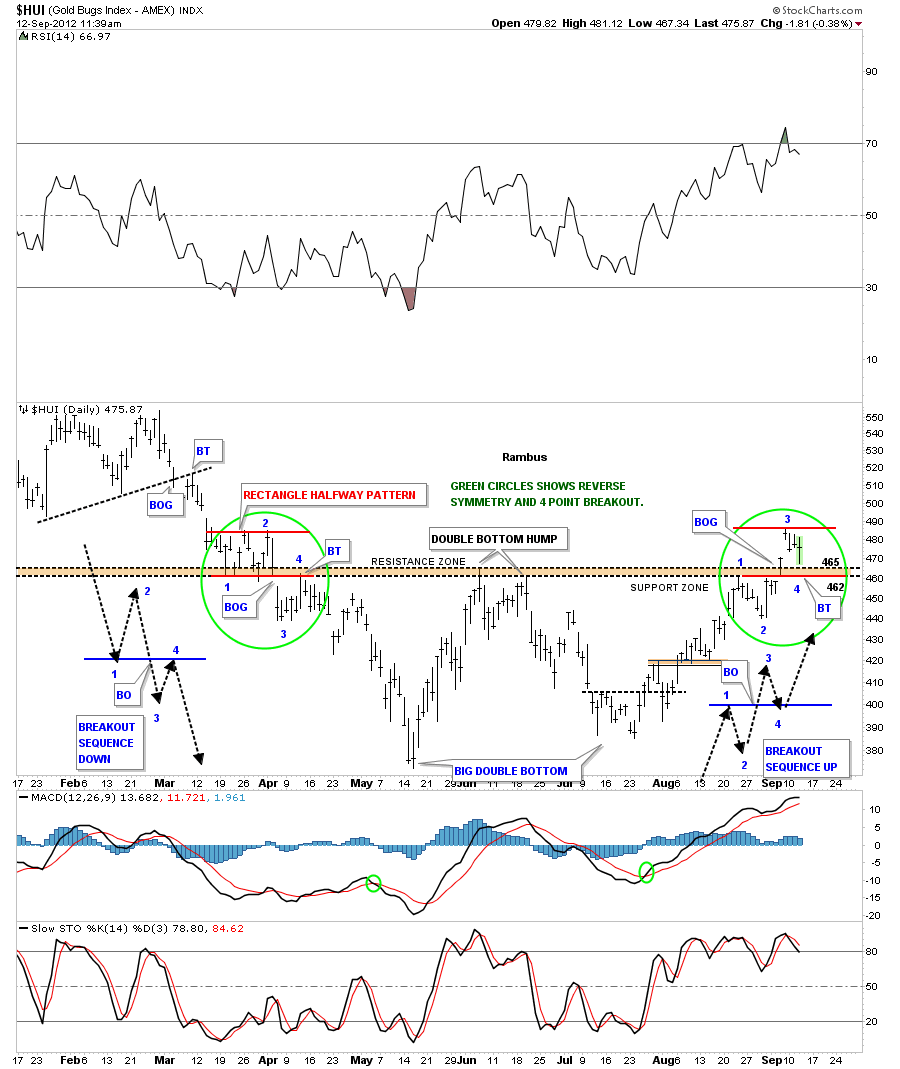

Just a quick update on the HUI that is in the backtesting process. Below is a chart I showed you several days ago with the four point breakout sequence in play. This morning the price action just slightly tested the very top portion of the support zone before reversing back up. We are in reversal point #4. Symmetry suggests we might even trade sideways for another week in a similar fashion to the green circle on the left side of the chart. Not necessary though. A move above point #3 would be needed to resume the impulse leg higher.

Category Archives: public

HUI Update

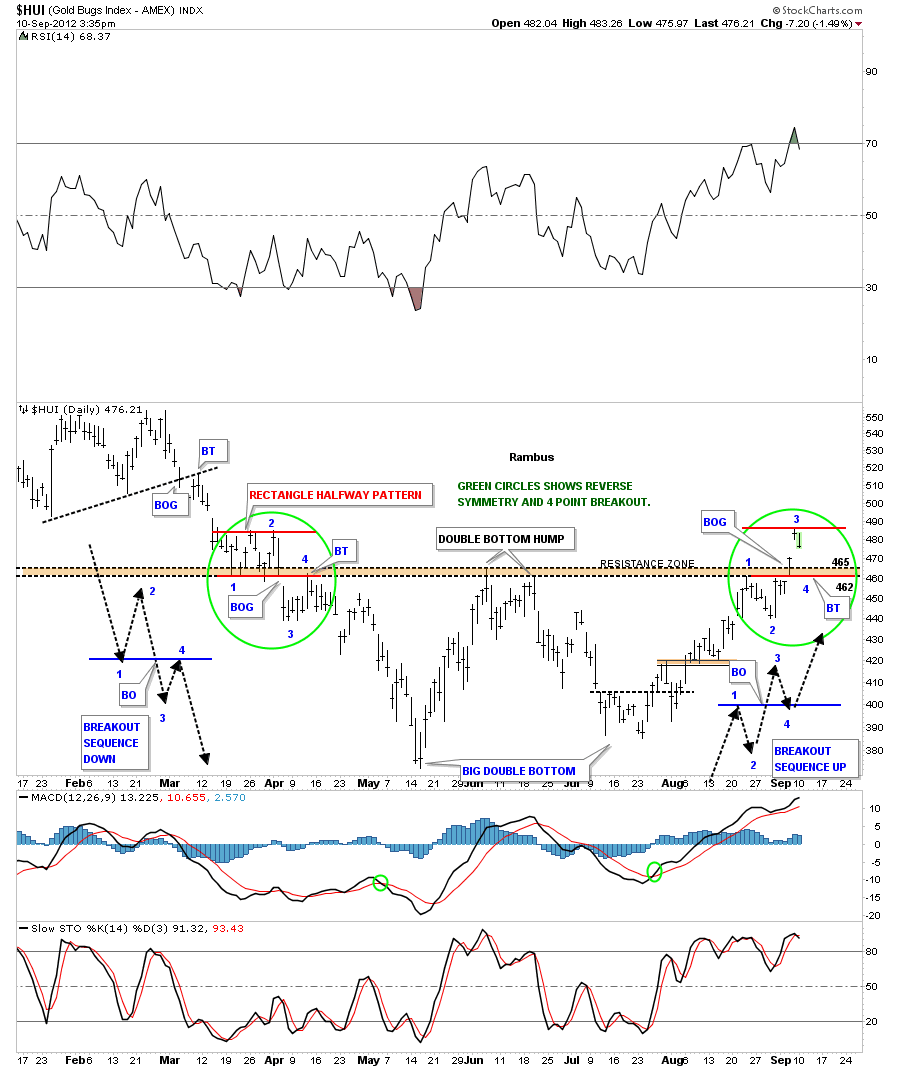

After a strong month of August the HUI looks ready for a small correction back down to the most recent breakout area around the 460 to 465, brown area on chart below. I have add two green circles that show where the reverse symmetry is now located. I have also labeled the breakout sequence one thru four. The four point breakout sequence goes like this. Lets start with the green circle on the left side of the chart. The number 1 represents the first reversal point after finding some support on the decline. Next you get a small counter trend rally that is point number 2. When that little rally fails prices then fall below point number 1 to point number 3. Point number 4 then makes one last small rally attempt that stalls out at the bottom of point number 1 which in now resistance. The black arrows shows how the 4 point breakout system works.

Now I want to focus your attention, on the chart above, to the green circle on the right side of the chart. I’ve labeled the four point breakout sequence that is showing the exact same breakout sequence as the left green circle only this time it is up instead of down. We should now be in the point four decline to the breakout area at 460 to 465 which would be the top of point number one. I don’t know if any of you can see how beautiful the symmetry is on this chart but from my perspective its as pretty as it gets. We will buy another stock or two when the price action gets back down to the brown horizontal area that should now act as support.

Rambus On Behalf of all your Subscribers

Let me Say Thanks a TON

You nailed the Bottom as close as can be 1 month ago in this Weekend Report

(after keeping us cautious throught this long drawn out Consolidation / Correction)

The Kamikaze Trades have been Spectacular

I have been getting emails from some who are up 50 to 60% in their trading portfolios in a month !

This Chartology Stuff is really Something

Very Happy to be a Part of it

Fully

…………………

PS : Subscribers…If you havent visited the Chartology Forum you are missing some good charts and discussions

The Link is on the right sidebar ..near the top

Same ID and Password as the main site should get you in….bring your requests and questions…or just read the back and forth

If password doesnt work e me at gmag@live.ca

Fully

Wednesday Stock Report…..Aurcana

Tonight I would like to show you a stock from the model portfolio and how I plan to keep it updated for easy reference. For the last month, since we reopened the model portfolio, my focus has been on finding some good quality stocks with bullish chart patterns in which we can invest. There are literally 100’s to look at which takes alot of time to analyze. Right now we have a pretty full portfolio that will keep us busy for awhile. This is by no means the end of looking for better precious metals stocks when they show up or tweaking the model portfolio when need be. For right now its important for me to bring the model portfolio up to date so we can have easy access, at a minutes notice, if one chooses to look at a certain stock.

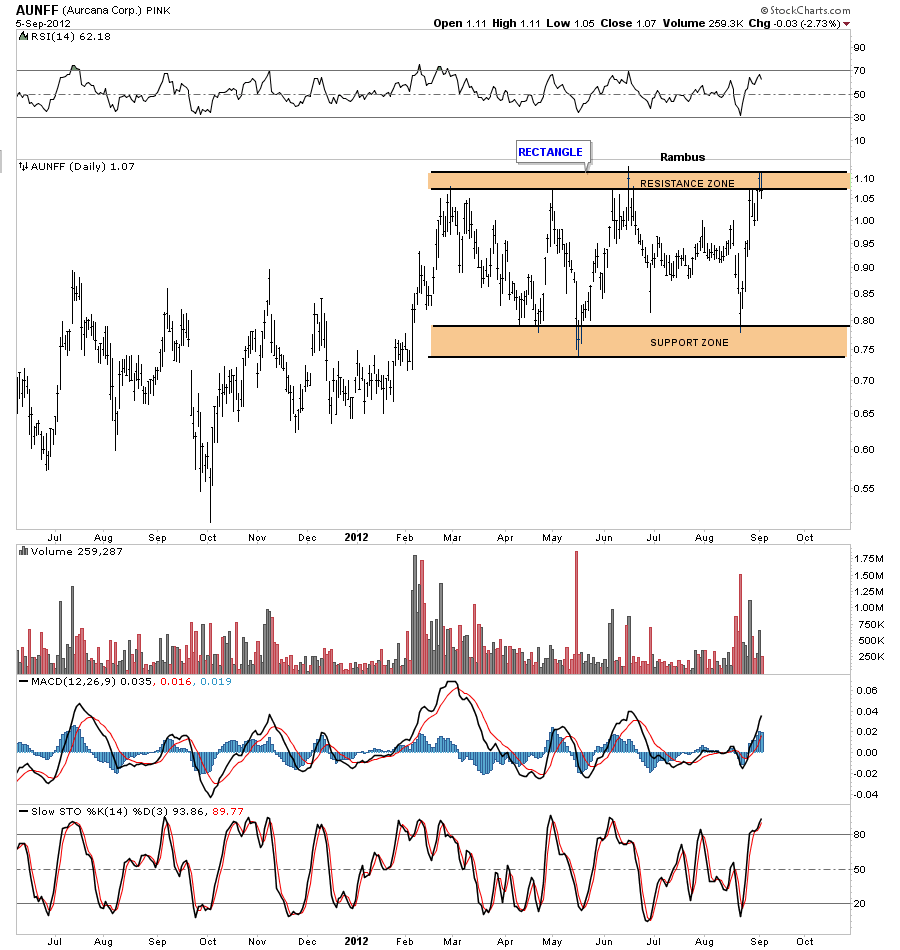

The first chart I would like to show you is a daily chart for AUNFF that I know several members follow very close. When you look at the model portfolio this analysis is what I want you to see with all the other stocks. I plan to keep an indepth look from daily, weekly to monthly if need be. There will be a green arrow on either a daily or weekly charts that will point to where we bought in on price and date.

Lets look at a daily charts for AUNFF that shows a loose rectangle formation that has been in place since February of this year. As you will see with the weekly look this loose rectangle is just a small part of a larger formation.

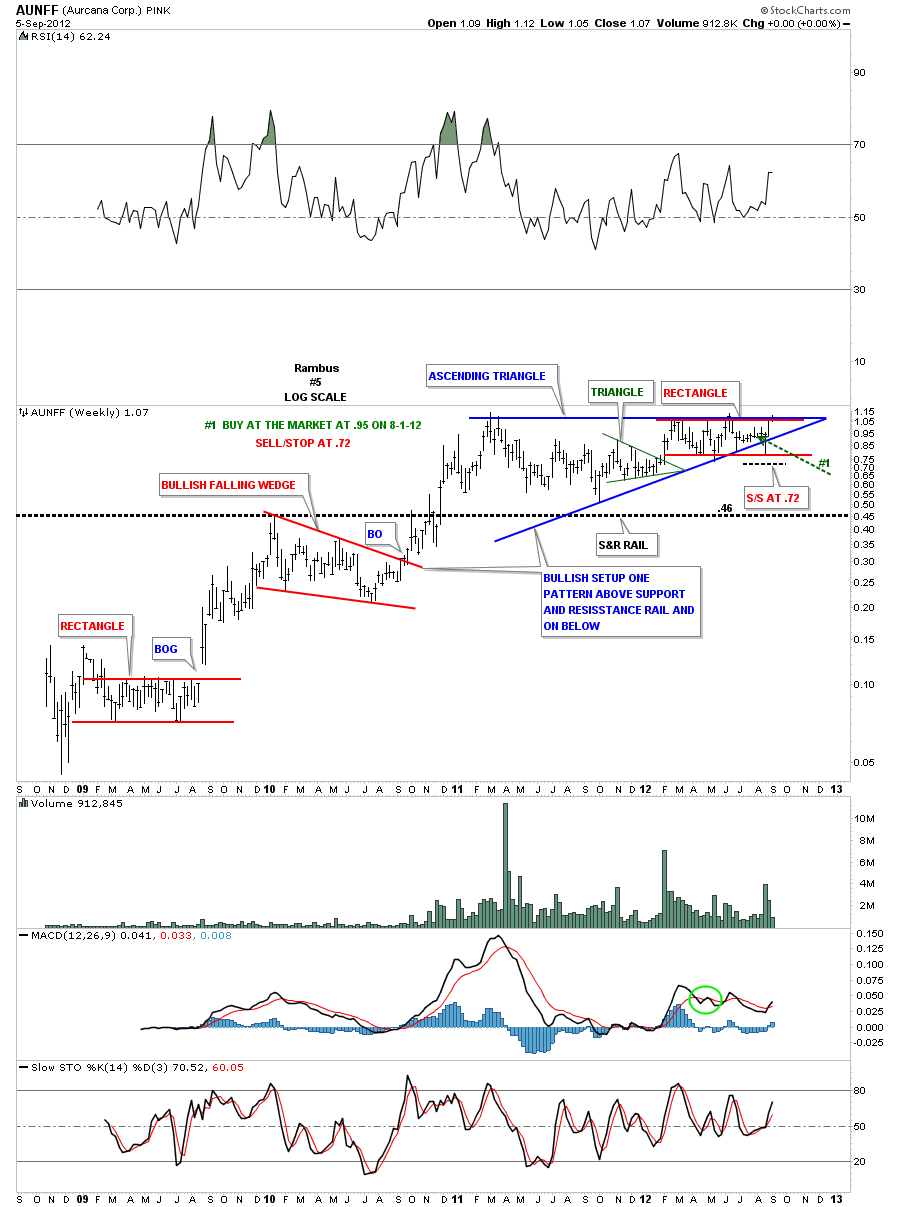

This next chart is a weekly look that shows how the rectangle, from the chart above, fits so well within the bigger blue ascending triangle. The green arrow points to the date and price we bought in at. Note the false breakdown from the blue triangle that ended up being the last reversal point in the red rectangle. AUNFF is also trading right at the top of the blue triangle where anything can happen at anytime now.

