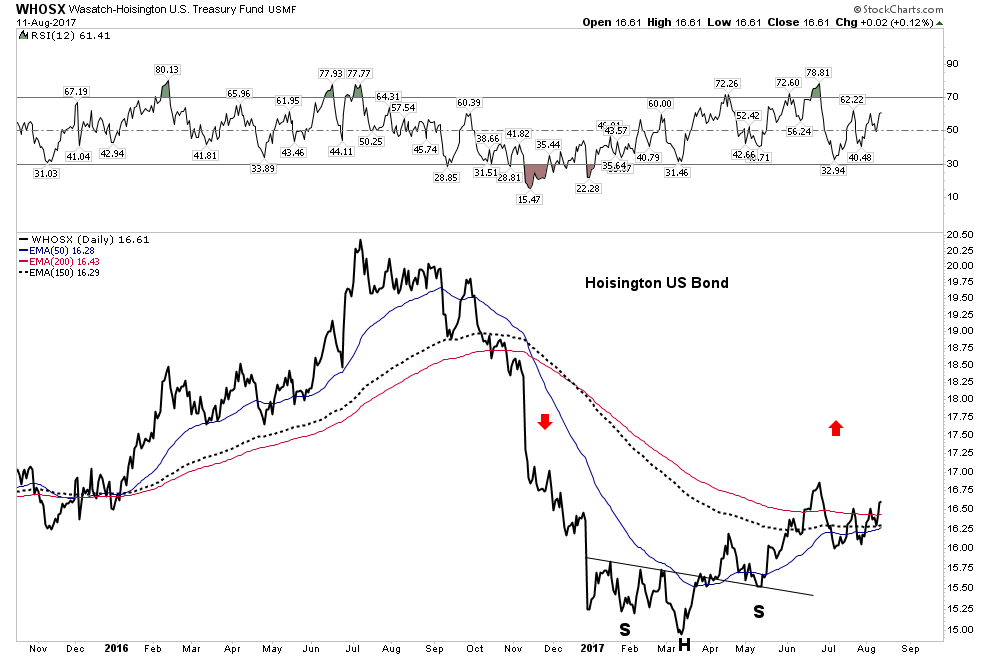

Bonds

Bonds seem to be delivering the same message. I have noted in the past that part of my war chest sits in the Hoisington LT Treasury Fund. These are reserve funds standing at the ready for the opportunities I see coming this fall. The bonds look prepared to embark on an advance if deflationary conditions break out.

Conclusion

I take no pleasure on raining on anyones parade. I am just here to call it like I see it. We have covered a lot of ground here and shown perspectives backed up with hard hitting chart analysis that you will not see anywhere else in the world. I have approached this entire year as a campaign towards an objective. Reading the tea leaves we have watched the individual bricks of a market top fall into place from market charts to investor psychology. Few people cared to observe or listen, but our payday is fast approaching. Girt your loins knights and prepare your war chest because as Churchill once said:

For this is our finest hour.