My past two weekend reports have armed the investor with ideas for the coming year 2018. This week’s report summarizes those ideas, updates the current PM rally and adds more ideas to the list. It is important to understand the driving force which will fuel the coming bull market in precious metals so I lay it out. I will then focus on what I consider the best risk/reward Precious Metals Royalty company… Sandstorm Gold Royalties.

Previous reports have detailed that we are in the end game of this Economic expansion and bull market in stocks. Numerous interest rate indicators suggest the economy and stock market have further to go before they peak as it appears likely the expansion has about 12-18 months remaining. During this time the FED plans to allow the economy to run HOT with inflation exceeding its 2% target. Mind you this will not be the “good” kind of inflation as it is likely to manifest itself as stag-flation. Think 1970’s.

Eventually the FED will be forced to respond to the threat of galloping inflation by raising rates which will result in pricking the bubble. That’s when things get very interesting, we will pick this theme up below, but first let’s analyze the current rally in gold and PM stocks.

GOLD- Puts in an Isolated Low

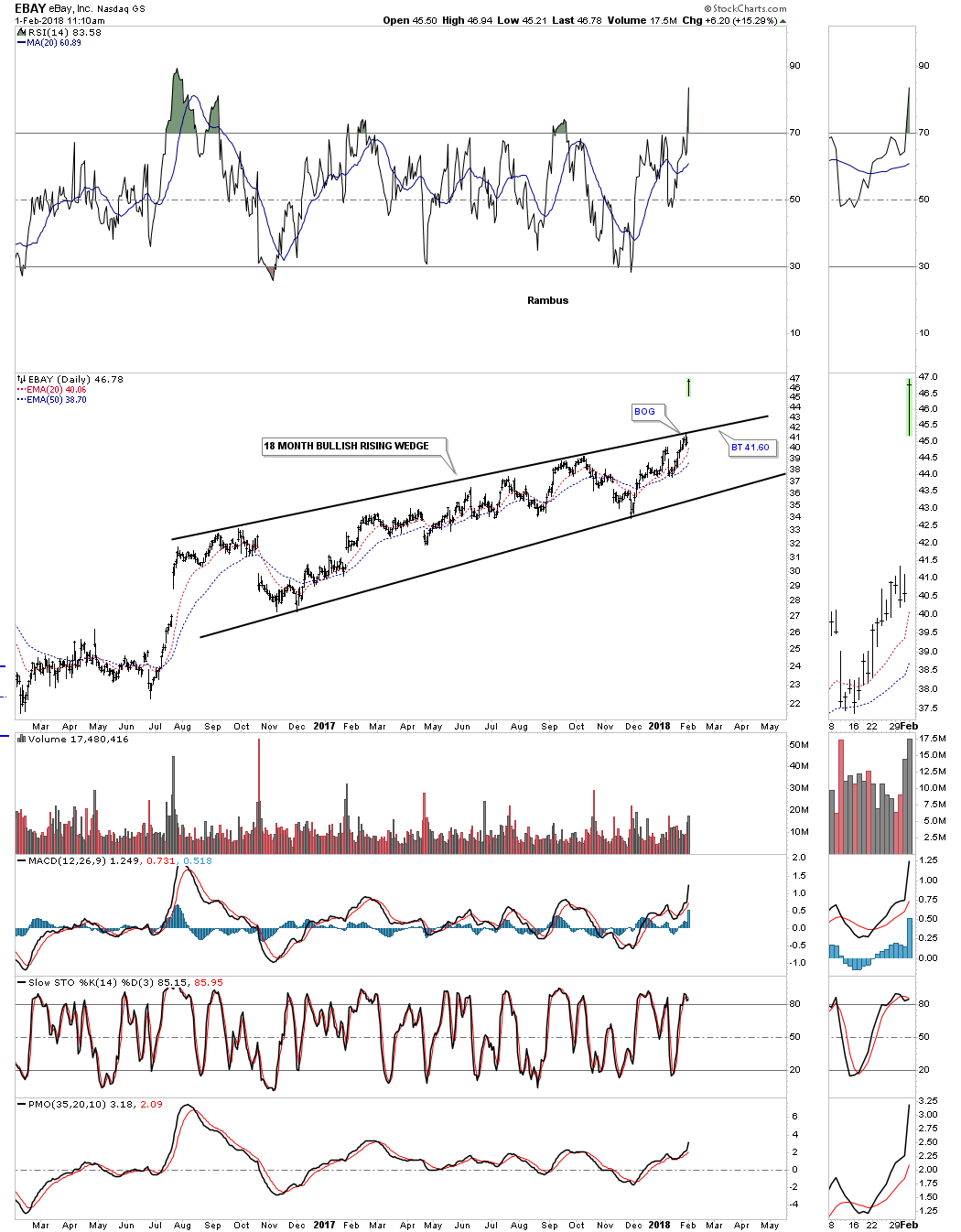

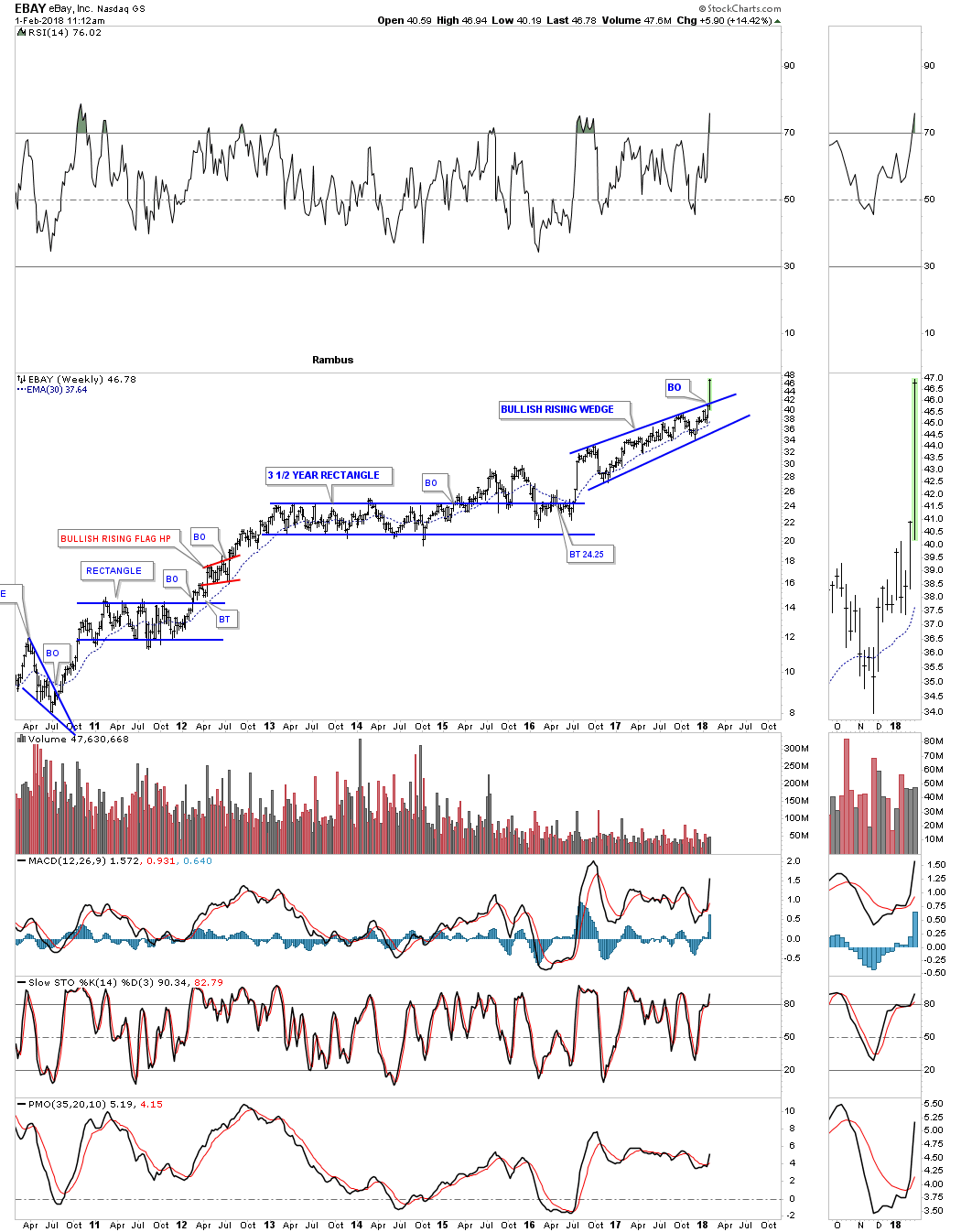

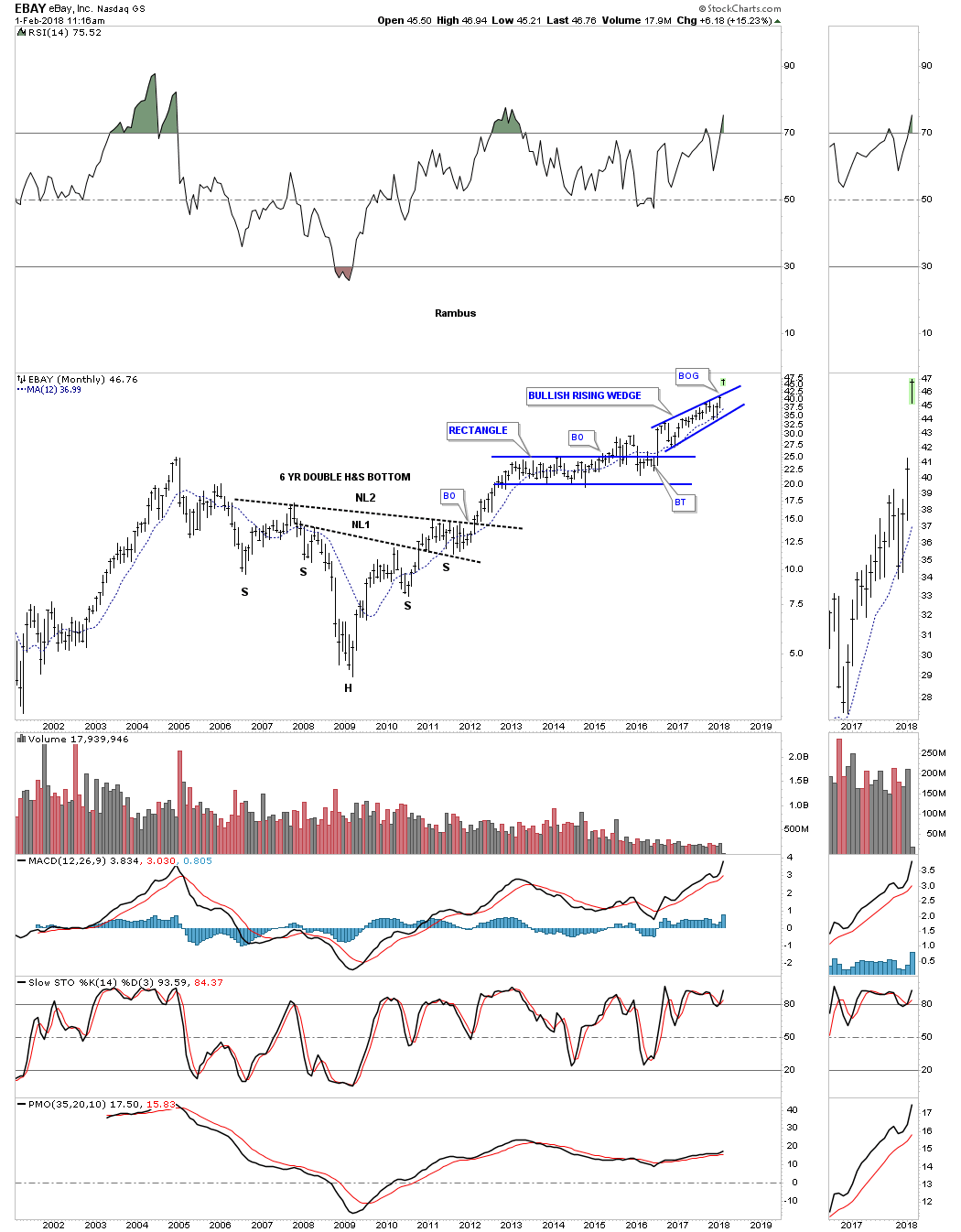

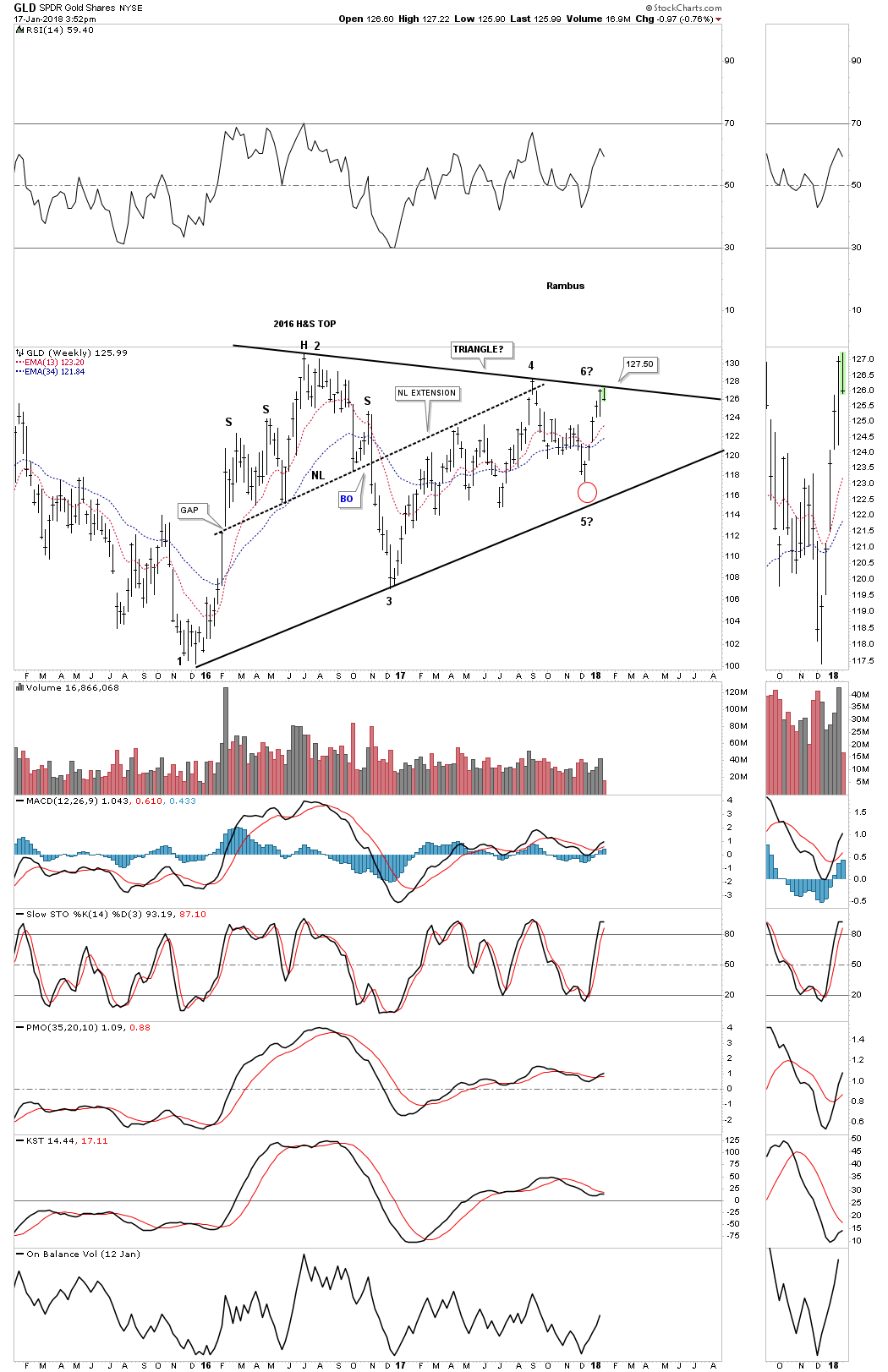

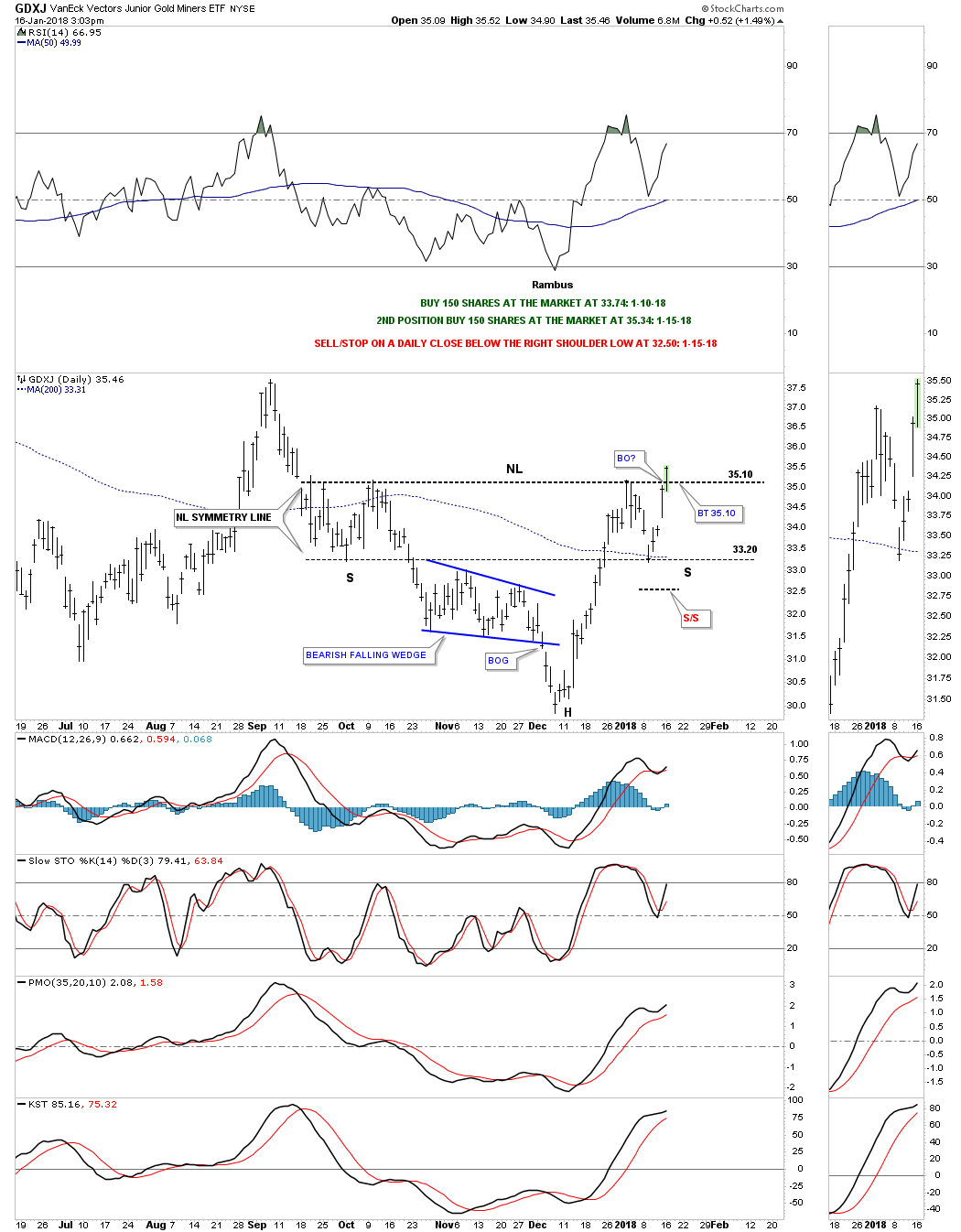

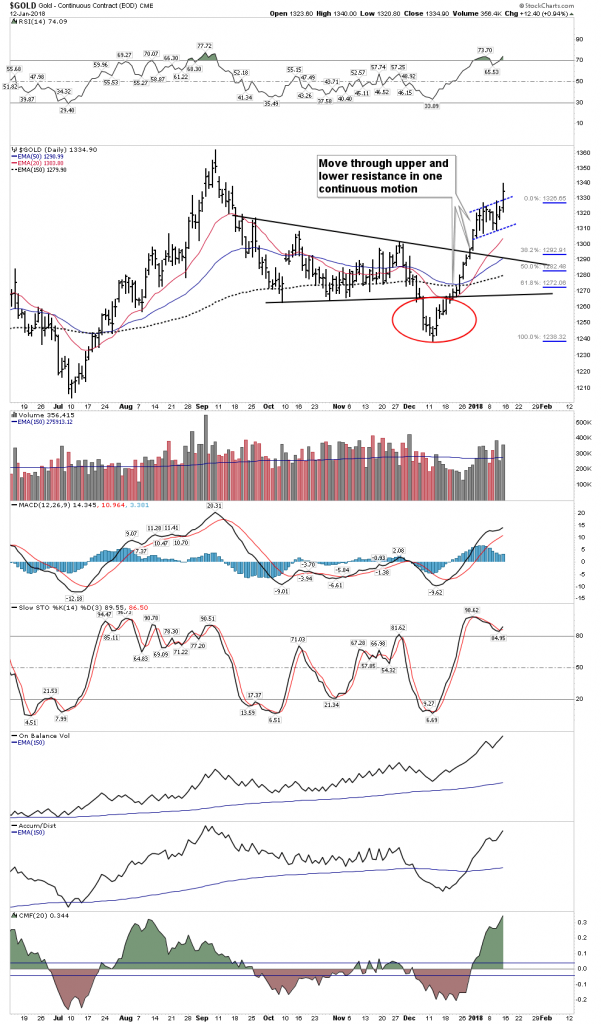

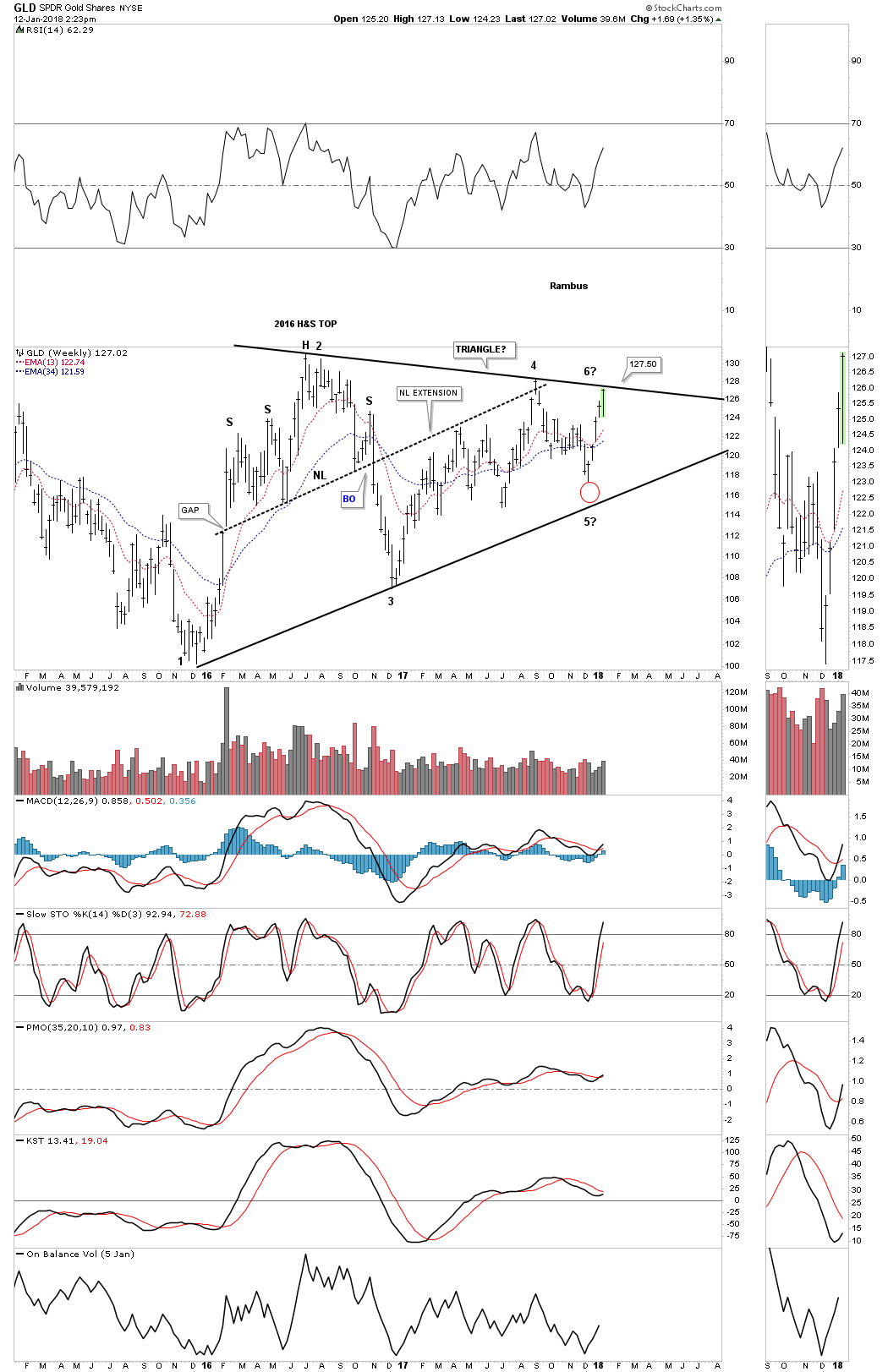

