This gallery contains 36 photos.

The economies of the world are at an inflection point. Enough data points have now presented themselves to be able to see the outlines of a major shift in the markets of the world. We are at a pay attention moment. There comes a time when a successful investor must make some hard decisions to position himself to be able to take advantage of opportunities down the road. The markets are telling us now is such a moment.

It’s time to sit up and pay attention to what Mr. Market is trying to tell us.

It appears we are at the top of the cycle, anecdotal evidence is now pouring in. But that is just a cyclical story. The bigger story is that major market forces that have been brewing in the system for 25-40 years are now coming to a head. They are now dovetailing with the cyclical turn and together they may cause a massive shift in the world’s economic structure which has been erected over these 25-40 years. Few can even imagine these changes let alone prepare themselves for them.

China’s Bubble Economy- Ripe for Bursting

The main driver of this process is China’s bubble economy. If it bursts, the world goes into a depression. I am going to ask you to keep an open mind about this issue. Phrases like bursting bubbles, and world depression, likely sound like hyperbole, simply too far out there to really get serious about. No, its a real possibility and you need to consider it as such. In fact, the US and China have now been in a trade “Cold War” for 18 years now, since China entered into the WTO. But here is the thing…the USA hasn’t realized this until just recently. What is going on right now is the trade-cold war just broke out into a trade-hot war and the U.S. finally realizes it is one of the main combatants. The two sides are so far apart that there is no mutually agreeable solution. Both sides have launched the first round of weapons at each other (tariffs) and their effect has the potential to burst each others credit bubbles.

I highly recommend reading the book Death by China by Peter Navarro. Peter is Trump’s lead trade advisor. Trump is executing Peter’s strategy. If you don’t have the time to read the book you can watch the documentary for free if you have 70 min of spare time. Again if you want to sit up and pay attention, you will do it, make it your weekends education.

This documentary delivers the message of how the US has been gutted of its manufacturing base. You may not have realized how complete it has been, watch it and you will know the extent of it. This documentary provides a good understanding of what has happened, however what is more important for investors to know is how it happened from a macroeconomic understanding. Once you understand the macro story you begin to see that any attempt to resolve it leads directly to the bursting the bubbles on both sides of the Pacific. Yes, this is how unstable the world economy has become.

The China Story in condensed bullet point form.

It would take a book to properly explain how all of this happened, but I am going to try my best to the weave the story into condensed form.

The huge bubble on both sides of the Pacific was enabled by the ending of the Bretton Woods monetary system. This was because since dollars could no longer be exchanged into gold, huge imbalances could now be accumulated and held as the result of trade surpluses. As the Chinese accumulated massive trade surpluses they bought US Treasury debt and held it on their balance sheet. This had many effects: first off by purchasing $4T in US Treasury debt with their trade surpluses it stoked the financial bubble in the USA. Secondly the Chinese printed Yuan and bought US Treasuries which was a form of currency manipulation. It kept the Yuan from rising thus keeping their goods competitive. Otherwise running such huge trade surpluses would have made their currency rise and prevented them from being able to sell cheap goods.

Deficits Pile Up

Then over the next 25 years China ran increasingly larger trade surpluses. Again, only having a fiat currency allowed this huge asymmetry since the imbalance never cleared as the surplus was converted into U.S. treasury debt and held on China’s balance sheet:

Trade surplus of over $4 T

So where did China get all of its money from?

In a word it came from a fractional reserve banking system. China received $4 T of foreign capital inflows and they used it as base money to loan off of. They created over $25 T of credit collateralized by the $4 T of foreign inflows. Essentially money out of thin air.

You should now start to see why a trade war is an impossibility for China, If foreign inflows reduce it shrinks their highly leveraged and unstable credit bubble. The nature of credit bubbles is they must keep expanding. The second it shrinks the entire structure has the risk of unraveling. This is why the dance between the US and China is a high wire act.

Through massive credit creation China has built out its export industry to where they now produce 59% of the world’s cement production, and 50% of world steel production. The world now only needs 65% of this capacity therefore a steel tariff on Chinese steel could result in China holding 35% of world steel production as idled capacity. This would blow a hole through the Chinese economy. The average daily wage of Chinese workers is $9/day so there is insufficient domestic demand to sustain these industries.

Bottom line: to survive China must export its extreme excess capacity in the face of lack of world demand. This is an unsustainable model which has now run out of time. China is now set-up for a hard landing and when China has a hard landing the world goes into a depression because since 2008 it has been their growth that has driven the world.