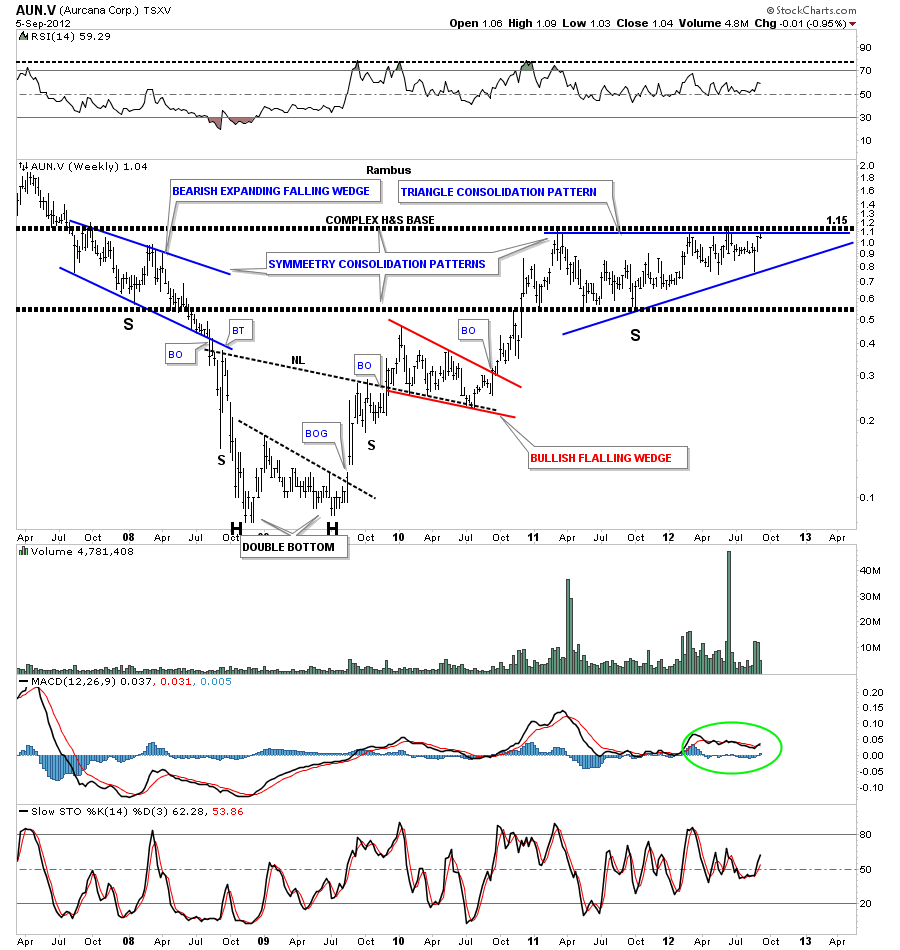

Lets look at another weekly chart for the Canadian symbol for Aurcana, AUN.V. This chart shows good symmetry on both the left and right side of the chart. You can see two very heavy black dashed horizontal trendlines that defines the top and bottom of the two blue consolidation patterns, the bearish expanding falling wedge on the left side of the ascending triangle on the right side. Putting all the pieces of the puzzle together you can also see the potential for a huge inverse H&S base.

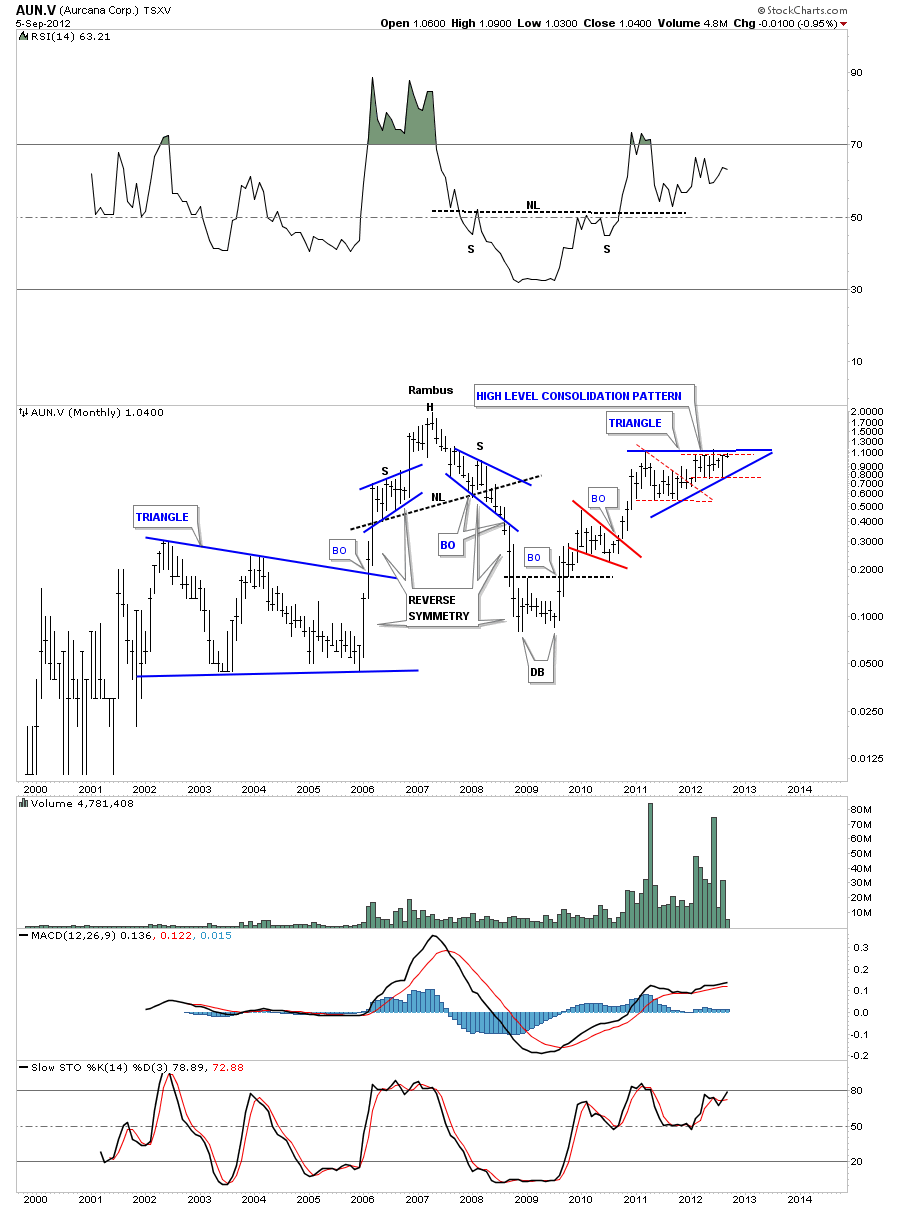

The monthly chart shows our very well defined blue triangle that is made up of two smaller consolidations patterns, the first is the red triangle and the other is our current red rectangle. Those two red patterns are creating the bigger blue ascending triangle which I’m labeling as a high level consolidation pattern.

This is how I’m going to do every stock in the model portfolio plus the kamikaze trades. I will keep them updated on a weekly basis with the daily charts needing the most updating. The weekly and monthly charts change much more slowly. I will still be posting each day when something interesting is happening with our precious metals stocks but my main focus over the next week will be to get the model portfolio 100% updated. Thanks for your patience as I think it will well be worth the effort for everyone concerned. All the best…Rambus

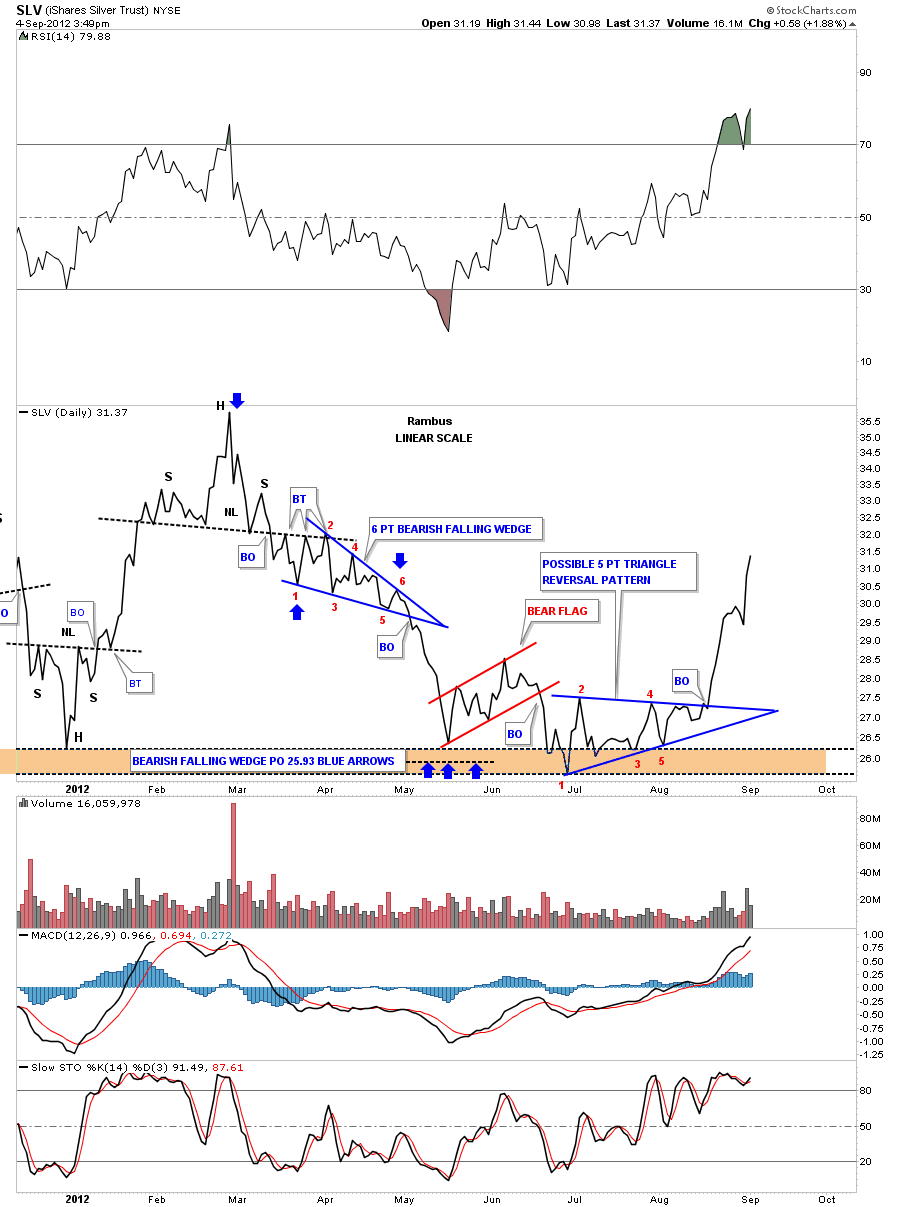

SLV Update

Just a quick update that shows a daily line chart for SLV. I know alot of chartists don’t like to use line charts but I find they add a different dimension to a chart. Double bottoms and tops tend to show up very well with line charts as they takeout some of the noise that a bar chart can produce. Also some other chart patterns like H&S and triangles can show a more clean chart pattern sometimes, that is why I find it useful to look at both. When you look at the daily line chart below notice the price action that takes place once a chart pattern is complete. On a line chart you will generally see a nice smooth line when the rally or decline begins letting you know the chart patterns was in fact a valid pattern. Also notice how the fight between the bulls and the bears takes place within each consolidation pattern by the choppiness within the confines of the pattern. Then the pressure is released and to the victor goes the spoils.

I have been working on getting the charts for the model portfolio and the other trades we have listed on the sidebar brought up to date. Most of the changes will take place on the daily charts as the weekly and monthly charts don’t change much over a month or so. I will try to post something interesting each day but my main focus for the very near term is to get the model portfolio updated so everyone can see what is taking place. Thanks Rambus