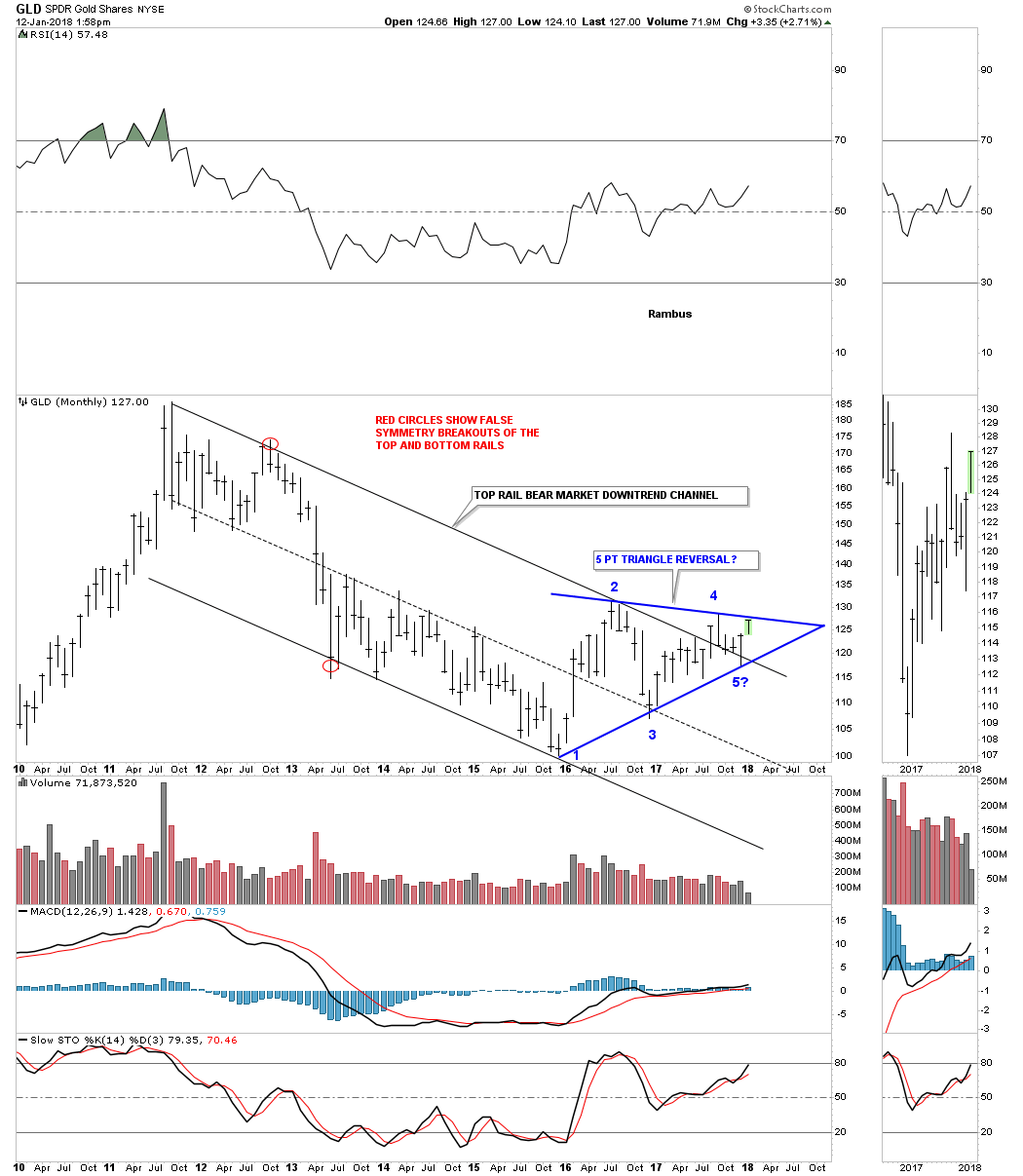

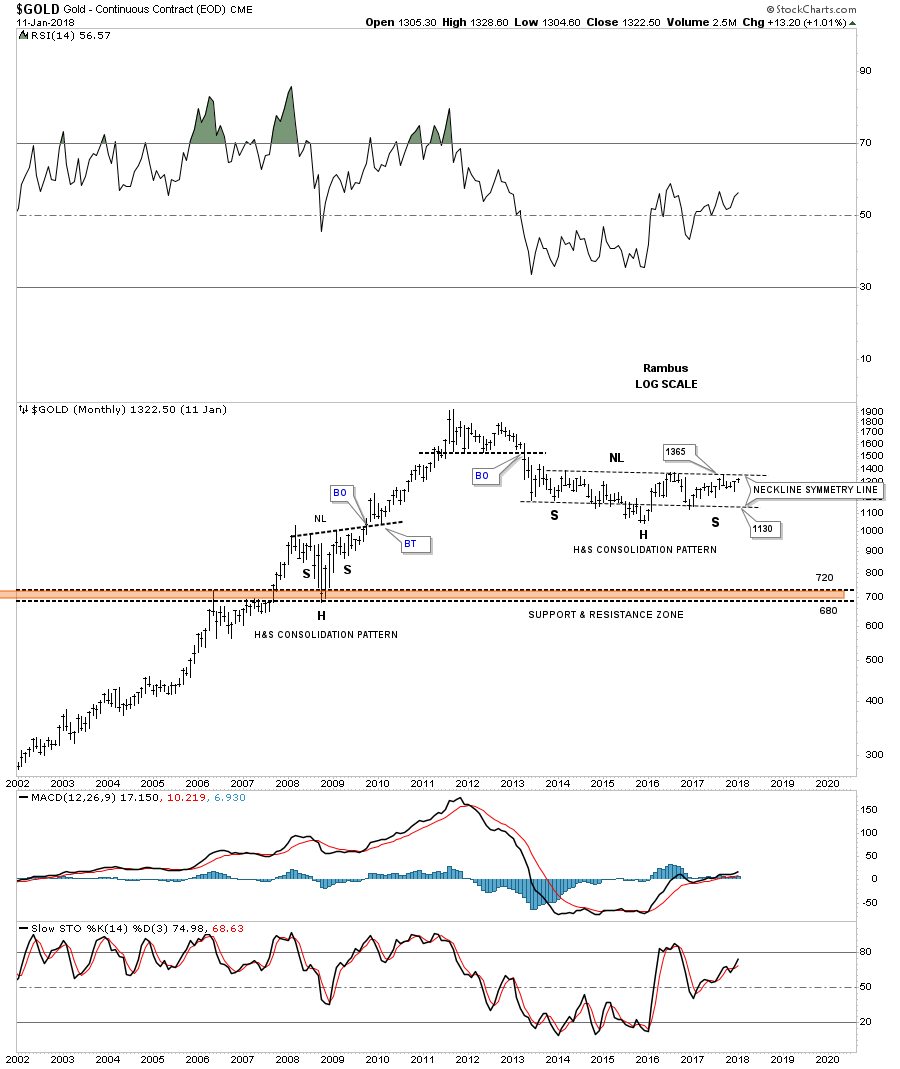

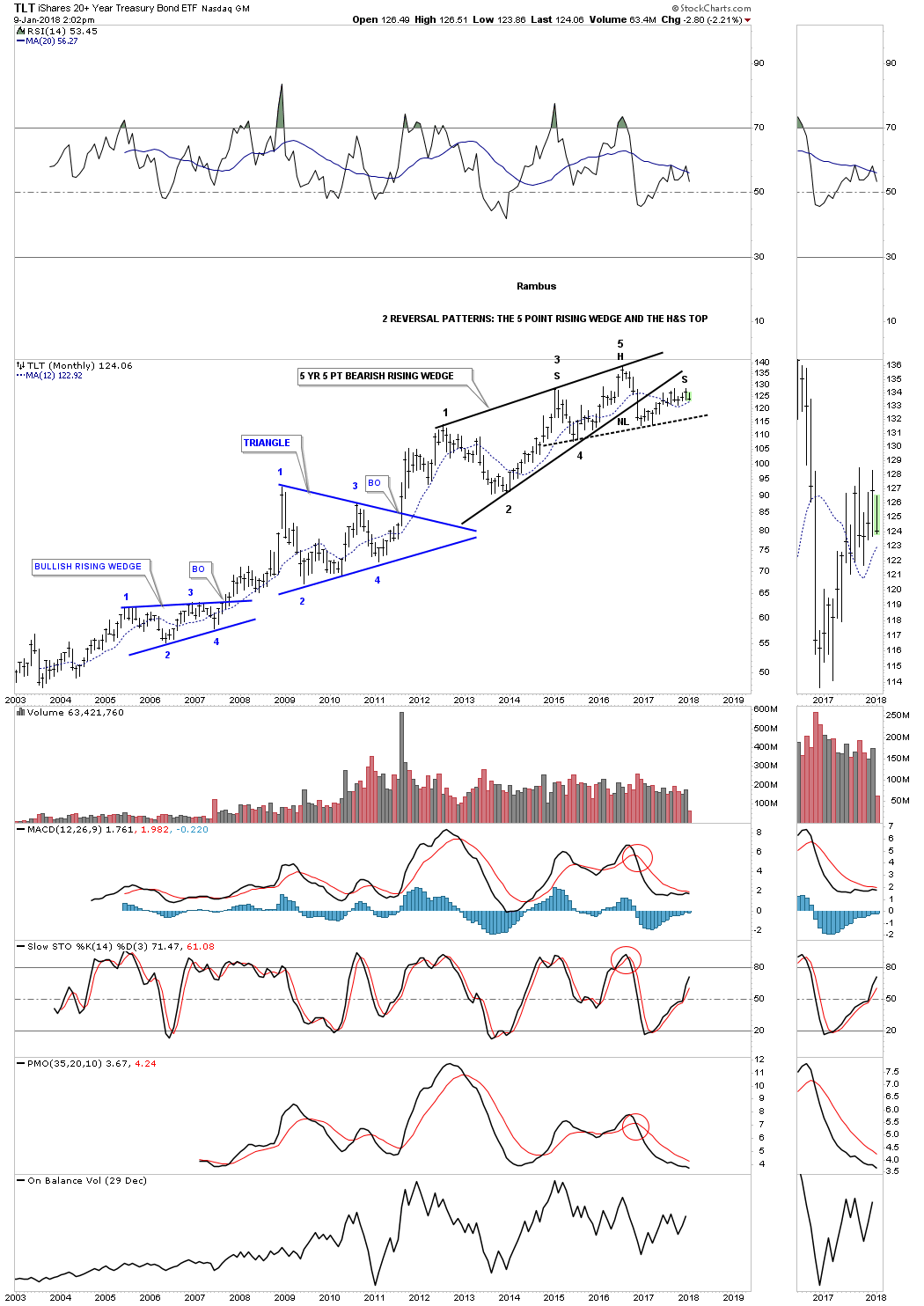

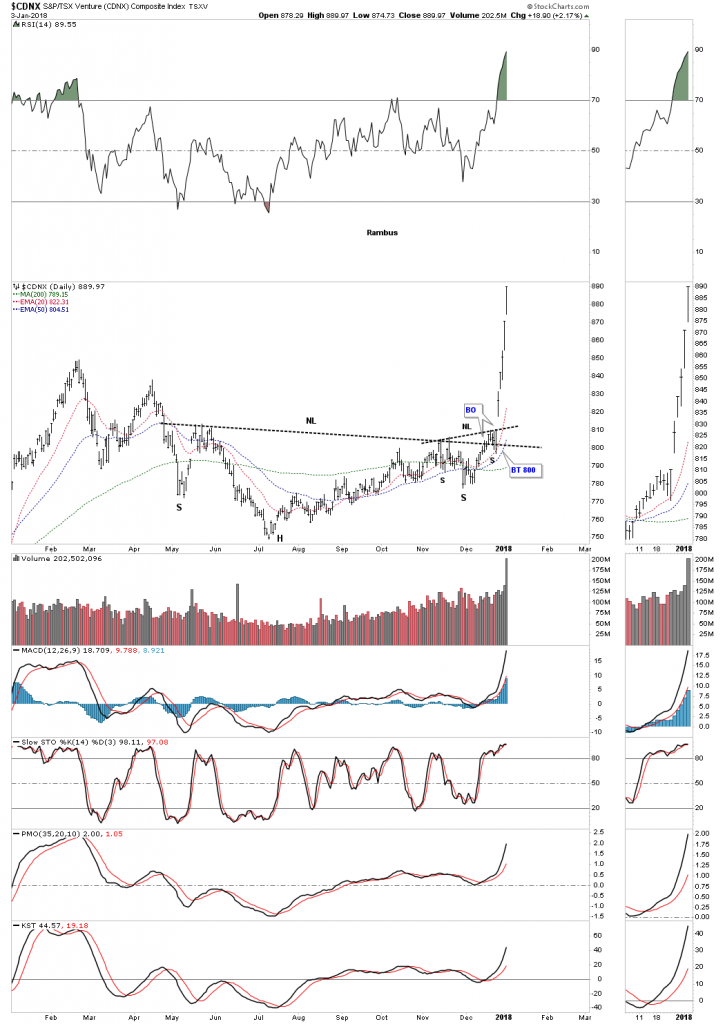

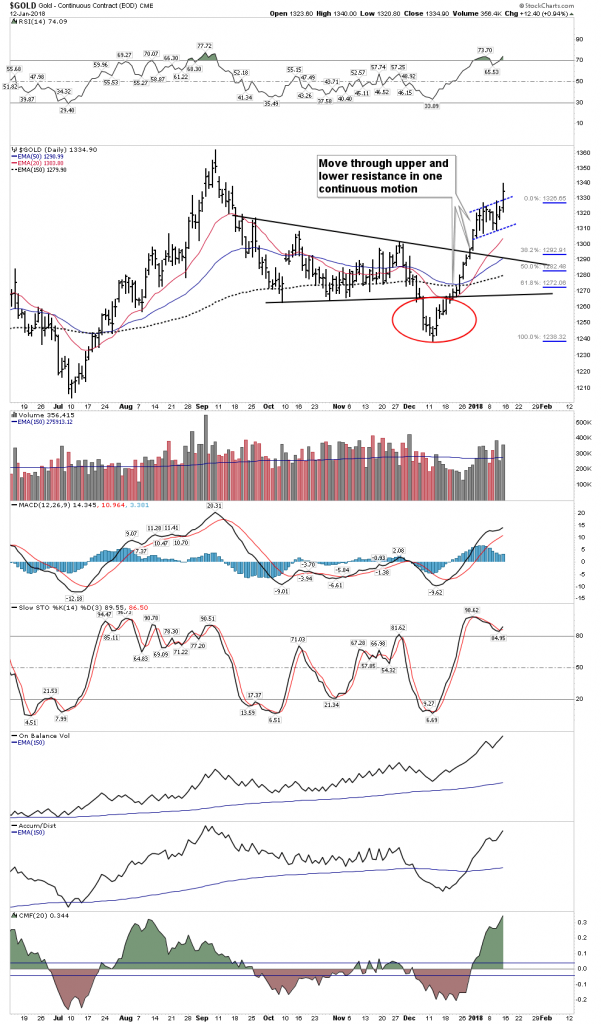

On 12 December gold put in a low of $1238 USD. The tell was the previous days volume was the lowest since August 7th. Very few sellers were willing to sell at that depressed price while others simply stayed home. Furthermore, the COT was generating a major buy signal as commercials used early December to cover their shorts and retail longs finally gave up and sold their long positions. In the chart below we see how gold underwent a 2-week power dive from late November to early December, slicing down through its horizontal contracting triangle.