Trade War-Tit for Tat

Recently the Trump trade negotiators slapped on a $50 B tariff as a negotiating tool. China responded with a similar counter response. The US then upped the ante with a $200 B additional tariff. This is a nuclear option as one can see in the below import-export numbers:

US to China- $130 B

China to US- $506 B

So the Chinese are already out of bullets, they cannot match the tariffs thrown up by the US since their exports are 4X greater than the US and they only import $130 B. Understanding the nature of the Chinese model which they have built out over the past 30 years one can see they cannot possibly comply with any of the US demands because they must maintain a trade surplus. Without this surplus their economy implodes.

The Ugly Truth of the Matter

What Trump trade policy is attempting to do is to reverse the 35 year structural configuration of the world economy without triggering a collapse. The key element of this structure is the ongoing trade deficit between China and the world. The seemingly impossible task is to eliminate the trade deficit without popping the bubble.

Government propaganda would have one think that our current recovery is an organic growth story and the US engine is pulling the world out of the 2008 GFC. This of course is delusion as the truth is that since the 2008 GFC China has been the driver of world economic growth. This growth has been fueled by rapid credit growth within China. Ending growth in China would be the catalyst for the world slipping into a depression with massive idled capacity to reconcile.

So with a hot trade war breaking out its easy to see that if this gets out of hand it could have immediate and dire consequences for all the world’s economies.

The Post Bubble Contraction- (PBC)

All of this of course is custom designed as the ingredients to the post bubble contraction which it appears we are now entering into.

Question: What happens to the senior currency during a PBC?

Answer:- Simple, it goes up. Because credit contracts and debts must be paid off in the senior currency. Also money from around the world flows towards the senior currency and the most liquid financial instruments in that currency: short term treasury paper.

Below: Rising USD.

The Gathering Storm- Data Points start to coalesce.

We should all know our current market is only months away from being the longest bull market in US History if we go on to new highs. Also the current economic expansion is just months short of being the longest in US history. Yes, the cycle is very long in the tooth. Therefore we should be on the look out for ending action and there is plenty out there.

The Yield Curve:

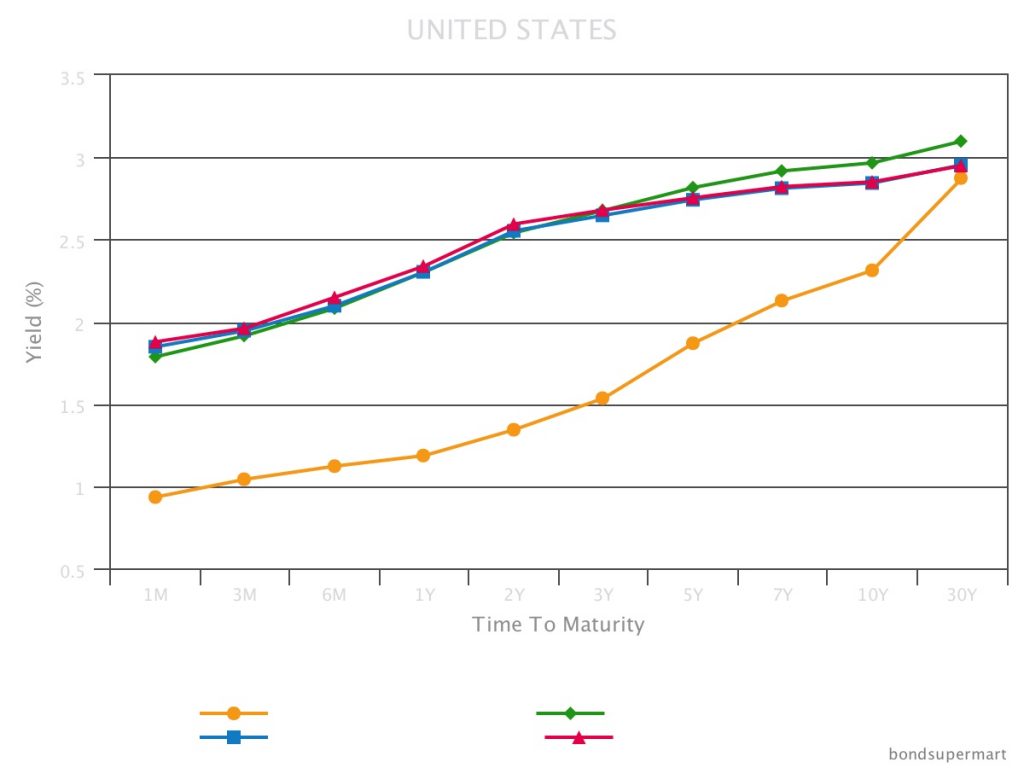

You have heard a lot about this. Contrary to what you may have heard it doesn’t have to invert to trigger a recession plus the current curve is just as flat as when the last two market peaks occurred.

