Many of Our Members are asking how Rambus Chartology was conceived .

……………………….

This is as good a time as any to explain who we are and how we happened !

……………………………..

Our Website was started December 2011

At first Rambus Chartology was know only to those at Goldtent (www.goldtent.com)

Which by the way was billed as the best damn Gold Site On the Net !

6 Years running self supported Bulletin Board with some of the finest and brightest and definitely most militant Goldbugs you could ever get to know…And a cast of real interesting characters !

2.5 million Hits a month…thousands of lurkers and hundreds of posters !

Rambus was posting there and was a cherished member in 2007 and 2008

We loved him, as he showed Continuation pattern after Continuation pattern and Gold rose strongly as did Silver and the PM Stocks..He nailed every move .

…….All was right with the Gold World……

Then Rambus switched course ! egad !

Some damn thing about a breakdown that he didn’t like the looks of …but of course no goldbug could see .

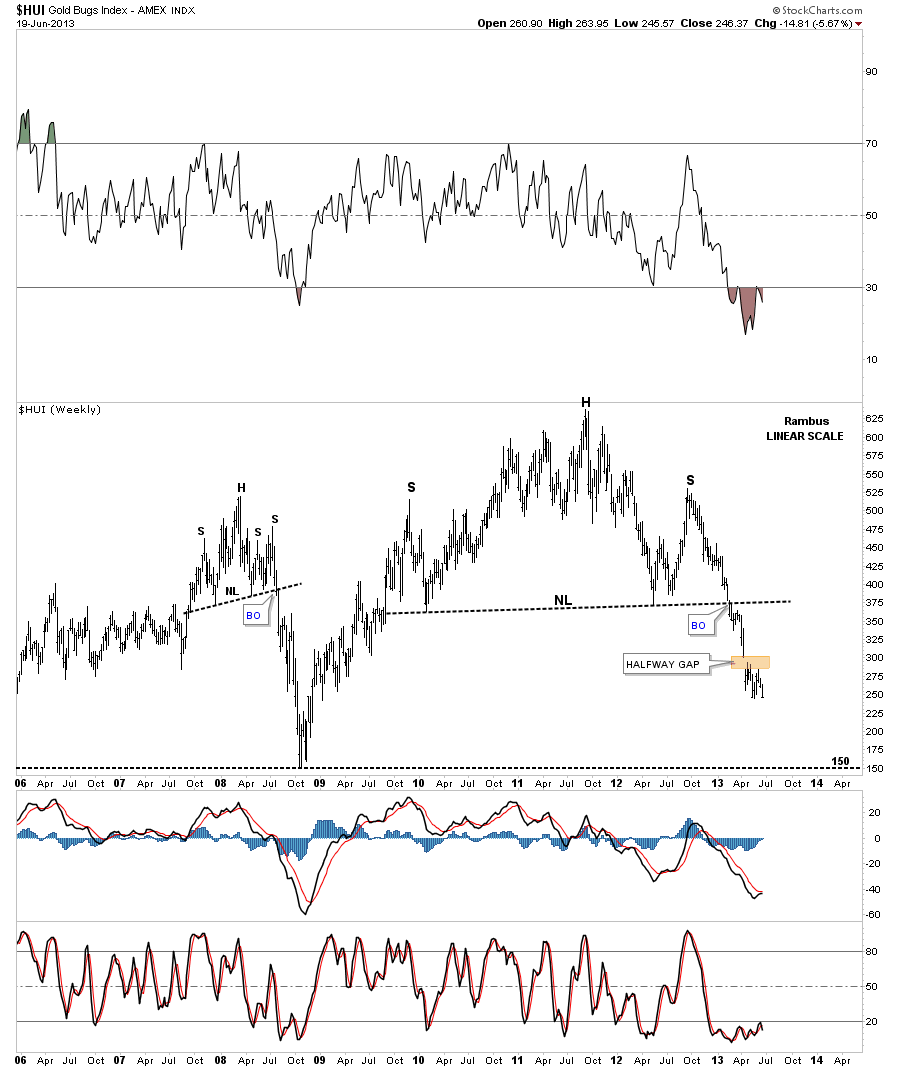

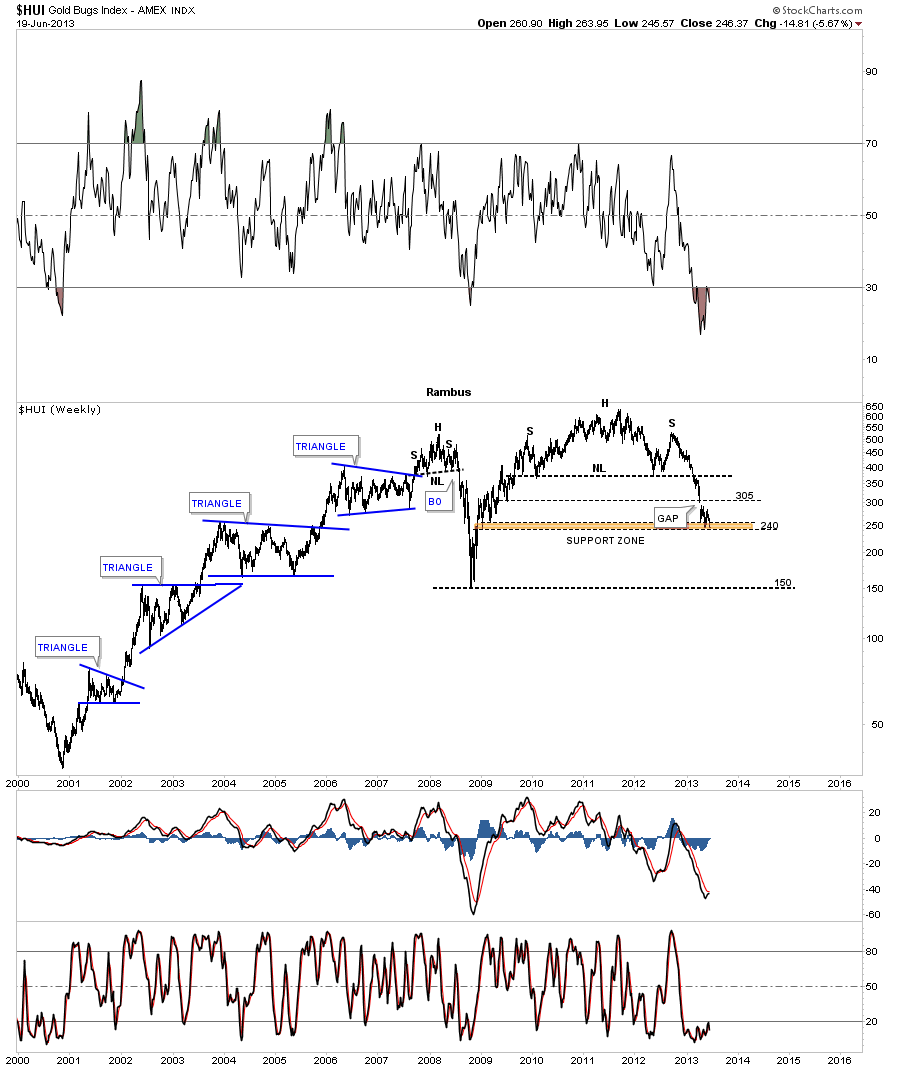

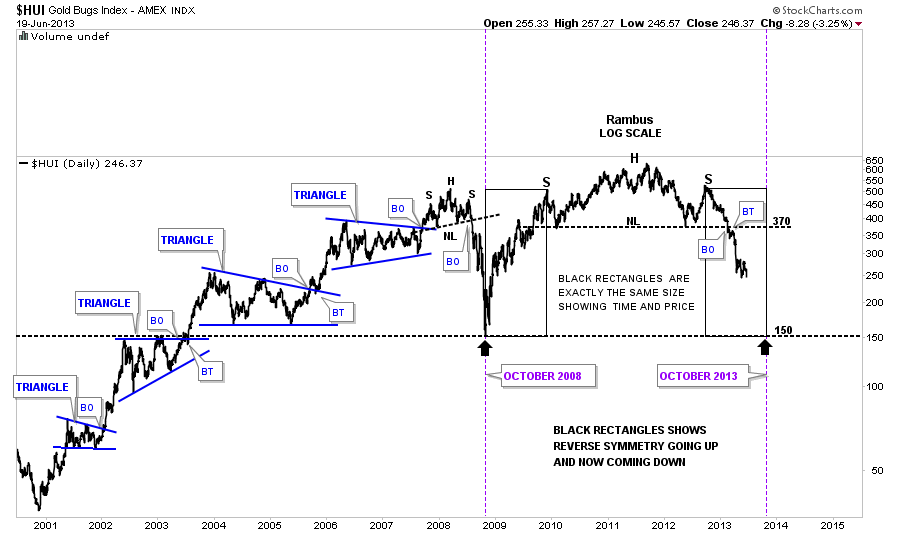

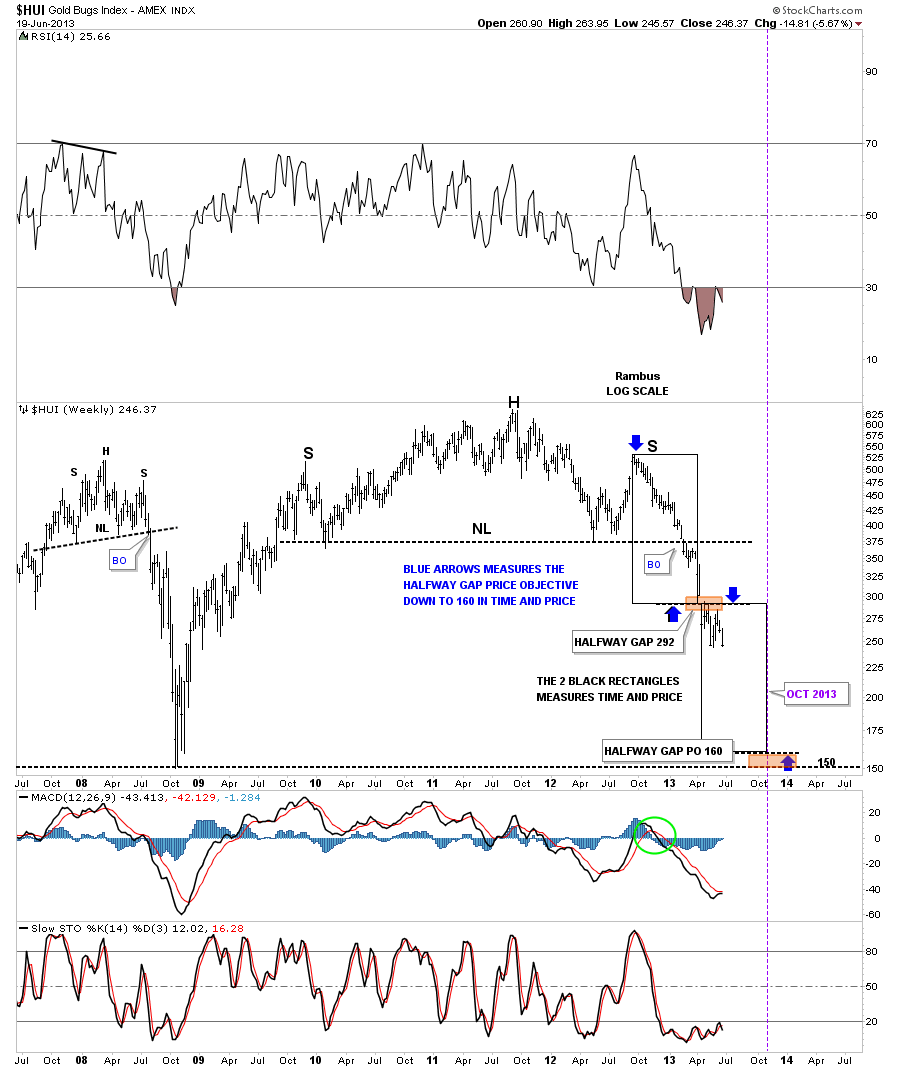

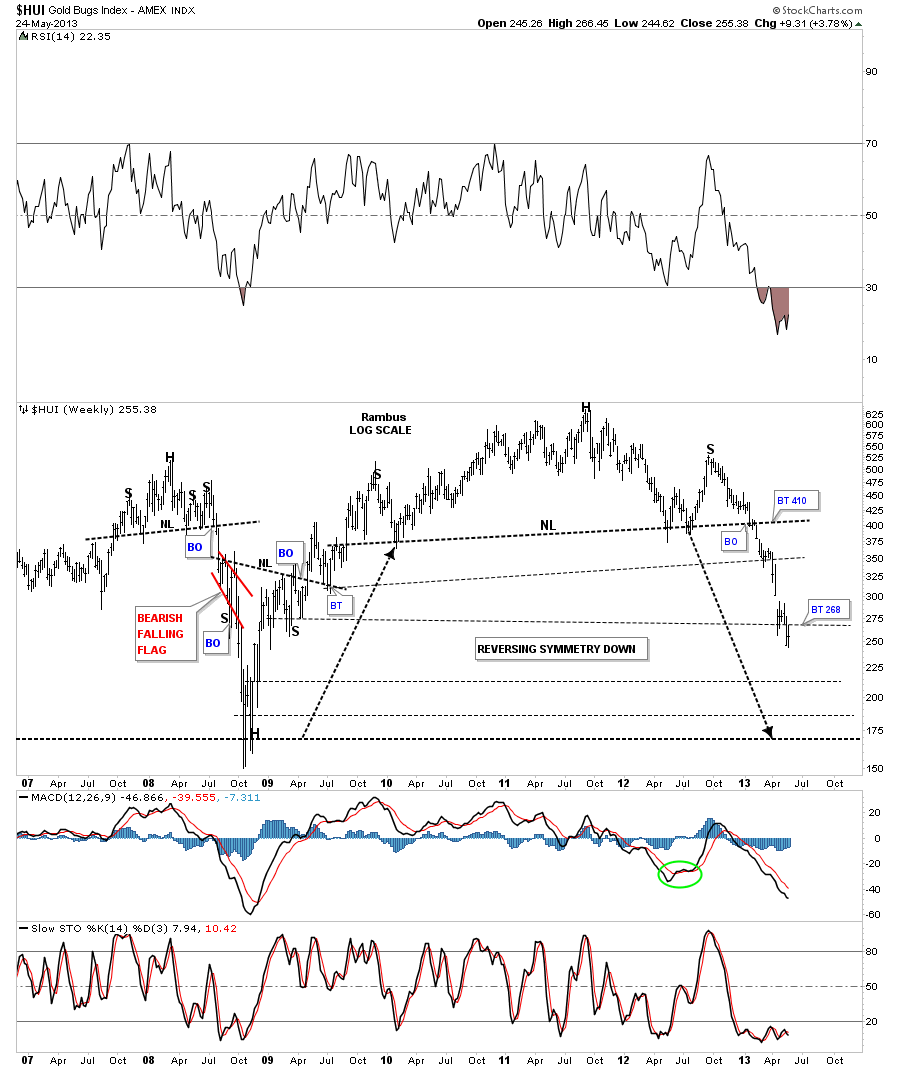

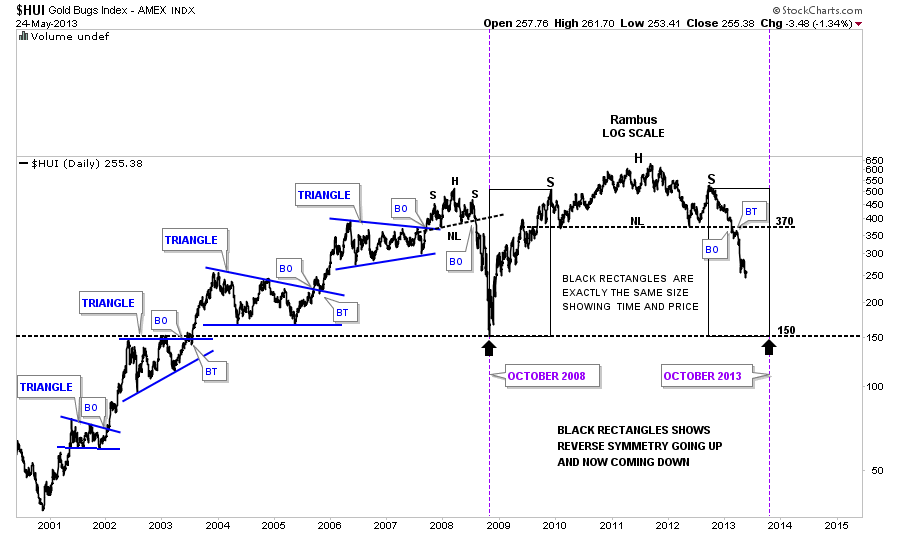

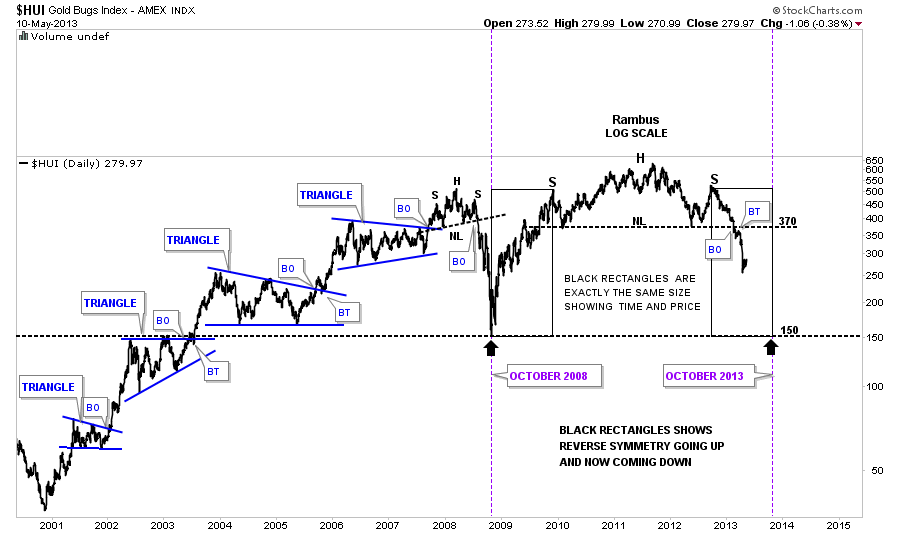