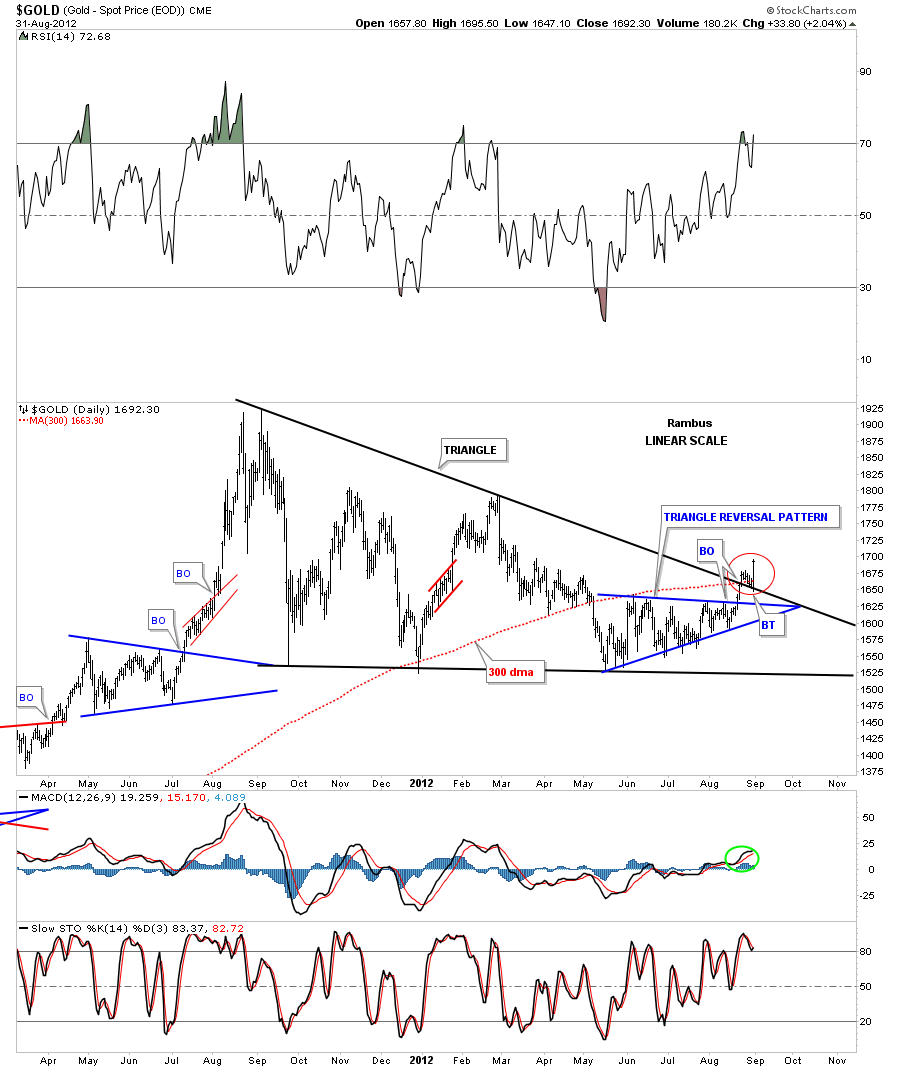

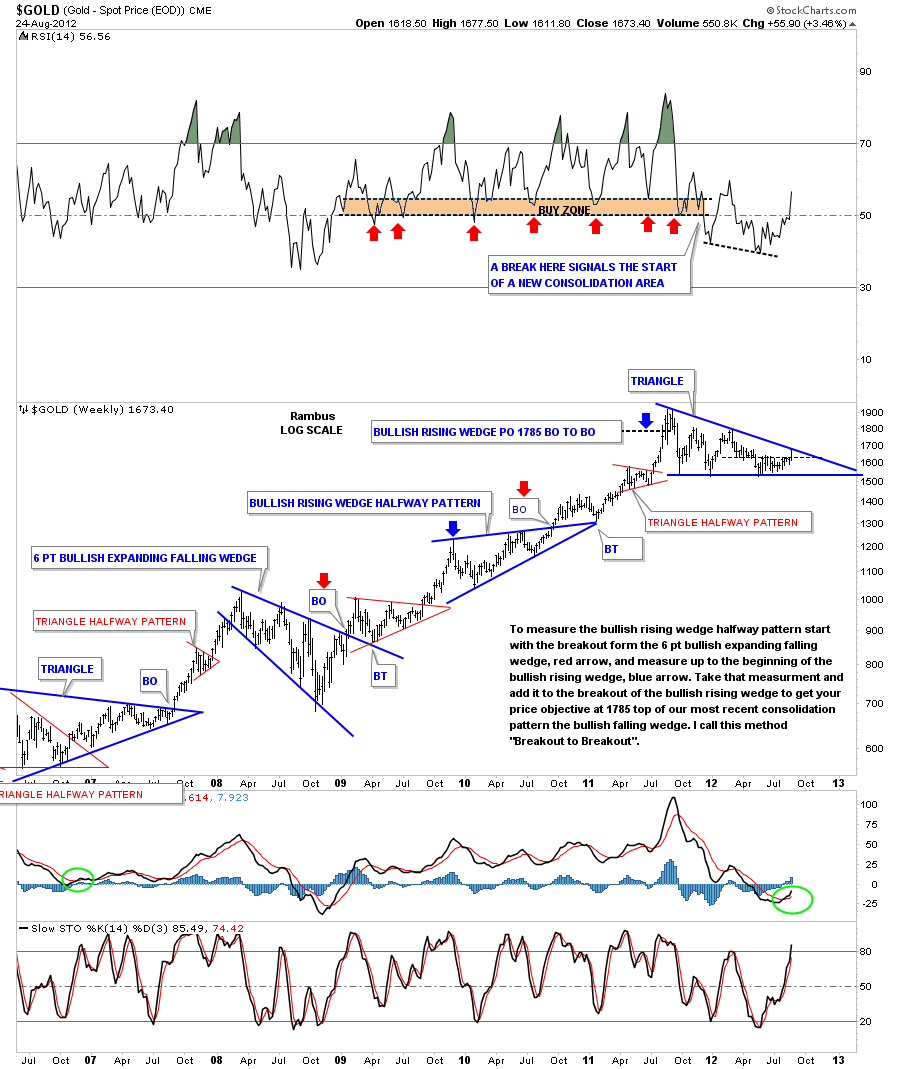

Weekend Report…Longer Term Look at Gold

In this weekend report I would like to focus in on some of the longer term weekly and monthly charts for gold but would like to start off with just one daily chart. Last week was probably the most important week for gold in quite sometime as it finally took out the top black rail of the possible triangle consolidation pattern. There is alot going on where I’ve added a red circle to show you how critical that area is going forward. The first thing to note is the breakout from the blue triangle that has given gold the energy to finally break through the top black rail of the much bigger triangle consolidation pattern plus the 300 day moving average. You can see how once the top black rail was broken to the upside it reversed it’s role and held support last week. This was a very encouraging event IMHO. Most important is Friday’s price action that produced a nice long bar. So now gold has experienced a breakout and a backtest this week. It would be nice to now see some decent follow through to the upside and leave the breakout area behind.

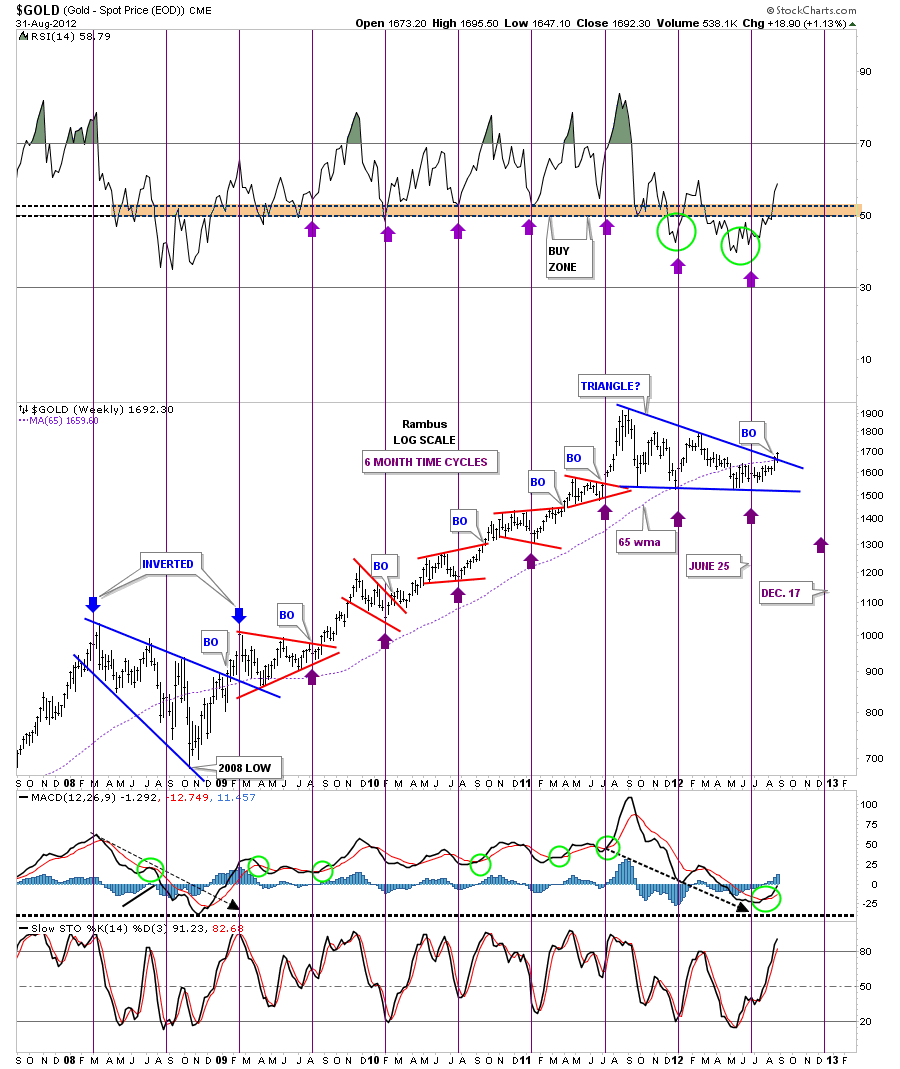

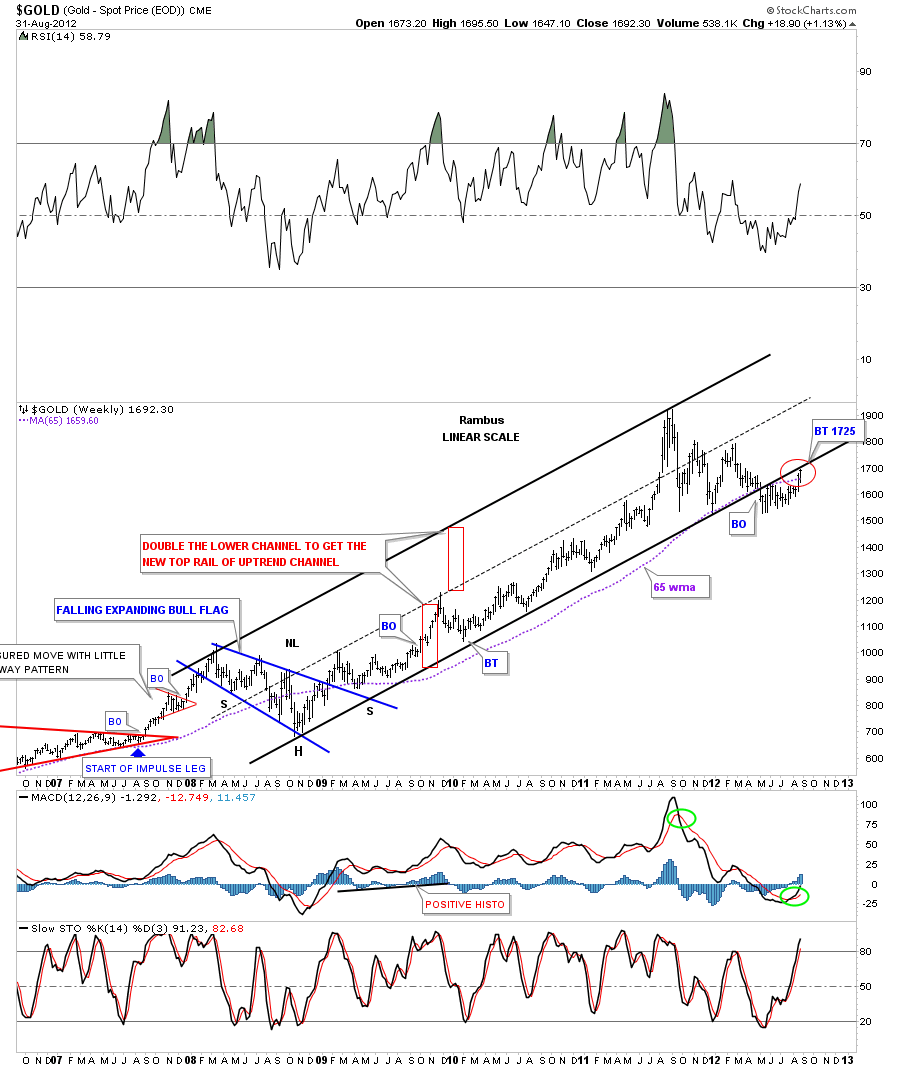

The next chart is a six month time cycle chart that has been very effective over the last several years, especially since the big rally out of the 2008 crash low. The latest six month time cycle came in just a tad earlier than what has been the case lately but its still looking good in here. When I experiment with a time cycle chart I not only look at the price but also the indicators that can give one a good confirmation that the cycle is indeed relevant. For instance notice the RSI indicator at the top of the chart and the slo stoch at the bottom of the chart. They usually turn on a dime when the six month time cycle hits. The MACD is alittle different in that it’s the last indicator to confirm the six month cycle as it usually crosses over several weeks later. One last note on time cycles. Sometimes they will invert meaning, in our current case where the six month time cycle is bottoming, sometimes they will invert and instead of making a bottom they will make a top. Note the two inverted 6 month time cycles that hit back in 2008 and 2009 that showed highs instead of bottoms.

This next weekly chart shows the most critical test for gold right now. I’ve shown you this chart in the past where the price of gold broke below the bottom black rail of the uptrend channel made off the 2008 low. As you can see that bottom black trendline has been acting as resistance since it was broken. Gold is now testing it from below so we should know very shortly how much energy that bottom rail has left. Also note gold is now trading above the 65 week moving average which is a healthy sign.

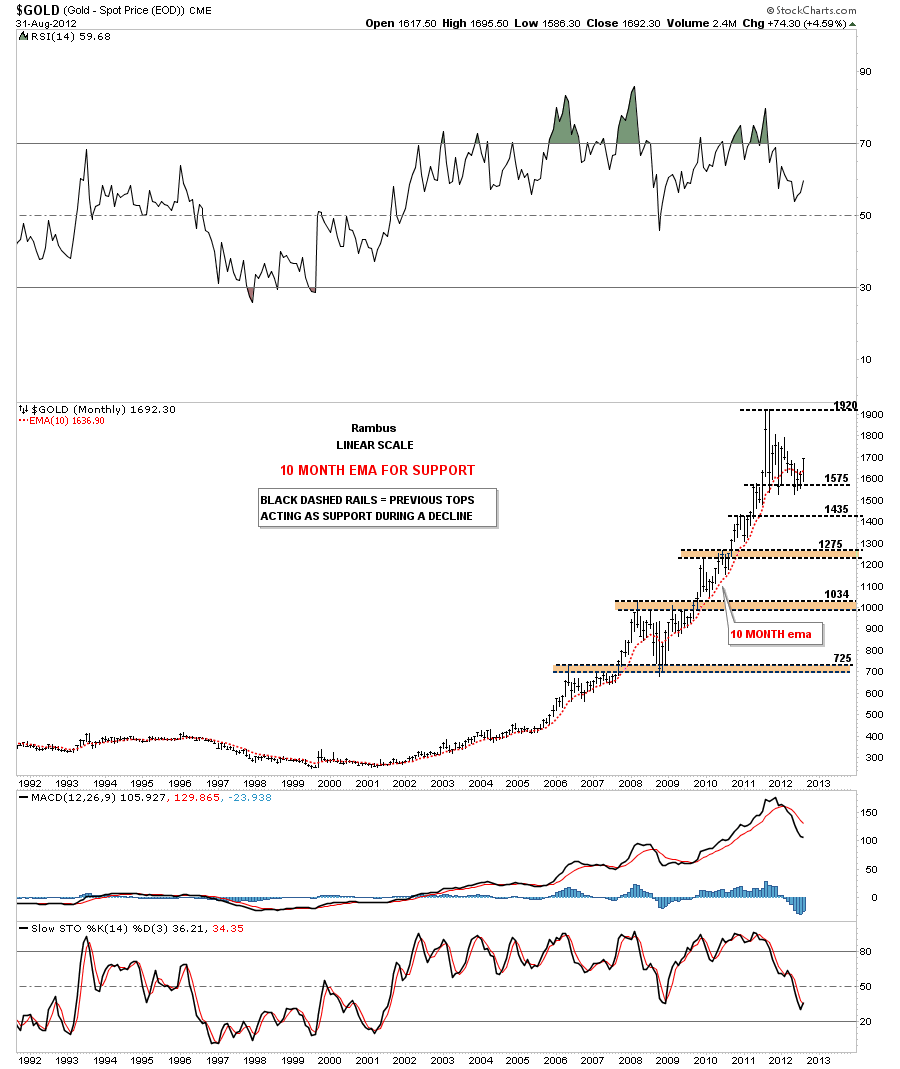

This next chart for gold is a long term monthly chart with a 10 month moving average that has done a very good job of holding the major uptrend intact. The only two times it has failed to do so was the 2008 crash and our most recent correction. On the monthly chart below I just want to show you how support and resistance really works even on large time scales. Again, the main psychology on why support and resistance works is very easy to understand. I’ve labeled the tops that were made on the way up with a horizontal black dashed rail or brown area if the tops were just a little ragged. The reasoning behind how this monthly gold chart is showing support on declines is because the investors who bought at these previous tops, black dashed rails, are still ahead of the game even though prices have fallen. So the psychology is “I’m still ahead and and can stand the pain, so they don’t sell. The buyers come back in and up prices go. Now if the price of gold were to penetrate any of the previous tops by a fair margin the psychology would be, ” if I can only get out even I will sell on any strength.” Then everything changes as what was support now turns into resistance as investors want to limit their loses and pain.