Flattening Yield Curve at the market peak in the year 2000:

Below Market Peak Oct 2007:

Today’s Yield Curve in Blue- Just as Flat as previous market tops. The scale may make the slope look steeper, but it’s essentially the same as the two above with only a 1% difference between short and long duration:

US Yield Curve Jul 2018 US Yield Curve Jul 2018

I have chronicled before the sequence of events we have been witnessing as the market stepped through the topping process of the past year. Throwover top, buyers capitulation, bitcoin as the the main object of speculation at the top, and once the top was in the immediate the slaughter of the volatility traders. Since then the market has been going through the motions of a Dow Theory confirmation process while the market has put in divergences of the NASDAQ and Russell going onto new highs. We have covered this before, but now we have new elements of a topping process which have surfaced recently, principally in the commodity sector. Commodities have had a rough time over the past month and look to have put in its top as well.

The above charts are pretty eye popping once one looks beneath the surface. Overall the commodities index shows a minor turndown, but that’s mainly due to the energy complex holding the overall index up. Keep in mind energy typically holds up until the last second. In 2008 oil reached its peak in early July well after everything had already begun to turn down.

Copper: Broke in a catastrophic failure. More on this below

Industrial Metals– Broke with 30 EMA turned down.

Precious Metals- Broke 30 EMA down

Agricultural Index– Dead, just waiting for confirmation

Energy/Oil – Still in an uptrend, however possibly putting in a top currently…see below.

Commodities getting crushed is part and parcel of a PBC taking hold of the market.

So above we see another major piece of the puzzle falling in place with commodities topping. A few weeks back it was the emerging markets and now the latest is commodities themselves.

So why aren’t stocks themselves headed down?

I suspect they are simply marching along on borrowed time. We are in peak summer La La Land. In my view the key tell to the market is Tesla. As long as Tesla can remain elevated it means psychology remains positive and risk on. Here is a stock that is so clearly a fraud yet, it continues to hover and brutalize the shorts. As long as investors chose not to see the obvious frauds that are out in plain site such as Tesla, it tells us the public desires to keep their blinders on and whistle past the graveyard.

Recall what a glorious summer in Paris it was in July 1914, as people took in the sun and enjoyed themselves in the cafes throughout the city, oblivious to the forces of disaster coalescing throughout Europe.

Could that be where we are today… metaphorically?

DOW/Transports-Non Confirmation developing:

Below we see the transports going the opposite direction as the DOW over the past three days.

Drilling Down on Copper

One thing is clear…copper is now in a bear market. It spent the past year putting in a flat distribution top with momentum waning the whole time. When it finally finished the job of passing the bag to those staying too long at the party, it let go with with no uncertainly. This is the type of signal that one must pay attention to…it’s meaningful.

The economic implications of this copper move are profound. It dovetails with the chart I posted a few months ago which signaled China was in trouble. The jump across the creek of the 200 & 150 EMA on a single day back in February was unmistakably announcing to the world China had a problem:

The Shanghai exchange is now set-up for a recovery bounce as it has put in a DeMark 13 exhaustion low. But it comes off of a V-bottom, I wouldn’t go near this market.

The copper signal taken in context with the Shanghai chart indicates that the problem is coming out of China.

Bonds Follow Copper

After a breakdown signal from copper we could expect bonds to follow and that’s what seems to be setting up. Rambus has pointed out how the bond market looks ready for yields to put in a top. This is of course what Lacy Hunt has made clear for sometime that yields will not stay at these levels with an economic downturn in a PBC.

TLT resuming its uptrend above its 30 EMA:

Below we see yields looking ripe for a fall:

Energy Stocks

The XLE is still near its highs, however momentum has been waning and is in a position where a top could be put in.

Weekly XLE in an uptrend with waning momentum: RSI, MACD, PPO nearing crossover…Could it be last call?

Daily: Note the last two candlesticks putting in shooting star tops.

OIL- Could the oil price be setting up for a cyclical top?

RSI indicates failing momentum… Volume unable to make a new high.