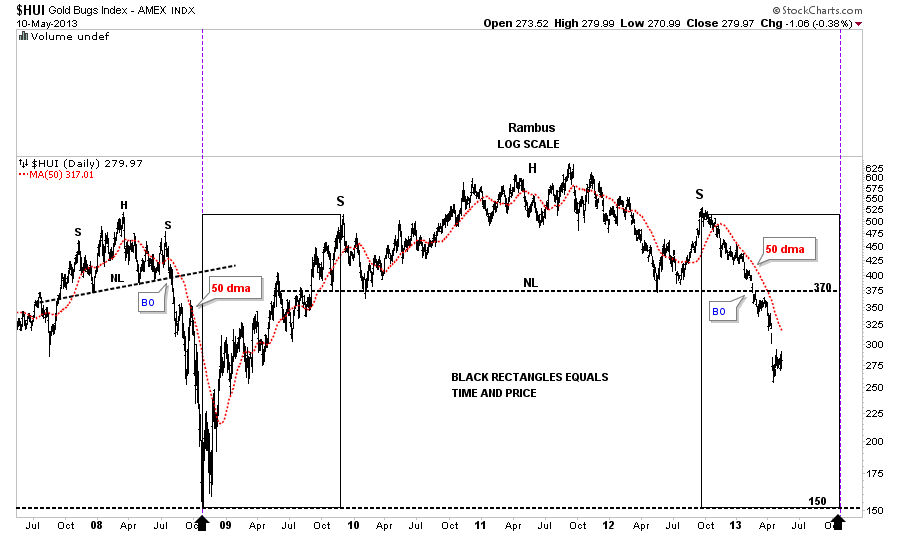

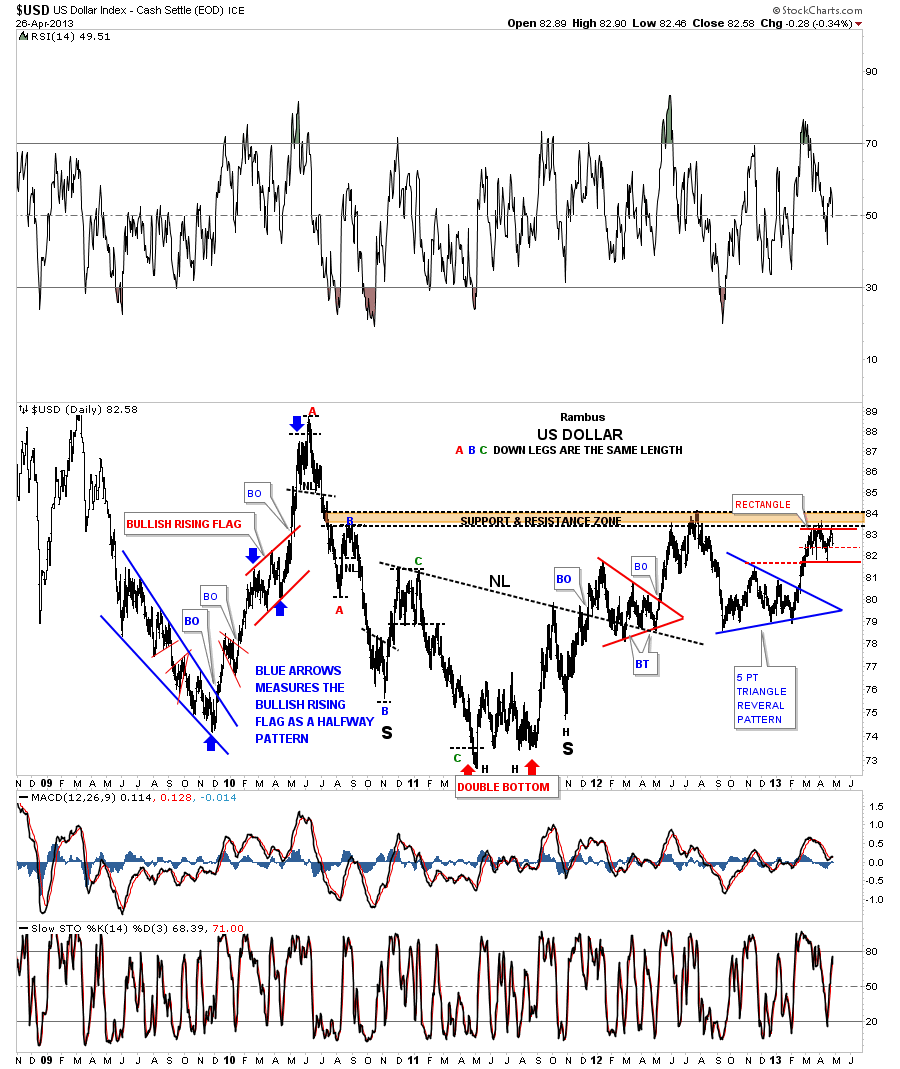

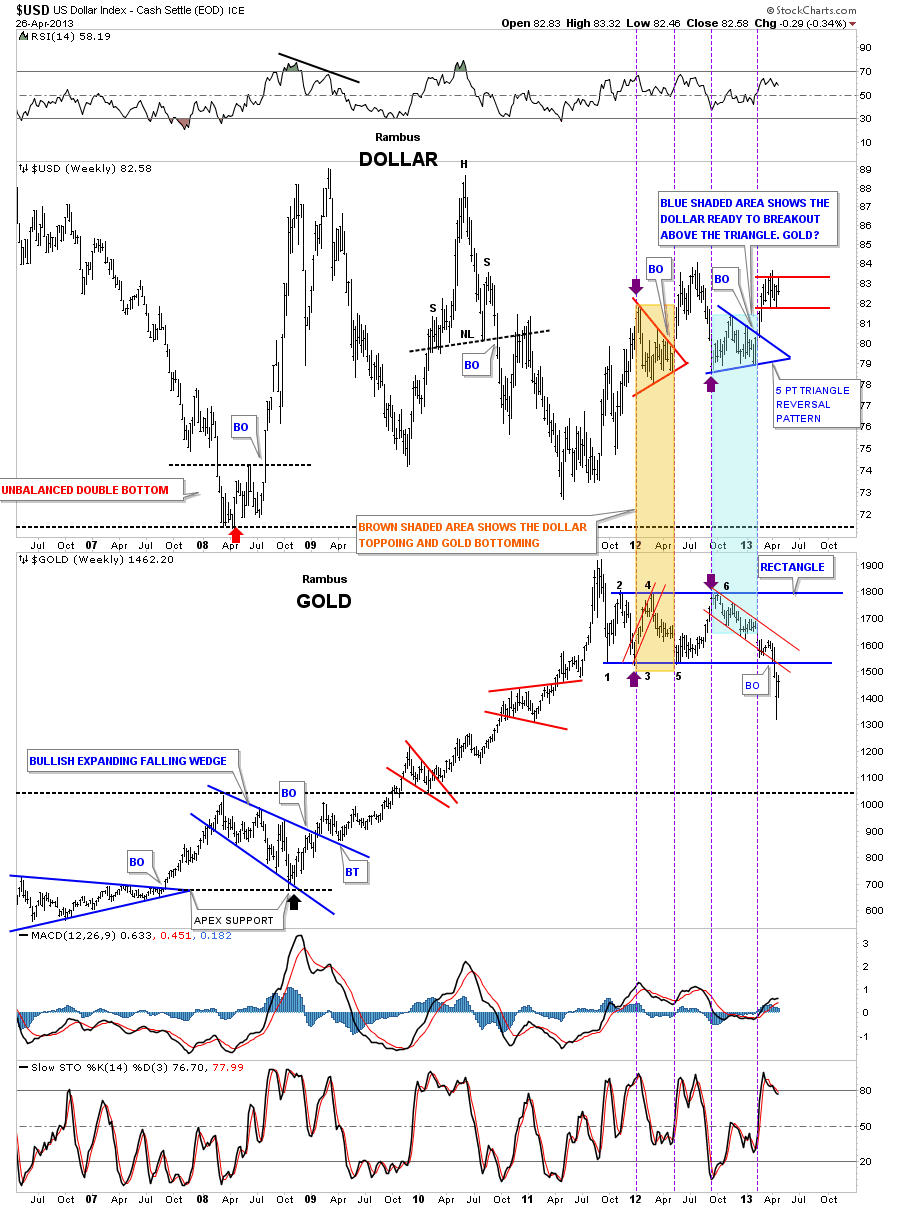

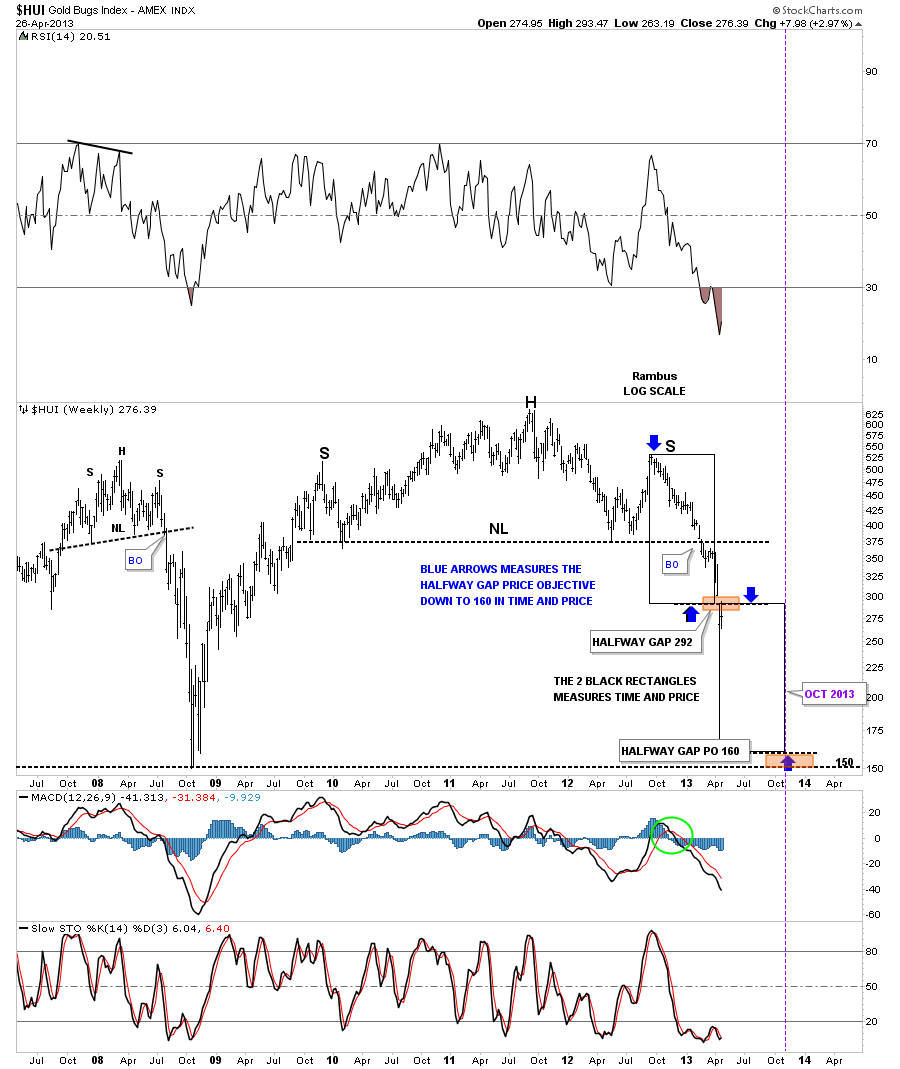

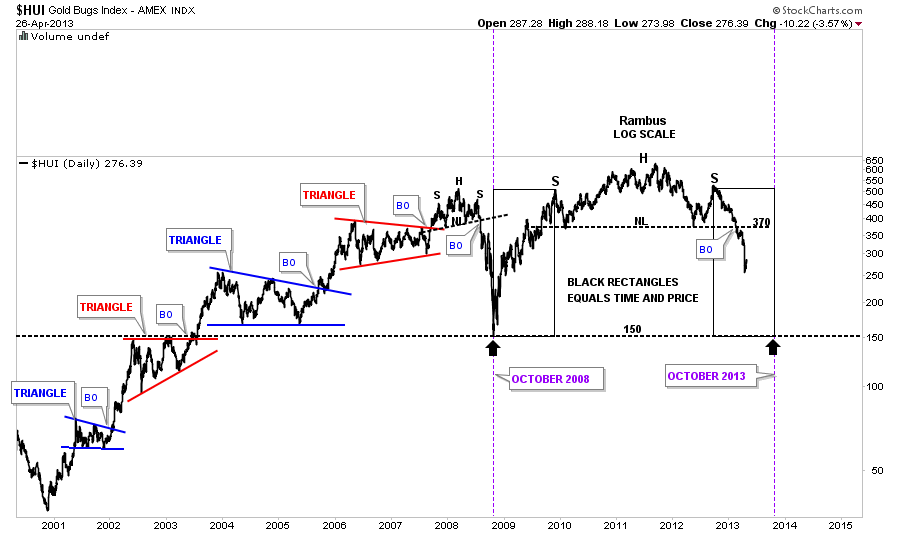

..Long story short ..Rambus called the HUI 150 bottom…(his target was 160)…a long time before it happened

But when he posted his now famous “What If” post (linked at the Wizard of Rambus ) we started to challenge his work

all of a sudden his shoulders weren’t big enough on his heads…his trendlines were arbitrary…and he took a lot of criticism from Us.

And no one participated more than I , Fullgoldcrown !

So he did what any self respecting Chartologist would do .