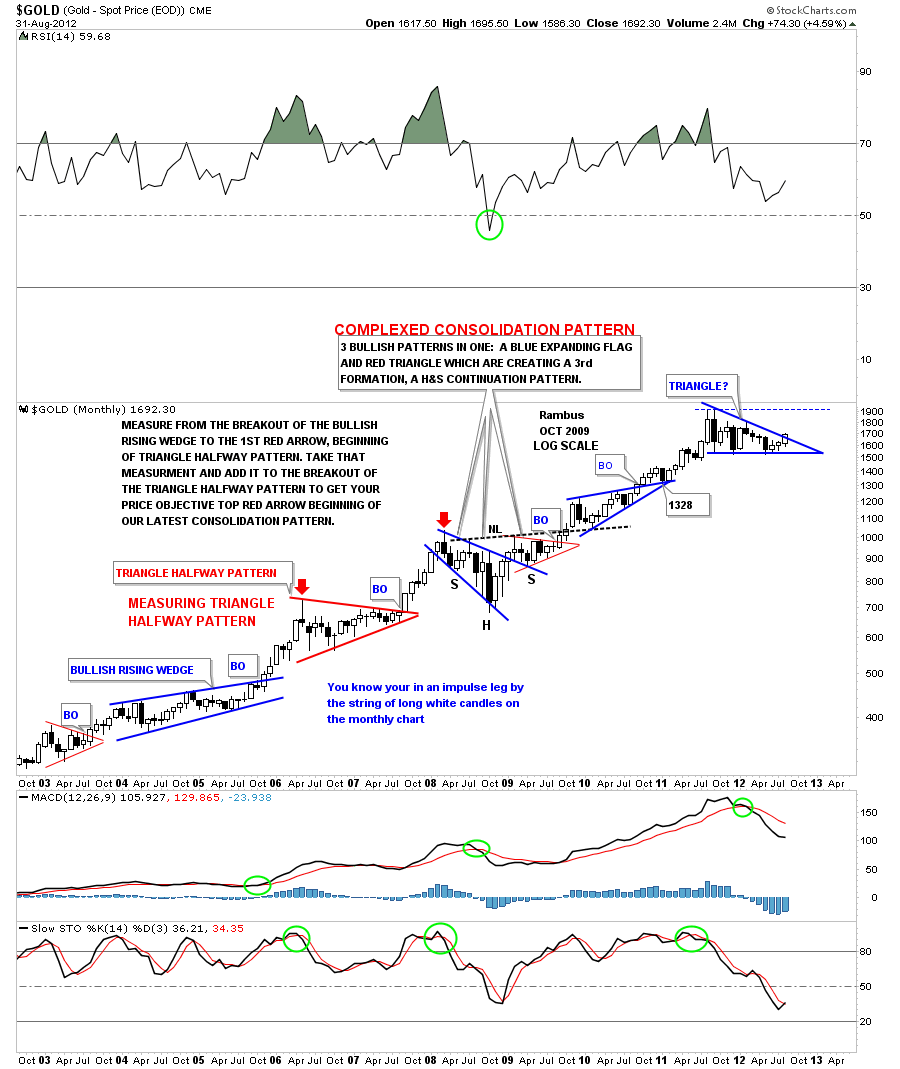

The next chart I would like to show you is another monthly look that is a candlestick chart. The reason I’m showing you this chart is so you can get a good feel for when an impulse leg up is in full swing. When a good bull move is underway you will start to see alot of white candles in a row. Then when you see one or two black candles in a row, within the impulse leg up, it usually suggests a small correction is taking place and you will be able to see it on a daily chart. This technique also works very well on weekly charts. Note the last three candlesticks are white while gold is trying to breakout from the blue triangle.

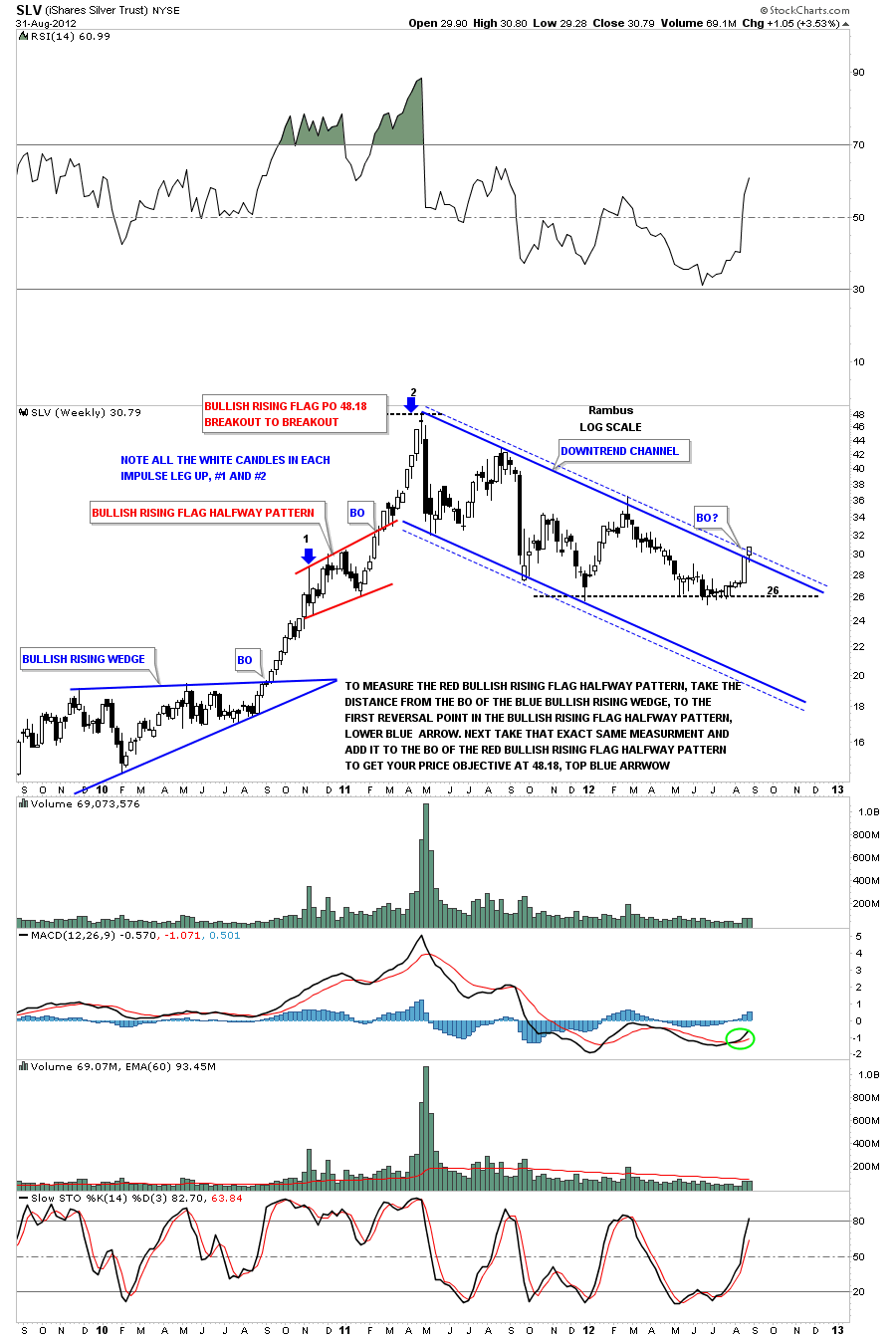

Let me just throw in this weekly chart for SLV that shows a better example of how a really good impulse leg up shows a string of white candles that lets you know you are in a strong bull move.

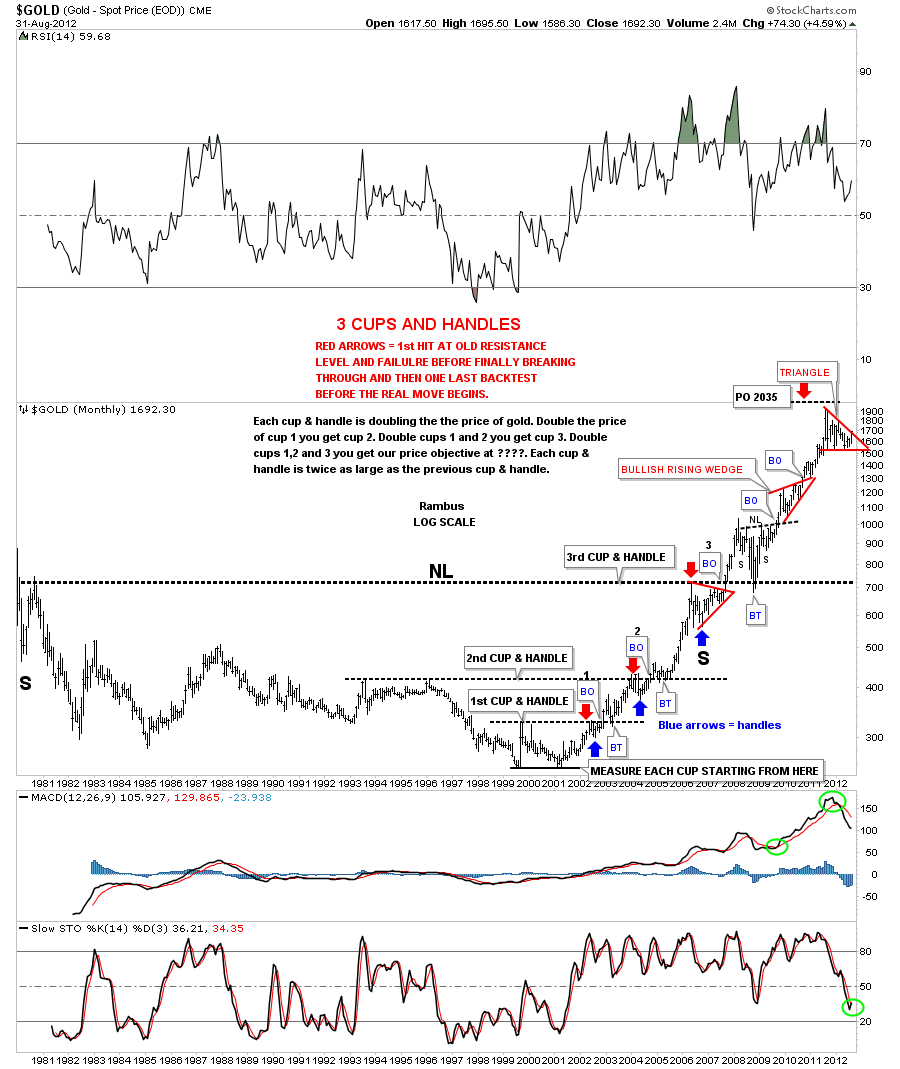

Finally, the long term look at gold wouldn’t be complete without looking at my favorite chart of the yellow metal going all the way back to the 1980 high. There is a massive 25 year inverse H&S base that finally broke out in September of 2007. When everything crashed in 2008 gold found support just where one would expect, at the massive neckline. From that backtest to the 25 year neckline gold went on to rally nearly 1200 points before topping out last year at 1920.

From this longer term perspective gold still looks remarkable strong after being in a bull market all these many years. Finding key support and resistance zones, as the monthly chart above shows, gives one a place to look for support and a place to add to your portfolio. Gold’s most recent high at 1920 will most likely come into play as support once its taken out to the upside. From my perspective, and the last several weeks of price action, gold is in the best technical shape I’ve seen in quite sometime. We just need to see some follow through to the upside now showing us many white candles on the monthly and weekly charts. All the best…Rambus

EDITOR’S NOTE :

Rambus Chartology is Primarily a Goldbug TA Site where you can watch Rambus follow the markets on a daily basis and learn a great deal of Hands on Chartology from Rambus Tutorials and Question and Answeres .

Most Members are Staunch Goldbugs who have seen Rambus in action from the 2007 to 2008 period at www.goldtent.org and now Here at Rambus Chartology since early 2012 .

To review his Work and incredible calls from the 2007-2008 period click on the top right sidebar in the “Wizard of Rambus” ….”What If !!” Post

To Follow Rambus Unique Unbiased Chart Work and participate in a Chartology Form with questions and answeres and learn the Art and Science and Mindset of a Pro Trader please Join us by subscribing monthly for $29.99 at

www.rambus1.com

We have many subscribers from all over the world who are glad they did as they enjoy the many daily updates and commentaries provided at this exciting new site

As you will see Rambus (Dave) has prepared us for this difficult period by being one of the only ones to see and warn about this incredibly debilitating PM smackdown as early as Jan 2 2012 …click on the” HUI Diamond in the Rough” Post in the “Wizard of Rambus” top right

You will find Rambus to be a calm humble down home country tutor with an incredible repitoir of all the TA based protocols tempered with his own one of a kind style…simply put…He wants to keep his subscribers on the right side of these crazy volitile and downright dangerous markets

See you at the Rambus Chartology

…………………….