This breakdown was a capitulation move which can now be seen as an isolated low. Gold was now primed for a sling shot move which then ripped up through upper and lower resistance lines without pause in one continuous motion. This past week it paused in a consolidation of the 4-week move but Friday broke out above above it. The consolidation lasted 2 weeks and can be considered an upward running consolidation.

I do not believe this is the beginning of Phase II in gold’s bull market which started in Dec 2015, however one cannot know for sure this early. It is my assessment that it is simply just another rally within an on going correction of the upside move from Dec 2015-Aug 2016. It is however, a tradable rally which is likely now approaching it’s halfway point. Late February to early March would be appropriate timeframes for it to end. If this is how it actually unfolds I will be taking profits at that time.

So here is what to look for: The 2-week running consolidation now appears to be over as of Friday. During that consolidation it was essential that any pullback not be any deeper than 50% of the initial move. That level is $1282 as can be seen on the FIB retracements. A daily close below this level aborts the rally. These type of rallies off of isolated lows typically last on average 9 weeks plus or minus 3. That would bracket an interval from 18 Jan-15 Mar. If the dashed running correction bull flag I have drawn resolves into an upside breakout this would be a markedly strong move and could point towards a measured move slightly above $1400. After Friday’s action this appears to be the case.

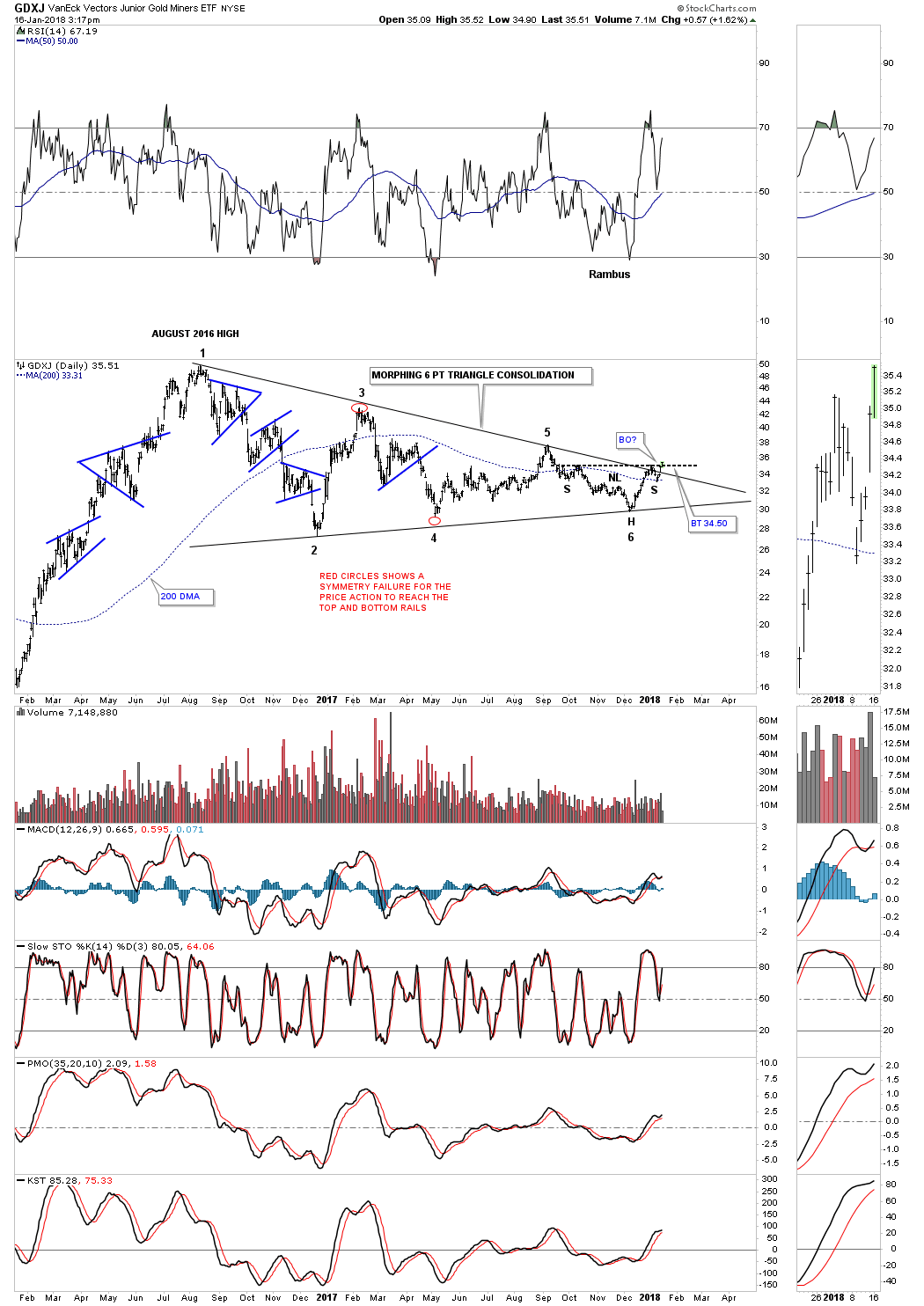

As always I defer to Rambus’ exceptional charts of the PM sector, but I also post my own below to show a different approach to compliment his work.

Weekly Global Gold Index- Shaping up for an end around apex breakout?

Daily Global Gold Index- Surged right up through the 200 & 150 EMA in one day:

GDX- Friday’s action shows the move resuming:

The USD

Yes, we all know the ultimate destination for the USD is to lose its status as the world reserve currency and to become simply a regional currency as the British Pound is today. But how it gets there no one really knows. It is my understanding that before it loses its reserve status it will undergo a rally of strength during the post bubble contraction phase after the bubble bursts. I have forecast that the bubble begins to burst within 1-2 years.

Below we see a chart of the USD from 1989-1991 where it reversed a 2 year bear market with another example of an isolated bottom. The pattern we see has similarities to what the current bear market in the dollar shows today. Note the prolonged accelerated decline and the bounce up to the 30 W EMA. This average then repelled three weekly price bars before the price resumed downward. The USD then went on to violate the previous low and put in an isolated low.

The current chart of the USD has a similar appearance. If the same outcome were to occur it would support the scenario of the gold rally I have described above. Over the next two months a breakdown below previous lows would juice the gold price, perhaps above $1400. However, a bottom in the USD followed by a renewed uptrend would likely crush the existing gold rally. We will be keeping an eye on this as a possible outcome.

Boeing (BA) is it starting to sniff out a USD devaluation?

Boeing has a historic pattern of declining after the Paris Airshow in June, similar to mining stocks declining after PDAC. Therefore I attempted to short Boeing last summer at the time of the airshow. It was a short-lived unsuccessful trade. Judging by the huge rally in the stock one would think their earnings are going vertical as well, however they are not. So what’s behind the parabolic rise in the stock? Maybe it’s the market sniffing out an eventual devaluation of the USD? Boeing more than any company would profit from such an event. Their product pricing would then have a huge advantage over Air Bus or Bombardier.

Put Your Macro Hat Back On- The Fuel for The Upcoming Bull Market in Gold.

The transition of the USD from the world’s reserve currency to a regional currency will be wildly bullish for gold and the mining stocks.

Gold is historically undervalued relative to the US Government’s outstanding debt position. When these debt obligations are finally resolved either through default, inflation or renegotiation, gold will become the prime asset that collateralizes the FEDs balance sheet since the value of its existing collateral made up of its bonds will be diminished. This process will cause gold to rise to levels which the general public cannot remotely conceive of today.

In the next financial crisis gold will serve the role which the CDO fulfilled in the last crisis in 2008. As debts imploded the short sellers used the CDOs as their vehicles to capture the trade. However, those CDOs didn’t move until the crisis was well developed. This is why the characters in the movie The Big Short underwent prolonged pain before their accounts finally rose. I suspect gold may perform the same way, with its vertical rise not arriving until late in the sequence since its price is principally determined through paper instruments. However, once the paper is swept away the spring tension will be released. This means that its rise should be instantaneous and could occur literally overnight. This is what occurred in 1934 when FDR reset the gold price and its why one needs to be in the trade early on. Keep in mind that central banks create not only bubbles, but they also create anti-bubbles. The foremost anti-bubble in the world today is of course gold. When the compressed spring gets released in the next crisis it will be too late to acquire a position.

Inflation is Coming

Recall the visual picture of massive FED QE analogous to record snowfall in the mountains. It’s not a problem to valley dwellers until the temperature rises. A warming economy (increased monetary velocity) has the same effect, it releases the stored up credit in the economy. Let’s look at another visual picture that portrays the process of FED money printing:

A man in the shower initially turns on the water only to get a trickle of cold water. So he turns the knob up a notch…more water, but still cold. He turns it some more…still cold. Finally he turns it all the way and eventually gets scalded with gushing hot water. This is what the FED has done with each QE program, unsatisfied with the result they continued turning the knob. Recall the last turn was called QE to infinity… no different than the man in the shower turning it full hot.