Precious Metals:

The script for a PBC is for the gold and silver stocks to initially get hammered since they are still stocks and for gold to dip initially. Gold serves as a liquidity bank so it gets tapped when markets get sold. But it is also the first to bottom then start an uptrend that develops into a bull market. That’s the script I am following so I raised a lot of cash this week and plan on waiting until the fall to deploy it. Rambus has stated that the last 2 years in the gold market was just a consolidation in an ongoing secular bear market. I am not willing to cede this, however within the context of the Jan 2016 lows we are likely headed for a hard shakeout over the next 3 months.

Below: Hopes dashed again?

Gold-Now in a down turn in all currencies:

Novo: The Market Losing Patience

Novo has a problem. It has a huge market cap valuation with nothing yet proven. Not saying the gold is not there, but the company has not yet proven anything after one year. I think the market is losing patience and appears ready to breakdown. Novo’s communication strategy has failed.

Could the triangle below be a halfway pattern? If so a sub $3 price seems imminent.

The Weekly: 10 EMA crossing over the now declining 30 EMA

The Great Yellow Hope- Uranium

This is about the only sector I still feel good about as it remains undervalued, oversold and in an uptrend. It is still coming off of its bottom, but positive fundamentals are fast catching up with this group. Utilities are going to have to start buying long term contracts within one year. Commodities are in a down trend and even possibly in a bear market, but I am holding onto my uranium positions. Once the string gets pulled tight on supply one wont be able to get into this sector at anywhere near today’s prices… it will be instant.

I will be at the Sprott conference next week. Anyone else attending drop me a line.

Editor’s Note : Plunger is resident Market Historian at Rambus Chartology. To follow his work on the Post Bubble Contraction and Rambus’ Charts

First off, I would like to thank Rambus for allowing me the intellectual freedom to deliver to you the straight story as I see it. Our views are not always in sync but I will tell you he has not ever tried to spin my views. I understand I write here as a privilege and am presenting my honest opinion, with no ulterior motives. We just want to get these markets right and make money…Thanks Rambus.

This weekend I would like to review the main features characterizing the markets which I have chronicled over the past 6 months. Often times “less is more” so I will keep my remarks condensed and focus on the overall stock market and the precious metals.

This past week I have emphasized that the stock market is in a state of high risk. This is because valuations are sky high in all asset classes and I see the elements of a broad top in the market which will likely prove to be the end of this 9 year bull market. That’s not saying the market falls hard anytime soon, but the process of a top has begun and is ongoing. Stated differently, we are likely in Phase I of a bear market and once Phase II arrives it may prove to be devastating and adversely impact an entire nation of investors.

Systemic Collapse

That’s what we actually had in 2008 with the derivative implosion which led to the deep plunge of that year. So what is required to have a systemic collapse? What are the prerequisites?

To have a systemic collapse there must be a large, broad error right out in plain sight which the masses don’t see. It must be a deeply held belief that is wrong. It must be big enough that it causes the misprizing of assets. We had this in 2007. What was the myth then? What was the deeply held belief that allowed the misprizing of assets? It was the firmly held belief that housing prices could never fall on a nationwide basis. Even Ben Bernanke stated this myth specifically.

http://www.youtube.com/watch?v=u5A4Gw20dcw

Trouble is the man is a crank. Once prices fell derivatives transmitted the shock into the core of the system. The myth was false.

Today’s Myth

So could we possibly have a similar myth, deeply held throughout the population causing asset prices to be misprized today? A myth in plain sight, yet few care to even see it? Making them so blind to the reality that it causes a total misprizing of assets. I believe that myth today is the belief that central banks are infallible. The belief that markets can be rescued and undergirded by the words and policies of central banks. It explains why young couples in Seattle are willing to commit millions of dollars that they don’t have into the purchase of an inflated home. This despite a collapse in these assets less than 10 years ago. This very act is a manifestation of this myth.

But here is the fundamental flaw of QE: by keeping rates submerged for 7 years, markets were not allowed to price risk. Therefore, investment decisions could be made without reference to RISK. The depth of this mistake is much larger than the housing bubble ever was, so when the myth is revealed to be false the correction of the myth will play out as a profoundly deep bear market.

Transition from Bull to Bear

Let’s review some of the bullet points of the process we have been witnessing over the past year.

4. End of year top. This market saw a top in the end of year period, typical of many other famous bull markets.

5. Bitcoin Blowout. Bitcoin served as the object of fancy or the cherry on top of the everything bubble. This fits the bill for a speculative object at the top often seen at the peak of a mania bull.