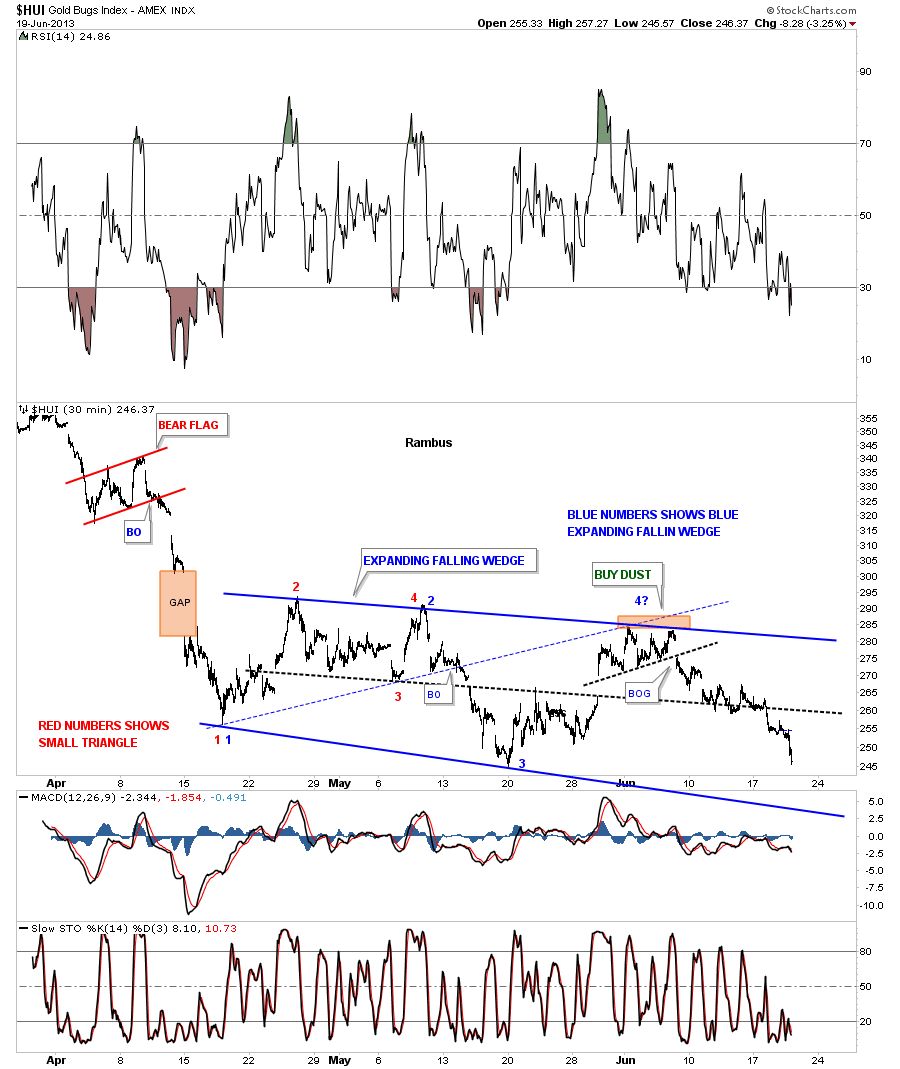

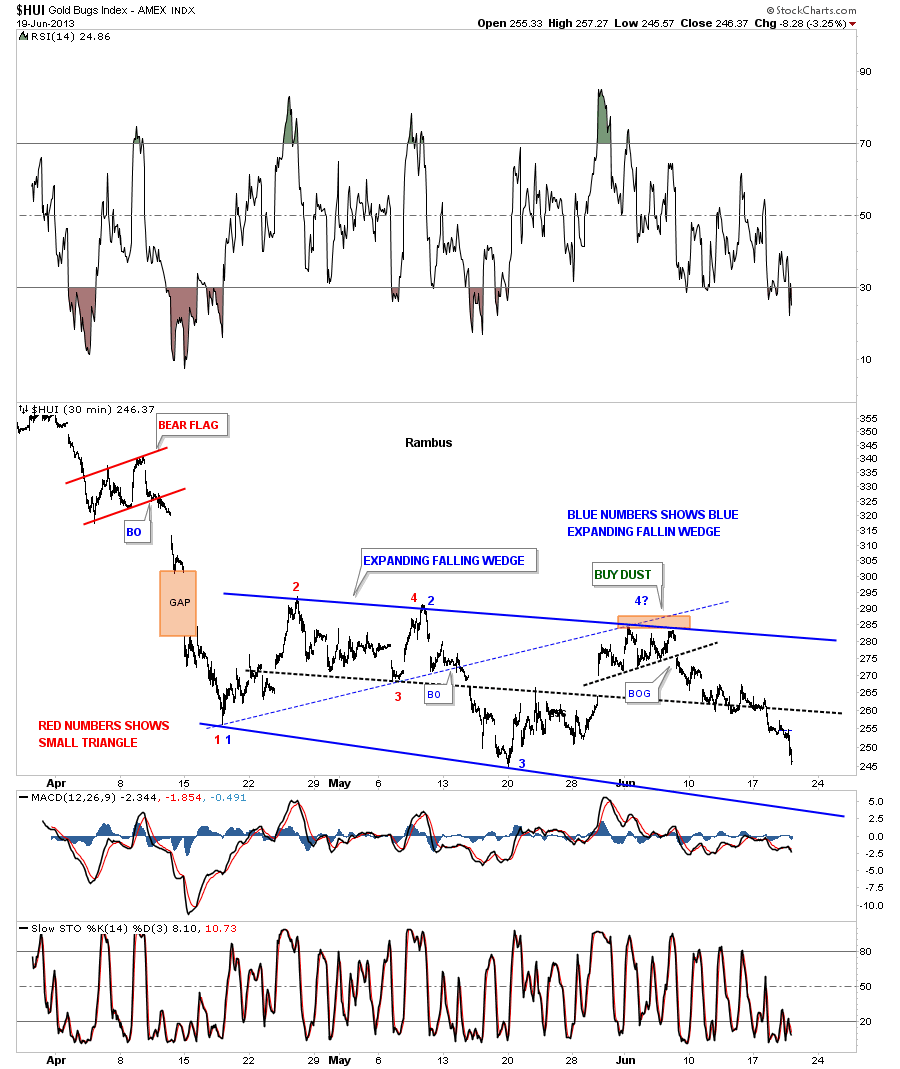

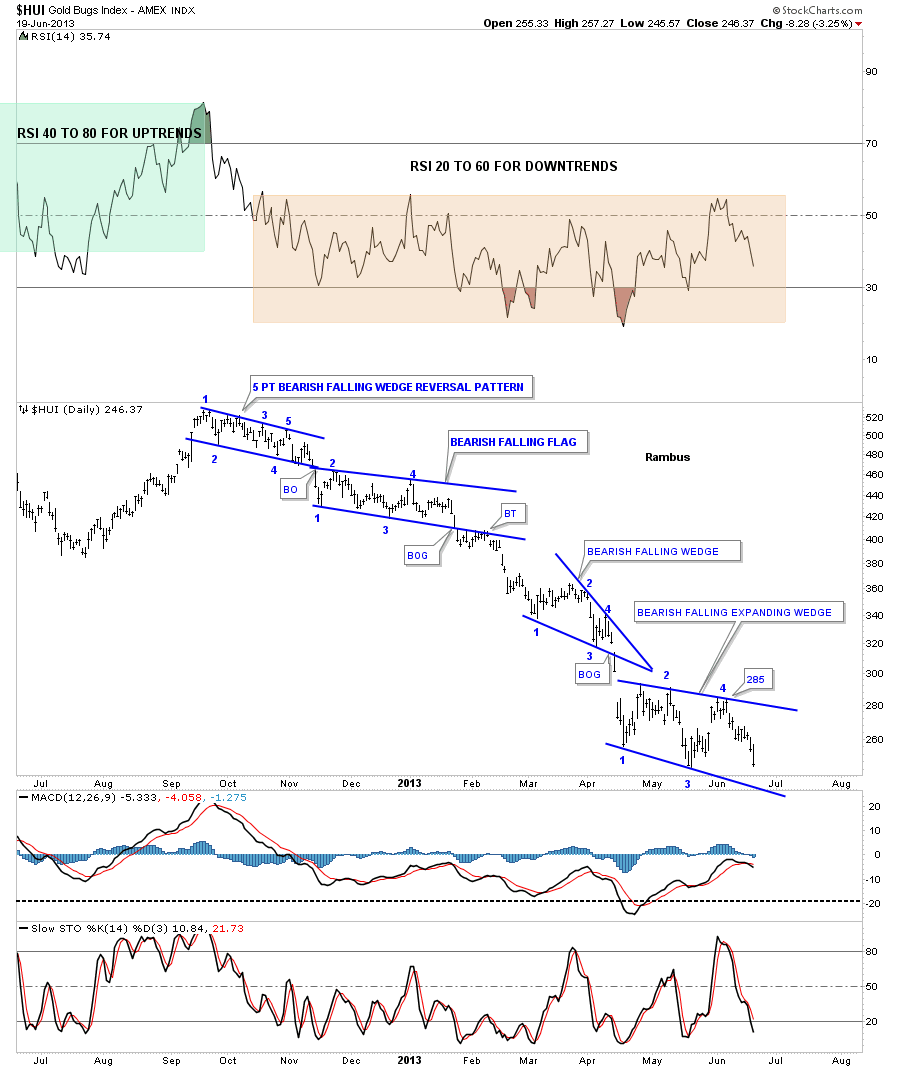

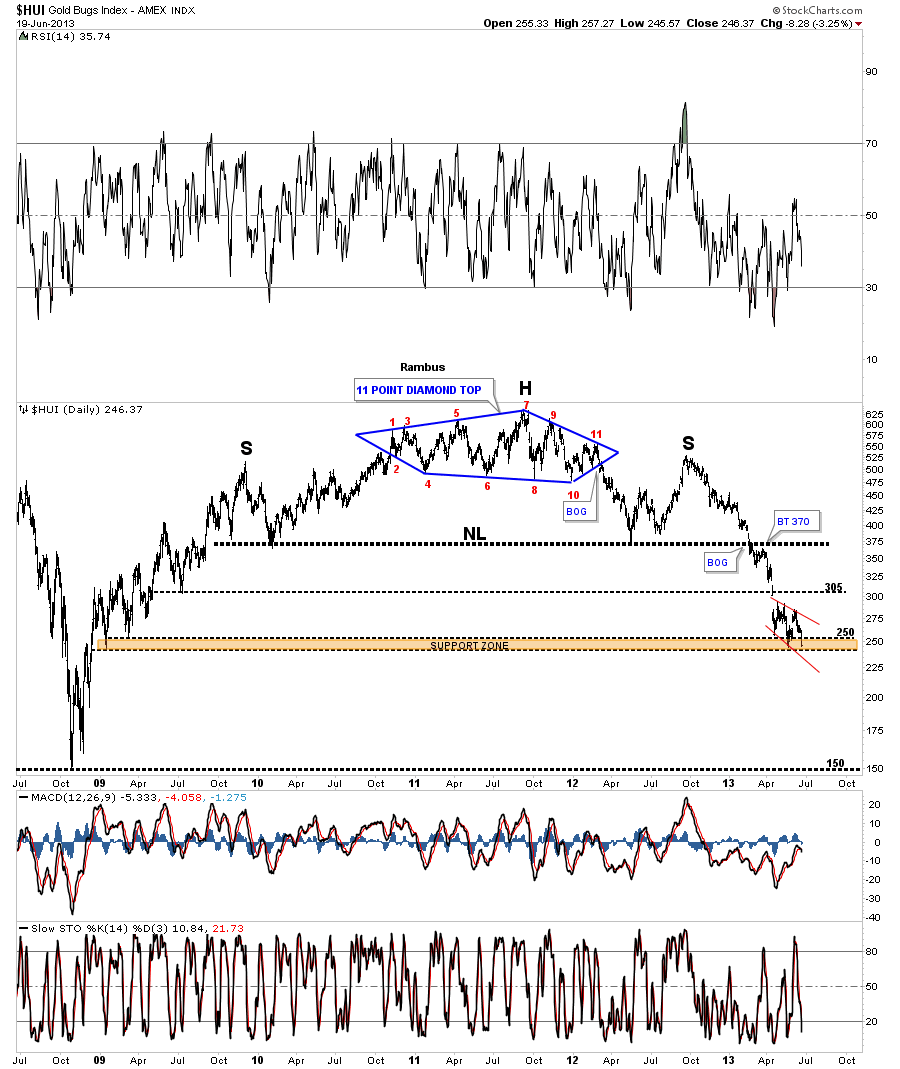

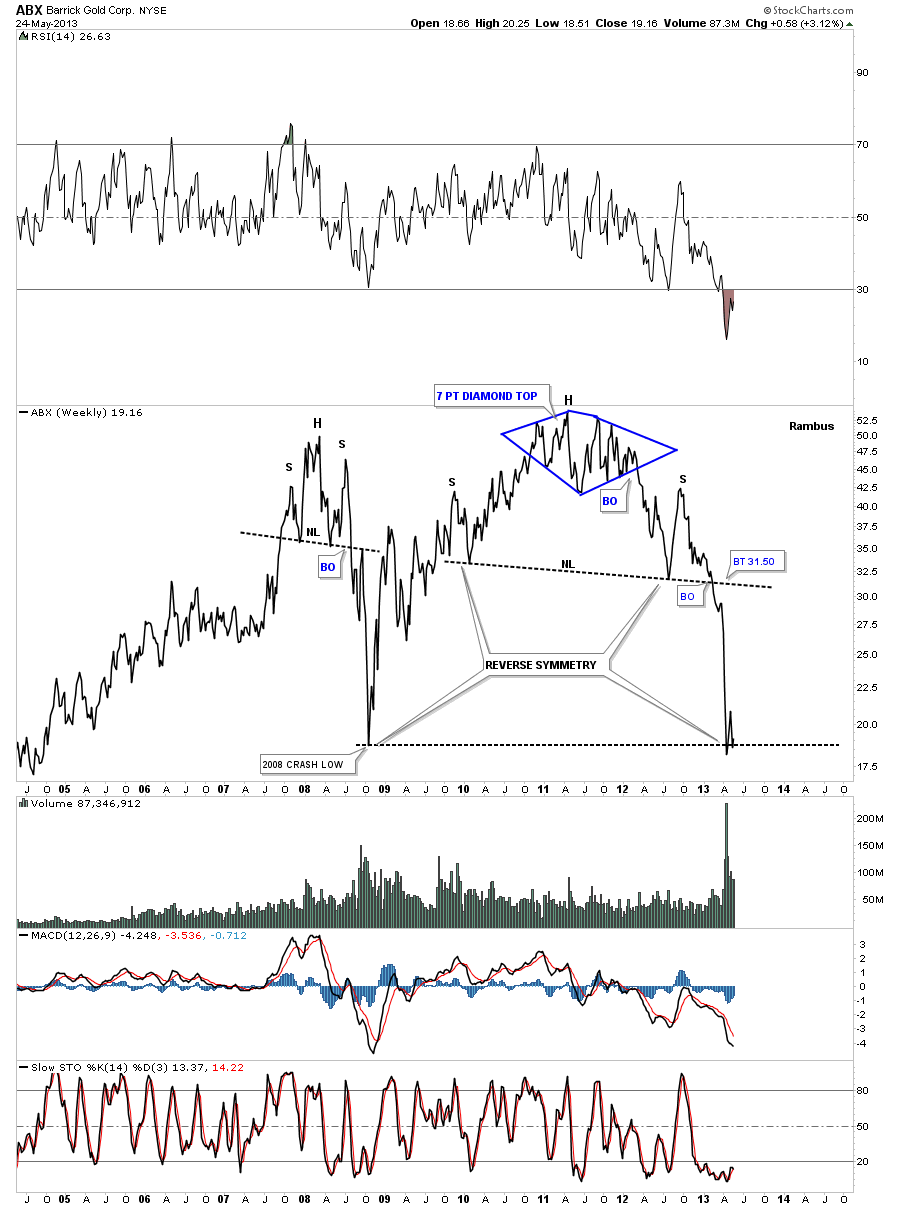

