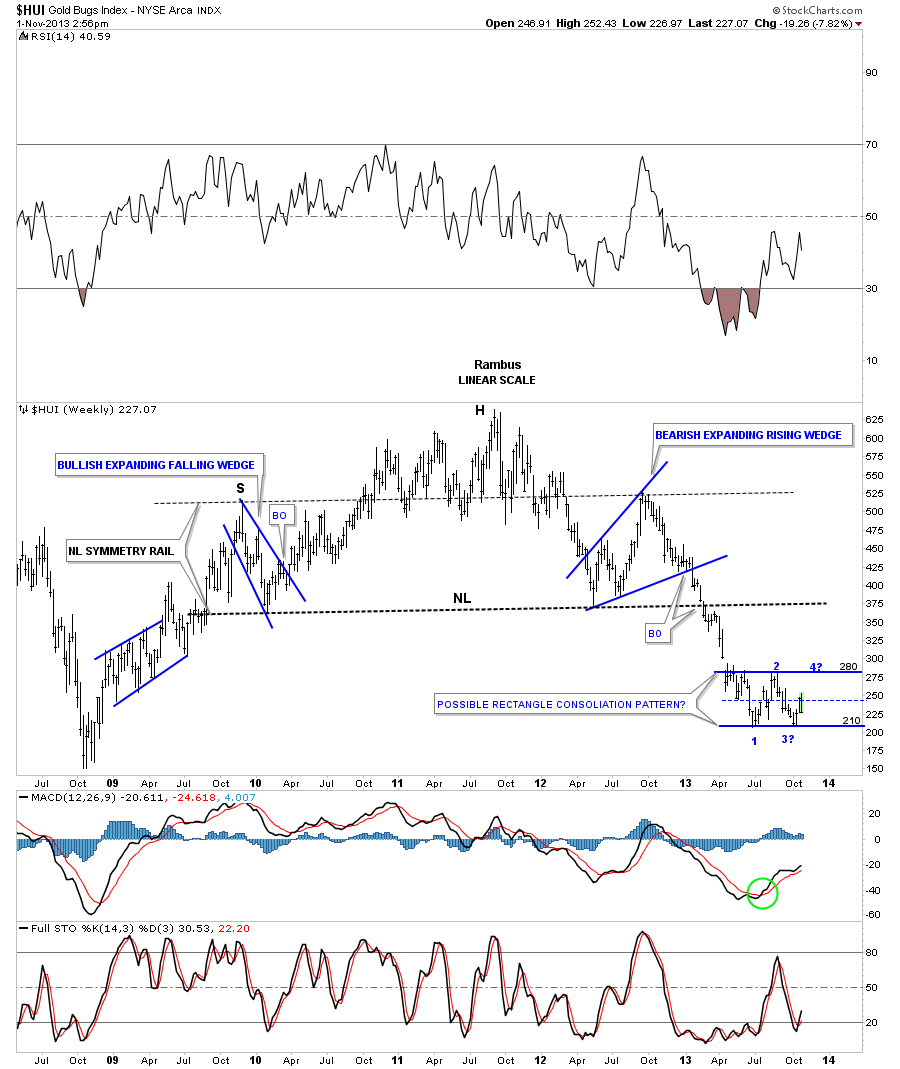

Below is a weekly look at the HUI that shows a possible rectangle forming. As you can see we are getting a bounce off of reversal point #3 that could be the start of the move up to the top of the trading range. The price action could also come back down to test the bottom rail one more time to form a small double bottom at reversal point #3 before it rallies up. Note the thin blue dashed rail that runs through the center of the rectangle. Most rectangles have these halfway lines in them that divide the upper and lower half’s. You can see the low that formed in April starts the center dashed rail. Our current rally has stalled out at the center rail. This is just more confirmation that we are still trading in a congestion zone either be it a consolidation pattern or a bottom pattern. The plan will be to trade the bottom of the rectangle and sell the top until prove otherwise.

Category Archives: public

Weekend Report… Caught in a Trap ? Bull Trap / Bear Trap In the Precious Metals Complex

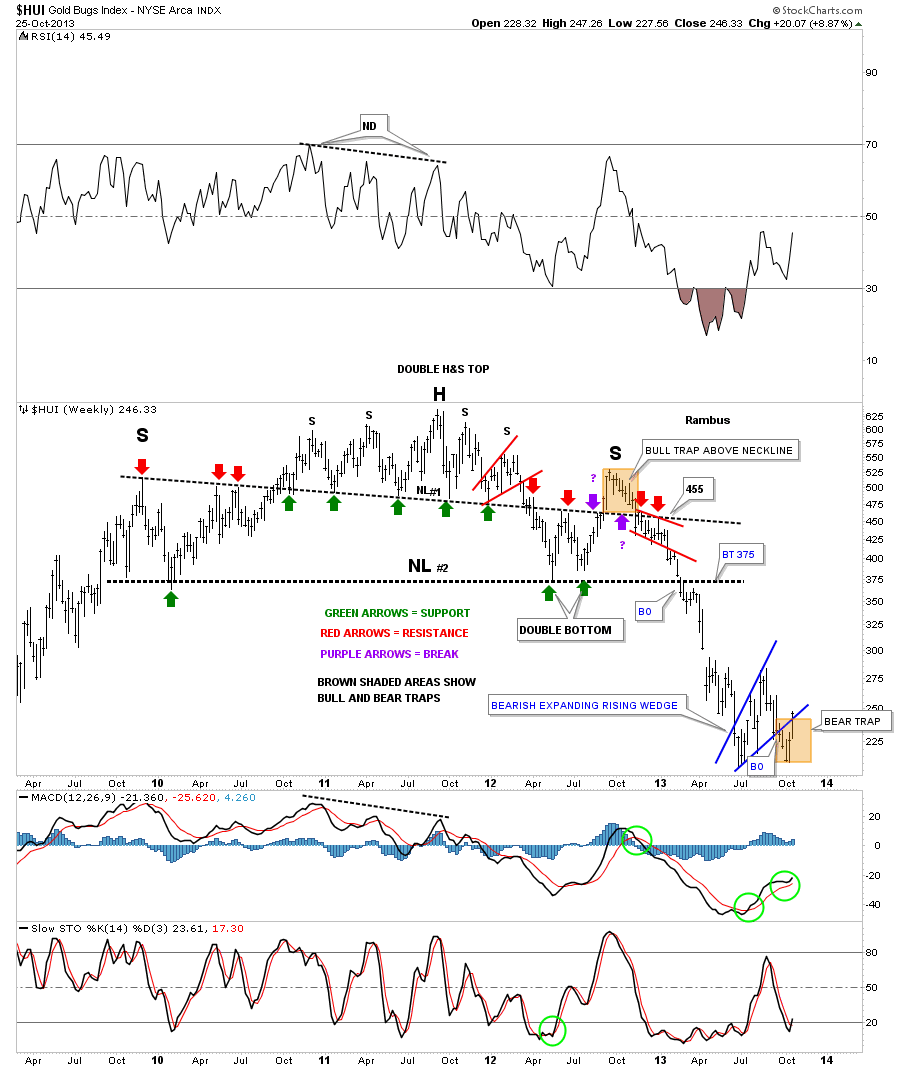

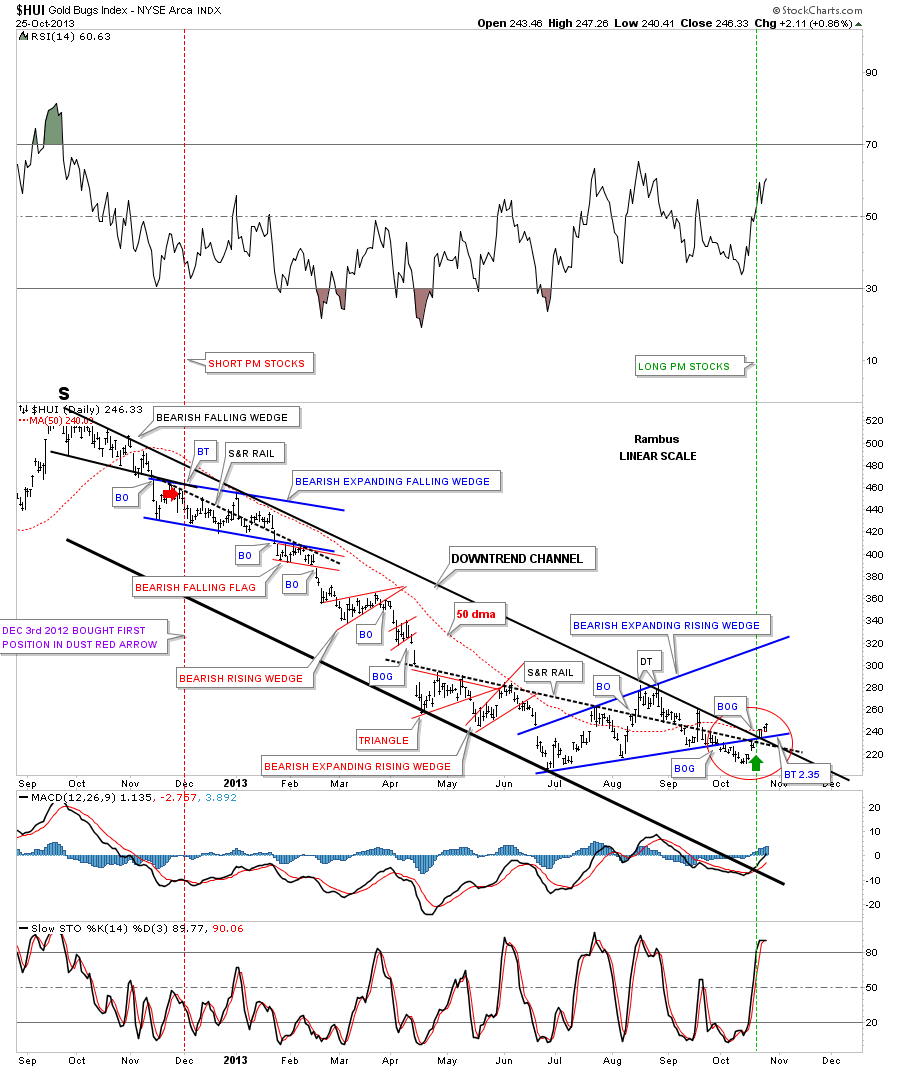

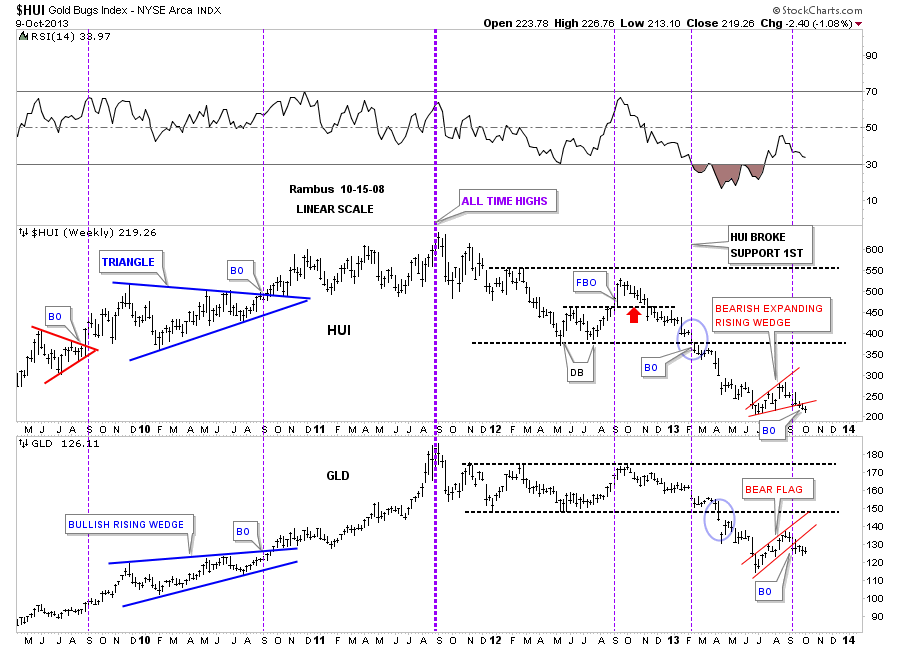

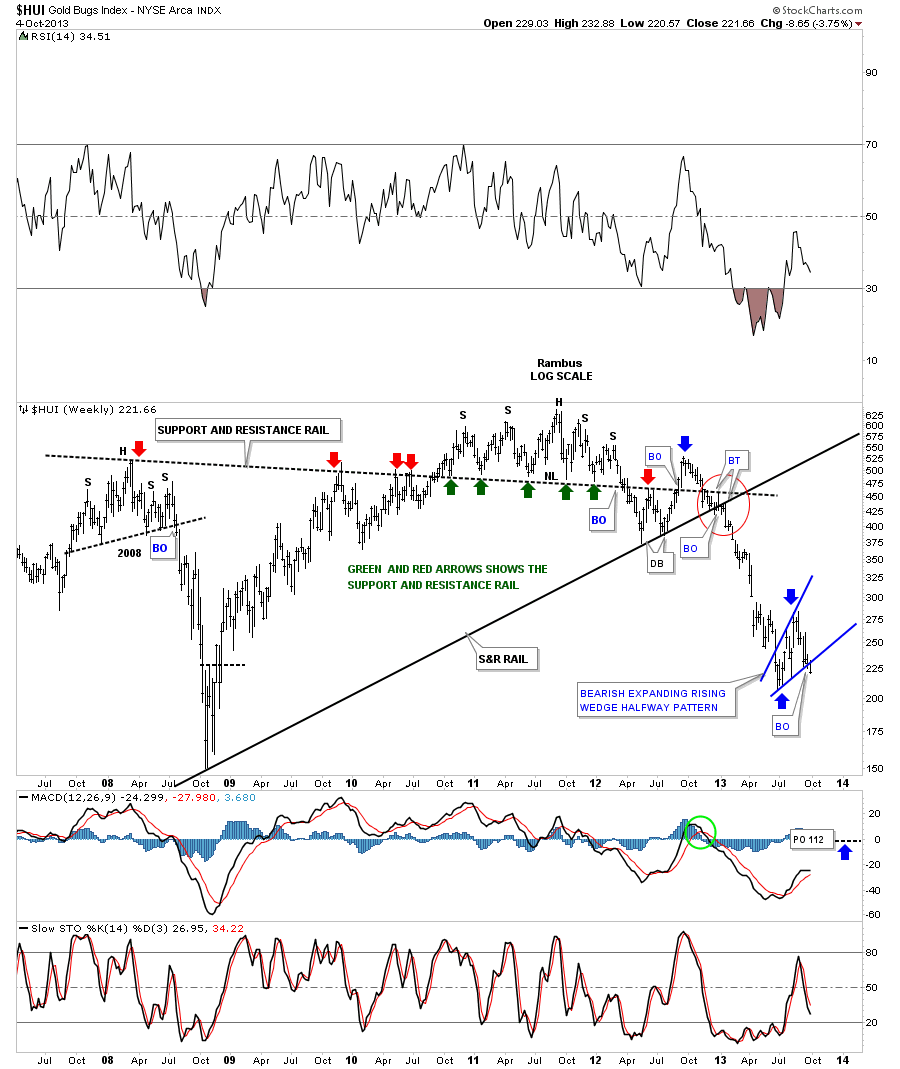

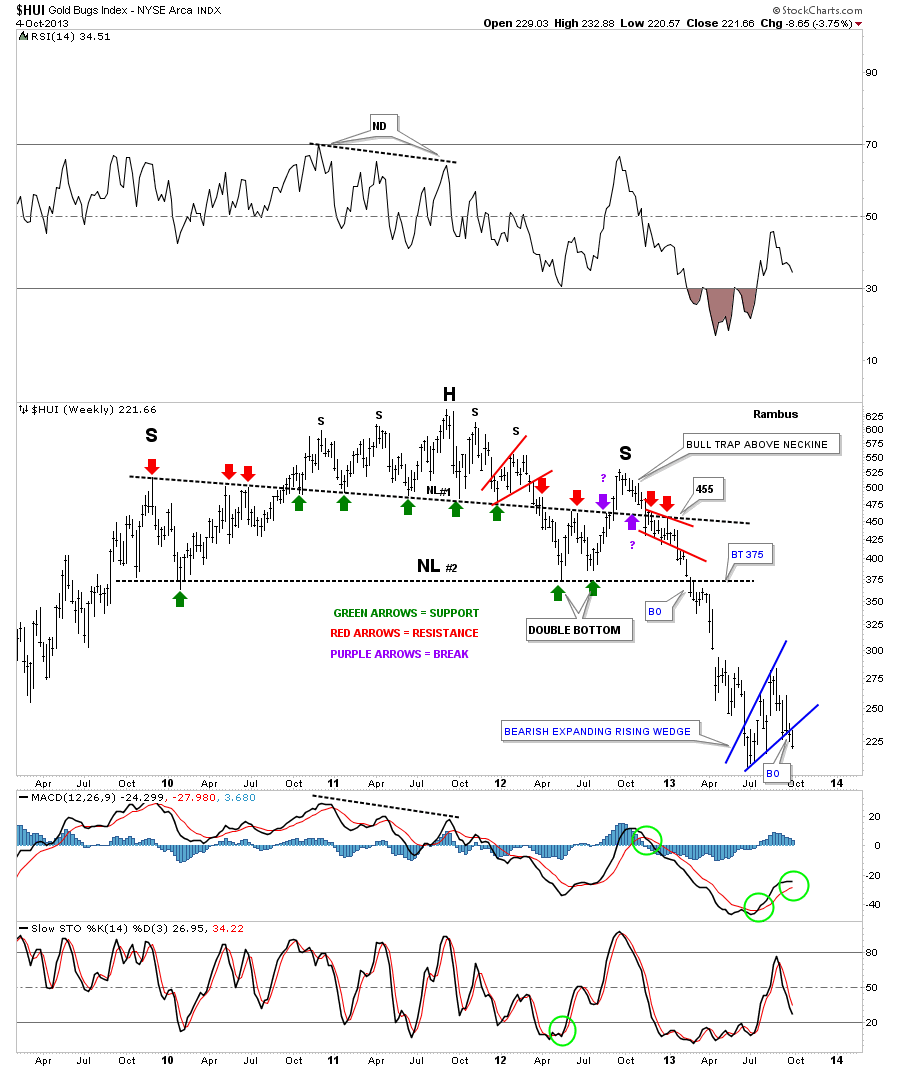

Many times, just before a big move is to occur, you will get a false breakout that can whipsaw you before you know what hit you. It gets everyone moving one way and then out of know where the price reverses direction leaving everyone shaking their heads and afraid to make a move. As you were just whipsawed your thinking is, I’m going to wait until I see a better setup. Does this sound familiar to you. The problem is the real trend is just starting and you are sitting on the sidelines waiting for a new entry point that gets higher and higher. Whipsaws are just part of the game we play and can be painful if not understood. One year ago we got a good whipsaw on the HUI when it broke back above the smaller H&S top, neckline #1, that looked like a real move to the upside when it happened. I got sucked into that one just like everyone else at the time because there was a nice double bottom that had formed that created the right side of the much bigger H&S top, neckline #2. The brown shaded area, just above the smaller neckline #1, turned out to be a bull trap just as the big downtrend was beginning. It trapped many bulls that held on far longer than they should have. You talk about a head fake. Luckily I was able to reverse our long position when the smaller neckline #1 was broken to the downside, breaking even for the trade. That’s when we got short and rode the new downtrend all the way down into the August time frame when the HUI finally crossed above the 50 dma. You can see a couple of small backtests to neckline #1, last two red arrows on the right side of the chart, that gave us all the clues we needed to be short the precious metals stocks. Now look down to the bottom right hand side of the chart that shows the exact same brown shaded area that I’m calling a bear trap. Again, we were short when the blue bearish expanding rising wedge was broken to the downside. When the price action couldn’t move lower than the June bottom a red flag came up for me. As you know I abruptly reversed course again on October 18th and went long. I know many of you were thinking what is he doing? How could he be a bear one day and a bull the next? After being whipped sawed as many times as I have been you begin to understand what is happening and you actually become more embolden once you figured it out. That is why I wasted little time going from being short to being long. If I’m correct on this one we’ll have bought very close to the actual bottom which is looking more like a double bottom now. We still need to trade above 280 or so to confirm the new uptrend but we have excellent positioning right now with our NUGT 3 X long the precious metals stocks etf.

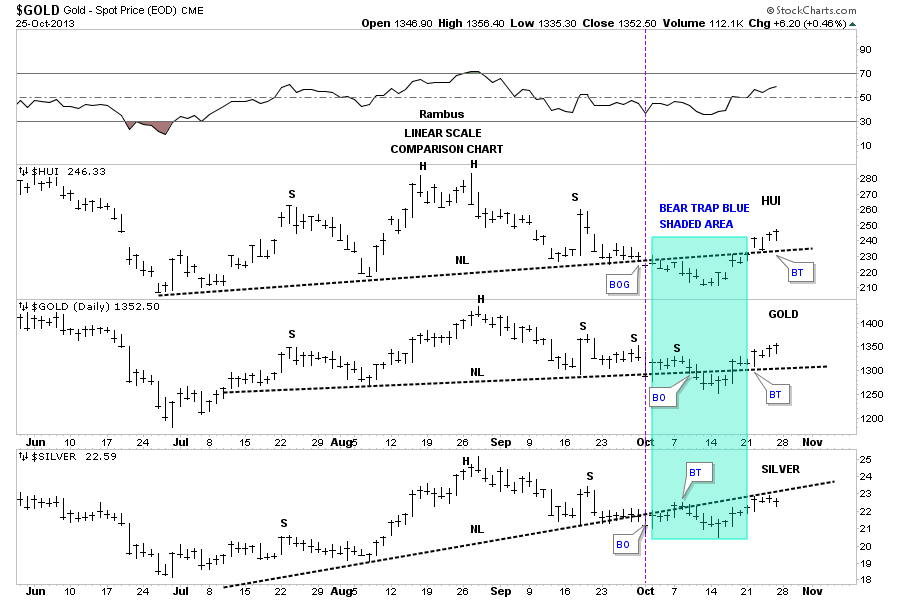

The next chart is a comparison chart that shows the HUI on top gold in the middle and silver on the bottom. If you recall I was looking at the many H&S consolidation patterns that were forming on the precious metals stocks and the PM stock indexes. As you will see the HUI and gold have now broken back above their respective necklines negating their H&S consolidation patterns. Silver is still trading below it’s neckline but it’s steeper than the HUI and golds. The blue shaded area shows the bear trap that many don’t believe is happening. There is an important clue but a very subtle one on the HUI. Follow the price action when the neckline was broken to the downside, which is the bear trap. Notice how the HUI gapped above the neckline and then the very next day backtested it from above. As you can see gold had a similar breakout and backtest form the top side of it’s neckline. This explains why I reversed course when I did. So far it has worked out beautifully.

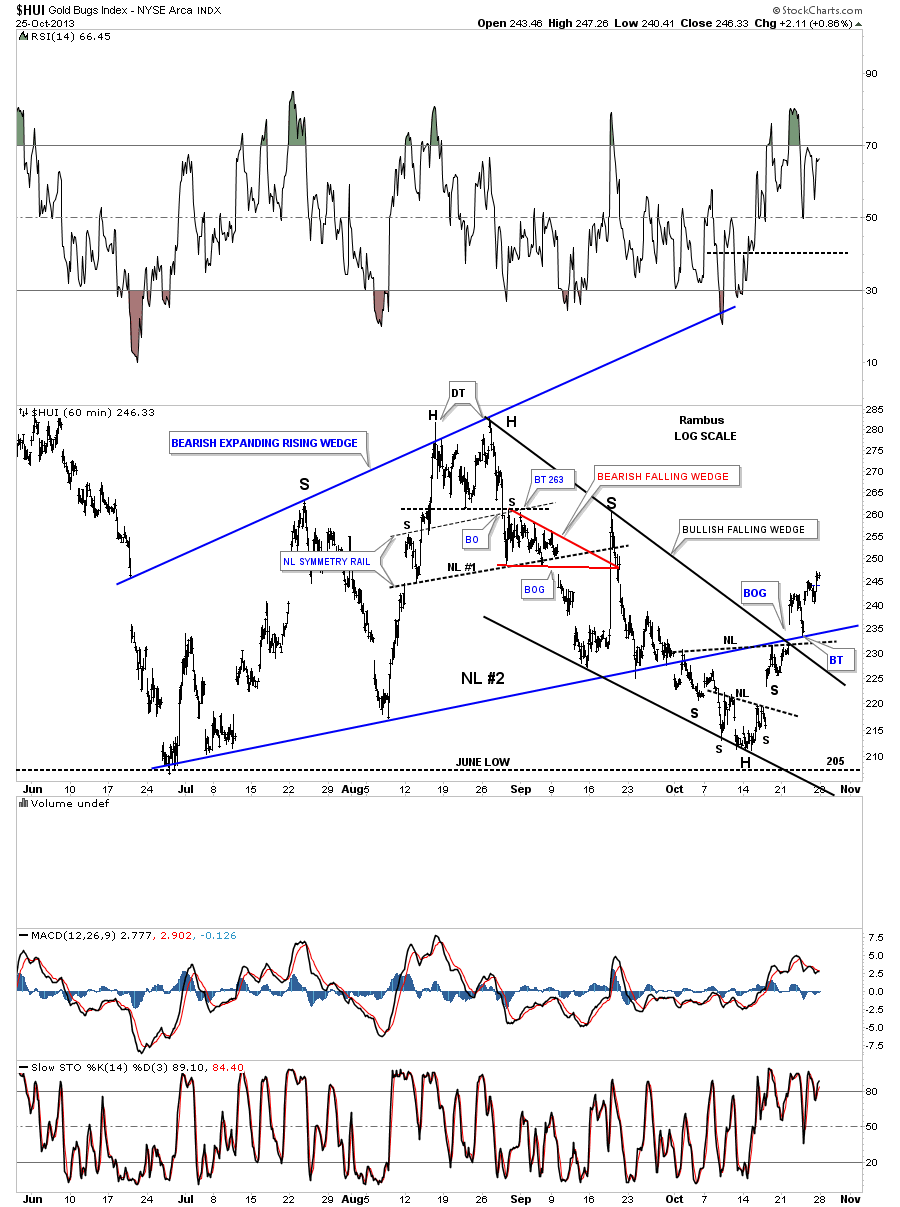

Next I would like to show you a 60 minute chart that shows more detail of the reversal, off our current low, that has taken place on the HUI. There is a really big clue that stands out like a sore thumb. Note the big breakout gap that occurred at the bottom rail of the blue expanding rising wedge – neckline and the top black rail of the bullish falling wedge, on the far right hand side of the chart. That big gap is one way to get over resistance. Also note the backtest to the blue rail that told me that rail was hot even though it had failed to hold resistance on our current rally. Whenever you see a gap that trades above an important support or resistance rail listen very carefully to what the market is telling you. Its talking to you but you have to understand the language and with enough time and experience you will be able to interpret what she is saying.

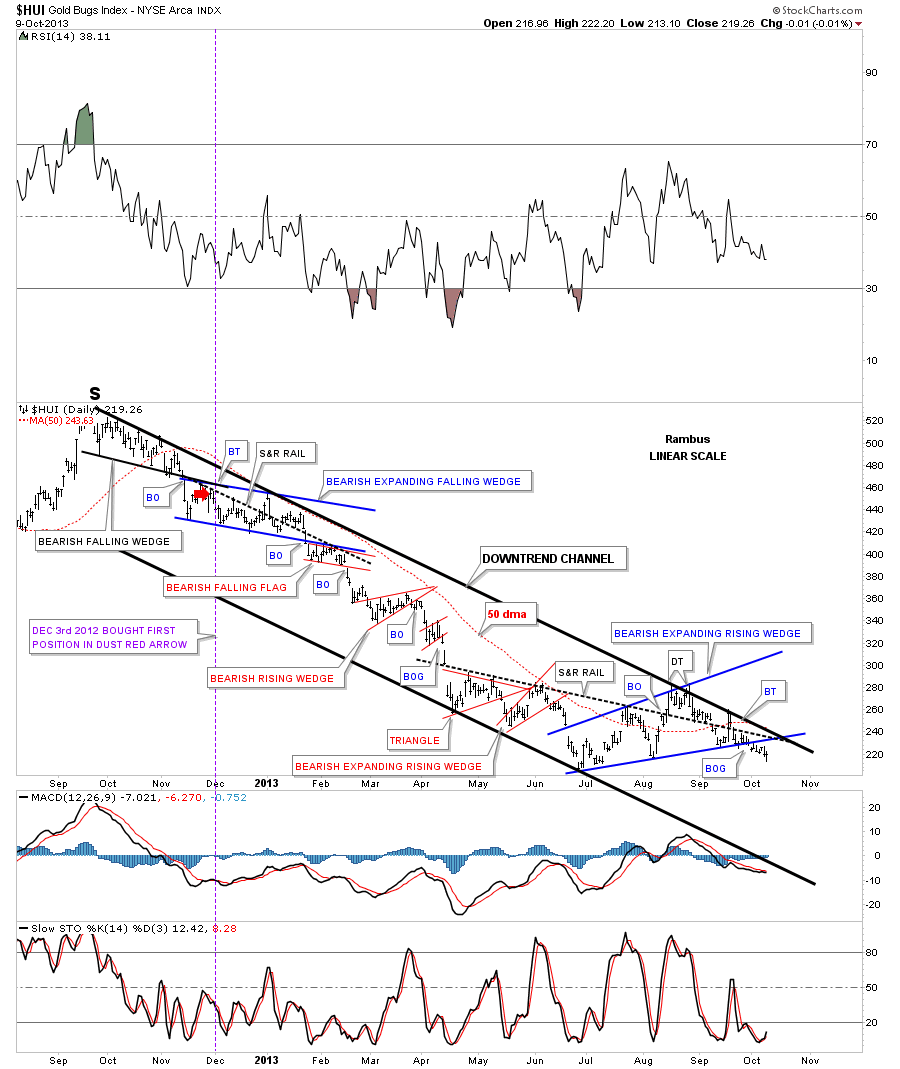

There was another very important clue that caught my attention this past week. The chart below shows the downtrend channel, that began with the bull trap I showed you on the first chart above, that is the top of the right shoulder of the big H&S top pattern. This chart shows you all the small consolidation patterns that we watched form in our long ride down from the red arrow, red vertical line, to where the HUI gapped above the 50 dma in August. That is where we exited our short positions on DUST, DGLD and DSLV. The green arrow, green vertical dashed line, shows where we have gone long starting on October 18th. I think this would qualify as selling or shorting the top and buying the bottom, at least up to this point in time. I would like to focus your attention on the red circle that shows how the HUI interacted with the confluences of resistance rails. You have to look real close, inside the red circle, that shows a big gap right where the green arrow is pointing up. That gap took out the big one plus year top rail of the downtrend channel, the bottom blue rail of the expanding rising wedge, the black dashed support and resistance rail and the 50 dma all at one time. That was a very important development IMHO.