Slaughter of the Vols

The initial takedown in late January-early February was focused on the most egregious area of speculation which was the volatility traders. This entailed short term total annihilation. Since then, the market has been attempting to recover its old highs. I have detailed this process on many occasions, we still sit in no mans land. According to DOW Theory we are inside a Secondary Reaction. A bear market signal only comes if both averages violate the SR lows indicated by the red line, but the bull is only revalidated when both averages go onto new highs.

My interpretation of the above chart is the blue channel is a bear flag containing the consolidation of the drop from the highs in JAN/FEB. In order for the bull market to be revalidated BOTH averages must go onto new highs. In the mean time we have seen the RUT and QQQ (small caps & tech) go on to new highs. For now I interpret this as non-confirmation of the bull’s recovery. In Mr. Markets sick way it also serves to keep investors in the market as the internal action deteriorates. I emphasize, I don’t “know” what’s going to happen. If the averages all go on to new highs this analysis will have been proven wrong, I am simply describing the process in real time as I see it.

The “Right” Strategy according to Plunger

As mentioned, I believe we are in the early stage of a bear market that cannot yet be officially categorized as such. So what’s the right strategy? Let’s go back and look at the past 2 cycles. If you suspected this to be occurring back in 1999 (I did, it drove me nuts) the best thing to have done would have been to move to the sidelines. If you shorted it you got killed for the next year. Same thing occurred in 2007 and the best strategy would be to go to the sidelines and wait for the bear signal. In the movie, The Big Short, we see how the eventual winners suffered greatly waiting to finally be right. You don’t want to do this.

So my advice is to start moving large chunks to the sidelines and build cash. I am not selling my long term holds such as Altius because they are antifragile companies (read the book Antifragile, N. Taleb) I am selling fringe resource stocks, but keeping most of the portfolio.

Question: Plunger, if this is a bear market, the FED has our back right? It may take them a while to formulate a policy response, but eventually they will turn it around like they did in 2008/9. Within a year we will be back on track and back in the game…right?

Answer: I see you have not been listening, go back and re-read the section above about the FEDs powers being a myth. I think once the myth is revealed as false the FED will be unable to conduct its serial bubble operation to reinflate the economy. They have done it two times now intentionally creating a bubble in order to jack the economy up. It worked in a sense that they were able to create another bubble, however this one goes to the heart of money and credit. When the myth is gone their tools will be broken.

Question: That sounds scary, how bad could it get?

Answer: So you really want to know? OK then, gird yourself. First off it was Sir Issac Newton who said for every action there is an equal and opposite reaction. So the extent of the excess is proportionate to the ultimate correction. That’s what the 89% decline from 1929-1932 was all about. I understand we had a sound money system back then and not a fiat money system, but you should stop thinking in only nominal terms. We could have those kinds of numbers, but maybe not in nominal terms, in real terms instead. The excesses in this cycle are so huge it’s hard to get your head around them.

If you want to try getting your head around it I suggest reading the book “The Everything Bubble” by Graham Summers. It is written for the average guy and is an easy read in simple terms. Graham really grasps what has gone on over the past 40 years to the extent of how the bubble has been blown to vast excess.

In the next bear market, I would not count on the FED being able to just blow another bubble and use it to come to the rescue like they have in the past 2 exercises.

Question: So then what comes next?

Answer: The Post Bubble Contraction (PBC)

Post Bubble Contraction-Breeding Ground for the Gold Stock Bull Market

It shouldn’t be necessary to explain the PBC, as it has been chronicled extensively before. We have seen a few cyclical gold stock bull markets, but we haven’t seen a PBC driven bull market in the gold stocks since the 1930’s. They only come around every 50-70 years, but that’s the time you want to be “all in”.

Take a walking tour of San Francisco’s Knob Hill

If you want to see the remnants of a PBC bull market in gold and silver, when in San Francisco take a walk up to the top of Knob Hill where you will see the Pacific-Union Club building. Trust me you are not going to be invited in as it is reserved for the most exclusive innermost of circles of industrial America. The Mansion sits on top of the hill and was not destroyed by the 1906 fire.

http://en.wikipedia.org/wiki/Pacific-Union_Club#/media/File:2009-0723-CA-PacificUnionClub.jpg

This mansion was built by James Clair Flood. Who was he? A stock broker who became a silver baron. That’s right the most prominent home in all of San Francisco owned by a precious metals guy. Let this sink in for a while as it shows the prominent role the metals can play in a post bubble contraction. Enough wealth was created to rise to the literal top of San Francisco society.

http://en.wikipedia.org/wiki/Pacific-Union_Club

Timeline of the PBC

In the past the PM stocks have initially declined in sympathy with the stock market. Once this process is over the bull market has unfolded. In 2008 this period only lasted 2 months. One can only speculate if this occurs this time around. But the PBC typically lasts 15 years or so. Within that time window expect several cyclical bull and bear markets within the context of a secular bull market.