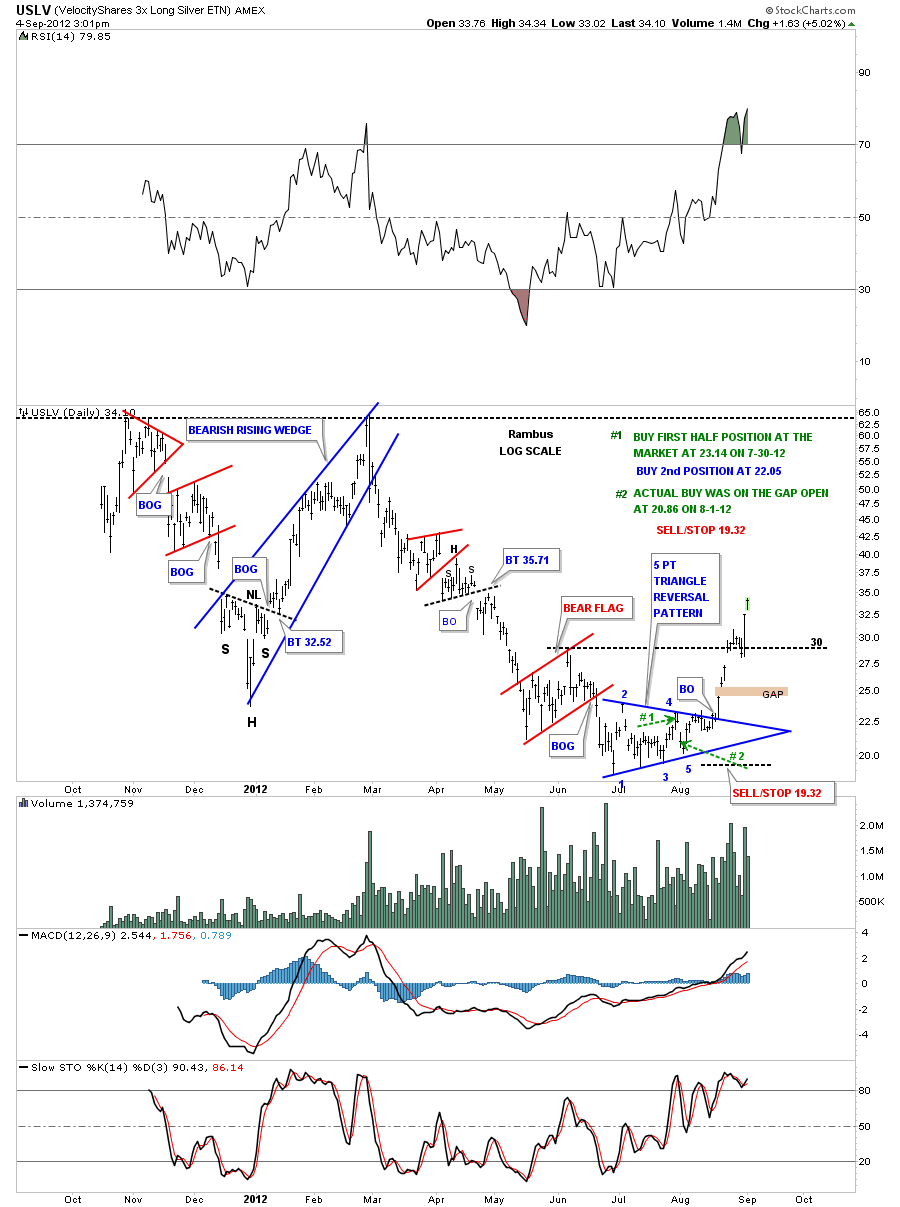

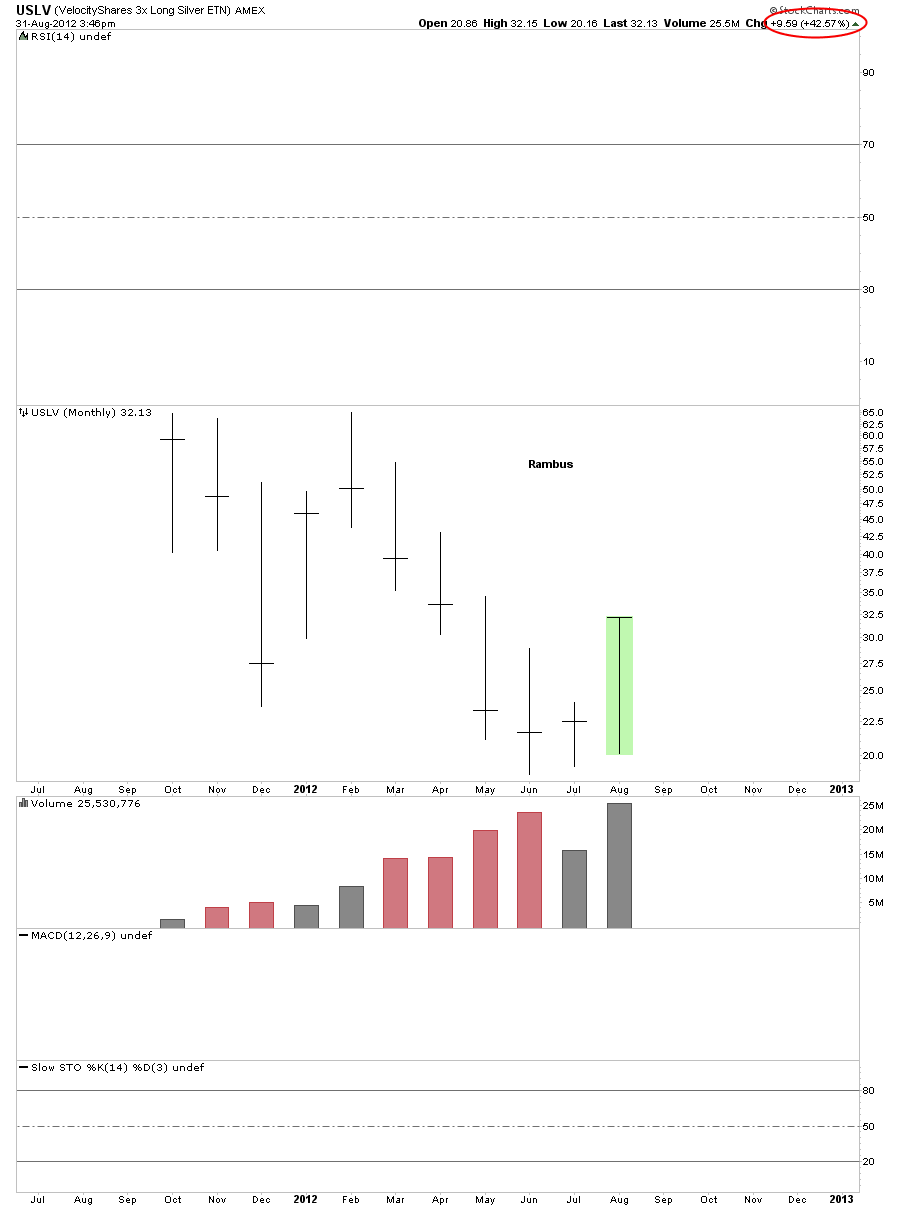

USLV Update

September 4th daily update. After breaking out of the 5 point triangle reversal pattern USLV has been on a tear. Its signaling it has alot of strength to this move as the pullbacks are very shallow. The green arrows shows the date and price of our 2 buys in the blue 5 point triangle reversal pattern.

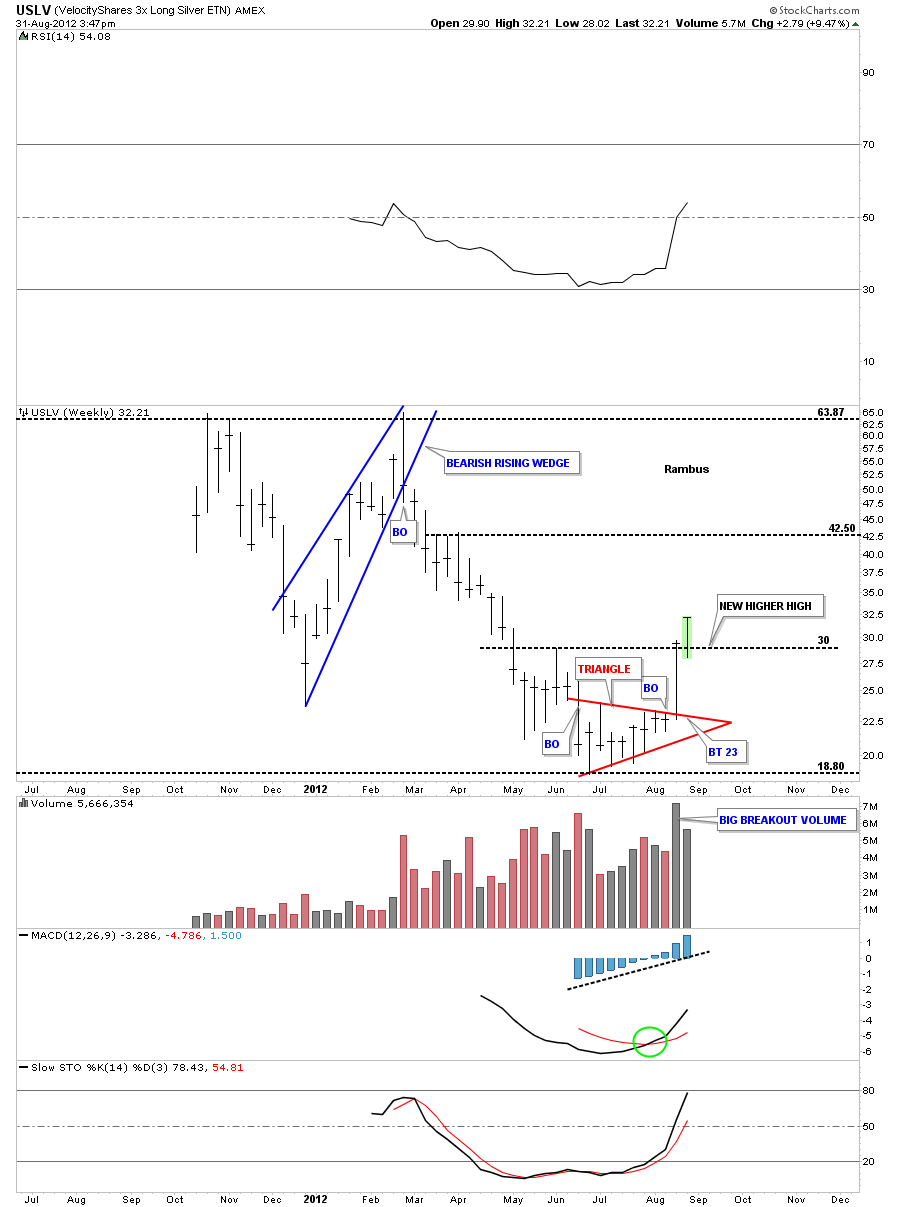

Just a quick update on the star performer for the month of August. Weekly look shows the breakout of the 5 point triangle reversal pattern. I like to see nice long bars when a stock begins a new leg up. Its a sign of strength.

Note the percentage change for the month of August at the top of the chart, red circle.

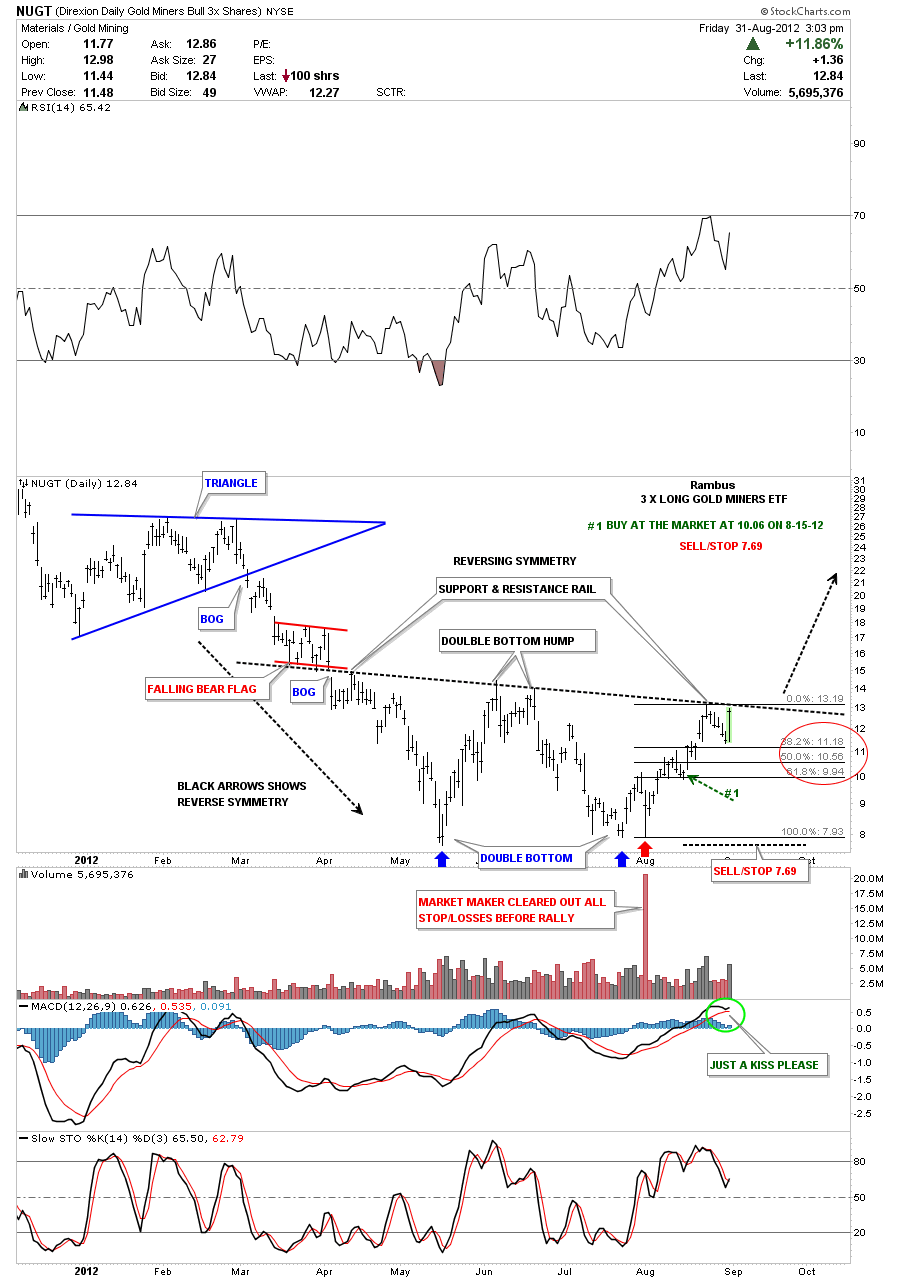

NUGT Update

I just want to quickly update NUGT from yesterday. So far the 38% retrace is holding as support. Today’s rally is taking the price action back up to the all important support and resistance rail. I want to add another dimension to this chart hopefully showing some reverse symmetry back up. Note where the pointers from the support and resistance rail are pointing right now. If we are starting to reverse symmetry back up, today’s price action back up to the S&R, shows us the bulls are still strong by the ease of rallying backup to the S&R rail. Next the bulls really need to show who’s in charge by either gaping above the key S&R rail, or producing a nice long weekly bar, closing close to the high for the week. Price with some good volume would also be nice..