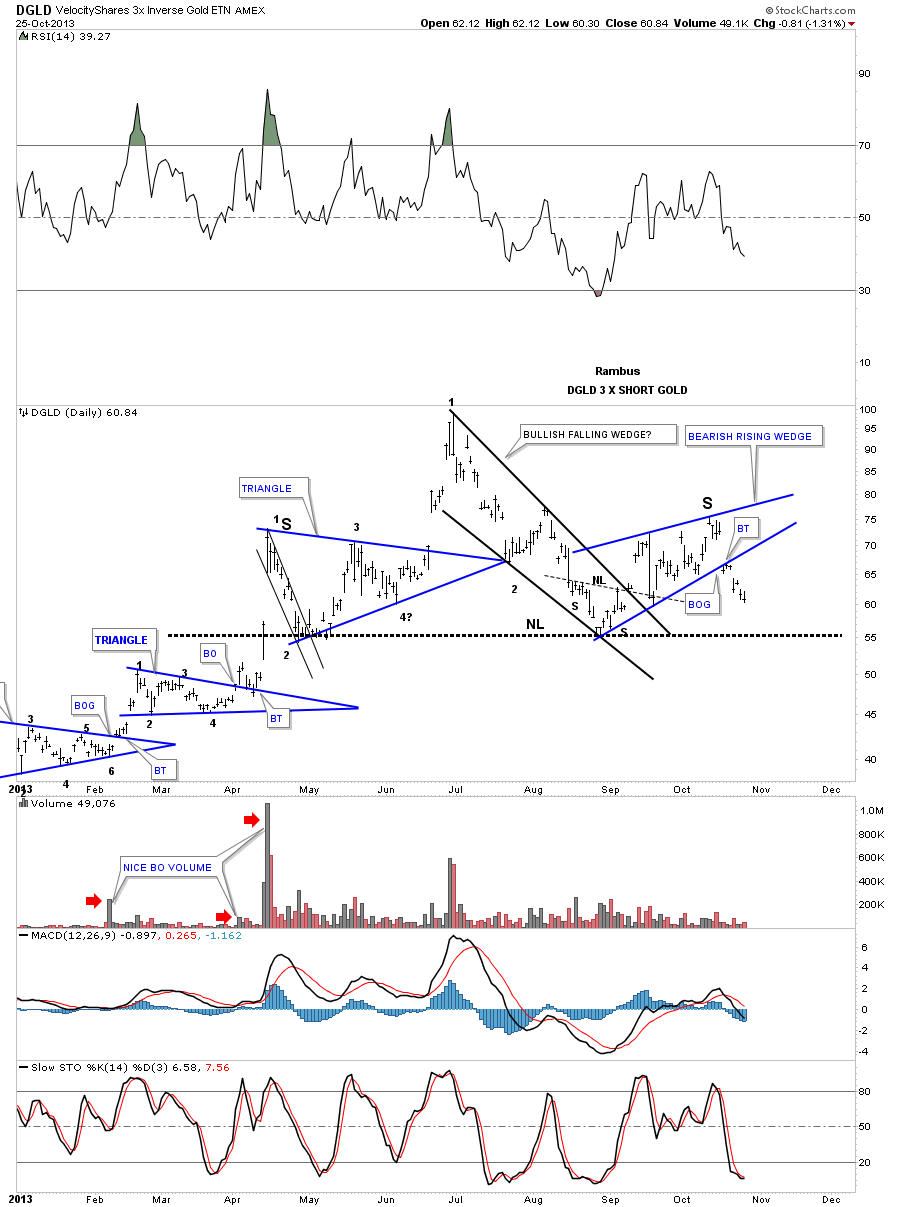

Next I would like to look at some inverse etf’s for gold, precious metals stocks and silver. I’m actually getting a pretty clear reading on these short 3 X etf’s that are painting a very positive picture for the precious metals complex. Remember they are inverse etf’s that shows if DGLD is building a H&S top then gold is showing a H&S bottom. The first chart we’ll look at is DGLD 3 X short gold that has a very nice looking H&S top in place. As you can see it’s made up of three different chart patterns. The price action broke below the blue bearish rising wedge, about 8 days ago, with a quick backtest that told me to expect a move down to the neckline at the very least. This is good for our UGLD trade which is 3 X long gold.

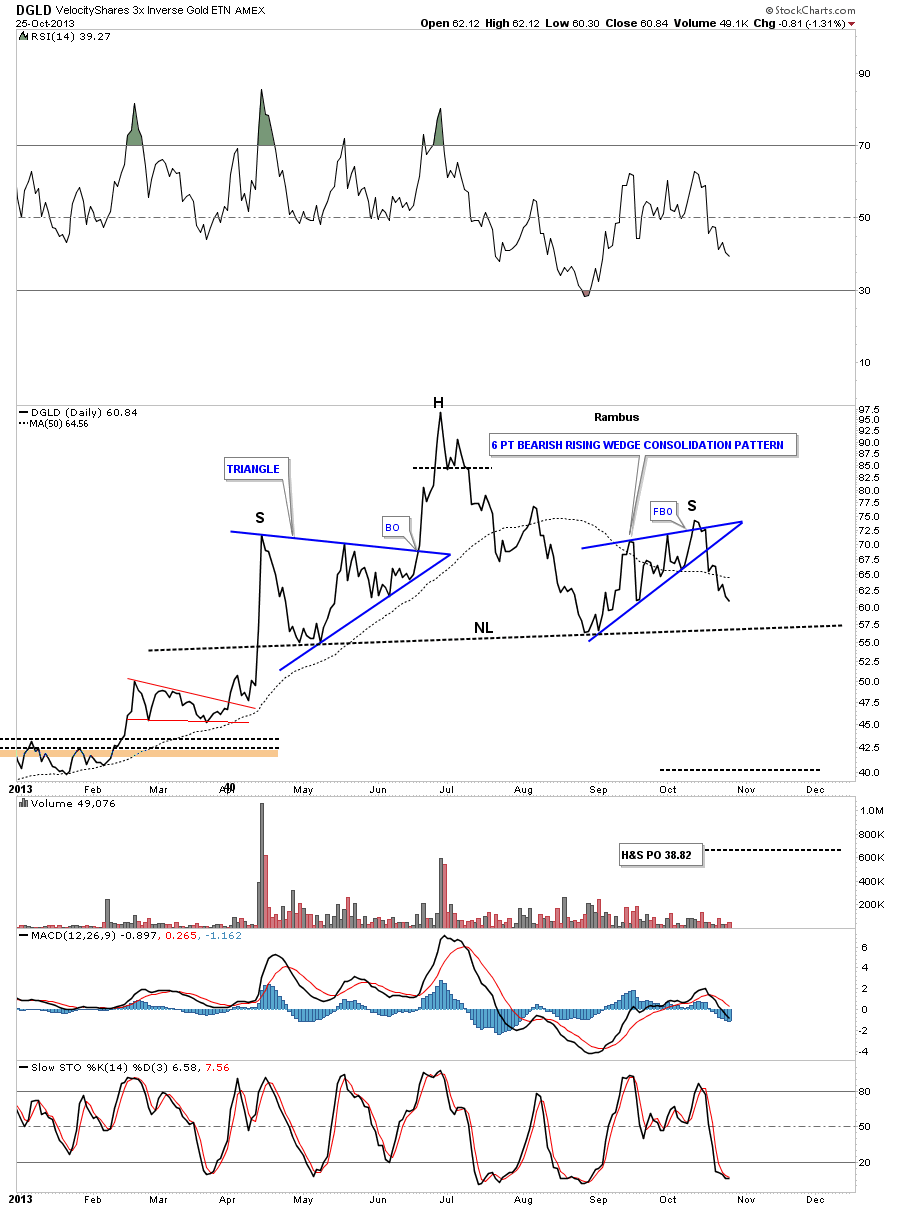

Below is a line chart for the DGLD short gold etf that shows a nice symmetrical H&S top that is trading below the 50 dma.

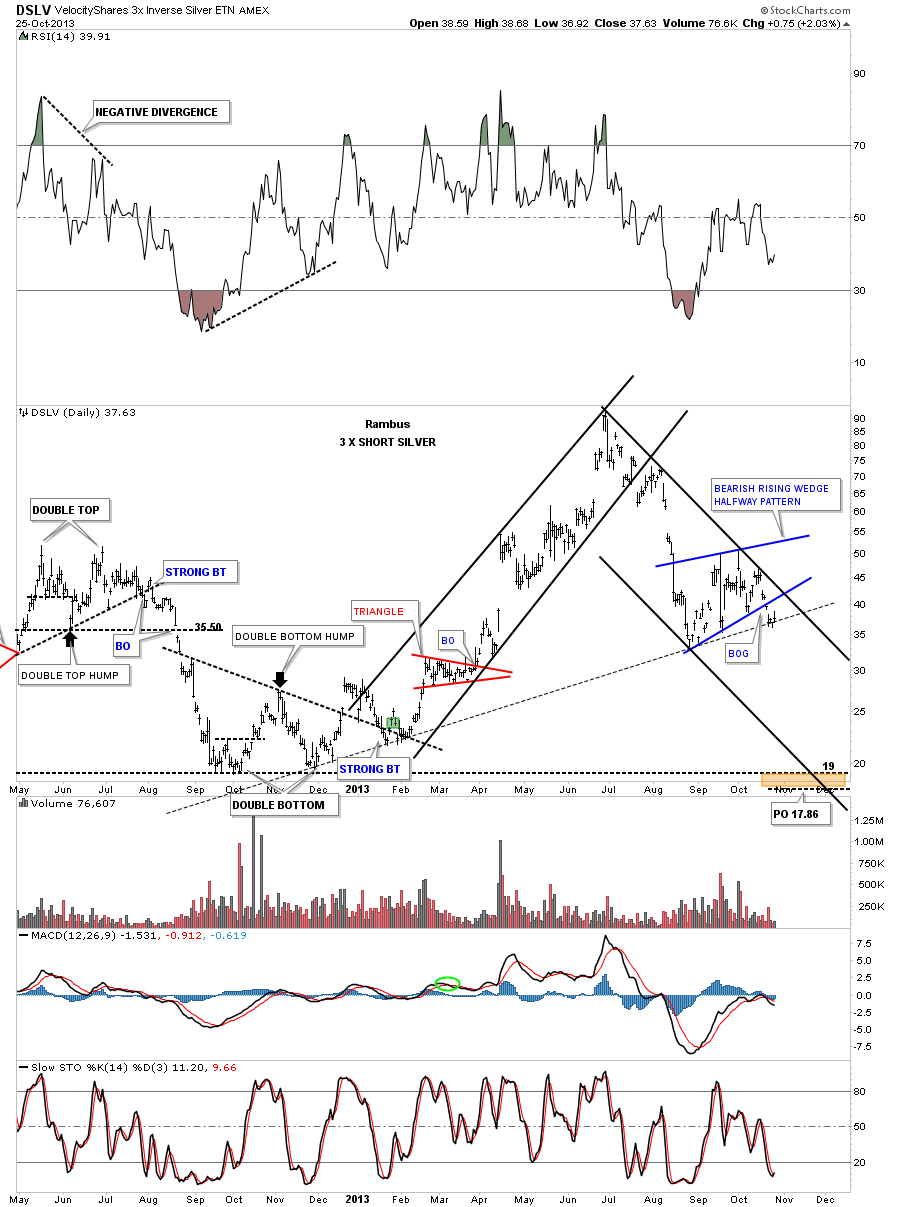

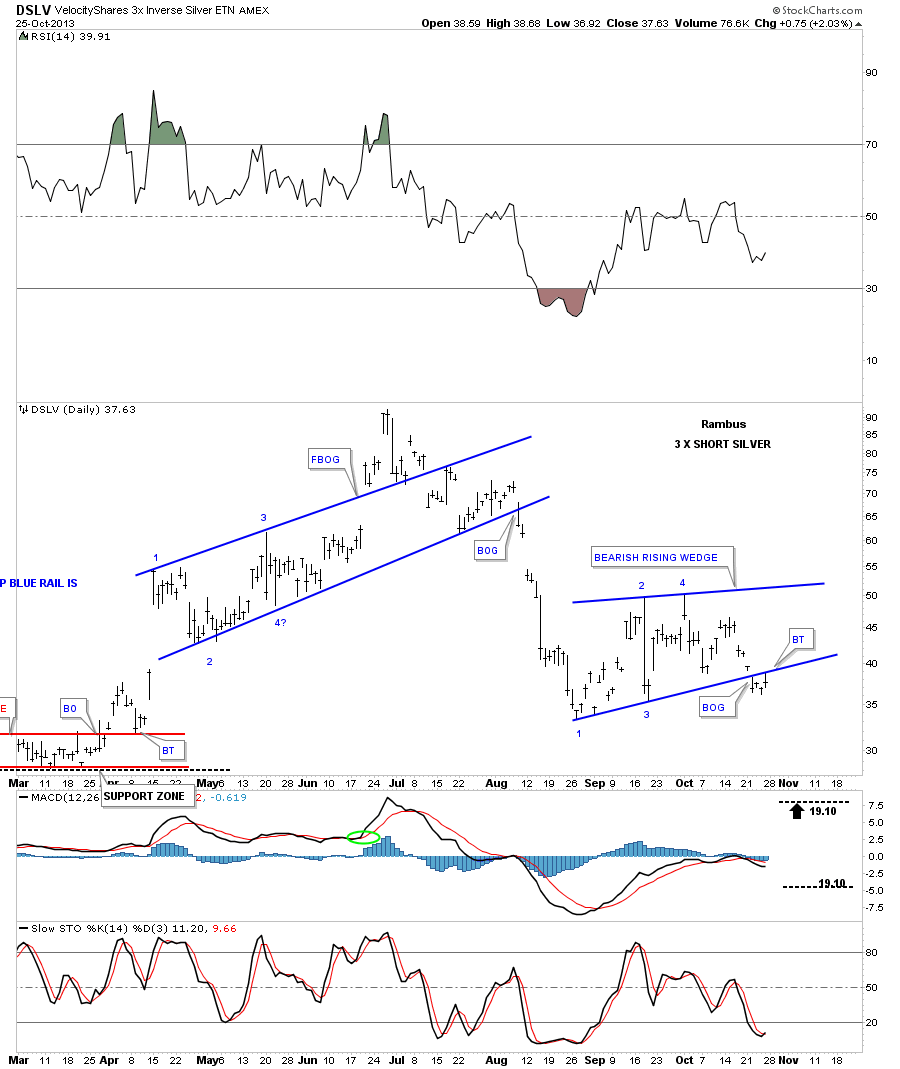

Next lets look at DSLV which is a 3 X short silver etf that is showing a very bearish picture for that etf but a very positive picture for your USLV 3 X long silver etf. DSLV is hanging on by a fingernail to the black dashed uptrend rail. Note it has already broken out from the blue bearish rising wedge halfway pattern. These types of patterns generally form about halfway through the impulse leg down. By the looks of this chart the next 4 to 6 weeks should be very bad if you are short silver but very good if you’re long silver.

Below is a close up view of DSLV’s bearish rising wedge complete with a breakout gap and backtest last Friday. This is the reason silver was weaker last Friday compared to gold and the HUI as it was in backtest mode, not quite ready to start its impulse leg.

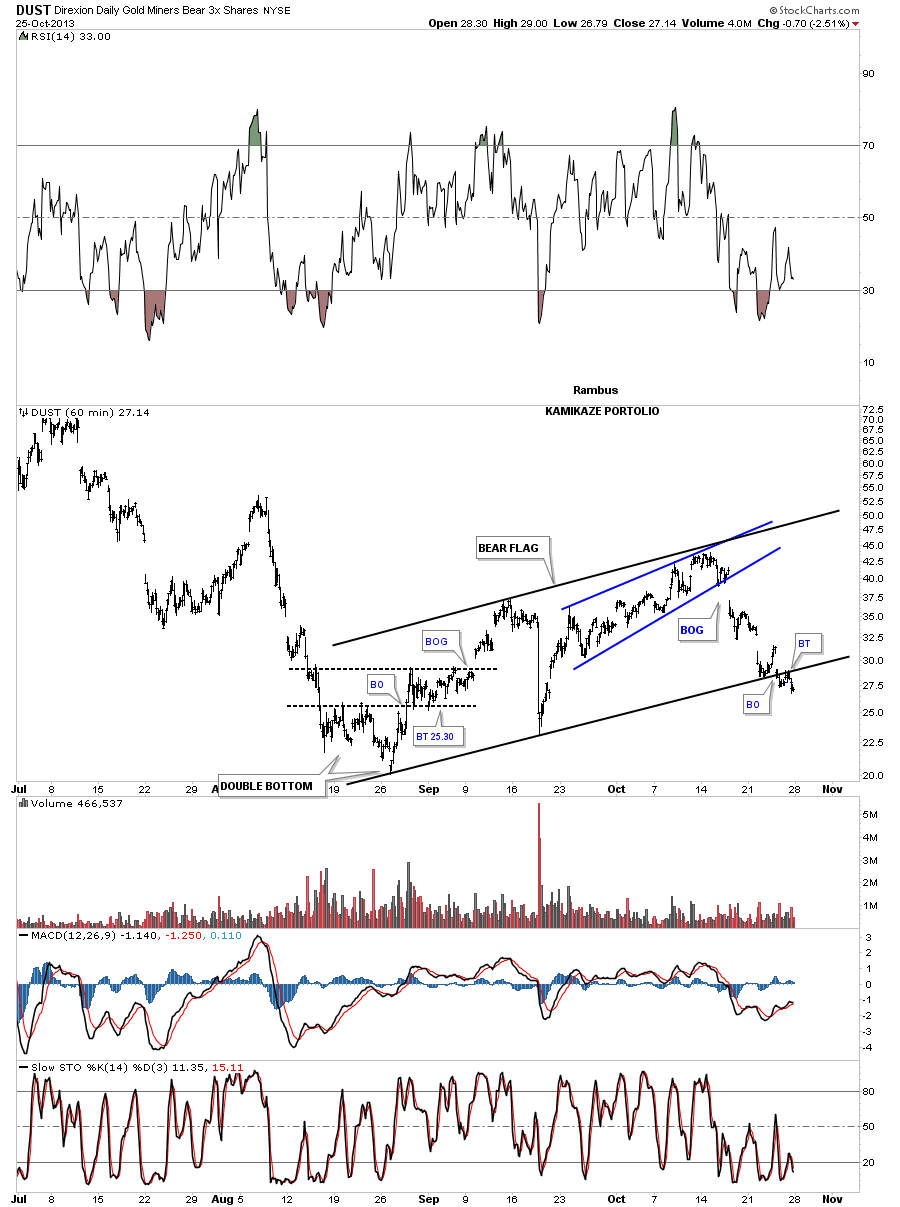

Now lets look at everybody’s favorite 3 X short etf, DUST. The 60 minute chart shows the blue bearish rising wedge that we were watching very close that had a false breakout to the upside if you recall. It is now part of a much bigger chart pattern the bearish rising flag. Notice the big break away gap from the blue bearish rising wedge. If you recall that is where we exited our DUST position at the time. I said when you see a big gap like that, don’t ask questions, just get out of your position as quickly as possible because there is a good possibility that a big move is about to begin. That is another clue as to why I made such an abrupt turn around from being short the PM complex to going long. Gotta listen to the clues. As you can see DUST has already broken out of the bear flag and did a backtest last Friday.

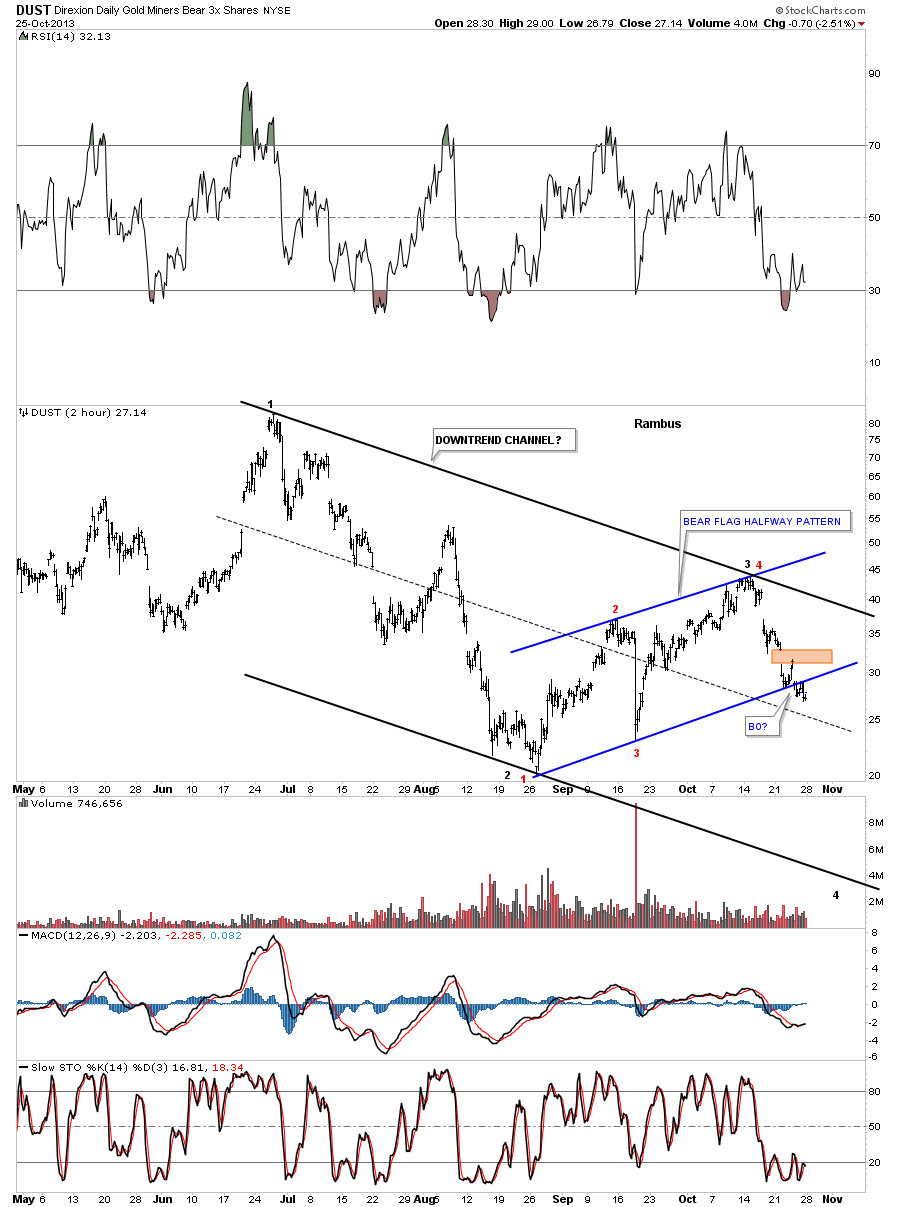

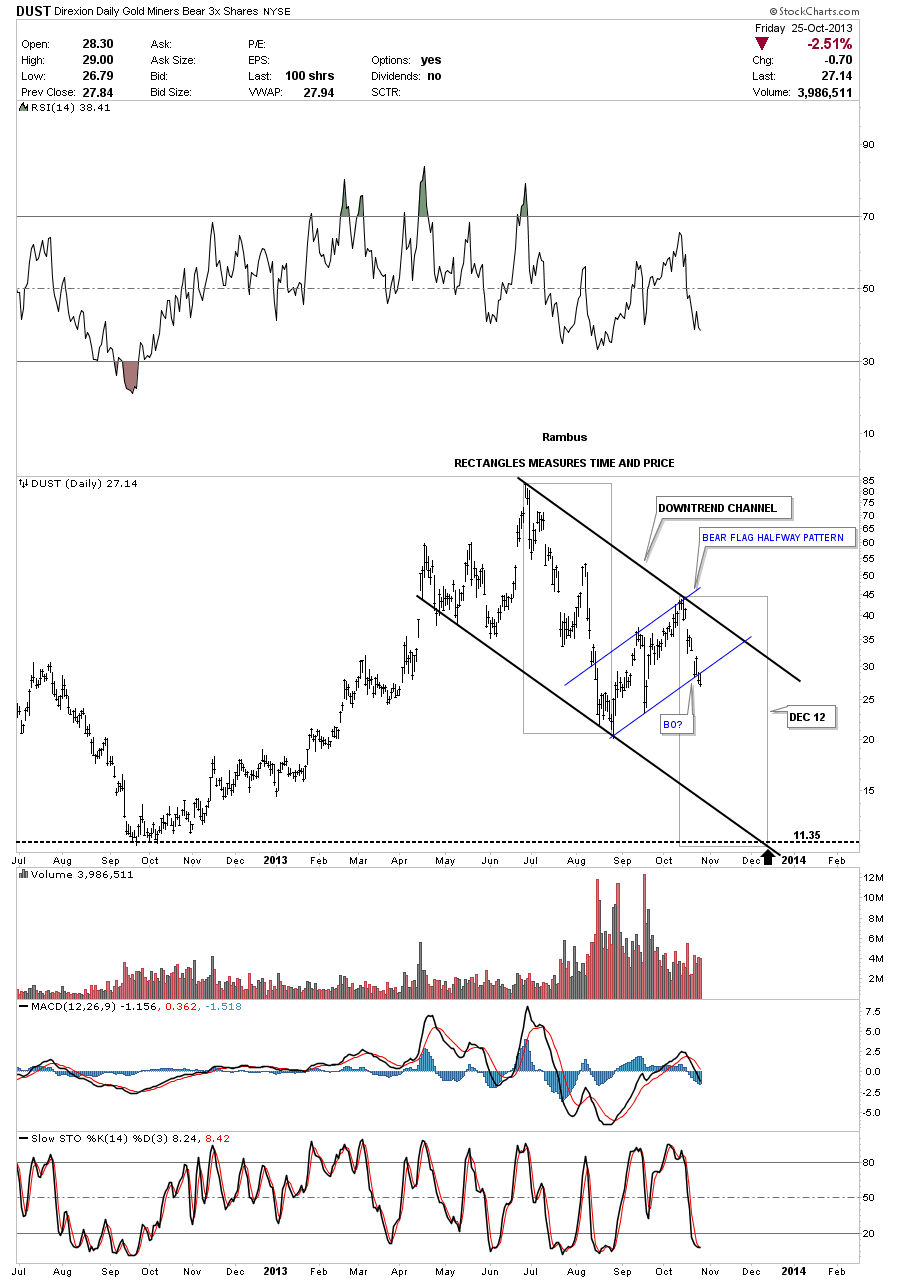

This next chart of DUST puts our bear flag into perspective as a halfway pattern within a bigger downtrend channel. The red numbers shows the nice clean reversal points in the blue bear flag.

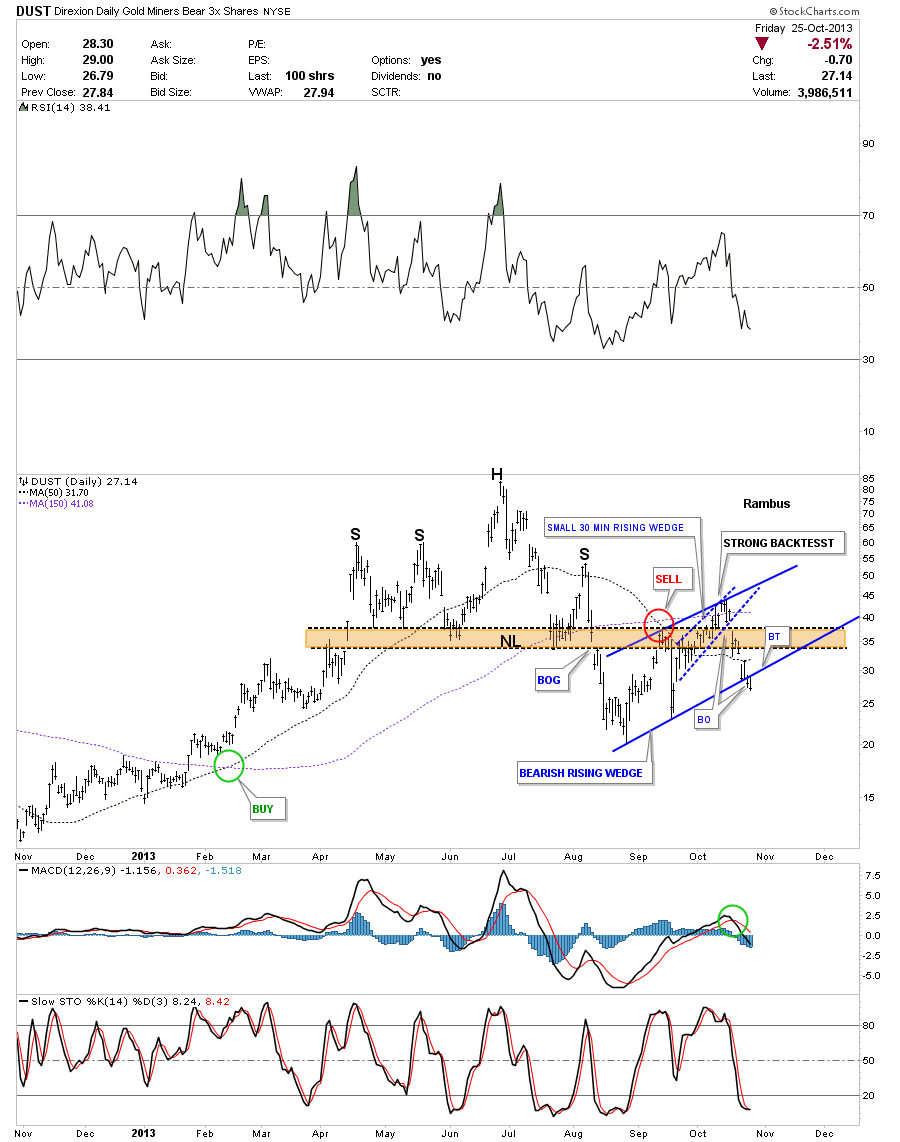

The daily chart for DUST shows a rather ugly H&S top formation with a strong backtest. As you can see the price action from the last two days has traded below the bottom blue rail of the blue bearish rising wedge so we are actually 2 days into the breakout.

This last chart shows how I’m measuring the blue bear flag as a halfway pattern. Each rectangle measures time and price. Notice how the price objective is all the way down to the October low from last year that should come in around the 11.35 area around the 12th of December. This chart is a template for us to watch to see how things progress. As long as nothing gets broken and the price action continues to fall we’ll just bid our time waiting for the price objective down to the 11.35 area to be hit. There are no guarantees that this will unfold exactly how I have it laid out but this is the best scenario I see from a Chartology perspective.

Keep in mind these three etf’s are short the precious metals complex. The reason I’m showing you these short etf’s is because they have a clearer picture and are easier to see their tops which would be bottoms on our long precious metals stocks, NUGT, UGLD and USLV. By the looks of these chart above we are on the cusp of something interesting that is about to happen in the precious metals sector. Stay tuned for further developments. All the best…Rambus

Goooood Morning Chartologists

Rambus Has completed his all important Weekend Report early

He is busy with his Grandson’s Third Grade Football Playoffs today

He has asked me to post it

But I decided to keep it to myself this week

…………………………………

OK OK….Stop with the Brick Throwing Please

Posting will be This evening about 7 to 8 PM Eastern North America Time

Here is a Hint :

Me and My DUST

………………………….

