Welcome new subscriber

You must send us a valid email adresse to recieve your password

send to gmag@live.ca

Welcome new subscriber

You must send us a valid email adresse to recieve your password

send to gmag@live.ca

Editors Note :

The Weekend Reports are traditionally sent out to all “Newsletter Subscribers ” Free :

However THIS one ” PM Indices Perhaps a Bottom but Not THE Bottom”….is chock full of Targets for the Short and Mid Term for the PM Indices :

And so will remain available to Subscribers of Rambus Chartology Only

What is Rambus Chartology all about ?

EDITOR’S NOTE :

Rambus Chartology is Primarily a Goldbug TA Site where you can watch Rambus follow the markets on a daily basis and learn a great deal of Hands on Chartology from Rambus Tutorials and Question and Answeres .

Most Members are Staunch Goldbugs who have seen Rambus in action from the 2007 to 2008 period at www.goldtent.org and now Here at Rambus Chartology since early 2012 .

To review his Work and incredible calls from the 2007-2008 period click on the top right sidebar in the “Wizard of Rambus” ….”What If !!” Post

To Follow Rambus Unique Unbiased Chart Work and participate in a Chartology Form with questions and answeres and learn the Art and Science and Mindset of a Pro Trader please Join us by subscribing monthly for $29.99 at

www.rambus1.com

We have many subscribers from all over the world who are glad they did as they enjoy the many daily updates and commentaries provided at this exciting new site

As you will see Rambus (Dave) has prepared us for this difficult period by being one of the only ones to see and warn about this incredibly debilitating PM smackdown as early as Jan 2 2012 …click on the” HUI Diamond in the Rough” Post in the “Wizard of Rambus” top right

You will find Rambus to be a calm humble down home country tutor with an incredible repitoir of all the TA based protocols tempered with his own one of a kind style…simply put…He wants to keep his subscribers on the right side of these crazy volitile and downright dangerous markets

See you at the Rambus Chartology

…………………….

Below is a 60 minute chart of DUST that shows the price action sitting right on the possible neckline and the bottom rail of the uptrend channel. A break of that area will takeout 2 critically important support rails. Again you can sell half your position right here at the market and the other half on the breakout if that is to happen. Or you can just put this DUST position into cash for the time being. This still doesn’t change the long term look. This could be the beginning of a bigger consolidation pattern where we will chop around for sometime before heading lower.