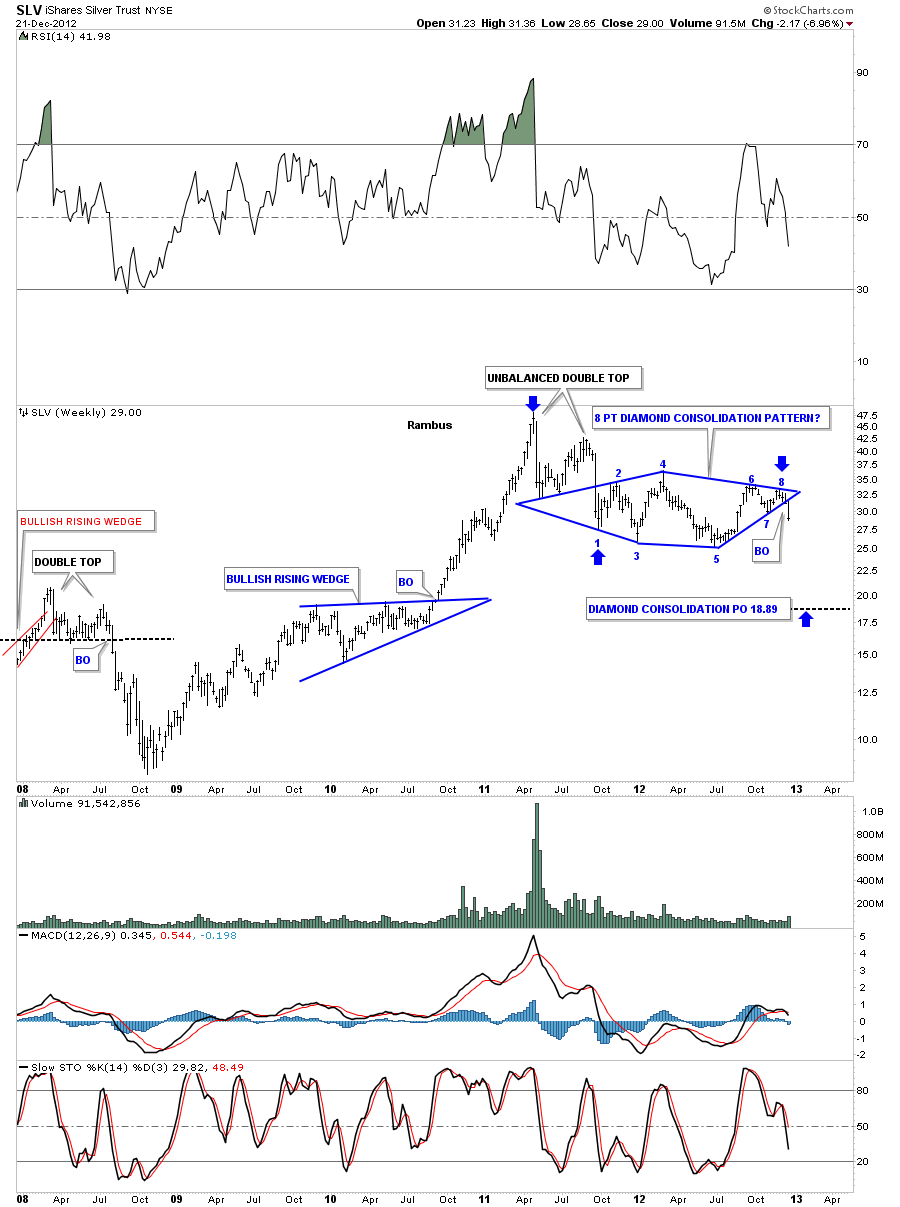

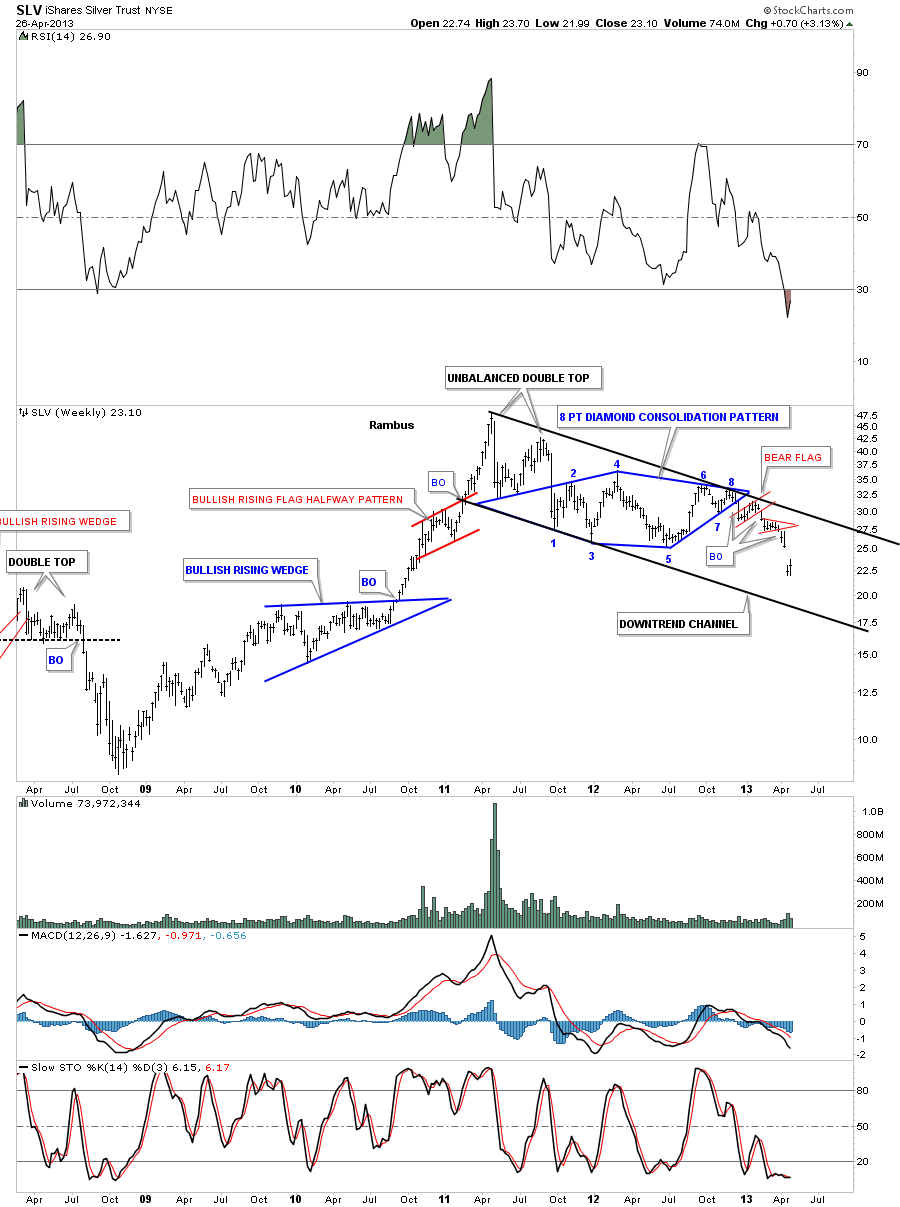

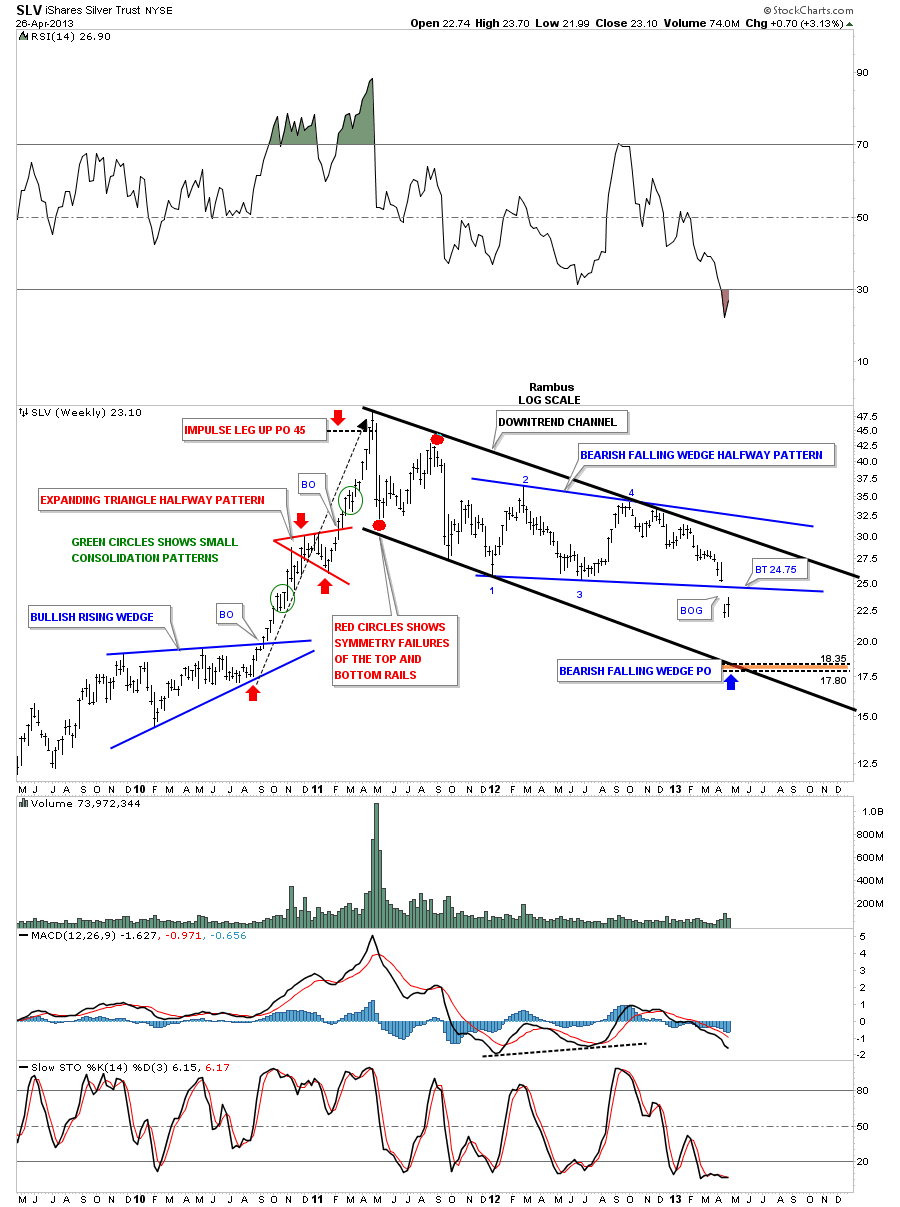

He took his Bearish Falling Wedges and 11 Point Diamond Topping Patterns and went home…Ozark Mountains Arkansas !