Meanwhile Please gather at the Forum to share your ideas and Vote the new Poll

For those with Forumophobia ..or those who like to vote twice…we have the same Poll Here at the main Site

Vote Vote Vote

(Scroll Down half way to the Poll on the Sidebar)

Weekend Report…The “Dollar Diamond Top” : Implications for the Precious Metals

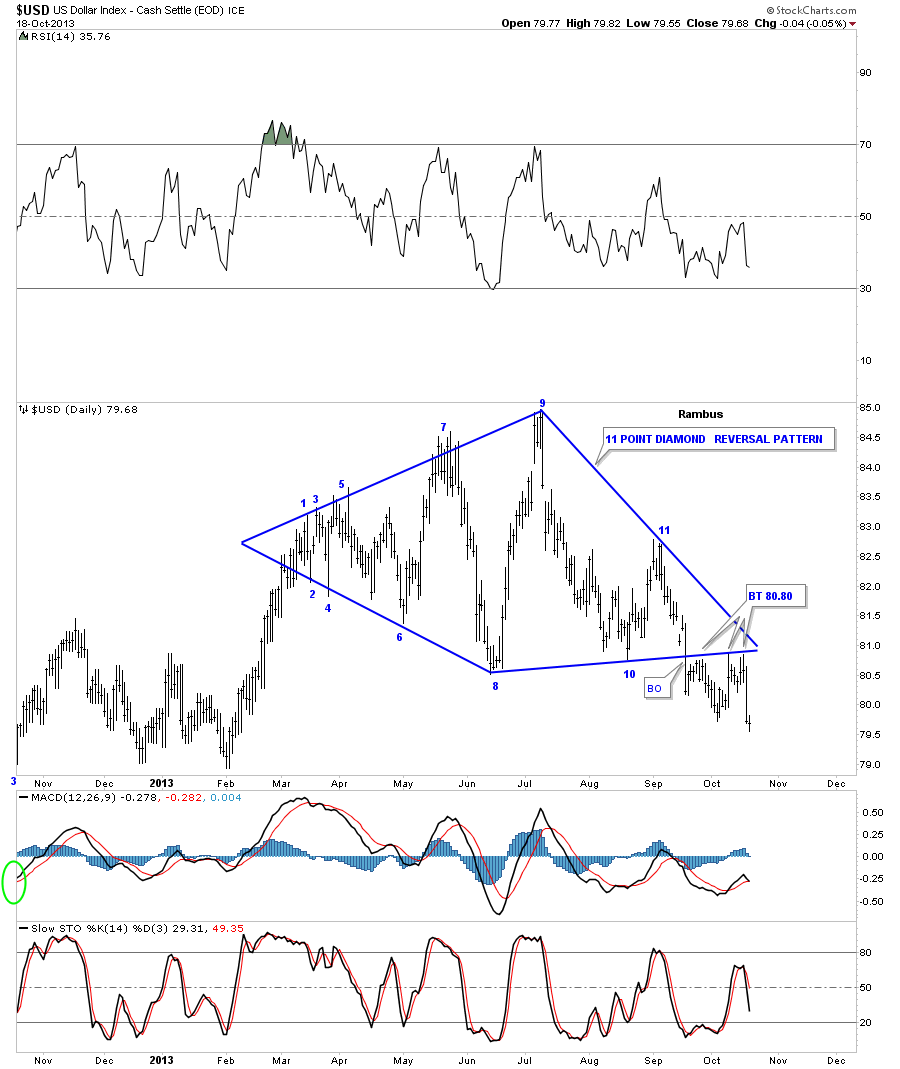

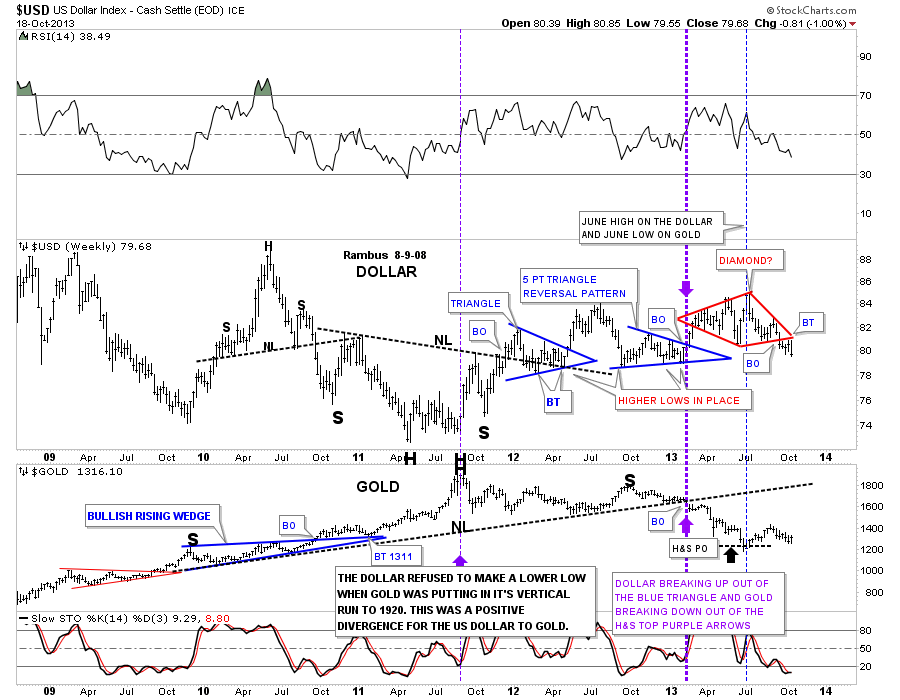

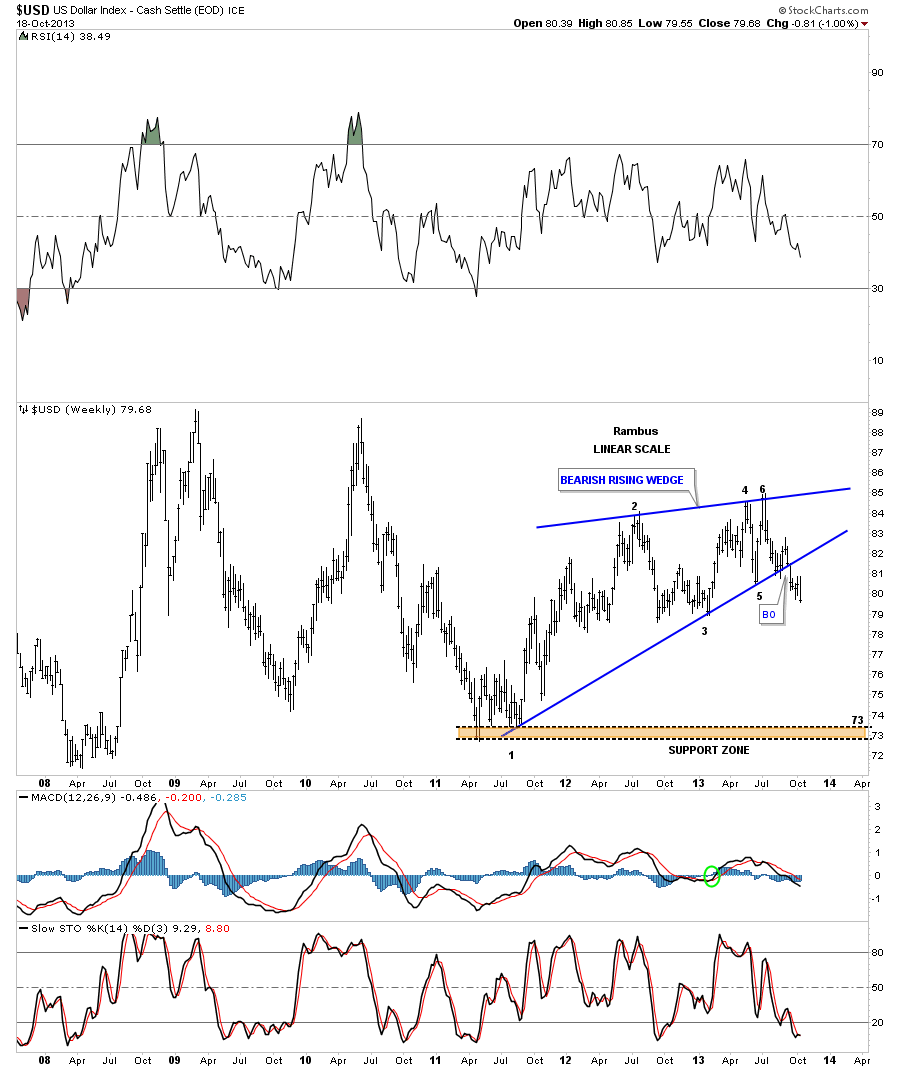

In this Weekend Report I would like to show you some charts as to why I have made an abrupt short term move out of our short positions in the precious metals complex. I know some of you think I have lost my mind but I can assure you that isn’t the case. Regardless if I’m bullish or bearish I’m always looking at both sides of the market looking for clues for either direction. This week we got a major clue when the US dollar finally finished its third backtest to the bottom rail of the 11 point diamond top. It’s possible that gold and US dollar can trade in the same direction for awhile but I don’t think that will be the case longer term. So lets look at some charts for the US dollar first as that’s where the biggest clues lie.

A diamond is generally consider a bearish topping pattern but from my experience they can go either way. I’ve shown you some beautiful diamond consolidation patterns that worked out very well. It’s the same with the rising and falling wedges. Whichever way they breakout will be the direction of the next move. It just so happens that our 11 point diamond pattern on the US dollar has broken down and out of the pattern. If the reversal point at #10 held and the price action rallied back up and through the top rail it would have been a consolidation pattern but that is not the case. After a month or so of backtesting the bottom rail of the diamond pattern it now looks like the move down on Thursday maybe starting the impulse leg lower.

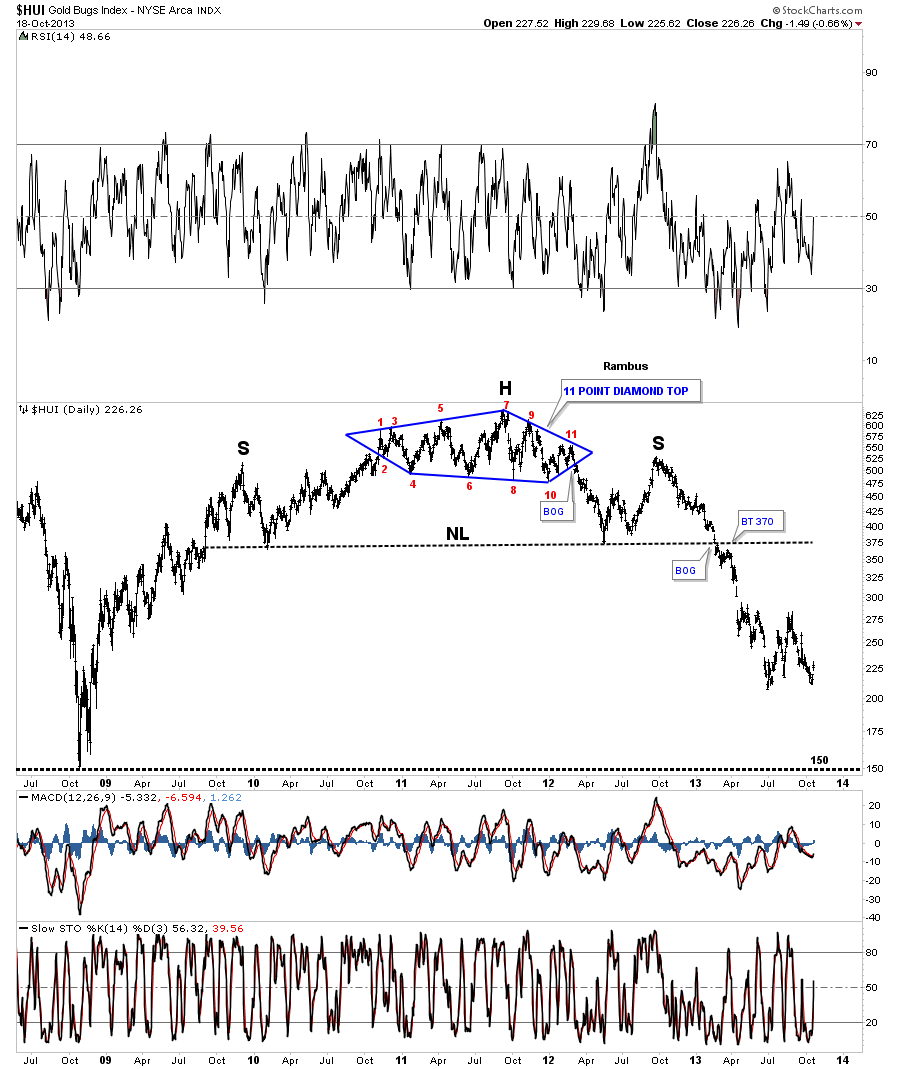

The reason the 11 point diamond on the US dollar chart is so negative for me is because one formed on the HUI as the head portion of the massive H&S top. When you spot one it pays to heed its warning either as a topping pattern or a consolidation pattern.

Below is a combo chart that has the US dollar on top and gold on the bottom. Up until the dollar broke below the diamond top five weeks ago I was bullish on the dollar and bearish on gold which proved to be the case since gold topped out in 2011. I don’t know about you but when I look at the red diamond and see nothing but air below it it doesn’t make me feel very bullish. Sir Chuck here is a strongly slanted H&S top on gold, that you won’t see anywhere else but at Rambus Chartology, that reached its price objective at the June low as the US dollar was putting its high on the diamond. As you can see over the last two months or so the inverse correlation hasn’t been that strong but I think if the dollar continues to fall we will see gold move higher.

Lets look at one more chart for the US dollar that shows a 6 point bearish rising wedge. The bottom of the bearish rising wedge would be the price objective which would come in around the 73 area. How long it takes the dollar to reach that first real support zone should tell us how long gold will have to be in rally mode.

A weak US dollar usually means a stronger commodities market in general. The chart below shows the GNX trading in a falling wedge pattern for just under three years now. As you can see the price action is now being squeezed into the apex of the bottom black uptrend rail and the top rail of the blue falling wedge. If the GNX breaks out through the top blue rail I would have to consider this big falling wedge as a halfway pattern to the upside. As you can see this commodities index can really move in both directions. It would also be telling us that commodities in general maybe a good place to park some capital.

There is an area I like to follow when we see a weaker US dollar and that is the Basic Materials sector. As you can see the IYM, basic materials etf, has just broken out of a 6 point bullish rising wedge and completed the backtest a week ago. It’s hard to believe but this etf is within striking distance of its all time highs.

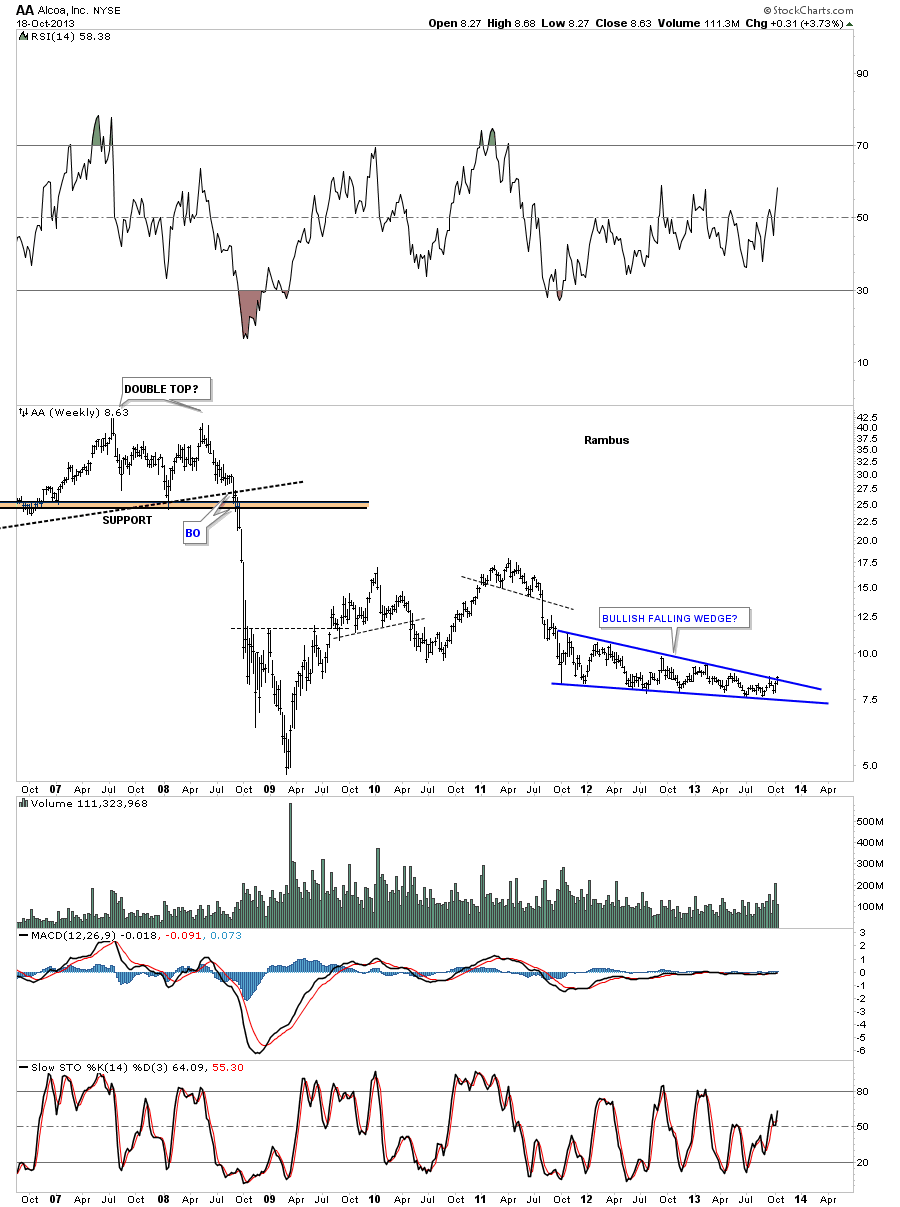

Lets looks at several stocks that are in the basic materials sector. AA has been building out a very tight falling wedge that is right on the verge of breaking out through the top rail. It had many chances to break below the bottom rail over the last two years but it never happened.

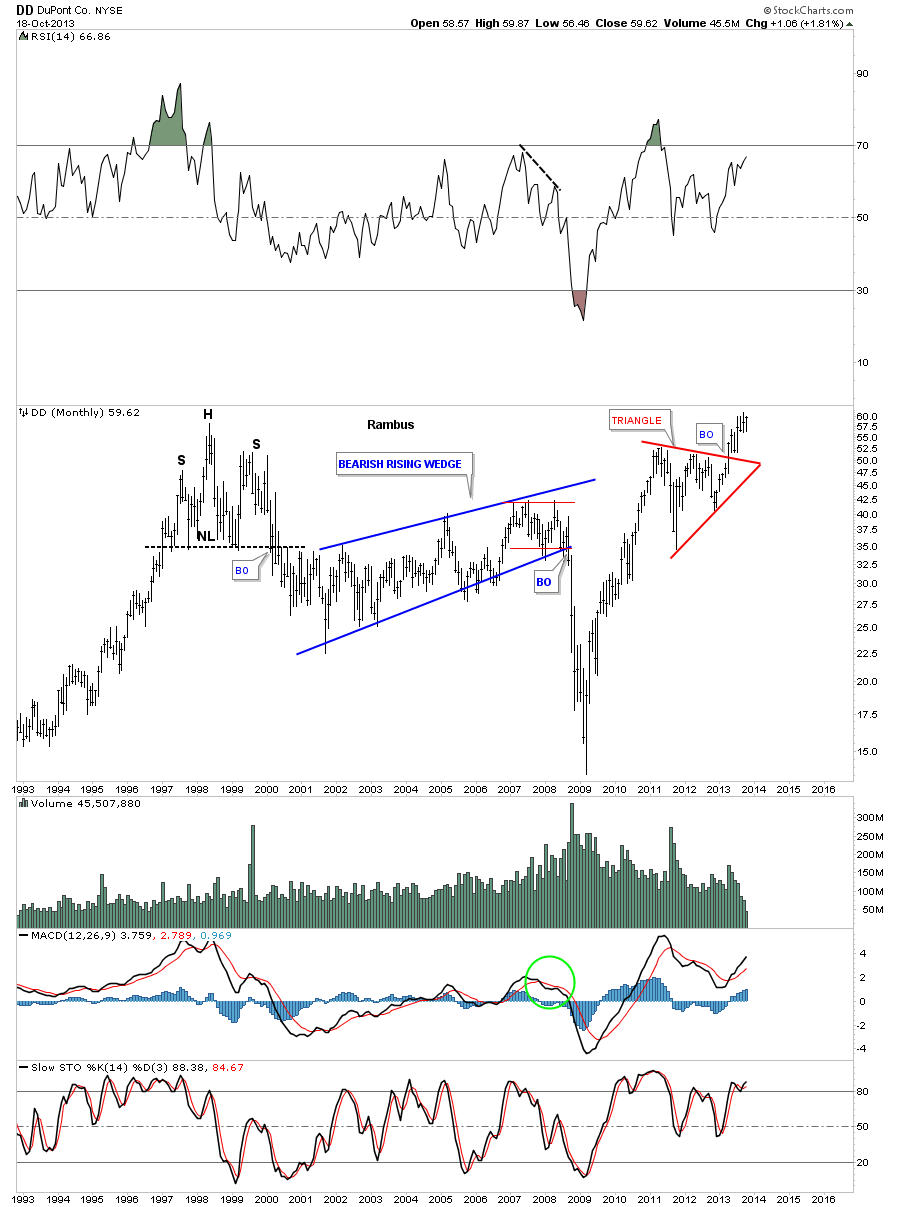

DD – DuPONT has broken out of a very pretty symmetrical triangle consolidation pattern and is now in an impulse move higher. It’s also trading at new all time highs.

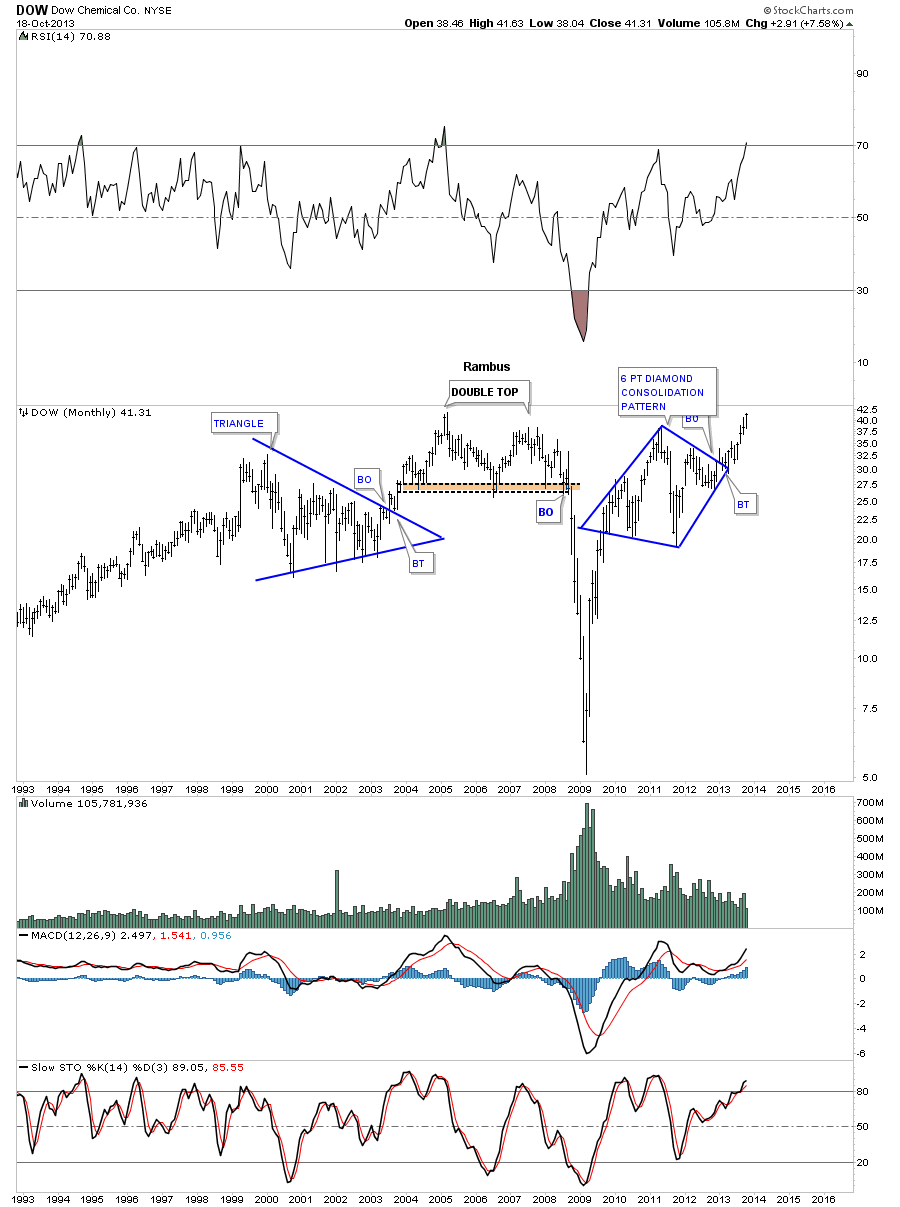

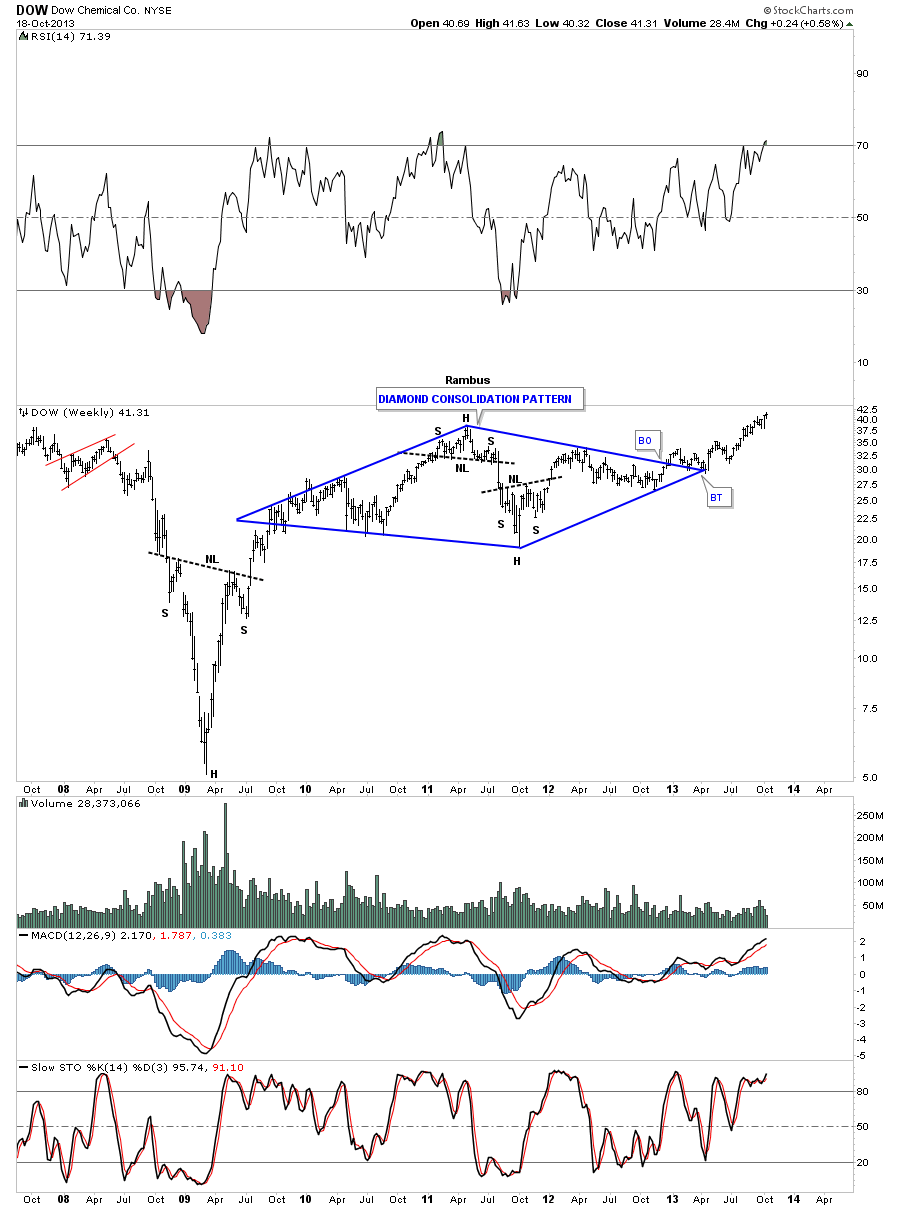

Dow Chemical has broken out of a diamond consolidation pattern and is running to the upside trading very close to new all time highs.

Dow Chemical weekly diamond.

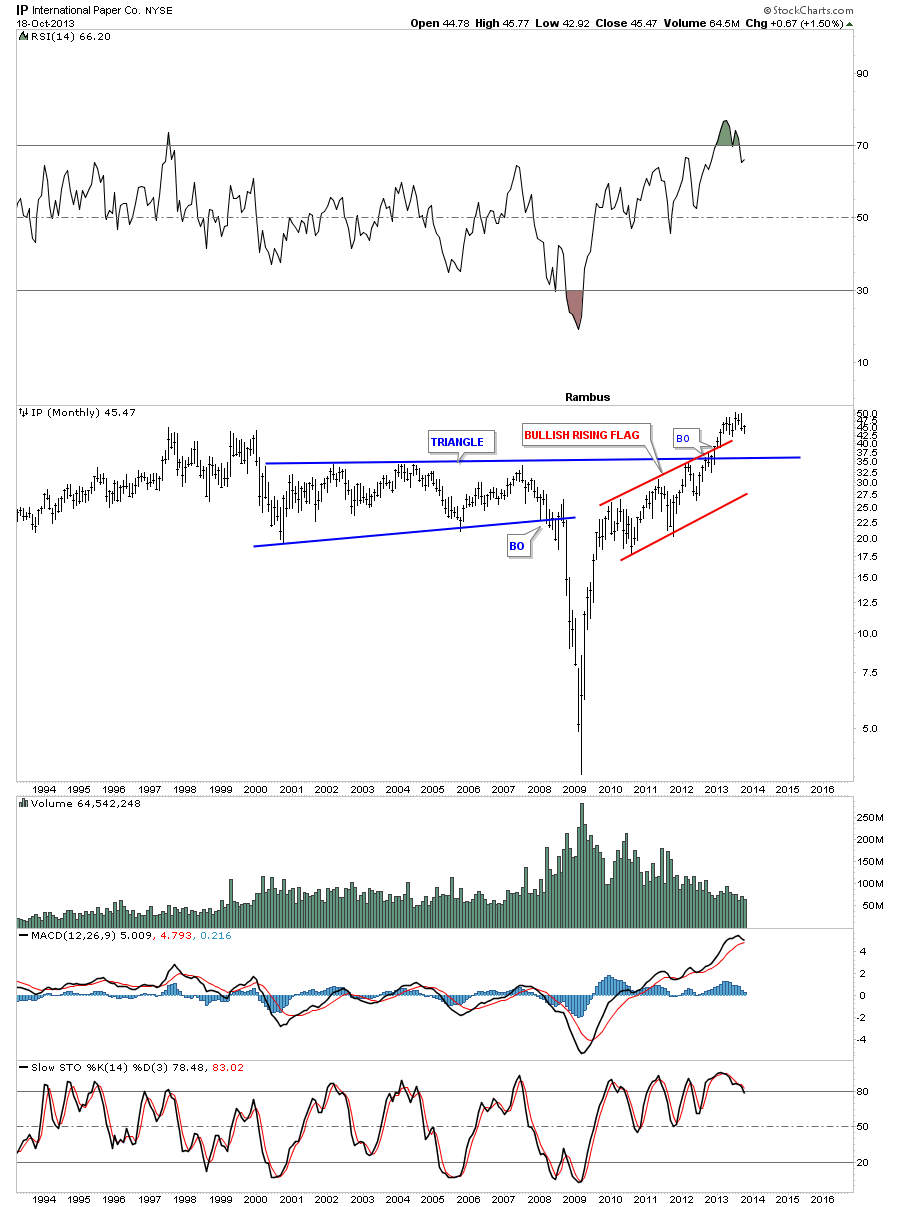

IP – International Paper is trading back above the top rail of the blue triangle that led to the 2008 crash low. It formed the red bullish rising flag just below the top blue rail and is now trading close to new all time highs.