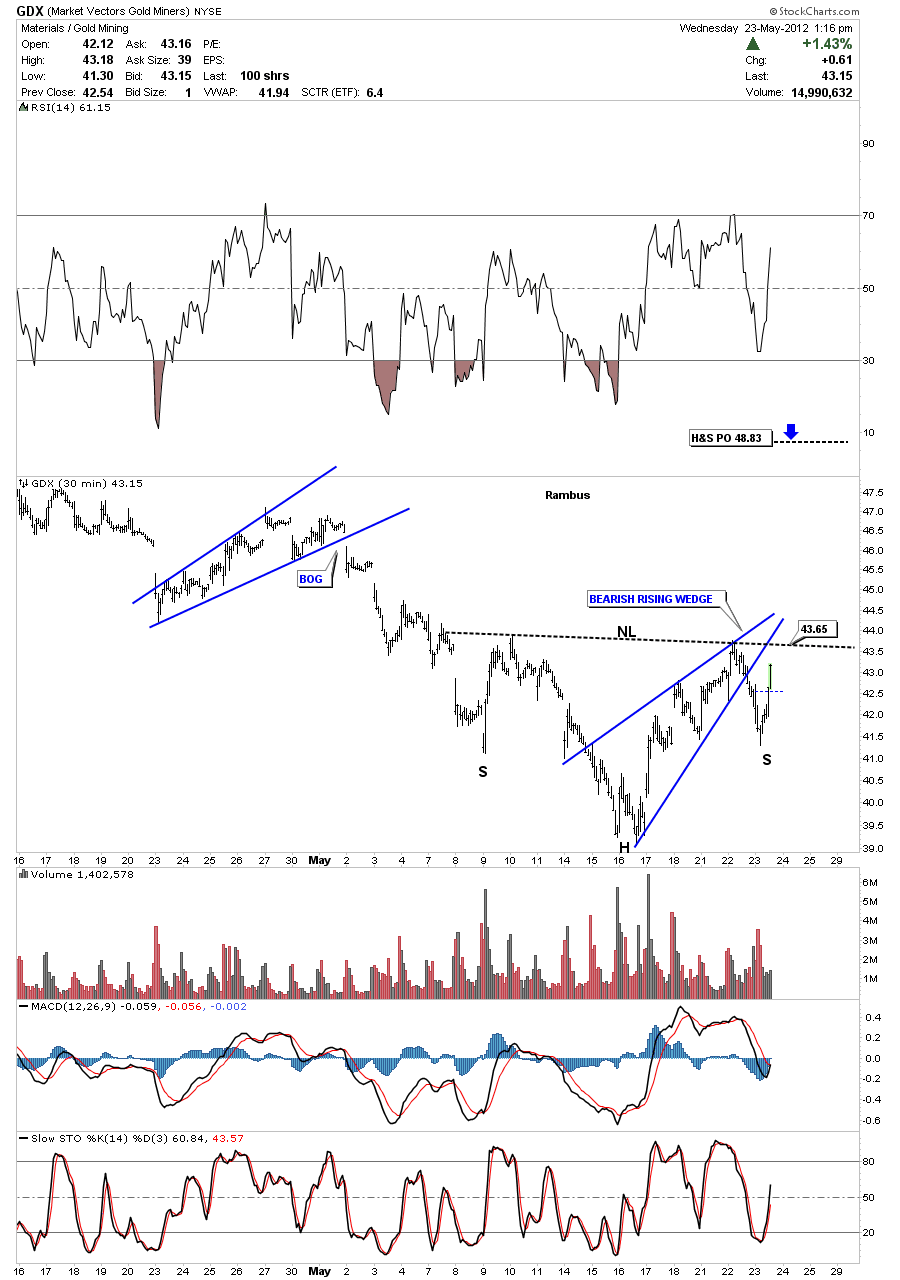

Up until an hour or so ago it looked like the PM mining indexes were going to follow everything lower today. Even as bearish as I have been on the miners I’m still always on the lookout for a reversal pattern. This possible inverse H&S bottom on the GDX is indicative of the other PM mining indexes. Keep in mind this is just a 30 minute chart but if the inverse H&S bottom plays out it will have a price objective up to 48 or so. I’m going to sell half of my DUST position right here at the market. I will wait and see if we break the neckline to the upside to exit the other half.

Its the moment of truth for Priceline.Com as it’s backtesting the double top hump at 682. How this stock moves affects the big cap tech indexes. Last week the stock markets and big cap tech stocks fell pretty hard so this week they are in a counter trend rally. Two steps forward an one step back or in our current case two steps down and one step up.

EDITOR’S NOTE :

Rambus Chartology is Primarily a Goldbug TA Site where you can watch Rambus follow the markets on a daily basis and learn a great deal of Hands on Chartology from Rambus Tutorials and Question and Answeres .

Most Members are Staunch Goldbugs who have seen Rambus in action from the 2007 to 2008 period at www.goldtent.org and now Here at Rambus Chartology since early 2012 .