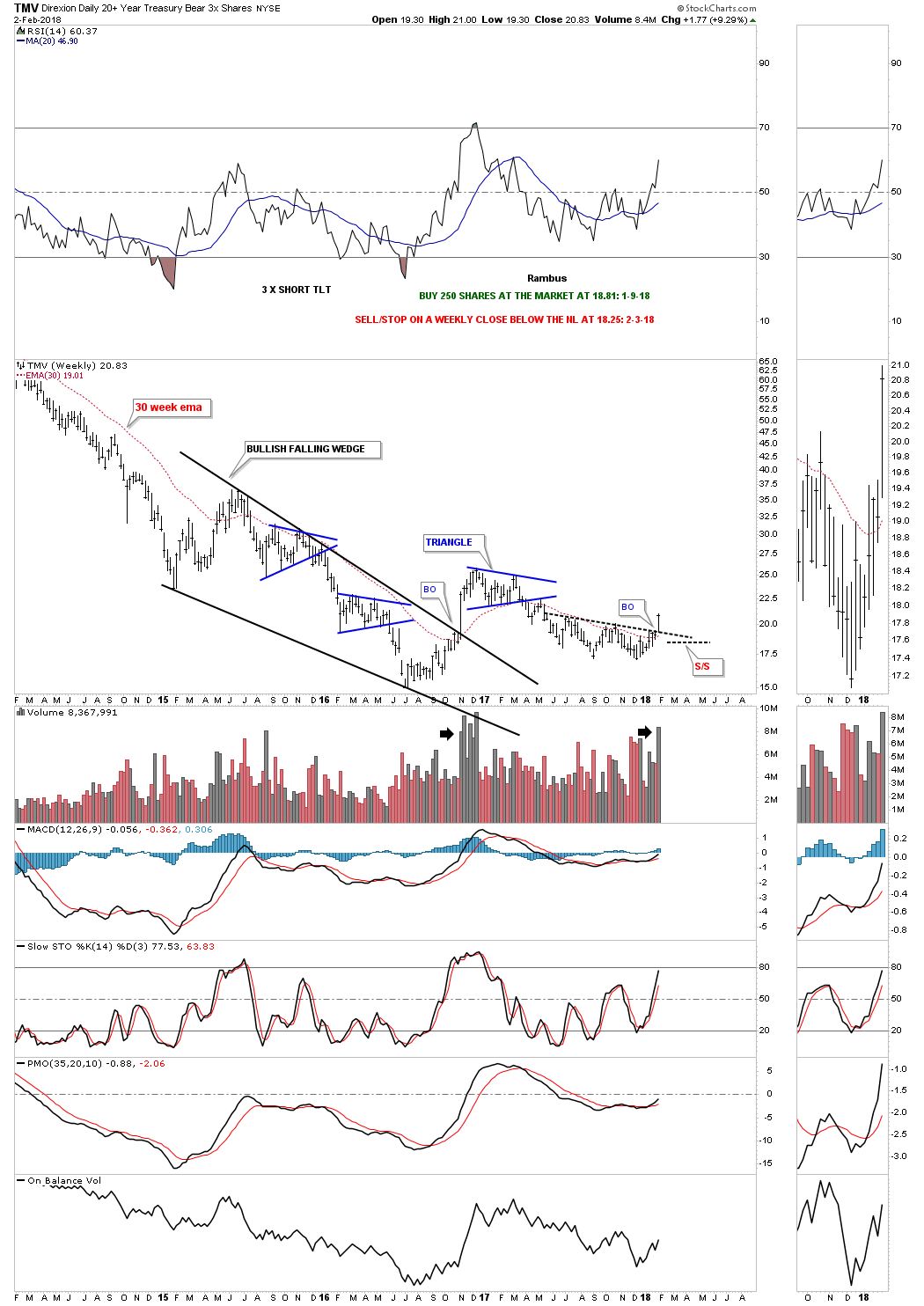

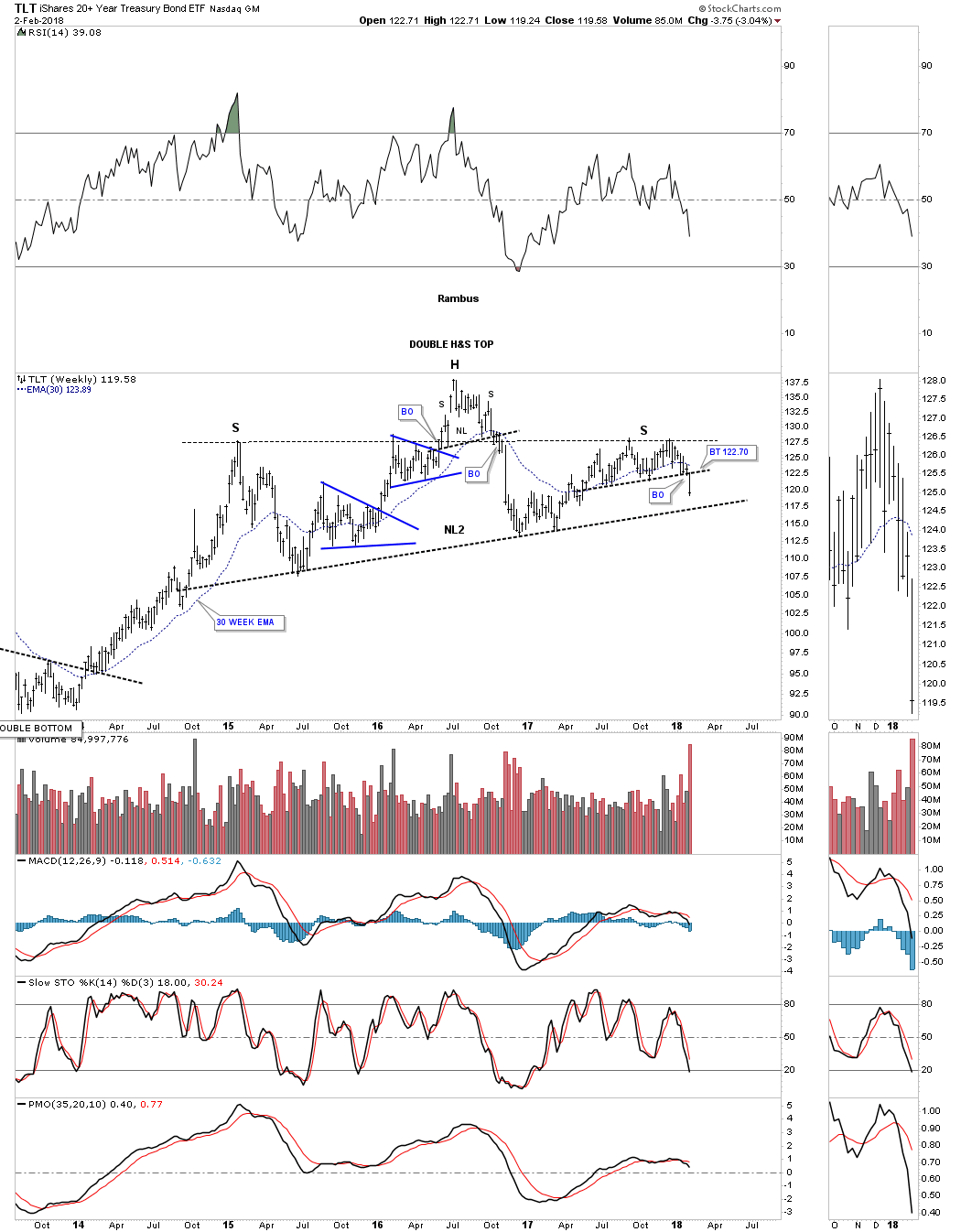

We can now see their efforts unfolding in the charts, the Chartology has set up, inflation is getting ready to bust out. Eventually the FED will respond to it and will prick the bubble.

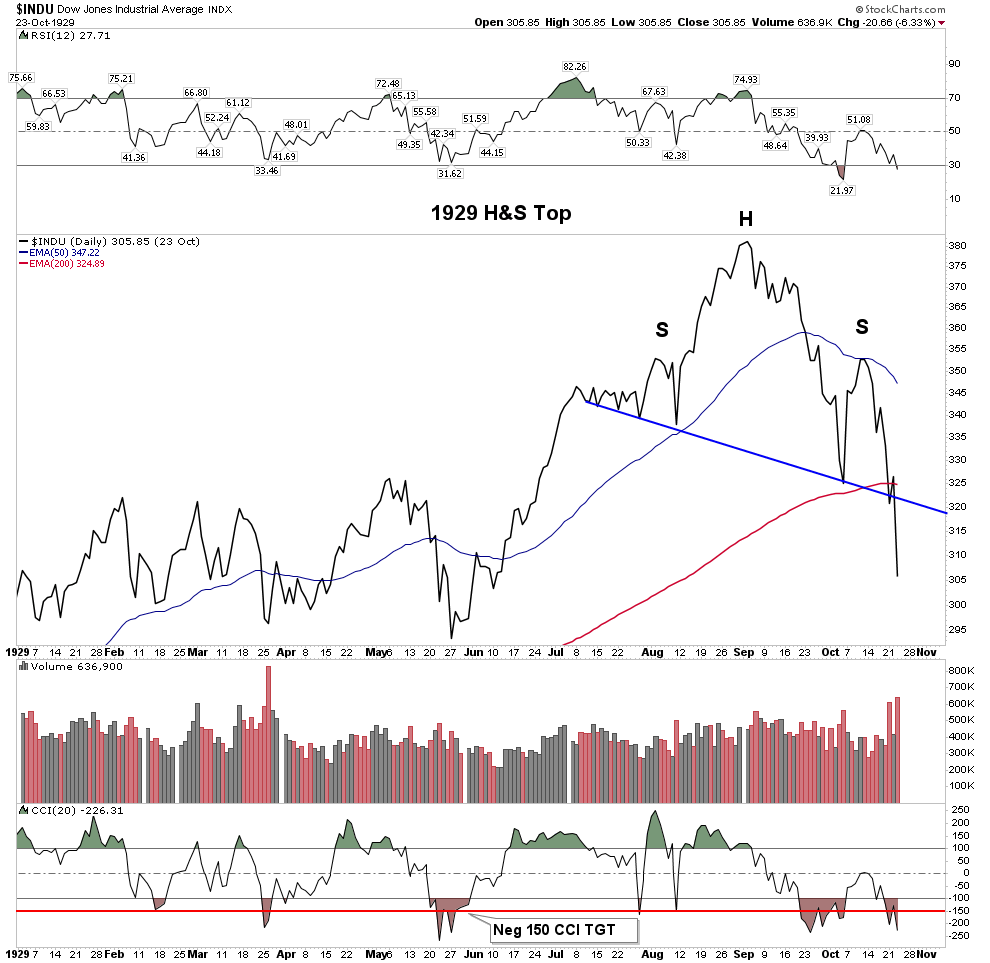

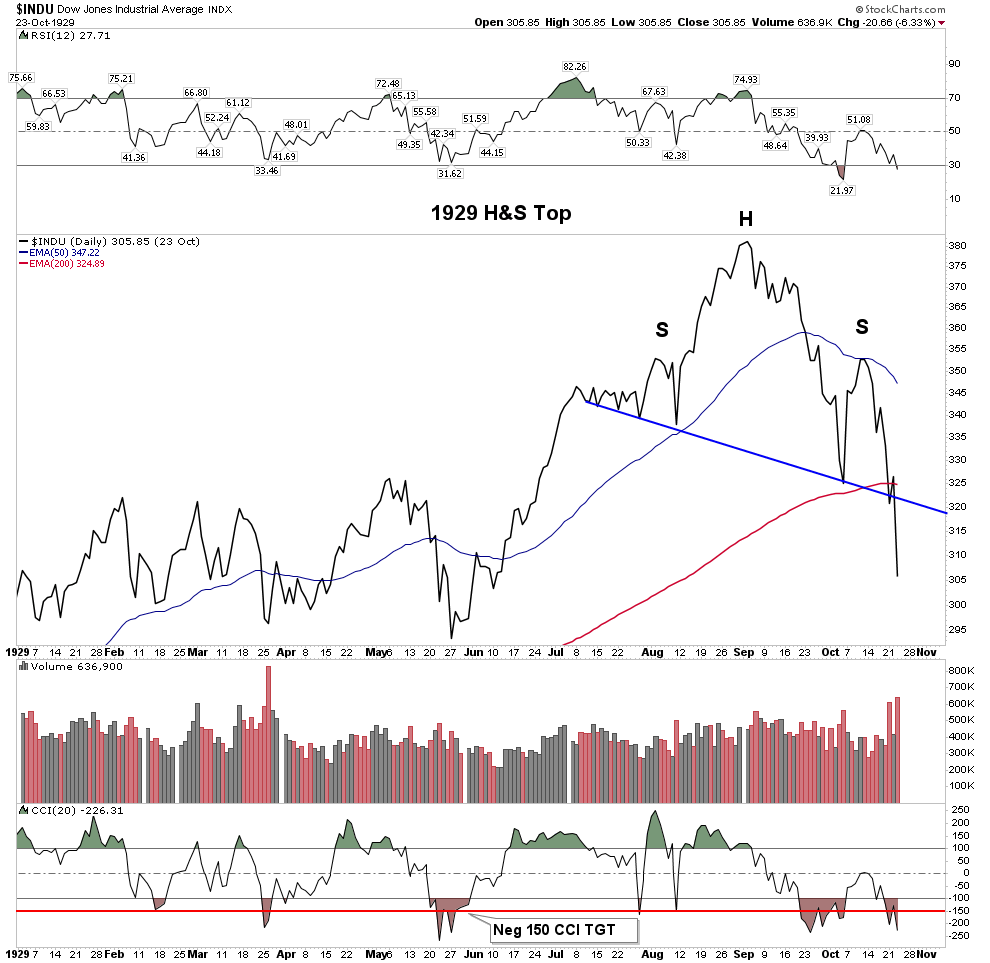

A 1929 Review- Past is Prologue

1925– The FED believed they had abolished panics (sound familiar) so they lowered rates which ignited the boom phase of the bull market. This was done to accommodate the British in their need to stem the flow of gold out of England due to Churchill pegging the gold price too low at the pre-war exchange rate.

1926– Commerce Secretary Herbert Hoover warned of the danger of excessive speculation and excess use of credit.

1927– Benjamin Strong, NY FED chairman again helped the British by lowering USD rates to 3.5% to strengthen the British Pound. He literally referred to this as “administering a coup de whiskey” to the stock market. It indeed worked!

1928– With speculation getting out of hand by February 1928 the FED changed policy and began raising interest rates.

1929– Paul Warburg, prominent banker, warned that “speculative overexpansion invariably ends in overcontraction and distress”.

The FED was not able to reign in the excesses as they had now taken on a life of their own. With no remedy provided by any authority the excessive speculation was left to produce its own cure.

The bursting…by August 1929 the FED had raised rates over the past 19 months by 2.5% thus reaching 6.0% This 2.5% rise served to prick the bubble. There was no other outright visible catalyst for the crash of 1929. The overheated, over indebted edifice simply began it implode onto itself.

Other historical bubbles such as the British Railway boom had its bubble pricked in 1845 by the Bank of England when they raised rates from 2.5% to 3%. The worst depression in USA history began with the bursting of the railroad bubble in 1873. The country had been engaged in speculation for the past 13 years leaving it with mountains of bonds that came crashing down ushering in a 20 year depression.

The point here is that prolonged excessive speculation leads to contractions. The FED has been enabling rampant speculation since the mid 1980’s starting with Michael Milken’s bond orgy.

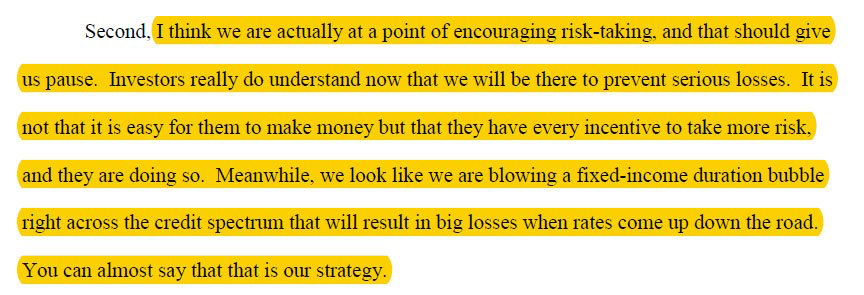

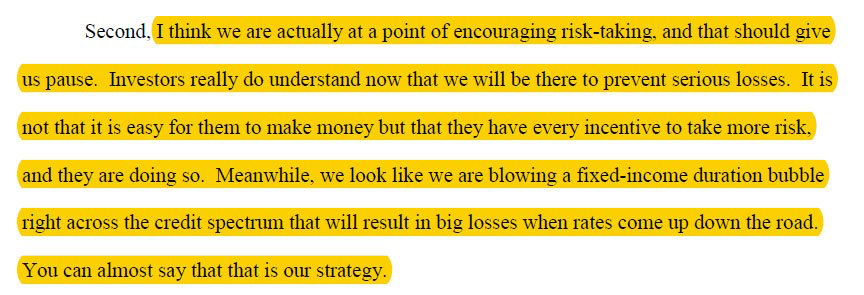

The FED has been intent on blowing a bubble to induce speculation. This plan is revealed in the below quote taken from FED minutes by none other than the new FED chairman Jerome Powell in this rather shocking revelation:

Almost say?