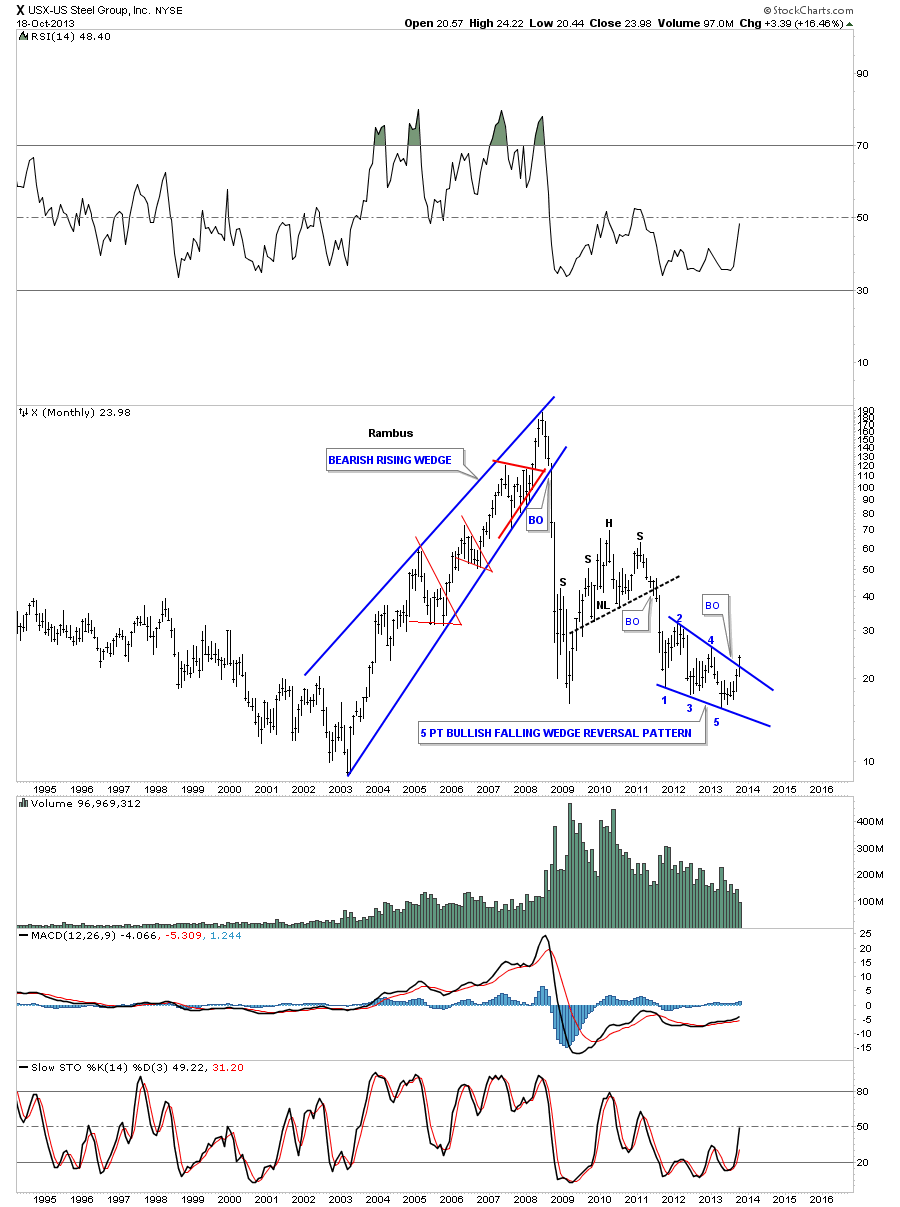

Lets look at one more stock in the basic materials sector that is just now breaking out of a 5 point bullish falling wedge. X – US Steel is trading way below its all time highs but it looks like a bullish setup to me as it has broken out of a 5 point bullish falling wedge. There is a lot of room to the upside on this one.

Next I would like to look at several of the very largest miners that have been morphing from what was looking like a H&S top pattern that is failing as the price action is now eroding the neckline to the upside. These H&S patterns were formed about the same time the HUI’s big H&S top formed but unlike the HUI that crashed down to the 200 area these big miners kept hanging around their necklines. I kept wait for them to follow the HUI lower but they refused. Now with the weaker US dollar they’re beginning to show some life.

The first big miner I would like to show you is RIO that actually had a double H&S top with a clean breakout to the downside and backtest. Over the last eight weeks or so the price action has been trading just above the neckline and now looks like it maybe forming a smaller inverse H&S bottom right on the big neckline. It’s still possible it could trade back below the neckline but I have to give the benefit of a doubt to the smaller inverse H&S bottom until prove otherwise.

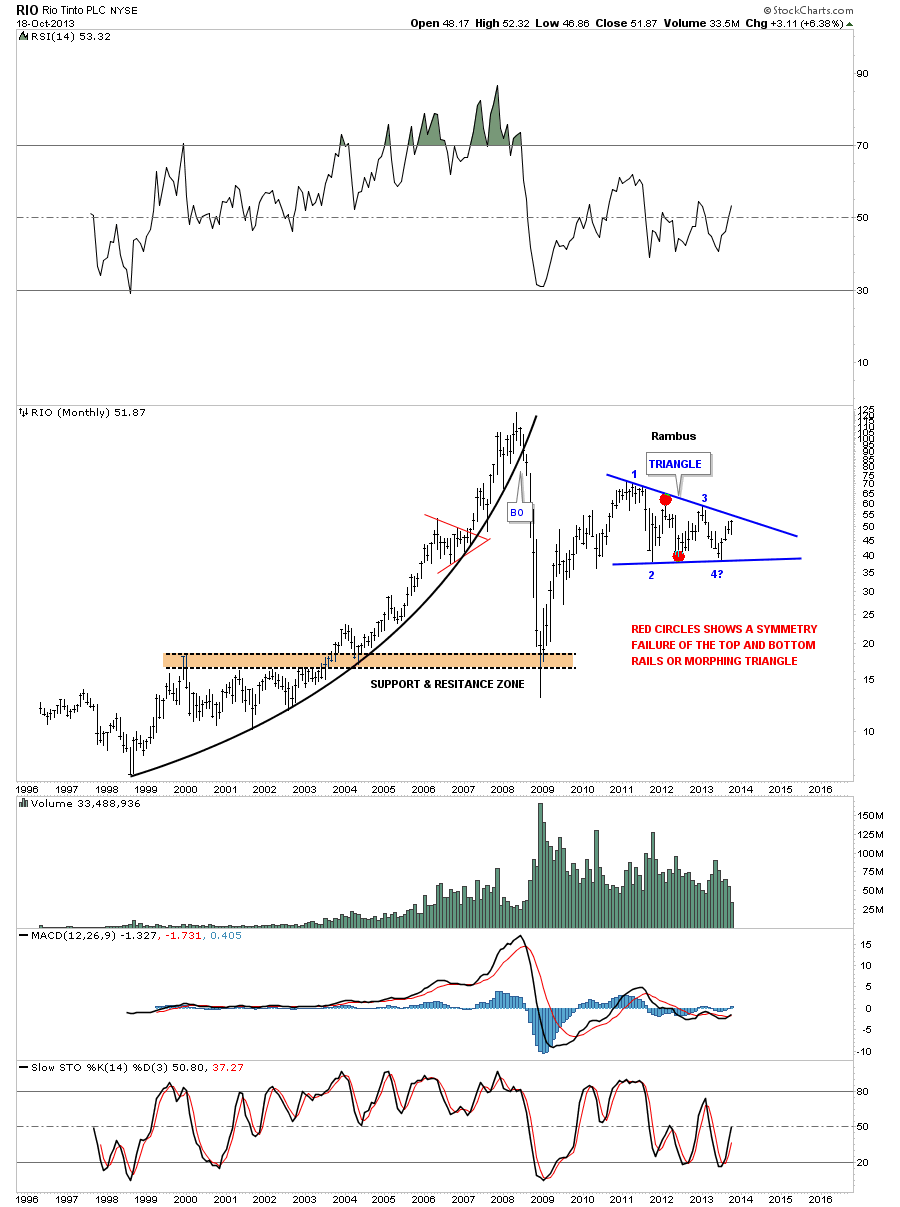

Below is the monthly chart for RIO that showed the unbalanced H&S top which now looks like a false breakout.

Below is the same monthly chart for RIO but this time I’ve changed the trendlines to the new pattern that is emerging. It still hasn’t broken out of the top rail yet but if it does I would have to consider this triangle to be a halfway pattern. Note how the brown shaded support and resistance area held support during the 2008 crash.

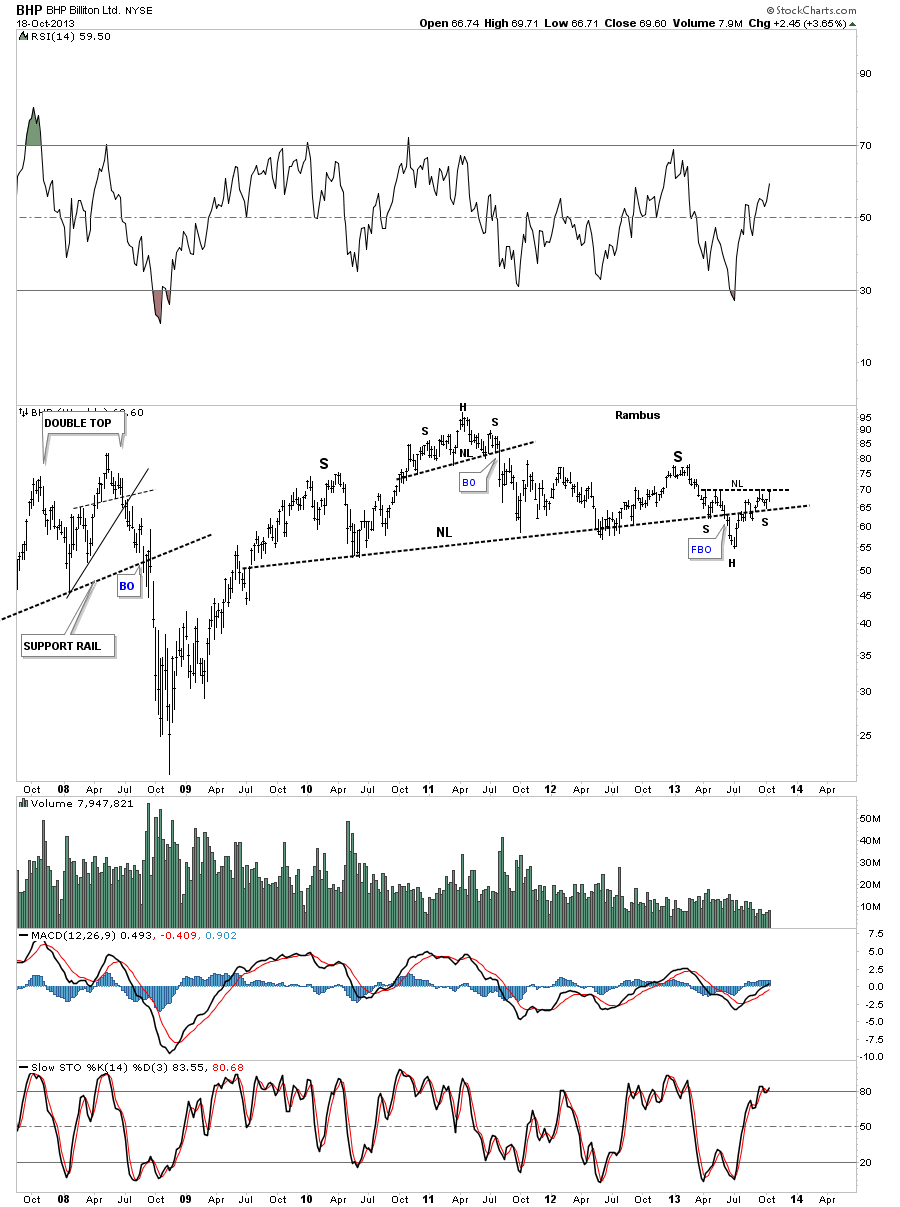

BHP weekly chart shows the exact same setup to RIO with the false breakout from the neckline and now is trading on top of the neckline.

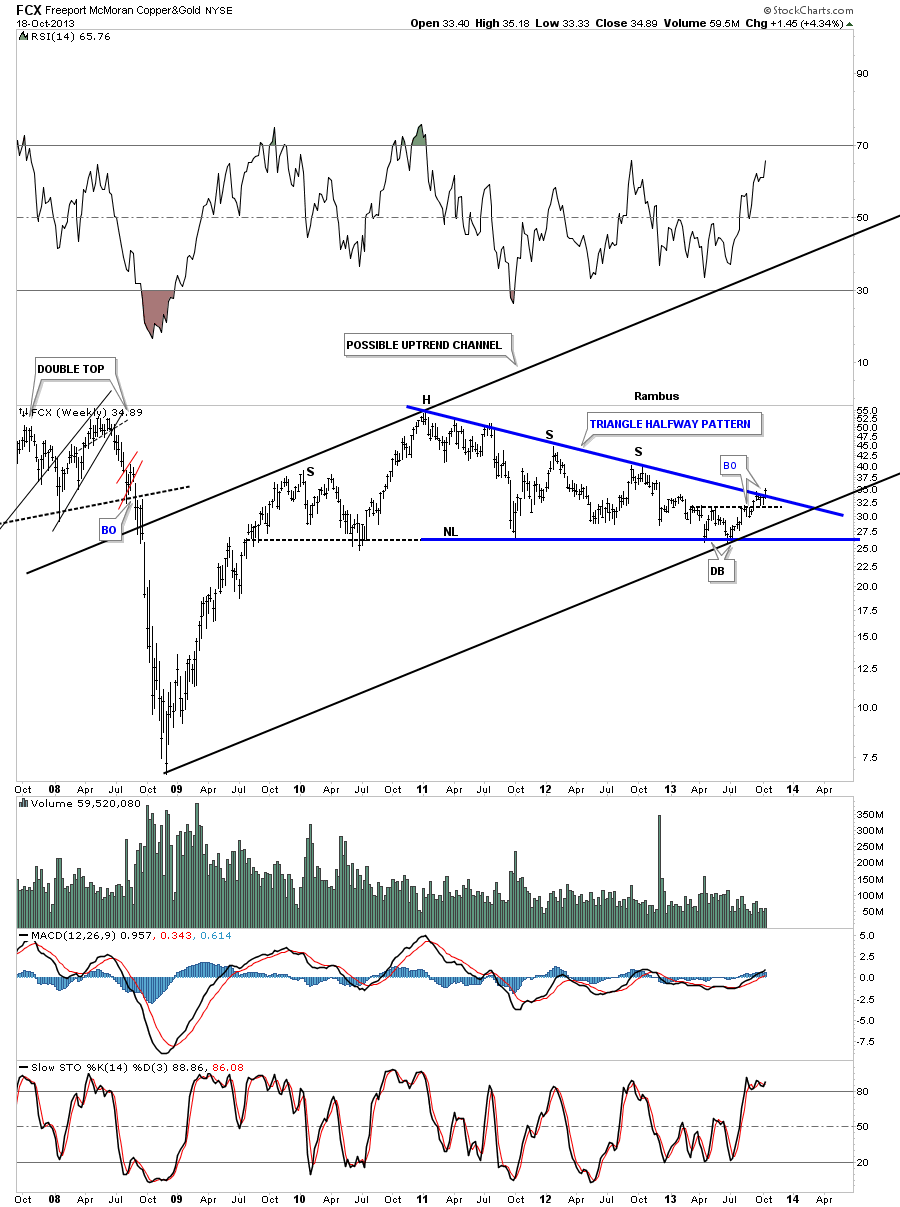

Lets look at one more big miner FCX that is actually breaking through the top rail of its now morphing H&S – triangle pattern. I’ve left the original annotation on this weekly chart that shows how the H&S looked in conjunction with the blue triangle. Note the small double bottom that formed on the right side of the chart that has led to the breakout of the top blue rail.

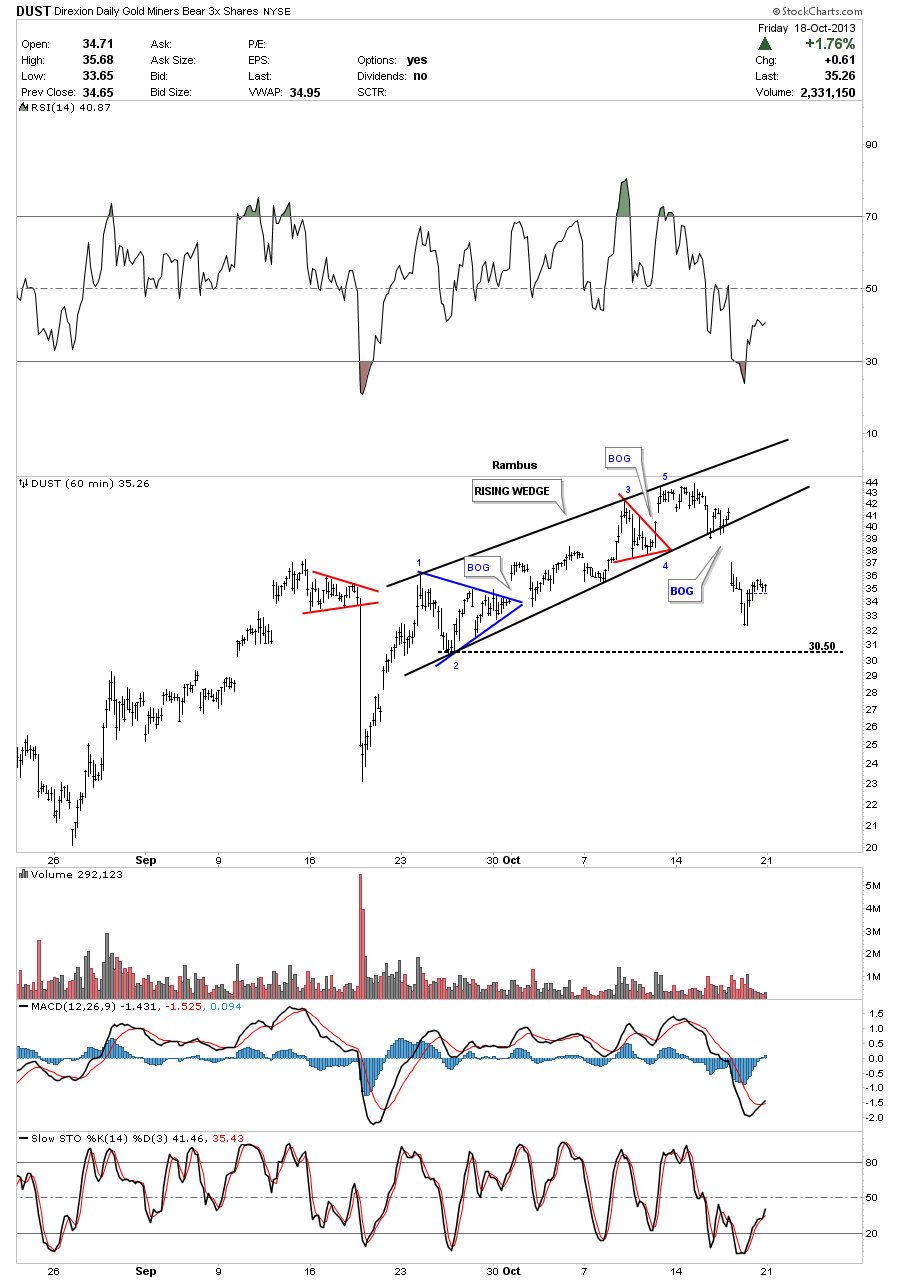

Lets look at one more stock that I know most of you are interested in, DUST. Earlier last week we were looking at a morphing rising wedge that looked like it was breaking out to the topside on the 30 minute chart. Right after the breakout it declined and found support at the apex of the original rising wedge, blue dashed trendlines. From there it made one last attempt to breakout and move higher but as you can see it lost momentum and closed at the bottom rail. Nothing was broken at that time and it looked like it had just formed a small double bottom on the bottom rail. The next morning there was a big to the downside that forced us to exit our positions. What is left behind looks like a 5 point bearish rising wedge. When there is a big break like that it doesn’t pay to be cute and out guess what the stock may do. That big gap is talking to us even if DUST recovers, discipline says to get out of harms way and don’t ask questions.

DUST 60 minute look.

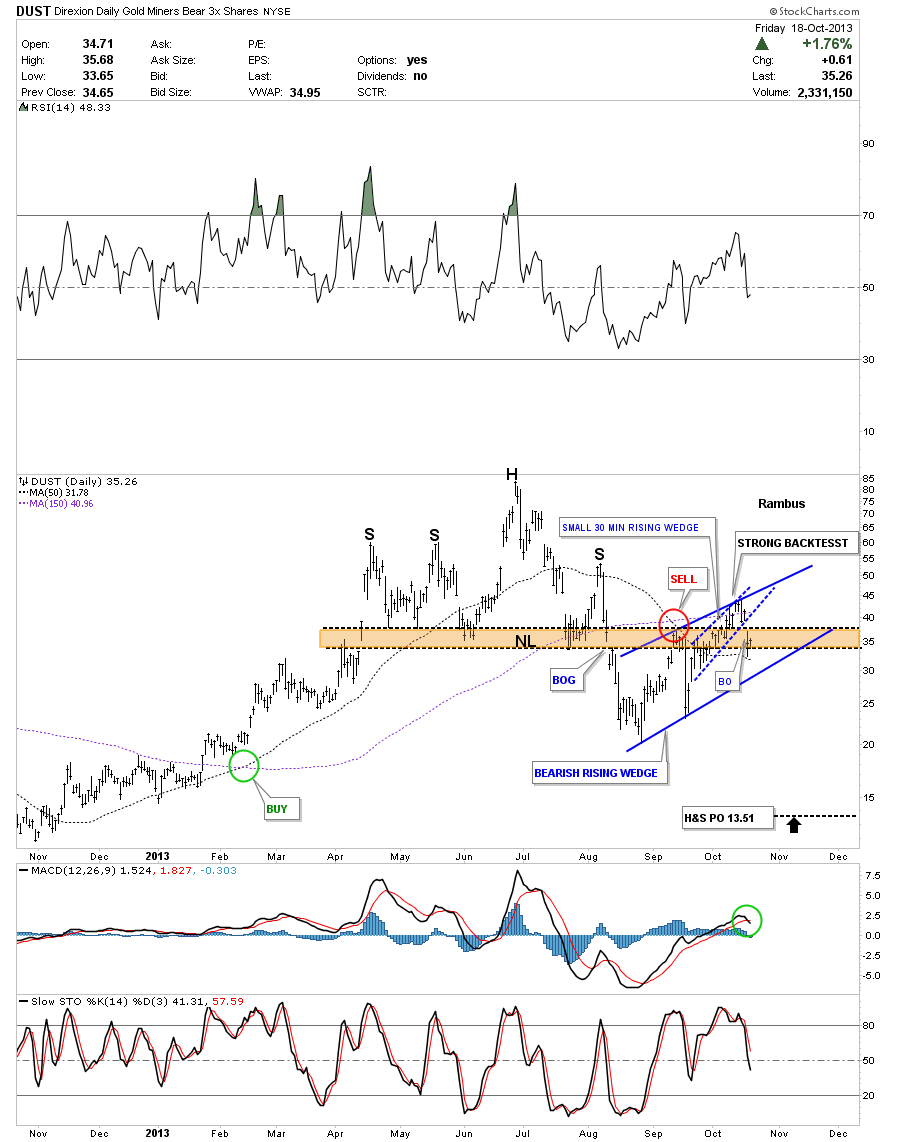

Below is a daily chart for DUST that shows what I think is happening right now. There is a possible unbalanced H&S top with a fat neckline, brown shaded area. There is a bigger rising wedge that is making a strong backtest to the neckline. I have to admit it’s not the prettiest H&S top I’ve ever seen but it could fit the bill. Just like the HUI, that doesn’t have a clear picture yet, is leaving some room for further interpretation. Right now DUST is trading between the 50 dma and the 150 dma. As you know we took a small starter position in NUGT based on the breakout from the smaller, rising wedge, blue dashed rails. The bigger rising wedge still hasn’t broken out to the downside yet. if it does we can add more to our NUGT position. If DUST can rally back above the bottom dashed blue rail of the smaller rising wedge we would then have to exit our NUGT position.

If one can get the direction of the US dollar right that goes along way towards making the right decision in which area to invest. Up until just recently the US dollar was in that chopping sideways diamond that didn’t show itself as a top or consolidation pattern. With the breakout and now three backtests to the bottom rail of the blue diamond, the evidence now becomes undeniable until something changes for the positive for the dollar. The first thing the dollar would have to do to show it’s becoming positive would be for it to trade above the apex of the blue diamond. That would get my attention. The burden of proof now lies with the dollar bulls to turn things around. I really believe that we are at the very beginnings of a major shift back into commodities again as the charts above are showing. It’s still very early in the transition phase but the commodities have basically been consolidating for close to three years now. With a long term consolidation pattern you get a long term move in the same direction leading into the consolidation pattern. The US dollar is key going forward and if it stays in its downtrend commodities should benefit. It’s still very early yet so we have plenty of time to put together our portfolios. All the best…Rambus

Last Call

New Pricing takes effect at Midnight Sunday Oct 20

as per this Post

http://rambus1.com/?page_id=10112

Present Monthly and Yearly Members are All Grandfathered at the Present rates as long as you continue to subscribe

Note :

If a Monthly Member wishes to go to Yearly…the paypal buttons will reset at midnight to $399 a year

so if you wish to do so at $299 you have until Midnight Cindarella

🙂

Rambus Chartology : State of the Union October 2013

Team Chartology would like to thank each and every member who has found your way to our website and have honoured us

with your support these past 2 years . We are truly humbled by this experience .

………………………

Some of you have been with us from the very beginning in November 2011 .

Most of you early Subscribers are from Goldtent , (the best Damn Goldbug Site On the net) where Rambus first posted his charts back in 2007- 2008

Who We Are and How We Happened

2008 Rambus Deja Vu Post

…………………….

Many more of you found us via Precious Metals Information sites such as

Gold-Eagle

Safehaven

Market Oracle

Investing.com

Kitco and

Safehaven

We thank the Owners and Editors of these sites for posting Rambus Public Posts

Example :

Gold-Eagle Rambus Posts

http://www.gold-eagle.com/authors/rambus

…………………………………..

We are also overwhelmed by the notes of appreciation we have received these past 2 years…some of which can bee seen here

Testamonial Testamania

and

Some Stunning Research into Rambus Chartology from a Member

……………………………………………

The Point of this Post is Not to brag or gloat about Rambus’s Successes( Rambus Hates when I do that) because as we all know

In this business we are only as good as our last trade .

The Point of this Post is to Recap where we have come from and where we are going

HUI a Diamond in the Rough (Posted January 2 2012 !) …just 2 months after we opened

………………………………………………..

Rambus has 2 Portfolios

Both Started August 1 2012

1… Model Portfolio which was originally intended to contain 20 or so PM Stocks

Rambus has been Bullish for very short periods and has carefully built this portfolio 3 times

only to abandon them shortly after when things did not line up

this portfolio has recently held other General Market Stocks and occasionally shorts as well

Presently it is Up a mere 38% since inception and presently it is all in cash..but if I know Rambus

Not For long

2…the Kamikazi Portfolio which is for Agressive Traders and houses 3 X Precious metals Bull and Bear ETFs

as well as occasional other 3X ETFs in other sectors…This Portfolio is presently Fully Invested

and is presently up 358% from Inception…Yes Rambus has turned $100,000 into $458,000 in 14 months

PORTFOLIO TRACKER

http://rambus1.com/?page_id=6926

………………………………….

Now to the Point :

We have Decided to raise the Price of Subscription from $29.99 a month to $39.99 a month

and from $299 a year to $399 a year

Starting on our Second Anniversary Next Sunday October 20th

BUT

All Present Members are Grandfathered at the Present Rate

You will continue as Rambus Members for as long as we are here for $29.99 a month or $299 a year

until you chose to unsubscribe

Now…Present monthly Members who have been considering yearly can do so this week (until Next Sunday)

at the present $299 Yearly price

After that date there will only be 2 Subscription price options available via paypal

$39.99 and $399

So if you chose to go yearly after the 20th it will be at $399

For those who pay by cheque or monthly invoice

we will still honor you present price but if you chose to go with recurring monthly or yearly payments

please do so this week at the present price

Here is the Sign up Link

http://rambus1.com/?page_id=10112

…………………………………..

Again We wish to thank each and every one of you for Subscribing and Look Forward to more Exciting and interesting and Profit Filled years

Fullgoldcrown ……(for Audept, Mrs Rambus and Rambus)

PS : Questions and Comments can be sent to the Contact link on the top right of the Home Page

Wednesday Report…You are Experiencing an Impulse Move…How does it Feel ?

I hope everyone is enjoying the volatility because that is the name of the game we are playing. There is no such thing as a safe investing environment. As with nature you always have two opposing forces, the ying and the yang, the good and the bad, the democrats and republicans and the bulls and the bears. This creates tension between the two sides which leads to movement in one direction or the other. Nature demands change because without it everything would become stagnant and die. Just when you think you have the markets figured out something will change and leave you wondering why this is happening when that should be happening. I’ve stated several times in the past, “the only rule in the market is there are no rules.” This means markets are always changing and what may have worked before may not work this time. So we are always trying to hit a moving target with our Chartology, Elliot Wave or time cycles, whichever method you use, to gain an edge. This is just the nature of the beast pure and simple. If it was easy there would be no markets to trade because everyone would be right and nobody would be wrong. Like I said you have to have the ying and the yang, the good and the bad, the democrats and republicans and the bulls and the bears.