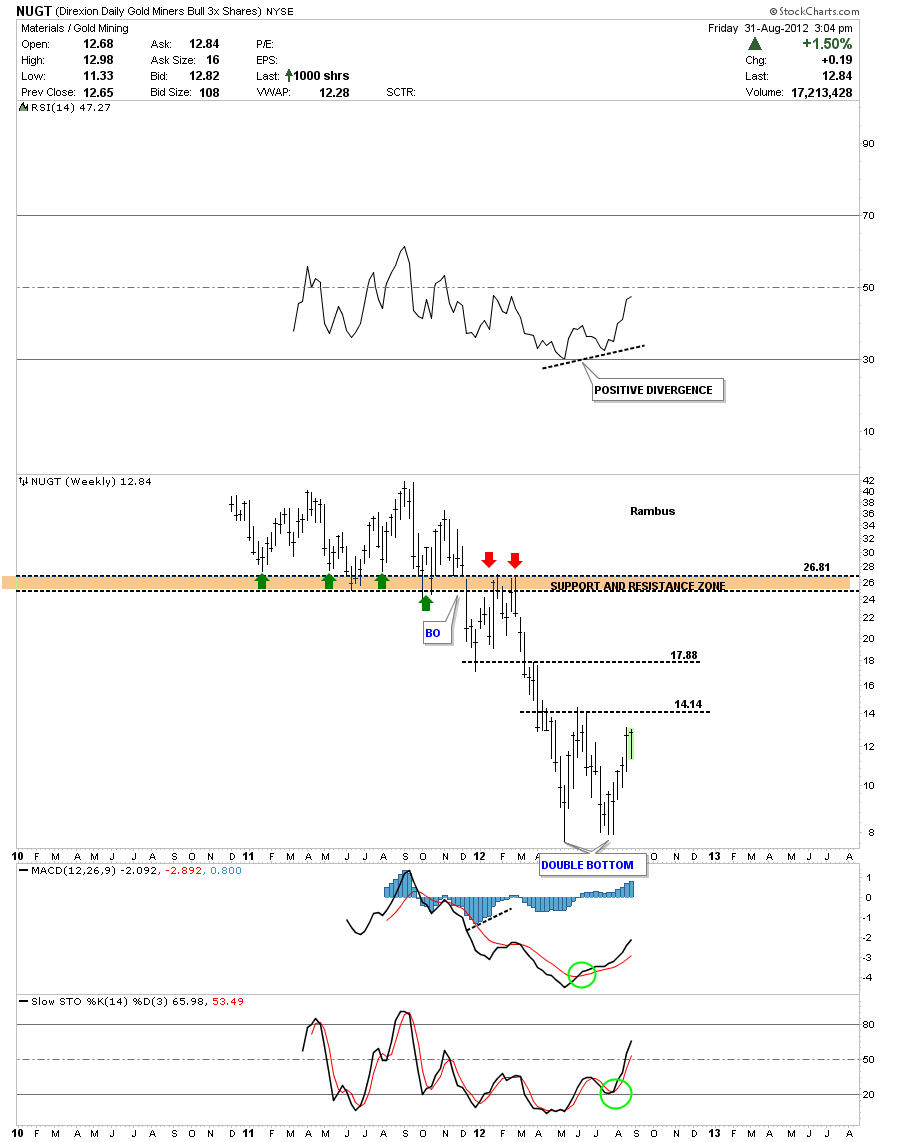

Its nice to see the closing price on the high end of the weekly bar this week. Double bottom still in progress.

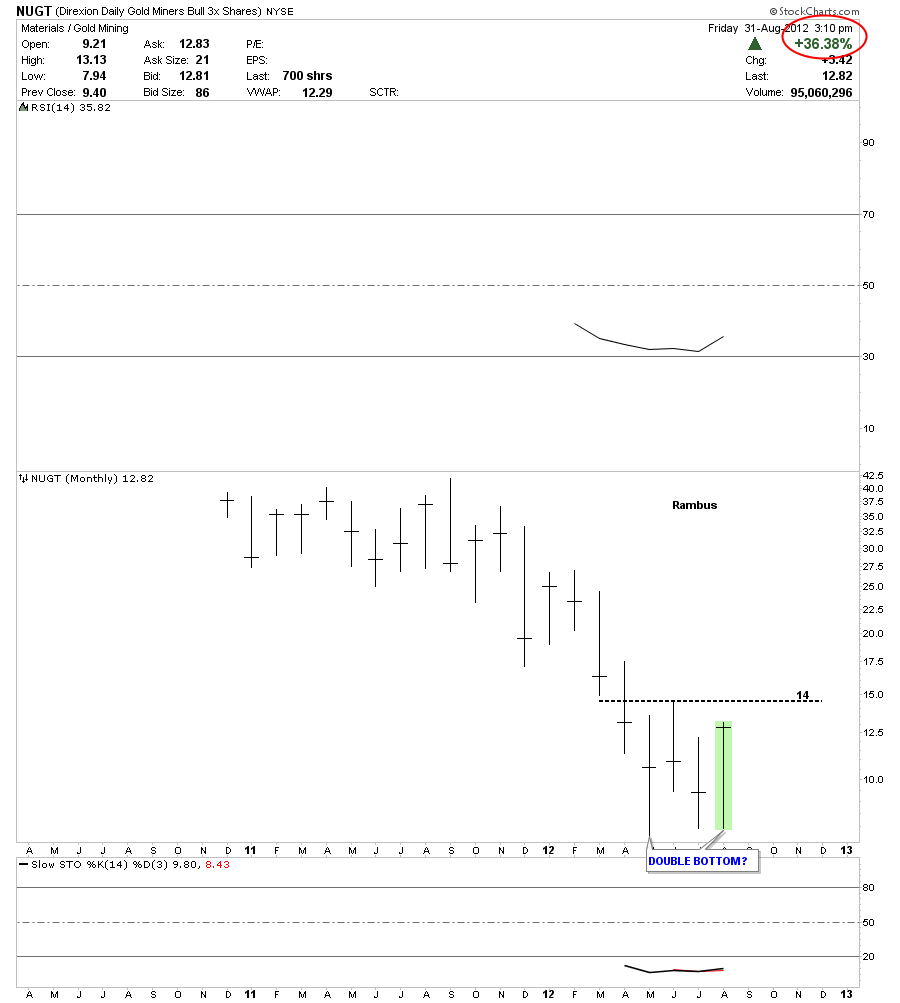

Seeing its the end of the month I’ll post the monthly chart for NUGT so you can see what it has done on a percentages basis. You will see why we call them Kamikaze trades. NUGT

Weekend Report…A Comprehensive Look Into the Chartology of Precious Metals

In this weekend report I think its time to look at the precious metals complex as last weeks move finally showed some underlying strength that took prices up to some important resistance zones. At the close of trading last Friday, August 24th, gold, silver and the precious metals stock indexes were all trading at key trendlines. We know there hot as they all stalled out on their initial hit which should be expected. The next couple of weeks are going to be critical for the precious metals complex as those important resistance rails will need to be taken out before a serious new leg up can begin. Last weeks price action was very positive as there was enough energy to rally the precious metals sector back up to critical resistance which is the first step in a new impulse leg higher. Keep in mind the markets generally move two steps forward and one step back during a good move up. Only when we reach the parabolic portion of the bull market is when we will see maybe five steps forward and one step back. So lets look at some of those important resistance rails, that we can keep an eye on for future reference.

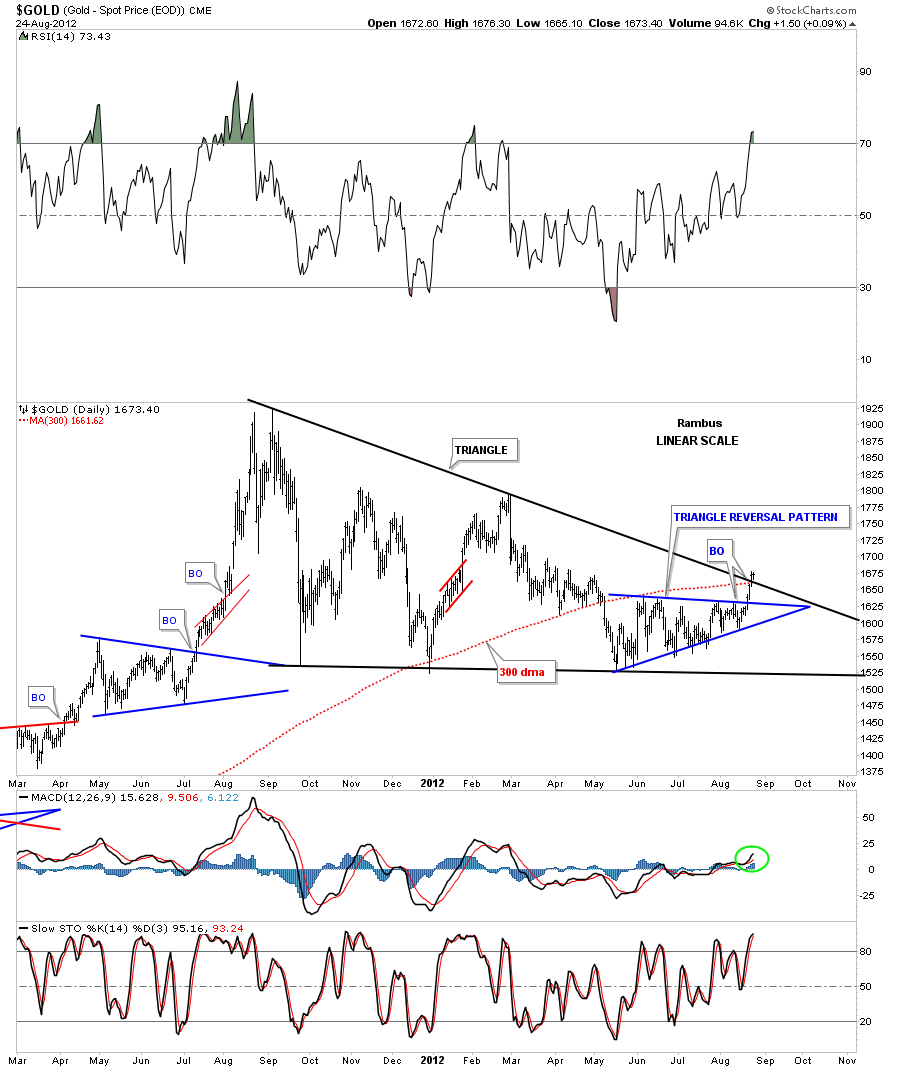

Lets start with gold as it has actually penetrated the most important downtrend rail of what is looking more like a triangle consolidation pattern to the upside in black. The smaller blue triangle that has formed over the last 3 months or so is located in the best possible place to to offer it’s strength for a complete breakout of the much bigger year old black triangle. Also note the 300 dma, in red, that was also broken to the upside right at the top rail of the big black triangle. This is what you call killing two birds with one stone. If this is a true breakout the top black rail of the big triangle should not be violated on any backtest in the future.

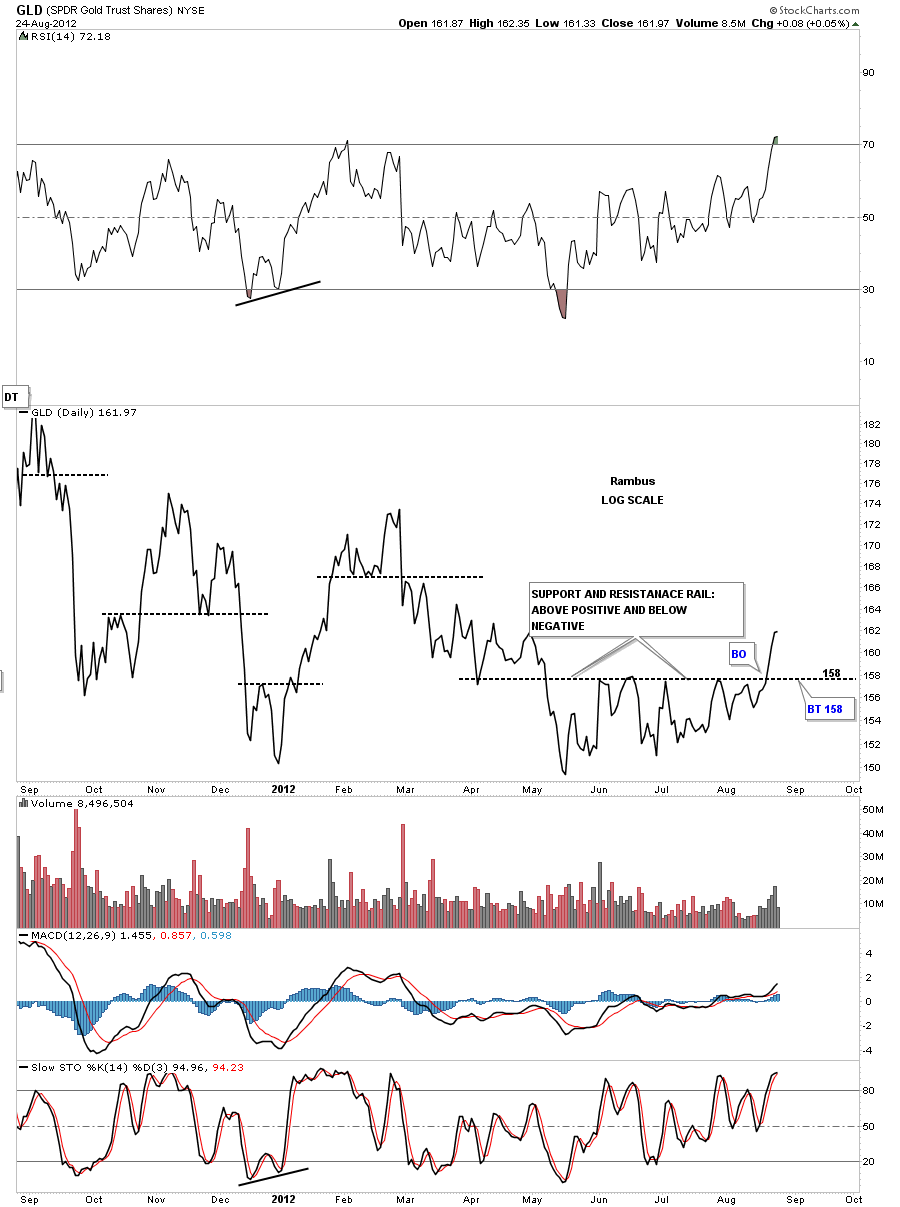

The next chart I would like to show you is a daily line chart for the GLD. Line charts have their place in charting as they can identifying support and resistance zones. They can takeout a lot of noise that a bar chart some times exhibits. Line charts also do a good job of identifying double tops and bottoms that might be harder to see on a bar chart. With that said lets look at a one year line chart of the GLD that is showing the 158 area has held resistance from May of this year until it was decisively broken to the upside this week. If we have any weakness over the next week or two the 158 area on the GLD should now act as strong support. Basic Technical Analysis.

The weekly look at gold is showing the possible triangle that has been forming for close to a year now. Breakouts can take their time on occasions with alot of backing and filling around the breakout area. Then there are other times when a stock has a breakout gap and never look back. You never know for sure what type of breakout you’ll get until after some time has passed. As of today gold is testing the top blue rail of the blue triangle so what type of breakout we will get is still up in the air. Any type of breakout will be positive though. Note the RSI indicator at the top of the chart. When gold was in it’s last strong impulse leg higher, anytime the RSI fell down to the 50 area that launched the next leg higher. When the RSI finally broke below 50 is when we started our latest consolidation pattern. Also you can see where the RSI made a lower low, black dashed rail, and gold failed to follow through, that was a bullish sign for gold.