Von Mises made clear that a credit bubble can have only one resolution: liquidation. The historical record bears this out and gold is the only asset one can count on to rise during such liquidation. Credit bubbles run in cycles and they inevitably end. Our keynesian overlords have blown this bubble beyond all historical boundaries. It will deflate, however this time the process could entail an inflationary outcome due to the purposeful devaluation of the USD.

Preparing for the next 10 years

It is now time to prepare for the next cycle. One can ride the tiger of the current stock market and try to jump off at the top, but as I have said…good luck with that, Sir Issac Newton tried that in the South Sea Bubble and lost everything. I prefer to start positioning early with long term buy and hold assets. This requires one to take on non-consensus positions and eventually be proven right. I have said it before, I want everyone to agree with me, only later.

Whenever the next crisis comes it will undoubtedly include a contraction in the economy and the stock market. It’s not really hard to imagine how the FED will react. Quite simply, they will buy everything that is not bolted down. The government cannot survive a 1930’s style deflationary contraction. Such a contraction would lead to a loss of legitimacy since the government will not be able to fulfill their promises and obligations. The promises of medicare, social security and other social spending can only be met through rising tax receipts. They can accomplish this through inflation which solves their problems. So we see that once the crisis arrives the FED will not choose to fight inflation, instead they will surrender to it.

Portfolio Construction

So what should we own in this coming environment? We need to own investments that have intrinsic or tangible value. Assets that will go up with inflation without lifting a finger. This is an investment sector that has been out of favor for almost 40 years now. Beginning in 1980 the cycle slowly turned away from this sector and began to favor financial assets over tangible assets. That cycle is about to turn again. Let’s look at how one successful team navigated the transition last time from tangible assets to financial assets. Sid Bass and Richard Rainwater were friends and classmates getting an MBA together at Stanford. Throughout the second half of the 1970’s they minted money together investing in the oil sector, however by 1980 Rainwater realized a change was coming. He saw the transition from tangible assets to financial assets and began positioning for the change early. Rainwater didn’t believe in broad diversification he stated “You only have so many good ideas in life, why not put your money in what you really believe?”. And so they did, putting all of their eggs in one basket buying a controlling interest in Disney. They turned their $50 million starter position into $5 Billion.

This 40 year cycle is about to change back to favor tangible assets over financial assets. As the USD is intentionally devalued as a means of solving its debt problem the tangibles will provide a store of value that financial assets cannot. We want to own investments which will flourish in this environment.

Core Positions- Royalty companies

The reason the royalties should be the core of ones portfolio in this environment is because of their financial efficiency and ability to perform in an inflationary environment. It has been said that Warren Buffet is NOT a stock picking genius. Instead, his genius lies in his ability to obtain capital at a negative cost basis. He does this through owning insurance companies. There is a reason that insurance companies have been across-the-board top performers for the past 40 years: their business model is financially efficient. They acquire capital often at a negative cost. If their underwriters do their job correctly the company retains the premiums which becomes their capital base. The same principle applies to the resource royalty stocks as their capital costs are less than the miners and their business model is financially efficient.

Royalties have low over heads and fixed costs of production. Unlike the miners who are subject to increasing input costs the royalties have predetermined set costs for their metal production. This affords them unbelievable leverage in an inflationary environment.

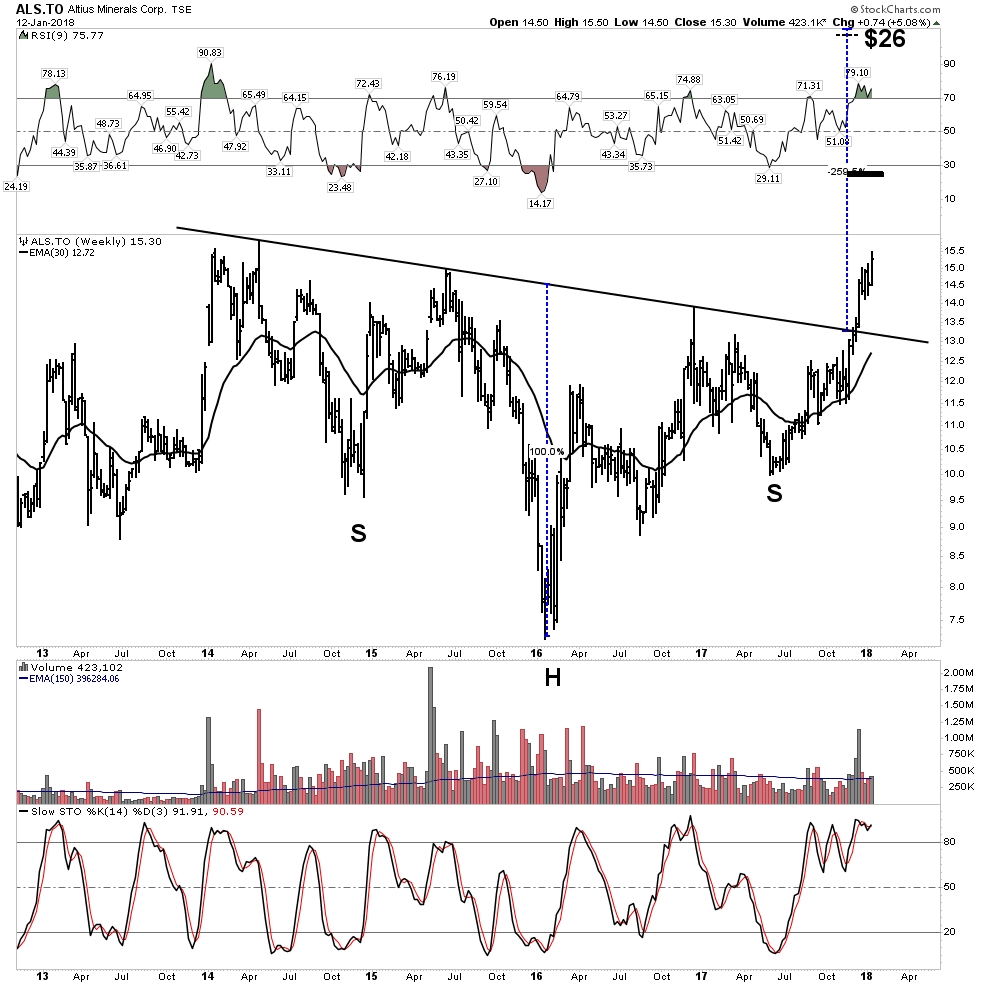

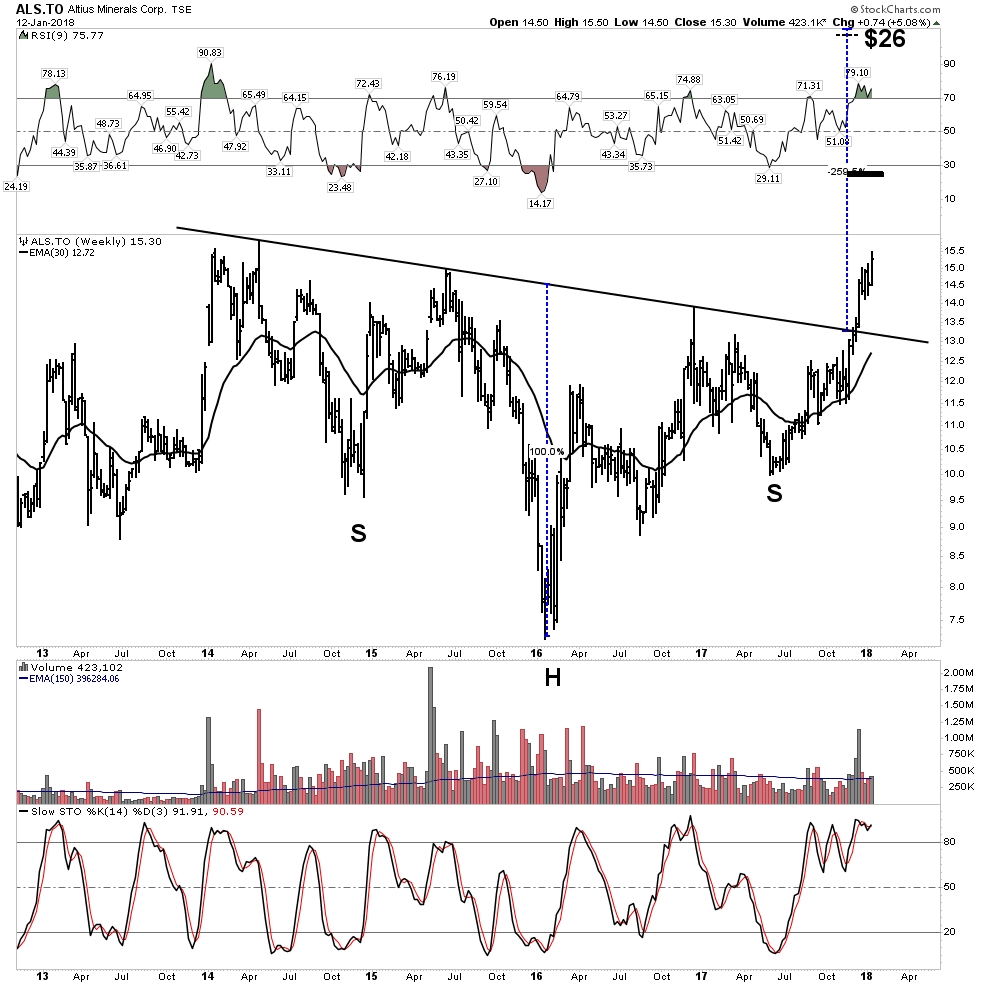

Altius Minerals– This company has been covered extensively before and it embraces this business model and is currently rising in an impressive impulse move. Since my last report Altius has reported an increase in earnings of 81% over the previous year and increased the dividend 33%. This is a coffee can stock… put it away and forget about it.

Monthly- Could the Triangle be a Halfway move?

Weekly- The Impulse Move Continues

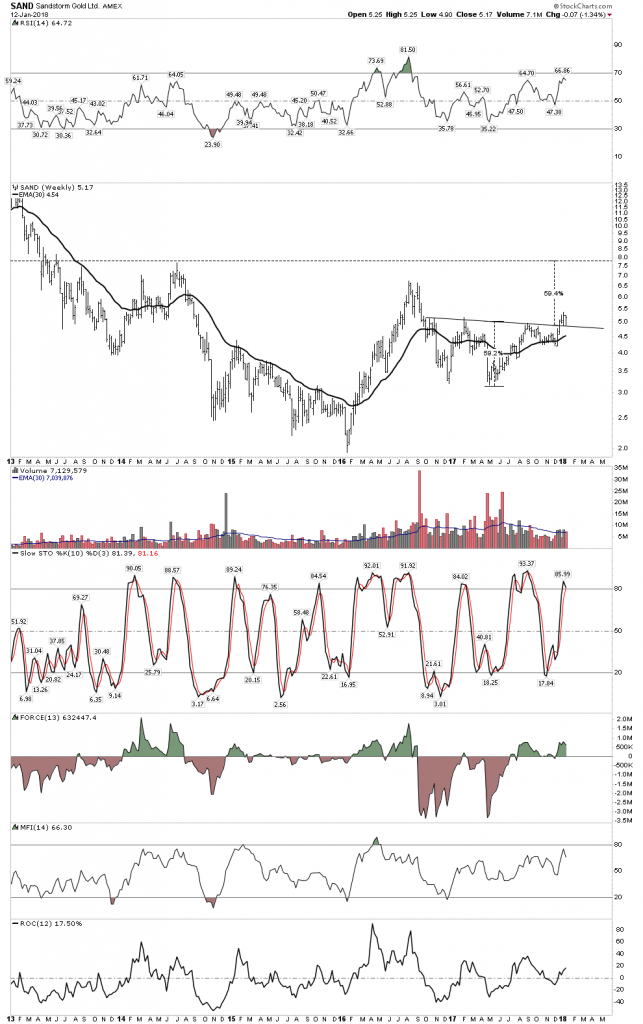

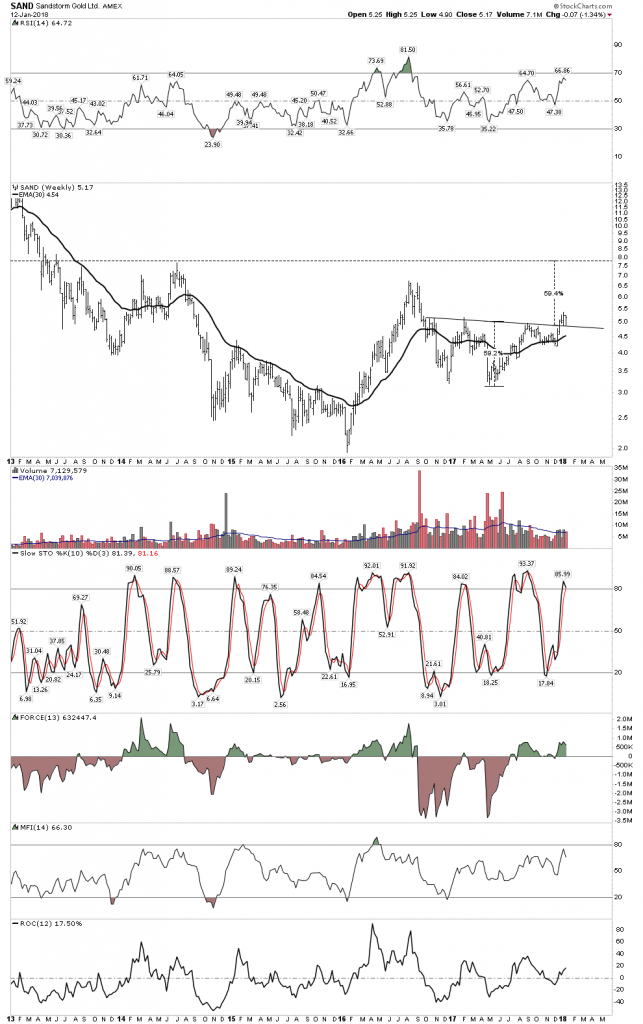

Sandstorm Gold Royalties

I named SAND as my #1 gold pick for 2018. It has the optimal risk reward balance of all the gold stocks IMO. Its CEO Noland Watson is assembling a resource and a team that will make this company a prominent player in the upcoming bull market. Noland was an industry prodigy graduating from college at 19 years old and dictated his own terms in his first job working as the direct assistant for the CEO of a major mining conglomerate. He was in the room for all the deals that this company closed. He moved on to become the CFO of Silver Wheaton and then struck out on his own with start-up Sandstorm. Sandstorm had a great start but then disaster struck for the boy genius. A few of the larger sized deals they had done blew up and the stock got smashed. What I love about all of this is that Noland got hammered then survived. Rick Rule has told me that the reason for the downfall was because Noland wouldn’t listen to his geologists counsel when he did these deals, He thought he knew better than them. There is nothing better than for a young man to have his comeuppance, as a life changing failure which teaches a little humility. I believe he has learned and is much better equipped to run this company after this schooling.