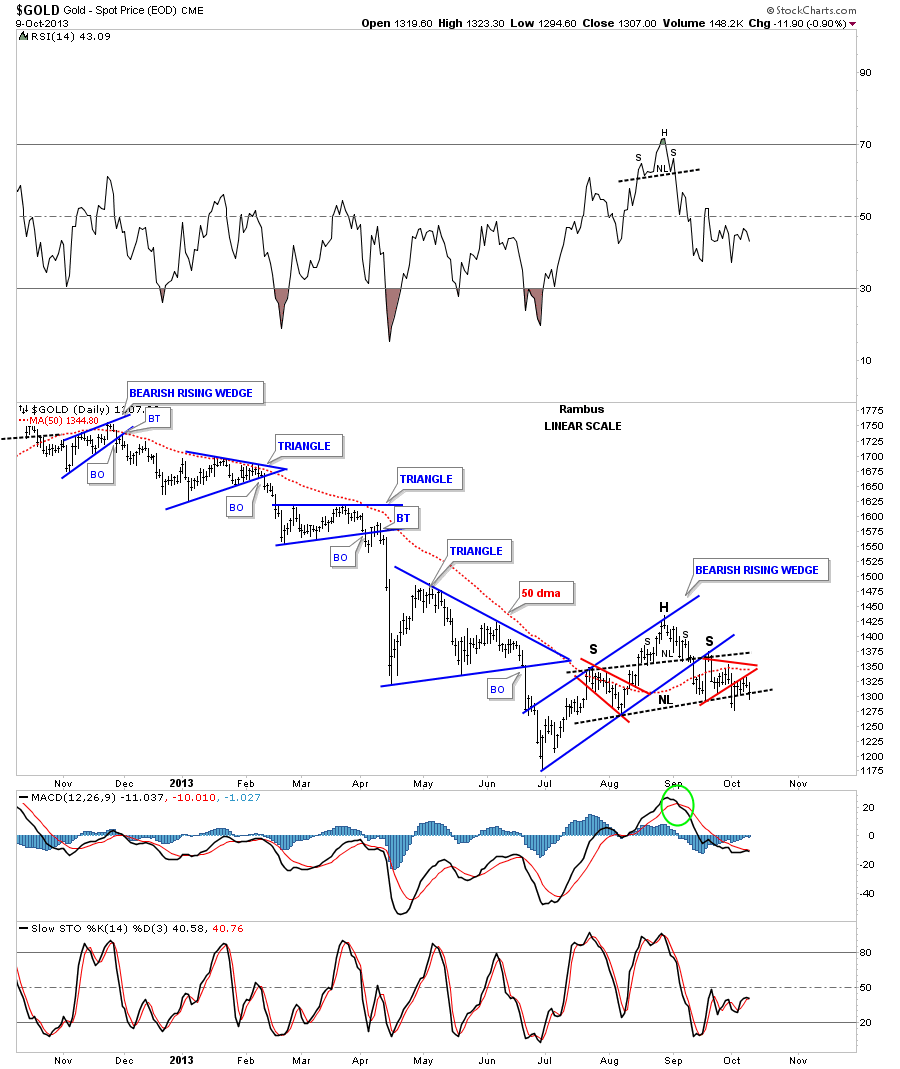

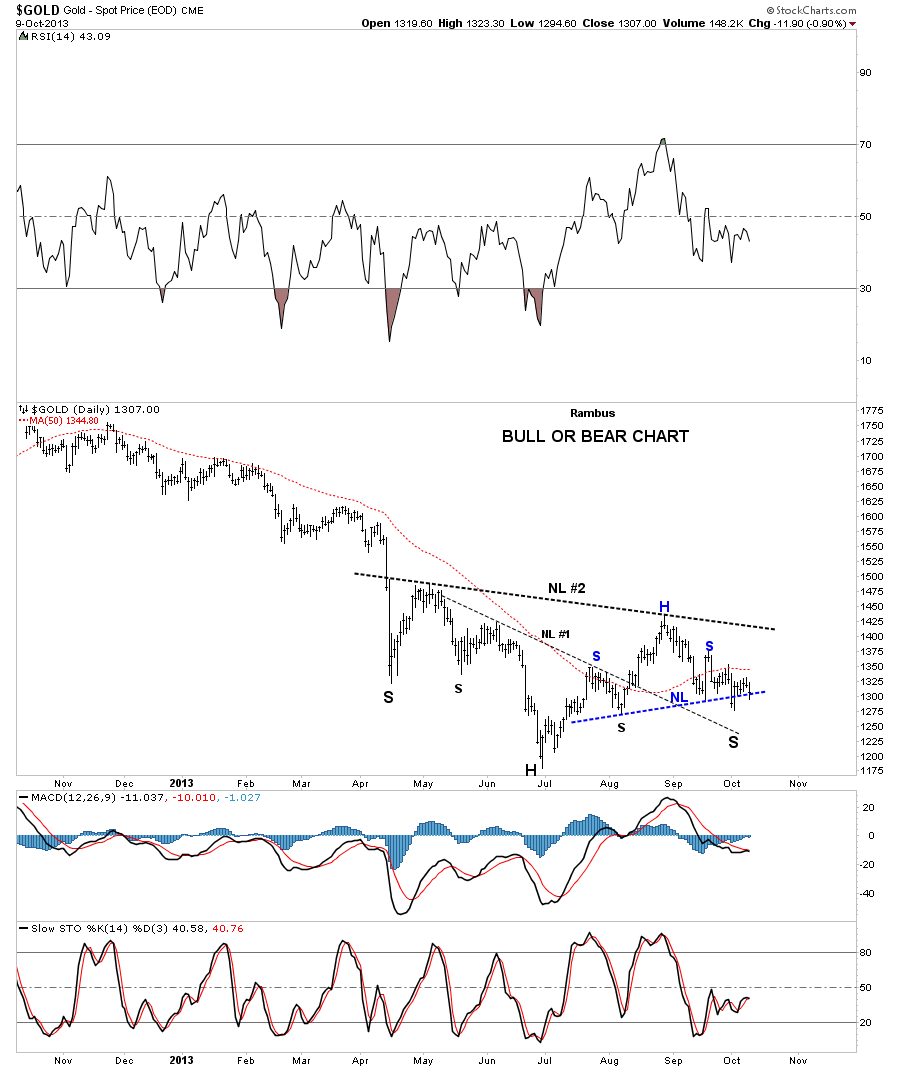

Tonight I want to show you some weekly line charts for some of the big cap precious metals stocks but before we do I would like to update you on a couple charts first. Below is a daily bar chart for gold that shows the double H&S top with the lower neckline coming in right at 1300. Even though there was a small false breakout the pattern still remains intact. We’re close but just not quite there yet.

(Editor’s Note : This Post was made Wednesday Night….. As You probably Know…as of Friday…we are Now “There” )

This next chart is what I call my bull and bear chart. The bulls are looking at this chart and are seeing an inverse H&S bottom that is going to lead to a brand new bull market. The bears look this same chart and see a bearish H&S top. One side is going to be right and the other side is going to be wrong. We’ve placed our bets and now we wait for confirmation.

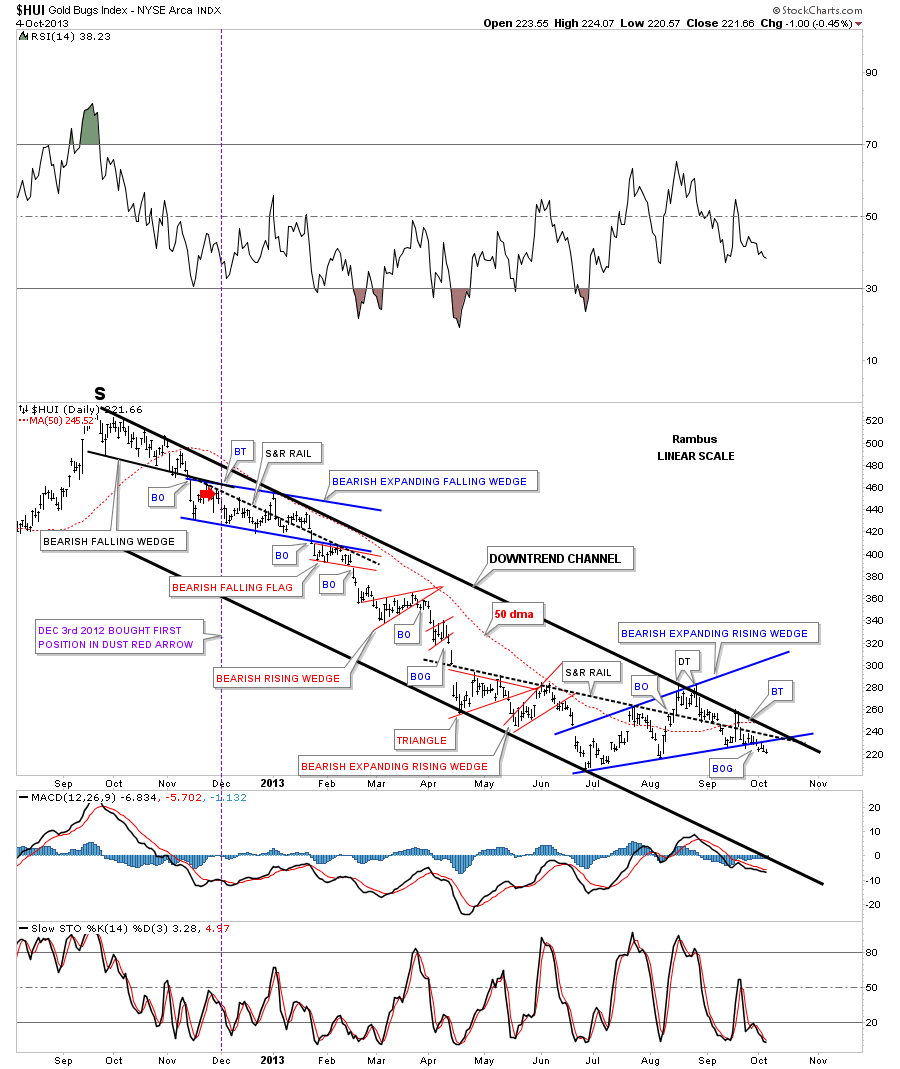

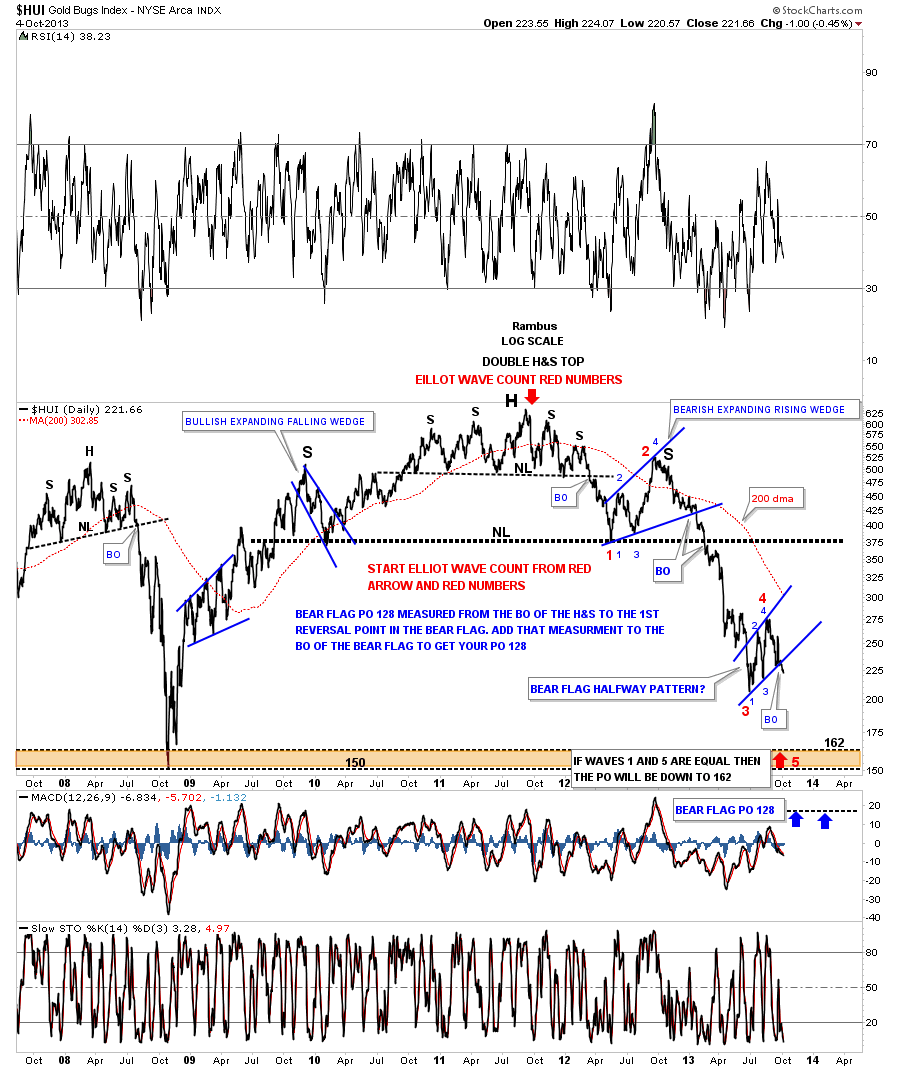

This next chart is a combo chart that I’ve been showing that shows gold breaking down from its small red bear flag five weeks ago already and the HUI has been in breakout mode for the last two weeks. Let me repeat this again. Gold has broken down out of its bear flag five weeks ago and the HUI two weeks ago. Folks we are and have been in an impulse leg lower. What you are experiencing right now is just normal market movement, nothing more or nothing less. In the case of the bear, the markets go down more than they go up but there is always the steady chopping action that frustrates both the bulls and the bears alike. It’s the trend of lower lows and lower highs that you have to observe, over time, to see who is in control. Note the heavy purple dashed line that shows the bull market tops in gold and the HUI. Look at the price action on the left side of the purple dashed line and you see higher highs and higher lows all the way up. Now look to the right side of the purple dashed line and you see just the opposite, lower highs and lower lows which is a downtrend. This is basic Chartology 101.

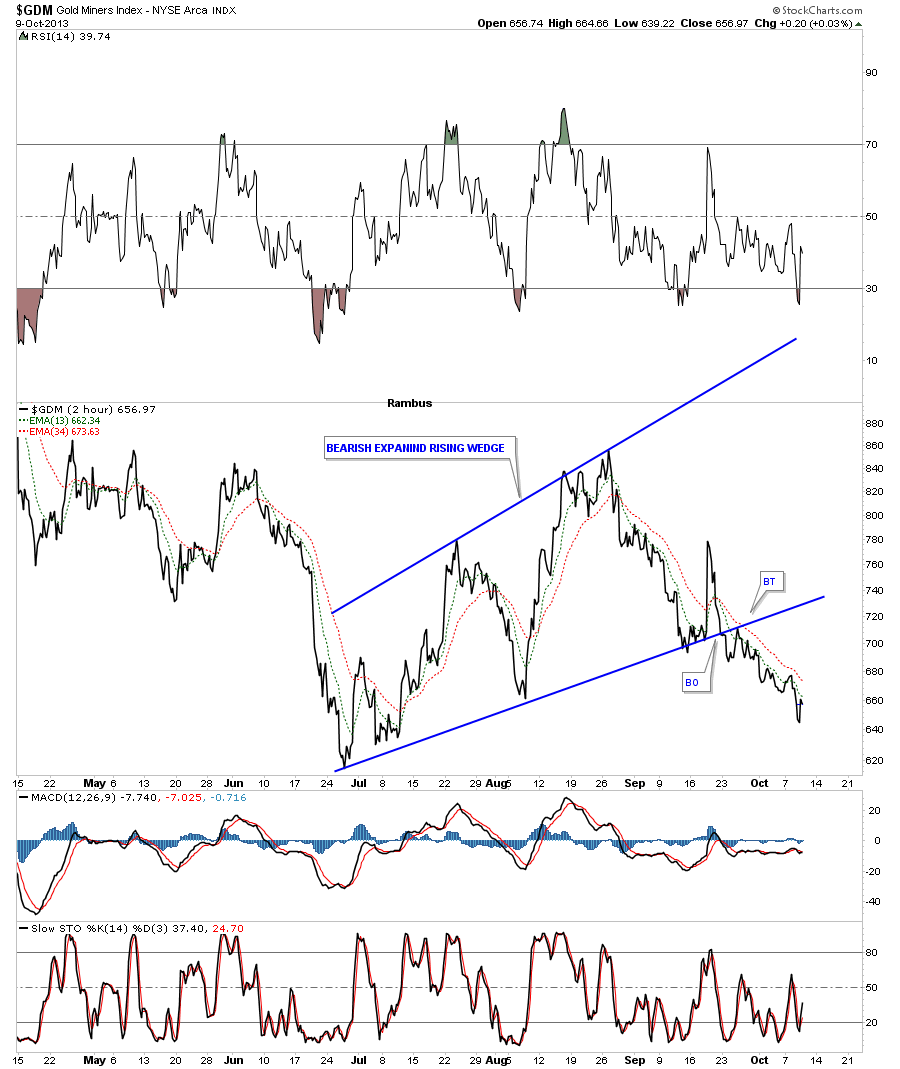

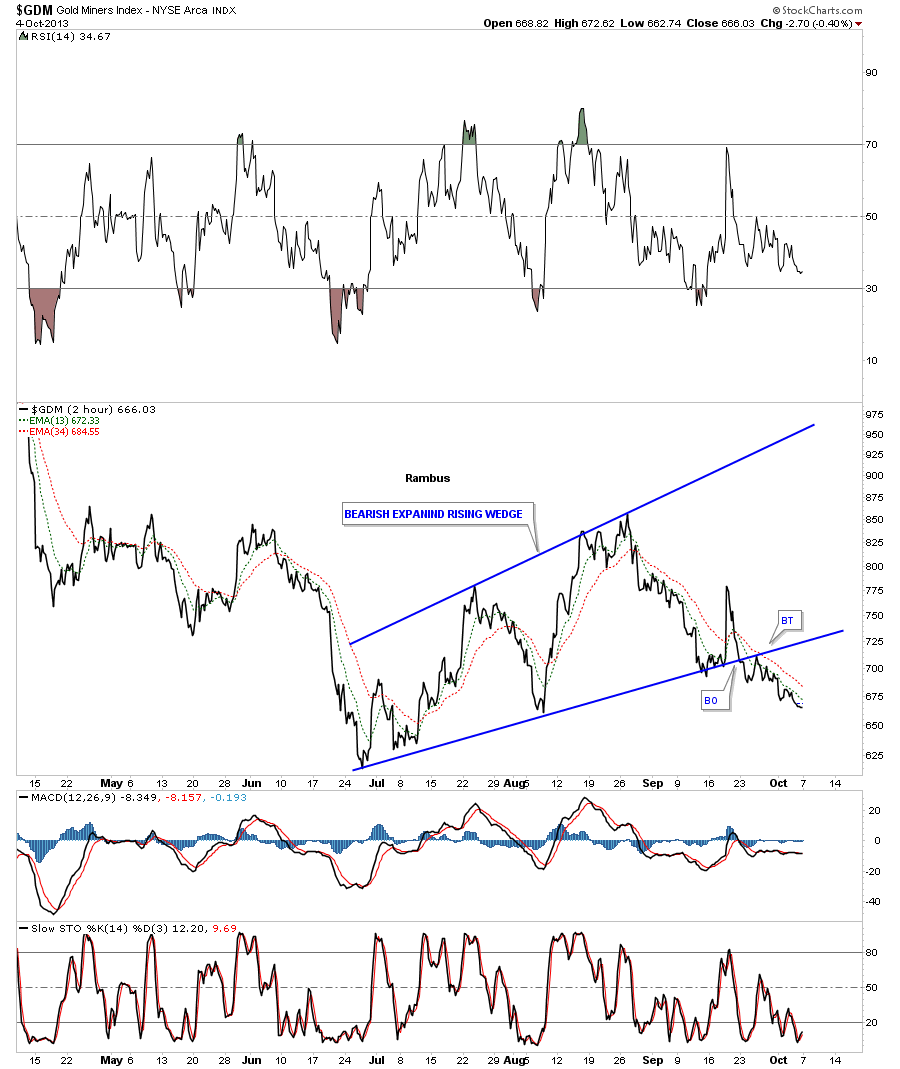

The two hour line chart for the GDM shows the breakout and backtest, that we observed in real time, when it happened. I don’t know how to make it any planer that the precious metals stocks have been in an impulse move lower since the breakout from the bottom blue rail of the bearish expanding rising wedge. There is nothing weird or strange about this downtrend. It actually looks pretty normal. Two steps down and one step up, backing and filling which is creating lower lows and lower highs. This is a downtrend you are experiencing.

This next long term daily chart for the HUI puts our bearish expanding rising wedge into perspective within the confines of the downtrend channel that started one year ago already. As you can see its been a steady grind lower until the blue bearish expanding rising wedge developed. The market need a timeout and this is the consolidation pattern it chose to form. Note the breakout and backtest when the HUI broke through the bottom blue rail of the expanding rising wedge. It just doesn’t get any pretty than this. As long as the price action stays below the bottom blue rail of the bearish expanding rising wedge we have to play the odds that the move lower will continue.

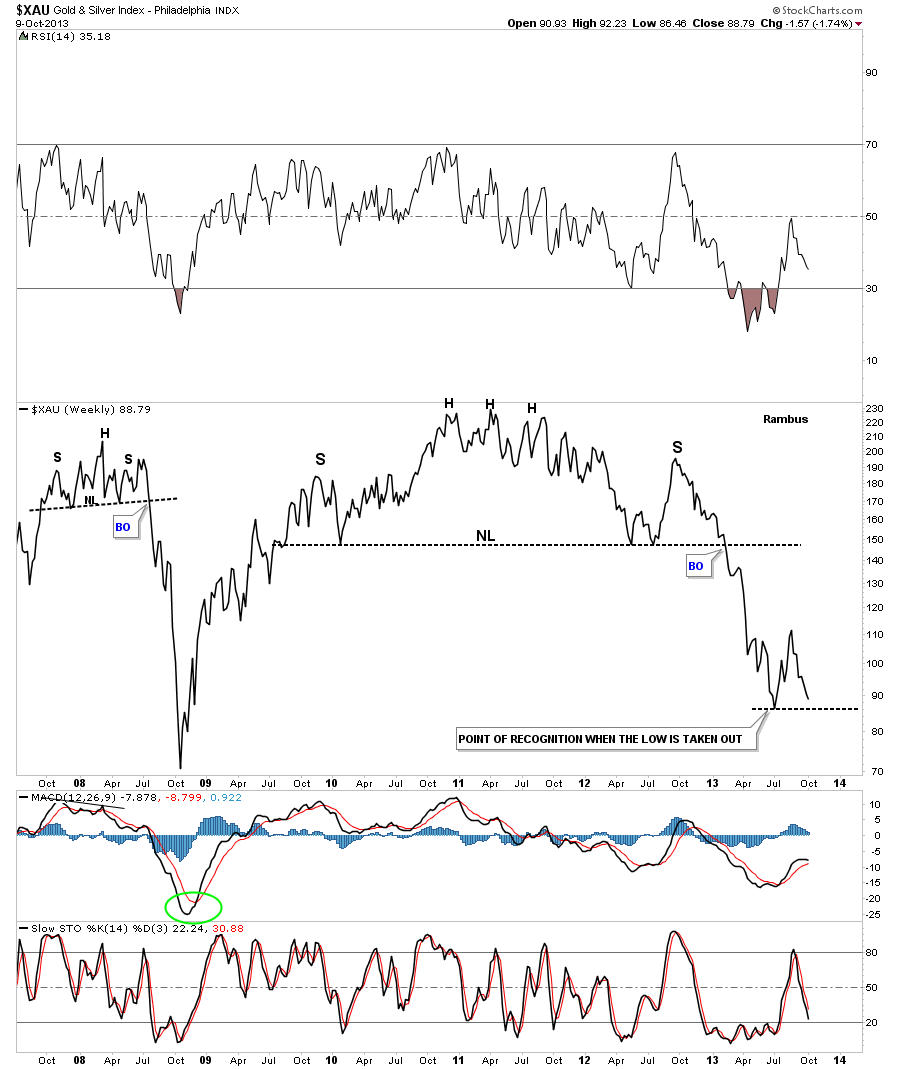

Earlier in this post I showed you my bull and bear chart and said I believe the bears were going to win the battle. These weekly line charts shows why I still remain bearish and why the bulls will have to start proving their theory before the precious metals stocks go much lower. As sir Plunger so aptly put it, the point of recognition is close at hand for the third phase of this bear market. I believe when the bulls can no longer make a case for their inverse H&S bottom they will start to capitulate and run for the hills. That has yet to happen but it’s getting closer by the day.

The first weekly line chart I would like to show you is the XAU that is just a simple chart that says alot. Sometimes you don’t need alot of lines on a chart to make your point. You can see the two H&S top patterns that most missed that stand out like a sore thumb now that they can be seen in hindsight. I believe the point of recognition for the bulls will be when the previous low is broken to the downside.

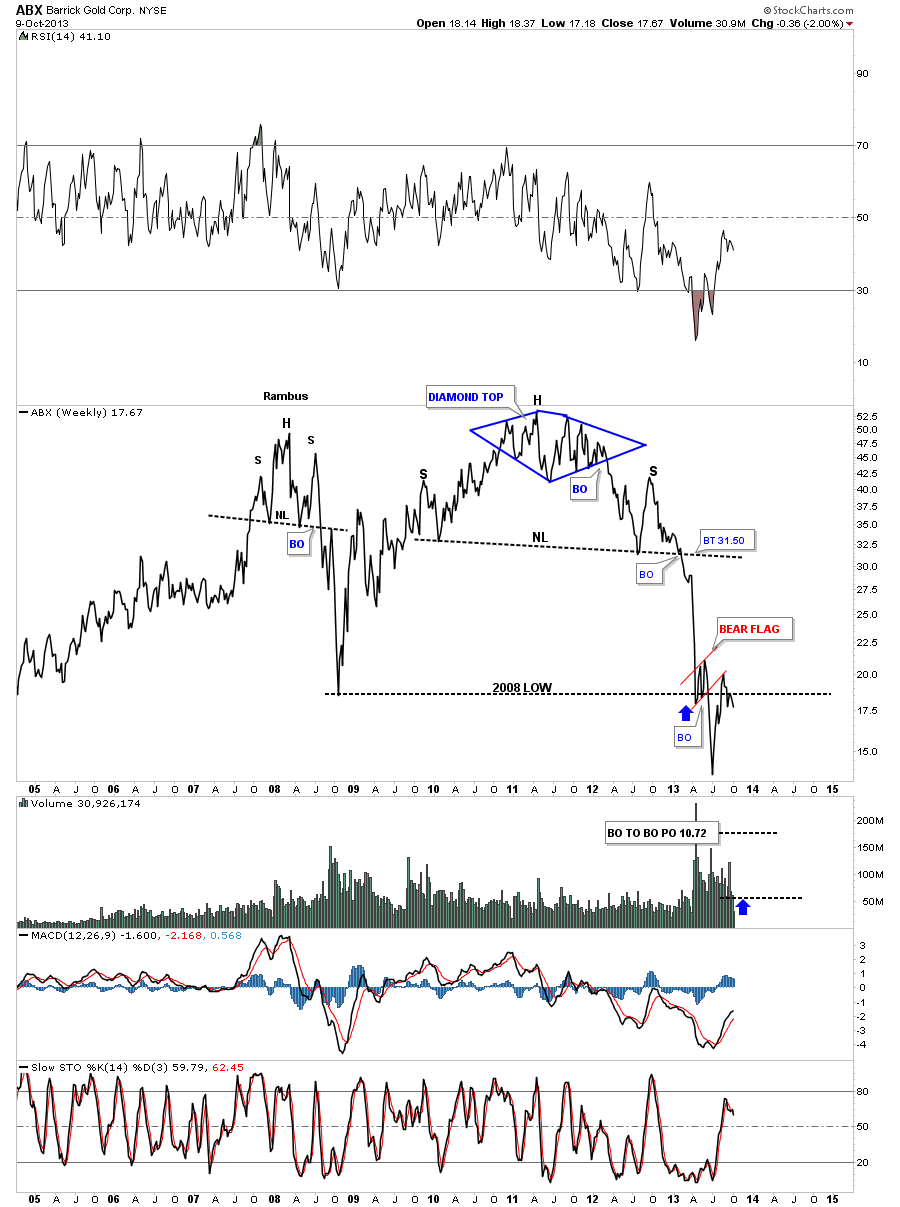

ABX is currently trading below the 2008 bottom.

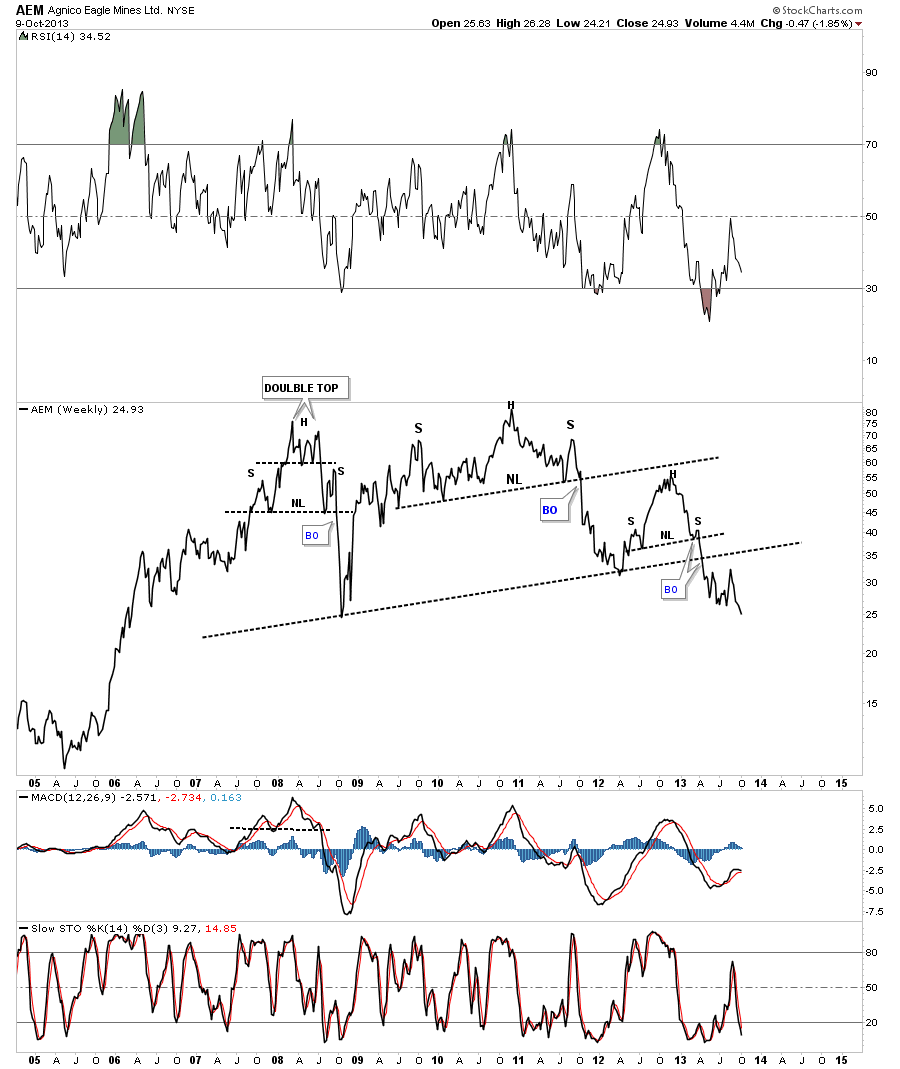

AEM is currently trading at multi year lows on the weekly line chart.