This last chart for gold is a long term 30 year look that puts our latest triangle consolidation pattern in perspective. You can see when gold finally left it’s big base it has produced one consolidation pattern ofter another. Our most recent triangle consolidation looks like it fits right in to the major uptrend that began in 2000. One last note on the chart below and that is the big neckline that runs through the center of the chart. We know that big neckline was hot by the way the price action traded at the breakout area in 2007. As you can see there was a nice red triangle that formed just below the big neckline. That told us gold was building up the energy to finally take out that 27 year neckline, which it did. What is more important is how the big neckline reversed it’s role and held support during the big stock market crash in 2008. Gold built a beautiful H&S consolidation pattern with the head portion testing the big 27 year neckline. So the breakout and backtest were complete which led to the biggest impulse run higher for the entire bull market to date.

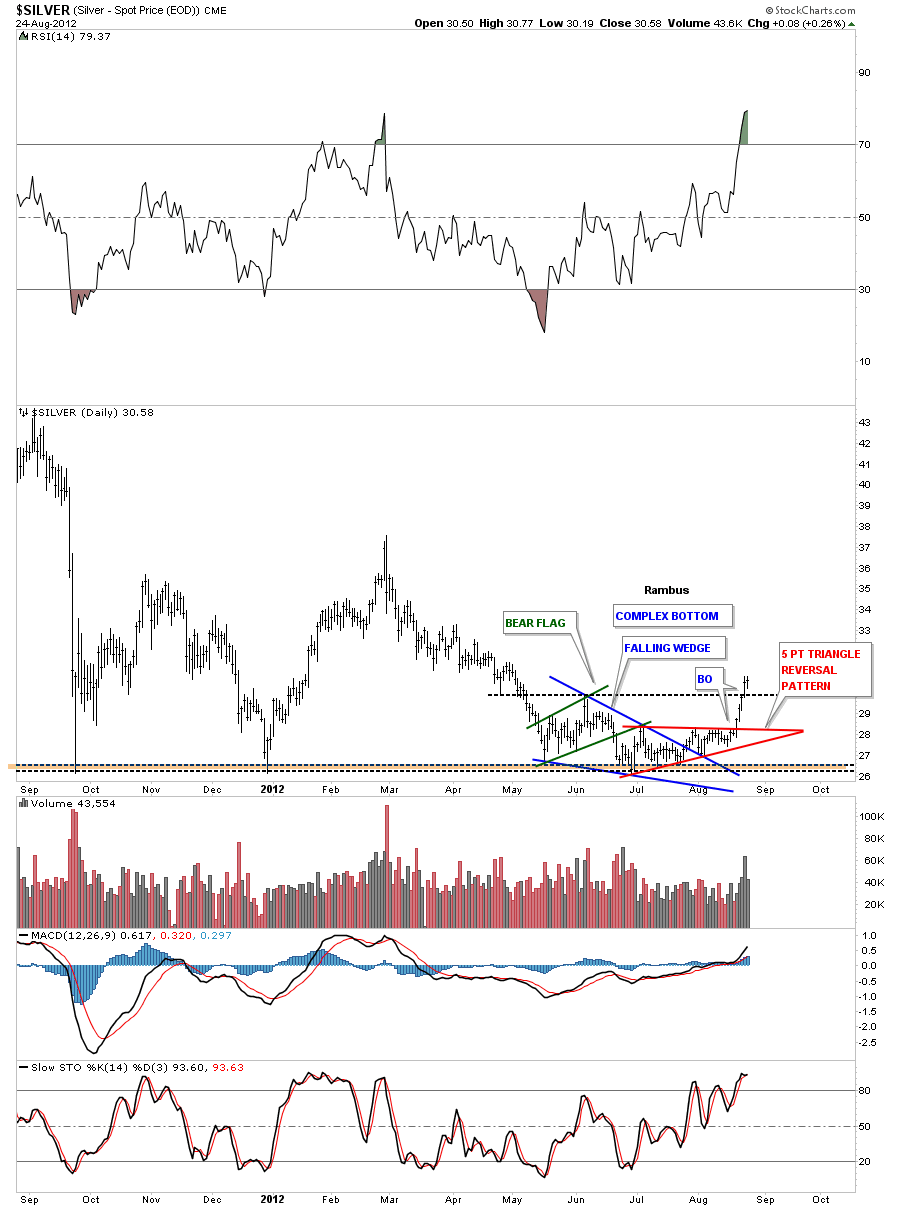

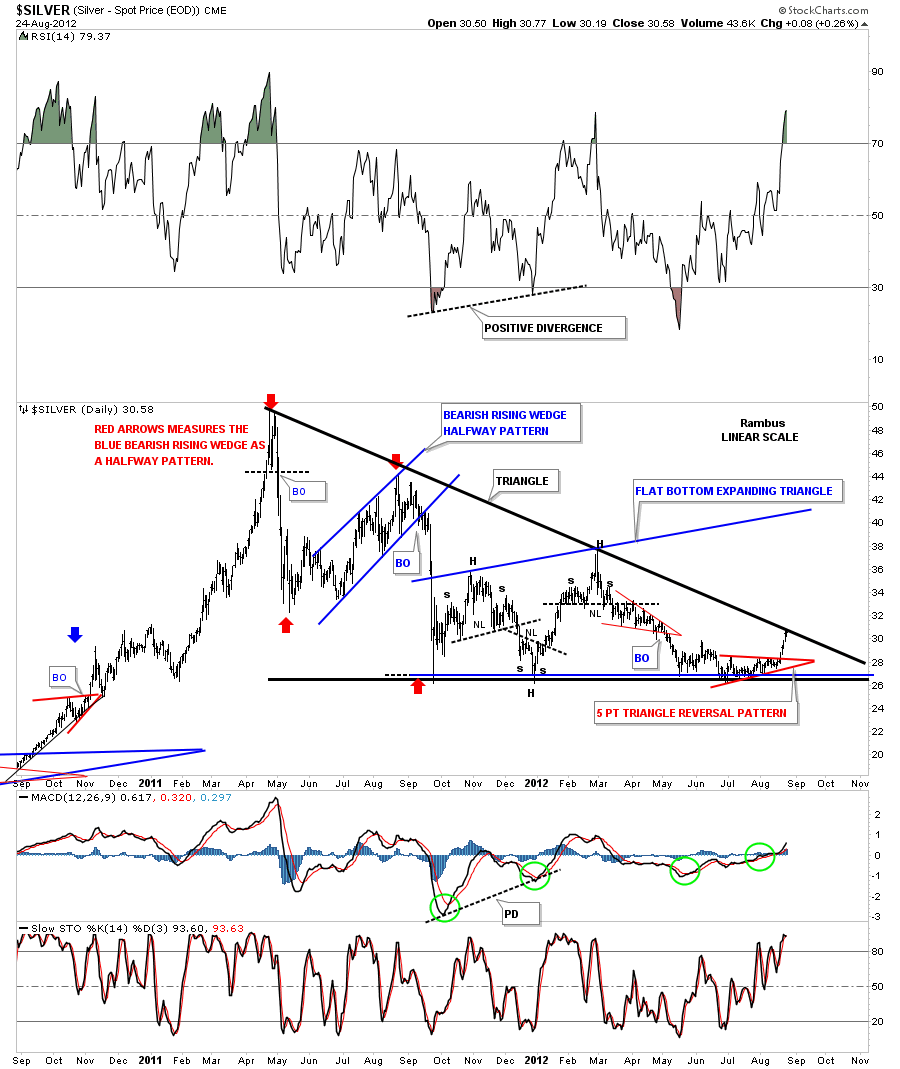

Lets now turn our attention to silver and see how it has performed last week. On the chart below I’m labeling the bottom formation as a complex pattern because it is made up of three different chart patterns. The green pattern is the bear flag, the blue pattern is a bullish falling wedge and the most recent and most important pattern is the 5 point red triangle reversal pattern. By the close of trading on Friday silver closed above the June high. That is significant as Silver has now put in a higher high.

Lets now look at a two year chart for silver that starts to paint a bigger picture since the all time high at 50 in April of last year. As you can see on the chart below the price action took silver right up to the downtrend rail of a possible big triangle formation. The bottom rail of the big triangle has held support many times since the correction began in April of last year. You can see another big chart pattern that has formed since the initial crash down to the 26 1/12 area that started the flat bottom expanding triangle in blue. That pattern is similar to the gold big rectangle that I showed earlier. So silver is now testing the all important top rail of the triangle.

The 30 year chart of silver is a very beautiful chart technically speaking. Silver had two massive H&S bases stretching back to 1982. Note the red triangle that formed just below neckline #1. That red triangle was going to fuel the breakout once everything was in place. The rally that followed took silver form 8 to 20 before it was time for the next pull back. As with the big 30 year chart for gold that I showed you above, silver also had a crash that took prices all the back down to the breakout of neckline #1 around eight. From that backtest to neckline #1 silver went on to have it’s biggest rally of the bull market topping out close to 50 the1980 high. From there silver has been in a very strong correction that has take the price all the way back down to 26 or so where strong support has come in on every test. You can see the brown area is where I was looking for support at neckline #2 backtest around the 24 area. If our latest consolidation pattern does indeed takeout the top rail of the big triangle then the 24 support zone will most likely not be hit. Just for what its worth the big H&S #2 price objective comes in around the 132 area. Big bases big rallies.

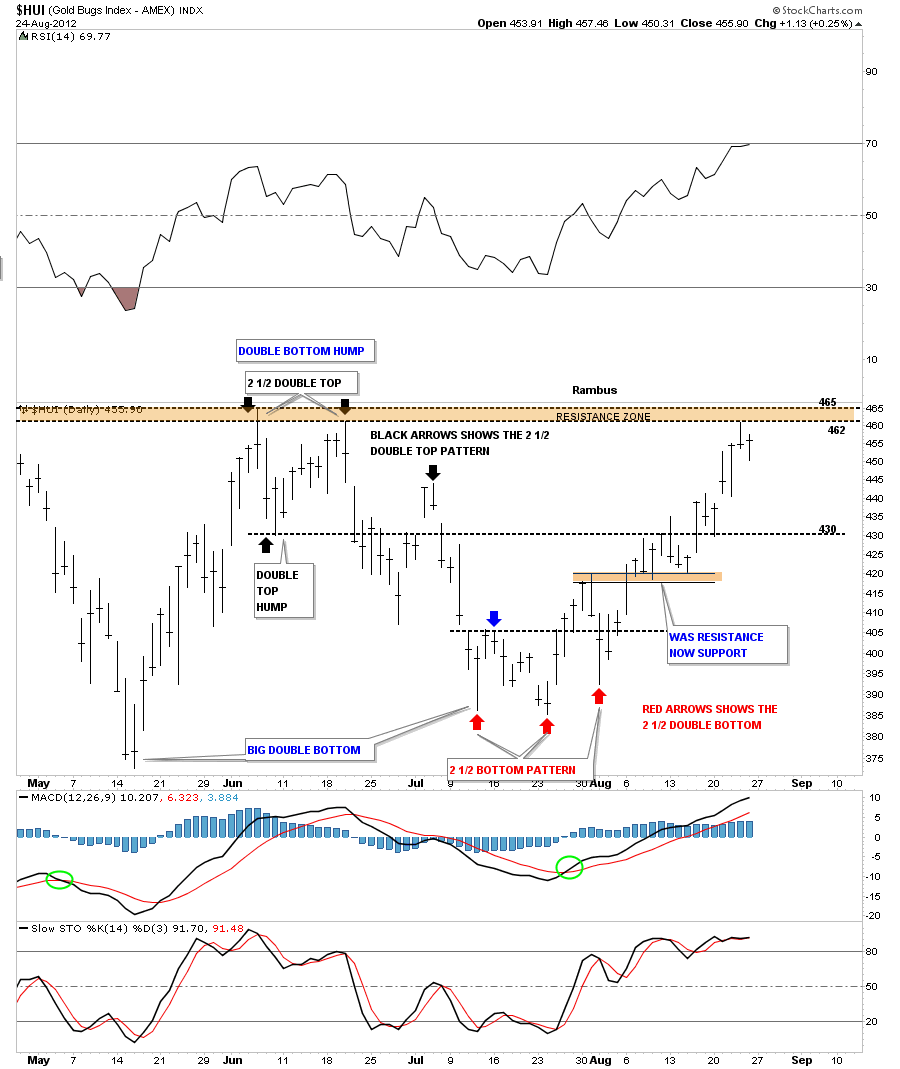

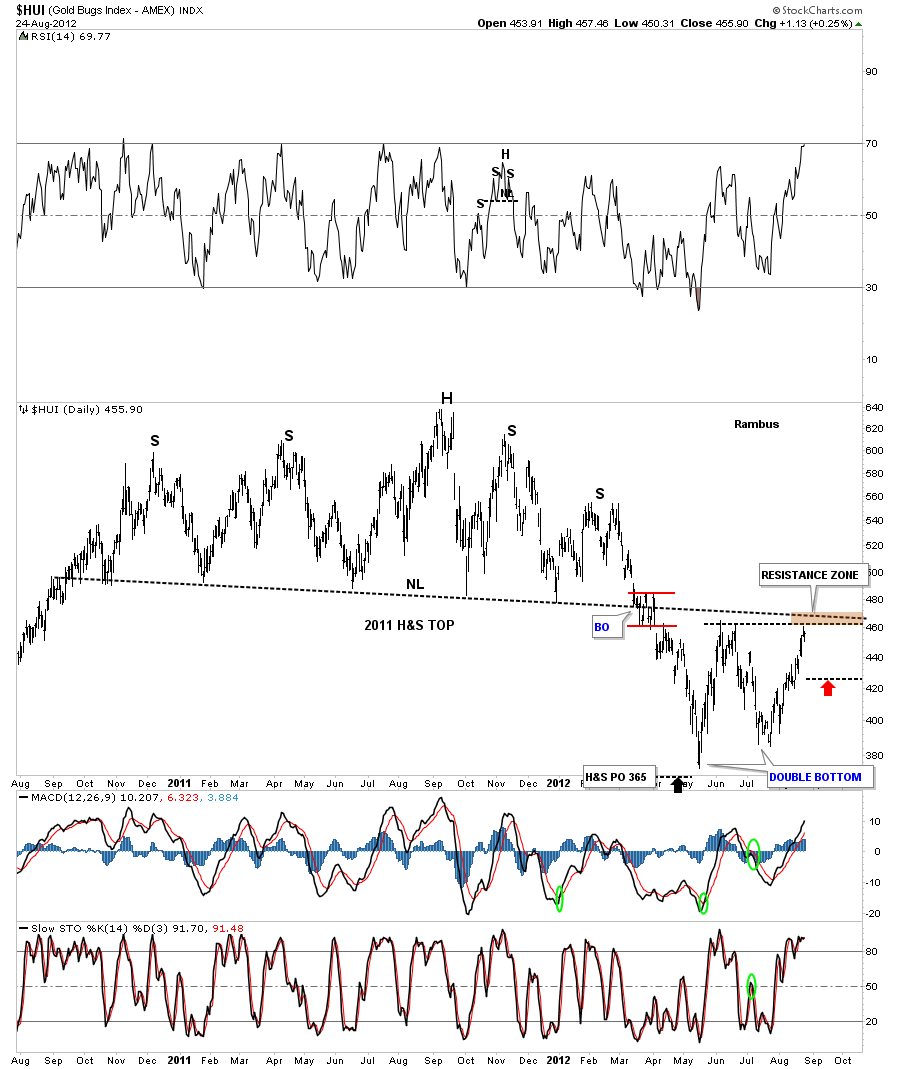

Lets now look at the HUI as a proxy for the other precious metals stock indexes. The HUI is building out what could be a double bottom reversal pattern. At the top of the chart I’ve labeled the critical double bottom hump that the HUI needs to trade above to signal that the double bottom is in place. That comes in around the 465 area. As you can see by last weeks price action the HUI hit the top resistance zone on Thursday and sold off telling us that top rail is hot and is still holding resistance. After a small sell off on Friday the HUI is in the process of rallying back up to test the top rail again. At some point if we are truly embarking on the next impulse leg higher that 465 will be taken out and then it will reverse it’s role from resistance to support. The black and red arrows shows the smaller double top and bottom that have formed within the much bigger double bottom. I’ve labeled these two smaller reversal patterns as a 2 1/2 double top and double bottom. I know many of you out there are thinking “where did Rambus come up with the name for those pasterns?” I’ve seem these patterns form many times over the years but you won’t find them in any text book. The half bottom refers to the move after a breakout from the double bottom that quickly runs out of gas and declines back below the double bottom trendline about half the distance to the bottom. Note the 3 colored arrows that shows the top and bottom 2 1/2 patterns. The double tops and bottoms are still valid patterns its just that the backtest was stronger than normal creating the half part of the double top or bottom. You can also view the half part as a false breakout that doesn’t really materialize as it moves back below or above the horizon black dashed rails. There were probably alot of sell/stops that the market maker could see that he could catch before the rally began in earnest. That’s how alot of the long tails come about at tops and bottoms.