State of The Gold Market

It was a rough week for gold. It got blasted down $40 over the past 2 weeks. No doubt investors are rattled and profoundly discouraged.

I would like to make the case that viewed from longer duration charts it’s really not that bad. Many juniors have taken good sized hits, however overall the stocks have held up fairly well. The chart above argues for a bottom.

Below the Silver buy signal indicator continues to look positive. Keep in mind these are broad turn indicators:

HUI:GOLD:

My prime gold stock indicator the HUI:Gold continues to make progress and is at least primed for a turn upward:

Silver: Gold

Another positive indicator:

Global Gold Stock Index-

Again things look like they are grinding out a bottom and a turn… the weekly:

Close-Up on the daily:

Gold- Hanging by its fingernails:

Gold vs HUI

It sure hasn’t felt good, but no reason to panic. Perhaps gold is just resolving its divergence with the stocks, but its still intact.

Bottom Line Gold

If you need to know why gold got splattered over the past 2 weeks I defer to Fred Hickey’s twitter comment:

Now we know why gold dropped $40oz in just a little over a week -the biggest one-week increase in large speculator futures short contracts (from 72.5K to 106.4K up 47%) that I can ever remember. Good news is they’ll have to buy them back as the seasonal strong period gets started

The gold decline was 100%+ due to the shorts – there was actually a (smaller) increase in spec long positions

So I myself am trimming around the edges of my gold stock holdings in case the initial wave down in the PBC takes the gold stocks with it, but I am not selling my core holdings.

A Big move is Coming

Take a look at the monthly Bollinger Band Pinch. This is telling us a big move is coming. I suggest that since volume is bombed out sellers have already exited so the move is most likely to be to the upside.

Below are some bullish charts of various metals stocks. It’s why I am not selling:

Orezone: get ready for the takeover:

Novo– I am holding. QH is getting increasingly bullish.

Riverside– Recent trenching results:

MAG- Gathering Steam:

Fortuna- Powerful BT

Pan American– Primed

UEC– USA based uranium production

Short Selling

I mentioned the best strategy is to go to the sidelines with the cash you want to hold outside of your core positions. But one should start compiling his short list. You could even start testing the waters to hone your skills, just just don’t get carried away since we don’t know its a bear market yet. Here are some shorts I have taken on.

Hertz:

The rental car industry is sick. Their stocks are reflecting this. Hertz has a very large short interest as its no secret they are in trouble. This is likely the reason behind the recent rally in the stock. It’s a short squeeze, but looks like its ending now. Same story with Tesla. The squeeze killed the shorts.

Homebulders

Interest rates, labor and material costs have put the squeeze on homebuilders profitability. Also they have started to write down land purchases. This sector is early stages bear market IMO

ITB Homebuilders Index

TOL– I mentioned recently this looked like the perfect short tucked up under its 30 EMA. So far so good:

DHI– Nations Largest Homebuilder:

IBM- Industrial Giant

World Wide Look

We don’t have time to take a trip around the world, but let me say this it’s getting ugly out there. Last week I mentioned that the periphery of the world is starting to blow up due to the rising USD, a PBC phenomenon by the way. Let’s look at just a few:

The World… Vanguard All World ex-USA

This has short sale written all over it;

Emerging markets… it get’s worse:

EEM

The MS World Ex-USA… Not good:

China-Believe in yourself and the charts

A few months back I posted the below charts on China and mentioned how profoundly bearish they were and they were announcing a deflation. I wasn’t hearing this from other analysts. In fact quite the opposite. Stansberry writer Steve Sjuggerud has been pounding the table all year to buy China and buy in big. Long term no doubt he is right, but this year… I don’t think so. I read his stuff and then look at the chart and I say sorry …no way. One must believe the chart and believe in ones own analysis.

The gap above was the announcement made around the world.. Deflation is coming. I posted this in March… believe the chart!

China…OMG

Not the end of the world, but do you think a 40% bear market will do some damage?

Summary

I am working on tons of short sale candidates… they are everywhere. But let’s take our time for now and play defense. If the DOW and Trannies go to a new high together all of this analysis will have been wrong. But what I see here is a process unfolding. You are not going to hear this on CNBC.

Editor’s Note:

Plunger is Rambus Chartology’s Resident Market Historian and an associate writer. For a complete compilation of his work members can check the “Plunger” Tab .