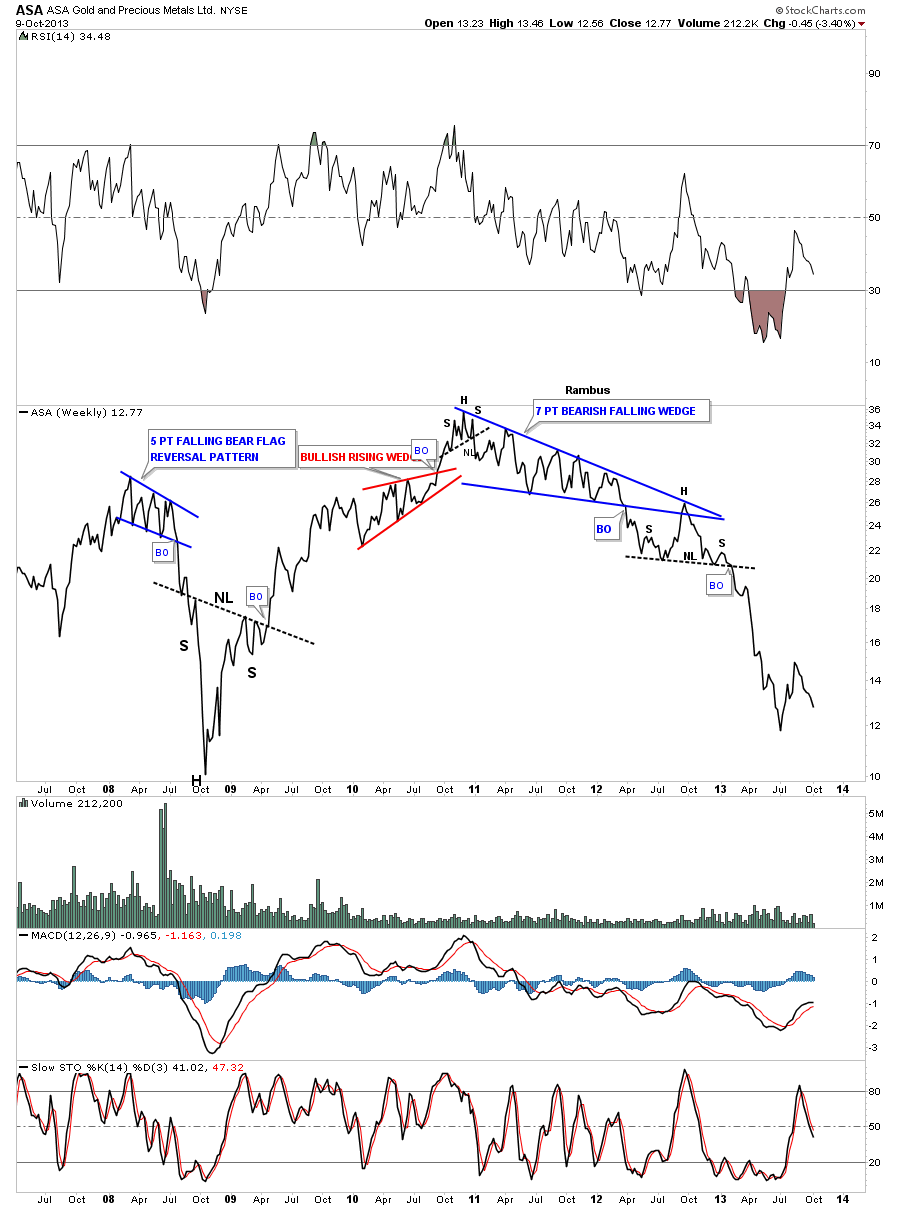

ASA is showing some nice reverse symmetry down but is still trading several points above its 2008 low.

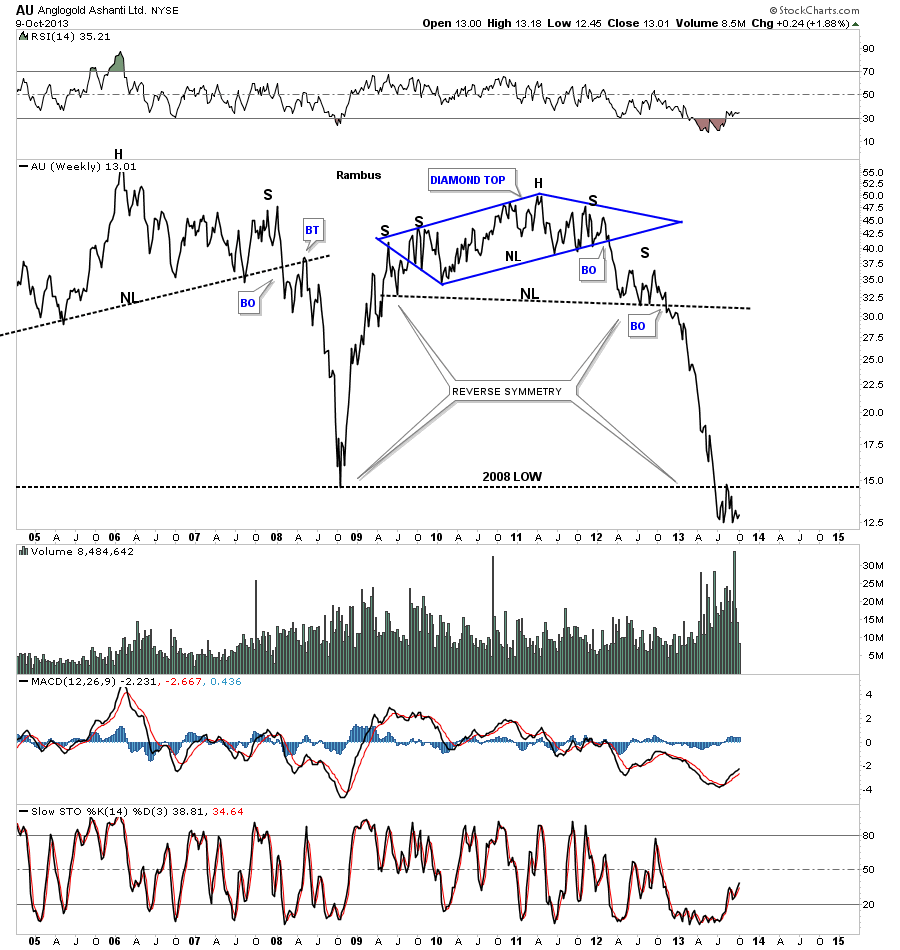

AU has been trading below its 2008 low for sometime now. Note the breakout and backtest to the 2008 trendline.

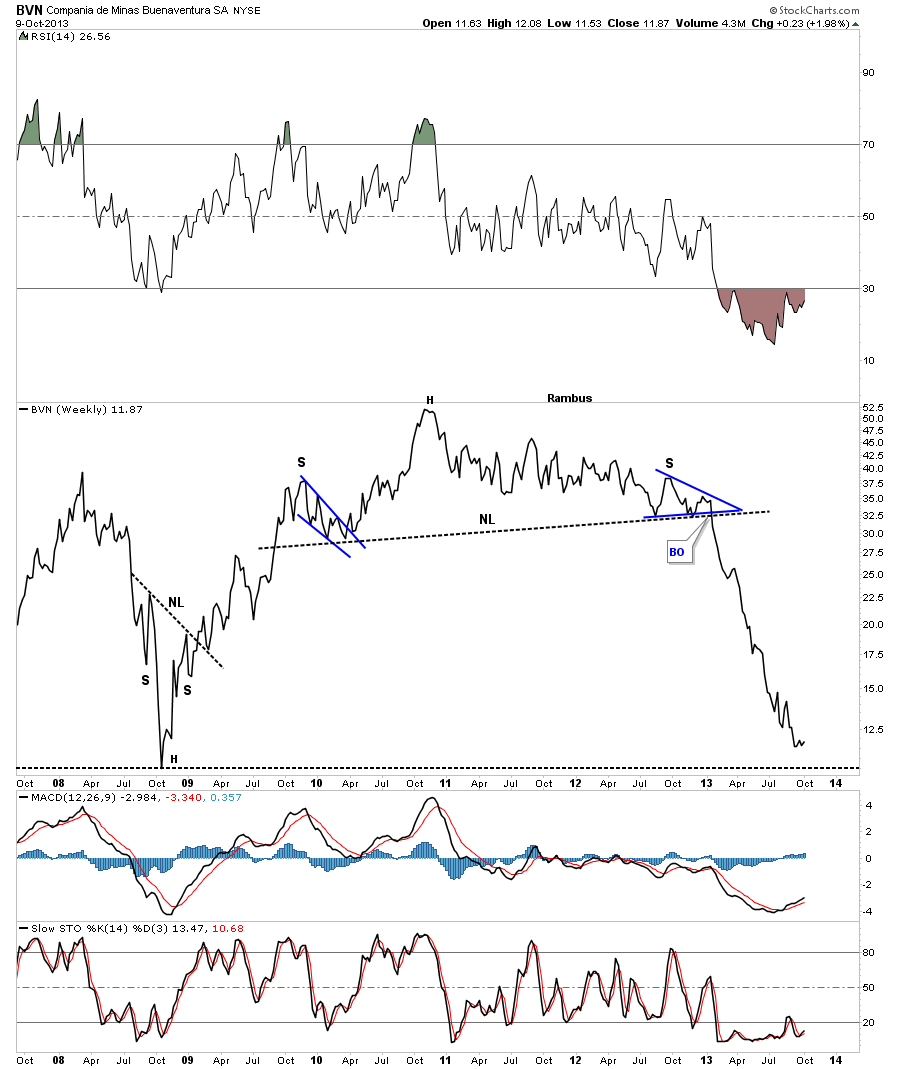

BVN is just a point or so away from its 2008 low.

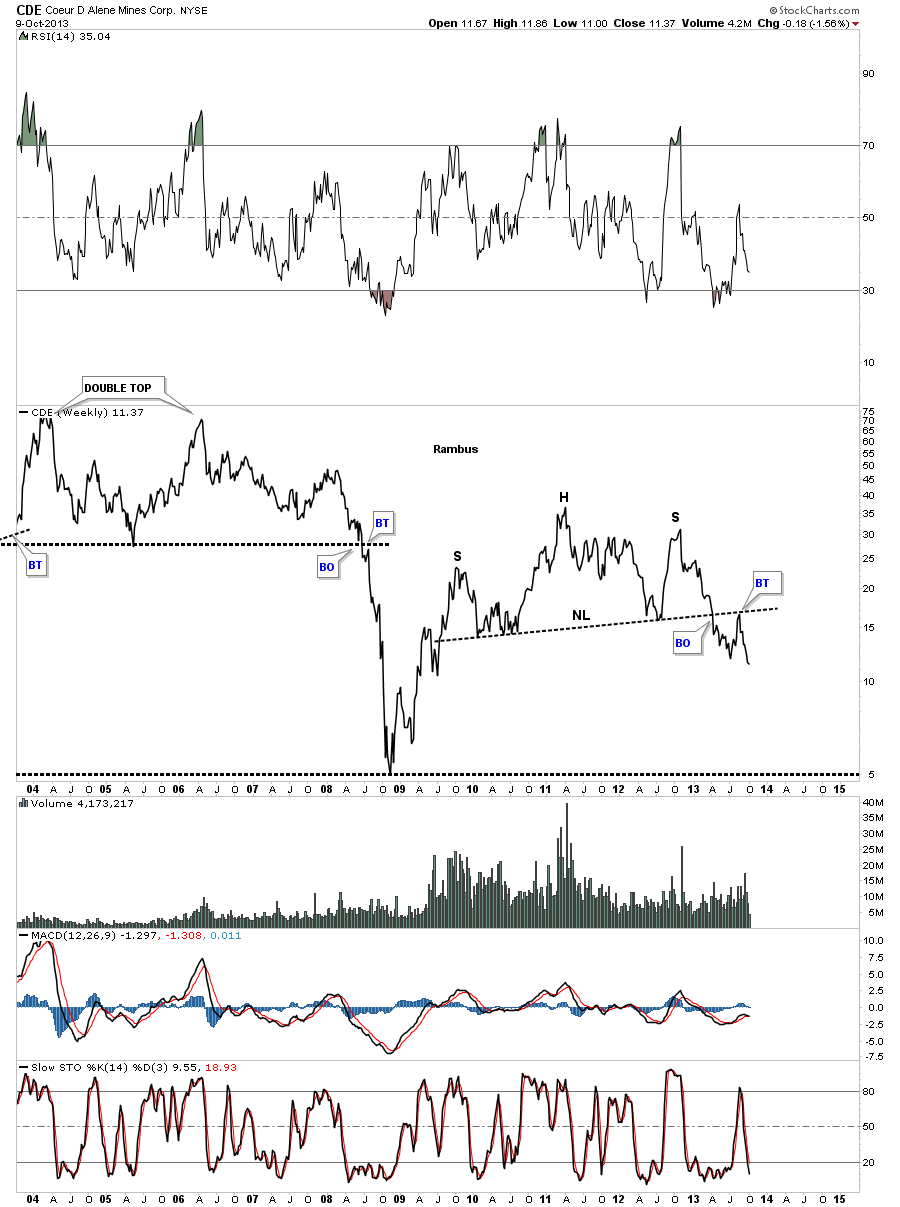

CDE shows a beautiful H&S top that just completed the backtest and now has plenty of room to run to the downside.

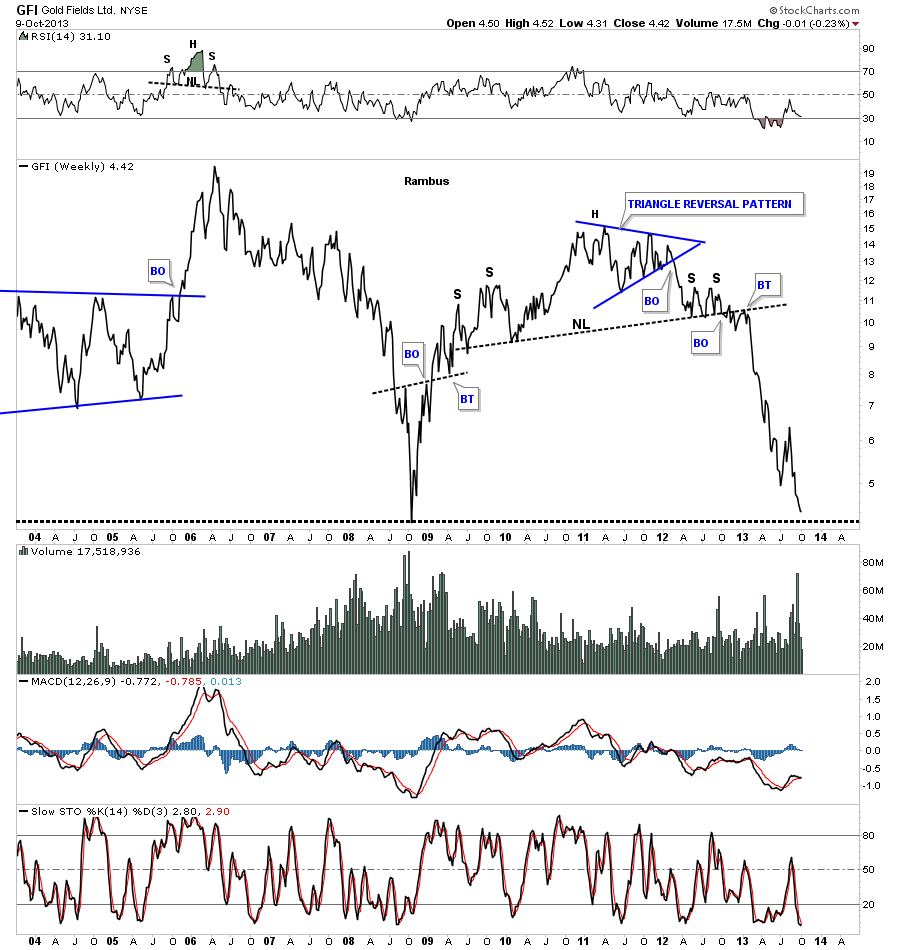

GFI is trading at multi year lows and is approaching the 2008 bottom.

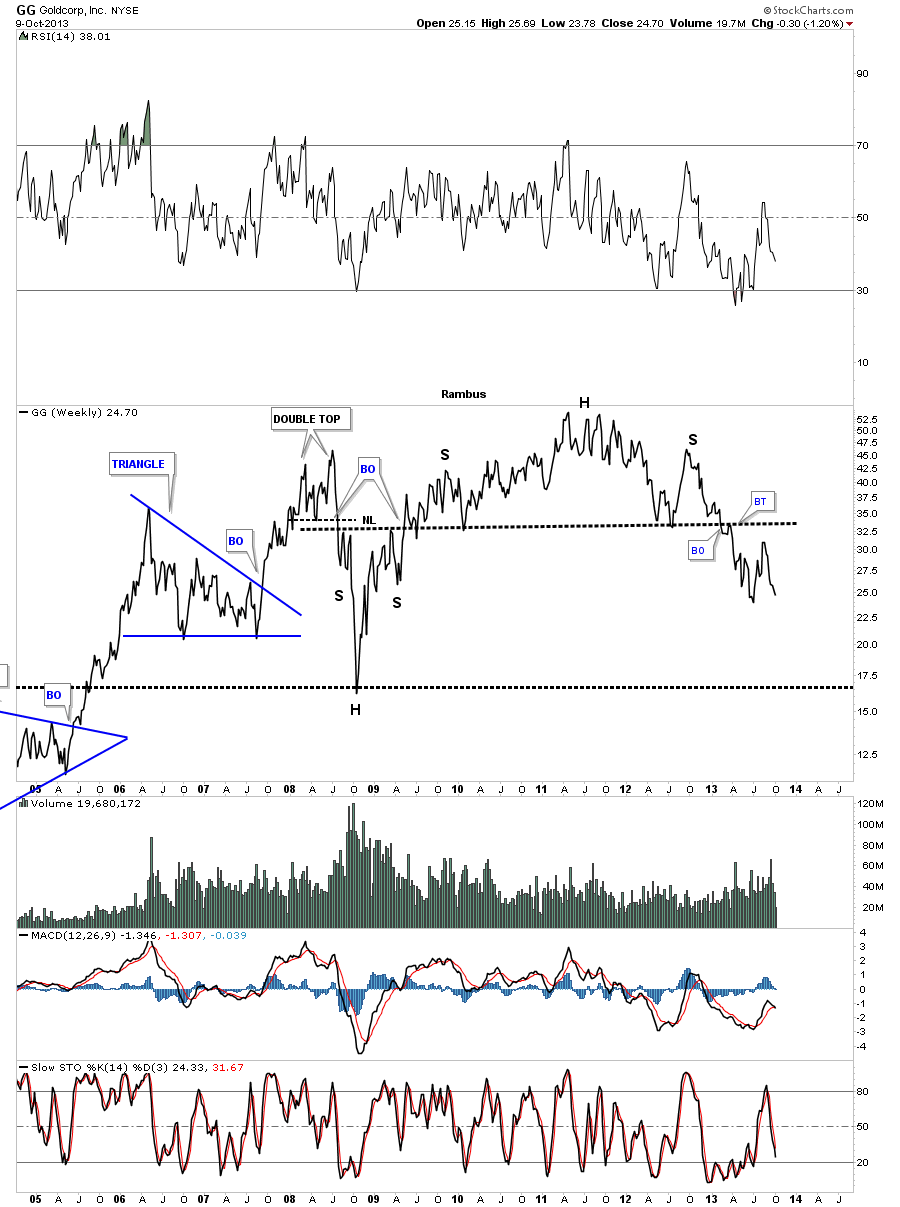

GG still has a lot of room to move lower.

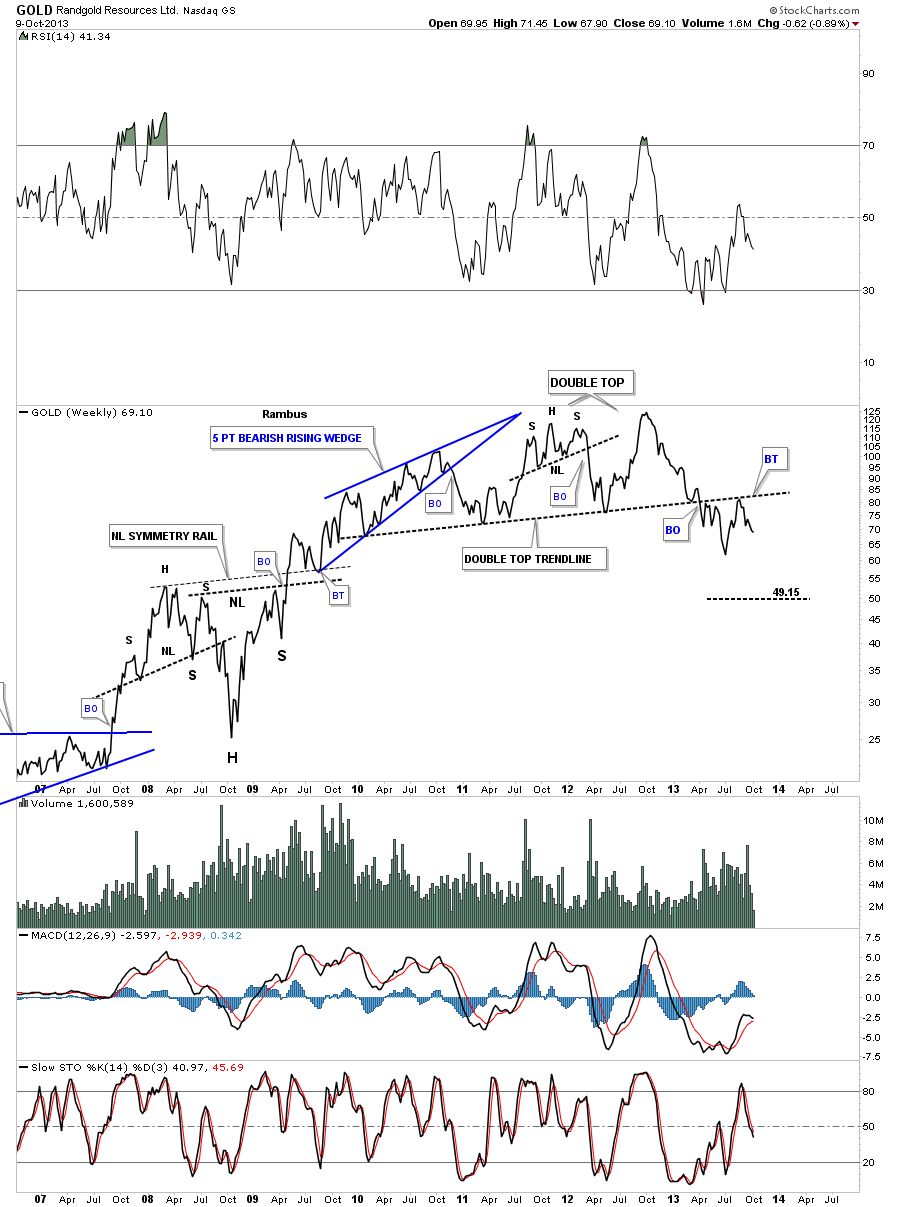

Randgold just completed a backtest to its double top trendline and has a lot of room to move lower now.

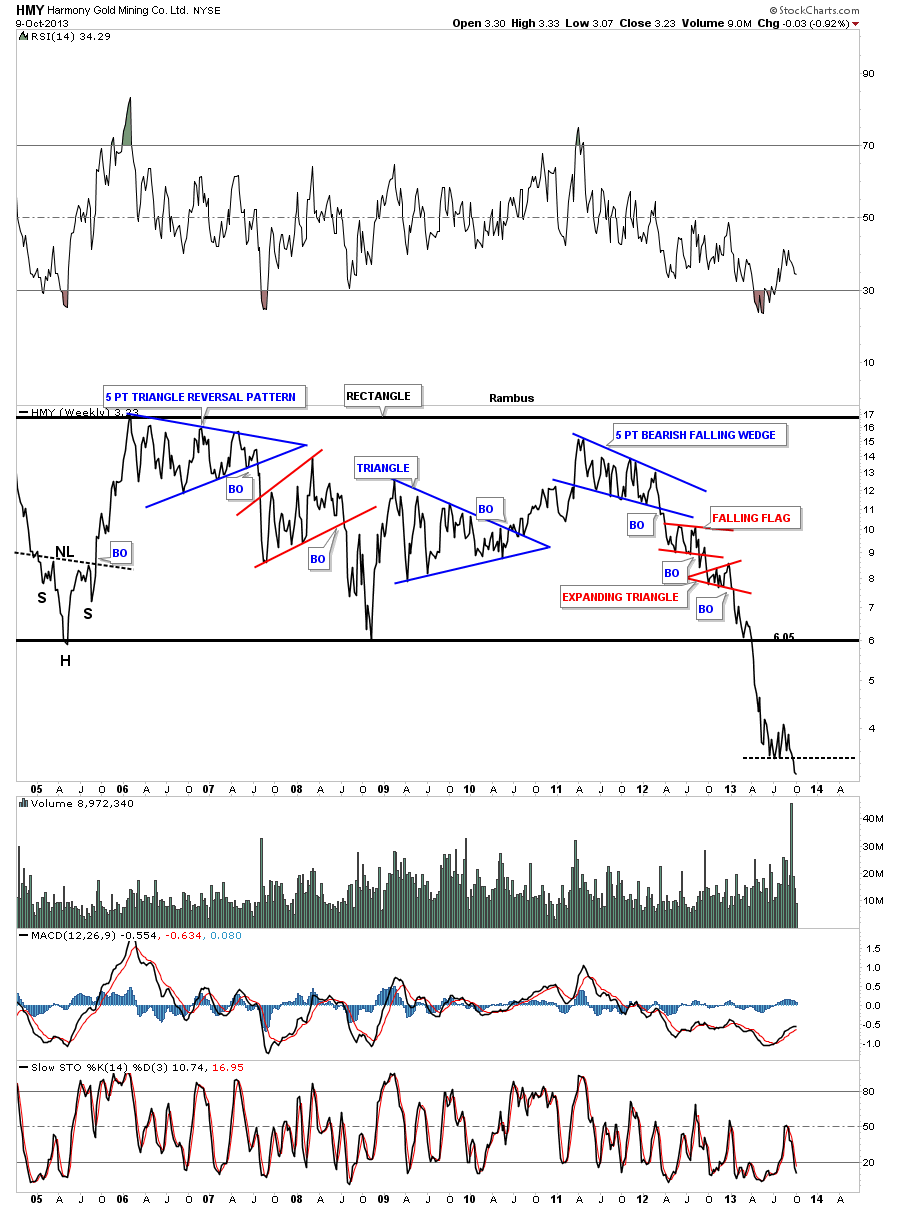

HMY is trading way below the 2008 bottom is now approaching new all time lows.

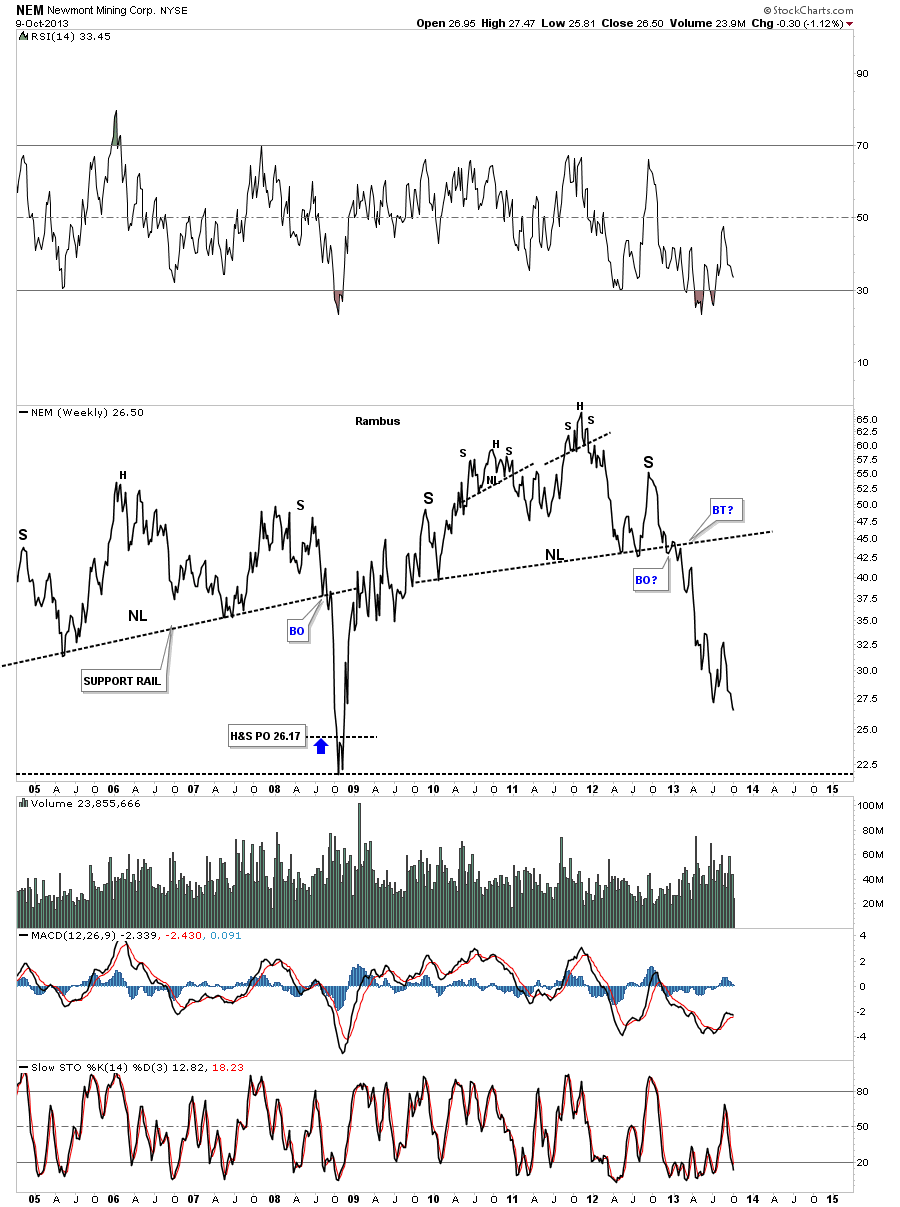

One last chart and then I need to get this posted. NEM is now trading at multi year lows. There are still two days left of trading for this week but if NEM closes below the previous low that will not be a good omen if your a bull.