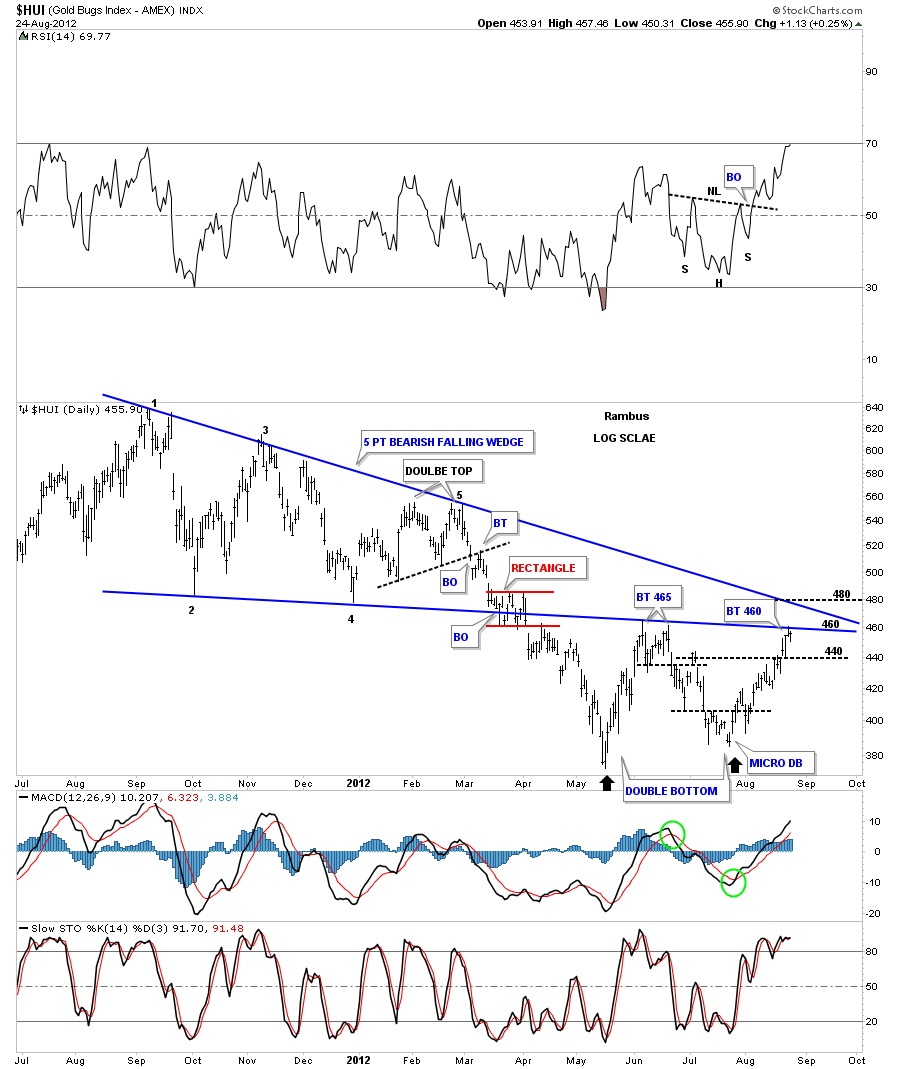

The next chart shows why we are now just starting to enter into some overhead resistance. There was a five point bearish falling wedge that gave way back in March of this year, red rectangle. That point represented the breakout. After bottoming out in May of this year the HUI rallied all the way back up to the underside of the bearish falling wedge where it ran out of gas and sold off again taking the price action back down toward the previous low. As you can see on the chart below the HUI as rallied all the way back up to the bottom blue rail again this week. Thursday it hit the bottom rail and sold off and Fridays action is starting what looks like another move higher to challenge the double bottom hump at 465. The most positive thing the HUI could do in here is takeout both the bottom and top rail of the bearish falling wedge that would have them reversing their roles from resistance to support.

Below is another chart that shows why the 465 area is critical resistance right now. There is a confluence of trendlines that intersect, right now at 465, red arrow.

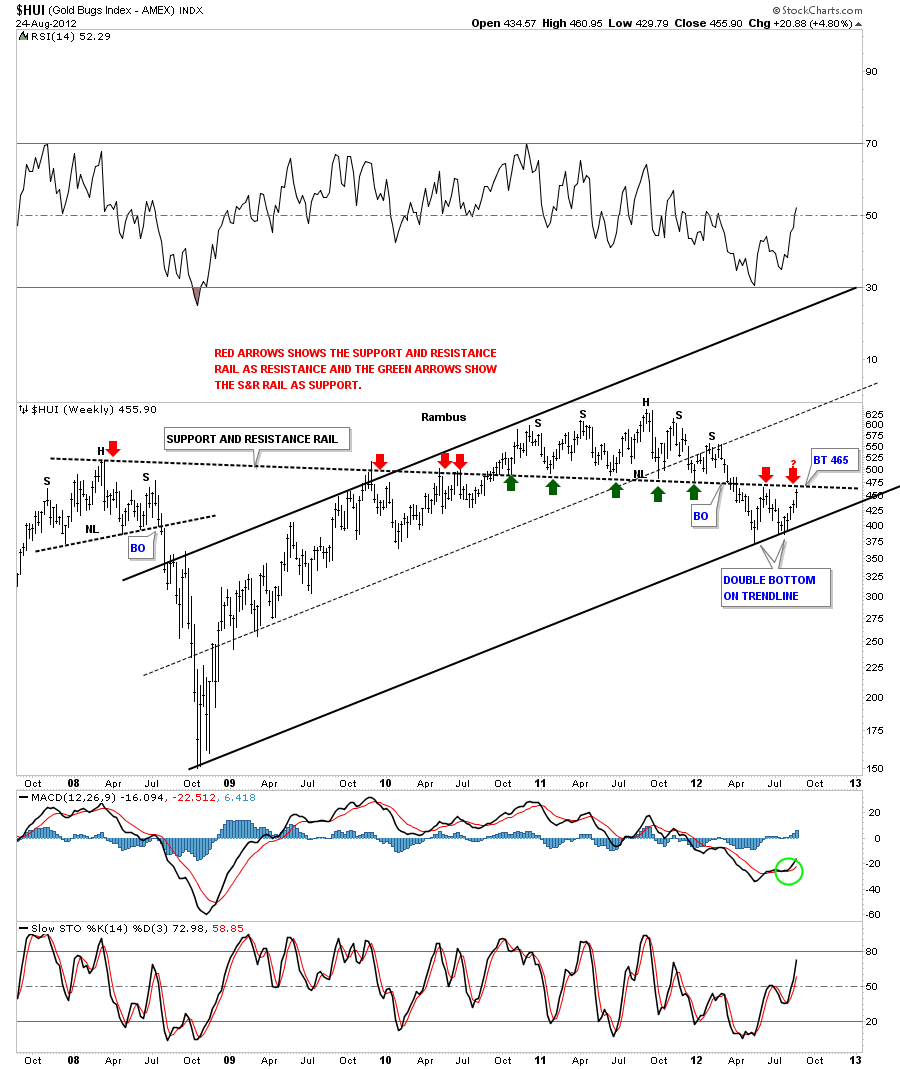

The next chart is a weekly look that again shows why the 465 area is such critical resistance right now. I’ve added a long black dashed support and resistance rail that goes all the way back to the H&S top that was made back in 2008. As you can see it has worked its magic reversing it’s role from resistance at the 2008 high, red arrows, to support at the neckline, green arrows. As you can see we are approaching the S&R rail again from the underside.

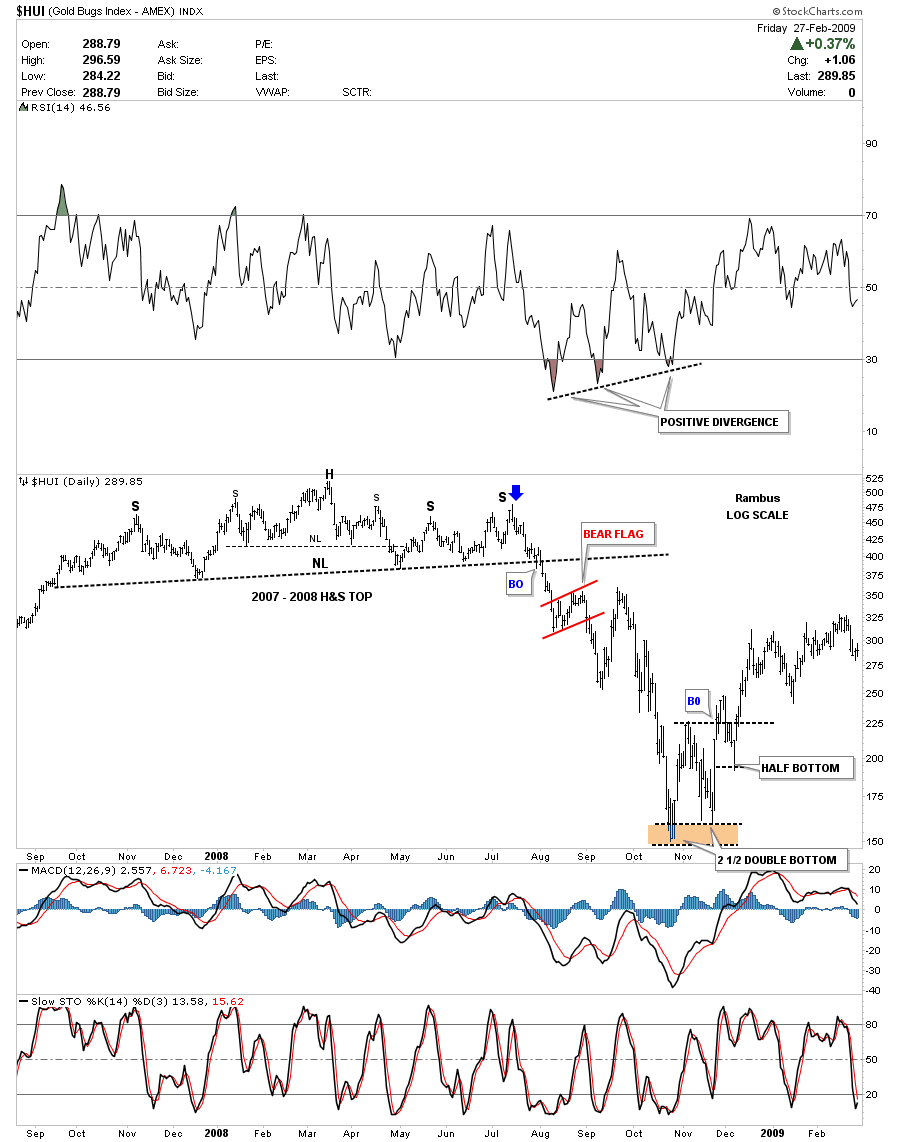

The next chart I would like to show you is a chart from the 2008 period and how similar that setup was compared to our most recent price action. First, the 2008 time frame shows the big H&S top that most couldn’t believe was taking place at the time. Only after the fact did it become apparent. What I want you to focus in on is the 2 1/2 double bottom that was created when prices were finally exhausted. You can see the half bottom formed abut halfway below the double bottom hump horizontal trendline. It didn’t hurt the double bottom pattern that actually reversed the downtrend but it gave a scare to the few technicians that were following the double bottom development. The rest is history as they say as the HUI went on to trade above 600 before it topped again.

The last chart I would like to show you is our most recent H&S top and the price action that followed the breakout. This is a comparison chart to the one above. I want to focus your attention to our current double bottom that is in the processing of building out. You may have to do a double take to make sure you aren’t looking at the 2008 double bottom. They are very similar looking.

So far last weeks rally in the precious metals complex moved the price action back up into critical resistance for the most part. It will be a very big tell if and when the precious metals complex starts trading above all the overhead resistance rails that I have shown you in this article. With the dollar trying to top out in here a strong move lower will propel the precious metals and indexes through their critically important resistance rails and take away some of the over head resistance that has been in play for over two years now. This should get everyone caught up on where we are in regards to the precious metals 12 year bull market. All the best….Rambus

EDITOR’S NOTE :

Rambus Chartology is Primarily a Goldbug TA Site where you can watch Rambus follow the markets on a daily basis and learn a great deal of Hands on Chartology from Rambus Tutorials and Question and Answeres .

Most Members are Staunch Goldbugs who have seen Rambus in action from the 2007 to 2008 period at www.goldtent.org and now Here at Rambus Chartology since early 2012 .

To review his Work and incredible calls from the 2007-2008 period click on the top right sidebar in the “Wizard of Rambus” ….”What If !!” Post

To Follow Rambus Unique Unbiased Chart Work and participate in a Chartology Form with questions and answeres and learn the Art and Science and Mindset of a Pro Trader please Join us by subscribing monthly for $29.99 at

www.rambus1.com

We have many subscribers from all over the world who are glad they did as they enjoy the many daily updates and commentaries provided at this exciting new site

As you will see Rambus (Dave) has prepared us for this difficult period by being one of the only ones to see and warn about this incredibly debilitating PM smackdown as early as Jan 2 2012 …click on the” HUI Diamond in the Rough” Post in the “Wizard of Rambus” top right

And Now Rambus is Preparing us for a Potential Big PM Rally

Dont miss Rambus PM Portfolio of 20 of the Best Stocks which is in the process of being developed now

You will find Rambus to be a calm humble down home country tutor with an incredible repitoir of all the TA based protocols tempered with his own one of a kind style…simply put…He wants to keep his subscribers on the right side of these crazy volitile and downright dangerous markets

See you at the Rambus Chartology

…………………….