I hadn’t planned on submitting anything this weekend, however in light of Friday’s action I felt it may be useful. After Friday’s smashing in the commodities and precious metals market many investors are now rattled and may have bailed from the sector already. It is not my purpose to recommend holding or selling, however I would like to lay out for you what is going on beneath the surface…the process that the markets are undergoing.

First off one should see Friday’s action as only short term noise. It is my view that it was triggered by the markets reaction to the Trump tariffs and the fear of it hurting global trade. Here we see the gap down action in the CRB. It chose to stop at the 150 EMA and its lower Bollinger Band:

The action of late in the CRB has been pretty bearish to the downside with its gap off of the top followed by a failed bear flag right under the 50 EMA. Even though the upside move is still intact, I for one, am on the lookout for the top in commodities for now.

One could say that the move down in gold and silver was collateral damage due to the drop in commodities. That’s a reasonable assessment, however there could be a more sinister element involved which entails a paper smash of the gold market. We have seen numerous cases of this in the past and it looks likely that’s what this was also. But if you are resistant to believing this stuff happens, that’s fine also as what you should know is that as these price dives occur, physical metal is being taken out of the market and being delivered to stronger hands. These hands will not be shaken in the future as they are the hands of central banks which are not involved in the gold price suppression scheme. As .999 gold gets bought up and refined into .9999 metric it goes into deep storage and it wont be available for export sales. These gold tonnages cannot be replaced at today’s prices. Stated differently, the physical supply bought up in these high volume gold smashes gets taken out of the market and moves to entities where it will serve as the collateral to the national currencies of the future.

Below we see the daily gold chart and its smash down from just under the overhead resistance of the 200 EMA. It certainly looks grim and may very well continue down, however one can see in the second chart below the weekly view which shows an intact uptrend.

Below is the weekly showing the bull market uptrend still intact, however price remains below a now downward sloping 30 EMA sitting right at trendline support.

Silver

Silver has shown recent relative strength to gold, however it has trailed gold in turning up to the upside. You can see in the chart below it needs to break above the forming NL. The smash Friday put this process back on hold.

Bottom Line PM:

The metals and the PM stocks appeared at the cusp of a break upward before Friday’s smash. After Friday’s whacking many gold newsletter writers have now advised their subscribers to sell and seek safety. They may be proven right, however nothing has changed in my view. The forces of a bull market continue to coalesce. Selling out ones position in this sector is an error in my view. Weak hands are letting go their positions right now, I prefer to hold onto quality companies.

Connecting the Dots and solving Mr. Market’s puzzle.

Above we see the chart view, however what I really want to show you is the big picture. The underlying strategic process that is occurring underneath the surface of these markets. It is the story that IS NOT being told. It is the essential story, the underlying process that is driving these markets. If you understand this you have a chance of not only capturing the next major uptrend, but also protecting yourself from the next bear market.

It is said that Americans have the attention span of a major league baseball season. I am not even sure investors can keep a thought in their head for that long. So to think that the average investor can formulate an investment theme and comprehend it unfolding over several years may be too tall an order. But that’s what we have to do if we are to understand and ride the trend change which is occurring right now.

The End of the Super Cycle and the Post Bubble Contraction

The world has been in a secular expansion since the late 1940’s. This credit cycle began with public and private balance sheets at low debt levels. We are now in a fully mature end of cycle, where these balance sheets must be ratcheted down. This process entails a post bubble contraction of credit. Typically the process unfolds over a period of 20 years. This is what we now face and historically it is an environment bullish for gold and gold stocks.

The 1937 Bear Market- You heard it here first

Since late last year, I have pointed out that the current bull market resembled the bull market from 1932-1937. I heard of no other source making this claim until now. The 32-37 bull market is the only bull with declining volume throughout its lifespan, just like our current 9 year bull has shown. The 32-37 bull was driven by a perception that the government was going to spend us out of a depression, a close cousin to today’s various QE programs. It has been my hypothesis that since the current bull has such a close resemblance to the 32-37 bull that it may end in similar fashion.

Well, this month Robert Prechtor wrote several pages in his monthly EW letter laying out a similar scenario regarding the 1937 bear market which ensued. Welcome to the same conclusions we have arrived at Robert, I believe we are in good company. So let’s compare today’s market with what occurred in 1937.

First off let me say I have reviewed Rambus’ charts of the overall stock market averages. I see how the long term uptrends remain intact and viewed from a long term perspective they continue to appear in upward trajectories. What I show below is an internal view of the averages and what the movement of the averages this year seem to be telegraphing according to DOW Theory principles.