All these charts above shows you why I’m still bearish on the PM sector and until something changes these charts for the better it is what it is regardless of what the fundamentals may say. There are going to be good days and bad days coming up. The volatility will probability increase as we move lower with the bottom pickers looking for a bottom and the lonely bulls selling at all cost to save whatever capital they can. Stay calm and strong. All the best…Rambus

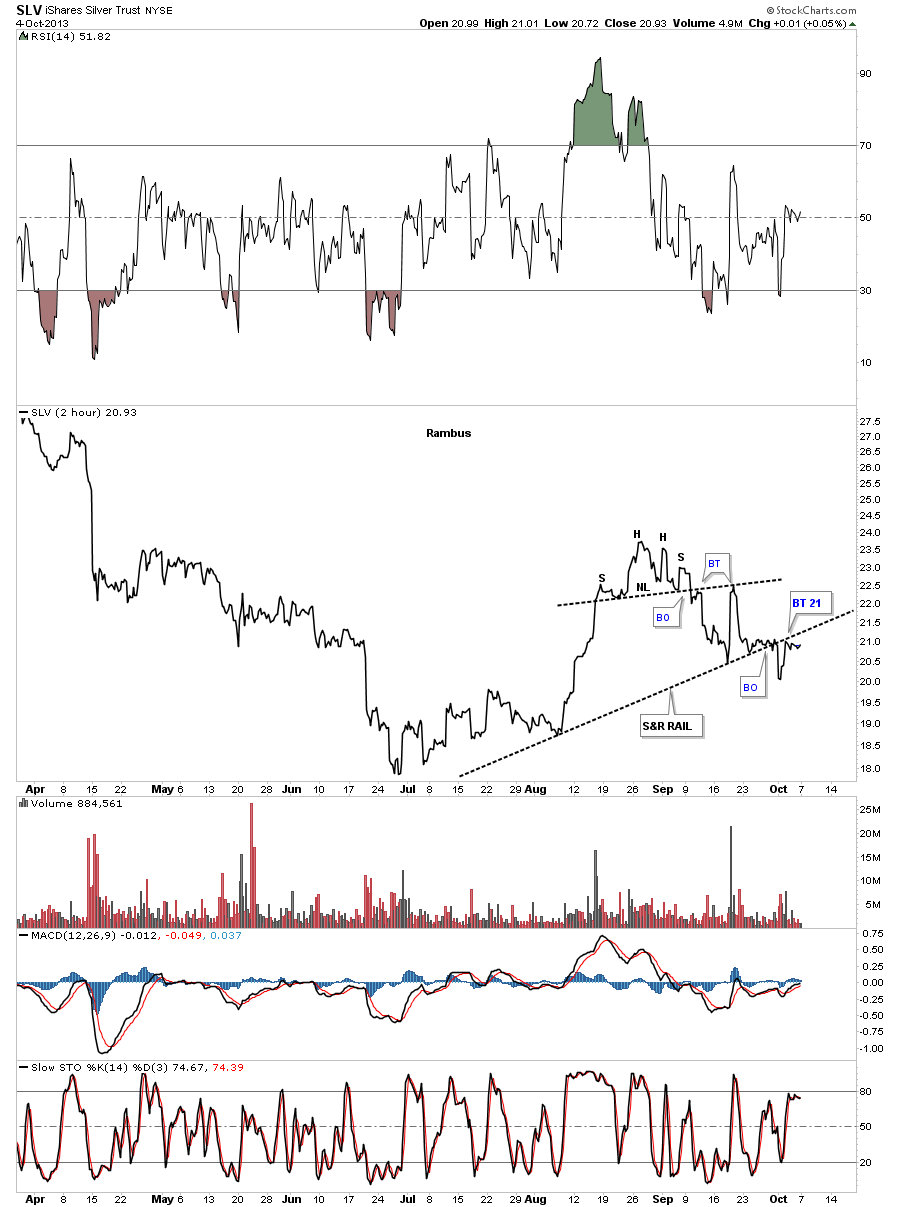

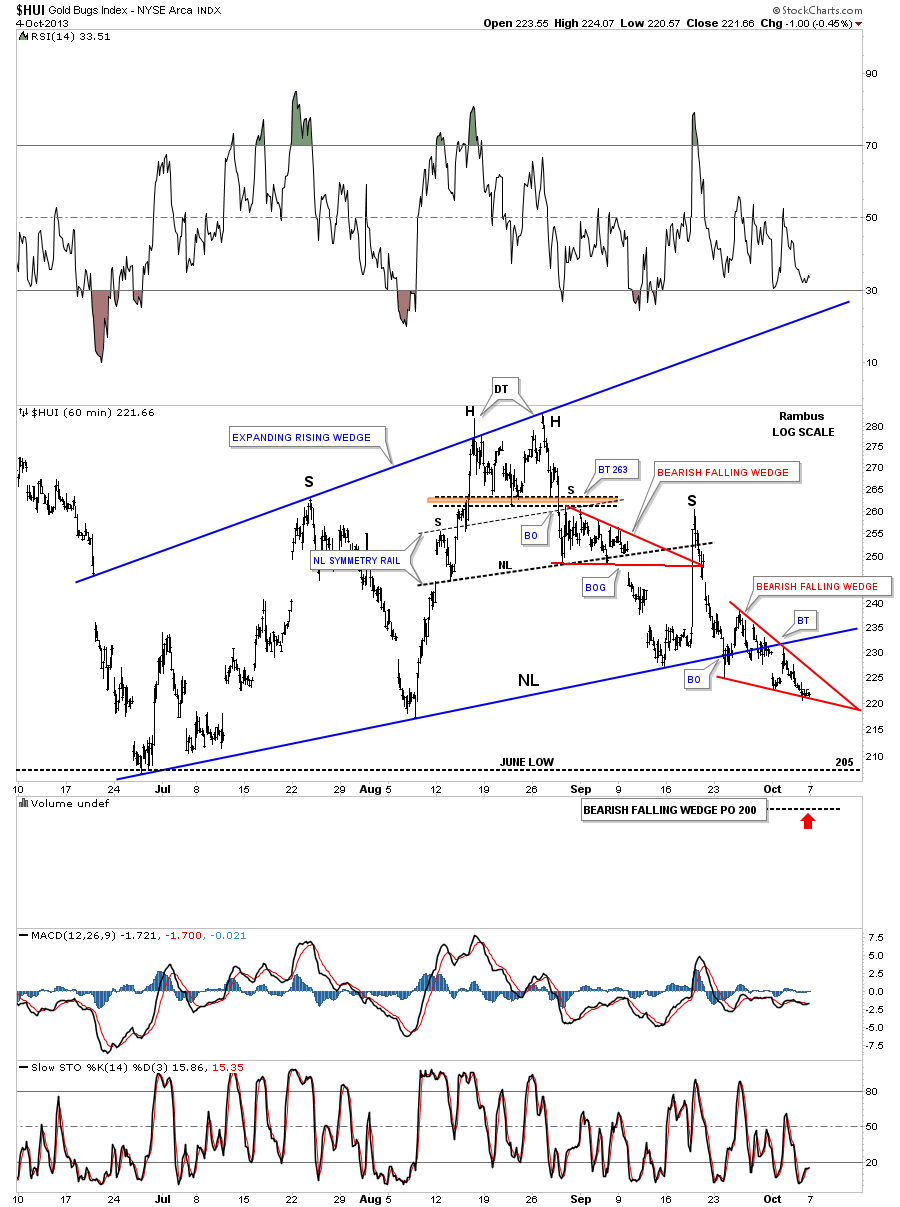

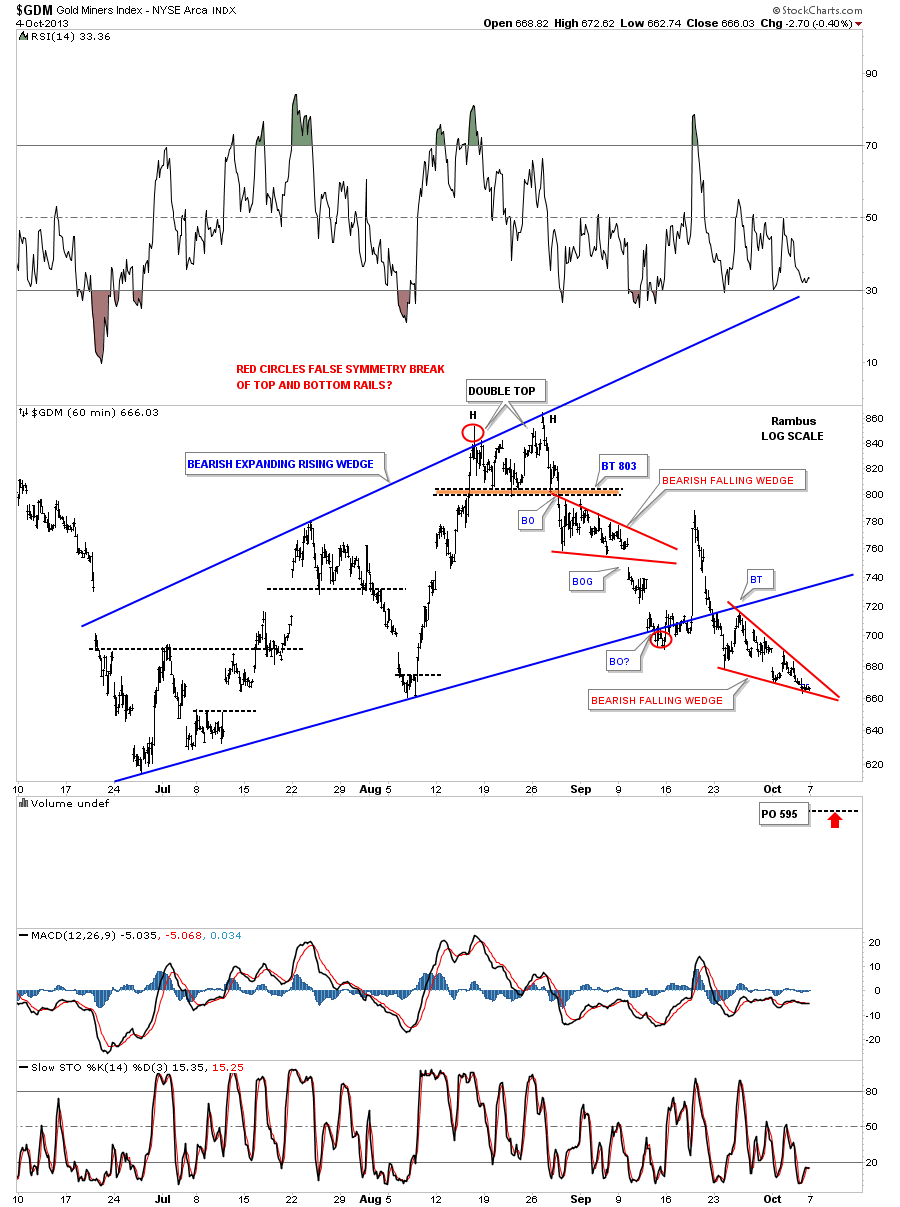

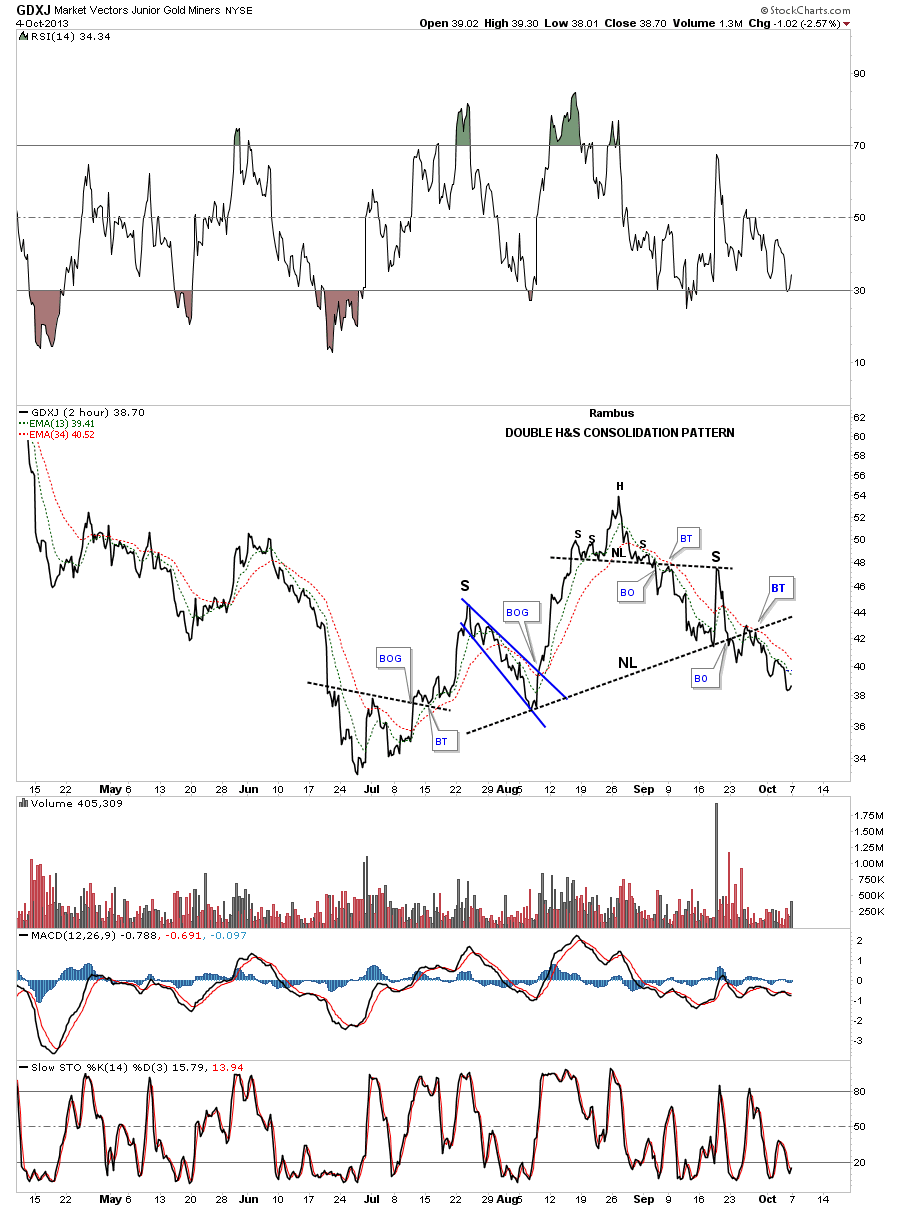

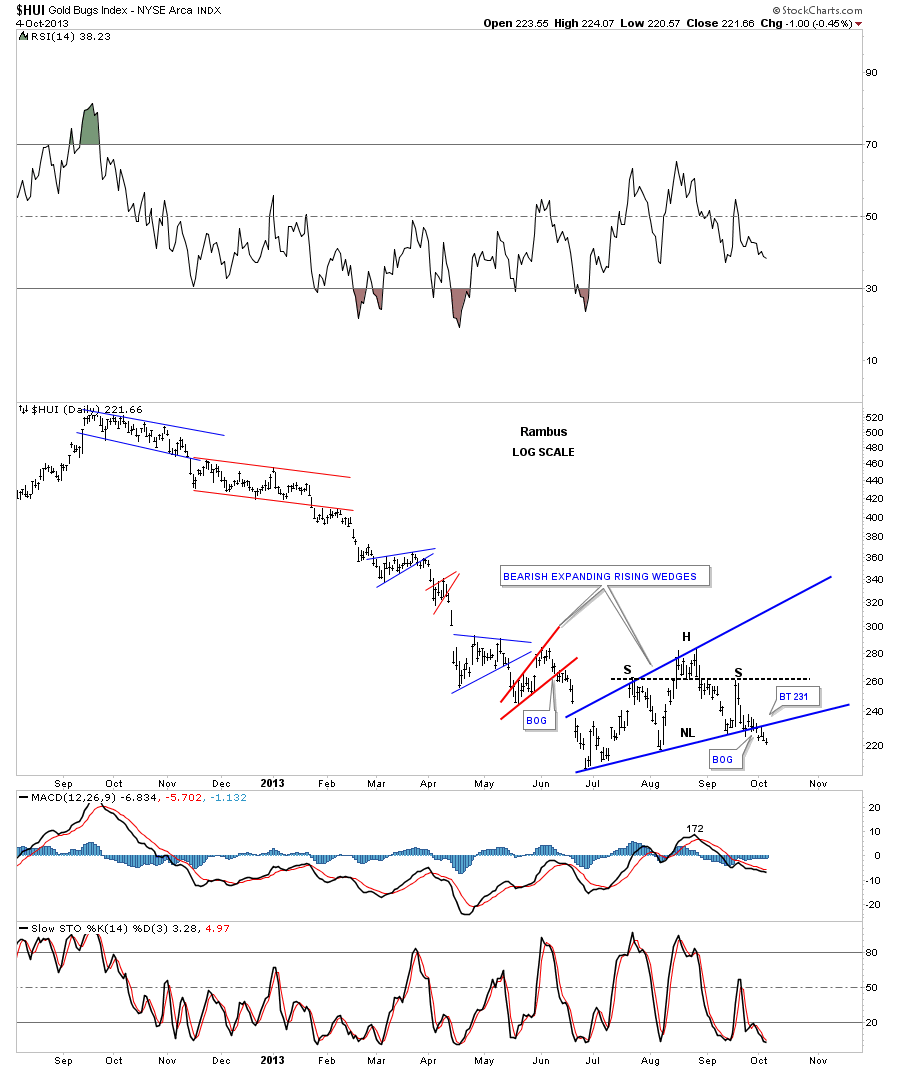

Weekend Report…One More Comprehensive Look at the Precious Metals Stock Indexes

In this Weekend Report I want to continue looking at the precious metals stock indexes and the consolidation patterns that have been building out since the June low. The reason I’m spending so much time looking at this possible consolidation area is so you can get a feel, in real time, how breakouts and backtest work. There is no better way to learn how the markets work than to watch how things unfold moment by moment. Its easy to say after the fact, yes I should have done this or that, but real time doesn’t give you the luxury of 20/20 hindsight.

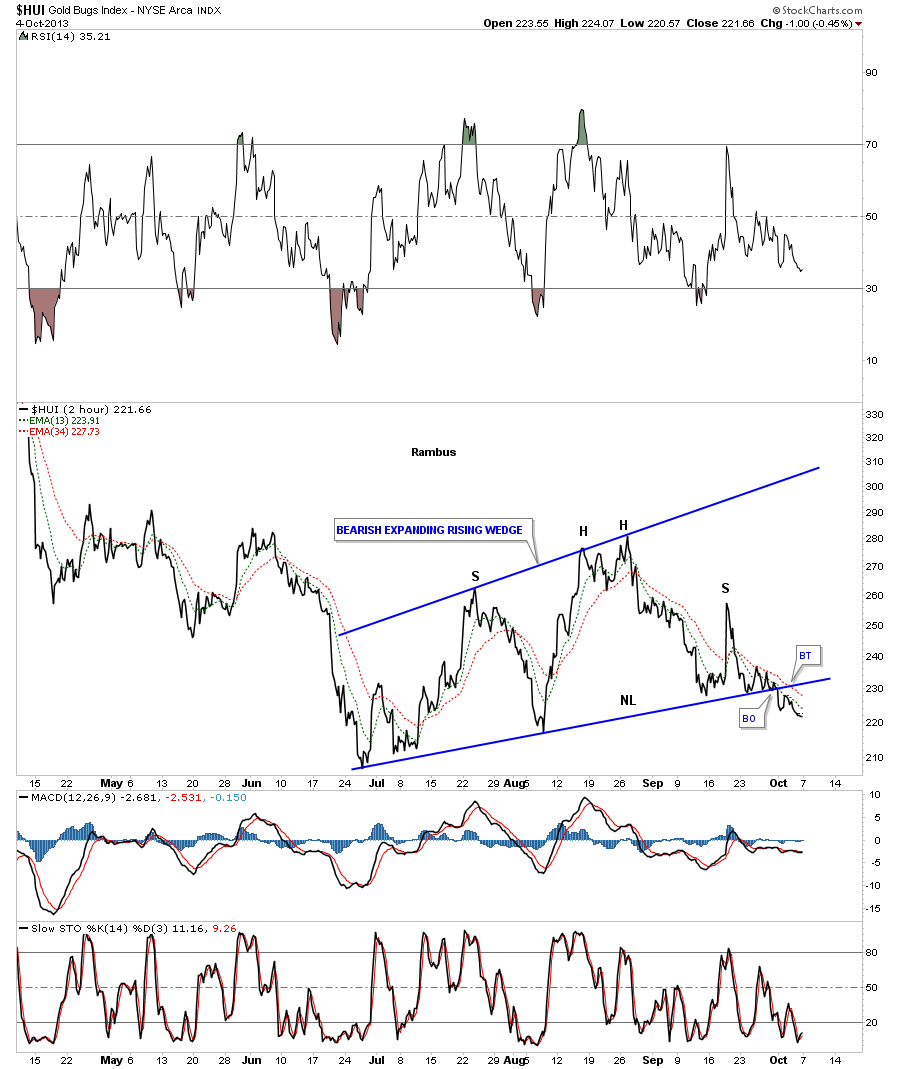

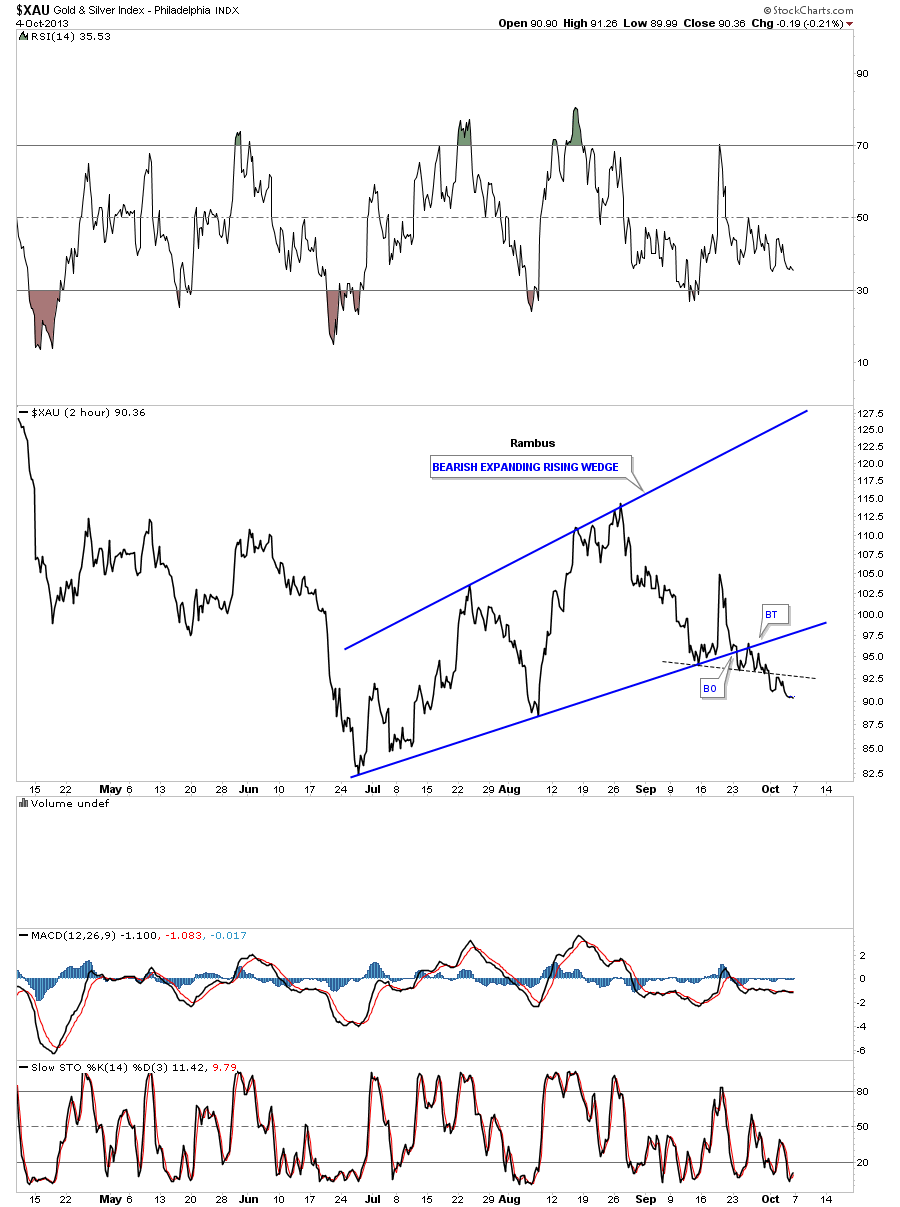

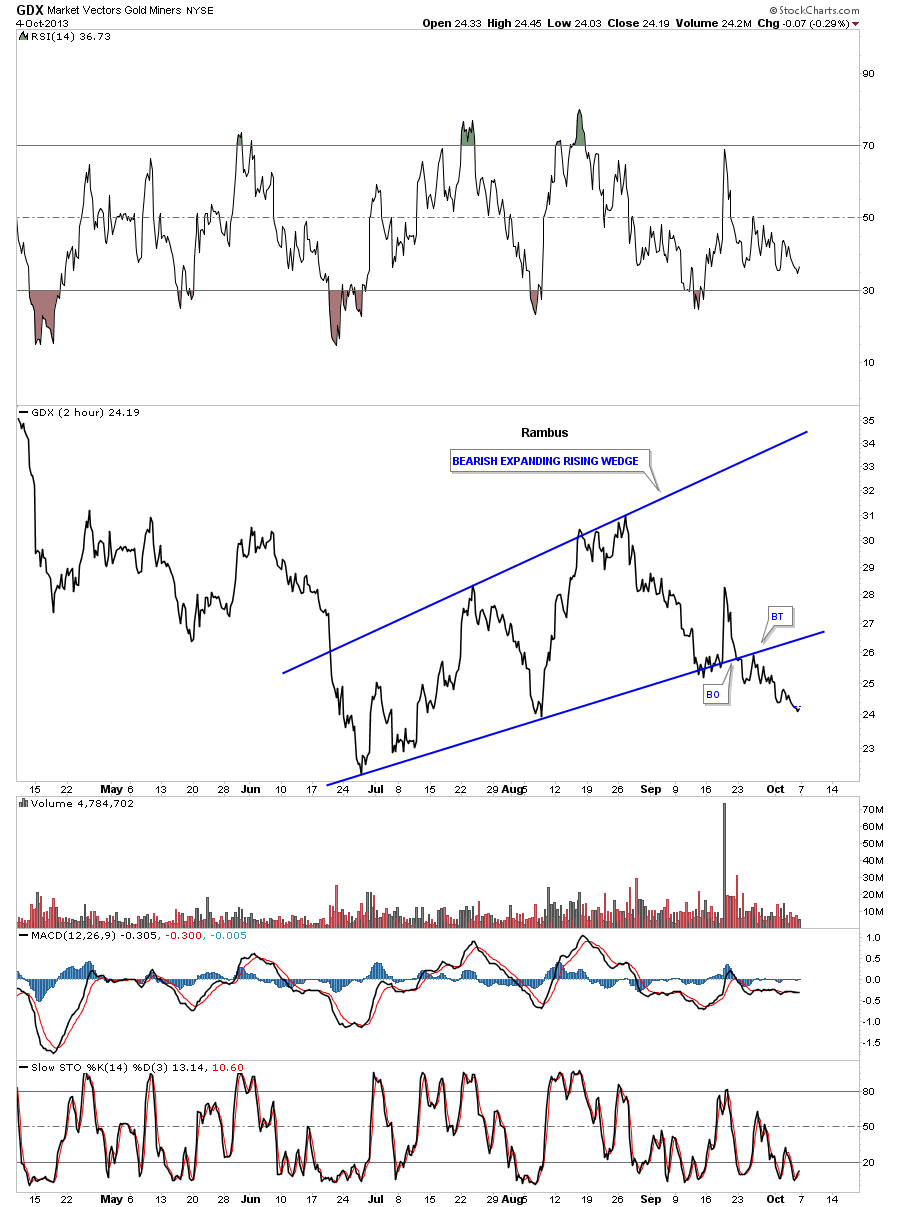

I’m going to start with the 2 hour, 6 month line charts that I showed you a couple of weeks ago before the flash rally. They looked like they were on the verge of breaking down at the time. I think the flash rally just delayed the inevitable. It may not feel like it but a lot of work has been going behind the scene with the breakout and backtesting that takes time to complete. As you will see everything up to this point is still working out as planned except for the flash rally. Keep in mind when I posted these chart we were still trading inside the bearish expanding rising wedges.

Lets start with the strongest of the precious metals stock indexes the HUI that now shows the breakout and a half hearted backtest so far. You can also see the H&S consolidation pattern that is part of the bearish expanding rising wedge consolidation pattern that shows up on the other PM stock indexes as well.

The XAU shows it a little further along in it’s move lower.

The GDX shows a nice breakout and backtest.

GDM is a proxy of our DUST trade which is trading lower which is good for DUST.