……………………………

2008 2009 2010 came and went ..and Goldtent was thriving…but every so often someone would say..I wonder whatever happened to that guy Rambus

He was so annoying but so right ?

Anyhow after 3 long years in self appointed exile….. Dave (Rambus) contacted me and said

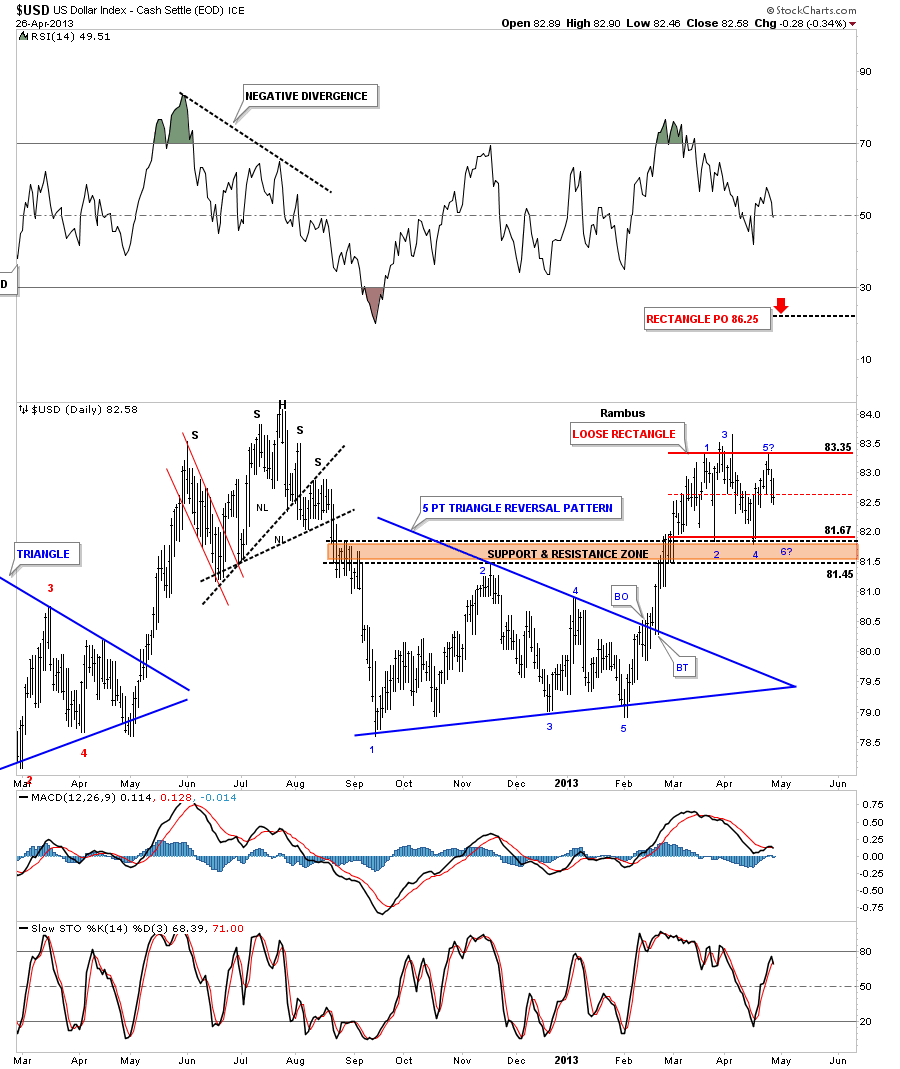

He was reading ” The Tent” and was concerned again that everyone was all in , but there was again potential trouble on the horizon .

He sent free charts for me to post there..but goldbugs being goldbugs…we weren’t really listening…

I Encouraged Dave to Start his own site…and told him if you Build It They will come .

I am sure you longer term members all agree .. his work is unique .

He was reluctant to go through the drama and trauma at first but thankfully he hooked up with Audept who is The other Tech WIZARD on the site..

Audept is the Goldtent site creator and Webmaster

who also created this ever evolving Rambus Chartology Site !

Look for his voice interviews coming to the site some day soon !

……………………………………………….

So who is Rambus ?

Just a good old down home country boy who happens to have a Wizard like knack for Charting Market Psychology (Chartology)

and for being able to teach (preach) these principles in a very enlightening entertaining and informal manner.

I would describe him as a humble strait shooting teacher who learned his principles out of a book , Edward’s and Magee …the old fashioned way…then practiced and failed

with sharp pencil and paper and ruler until he compiled enough knowledge to learn to spot things like 11 point topping patterns that are absolutely Invisible to anyone else

(See the Diamond In the Rough post at the Wizard of Rambus)