To review his Work and incredible calls from the 2007-2008 period click on the top right sidebar in the “Wizard of Rambus” ….”What If !!” Post

To Follow Rambus Unique Unbiased Chart Work and participate in a Chartology Form with questions and answeres and learn the Art and Science and Mindset of a Pro Trader please Join us by subscribing monthly for $29.99 at

www.rambus1.com

We have many subscribers from all over the world who are glad they did as they enjoy the many daily updates and commentaries provided at this exciting new site

As you will see Rambus (Dave) has prepared us for this difficult period by being one of the only ones to see and warn about this incredibly debilitating PM smackdown as early as Jan 2 2012 …click on the” HUI Diamond in the Rough” Post in the “Wizard of Rambus” top right

You will find Rambus to be a calm humble down home country tutor with an incredible repitoir of all the TA based protocols tempered with his own one of a kind style…simply put…He wants to keep his subscribers on the right side of these crazy volitile and downright dangerous markets

See you at the Rambus Chartology

Just a quick update on the gasoline chart that I’ve been showing on Friday’s. Its still reversing symmetrying to the downside just as we thought it would. Another little clue to add to our deflationary slowdown scenario.

Below is the same chart from above but with a bigger H&S top pattern. You can see how it has morphed into a bigger H&S top pattern that has a PO down to the previous lows around 2.50.

EDITOR’S NOTE :

Rambus Chartology is Primarily a Goldbug TA Site where you can watch Rambus follow the markets on a daily basis and learn a great deal of Hands on Chartology from Rambus Tutorials and Question and Answeres .

Most Members are Staunch Goldbugs who have seen Rambus in action from the 2007 to 2008 period at www.goldtent.org and now Here at Rambus Chartology since early 2012 .

To review his Work and incredible calls from the 2007-2008 period click on the top right sidebar in the “Wizard of Rambus” ….”What If !!” Post

To Follow Rambus Unique Unbiased Chart Work and participate in a Chartology Form with questions and answeres and learn the Art and Science and Mindset of a Pro Trader please Join us by subscribing monthly for $29.99 at

www.rambus1.com

We have many subscribers from all over the world who are glad they did as they enjoy the many daily updates and commentaries provided at this exciting new site

As you will see Rambus (Dave) has prepared us for this difficult period by being one of the only ones to see and warn about this incredibly debilitating PM smackdown as early as Jan 2 2012 …click on the” HUI Diamond in the Rough” Post in the “Wizard of Rambus” top right

You will find Rambus to be a calm humble down home country tutor with an incredible repitoir of all the TA based protocols tempered with his own one of a kind style…simply put…He wants to keep his subscribers on the right side of these crazy volitile and downright dangerous markets

See you at the Rambus Chartology

…………………….

Last Friday I showed this chart for JPM that had a huge gap breakout. I put on the chart a black dashed down sloping trendline that was made off the 2011 double bottom. Whenever I have a double bottom or H&S neckline I always like to extend them out in time as they can still offer some support or resistance whichever the case maybe. Today JPM gaped the double bottom extension rail, red circle, which is telling me JPM is very weak. Normally you might get a bounce and then come down to break the extension rail. That double bottom extension rail will now reverse it’s role and act as resistance,

………………………………………………………..

EDITOR’S NOTE :

Rambus Chartology is Primarily a Goldbug TA Site where you can watch Rambus follow the markets on a daily basis and learn a great deal of Hands on Chartology from Rambus Tutorials and Question and Answeres .

Most Members are Staunch Goldbugs who have seen Rambus in action from the 2007 to 2008 period at www.goldtent.org and now Here at Rambus Chartology since early 2012 .

To review his Work and incredible calls from the 2007-2008 period click on the top right sidebar Deja Vu

To Follow Rambus Unique Unbiased Chart Work and participate in a Chartology Form with questions and answeres and learn the Art and Science and Mindset of a Pro Trader please Join us by subscribing monthly for $29.99 at

www.rambus1.com

We have many subscribers from all over the world who are glad they did as they enjoy the many daily updates and commentaries provided at this exciting new site

As you will see Rambus (Dave) has prepared us for this difficult period by being one of the only ones to see and warn about this incredibly debilitating PM smackdown

You will find Rambus to be a calm humble down home country tutor with an incredible repitoir of all the TA based protocols tempered with his own one of a kind style…simply put…He wants to keep his subscribers on the right side of these crazy volitile and downright dangerous markets

See you at the Rambus Chartology

…………………….