What I like about Noland is he is a no-BS kind of guy. He doesn’t suffer fools gladly. He is on a mission to build Sandstorm into a world class royalty company. Another reason the royalty model is so efficient is because like insurance companies their cost of capital is cheaper than the miners. This is what makes it all work as they can access capital cheaper than the miners and invest it into them. Also their earnings are assigned a higher PE than the miners.

For these reasons the royalties should form the core of ones portfolio in the upcoming bull market.

Below the daily chart of SAND shows the current consolidation resembling the gold chart at the top of this report. If price breaks above the bull flag running correction it has a measured move as depicted at the top of the chart up to $6.50.

The weekly chart below depicts it making a nice back test holding support this past week. You can see a measured move above the NL measures to the peak of June 2014.

Back in April 2017 the stock got crushed when they announced their purchase of the Mariana Resources discovery in Turkey. Initially the market didn’t understand the deal and thought it outside the business model of SAND. Investors, however have come to understand the incredible advantage of owning this claim and the role it will play in Sandstorm’s future. The Hot Maden deposit is a 14 g/t resource with plenty of upside discovery potential. This is the best discovery in the gold sector in years. The mine should begin producing in the year 2020. Recall that S-curve analysis shows companies get re-rated as they get closer to production. So the year 2020 should be right in the sweet spot of the beginning of the next financial crisis and Sandstorm brings on new high grade production. This is one of the reasons I see this stock in the vicinity of $25 once production begins. By 2022 Sandstorm production should be about 130,000 ounces, with production costs virtually fixed.

Osisko (OR)- Another Royalty for the Core Portfolio

Simply put Osisko is a machine… Cranking out projects and spin offs faster than one can keep track of. If you have ever watched Sean Rosen present he impresses as the most knowledgable in the business. Recall he likes to say “wealth is created at the drill bit, everything else is just a derisking operation”. If Sandstorm’s Turkey exposure gives you pause then Osisko is a great alternative since they are focused on North America.

Over the past 4 years since their IPO the stock has been chiseling out a broad base…remember big bases support big moves:

Friday’s one day move in Osisko was impressive. Now with all gaps filled it is ready to go:

Franco Nevada and Royal Gold

These are the blue chips of the group and will serve you well, however I prefer not to hold them as I see Sandstorm and Osisko delivering much more bang for the buck in a bull market.

Noteworthy Stocks in the resource sector:

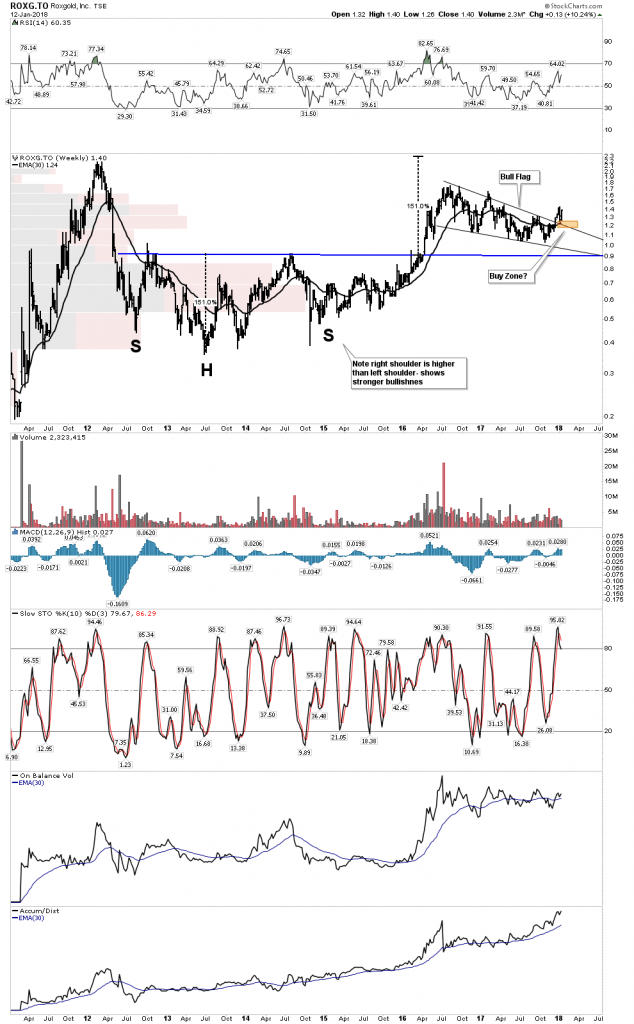

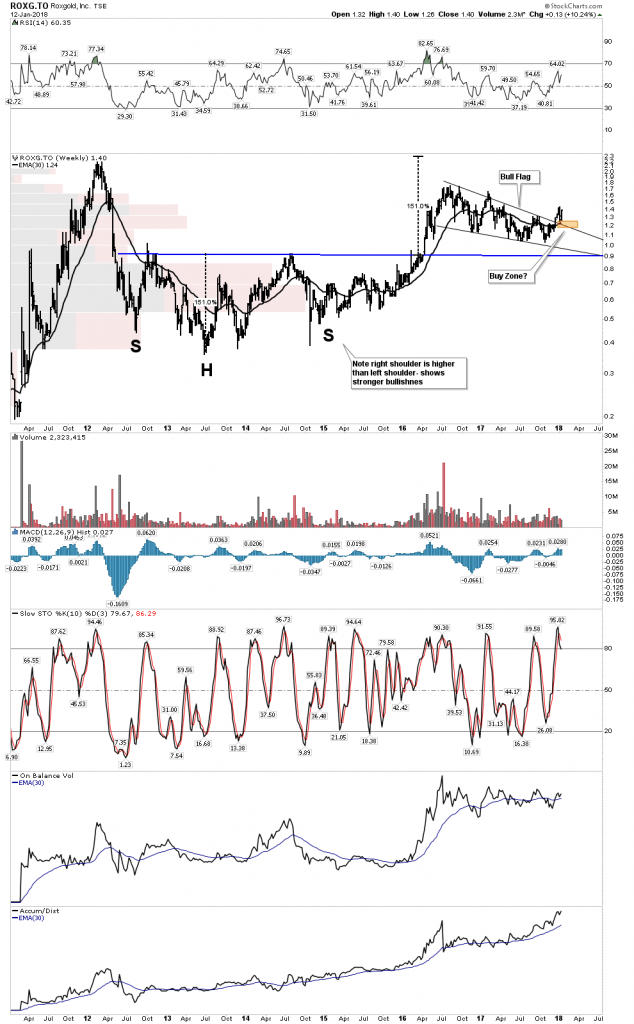

Roxgold (ROGX.to)

This one now looks ready to go. Having spent the past 18 months consolidating its break above the NL. It appears to have completed all of its technical work and is now poised to move higher.

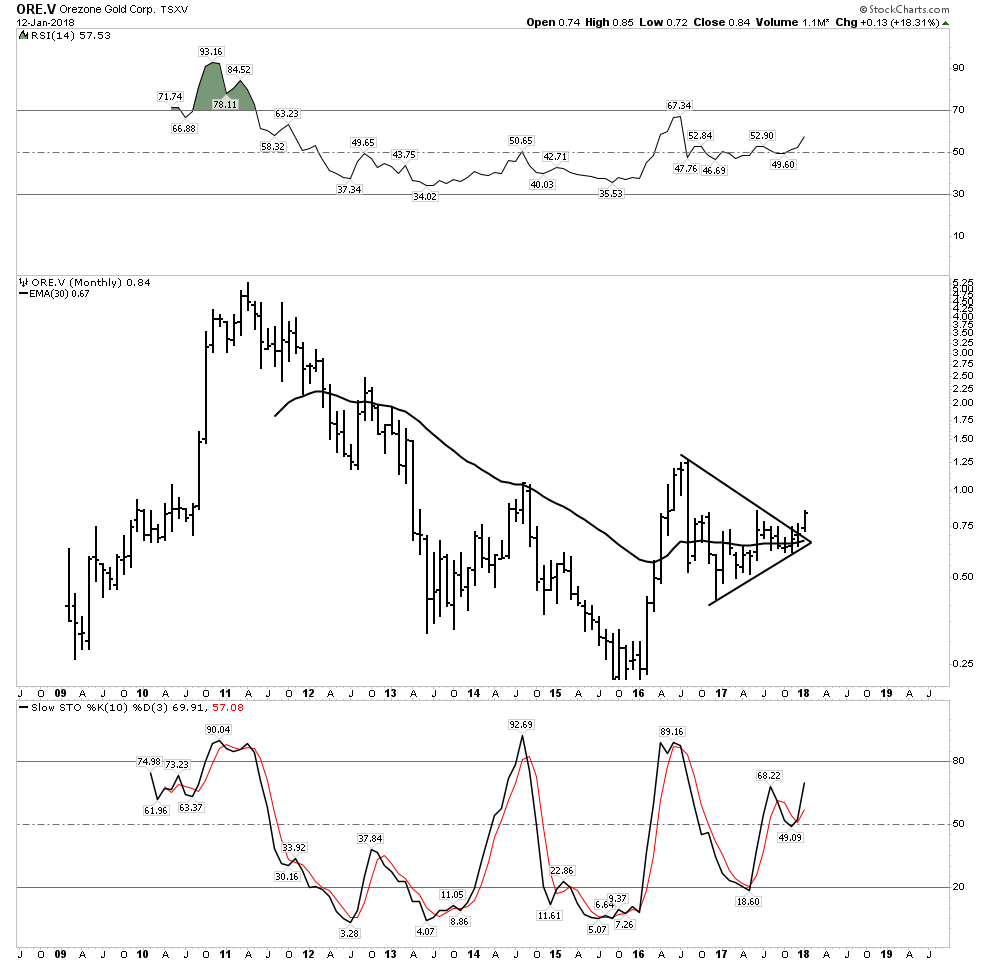

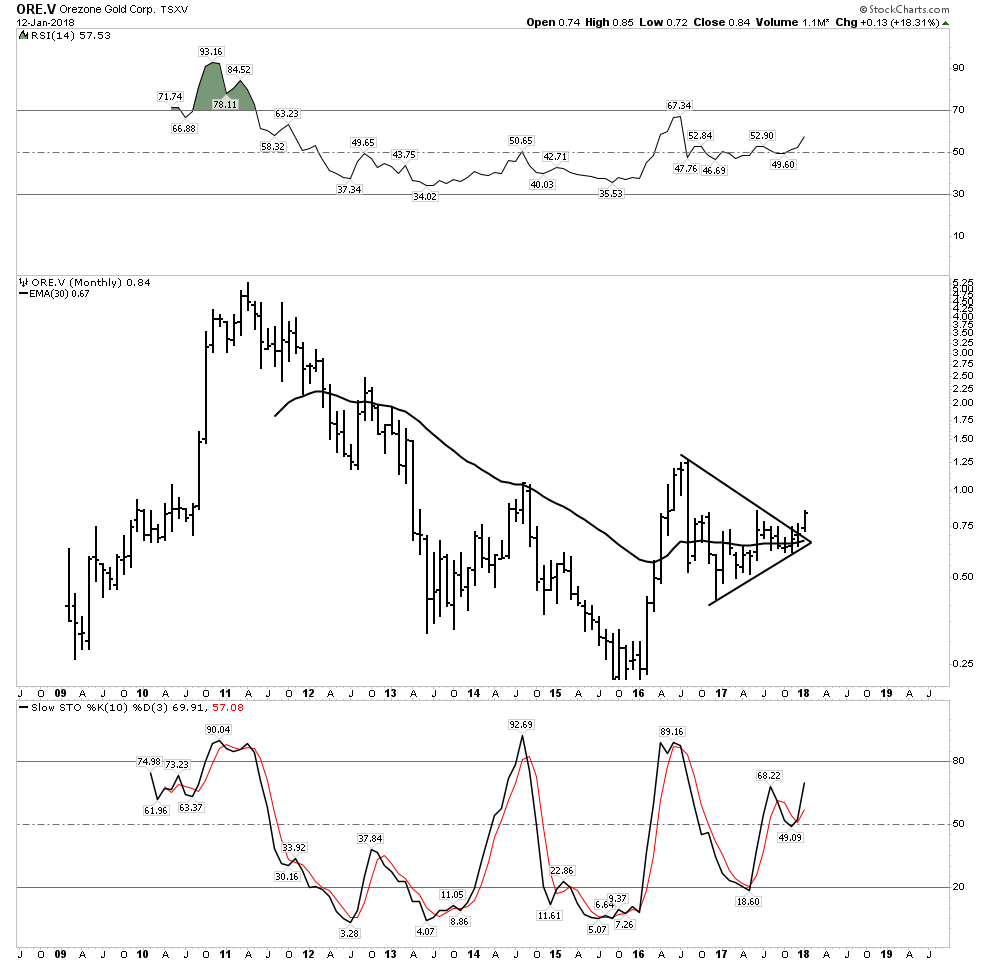

Orezone (ORE.v)

The below monthly chart really shows this stock is on the move. Orezone was one of the most likely to be taken over blue ribbon picks in my EOY report.