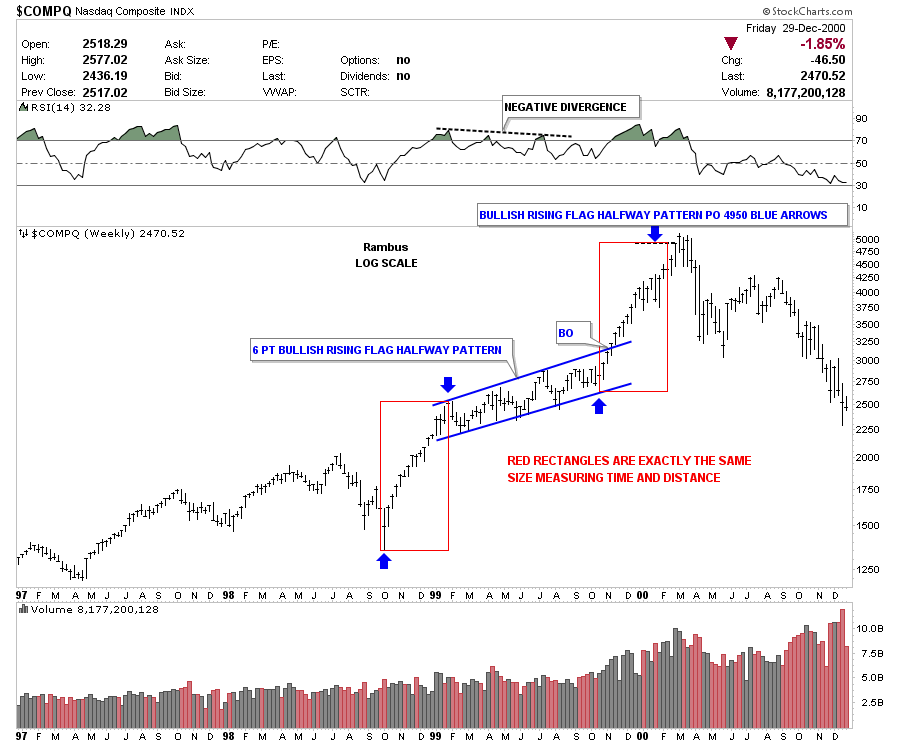

His Handle Rambus derives from his favorite trading stock of the tech mania

which he played until 2001 when he fell in love with the Gold Sector

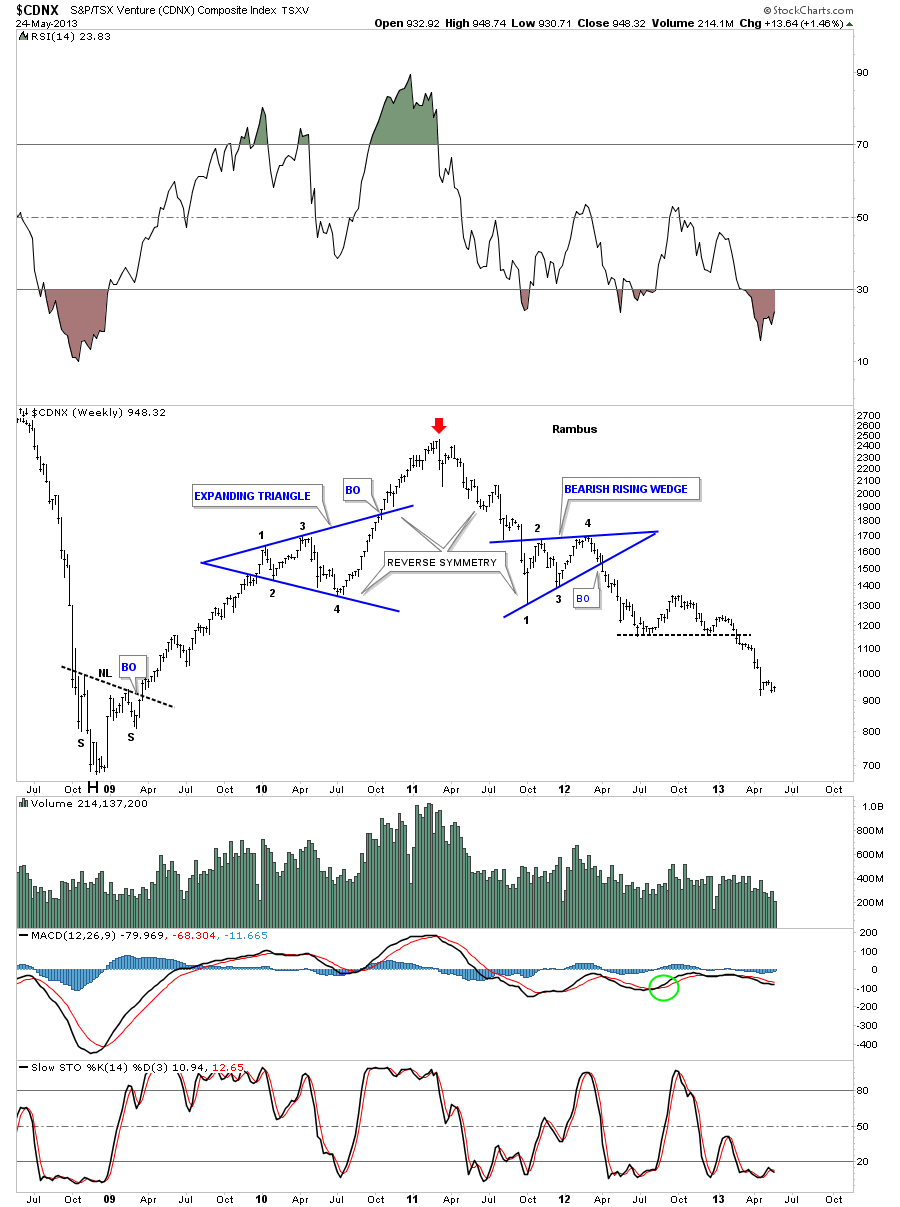

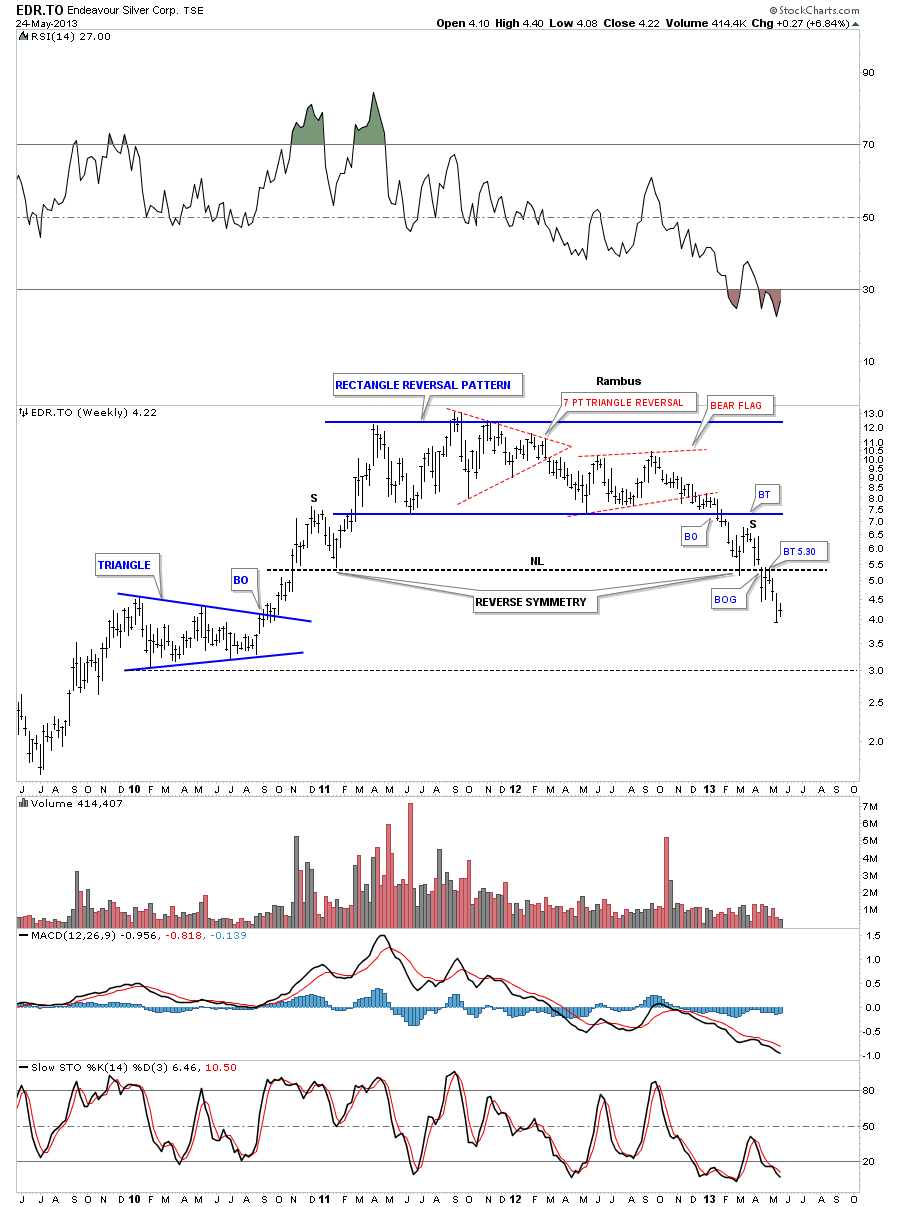

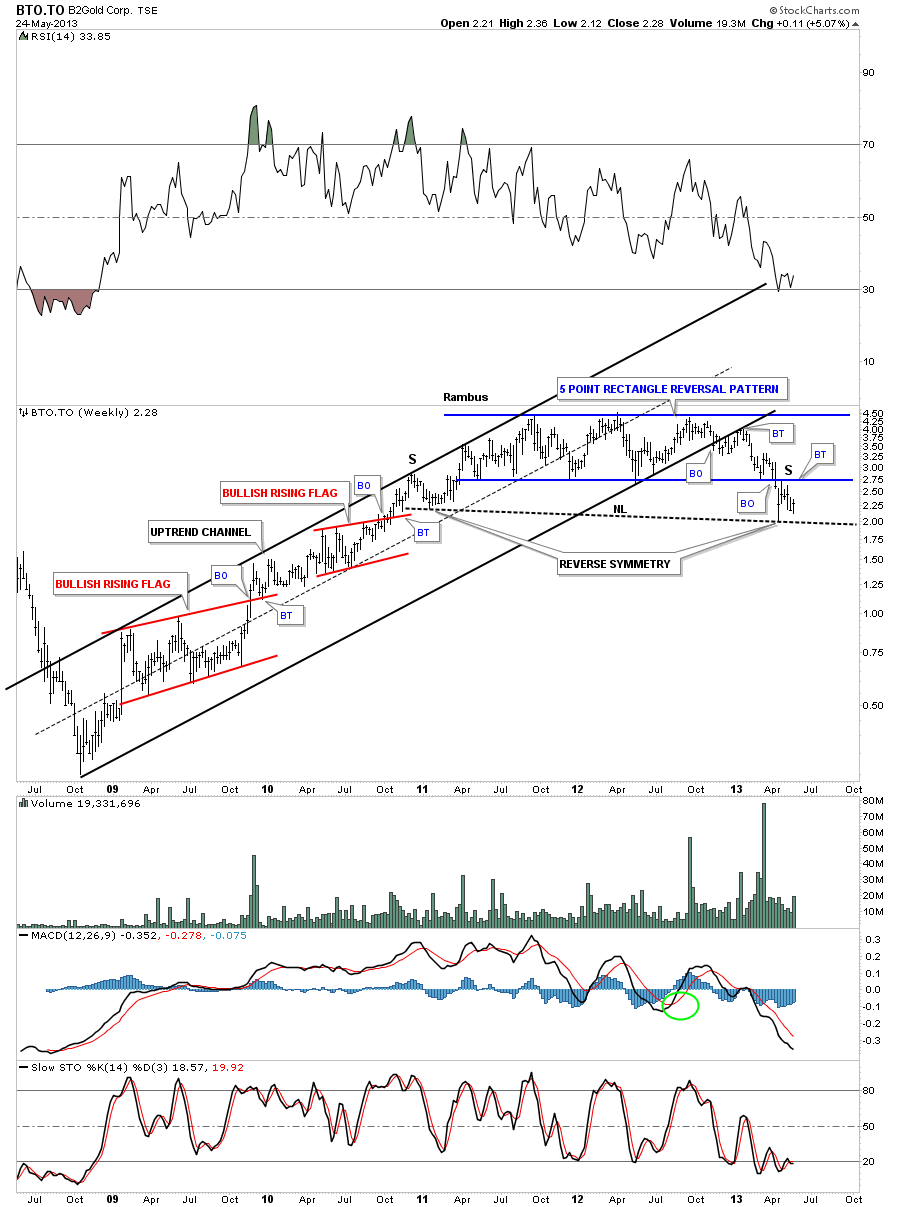

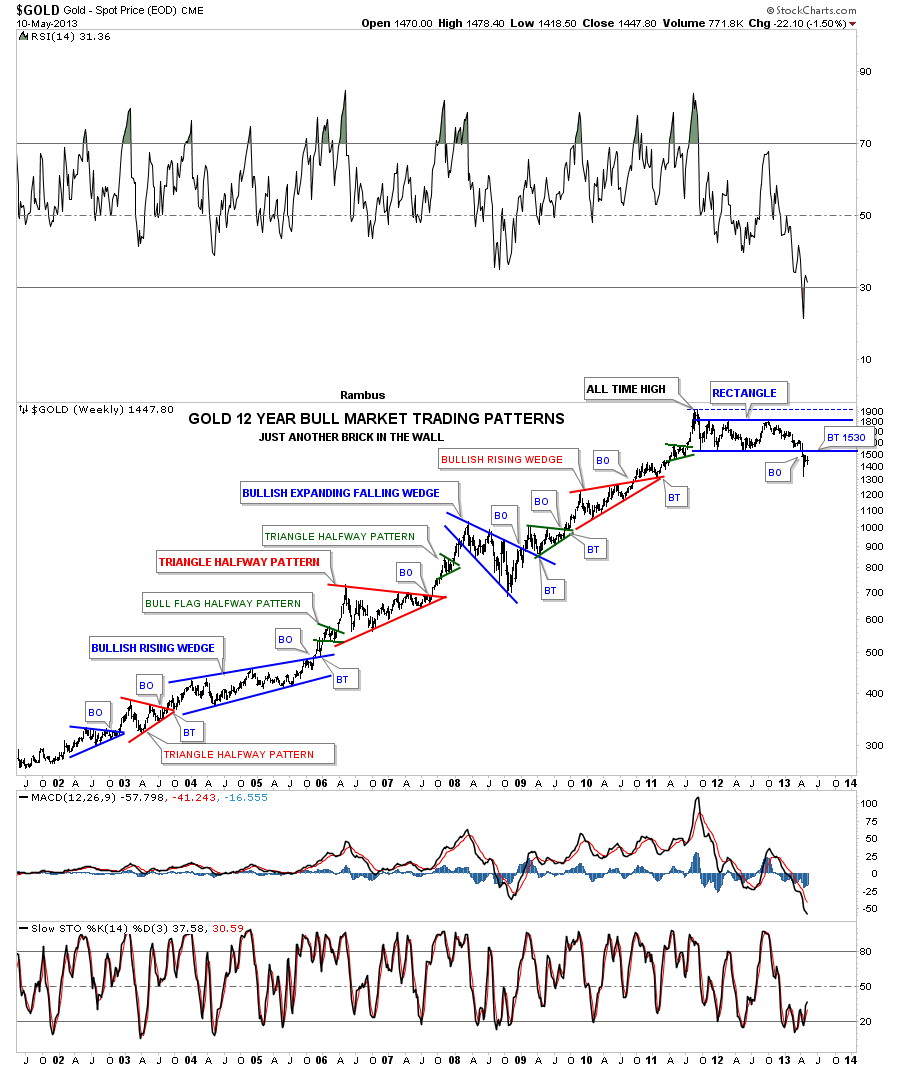

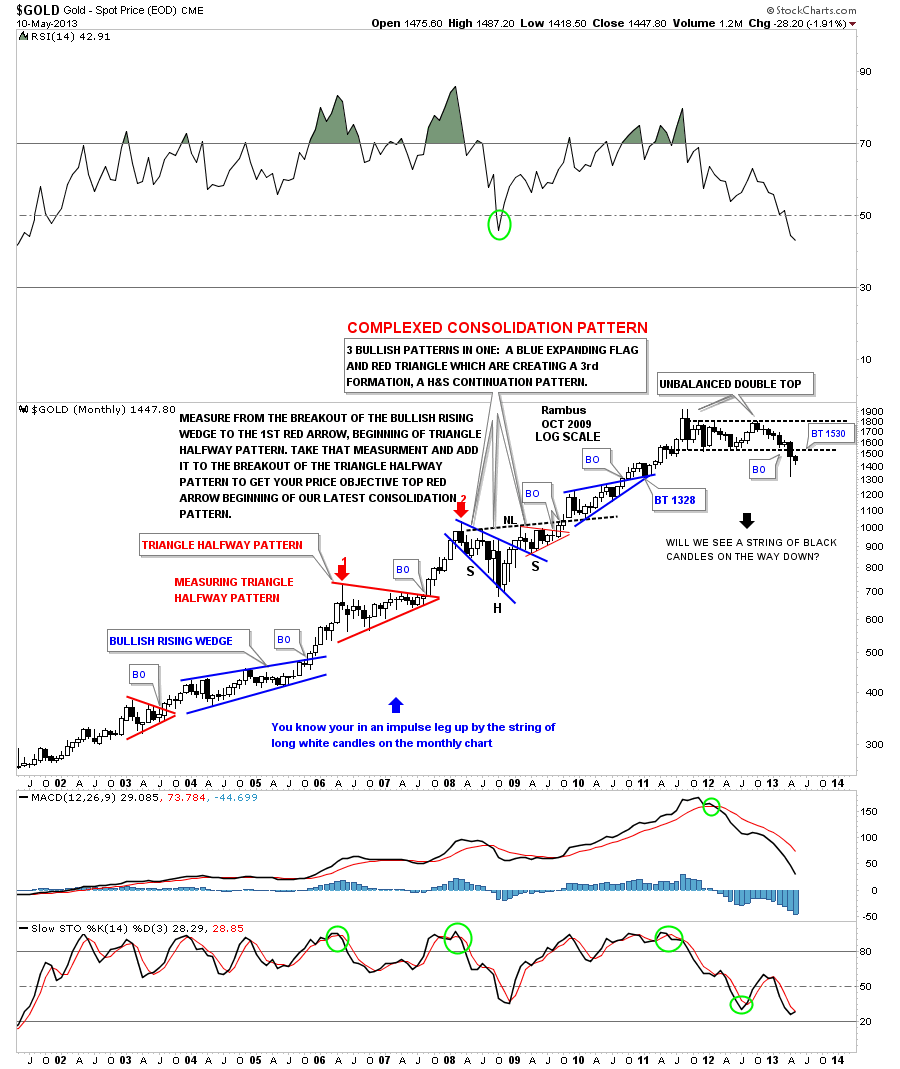

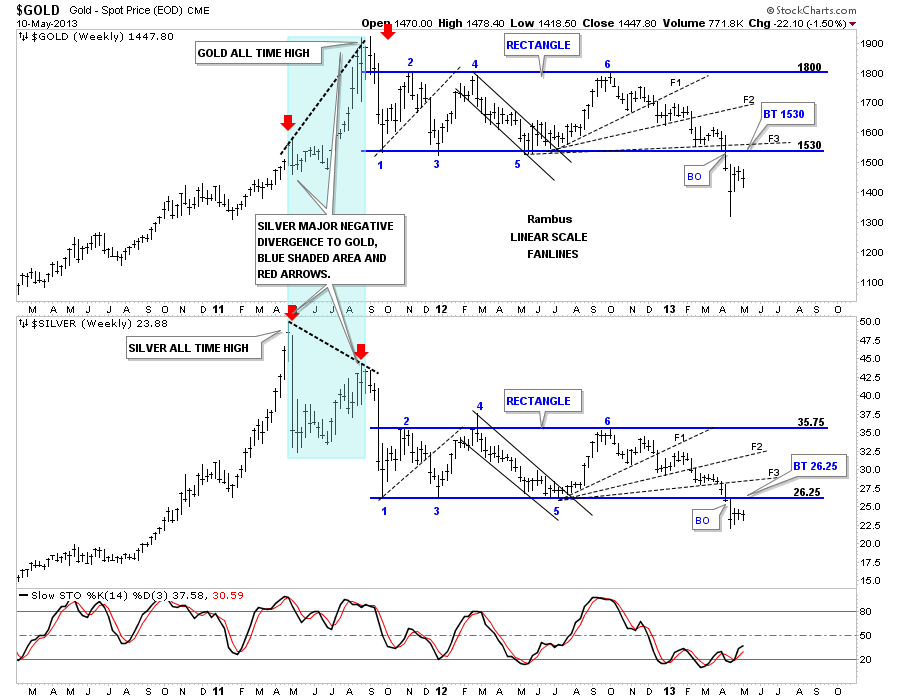

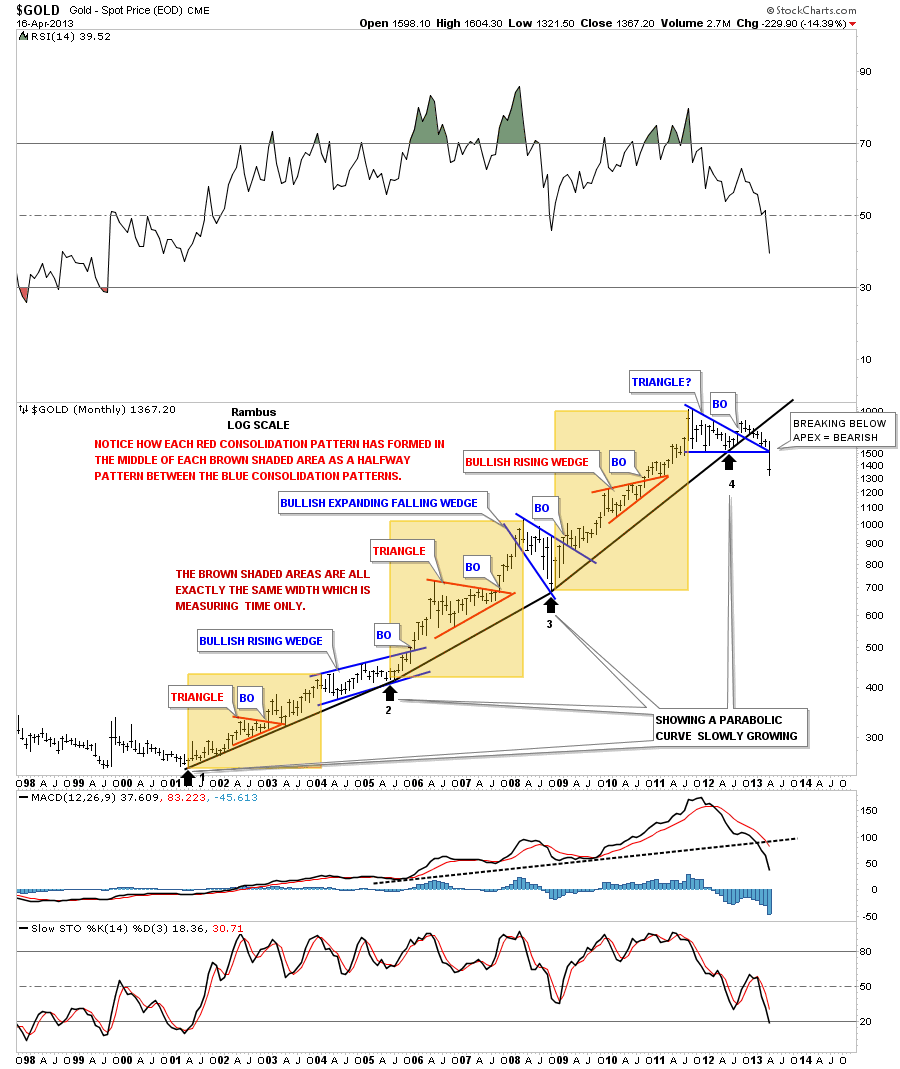

Dave has told me PMs have the BEST and most concise Chartology patterns of all the sectors .

Alas he is Not a Goldbug. He Doesn’t concern himelf at all with manipulation…its all in the charts anyhow

I of course used to furiously debate him on this point. But my take ..the manipulation is a source of supply and its baked into the cake too .

Personally I am a Goldbug to the Nth degree… but I decided I didn’t want to replay 2008 as I watched my pf loose 80%…as remote a possibility as that seemed to be

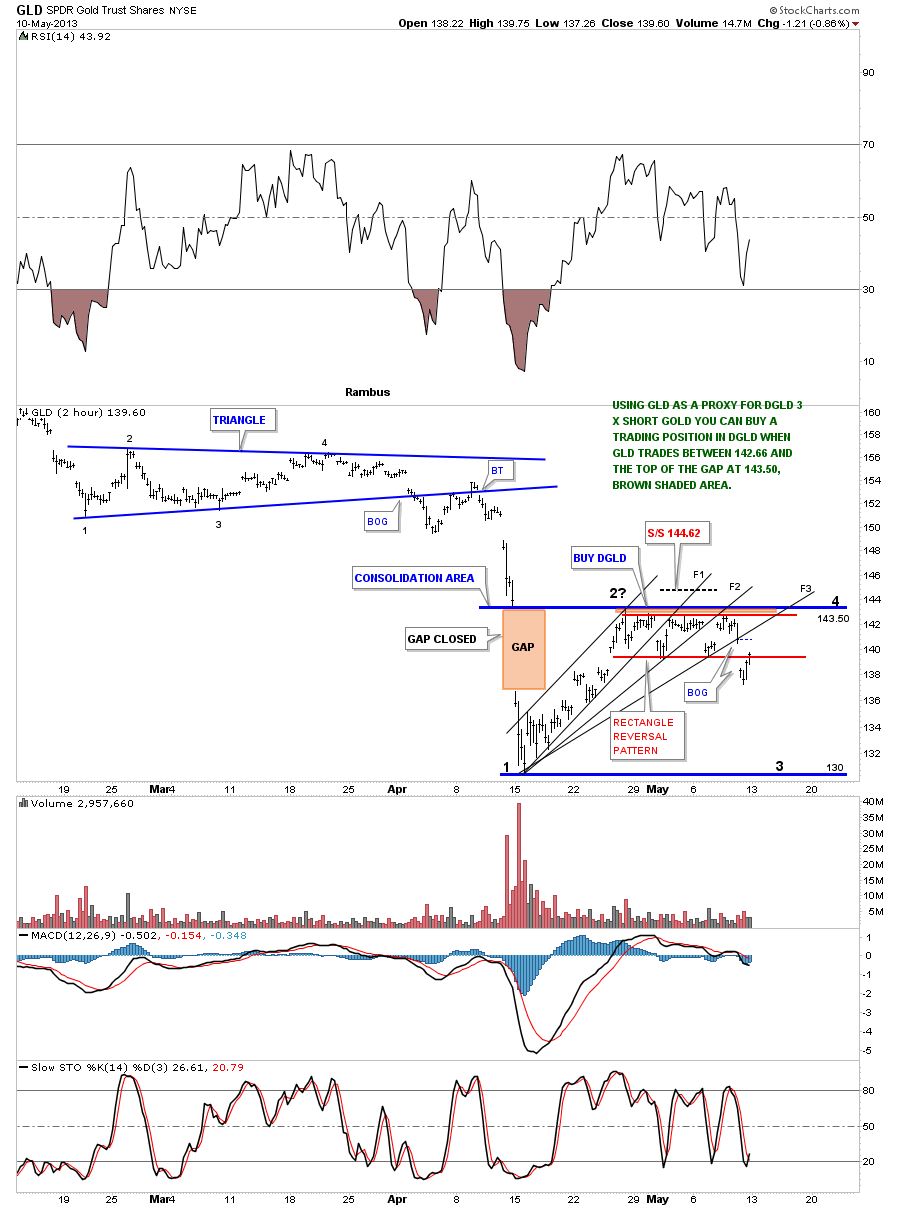

So How does a Goldbug like me rationalize being Darth Traitor…Holding DUST instead of NUGTs ?

Like This :

We all thought we would buy PM Stocks for the leverage…The Idea of course was to.. at the right time when Precious metals stocks go Nucken Futz

sell em and buy Physical

The leverage was expected to be 3 to 5 times

Wrong savage

How has that been working for us goldbugs ?

But NOW…I believe I have become a Wizard too !

I have just cashed some profits made in DUST this week and bought some really cheaply priced Gold Maple Leafs

This is Alchemy .. turning Dust into Gold !!!

………………………

This site also has 1 more participant without who we could not thrive

Mrs Rambus…Chief Financial Officer Extrodinaire

(Behind every successful man is his CFO 🙂

…………………………..

So that’s who we are and that’s how we got here and we are really excited to be attracting so many

who are willing to do the time and learn this method to Improve their trading skills

………………………

One of our mottos has evolved to :

“Give a Man a Chart and he will Thrive for a Day

Teach a man to Chart and he Thrives for a lifetime”

In Keeping with the Wizardry on the Site…we invite you all to use the Chartology Forum for banter and questions with Rambus and other members

Thank you all for joining us and as Rambus Says “Let the Games Begin”

Fullgoldcrown (For Rambus Chartology)