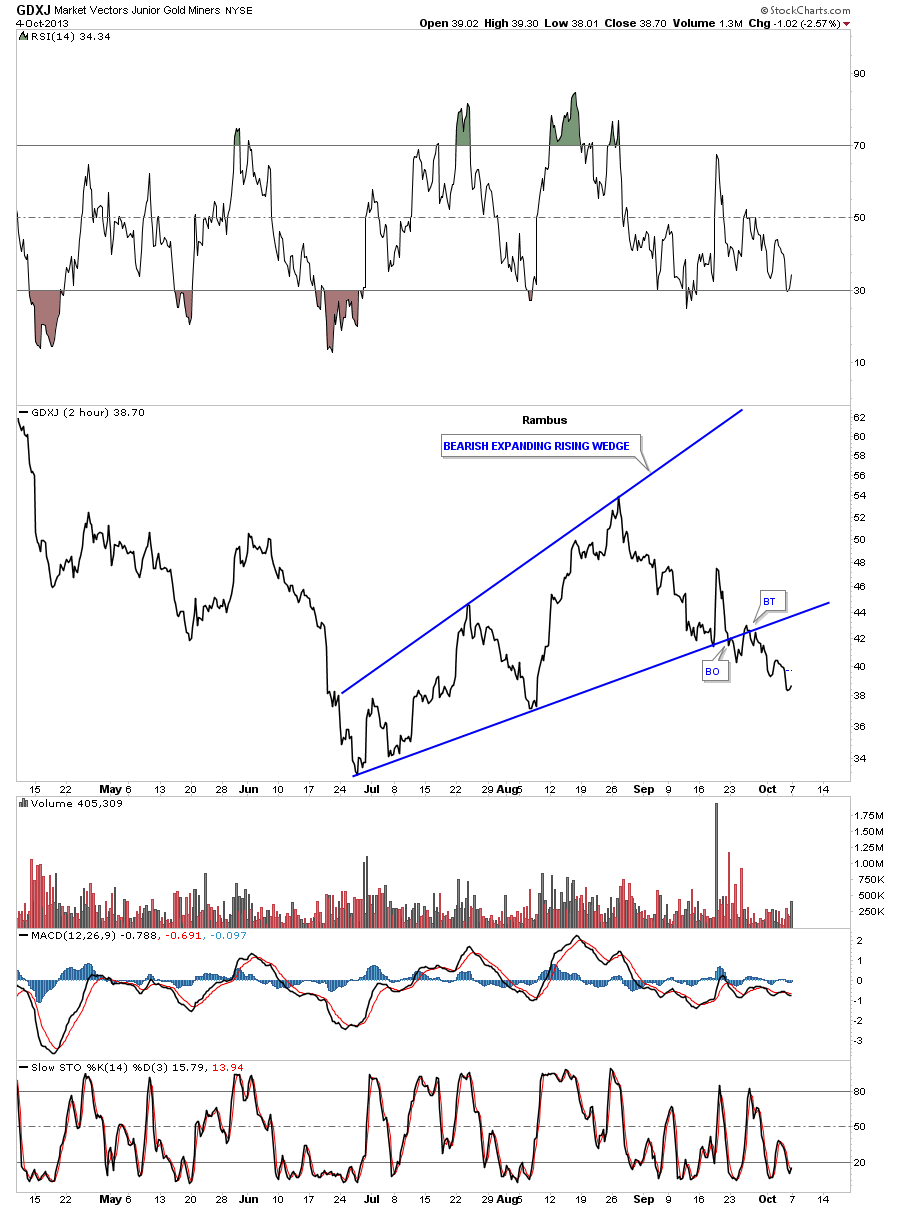

The GDXJ, small caps, shows the same setup as the other PM indexes.

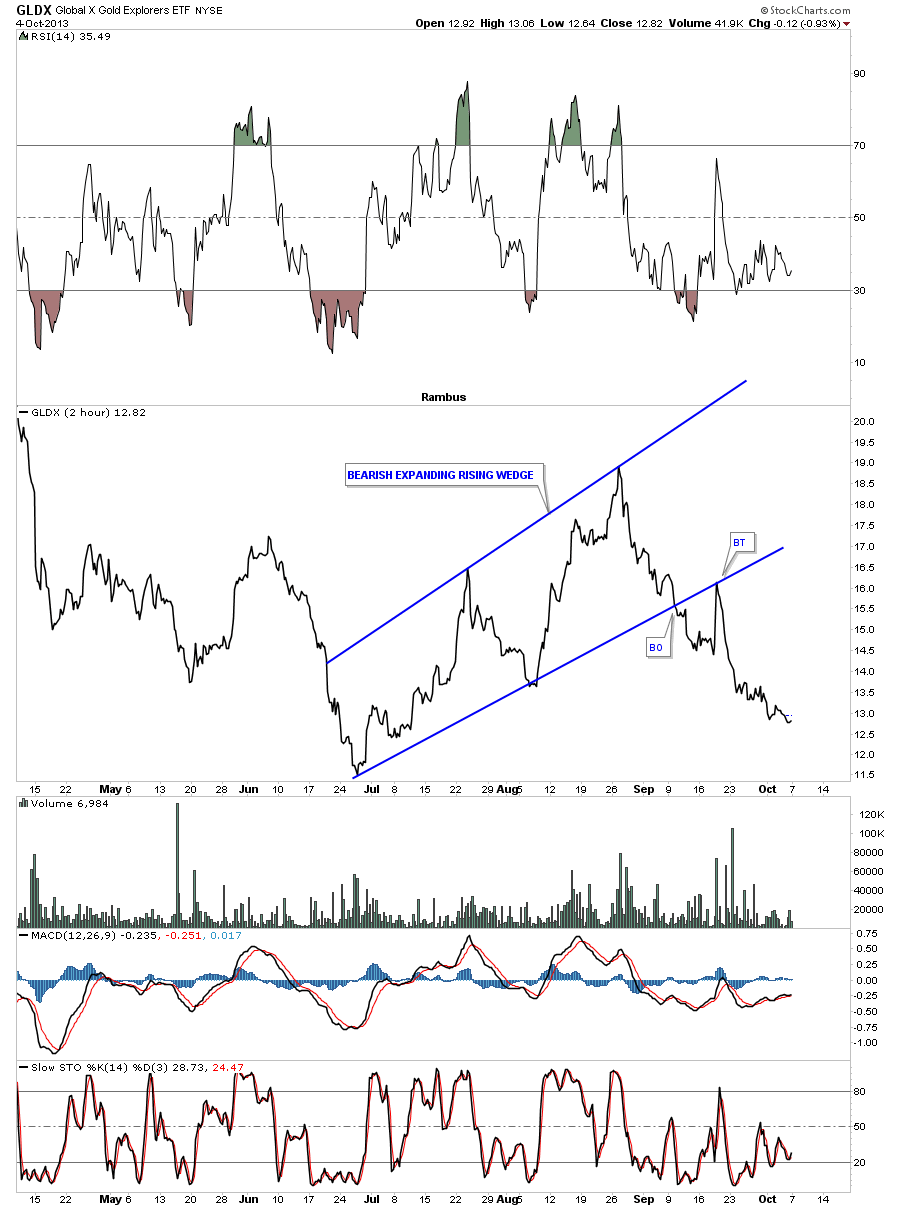

The GLDX small cap gold mining stock index is the furthest along in its impulse leg lower. Note, that one backtest after the breakout. That is something we have to keep an eye on with the big cap PM stock indexes. You never know for sure from what level a backtest could spring up from so this chart is a heads up just in case the big cap PM stock indexes have something up their sleeve. This chart also paints a bigger bear case as the little guys are leading the way down. You want to see just the opposite happen in a bull move.

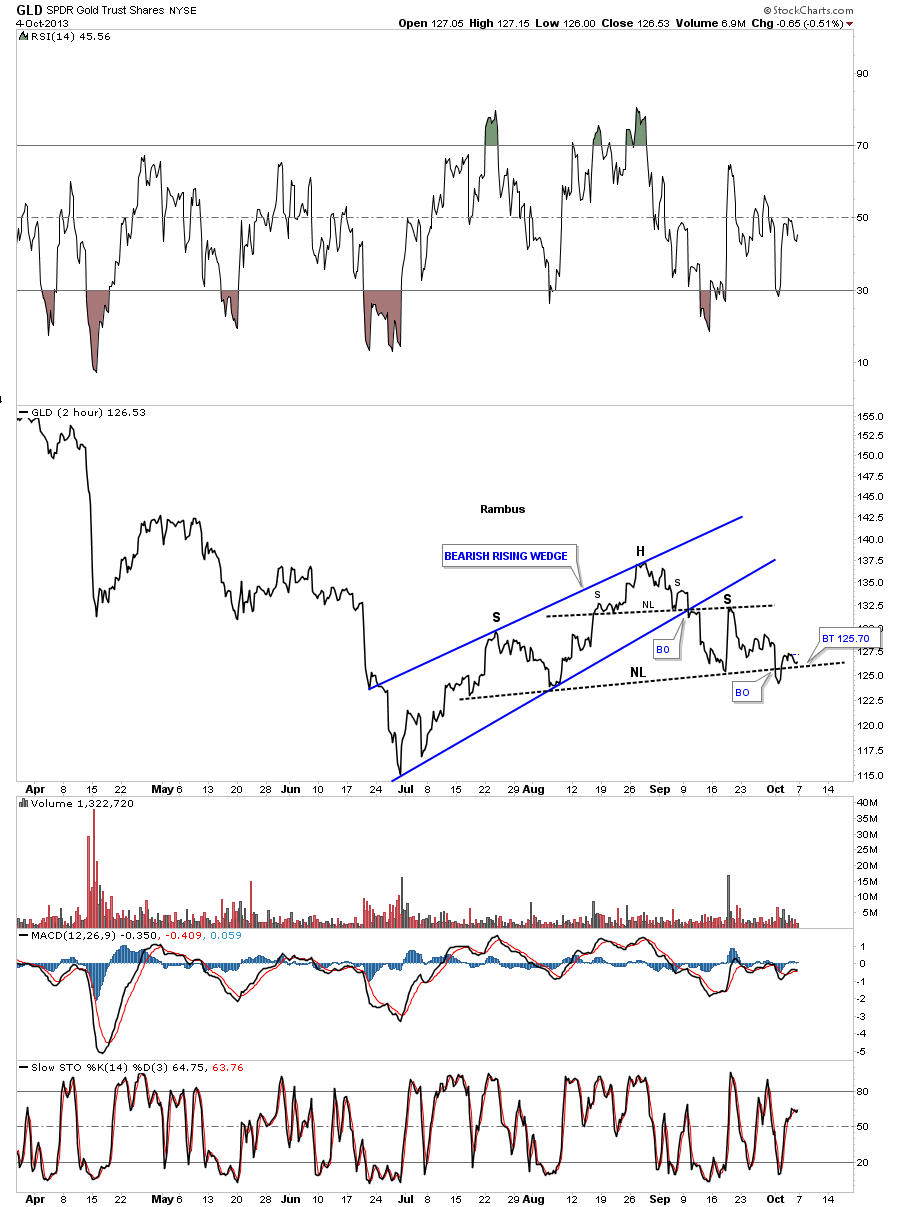

The 2 hour line chart for gold shows a H&S pattern that broke down and is now in a strong backtest. We need to see the price action break back below the neckline again to confirm the H&S pattern.

SLV is showing a small unbalanced H&S consolidation pattern that has broken down below the neckline with 2 backtests. It has also broken down from the much bigger support and resistance rail and is backtesting it from below. Above the S&R rail is positive and below is negative.

Next lets look at the internal structure of the blue bearish expanding rising wedge as seen on the 60 minute chart for the HUI. It wasn’t until the small double top was in place that the expanding rising wedge could even be seen as a possibility. Once I recognized the double top I was then able to draw in the top blue rail which so far has turned out to be the major resistance point for the HUI. As you can see there is a smaller H&S pattern with the double top as the head and the red bearish falling wedge as the right shoulder. Note the big breakout gap that took out the neckline and the bottom rail of the red falling wedge. That’s what you like to see happen in a situation like that. There is also a much bigger H&S pattern in play at this time with the left shoulder forming back in July. The last point of interest is the red bearish falling wedge that is forming basically right on the bottom blue rail of the expanding rising wedge and the H&S neckline. Note the beakout gap and the backtest last week to the underside of the neckline and the bottom blue rail that ended up being the 4th reversal point in the red falling wedge.

As you can see the GDM chart has a similar look to the rest of the PM stock indexes as they all look pretty much the same.

The GDXJ shows a double H&S top that is showing the way lower for the bigger caps.

Lets put our blue bearish expanding rising wedge into perspective which shows it as the last consolidation pattern in a string of consolidation patterns that have made up this downtrend that started at the right shoulder high made last year around this time. You can see a breakout gap accompanied by the backtest last week which shows the work that was being done to get ready for the next impulse leg lower. Everything is in place. Now we just need to see some follow through to the downside to really get the ball rolling. Also note that our bearish expanding rising wedge is by far the biggest chart pattern of this downtrend. This tells me it could very well be a halfway pattern. We’ll just have to follow the price action and see where it leads us.

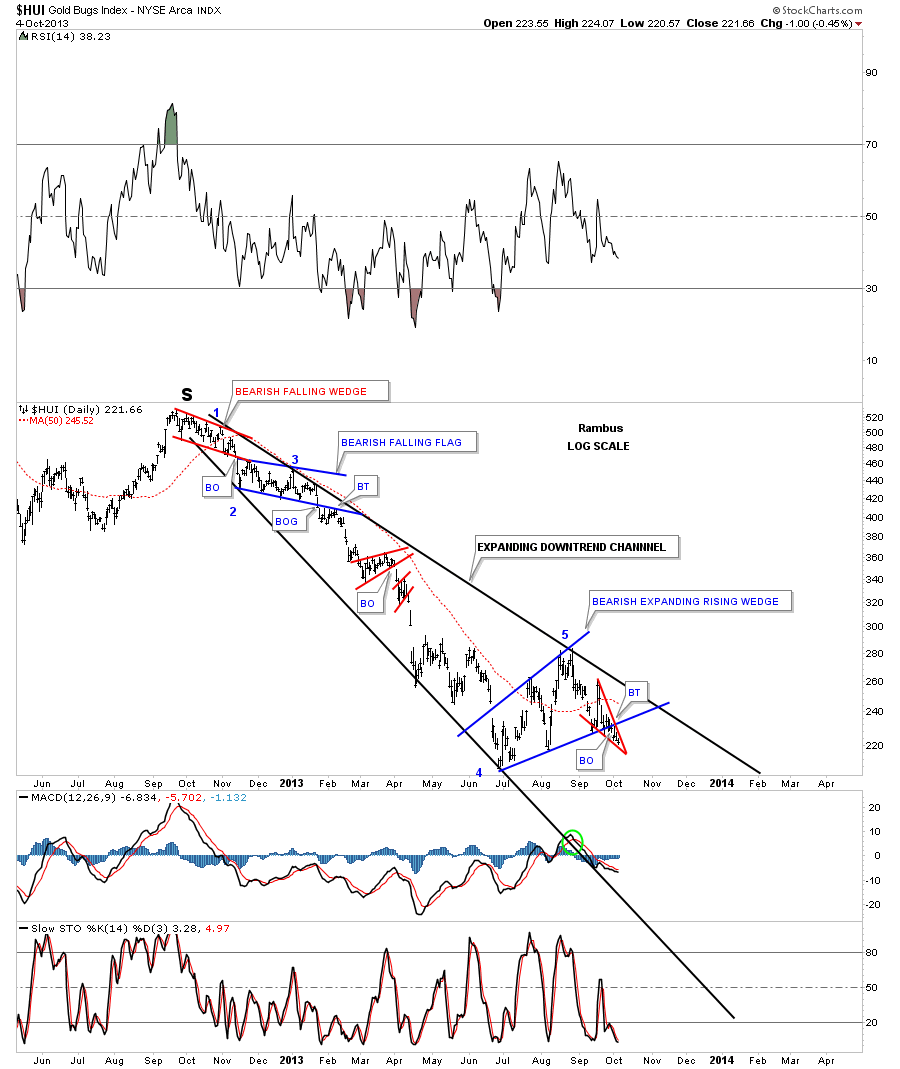

This next chart starts putting all the pieces of the puzzle together up to this point in time. The top and bottom rails of the expanding downtrend channel each have three touches which makes this viable pattern. Normally in a downtrend you will have a hard move down followed by a sideways consolidation pattern that can chop sideways until it hits the upper trendline. It can do this several times before the downtrend is finished. The blue numbers shows this happening on the chart below. Point #1 started the downtrend with points #2 and #3 being the sideways consolidation pattern trading between the bottom and top rails. Now fast forward down to reversal point #4 which is the beginning of our blue bearish expanding falling wedge that has now trade between the bottom and top rails. I don’t know if the price action will trade back down to the bottom trendline but it’s setup to do so. If it did the decline would probably look similar to the decline between reversal points #3 and #4. Again we will just have to watch the price action for clues along the way.

Using the linear scale chart we get a more parallel down trend channel.

I would like to go back in time and show many of our newer subscribers what we were looking at back in the beginning of 2012. The first thing you will notice is the black dashed down sloping trendline that I labeled as a support and resistance rail. The red arrows shows how it acted as resistance and the green arrows shows how it acted as support. That was a very important trendline at the time which let us know where we stood as far a being in the bull or bear camp. You can see the H&S top that has all the green arrows underneath it as it was acting as support. That was a very nice looking H&S top that I thought was going to be our major top at the time. As you can see the price action broke below the neckline that said all systems go for a move lower. The backtest started off of the solid black uptrend rail that took the HUI back up to the neckline, red arrow. So far everything was working out beautifully. I drew in the solid black uptrend rail connecting the 2008 low and the low we just made. When the HUI started to move lower after backtesting the neckline from below I really thought the price action would break through the solid black uptrend rail with no problem as the H&S top was in place. As you can see when the HUI declined back down to the black rail it didn’t give way and the HUI started to rally creating the double bottom. This was a very trickery situation as we had the H&S top in place and a double bottom that had just held. We were short at the time and I had to decide very quickly if that was the correct position to be in as the double bottom held and the HUI was rallying strongly up. Long story short we exited our short position and went long. Once above the neckline, red arrow, it felt like the bull market was taking off again and the place to be was to the long side. This is why following the price action is so important. The rally stalled out at the blue arrow, which we now see as the right shoulder of a bigger H&S topping pattern. I held my ground on the backtest from the top side just as you would have expected to happen as the support and resistance rail suggested should now hold as support, green arrows. The moment of truth came when the HUI broke below the black dashed support and resistance rail with a strong move. I said at the time this wasn’t supposed to happen if the bullish case was in place. We exited our short position with a small loss to break even. At that point we backtested the black support and resistance rail from below and is when we took our initial position in DUST on December 2nd I believe. I used the red circle to show how we were interacting with the neckline, which is part of the support and resistance rail and the solid black uptrend rail. The Chartology worked its magic within the red circle as you can see. The price action backtested the neckline and then when the uptrend rail was broken to the downside it backtested it as well. This was as clear a signal as you could get that the false breakout above the neckline or the support and resistance rail was nothing more than a bull trap that caught many bulls by surprise including me. I was lucky enough to have Chartology on my side so by following the price action we were able to get out of our precious metals stocks and ride the whole bear market impulse leg down using DUST, DSLV and DGLD.

Now you can see our blue bearish expanding rising wedge that nobody is seeing except members of Rambus Chartology. There is a very good possibility that this pattern is showing us the halfway point of the major decline that started at the top of the right shoulder on the bigger H&S top that I’ll show you in a minute.

The chart below shows the small H&S top on the chart above but also shows the much bigger H&S top that formed when the rally stalled out above the smaller H&S neckline that I’ve labeled as a bull trap.

Below is a daily log scale line chart that shows the double H&S top in place with our blue bearish expanding rising wedge as a possible halfway pattern. Keep in mind the linear scale chart gives a lower price target for the big H&S top.

I need to warp this up as it’s getting late. So far nothing is broken and the price action is moving along as expected. There are times when the markets whipsaw you before you know what hit you. By following the price action we can generally stay on the right side of the bigger move. The markets are always trying to shake you off before your price objectives are hit, it’s just the nature of the beast. We’ll see if we get any follow through to the downside this week that will leave our bearish expanding rising wedge in the DUST. All the best…Rambus

HUI to Gold and Silver Ratio Charts…

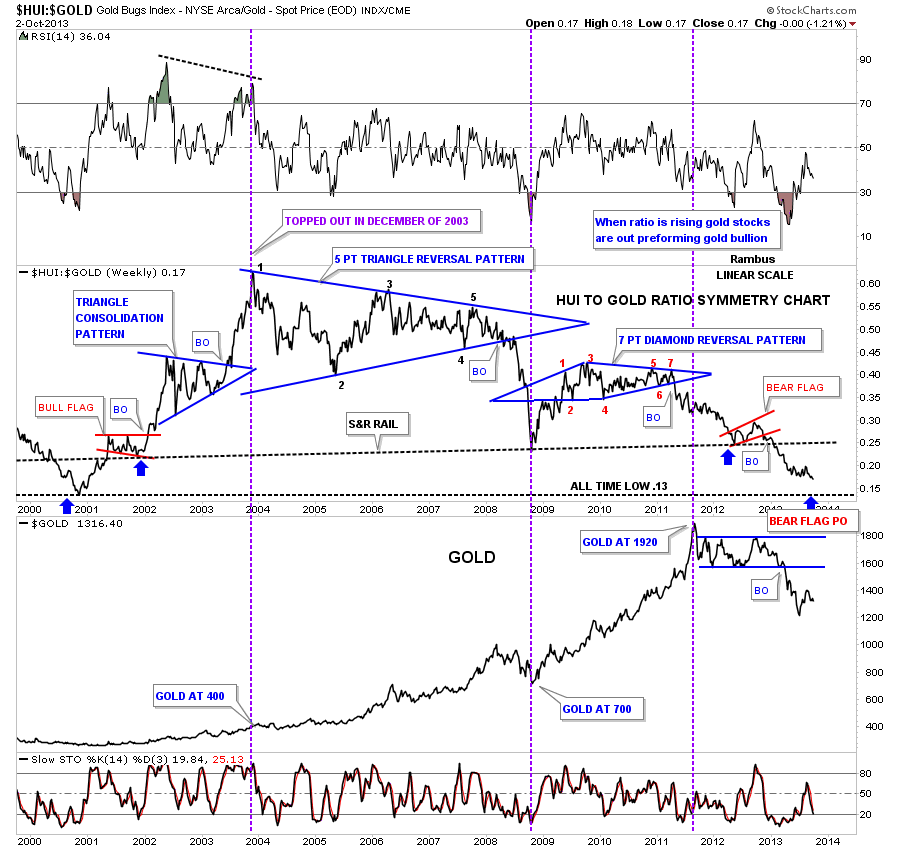

I just want to show you why we are much more leveraged to DUST or short the precious metals stocks vs just being short gold and silver. Below is a combo chart with the HUI to gold ratio on top and gold on the bottom. This is really a pretty incredible chart when you see how badly the precious metals stocks have preformed to gold. The ratio chart also has some pretty nice symmetry going on. I’ve been looking for the .13 area for a long time that will match the start of the bull market low made back in 2001.

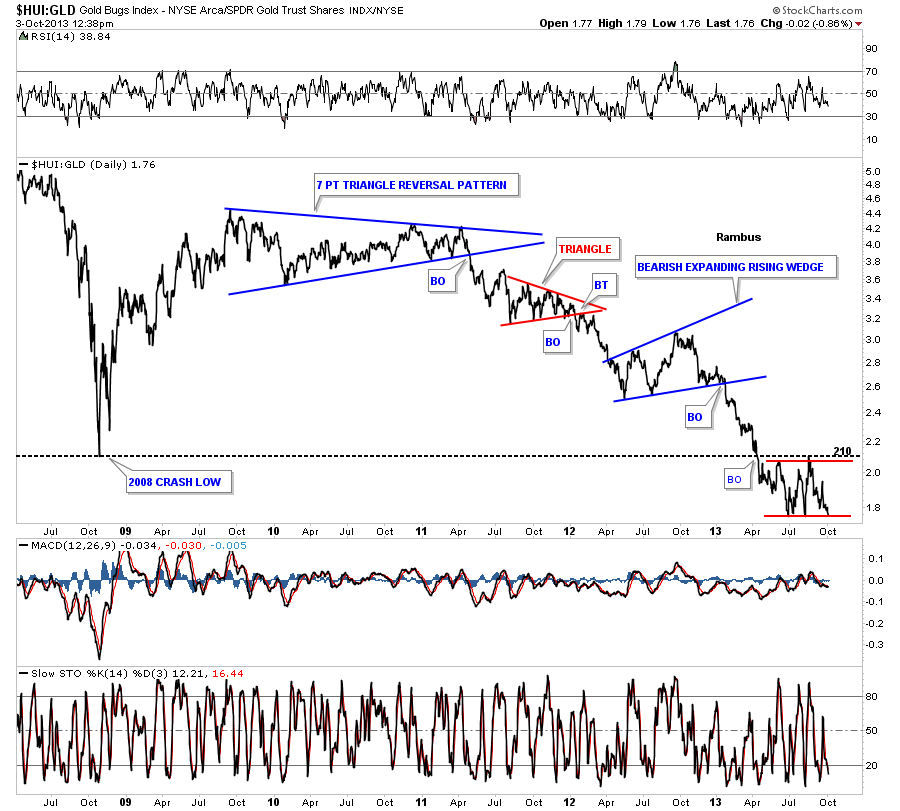

The next chart for the HUI to GLD ratio shows how it has broken below the 2008 crash low and has been consolidating just below that important bottom since July of this year.

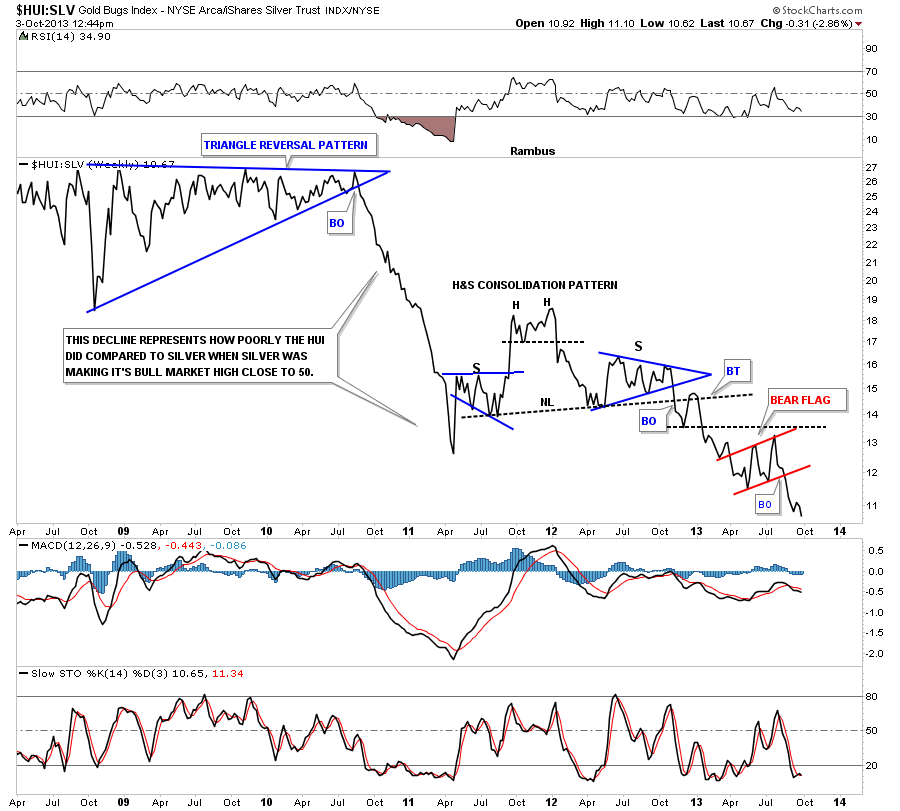

This next chart compares the HUI to silver that shows how badly the precious metals stocks did when silver was making its all time highs back in April of 2011. Notice the almost vertical drop the ratio made into the April 2011 bottom. That shows you how badly the PM stocks did as silver was going parabolic. I remember thinking to myself, something isn’t right with this picture, at the time. Note the big H&S consolidation pattern that formed in the middle of the chart that broke down last fall. In July of this year the ratio broke down again this time breaking below the red bear flag.

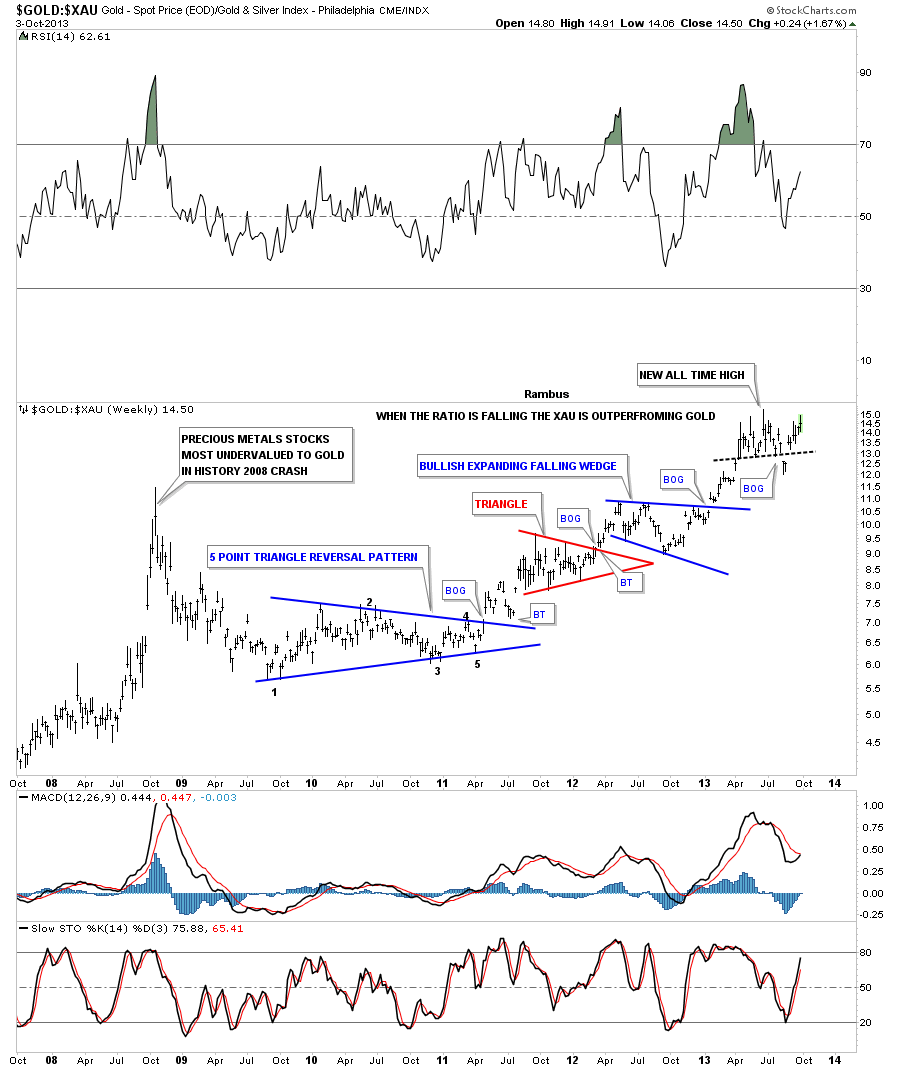

I want to show you one more ratio chart that compares gold to the XAU that tells an incredible story. First note the spike high that was made during the 2008 crash where the ratio went to a new all time high. Everyone said that was a fluke and it was truly an aberration that will never happen again. The ratio fell for the next year or so and then began the long risie back up again. Note the 5 point blue triangle that reversed the downtrend. As you can see two more consolidation patterns formed on the way up that kept suggesting that the precious metals stocks were still underperforming the metal. Then the ratio hit another all time high this summer that looked like it would be the ultimate high for the bear market for the precious metals stocks vs gold. Note the little island reversal that formed just under the black dashed trendline just below the all time high. I thought at the time that the ratio was finally breaking down and it was time for the precious metals stocks to start outperforming gold again. That’s when we took a stab at the precious metals stocks that lasted all of a week or two before we had to exit at breakeven. As I mentioned several times and to Sir Fully this week, ” the only rule in the markets is are there are no rules.” This means stocks can get overbought or oversold beyond anything reasonable and for an extended amount of time. I can guarantee you that if you said, at the beginning of the bull market for the precious metals stocks that they would under perform gold to this extent, they would have put you in a mental institution.

As long as these ratio chart continue to fall we will be more leveraged to the precious metals stocks using DUST as our main tool. It’s possible that when THE BOTTOM finally comes in the precious metals stocks will lead the way higher as they did back in 2001. Right now they are still under performing the metals.