Pretium (PVG)

The recent decline which shows up on a daily chart was due to Bob Quartermain playing take-over hardball. He is holding out for a higher price and one of the suiters walked away. But make no mistake, technically this stock is getting ready to rock.

Arch Coal (ARCH)

This stock is developing a head of steam and is continuing to power forward. Earnings is what is driving it.

Chipotle (CMG)

The chart is taking the form of a turnaround bottom. A break above the NL would be the initial buy signal.

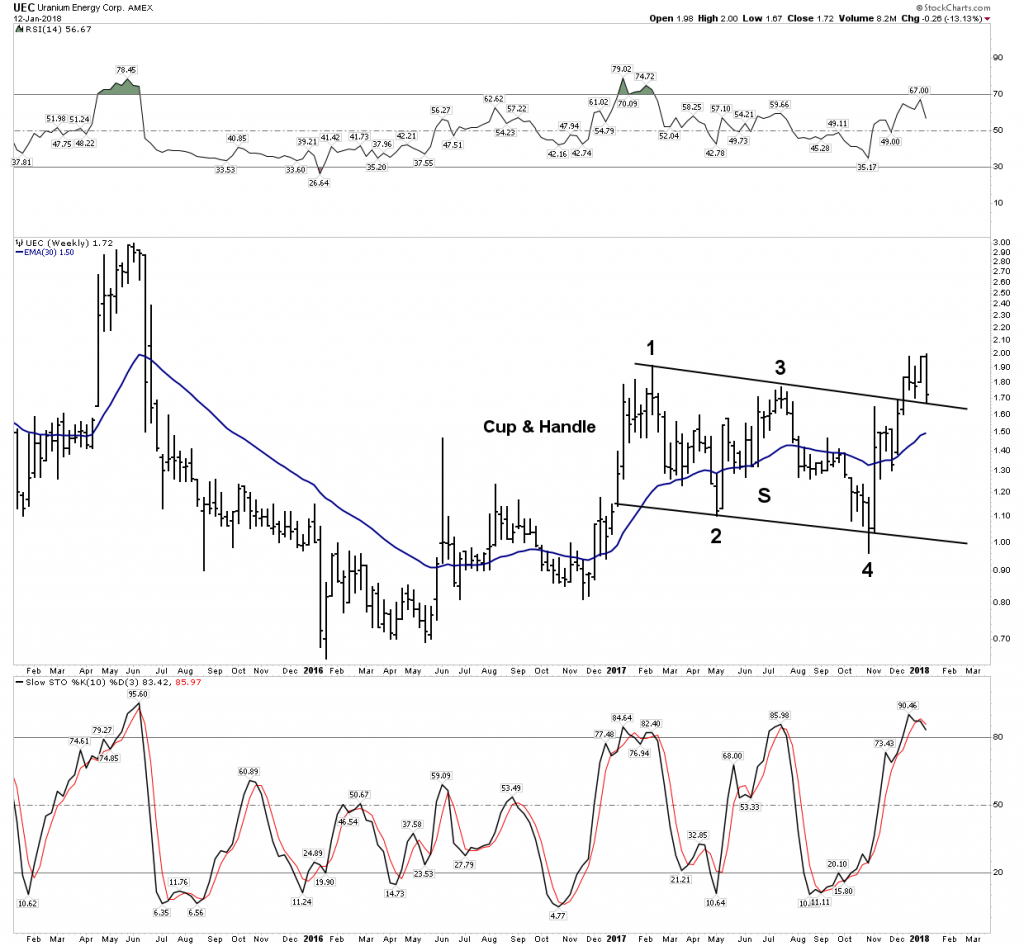

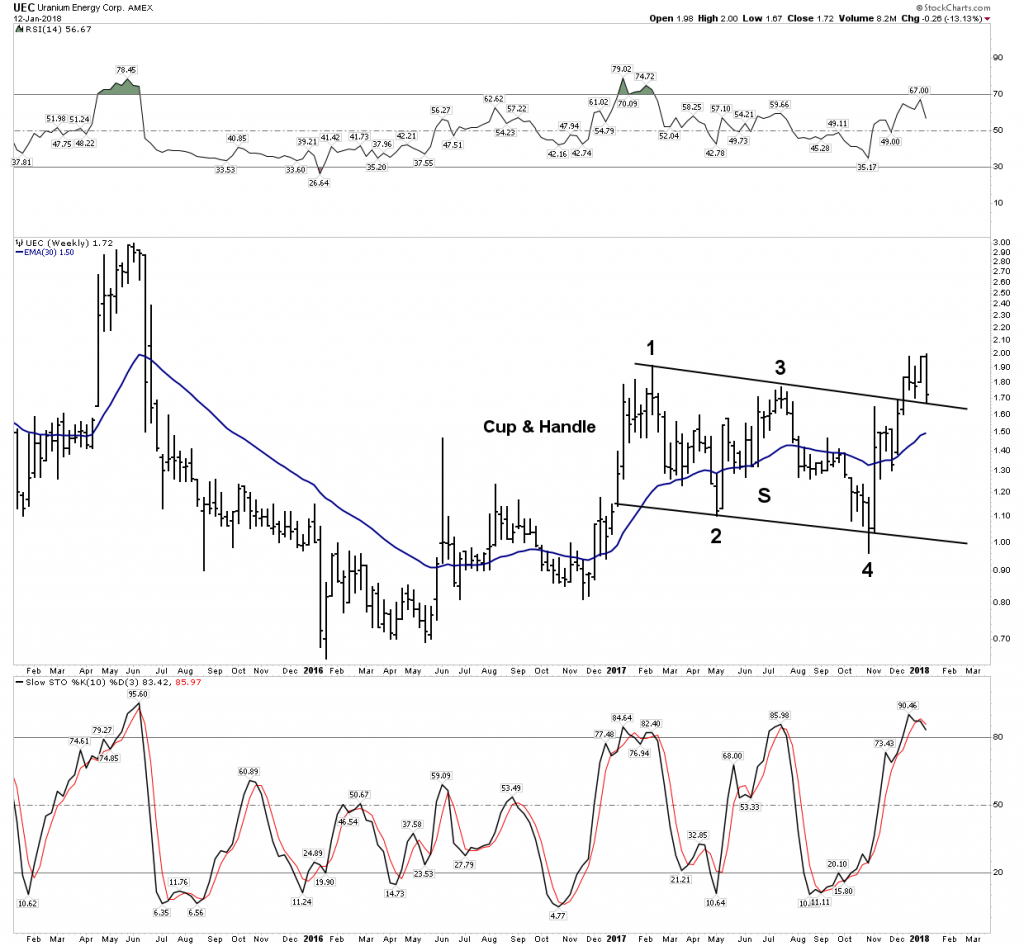

Uranium Energy Corp (UEC)

A low risk entry point if it survives a successful BT of the top line. When do we ever get a low risk entry in the uraniums? Well here it is…this is an opportunity.

Ivanhoe Mines (IVN.to)- An approaching accident?

The Blue Ribbon edition suggested that this may be the year for the Ivanhoe “Gentleman’s Entry”. Holding onto this level looks to be getting more and more precarious. Look out below?

Long Way Down:

Pan Orient Energy (POE.v)

This also appears to be in a low risk sweet spot. Weekly stochastics are just starting to curl up. An oil strike would rocket this stock.

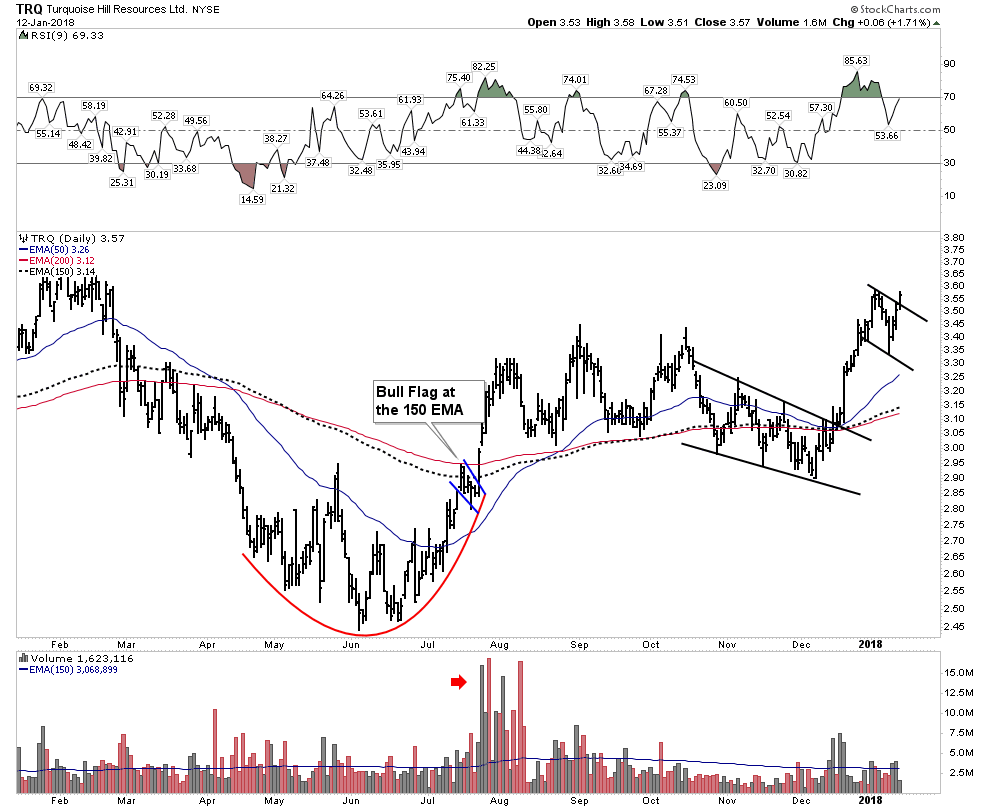

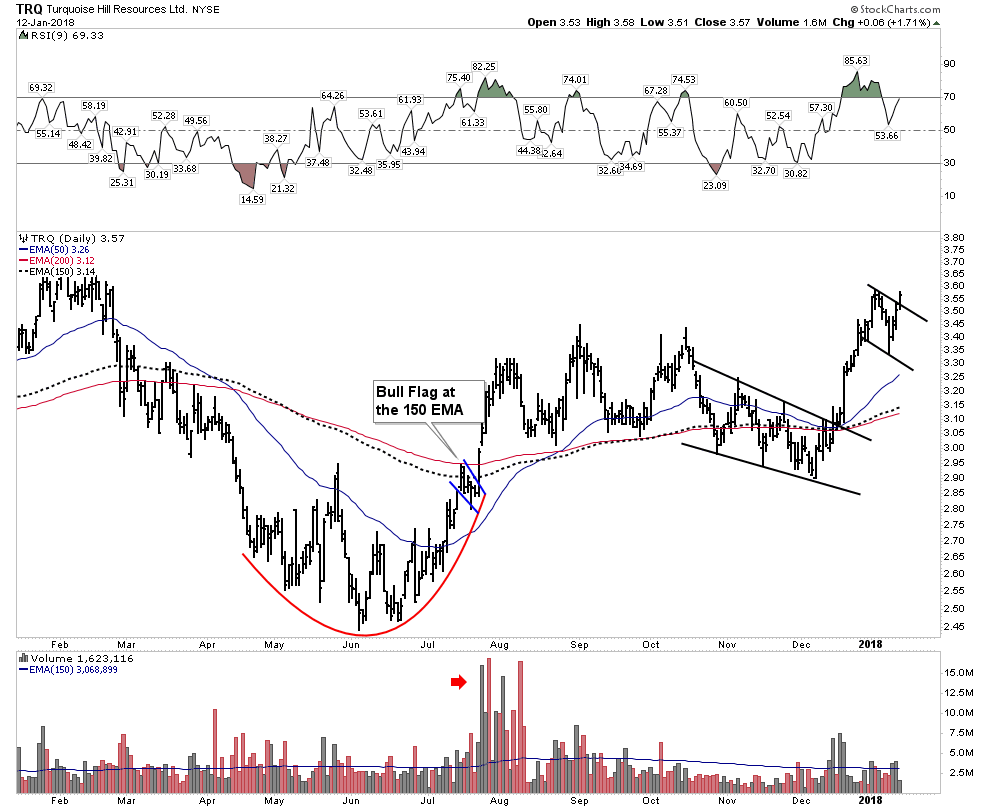

Turquoise Hill (TRQ)

Copper Monster TRQ is doing all the right things from a chart perspective.

Monthly shows it poised for a breakout:

The key to success in the next cycle is to know your companies and to get there early. Once the market starts moving there will be huge initial gains eliminating any chance of a near bottom entry. It’s time to saddle up and ignore the naysayers.