Update on DOW/TRAN

Above one sees the process of correcting the JAN/FEB flash decline which I have termed the “Slaughter of the Volitility Traders”. It came off of the upside buyers capitulation of Dec-Jan. The top occurred within the context of bitcoin blowing out on the upside and in the timeframe of typical bubble tops of the past. (Turn of the year tops 1973, 1989 Nikki, 2000 USA & others) After the crashette bottom the market underwent a failing rally and violated the closing lows in late March & early April for the transports. This triggered a secondary reaction classification to the move. If both market indexes violate the Mar/Apr lows it will deliver a Dow Theory Bear Market signal to the market. The only way to eradicate the secondary reaction classification is for both averages to go on to new highs. The market has been attempting this, however it has been struggling in this endeavor. Over the past week the averages may have put in a false BO above their rising channel depicted by the blue lines. My interpretation is that this channel is a bear flag, to be taken out to the down side. We will see.

A rolling top, similar to the 1937 rolling top?

Here is where it gets interesting. When we compare the process of what we discussed above to what happened in the rolling top of 1937.

Above we see the top of early March. It’s a broad H&S with a very strong RS bounce after a 14.7% drop to form its NL. It then squeezed out all of the shorts with a 2 month rally finishing up in early August. What then followed was nothing less than total rapid annihilation. Over the next 2 months market participants were violently smashed with little means to exit the market. The market then went on to lose 50% over the next 12 months.

Could this happen today? I can’t say, but recall this bull market of the past 9 years resembles the 1932-1937 bull market more than any bull over the past 120 years. After the top the 37 bear underwent an initial 14% decline. We saw a 12.3% decline in our current initial sell off and it has been struggling to ever since to recover the highs. For those holding out for the averages to resume their upward climb I remind you of Inspector Callahan’s line…. Do you fell lucky?… Well do you?

The Post Bubble Contraction Progresses

Grinding away in the back ground the post bubble contraction continues its process. Historically as rates rise, credit stress occurs at the periphery of the economic system. Eventually economic problems get transmitted towards the economic center of the financial capital of the reserve currency.

We see this now starting to occur. As the FED rises rates the weaker periphery currencies and economies start to blow up. Over the past month we now see this occurring in the Italian bond market the Argentine currency and Brazilian and Turkish stock market among others and it’s spreading.

Brazil

Turkey

Rising rates spells trouble for credit expansion. However even though nominal rates are rising, real rates remain negative which over time is fuel for a gold bull market. Remember at this part of the cycle the FED rises rates until something blows up. We are now starting to see this occur as emerging currencies and markets implode and the shock gets transmitted towards the center. Eventually the flow of funds will desire safety and will seek out the most liquid of assets: gold and treasury bills of the senior currency. The USD captures the flows and starts its rise. At that time it will be game on in the PM space.

This is the big picture process that is occurring now beneath the surface. It’s the slow motion process that the average investor does not have the attention span to keep in his head.

Risks to early stage bull market in gold and silver

So we now can see the process actually taking hold. Now that it is beginning to occur can we now start to deploy in size in ones gold portfolio? This is hard to say, since historically the mining stocks take a hit in the initial stage of a stock market decline. They decline in sympathy as they are equities and they act as a source of liquidity to draw on. Once the initial decline is over however, the bull market can resume. In the last crisis of 2008 this period lasted about 2-3 months. Next time is anyones guess. Remember markets learn, maybe next time it lasts much shorter, if at all.

The Dow and Transports: Looking from across the room

Looking at the above DOW/TRAN chart from an 18 month duration perspective one can see the current consolidation between the blue lines as a possible bear flag. It can continue to consolidate, but if it breaks below the flag by late summer the 1937 analogy presents itself front and center. We will remain objective and let the market speak its language…we’re listening.

Conclusion

The daily action in the general averages attract the eyes of the average investor. He sees the Russell and Nasdaq going to new highs giving him comfort and validation of the constant stream of bullishness he hears on CNBC. The FANGMAN stocks capture his imagination and dreams. He has no ability to see beneath the surface and piece together the market puzzle as we have done today. This is what is important and it’s unfolding before our very eyes. May you live in interesting times.

…………………………..

Editor’s Note : Plunger is the resident Market Historian and an Associate Writer at Rambus Chartology. His views based on Dow Theory and a lifelong study of Market History are welcomed by Rambus , even as sometimes they may be in opposition to Rambus’ Charts .